Private Banker Core Responsibilities

A Private Banker plays a crucial role in managing high-net-worth clients' financial portfolios, requiring a blend of technical, operational, and problem-solving skills. They bridge various departments, working closely with investment, compliance, and risk management teams to deliver tailored financial solutions. Success in this role hinges on strong analytical abilities, attention to detail, and excellent communication skills, all of which contribute to the organization's goals. A well-structured resume can effectively highlight these qualifications, showcasing the candidate's suitability for the position.

Common Responsibilities Listed on Private Banker Resume

- Develop and maintain relationships with high-net-worth clients.

- Conduct comprehensive financial assessments and risk analyses.

- Create personalized investment strategies and financial plans.

- Coordinate with various departments to provide integrated financial services.

- Monitor client portfolios and suggest adjustments as needed.

- Stay updated on market trends and regulatory changes.

- Provide exceptional customer service to enhance client satisfaction.

- Prepare detailed reports and presentations for clients.

- Ensure compliance with financial regulations and internal policies.

- Identify new business opportunities and initiate client outreach.

- Assist clients with estate planning and wealth transfer strategies.

- Educate clients on investment options and financial products.

High-Level Resume Tips for Private Banker Professionals

In today's competitive financial landscape, a well-crafted resume is crucial for Private Banker professionals aiming to make a lasting impression on potential employers. As the first point of contact between a candidate and a hiring manager, the resume must encapsulate not only the candidate's skills and experience but also their achievements in the field. It's essential that the resume reflects a deep understanding of both client needs and financial products, showcasing the unique value that a Private Banker brings to the table. This guide will provide practical and actionable resume tips specifically tailored for Private Banker professionals to help them stand out in the hiring process.

Top Resume Tips for Private Banker Professionals

- Tailor your resume to the specific job description, using keywords and phrases that align with the job requirements.

- Highlight your relevant experience in wealth management, investment strategies, or client relationship management.

- Quantify your achievements to demonstrate your impact, such as the percentage increase in client assets under management or the number of new accounts acquired.

- Showcase industry-specific skills, such as knowledge of financial regulations, investment products, and market trends.

- Include client testimonials or endorsements that highlight your relationship-building skills and professionalism.

