27 Private Banker Resume Skills That Stand Out in 2025

As a Private Banker, possessing the right skills is crucial to effectively manage clients' wealth and provide tailored financial advice. In this section, we will explore the top skills that are essential for success in this role, enabling you to build strong relationships, offer personalized services, and navigate complex financial landscapes. Highlighting these skills on your resume will demonstrate your expertise and suitability for the position, setting you apart in a competitive job market.

Best Private Banker Technical Skills

In the competitive field of private banking, possessing the right technical skills is crucial for building client relationships, managing portfolios, and ensuring regulatory compliance. Highlighting these skills on your resume can significantly enhance your employability and showcase your capacity to handle complex financial tasks.

Financial Analysis

Financial analysis involves evaluating financial data to guide investment decisions and risk management strategies, making it a core competency for private bankers.

How to show it: Quantify your analysis outcomes, such as improved portfolio performance percentages or reduced risk levels.

Investment Strategy Development

This skill includes crafting tailored investment strategies that align with clients' financial goals and risk tolerance, essential for building long-term relationships.

How to show it: Detail specific strategies you developed and their impact on client portfolios, highlighting returns achieved.

Regulatory Compliance

A strong understanding of financial regulations is vital for ensuring that all banking activities meet legal requirements, mitigating risks for both the bank and clients.

How to show it: Include examples of compliance audits passed or training sessions conducted to illustrate your expertise.

Risk Assessment

Risk assessment involves identifying and analyzing potential risks associated with investment opportunities, which is key to protecting client assets.

How to show it: Share metrics on how your assessments led to reduced losses or increased asset safety.

Client Relationship Management

Managing client relationships effectively is crucial for understanding their needs and ensuring satisfaction, which directly influences retention rates.

How to show it: Highlight client retention statistics or growth in client referrals as a result of your management strategies.

Portfolio Management

Portfolio management encompasses overseeing a client's investment portfolio to meet their financial objectives, requiring analytical and strategic thinking.

How to show it: Provide examples of portfolios managed, along with performance metrics such as ROI.

Tax Optimization

Tax optimization strategies help clients minimize their tax liabilities while maximizing investment returns, showcasing your value as a strategic advisor.

How to show it: Detail specific tax strategies implemented and the resulting savings or benefits for clients.

Financial Planning

Financial planning is the process of creating comprehensive strategies for clients to achieve their long-term financial goals, essential for effective wealth management.

How to show it: Illustrate the success of financial plans you’ve developed by showcasing goal achievement rates.

Market Research

Conducting thorough market research allows private bankers to provide informed recommendations to clients, enhancing their investment decisions.

How to show it: Include instances where your market insights led to successful investment choices or opportunities.

Wealth Management Software Proficiency

Familiarity with wealth management software is essential for managing client data and optimizing financial strategies efficiently.

How to show it: List specific software tools you are proficient in and any certifications obtained.

Financial Modeling

Financial modeling skills are crucial for predicting future financial performance and making data-driven investment decisions.

How to show it: Describe successful models you've created and their impact on decision-making processes.

Best Private Banker Soft Skills

In the competitive world of private banking, possessing strong soft skills is just as important as technical knowledge. These interpersonal abilities enable private bankers to build lasting relationships with clients, effectively communicate complex financial concepts, and navigate challenges in a dynamic environment. Here are some essential soft skills that every private banker should highlight on their resume.

Effective Communication

Clear communication is vital for private bankers to explain financial products and strategies to clients. It helps in building trust and ensuring clients' understanding of their financial decisions.

How to show it: Include examples of presentations or reports created for clients, showcasing clarity and effectiveness.

Active Listening

Active listening ensures that a private banker fully understands a client's needs and concerns, fostering stronger relationships and tailored financial solutions.

How to show it: Describe situations where you successfully identified client needs through attentive listening.

Problem-Solving

Clients often face unique financial challenges. Strong problem-solving skills enable private bankers to devise effective strategies and solutions that align with client goals.

How to show it: Highlight specific instances where you resolved complex client issues, emphasizing the outcome.

Time Management

Private bankers juggle multiple clients and tasks, making time management crucial for prioritizing responsibilities and meeting deadlines.

How to show it: Provide examples of how you efficiently managed your workload to meet or exceed client expectations.

