Tax Research Analyst Core Responsibilities

A Tax Research Analyst plays a critical role in navigating complex tax regulations and ensuring compliance across various departments. Key responsibilities include conducting in-depth research on tax laws, analyzing financial data, and collaborating with finance and legal teams to develop effective tax strategies. Essential skills encompass technical proficiency in tax software, strong analytical and problem-solving abilities, and excellent communication. These competencies not only support the organization’s compliance goals but also enhance decision-making processes. A well-structured resume highlighting these qualifications can significantly boost career prospects in this field.

Common Responsibilities Listed on Tax Research Analyst Resume

- Conduct comprehensive research on federal, state, and international tax regulations.

- Analyze tax implications of various transactions and business strategies.

- Prepare detailed reports and summaries for internal stakeholders.

- Collaborate with finance and legal departments to ensure compliance.

- Stay updated on changes in tax laws and regulations.

- Assist in the preparation of tax returns and filings.

- Evaluate tax risks and recommend mitigation strategies.

- Develop and maintain tax-related databases and documentation.

- Provide training and support to team members on tax issues.

- Participate in audits and respond to inquiries from tax authorities.

- Support strategic planning initiatives with tax insights.

- Monitor industry trends and best practices in tax research.

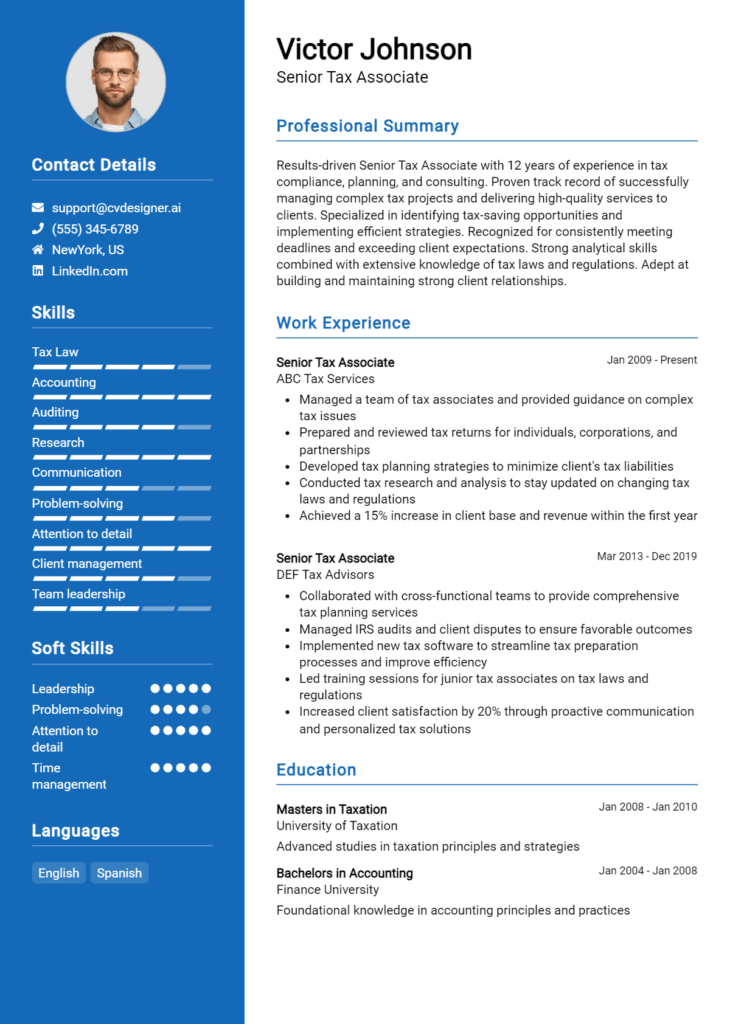

High-Level Resume Tips for Tax Research Analyst Professionals

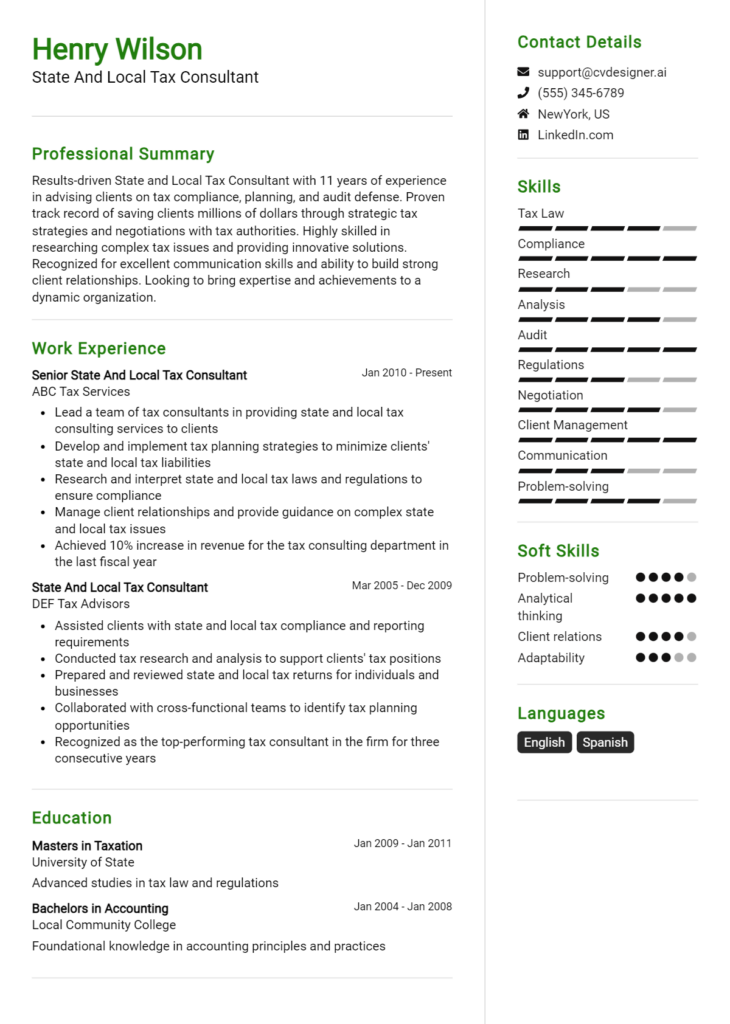

A well-crafted resume is crucial for Tax Research Analyst professionals, as it serves as the first impression a candidate makes on potential employers. In a competitive job market, a resume must effectively reflect not only the candidate's skills but also their achievements and contributions to previous roles. Given the analytical nature of the job, a resume that highlights relevant experience and industry-specific knowledge can set a candidate apart. This guide will provide practical and actionable resume tips specifically tailored for Tax Research Analyst professionals, helping you to create a compelling document that showcases your qualifications and draws the attention of hiring managers.

Top Resume Tips for Tax Research Analyst Professionals

- Tailor your resume to the job description by incorporating keywords and phrases that align with the specific requirements of the position.

- Highlight relevant experience by focusing on past roles related to tax research, compliance, or financial analysis.

- Quantify your achievements, such as the percentage of tax savings you helped clients achieve or the number of successful audits you supported.

- Include industry-specific skills, such as knowledge of tax software, regulations, and compliance standards.

- Showcase certifications and educational qualifications, such as CPA, EA, or advanced degrees in accounting or finance.