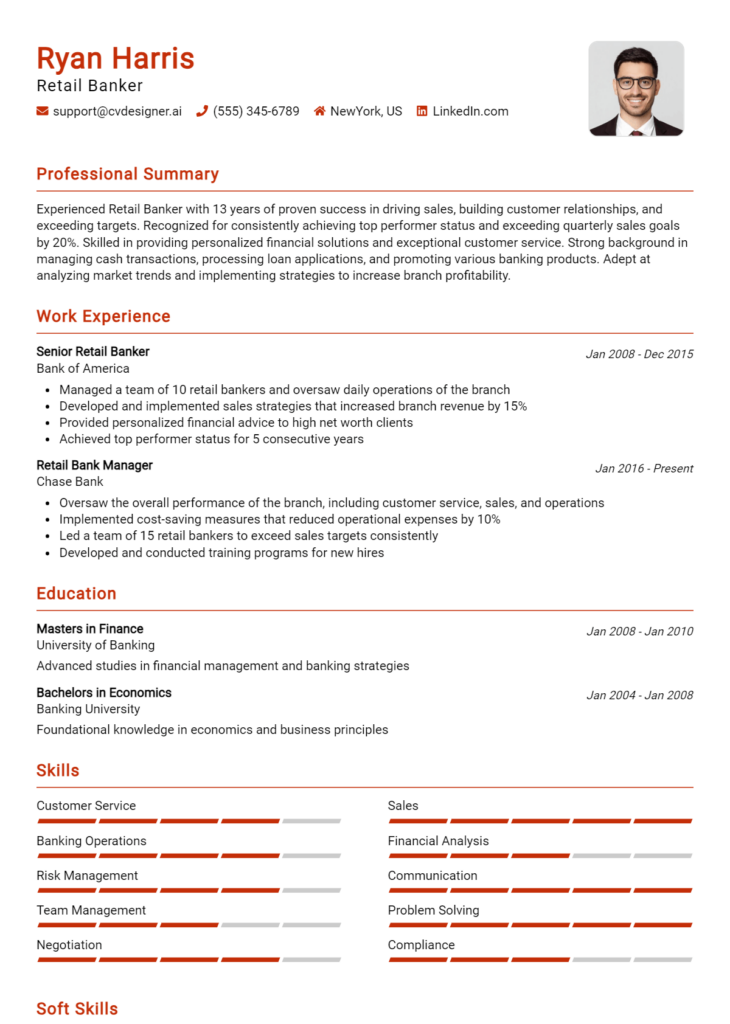

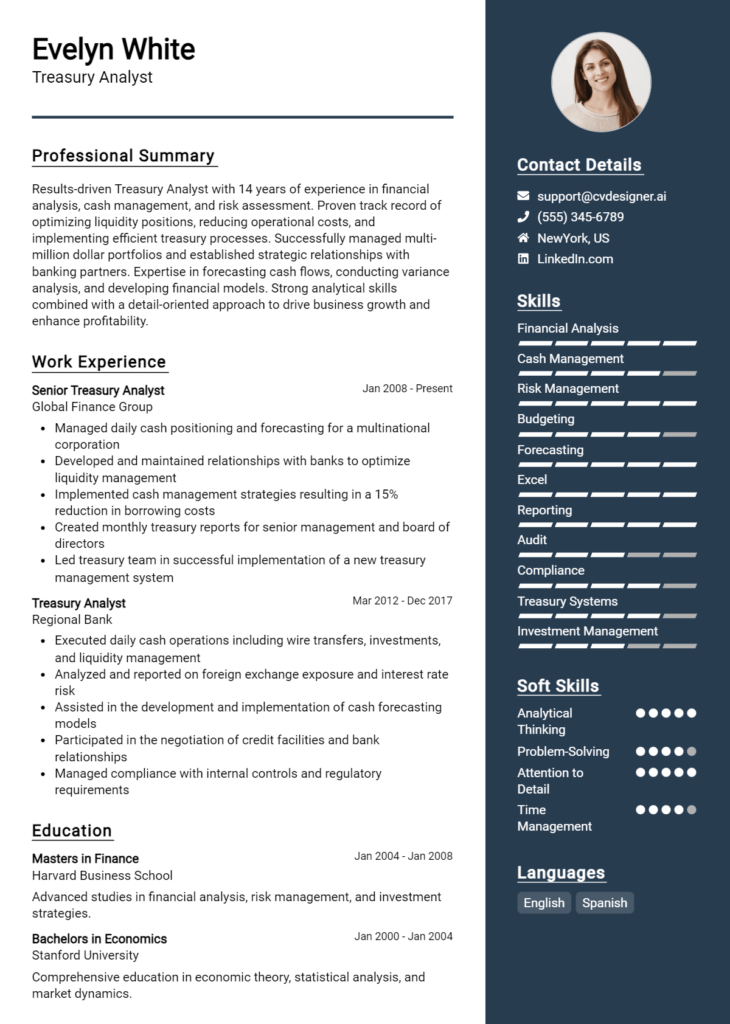

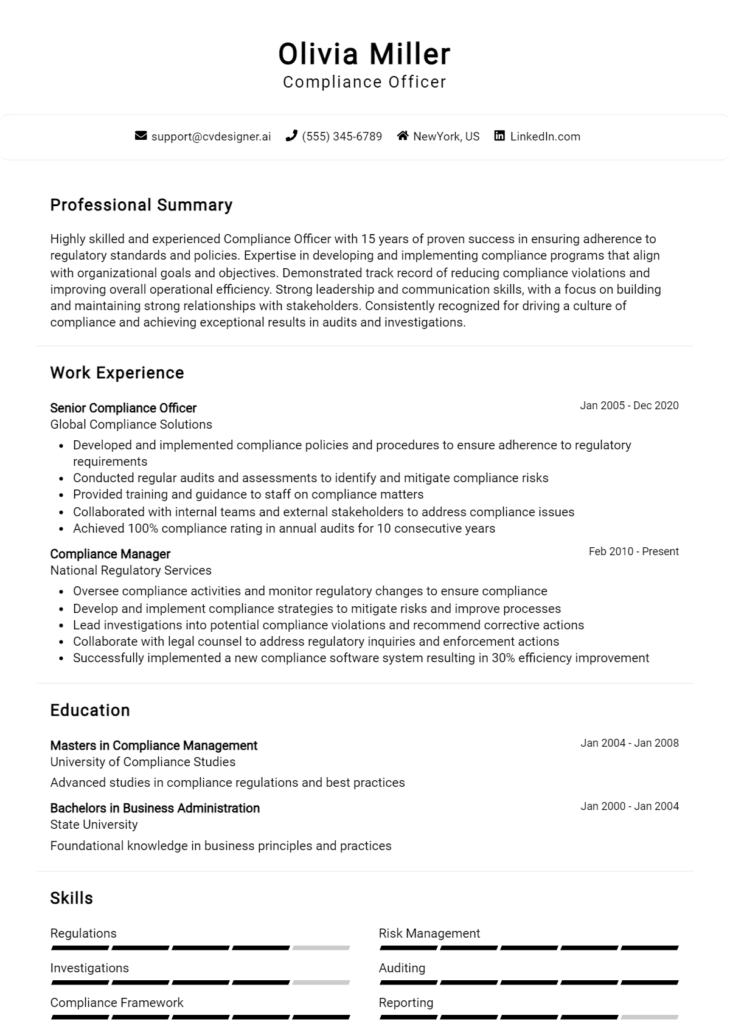

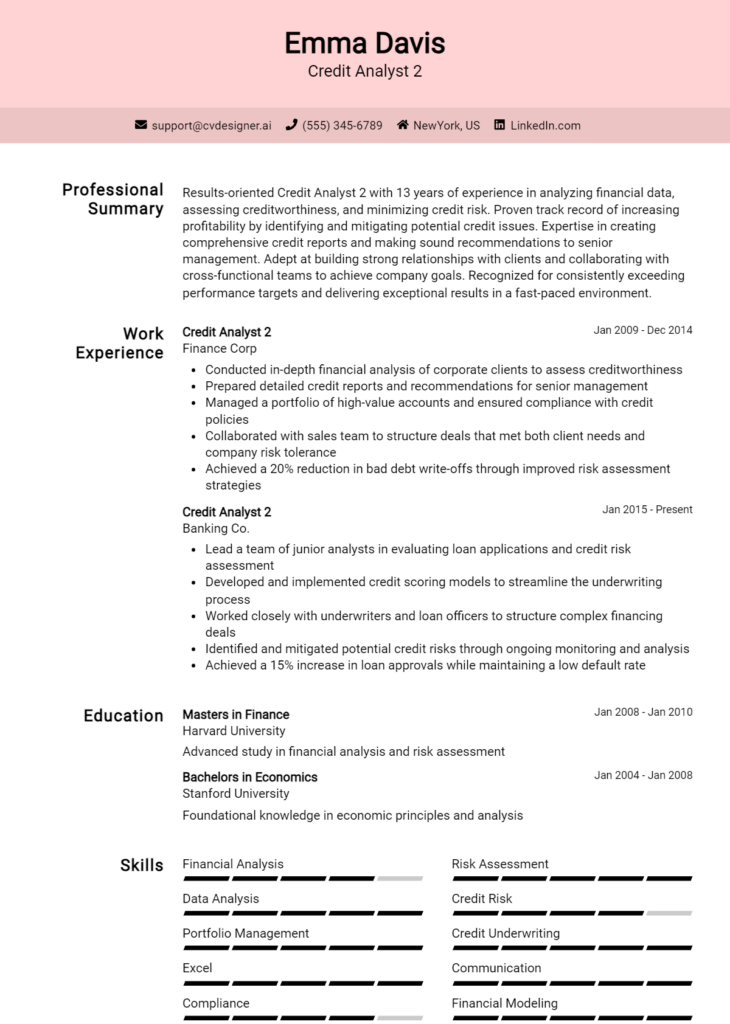

- Utilize a clean, professional layout that enhances readability, ensuring key information stands out.

- Incorporate professional certifications and licenses relevant to private banking, such as CFA or CFP, to bolster your qualifications.

- Keep your resume concise, ideally one to two pages, focusing on the most relevant and impactful information.

- Use action verbs to describe your responsibilities and achievements for a more dynamic presentation of your experience.

- Consider including a brief summary statement at the top of your resume to highlight your career objectives and unique strengths.

By implementing these tips, Private Banker professionals can significantly increase their chances of landing a job in this competitive field. A polished and strategically tailored resume not only showcases your qualifications but also communicates your dedication to excellence and your understanding of the industry, setting you apart from other candidates.

Why Resume Headlines & Titles are Important for Private Banker

In the competitive field of private banking, a well-crafted resume headline or title serves as a critical first impression for candidates seeking to stand out to hiring managers. A strong headline captures attention immediately, succinctly summarizing a candidate’s key qualifications and unique value proposition in just a few words. It should be concise, relevant, and tailored to the specific role being applied for, making it easier for hiring managers to quickly assess a candidate's fit for the position. An effective resume headline not only showcases the candidate's expertise but also sets the tone for the rest of the resume, guiding the reader to recognize the applicant's potential contributions to the organization.

