29 Tax Research Analyst Skills For Your Resume with Exampels in 2025

As a Tax Research Analyst, possessing the right skills is crucial for effectively navigating the complexities of tax laws and regulations. Employers look for candidates who not only have a strong foundational knowledge of taxation but also the analytical abilities to interpret and apply this information in real-world scenarios. In this section, we will explore the essential skills that can enhance your resume and set you apart in the competitive field of tax research.

Best Tax Research Analyst Technical Skills

In the competitive field of tax research, possessing the right technical skills is essential for success. These skills not only enhance your ability to analyze complex tax regulations and compliance requirements but also demonstrate your proficiency in using various tools and methodologies critical for tax analysis. Below are key technical skills that should be highlighted on your resume.

Tax Compliance Knowledge

Understanding federal, state, and local tax laws is crucial for ensuring compliance and identifying potential risks.

How to show it: Detail specific tax compliance projects and how your knowledge helped maintain compliance or resolve issues.

Data Analysis

Ability to analyze large datasets to extract insights and make informed tax-related decisions.

How to show it: Include examples where your data analysis led to improved efficiency or cost savings.

Research Skills

Proficient in conducting detailed tax research using primary and secondary sources to support tax positions.

How to show it: Highlight instances where your research directly influenced tax strategies or decisions.

Tax Software Proficiency

Familiarity with tax preparation and research software such as Intuit ProConnect, CCH Axcess, or Thomson Reuters ONESOURCE.

How to show it: List the software you have used and describe how they improved your work processes.

Financial Acumen

A strong understanding of financial statements and accounting principles to analyze tax implications effectively.

How to show it: Provide examples of financial analysis that supported tax strategies or compliance efforts.

Regulatory Knowledge

In-depth understanding of tax regulations, IRS guidelines, and compliance requirements.

How to show it: Describe your involvement in projects that required adherence to specific regulatory guidelines.

Communication Skills

Ability to convey complex tax concepts clearly to clients and stakeholders, both verbally and in writing.

How to show it: Illustrate how your communication led to successful client interactions or presentations.

Attention to Detail

Meticulousness in reviewing documents and data to ensure accuracy and compliance with tax laws.

How to show it: Emphasize instances where your attention to detail prevented errors or compliance issues.

Problem-Solving Skills

Ability to identify tax-related issues and develop effective solutions to mitigate risks.

How to show it: Share examples of challenges faced and how your problem-solving skills led to successful outcomes.

Project Management

Experience in managing multiple tax projects and deadlines efficiently to meet client and regulatory requirements.

How to show it: Highlight projects managed and the positive impact on timelines and deliverables.

Technical Writing

Ability to produce clear and concise documentation related to tax procedures, policies, and analyses.

How to show it: Provide examples of technical documents or reports you have authored that were well-received.

Best Tax Research Analyst Soft Skills

In the role of a Tax Research Analyst, possessing strong soft skills is essential for navigating the complexities of tax regulations and effectively communicating findings to stakeholders. These skills not only enhance your ability to work collaboratively but also improve your problem-solving capabilities and adaptability in a fast-paced environment.

Analytical Thinking

Analytical thinking is crucial for dissecting complex tax data and regulations to draw informed conclusions.

How to show it: Demonstrate your analytical skills by detailing specific projects where your insights led to significant tax savings or streamlined processes.

Communication

Effective communication is key for articulating tax-related findings to both financial and non-financial stakeholders.

How to show it: Include examples of presentations or reports you developed that simplified complex tax issues, showcasing your ability to convey information clearly. Learn more about Communication.

Problem-solving

Problem-solving skills allow you to identify tax-related issues and develop strategic solutions quickly.

How to show it: Highlight instances where you resolved a challenging tax issue and the impact it had on the organization. Explore more on Problem-solving.

Time Management

Time management is essential for meeting deadlines and effectively prioritizing multiple tax research projects.

How to show it: Quantify your achievements by sharing how you managed competing priorities and met critical deadlines. Learn about effective Time Management.

Attention to Detail

Attention to detail is necessary to ensure compliance with tax laws and to avoid costly mistakes.