Adaptability

The financial landscape is constantly changing. Adaptability allows private bankers to adjust strategies and approaches in response to market trends and client needs.

How to show it: Illustrate your ability to pivot strategies in response to changing circumstances or client requests.

Teamwork

Collaboration with colleagues and financial advisors is essential for delivering comprehensive services to clients. Strong teamwork promotes a unified approach to client management.

How to show it: Mention collaborative projects or initiatives where you contributed to team success.

Empathy

Understanding clients' emotions and perspectives fosters deeper connections and allows private bankers to offer personalized services that resonate with client values.

How to show it: Demonstrate how you used empathy to enhance client relationships or resolve conflicts.

Negotiation Skills

Negotiation is key in securing favorable terms and agreements for clients. Strong negotiation skills can lead to better outcomes in financial dealings.

How to show it: Share specific examples of successful negotiations that benefited your clients.

Networking

Building a strong professional network is essential for private bankers to identify opportunities and connect clients with valuable resources.

How to show it: Highlight your participation in industry events or organizations that expanded your professional network.

Attention to Detail

Attention to detail is crucial for ensuring accuracy in financial documents and transactions, which helps in maintaining client trust and compliance.

How to show it: Provide examples of how your meticulousness prevented errors or improved service quality.

Emotional Intelligence

Emotional intelligence enables private bankers to perceive and manage their own emotions as well as those of their clients, enhancing interpersonal interactions.

How to show it: Describe situations where you effectively navigated emotionally charged discussions with clients.

How to List Private Banker Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in a competitive job market. Highlighting your qualifications can significantly influence hiring managers, especially for specialized roles like a Private Banker. Skills can be prominently showcased in three main sections: the Resume Summary, Resume Work Experience, Resume Skills Section, and the Cover Letter.