Best Practices for Crafting Resume Headlines for Private Banker

- Keep it concise: Aim for one impactful sentence or phrase.

- Be role-specific: Clearly indicate your expertise in private banking.

- Highlight key qualifications: Include specific skills or experiences relevant to the job.

- Use strong action words: Choose dynamic verbs that convey confidence.

- Incorporate relevant keywords: Use terms from the job description to align with employer expectations.

- Make it memorable: Craft a headline that resonates with hiring managers.

- Avoid jargon: Use clear language that is easily understood.

- Adjust as needed: Tailor your headline for each job application to enhance relevance.

Example Resume Headlines for Private Banker

Strong Resume Headlines

"Results-Driven Private Banker with 10+ Years of Experience in Wealth Management and Client Acquisition"

“Expert Financial Advisor Specializing in Customized Investment Strategies for High-Net-Worth Individuals”

“Client-Centric Private Banker with Proven Track Record of Exceeding Sales Targets and Enhancing Client Loyalty”

Weak Resume Headlines

“Banking Professional”

“Experienced Worker”

The strong headlines are effective because they are specific, engaging, and tailored to the private banking role, allowing hiring managers to quickly identify the candidate’s strengths and relevant experience. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail, making them easily forgettable and ineffective in showcasing the candidate's unique qualifications. Strong headlines set a foundation for a compelling resume, while weak ones risk relegating the candidate to the pile of generic applicants.