How to show it: Provide examples of how your meticulous nature helped catch errors in tax filings or improved accuracy in reports.

Teamwork

Teamwork is vital as Tax Research Analysts often collaborate with other departments to gather necessary data and insights.

How to show it: Share experiences where your collaboration led to a successful project outcome or improved team efficiency. Read more about Teamwork.

Adaptability

Adaptability helps you stay effective in a continually changing regulatory environment and adjust strategies as necessary.

How to show it: Include situations where you quickly adapted to new regulations or shifts in tax law, demonstrating your flexibility.

Research Skills

Strong research skills are essential for gathering and analyzing tax information from various sources.

How to show it: Detail specific research projects where your findings contributed to strategic decisions or compliance improvements.

Critical Thinking

Critical thinking enables you to evaluate information and make sound judgments regarding tax strategies.

How to show it: Provide examples of how your critical evaluation led to better tax planning or risk management.

Networking

Networking skills can help build relationships with other professionals in the tax industry, leading to valuable insights and information.

How to show it: Mention any professional associations or groups you are part of and how these relationships have benefited your work.

Ethical Judgment

Ethical judgment is vital in the tax field to ensure compliance and uphold the integrity of financial practices.

How to show it: Discuss scenarios where your ethical considerations influenced decision-making and maintained compliance.