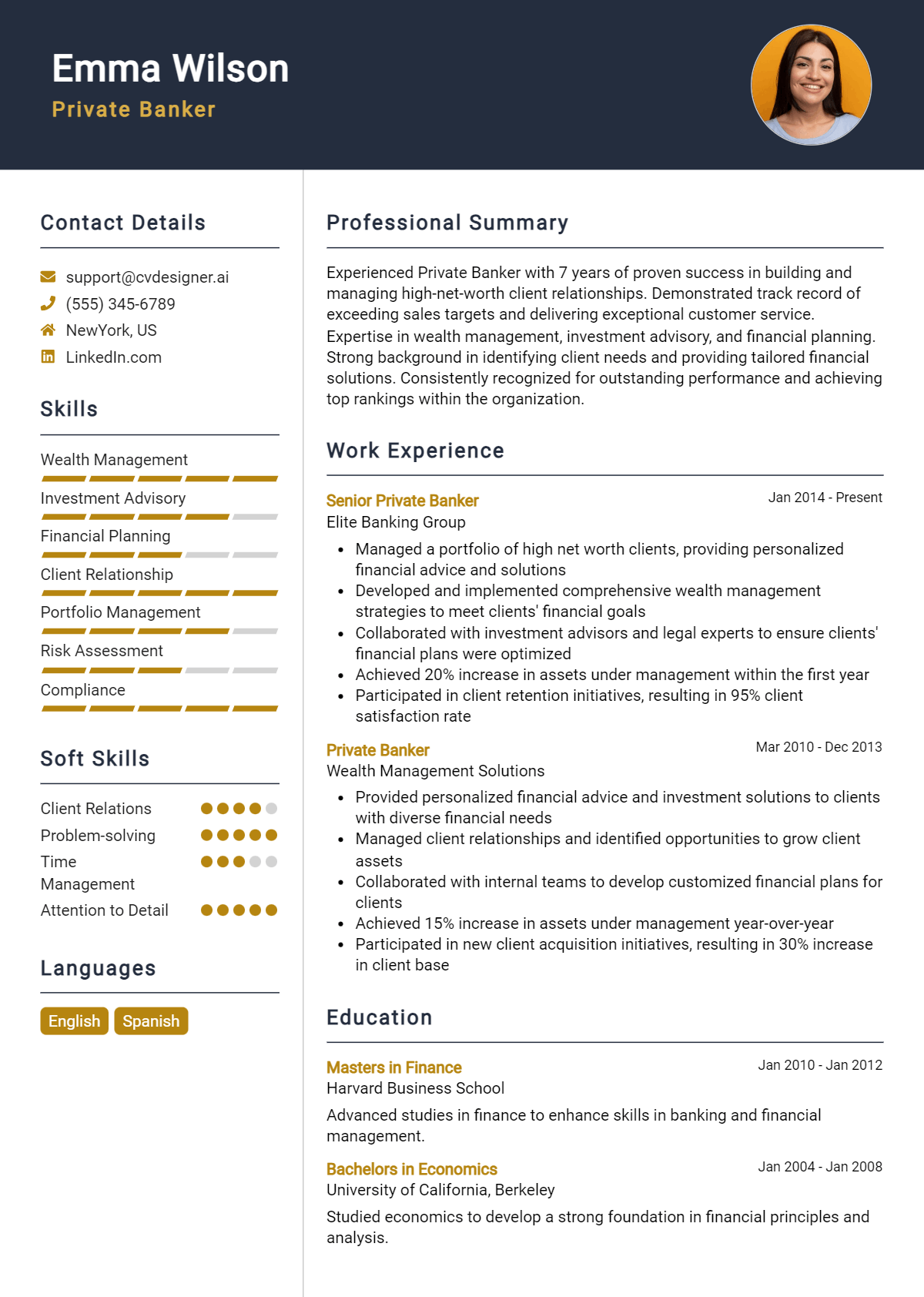

for Resume Summary

Showcasing your Private Banker skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This initial impression can set the tone for the rest of your resume.

Example

Dynamic Private Banker with over 5 years of experience in wealth management, client relationship building, and investment strategies. Proven track record in enhancing client portfolios and maximizing financial outcomes. Passionate about delivering personalized banking solutions.

for Resume Work Experience

The work experience section offers an excellent opportunity to demonstrate how your Private Banker skills have been applied in real-world scenarios. This is where you can detail your contributions and achievements.

Example

- Developed tailored financial plans utilizing analytical skills to assess client needs, resulting in a 30% increase in client satisfaction.

- Managed a diverse portfolio worth over $50 million, showcasing strong investment management expertise.

- Established and maintained long-term relationships with clients through excellent communication skills, leading to a 20% growth in referrals.

- Collaborated with cross-functional teams to implement innovative banking solutions, demonstrating effective teamwork and problem-solving skills.

for Resume Skills

The skills section is your chance to showcase both technical and transferable skills. A well-balanced mix of hard and soft skills enhances your overall qualifications and appeal to potential employers.

Example

- Wealth Management

- Client Relationship Building

- Investment Strategies

- Financial Analysis

- Regulatory Compliance

- Negotiation Skills

- Market Research

- Risk Assessment

for Cover Letter

A cover letter allows candidates to delve deeper into the skills mentioned in their resume while adding a personal touch. Highlighting 2-3 key skills that align with the job description can create an impactful narrative about your qualifications.

Example

In my previous role, my wealth management expertise and client relationship building skills enabled me to increase client portfolios by 40%. I am eager to bring this drive for enhancing financial outcomes to your team, ensuring personalized banking solutions for your clients.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job and illustrates your potential contributions to the company.

The Importance of Private Banker Resume Skills

In the competitive field of private banking, showcasing relevant skills on a resume is crucial for candidates seeking to differentiate themselves from others. A well-crafted skills section not only highlights a candidate's qualifications but also aligns their expertise with the specific requirements of the role. By presenting these skills effectively, candidates can capture the attention of recruiters and increase their chances of landing an interview.

- Private banking requires a unique blend of financial acumen and interpersonal skills. Highlighting these abilities can demonstrate your capability to manage client relationships effectively while providing tailored financial solutions.

- Employers often look for candidates who possess strong analytical skills. By emphasizing your analytical capabilities, you show that you can assess clients' financial situations and develop strategic investment plans accordingly.

- Communication skills are paramount in private banking. Including this skill indicates your ability to articulate complex financial concepts clearly and engage clients in meaningful conversations to build trust.

- Knowledge of financial regulations and compliance is essential. Showcasing this skill assures employers that you understand the legal landscape and can navigate it while protecting the firm's and clients' interests.

- Demonstrating proficiency in financial software and tools can set you apart. This skill reflects your ability to leverage technology for better financial management and reporting, which is increasingly important in today's banking environment.