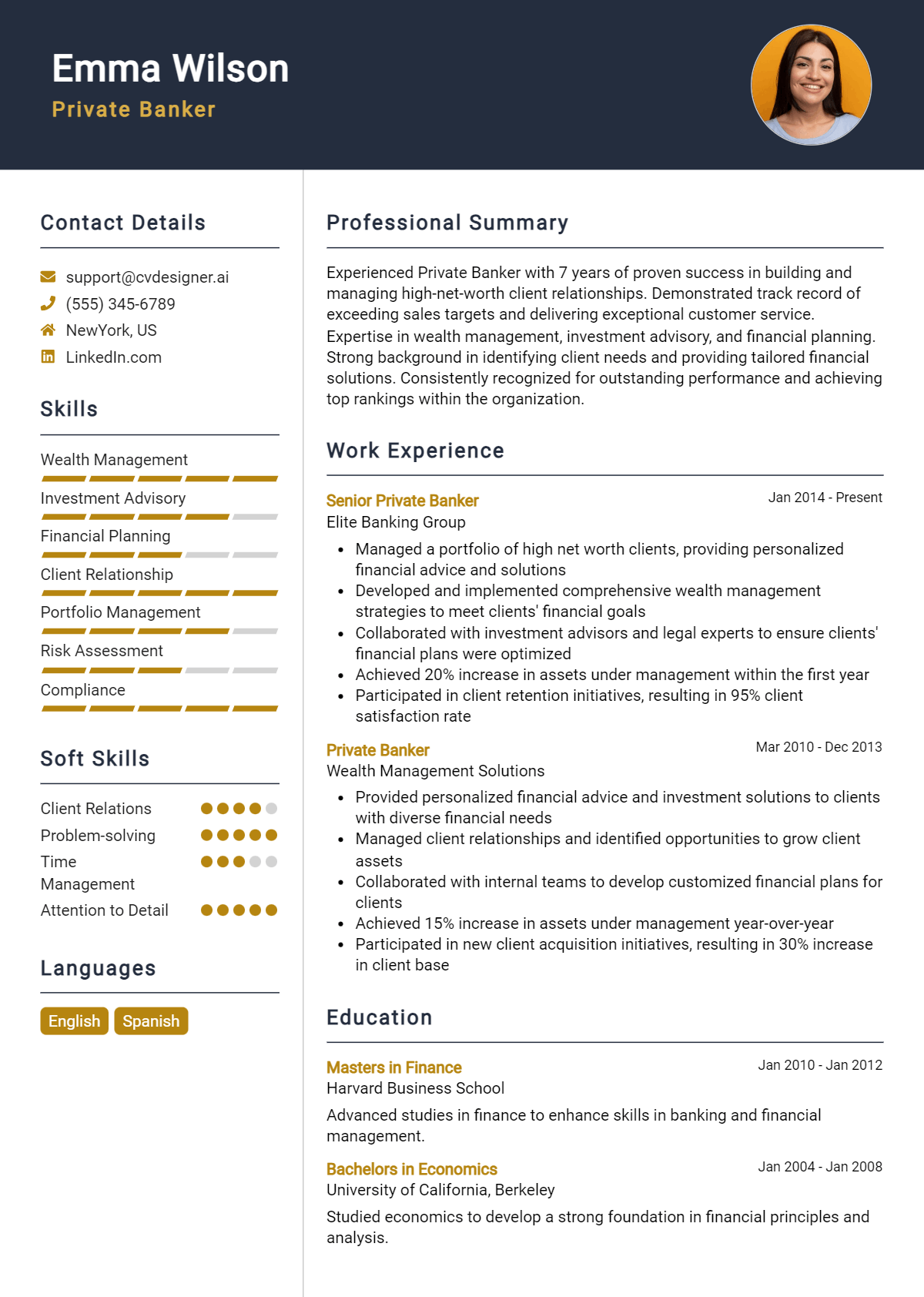

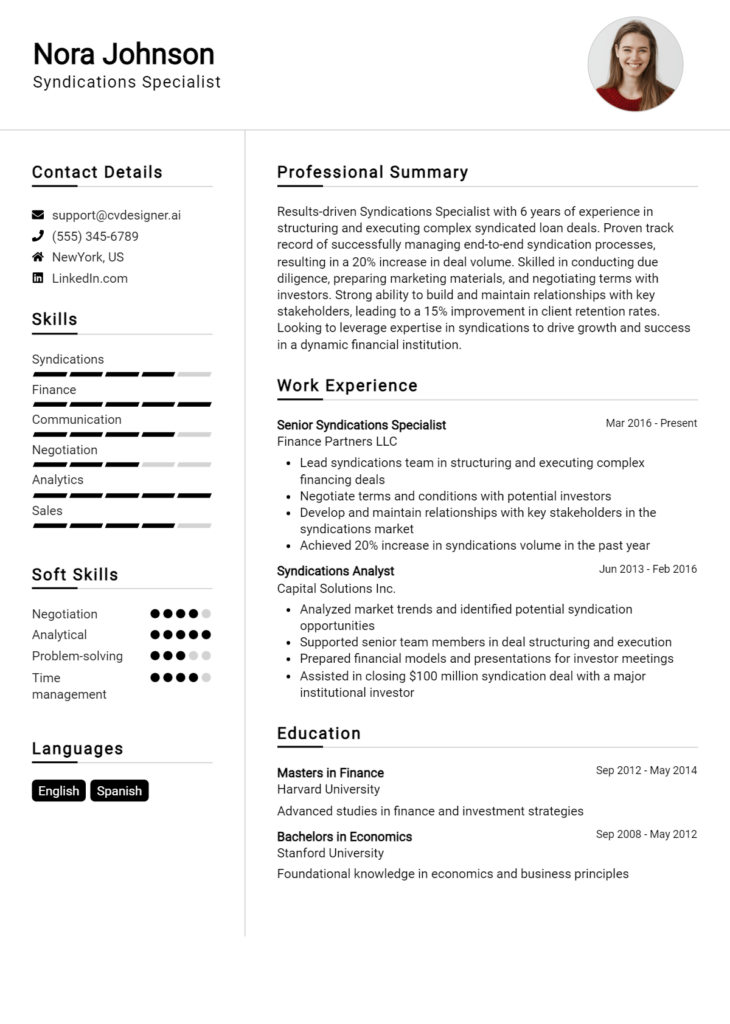

Writing an Exceptional Private Banker Resume Summary

A resume summary for a Private Banker is a crucial component that can significantly influence the hiring decision. It serves as a powerful introduction that quickly captures the attention of hiring managers by succinctly showcasing key skills, relevant experience, and notable accomplishments. A well-crafted summary can effectively communicate a candidate's value proposition, making it easier for employers to see their fit for the role. To stand out in a competitive field, the summary should be concise, impactful, and tailored specifically to the job being applied for, demonstrating an understanding of the bank's needs and expectations.

Best Practices for Writing a Private Banker Resume Summary

- Quantify achievements: Use numbers and percentages to demonstrate your impact and effectiveness.

- Focus on relevant skills: Highlight skills that are aligned with the job description and essential for a Private Banker.

- Tailor the summary: Customize the summary for each job application to reflect the specific requirements of the role.

- Keep it concise: Aim for 3-5 sentences that are direct and to the point.

- Use action verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Include industry-specific terminology: Utilize jargon that is familiar within the banking sector to demonstrate expertise.

- Showcase customer relationship management: Emphasize skills in building and maintaining client relationships.

- Highlight compliance and risk management knowledge: Mention any relevant experience in these critical areas.

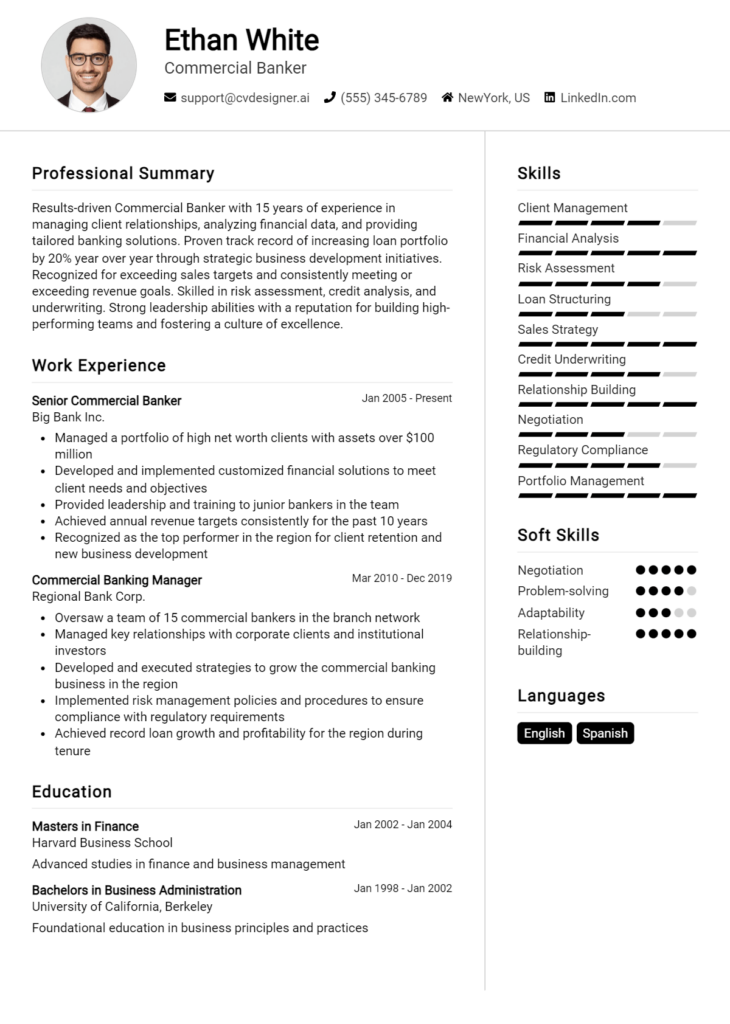

Example Private Banker Resume Summaries

Strong Resume Summaries

Dynamic Private Banker with over 10 years of experience managing high-net-worth portfolios, achieving an average annual growth rate of 15% for clients. Expert in developing personalized financial strategies and fostering long-term client relationships, resulting in a 25% increase in client retention rates.

Results-driven Private Banker with a proven track record of increasing assets under management by 30% in just two years. Adept at identifying client needs and delivering tailored investment solutions, complemented by strong knowledge of compliance and regulatory standards.

Dedicated Private Banker skilled in client relationship management and investment analysis, successfully generating $5 million in new assets through targeted networking and referrals. Recognized for exceptional customer service and a client-first approach that has led to a 95% satisfaction rating.

Weak Resume Summaries

Experienced banker looking for a position to use my skills in finance and customer service.

Private Banker with some experience in managing client accounts and providing financial advice.

The strong resume summaries stand out due to their specificity, quantifiable results, and direct relevance to the Private Banker role. They effectively highlight the candidate's achievements and skills, making it easier for hiring managers to recognize their qualifications. In contrast, the weak resume summaries lack detail and measurable outcomes, making them generic and less impactful, which is unlikely to capture the interest of employers.