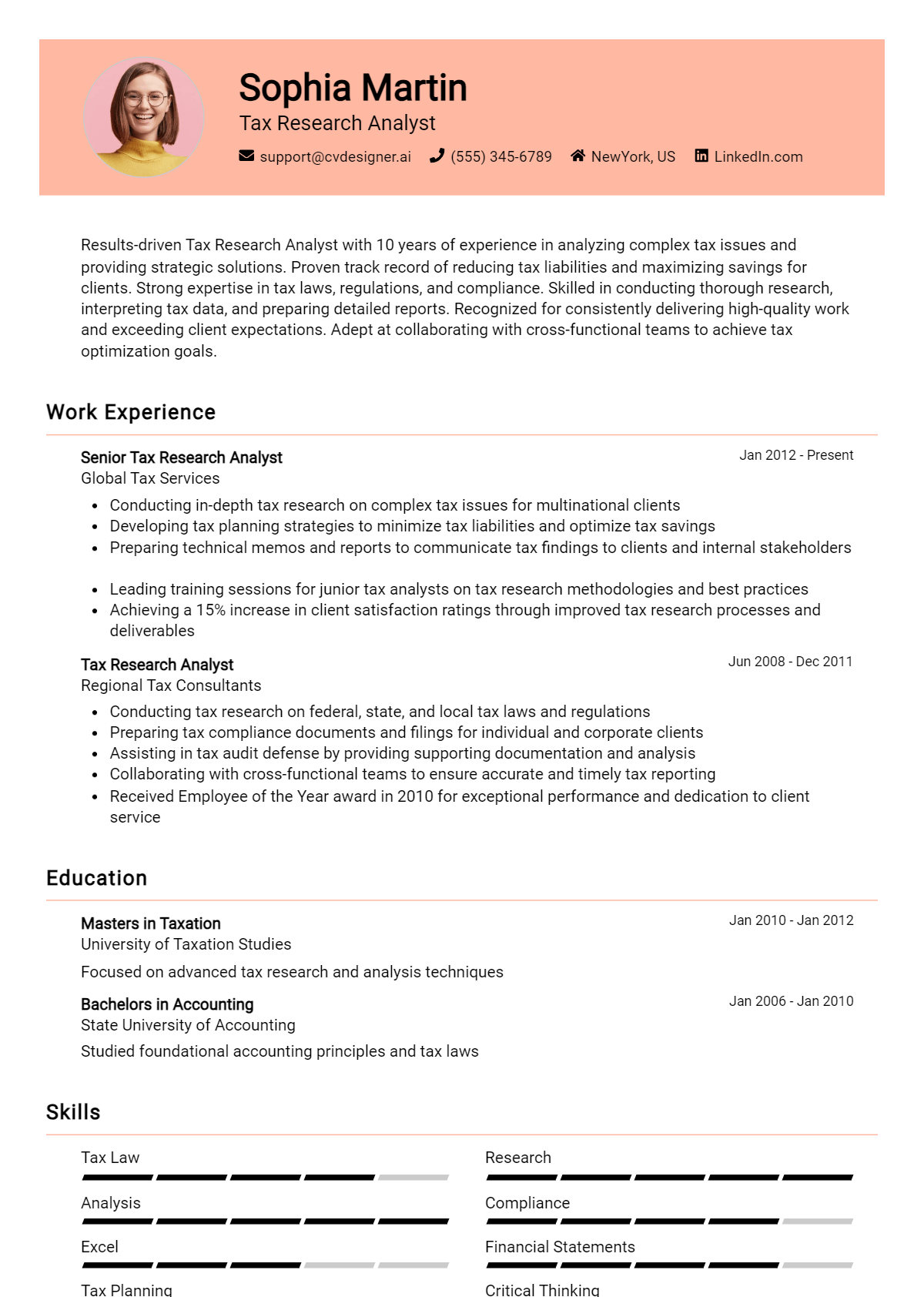

How to List Tax Research Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to employers in a competitive job market. Employers often look for specific skills that match their job requirements, making it essential to highlight them in various sections of your resume: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Tax Research Analyst skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and expertise.

Example

Dynamic Tax Research Analyst with expertise in tax compliance and regulatory analysis. Proven ability to identify tax-saving opportunities and enhance reporting accuracy through analytical skills and attention to detail.

for Resume Work Experience

The work experience section presents an excellent opportunity to demonstrate how your Tax Research Analyst skills have been applied in real-world scenarios, showcasing your practical experience to employers.

Example

- Conducted comprehensive tax research to ensure compliance with federal and state regulations, resulting in a 20% reduction in audit risks.

- Analyzed complex tax issues and provided actionable recommendations, utilizing strong analytical and critical thinking skills.

- Collaborated with cross-functional teams to streamline the tax filing process, improving efficiency and accuracy.

- Prepared detailed reports on tax implications for various business transactions, enhancing decision-making.

for Resume Skills

The skills section can either showcase technical or transferable skills. It's important to include a balanced mix of hard and soft skills to strengthen your overall qualifications.

Example

- Tax Compliance

- Regulatory Analysis

- Data Analysis

- Attention to Detail

- Problem Solving

- Communication Skills

- Research Proficiency

- Time Management

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume while providing a more personal touch. It's an excellent opportunity to highlight 2-3 key skills that align with the job description and explain how those skills have positively impacted your previous roles.

Example

In my previous role, my analytical skills allowed me to identify significant tax-saving opportunities that benefited the company financially. Furthermore, my attention to detail ensured compliance with all regulatory requirements, enhancing our reporting accuracy and building trust with stakeholders.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job, making your application more compelling.

The Importance of Tax Research Analyst Resume Skills

In the competitive field of tax research analysis, effectively highlighting relevant skills on a resume is crucial for candidates looking to make a strong impression on potential employers. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their abilities with the specific requirements of the job. This alignment helps candidates stand out to recruiters, demonstrating that they possess the expertise necessary to excel in the role and contribute to the organization's success.

- Demonstrating proficiency in tax law and regulations is essential for a Tax Research Analyst. This skill indicates a candidate's ability to navigate complex tax codes and provide accurate guidance to clients or employers.

- Analytical skills are paramount in this role, as they enable analysts to interpret financial data and identify tax-saving opportunities. Highlighting these skills shows potential employers that the candidate can make informed decisions based on thorough research.

- Strong attention to detail is vital for ensuring compliance with tax regulations. A candidate who emphasizes this skill can reassure employers that they will minimize errors and avoid costly penalties.

- Effective communication skills are crucial for conveying complex tax information clearly to clients and colleagues. Emphasizing this ability on a resume demonstrates that the candidate can facilitate understanding and collaboration.

- Research skills are at the core of a Tax Research Analyst's responsibilities. By highlighting their capacity to gather, analyze, and synthesize information from multiple sources, candidates can showcase their value in driving strategic tax decisions.