- Strong problem-solving abilities are critical in private banking. Highlighting this skill indicates that you can think on your feet and develop innovative solutions to meet clients' diverse needs.

- Networking skills are vital for building and maintaining a robust client base. By emphasizing your ability to cultivate professional relationships, you demonstrate your potential to grow the business and enhance client loyalty.

- Understanding of investment products and portfolio management is a key component of a private banker’s role. Highlighting this knowledge shows potential employers that you can offer comprehensive services to clients.

For more guidance on crafting an effective resume, you can explore Resume Samples.

How To Improve Private Banker Resume Skills

In the competitive world of private banking, continuously improving your skills is essential for career advancement and providing exceptional service to clients. The financial landscape is ever-evolving, and staying updated with the latest trends, regulations, and client expectations can set you apart from your peers. By enhancing your skill set, you not only increase your value to your current employer but also position yourself as a sought-after candidate for future opportunities.

- Engage in continuous education by attending relevant workshops and seminars focused on financial products and market trends.

- Pursue professional certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) to demonstrate your expertise.

- Join professional associations and networks to connect with other private bankers and share best practices.

- Stay informed about regulatory changes and compliance requirements in the financial industry through online courses or industry publications.

- Develop strong interpersonal and communication skills by participating in public speaking or negotiation workshops.

- Enhance your analytical skills by utilizing financial modeling and data analysis tools to better assess client portfolios.

- Solicit feedback from mentors and colleagues to identify areas for improvement and actively work on them.

Frequently Asked Questions

What skills are essential for a Private Banker?

Essential skills for a Private Banker include strong financial acumen, excellent communication abilities, and a deep understanding of investment strategies. Private Bankers must also possess analytical skills to assess client needs and risk tolerance, as well as relationship management skills to build and maintain client trust. Additionally, proficiency in financial software and regulatory knowledge is crucial for ensuring compliance and successful client interactions.

How important is client relationship management in a Private Banker role?

Client relationship management is paramount in a Private Banker role, as it directly impacts client satisfaction and retention. Building strong, trusting relationships allows Private Bankers to better understand their clients' financial goals and tailor services accordingly. Successful Private Bankers leverage these relationships to provide personalized advice, foster loyalty, and ultimately drive business growth through referrals and long-term engagement.

What role does risk assessment play in a Private Banker’s responsibilities?

Risk assessment is a critical component of a Private Banker’s responsibilities, as it involves evaluating the potential risks associated with various investment options and financial strategies. By accurately assessing a client’s risk tolerance and financial situation, Private Bankers can recommend suitable investment products while ensuring that clients are aware of potential market fluctuations. This skill helps in safeguarding client assets and aligning investment strategies with their long-term goals.

How do financial planning skills contribute to a Private Banker’s effectiveness?

Financial planning skills are vital for a Private Banker’s effectiveness, as they help in creating comprehensive financial strategies tailored to individual client needs. These skills enable Private Bankers to analyze clients' current financial positions, project future needs, and develop actionable plans to achieve desired outcomes. A strong grasp of tax implications, estate planning, and retirement strategies enhances the value Private Bankers provide, positioning them as trusted advisors in their clients’ financial journeys.

What technological skills are important for a Private Banker?

Technological skills are increasingly important for Private Bankers, as they often rely on financial software and tools to manage client portfolios, analyze data, and conduct transactions efficiently. Proficiency in customer relationship management (CRM) systems, financial modeling software, and data analysis tools enhances a Private Banker’s ability to provide timely and accurate advice. Staying updated on technological trends also allows Private Bankers to leverage innovative solutions that can improve client engagement and service delivery.

Conclusion

Including Private Banker skills in your resume is crucial for demonstrating your expertise and competitiveness in the financial industry. By showcasing relevant skills such as relationship management, financial analysis, and investment strategies, candidates can stand out from the competition and provide significant value to potential employers. Remember, a well-crafted resume not only highlights your qualifications but also reflects your professionalism and dedication.

As you refine your skills and tailor your job application, keep in mind that every effort you make brings you one step closer to your career goals. Take the time to explore our resume templates, utilize our resume builder, and review resume examples to create a compelling application. Don't forget to enhance your chances with our cover letter templates as well!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.