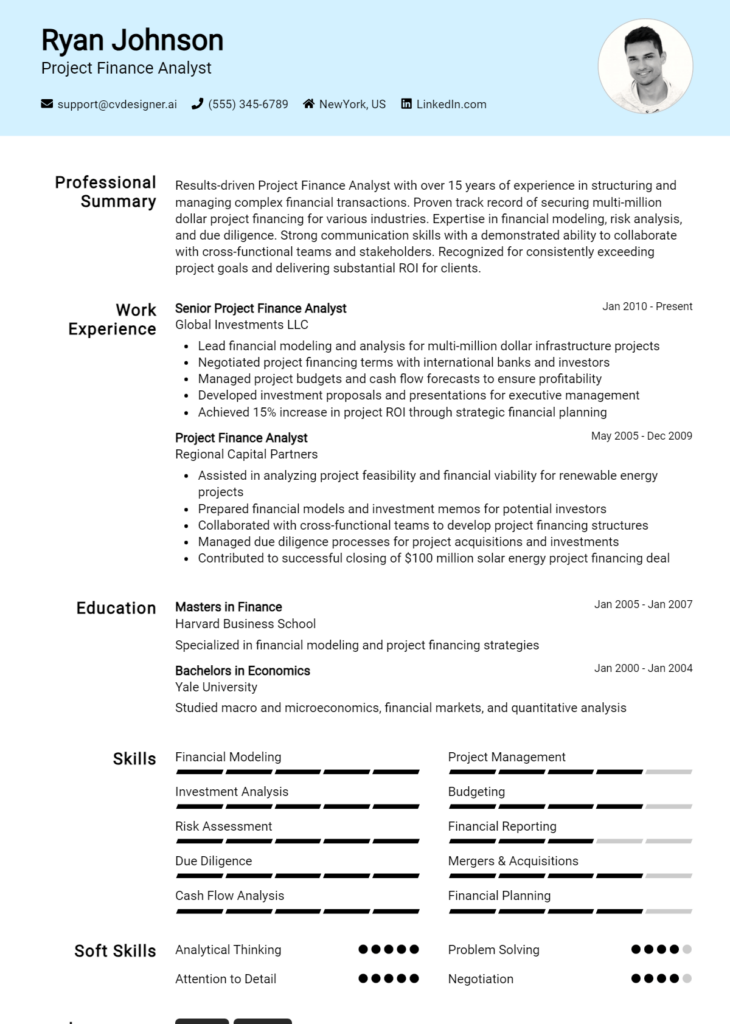

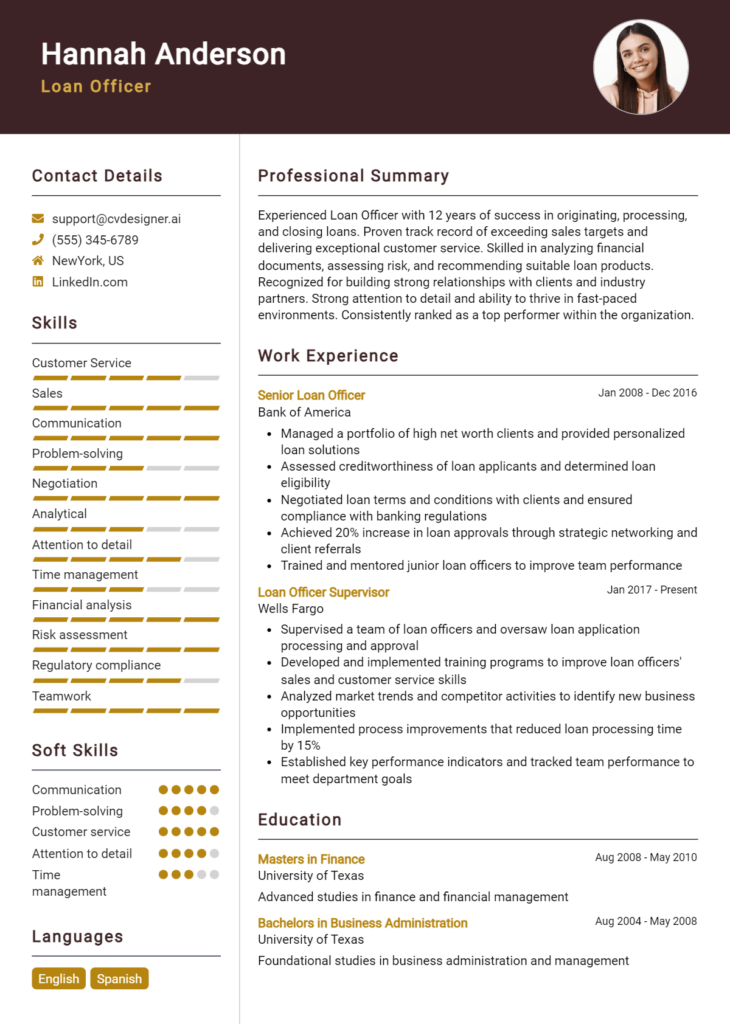

Work Experience Section for Private Banker Resume

The work experience section of a Private Banker resume is crucial as it provides a comprehensive overview of a candidate's professional journey, highlighting their technical skills, team management abilities, and the capacity to deliver high-quality financial products and services. This section serves as a platform for candidates to demonstrate their expertise in wealth management, client relationship building, and investment strategies. By quantifying achievements—such as assets under management, portfolio growth percentages, or client satisfaction ratings—and aligning work history with industry standards, candidates can effectively convey their value to potential employers.

Best Practices for Private Banker Work Experience

- Use specific metrics to quantify achievements, such as percentage growth in client portfolios or total assets managed.

- Highlight technical skills relevant to the banking industry, including financial analysis, risk management, and investment strategy development.

- Demonstrate leadership abilities by detailing experience in managing teams or projects, showcasing the ability to drive results.

- Include examples of collaboration with other departments, such as compliance, marketing, or investment teams, to illustrate teamwork and holistic service delivery.

- Focus on relevant industry certifications or training that enhance your expertise in private banking.

- Tailor your experience to align with job descriptions and industry standards, ensuring relevance to the position applied for.

- Utilize action verbs to convey a sense of initiative and impact, such as "developed," "led," or "achieved."

- Maintain a clear and concise format, making it easy for hiring managers to quickly identify key accomplishments and skills.