- Utilize a clear and professional format that enhances readability and emphasizes key sections like experience and skills.

- Incorporate action verbs to convey your contributions effectively, such as “analyzed,” “developed,” or “managed.”

- Provide a summary statement at the top of your resume that encapsulates your professional background and career goals.

- Keep your resume concise, ideally one page, while ensuring all critical information is included to maintain relevance.

By implementing these tips, Tax Research Analyst professionals can significantly increase their chances of landing a job in this competitive field. A well-structured and tailored resume not only highlights your qualifications but also demonstrates your attention to detail and commitment to the profession, making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Tax Research Analyst

In the competitive field of tax research analysis, resume headlines and titles play a crucial role in capturing the attention of hiring managers. A strong headline or title not only summarizes a candidate's key qualifications but also conveys their unique value proposition in one impactful phrase. This concise, relevant statement should be directly related to the job being applied for, allowing candidates to make a memorable first impression. An effective headline can set the tone for the entire resume, encouraging hiring managers to delve deeper into the applicant's experience and skills.

Best Practices for Crafting Resume Headlines for Tax Research Analyst

- Keep it concise: Aim for one impactful sentence that encapsulates your qualifications.

- Be role-specific: Tailor the headline to reflect the specific position of Tax Research Analyst.

- Highlight key skills: Focus on essential skills relevant to tax research, such as analytical abilities or tax law expertise.

- Use industry keywords: Incorporate terms that are commonly recognized in the tax research field to enhance searchability.

- Showcase your experience: If applicable, mention years of experience or notable achievements in tax research.

- Avoid jargon: Use clear and straightforward language that hiring managers can easily understand.

- Reflect your value: Communicate how your skills and experience can benefit the employer.

- Be authentic: Ensure that the headline accurately represents your qualifications and career aspirations.

Example Resume Headlines for Tax Research Analyst

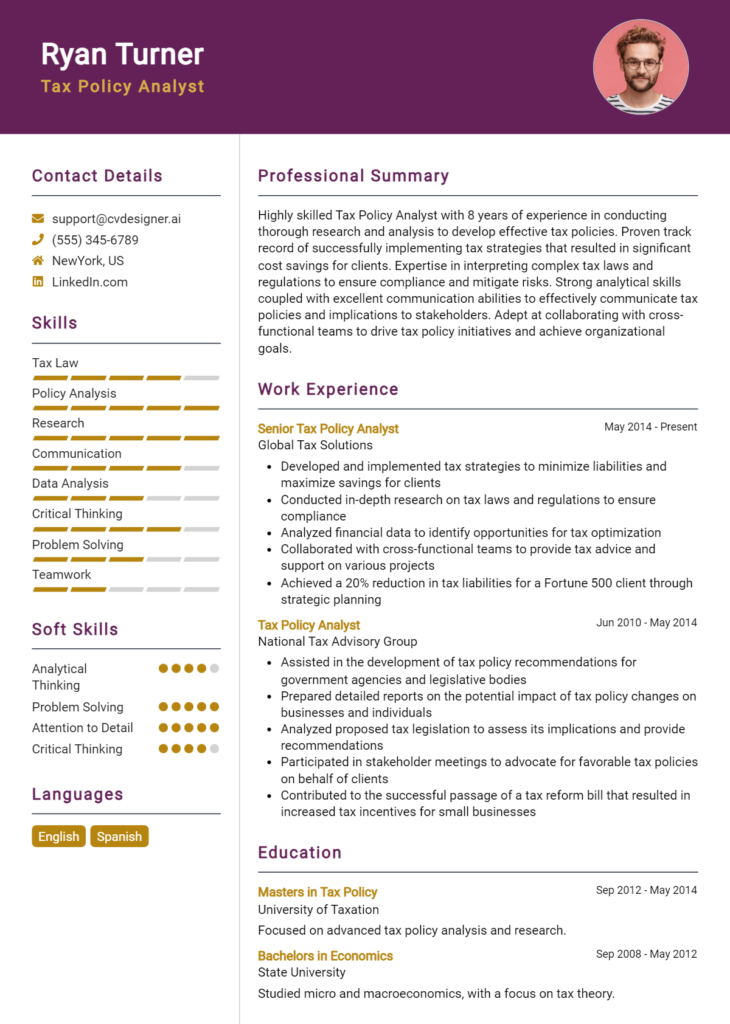

Strong Resume Headlines

Dynamic Tax Research Analyst with 5+ Years of Experience in Compliance and Strategic Planning

Detail-Oriented Tax Specialist Skilled in Advanced Tax Law and Risk Management

Results-Driven Tax Research Analyst with Proven Track Record in Minimizing Client Liabilities

Expert in Tax Legislation and Data Analysis with a Focus on Optimizing Tax Strategies

Weak Resume Headlines

Tax Research Analyst

Experienced Professional Looking for Opportunities

Seeking a Position in Tax Research

The strong headlines are effective because they provide a clear, specific overview of the candidate's qualifications and expertise, making it easy for hiring managers to see their potential value at a glance. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity, making them forgettable and uninformative. A compelling headline sets the stage for a successful resume by drawing attention and encouraging further exploration of the candidate's skills and experiences.