- Time management skills are essential in meeting deadlines and managing multiple projects simultaneously. Candidates who highlight this ability can demonstrate their capacity to work efficiently in a fast-paced environment.

- Knowledge of tax software and tools can significantly enhance productivity. Candidates who list relevant software skills indicate their readiness to leverage technology in their work, making them more attractive to employers.

- Understanding of financial statements and accounting principles is critical for analyzing tax implications effectively. Candidates who emphasize this knowledge can illustrate their comprehensive approach to tax research.

For more examples of effective resumes, visit our Resume Samples page.

How To Improve Tax Research Analyst Resume Skills

As a Tax Research Analyst, the landscape of tax laws and regulations is constantly evolving, making it essential to continuously enhance your skills. Staying updated not only helps you perform your job more effectively but also makes you a more competitive candidate in the job market. Here are some actionable tips to help you improve your skills for this role:

- Engage in Continuous Learning: Enroll in tax courses and workshops to stay updated on the latest tax laws and regulations.

- Read Tax Publications: Regularly read industry-specific publications and journals to gain insights into emerging trends and changes in tax legislation.

- Network with Professionals: Join professional organizations or attend conferences to connect with other tax professionals and exchange knowledge.

- Utilize Online Resources: Leverage online platforms such as webinars, podcasts, and e-learning modules to enhance your understanding of complex tax issues.

- Seek Feedback: Request feedback from peers or supervisors on your research methods and findings to identify areas for improvement.

- Practice Analytical Skills: Work on case studies or simulations to sharpen your analytical skills and apply theoretical knowledge to practical scenarios.

- Stay Proficient in Technology: Familiarize yourself with tax software and data analysis tools to improve your efficiency and accuracy in research tasks.

Frequently Asked Questions

What key skills should a Tax Research Analyst include in their resume?

A Tax Research Analyst should highlight skills such as tax law knowledge, analytical thinking, attention to detail, and research abilities. Additionally, proficiency in tax software and databases, excellent communication skills, and the ability to interpret complex regulations are crucial. Demonstrating these skills on a resume can showcase a candidate's capability to navigate the tax landscape effectively.

How important is technical proficiency for a Tax Research Analyst?

Technical proficiency is extremely important for a Tax Research Analyst, as familiarity with tax software and analytical tools can significantly enhance productivity and accuracy. Being skilled in using spreadsheets, databases, and tax compliance software allows analysts to conduct thorough research, analyze data efficiently, and present findings clearly, making these skills essential for success in the role.

What role does analytical thinking play in tax research?

Analytical thinking is a core skill for a Tax Research Analyst, as the role requires evaluating complex tax regulations, identifying trends, and formulating strategies based on research findings. Strong analytical skills enable the analyst to assess various scenarios, make informed recommendations, and solve problems associated with tax compliance, thereby ensuring optimal outcomes for clients or the organization.

Why is attention to detail crucial for a Tax Research Analyst?

Attention to detail is crucial for a Tax Research Analyst because the field involves working with intricate tax laws and regulations where even minor errors can lead to significant financial repercussions. By meticulously reviewing documents, calculations, and compliance requirements, analysts can ensure accuracy and reliability in their research, thereby safeguarding their organization and clients from potential legal issues.

How can communication skills enhance a Tax Research Analyst's effectiveness?

Effective communication skills are essential for a Tax Research Analyst as they often need to convey complex tax information to clients, stakeholders, and team members clearly and concisely. Good communication helps in presenting research findings, discussing tax strategies, and collaborating with others, ensuring that all parties understand the implications of tax decisions and fostering a productive working environment.

Conclusion

Incorporating Tax Research Analyst skills into your resume is vital for effectively showcasing your expertise and suitability for the role. By highlighting relevant skills, candidates can differentiate themselves from the competition and demonstrate the unique value they bring to potential employers. Remember, a well-crafted resume can open doors to exciting opportunities, so take the time to refine your skills and ensure your application shines.

For additional resources, explore our resume templates, utilize our resume builder, check out resume examples, and enhance your application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.