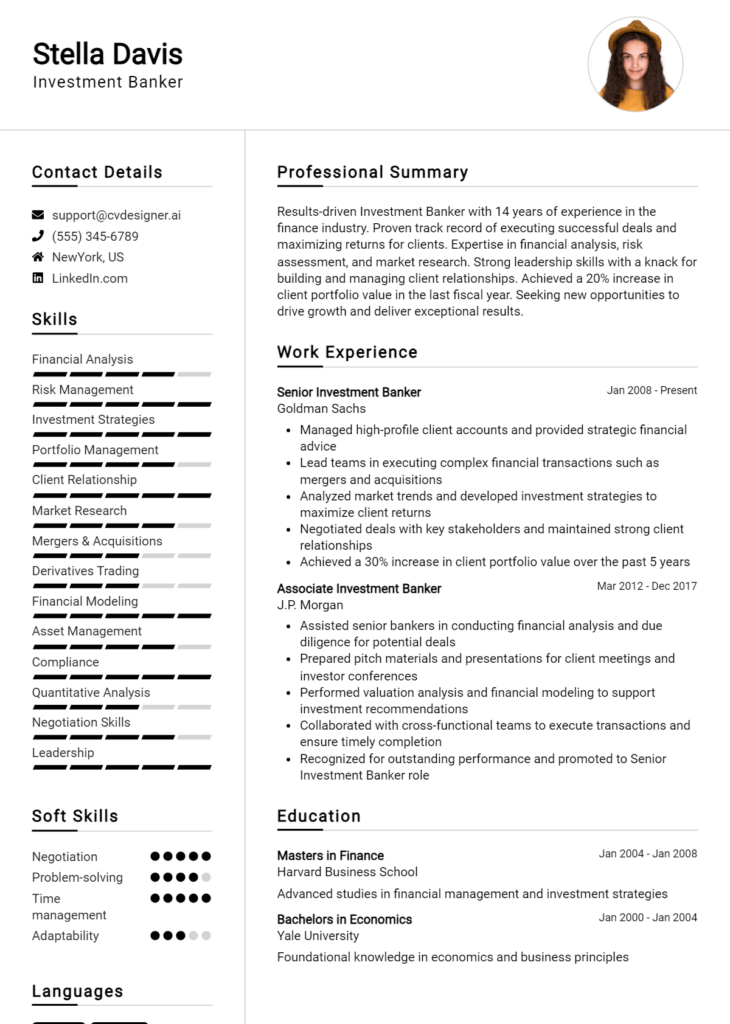

Example Work Experiences for Private Banker

Strong Experiences

- Managed a portfolio of high-net-worth clients, achieving a 25% increase in assets under management over two years through tailored investment strategies.

- Led a team of five financial advisors in developing comprehensive wealth management plans, resulting in a 30% improvement in client satisfaction scores.

- Implemented a new client onboarding process that reduced onboarding time by 40%, enhancing overall client experience and retention rates.

- Collaborated with the risk management department to design a risk assessment framework, reducing client portfolio volatility by 15% during market downturns.

Weak Experiences

- Responsible for client relations and general banking duties.

- Assisted in managing accounts and provided support to other bankers.

- Participated in team meetings and contributed to discussions.

- Worked on various projects with minimal impact on overall performance.

The examples listed as strong experiences are considered impactful due to their quantifiable outcomes and clear demonstration of leadership, technical expertise, and collaboration. They provide specific metrics and achievements that illustrate the candidate's contributions to their previous roles. In contrast, the weak experiences lack detail and measurable results, making them vague and unimpressive. These statements do not convey a clear understanding of the candidate's capabilities or their potential value to a prospective employer.