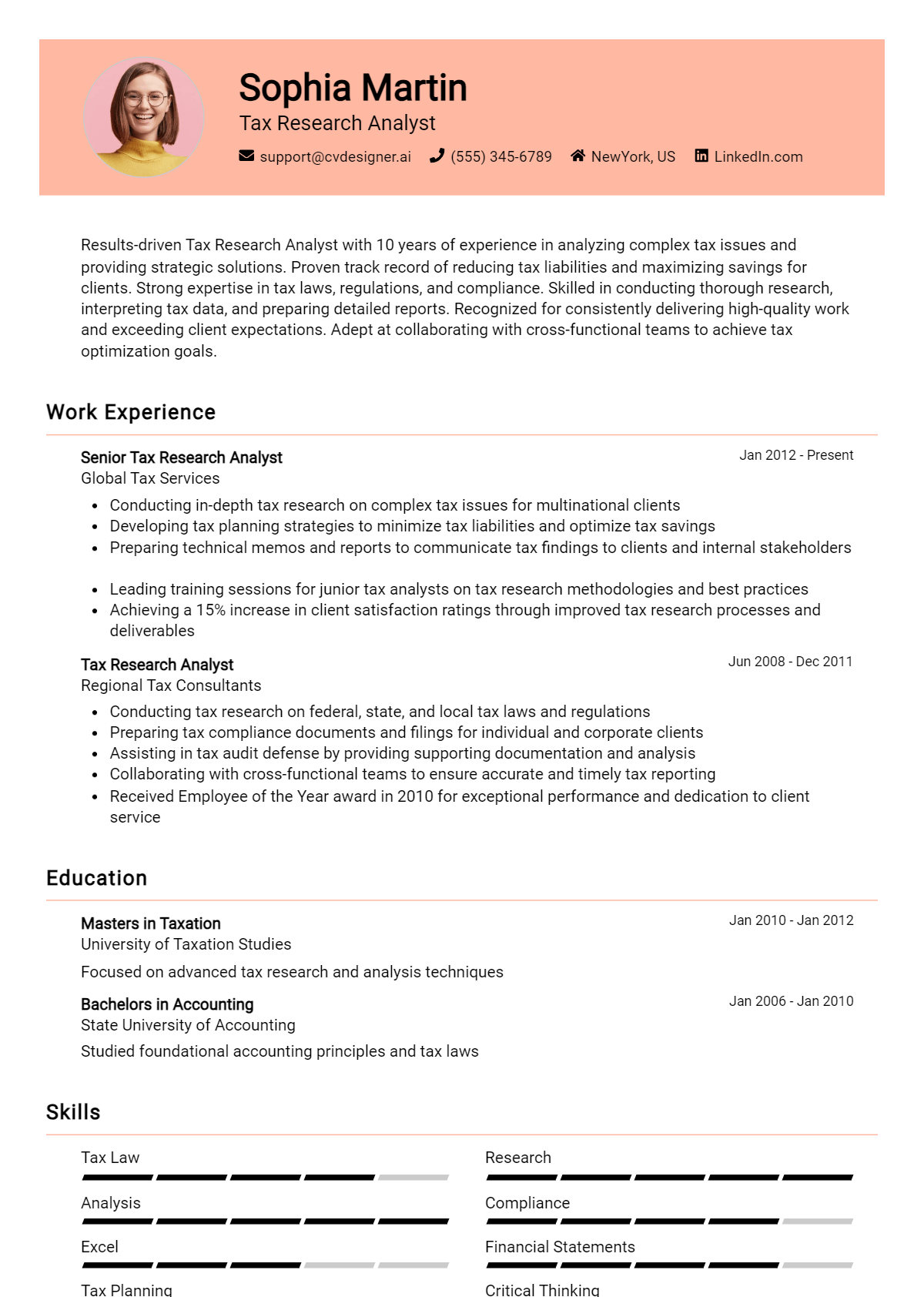

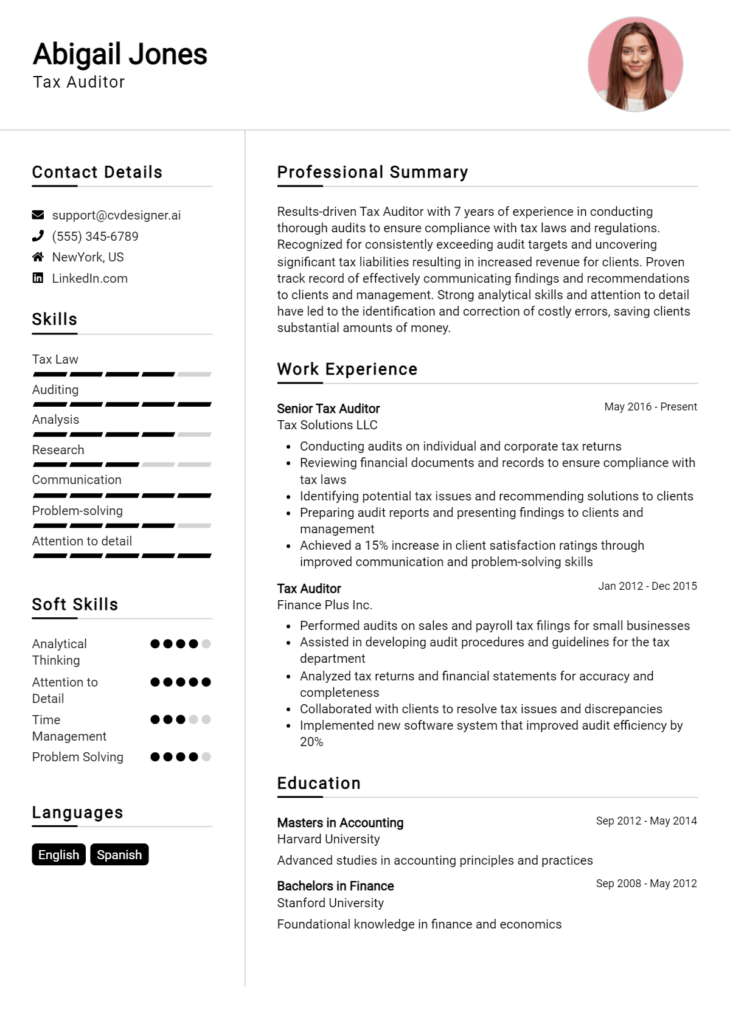

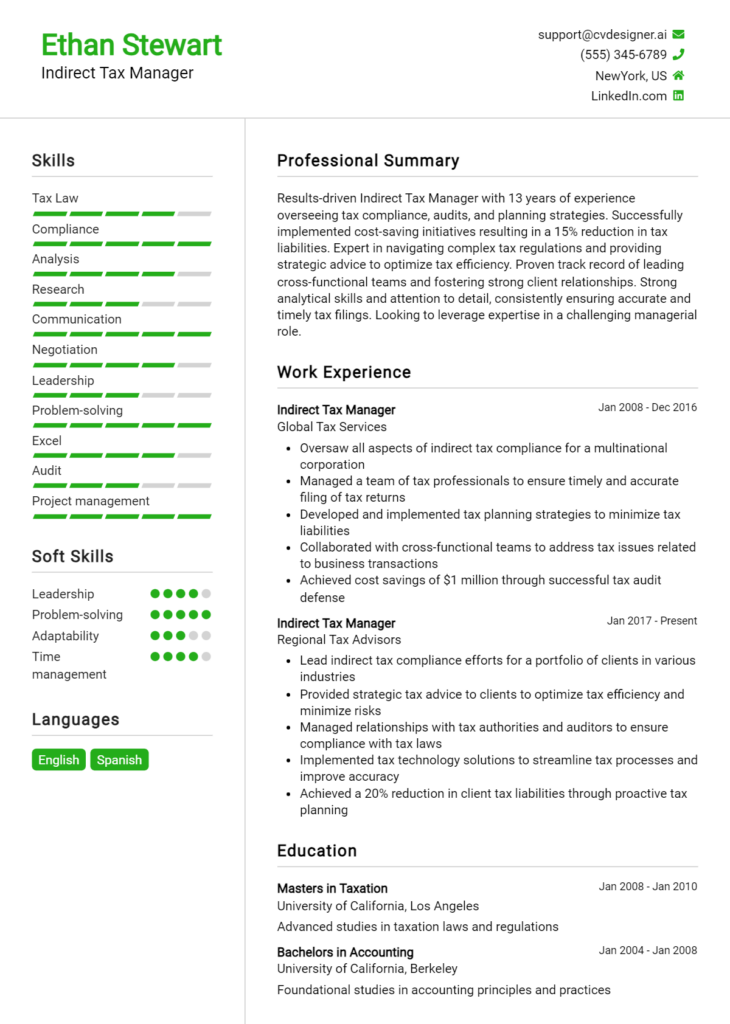

Writing an Exceptional Tax Research Analyst Resume Summary

A well-crafted resume summary is an essential component for a Tax Research Analyst, as it serves as the first impression a candidate makes on hiring managers. This brief introduction is critical in quickly capturing attention by highlighting key skills, relevant experience, and notable accomplishments that align with the job requirements. A strong summary not only sets the tone for the rest of the resume but also provides a snapshot of the candidate's qualifications, making it easier for recruiters to gauge their fit for the role. To be effective, this summary should be concise, impactful, and tailored specifically to the job the candidate is applying for.