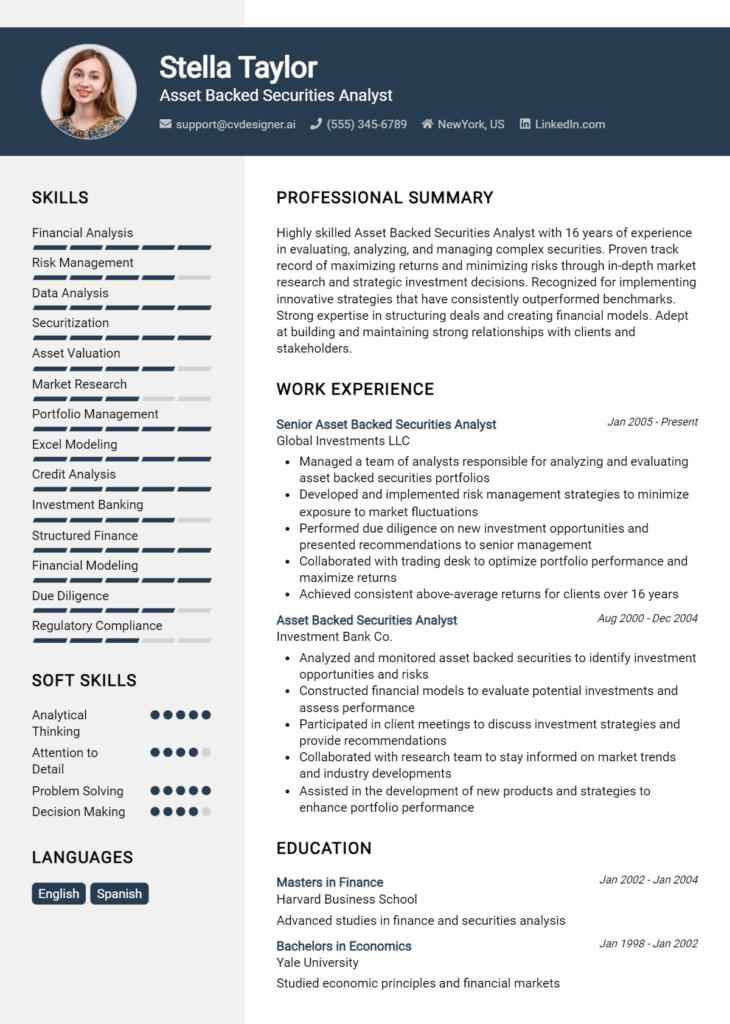

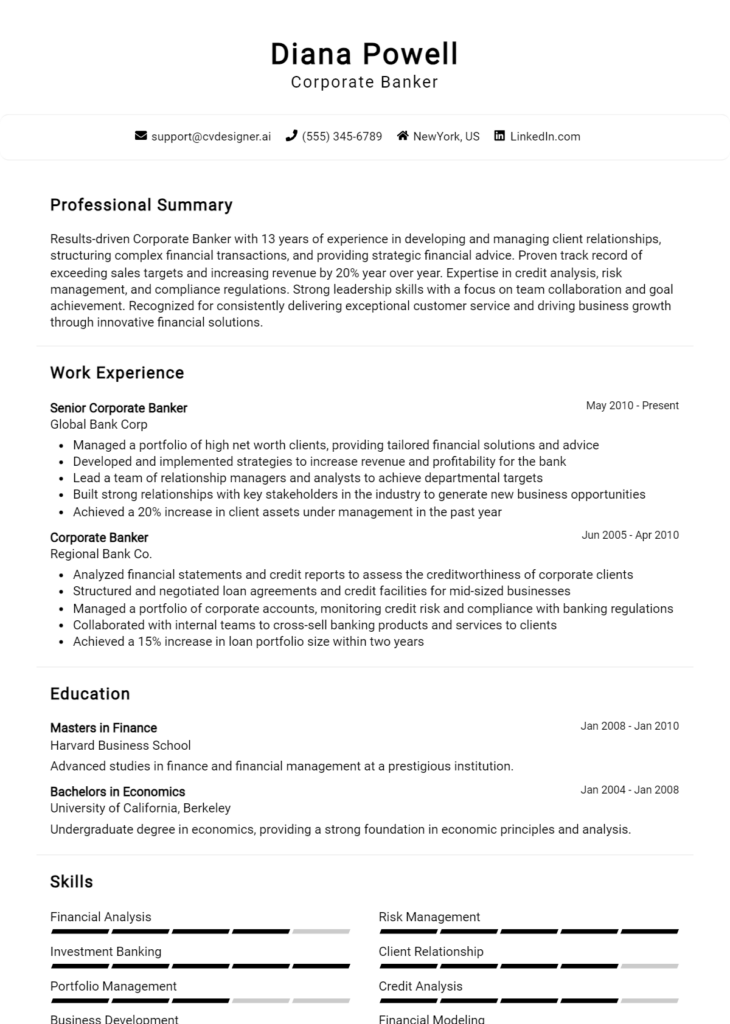

Education and Certifications Section for Private Banker Resume

The education and certifications section of a Private Banker resume is crucial as it reflects the candidate's academic achievements, industry-specific qualifications, and commitment to ongoing professional development. This section not only showcases the foundational knowledge obtained through formal education but also highlights the candidate's dedication to continuous learning through relevant certifications and specialized training. By including pertinent coursework and recognized credentials, candidates can significantly bolster their credibility and demonstrate their alignment with the demands of the Private Banker role, ultimately making them more appealing to potential employers.

Best Practices for Private Banker Education and Certifications

- Include only relevant degrees and certifications that pertain to the banking and finance sector.

- List certifications in order of relevance, prioritizing those recognized by industry leaders.

- Provide details about specialized training or workshops that enhance your banking skills.

- Highlight any coursework that directly relates to client management, investment strategies, or financial planning.

- Keep the section concise, focusing on quality over quantity to maintain clarity.

- Use bullet points for easy readability and to draw attention to key achievements.

- Update the section regularly to include any new qualifications or courses taken.

- Consider including GPA or honors if they are impressive and relevant to the role.

Example Education and Certifications for Private Banker

Strong Examples

- MBA in Finance, University of Chicago Booth School of Business, 2022

- Chartered Financial Analyst (CFA) Level II Candidate

- Certified Wealth Strategist (CWS), 2021

- Relevant Coursework: Advanced Investment Strategies, Portfolio Management, Risk Assessment

Weak Examples

- Bachelor's Degree in Art History, University of California, 2010

- Certification in Basic Computer Skills, 2015

- High School Diploma, Springfield High School, 2008

- Certification in Retail Sales, 2018

The strong examples are considered relevant and impactful as they showcase advanced educational qualifications and industry-recognized certifications specifically aligned with the Private Banker role. They reflect a solid foundation in finance and investment, which is essential for the position. Conversely, the weak examples demonstrate a lack of relevance to the banking industry, with certifications and degrees that do not contribute to the candidate's suitability as a Private Banker. These examples may suggest a disconnect from the required knowledge and skills for the role, ultimately diminishing the candidate's appeal to potential employers.