Best Practices for Writing a Tax Research Analyst Resume Summary

- Quantify achievements wherever possible to demonstrate impact.

- Highlight key skills relevant to tax research, such as analytical thinking and attention to detail.

- Tailor the summary to reflect the specific job description and requirements.

- Use strong action verbs to convey a sense of proactivity.

- Keep it concise—ideally between 2-4 sentences.

- Focus on what sets you apart from other candidates, such as unique experiences or specialized knowledge.

- Include relevant certifications or educational qualifications that enhance your profile.

- Write in a professional tone that reflects your expertise in tax research.

Example Tax Research Analyst Resume Summaries

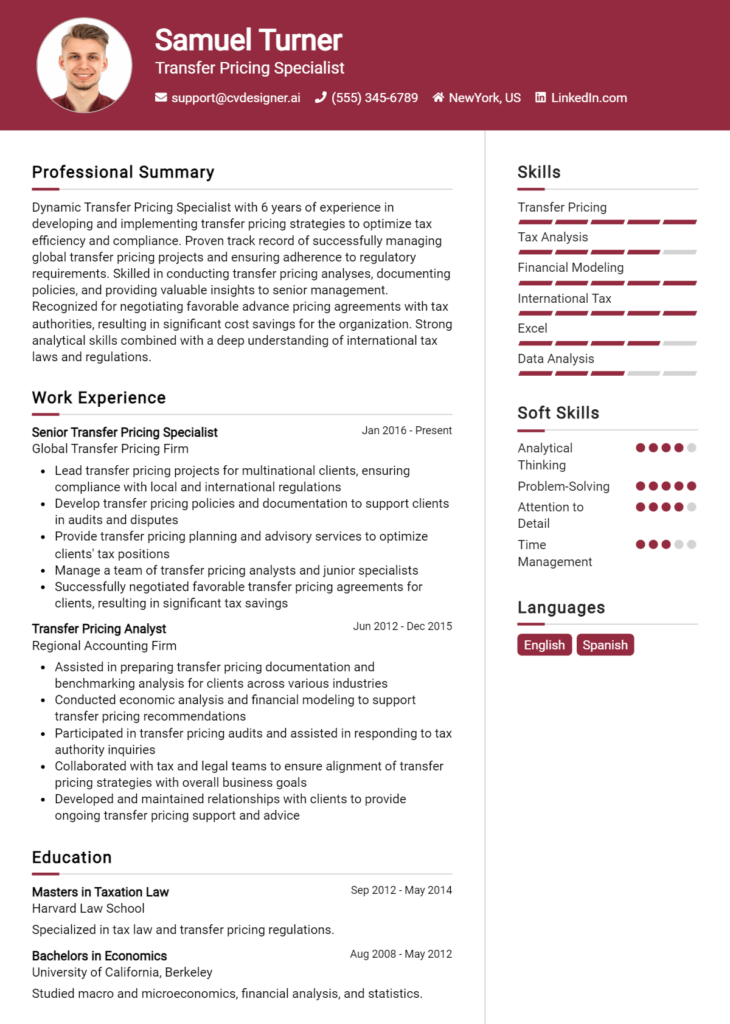

Strong Resume Summaries

Detail-oriented Tax Research Analyst with over 5 years of experience in conducting comprehensive tax compliance reviews, resulting in an average of 20% savings on audits. Proficient in using advanced tax software and analytical tools to streamline processes and enhance reporting accuracy.

Results-driven Tax Research Analyst with a proven track record of interpreting complex tax regulations, leading to successful outcomes in over 50 high-stakes audits. Adept at collaborating with cross-functional teams to develop strategic tax planning solutions that maximize client savings.

Dynamic Tax Research Analyst skilled in leveraging data analysis to identify tax-saving opportunities, achieving a 30% reduction in liabilities for clients annually. Strong background in federal and state tax regulations, with a Master’s degree in Taxation.

Weak Resume Summaries

Experienced professional seeking a Tax Research Analyst position with a focus on tax-related tasks.

Motivated individual with some knowledge of tax regulations looking to advance in the field of tax research.

The strong resume summaries are effective because they provide specific achievements, quantify outcomes, and directly relate to the competencies required for the Tax Research Analyst role. They demonstrate not only experience but also the value the candidate can bring to the organization. In contrast, the weak resume summaries lack detail and specificity, making them appear generic and unremarkable. They fail to convey the candidate's unique strengths or contributions, significantly diminishing their impact in a competitive job market.

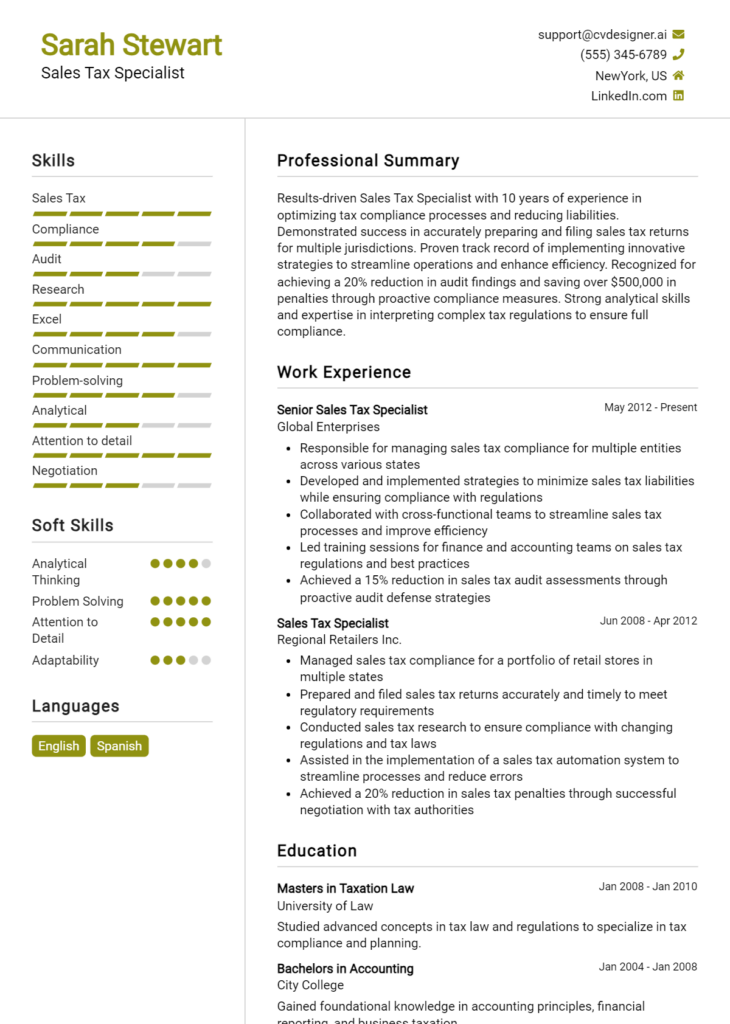

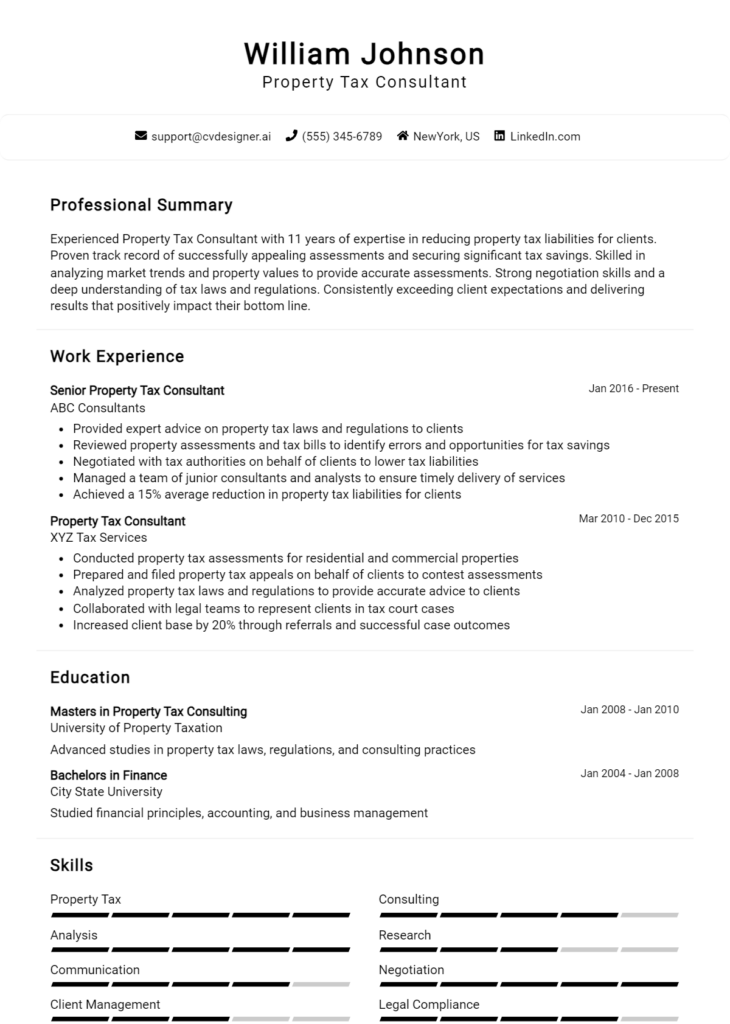

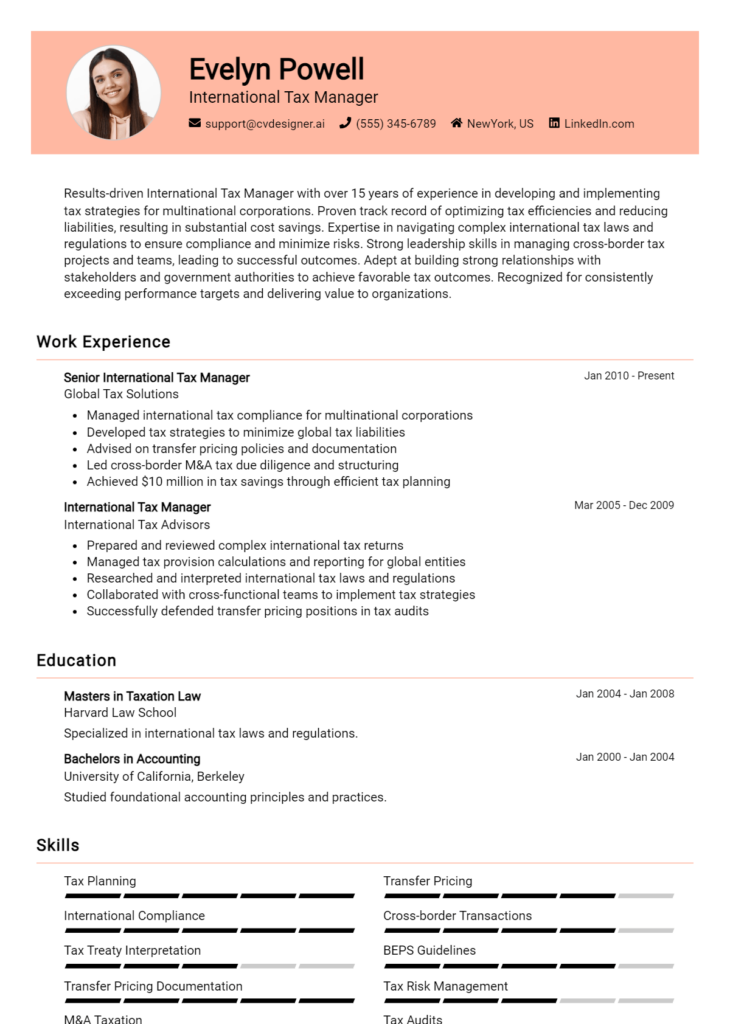

Work Experience Section for Tax Research Analyst Resume

The work experience section of a Tax Research Analyst resume is crucial as it serves as a testament to the candidate’s technical skills and professional growth in the realm of tax research and analysis. This section highlights the candidate's ability to manage projects and teams effectively while delivering high-quality outcomes that align with industry standards. By quantifying achievements and demonstrating a robust understanding of tax regulations and compliance, candidates can clearly communicate their value to potential employers, making this section a vital component of a compelling resume.

Best Practices for Tax Research Analyst Work Experience

- Focus on quantifiable outcomes, such as percentage increases in accuracy or efficiency.

- Highlight technical skills relevant to tax research, including software proficiency and analytical tools.

- Emphasize leadership roles in team projects or cross-functional collaborations.

- Use industry-specific terminology to demonstrate familiarity with compliance standards and regulations.

- Showcase examples of successful problem-solving and critical thinking in complex tax scenarios.

- Include continuous professional development, such as certifications or training related to tax research.

- Demonstrate adaptability to changing laws and regulations in the tax domain.

- Tailor experiences to align with the job description and desired qualifications of the role.