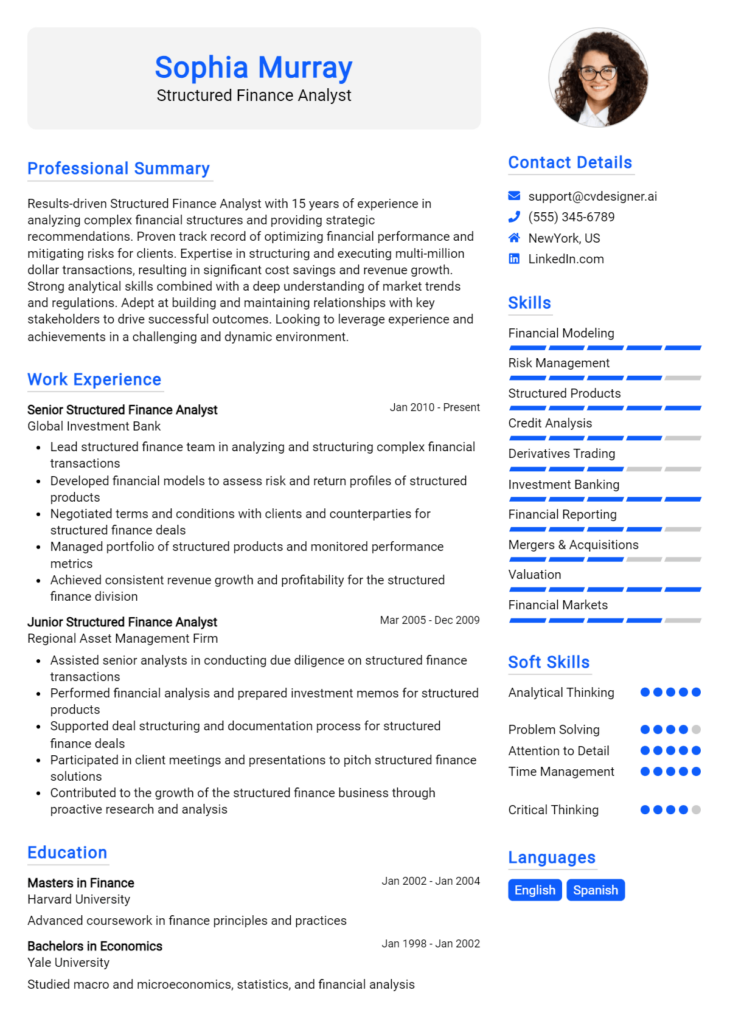

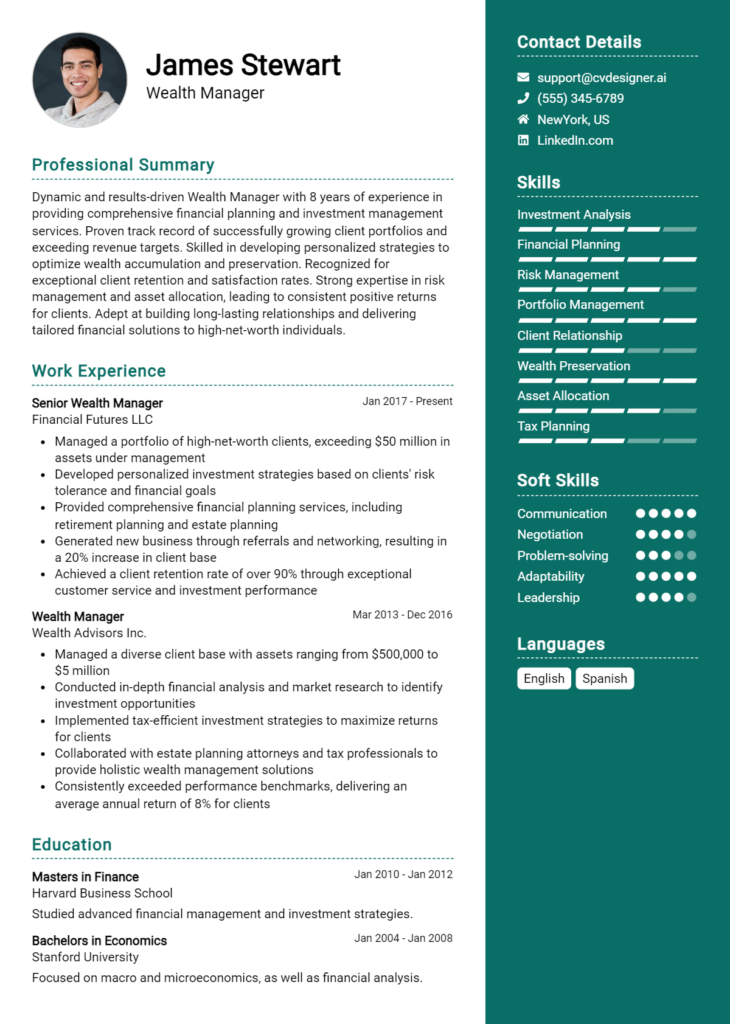

Top Skills & Keywords for Private Banker Resume

In the competitive world of private banking, having the right skills is essential for distinguishing yourself from other candidates and effectively serving high-net-worth clients. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing a desired position. Employers look for candidates who not only possess the technical expertise required for financial management but also the interpersonal abilities necessary to build trust and maintain long-lasting relationships with clients. By strategically showcasing these skills, you can demonstrate your value and readiness to succeed in the dynamic environment of private banking.

Top Hard & Soft Skills for Private Banker

Soft Skills

- Excellent communication skills

- Strong interpersonal abilities

- Customer-focused approach

- Problem-solving mindset

- Adaptability and flexibility

- Time management skills

- Negotiation skills

- Emotional intelligence

- Attention to detail

- Relationship-building capabilities

- Team collaboration

- Conflict resolution

- Active listening

- Empathy

- Networking proficiency

Hard Skills

- Financial analysis and reporting

- Investment management

- Risk assessment and management

- Knowledge of financial regulations

- Tax planning strategies

- Portfolio management

- Wealth management techniques

- Proficiency in financial software (e.g., Bloomberg, Excel)

- Understanding of estate planning

- Asset allocation strategies

- Regulatory compliance

- Market research and analysis

- Credit analysis

- Financial modeling

- Performance analysis

- Strategic financial planning

- Data analysis and interpretation

- Knowledge of alternative investments

For a comprehensive breakdown of skills and crafting effective work experience, visit the links provided.

Stand Out with a Winning Private Banker Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Private Banker position at [Company Name], as advertised on [Where You Found the Job Posting]. With over [X years] of experience in wealth management and client relationship building, I am confident in my ability to provide outstanding financial services to high-net-worth individuals and families. My expertise in investment strategies, estate planning, and risk management, combined with a genuine commitment to client satisfaction, has consistently resulted in strong client retention and substantial portfolio growth.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of clients, ensuring that their financial goals were met through tailored investment solutions. My proactive approach in analyzing market trends and identifying new opportunities allowed me to generate a [X]% increase in client assets under management over a [time frame]. I pride myself on my ability to communicate complex financial concepts in an accessible manner, which fosters trust and builds long-lasting relationships with clients. I am excited about the opportunity to bring my skills in strategic planning and personalized service to [Company Name], where I can contribute to enhancing the client experience.

What sets me apart as a Private Banker is my unwavering dedication to understanding each client's unique financial situation and tailoring solutions that align with their long-term aspirations. I am adept at leveraging technology and data analytics to provide insightful recommendations, ensuring that my clients are well-informed and confident in their financial decisions. I am particularly impressed by [Company Name]'s commitment to innovation in private banking, and I am eager to be a part of a team that prioritizes client success and growth.

Thank you for considering my application. I look forward to the possibility of discussing how my skills and experiences align with the needs of your team at [Company Name]. I am excited about the opportunity to help your clients achieve their financial goals with personalized and proactive banking solutions.

Sincerely,

[Your Name]

[Your Contact Information]

Common Mistakes to Avoid in a Private Banker Resume

When crafting a resume for a Private Banker position, it's crucial to present a polished and professional document that highlights your skills and experience. However, many candidates make common mistakes that can undermine their chances of landing an interview. By being aware of these pitfalls, you can enhance your resume and make a stronger impression on potential employers. Here are some common mistakes to avoid in a Private Banker resume:

Generic Objective Statement: Using a one-size-fits-all objective can make your resume feel impersonal. Tailor your objective to reflect your specific goals and how they align with the bank’s values.

Lack of Quantifiable Achievements: Failing to include specific numbers or metrics can weaken your accomplishments. Use data to demonstrate your success in increasing assets under management, enhancing client satisfaction, or boosting revenue.

Inconsistent Formatting: Inconsistent fonts, sizes, or styles can make your resume look unprofessional. Ensure that your formatting is uniform throughout the document to enhance readability and present a cohesive image.

Overly Complex Language: Using jargon or overly complex terminology can alienate or confuse hiring managers. Aim for clear, concise language that effectively communicates your qualifications without unnecessary complexity.

Ignoring Relevant Skills: Neglecting to highlight key skills such as relationship management, financial analysis, or investment strategies can limit your appeal. Make sure to showcase skills that are directly relevant to the Private Banking role.

Omitting Soft Skills: While technical skills are important, soft skills like communication, empathy, and problem-solving are crucial in Private Banking. Include examples that demonstrate these abilities to highlight your client relationship capabilities.

Including Irrelevant Experience: Listing jobs that have no relevance to banking can dilute your resume. Focus on experiences that showcase your financial acumen and ability to manage client relationships effectively.

Failing to Customize for Each Application: Sending out the same resume for multiple positions can reduce your chances of success. Tailor your resume for each job application by incorporating keywords from the job description and emphasizing relevant experiences.

Conclusion

As a Private Banker, your role is crucial in managing the financial needs of high-net-worth clients. You are responsible for providing personalized financial advice, investment management, and wealth preservation strategies. Your expertise in risk assessment and market trends is essential for helping clients achieve their financial goals while navigating complex financial landscapes.

In addition to building strong relationships with clients, a successful Private Banker must possess excellent communication skills, a deep understanding of financial products, and the ability to tailor solutions to meet individual client needs. Staying updated on industry regulations and trends is also vital for maintaining compliance and offering the best service possible.

It's important to ensure that your resume reflects all these competencies and experiences effectively. A well-crafted resume can set you apart in a competitive job market.

We encourage you to take the time to review and update your Private Banker resume to showcase your skills and achievements. To assist you in this process, consider utilizing the following resources: explore resume templates for design ideas, use the resume builder for an easy, guided creation process, check out resume examples for inspiration, and don’t forget to create a compelling cover letter with our cover letter templates. Start enhancing your resume today and take the next step in your career as a Private Banker!