Example Work Experiences for Tax Research Analyst

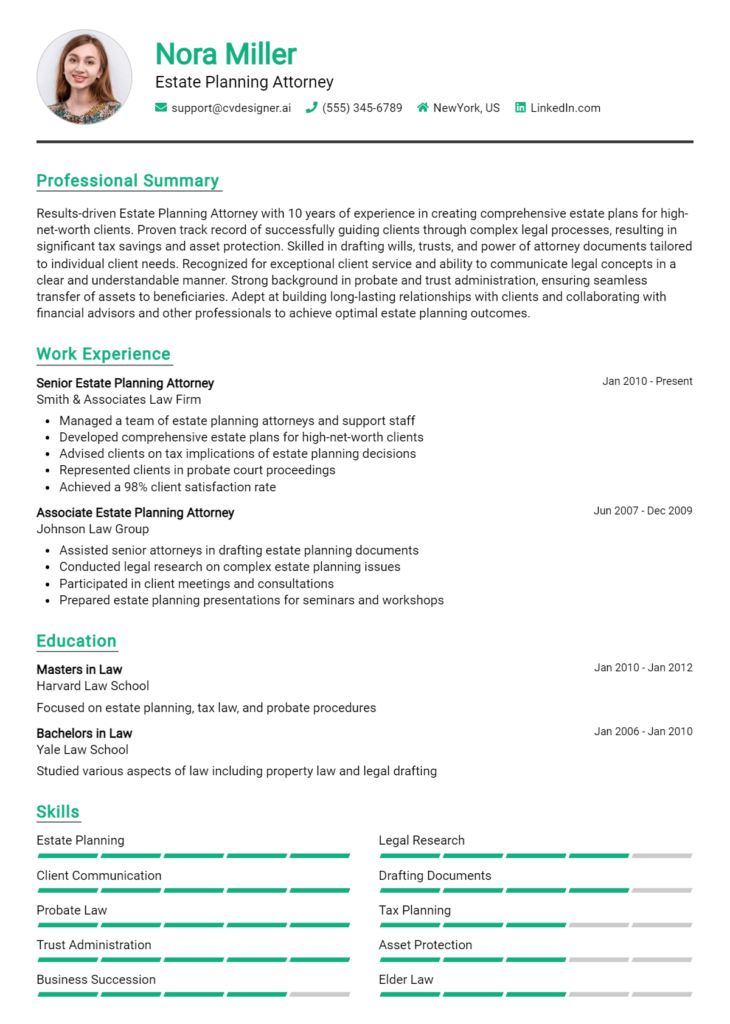

Strong Experiences

- Led a team of analysts to streamline tax compliance processes, resulting in a 30% reduction in audit discrepancies over two years.

- Developed a comprehensive tax research database that improved information retrieval time by 40%, enhancing overall team efficiency.

- Collaborated with cross-departmental teams to identify tax-saving opportunities, achieving a total savings of $500,000 for clients in the last fiscal year.

- Conducted in-depth analysis of emerging tax legislation, producing detailed reports that guided strategic planning for 100+ corporate clients.

Weak Experiences

- Worked on various tax-related tasks with little detail about the outcomes.

- Assisted team members with projects but did not specify contributions or results.

- Participated in training sessions without mentioning any new skills acquired.

- Performed general research duties without demonstrating impact or relevance to tax analysis.

The examples of strong experiences illustrate specific achievements that quantify the candidate's impact, showcasing leadership and collaboration in tax-related projects. In contrast, the weak experiences lack detail and measurable outcomes, making it difficult for potential employers to gauge the candidate's effectiveness or contributions to their previous roles. This distinction emphasizes the importance of articulating clear, impactful statements in the work experience section of a resume.

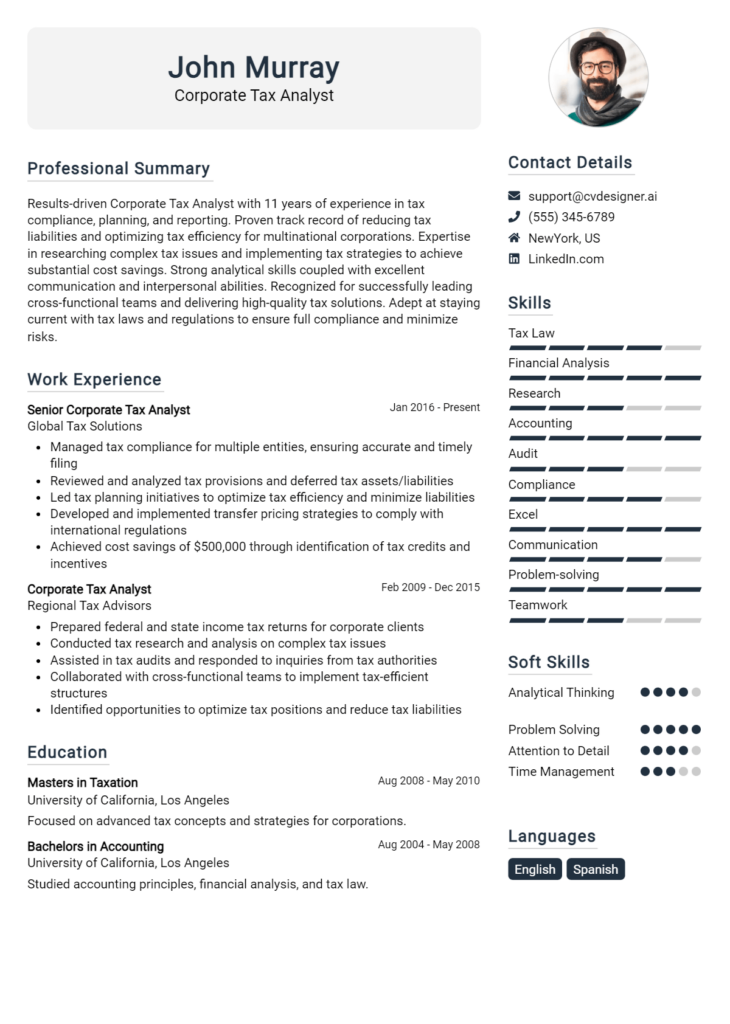

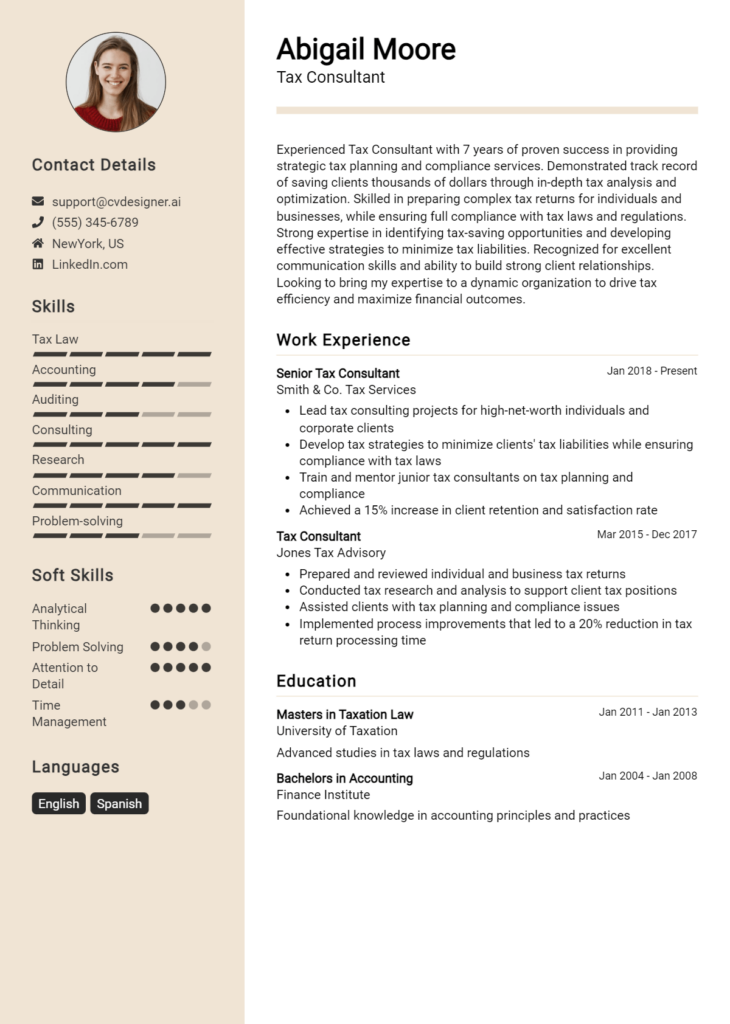

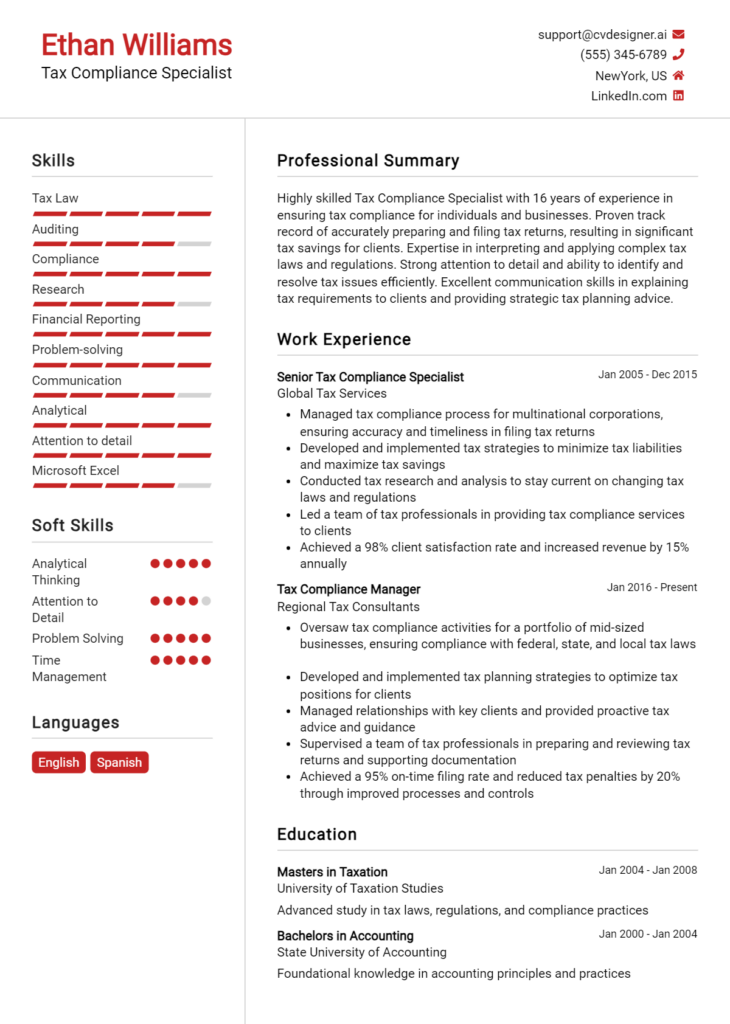

Education and Certifications Section for Tax Research Analyst Resume

The education and certifications section of a Tax Research Analyst resume is crucial in establishing the candidate's academic foundation and professional qualifications. This section not only showcases the relevant degrees and certifications that demonstrate expertise in tax law, accounting, and related fields, but it also reflects the candidate's commitment to continuous learning and staying updated with industry standards. By providing detailed information on relevant coursework, specialized training, and recognized certifications, candidates can significantly enhance their credibility and alignment with the demands of the job role, making them stand out to potential employers.

Best Practices for Tax Research Analyst Education and Certifications

- Include relevant degrees, such as a Bachelor's or Master's in Accounting, Finance, or Taxation.

- List industry-recognized certifications, like CPA (Certified Public Accountant) or EA (Enrolled Agent).

- Highlight any specialized training or workshops related to tax research and compliance.

- Provide specific coursework that aligns with tax research, such as Taxation of Corporations or International Taxation.

- Keep the format consistent and clear, ensuring easy readability for hiring managers.

- Update the section regularly to include any new certifications or educational achievements.

- Use bullet points for clarity and to emphasize key qualifications without overwhelming the reader.

- Focus on the most relevant and recent education and certifications to maintain the section's impact.

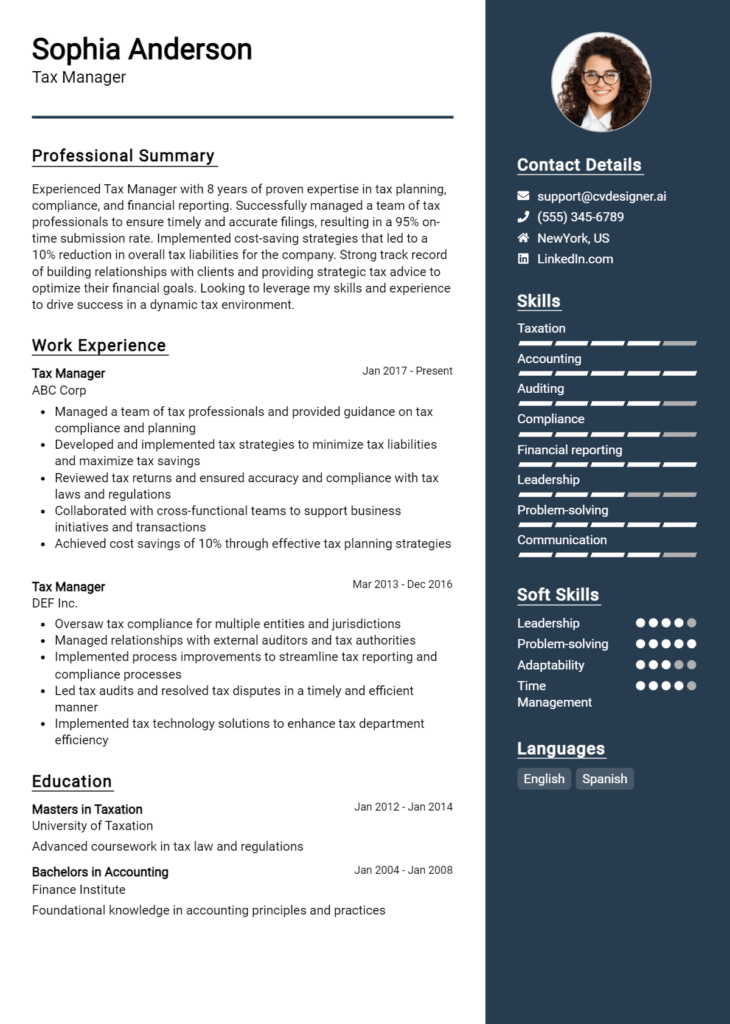

Example Education and Certifications for Tax Research Analyst

Strong Examples

- Bachelor of Science in Accounting, University of XYZ, Graduated May 2020

- Certified Public Accountant (CPA), State of ABC, License #123456, Obtained June 2021

- Certificate in International Taxation, XYZ Institute, Completed August 2022

- Relevant Coursework: Advanced Taxation, Corporate Tax Strategy, Tax Research Methodologies

Weak Examples

- Bachelor of Arts in History, University of XYZ, Graduated May 2000

- Certification in Office Administration, ABC Community College, Completed January 2015

- Outdated Certification: Tax Preparation Course, Completed December 2010

- Relevant Coursework: Introduction to Psychology, Completed March 2019

The examples provided highlight the importance of relevance and currency in the education and certifications section. The strong examples showcase degrees and certifications that are directly aligned with the responsibilities of a Tax Research Analyst, indicating the candidate's expertise and dedication to the field. In contrast, the weak examples illustrate qualifications that are either outdated or unrelated to tax research, which may detract from the candidate's suitability for the role and fail to capture the attention of hiring managers.

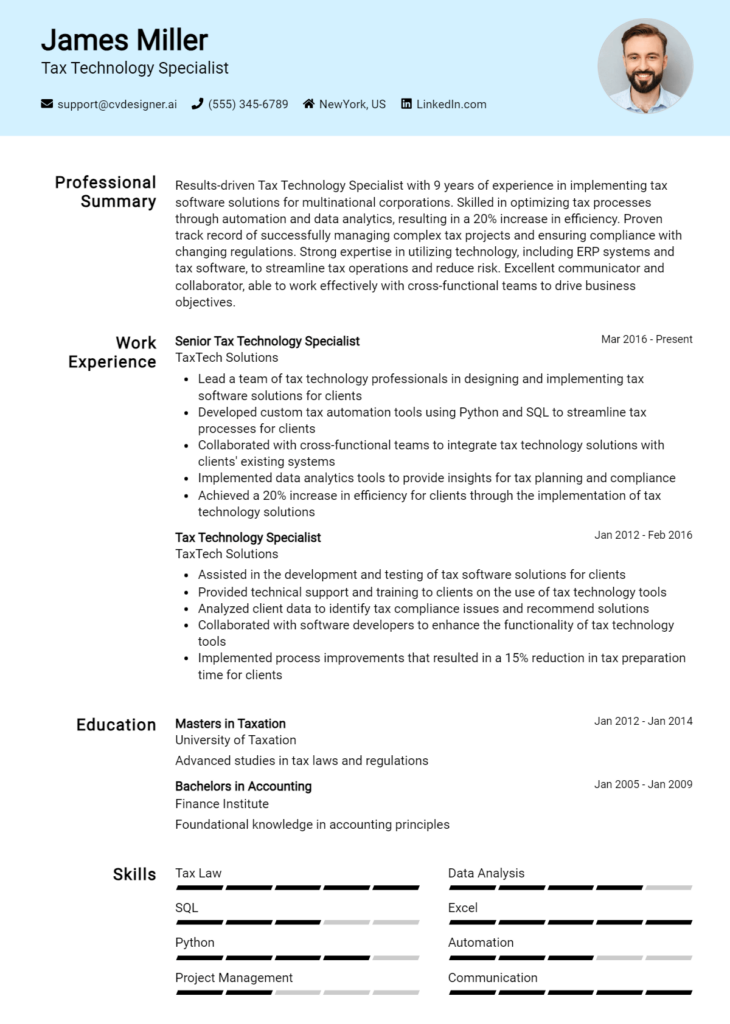

Top Skills & Keywords for Tax Research Analyst Resume

As a Tax Research Analyst, having a robust set of skills is crucial for navigating the complexities of tax regulations and providing insightful analysis. Skills not only demonstrate your qualifications but also highlight your ability to adapt to the evolving landscape of tax laws and practices. A well-crafted resume that emphasizes both hard and soft skills can significantly increase your chances of standing out to potential employers. By showcasing your expertise in tax research methodologies alongside interpersonal and analytical abilities, you can effectively illustrate your value as a candidate.

Top Hard & Soft Skills for Tax Research Analyst

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Communication Skills

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Research Skills

- Initiative

Hard Skills

- Tax Law Knowledge

- Proficiency in Tax Software (e.g., TurboTax, H&R Block)

- Data Analysis Techniques

- Familiarity with Accounting Principles

- Financial Reporting

- Risk Assessment

- Regulatory Compliance

- Microsoft Excel Expertise

- Database Management

- Statistical Analysis

For more insights on the importance of skills and how to effectively present your work experience, consider exploring resources that can help enhance your resume further.

Stand Out with a Winning Tax Research Analyst Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Tax Research Analyst position at [Company Name] as advertised on [where you found the job listing]. With a strong background in tax law, compliance, and research methodologies, coupled with my analytical skills and attention to detail, I am excited about the opportunity to contribute to your team and support [Company Name]'s commitment to delivering exceptional tax solutions.

In my previous role at [Previous Company Name], I was responsible for conducting comprehensive tax research, analyzing legislation and regulatory changes, and providing actionable insights to clients and internal teams. My rigorous approach to tax analysis enabled me to identify opportunities for tax savings and ensure compliance with the ever-evolving tax landscape. Additionally, I collaborated with cross-functional teams to develop strategies that aligned with our clients' financial objectives, resulting in a 15% increase in client satisfaction scores over one year.

I am particularly drawn to [Company Name] because of its reputation for innovation and excellence in tax services. I am eager to bring my expertise in tax research, along with my proficiency in utilizing advanced analytical tools, to help your team navigate complex tax issues and enhance operational efficiency. I am confident that my skills in synthesizing complex information and communicating it clearly will allow me to make significant contributions to your organization.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am excited about the chance to be part of a forward-thinking team and contribute to your continued success in providing top-notch tax research and analysis.

Sincerely,

[Your Name]

[Your LinkedIn Profile]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Tax Research Analyst Resume

When crafting a resume for a Tax Research Analyst position, it's crucial to present your qualifications and experience clearly and effectively. Common mistakes can hinder your chances of standing out in a competitive job market. Avoiding these pitfalls can significantly enhance the impact of your resume and showcase your expertise in tax research. Below are some frequent missteps candidates make when applying for this role:

Vague Job Descriptions: Failing to provide specific details about previous roles can leave hiring managers questioning your actual responsibilities and accomplishments. Use quantifiable results to demonstrate your impact.

Ignoring Relevant Keywords: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Not including industry-specific keywords may result in your resume being overlooked. Tailor your content to reflect the job description.

Lack of Focus on Technical Skills: Tax Research Analysts require a solid foundation in tax laws and regulations. Omitting relevant technical skills, such as proficiency in tax software or analytical tools, can diminish your credibility.

Overlooking Soft Skills: While technical abilities are essential, soft skills like communication, problem-solving, and teamwork are equally important. Failing to highlight these can give a skewed view of your capabilities.

Using an Unprofessional Format: A cluttered or overly complex resume format can distract from your content. Ensure your layout is clean, professional, and easy to read, with clear headings and bullet points.

Not Tailoring Each Application: Sending out a generic resume for every application can signal a lack of genuine interest in the position. Customize your resume for each job to align your experience with the specific requirements.

Neglecting Continuing Education: The tax landscape is constantly evolving. Not mentioning any relevant coursework, certifications, or ongoing training can make you seem outdated in your knowledge.

Excessive Length: A lengthy resume can overwhelm hiring managers. Aim for one page, especially if you have less than ten years of experience, focusing only on the most relevant information.

Conclusion

As we explored the essential skills and responsibilities of a Tax Research Analyst, it’s clear that this role demands a strong analytical mindset, proficiency in tax regulations, and the ability to interpret complex financial data. Key competencies include meticulous research skills, effective communication, and staying updated on legislative changes that impact taxation. Additionally, the importance of collaboration with various departments to ensure compliance and optimize tax strategies cannot be overstated.

In conclusion, if you’re looking to advance your career as a Tax Research Analyst, it’s crucial to have a well-crafted resume that highlights your relevant experience and skills. We encourage you to take a moment to review your resume and ensure it reflects your qualifications effectively.

To assist you in this process, consider utilizing our resources, including resume templates, which can help you format your information professionally. Explore our resume builder for a user-friendly experience that guides you step-by-step in creating your resume. Additionally, check out our resume examples for inspiration, and don't forget to enhance your application with a polished cover letter template. Take action today and ensure your resume stands out in the competitive field of tax research!