26 Payroll Tax Specialist Skills for Your Resume: List Examples

When crafting a resume for a Payroll Tax Specialist position, it's essential to highlight the specific skills that set you apart in this specialized field. Employers are looking for candidates who not only understand payroll processes but also have a strong grasp of tax regulations and compliance requirements. In this section, we will outline the top skills that should be included on your resume to demonstrate your expertise and suitability for the role.

Best Payroll Tax Specialist Technical Skills

As a Payroll Tax Specialist, possessing strong technical skills is crucial for efficiently managing and ensuring compliance with payroll tax regulations. These skills not only enhance accuracy in calculations but also improve the overall efficiency of payroll processes and ensure that your organization remains compliant with local, state, and federal tax laws.

Payroll Processing Software

Proficiency in payroll processing software like ADP, Paychex, or QuickBooks is essential for managing payroll calculations and tax withholdings.

How to show it: List specific software you have used and highlight any improvements in processing time or accuracy.

Tax Compliance Knowledge

Understanding federal, state, and local tax codes is vital for ensuring compliance and minimizing the risk of audits or penalties.

How to show it: Detail any training or certifications related to tax compliance and mention successful audits you managed.

Data Analysis

The ability to analyze payroll data helps identify discrepancies and optimize payroll processes through informed decision-making.

How to show it: Include examples of data-driven decisions you made that led to cost savings or efficiency improvements.

Attention to Detail

Meticulous attention to detail is necessary to ensure accuracy in payroll calculations and tax filings, preventing costly errors.

How to show it: Provide examples of how your attention to detail has directly impacted payroll accuracy.

Regulatory Reporting

Ability to prepare and submit necessary payroll tax reports on time, ensuring compliance with all regulatory requirements.

How to show it: Quantify the number of reports submitted and emphasize any recognition received for timely submissions.

Excel Proficiency

Advanced skills in Excel are essential for managing spreadsheets, performing calculations, and analyzing payroll data effectively.

How to show it: Highlight specific Excel functions you are skilled in and any complex formulas or reports you created.

Problem-Solving Skills

Strong problem-solving abilities are crucial for addressing payroll discrepancies and resolving compliance issues efficiently.

How to show it: Describe specific challenges you faced and the solutions you implemented to overcome them.

Communication Skills

Effective communication skills are necessary for collaborating with HR, finance, and employees regarding payroll-related inquiries.

How to show it: Include instances where your communication led to improved understanding or resolution of payroll issues.

Time Management

Excellent time management skills help prioritize tasks effectively to meet payroll deadlines and manage multiple projects.

How to show it: Share examples of how you managed competing deadlines while maintaining high-quality results.

Forms and Documentation Knowledge

Familiarity with various payroll tax forms and documentation required for compliance is essential for accurate reporting.

How to show it: List specific forms you have handled, emphasizing accuracy and compliance in your submissions.

Best Payroll Tax Specialist Soft Skills

In the ever-evolving field of payroll tax management, possessing strong soft skills is just as important as technical expertise. These skills enhance collaboration, communication, and problem-solving abilities, all of which are crucial for navigating the complexities of tax regulations and compliance. Here are some essential soft skills for Payroll Tax Specialists that can make your resume stand out.

Attention to Detail

Being meticulous is vital for a Payroll Tax Specialist, as even small errors can lead to significant financial repercussions. Accurate calculations and compliance with tax laws depend on this skill.

How to show it: Highlight specific instances where your attention to detail prevented errors or improved accuracy in payroll processing.

Communication

Effective communication skills are essential for conveying complex tax information clearly to team members and clients. This fosters better understanding and collaboration.

How to show it: Include examples of how you simplified tax concepts for non-financial stakeholders or led training sessions.

Problem-Solving

Payroll tax issues often require innovative solutions. A Payroll Tax Specialist must be adept at identifying problems and implementing effective strategies to resolve them quickly.

How to show it: Demonstrate your problem-solving ability by detailing situations where you tackled a challenging payroll issue successfully.

Time Management

With tight deadlines for tax submissions and payroll processing, being able to prioritize tasks efficiently is essential for success in this role.

How to show it: Share examples of how you managed multiple deadlines or improved processes to save time.

Teamwork

Collaboration with various departments is crucial for a Payroll Tax Specialist. Being a team player helps ensure that all payroll elements align with tax compliance requirements.

How to show it: Provide evidence of successful collaboration with other teams or departments to achieve a common goal.

Analytical Thinking

Strong analytical skills enable a Payroll Tax Specialist to interpret data effectively, identify trends, and make informed decisions based on tax regulations and payroll data.

How to show it: Include specific metrics or insights you derived from data analysis that contributed to tax compliance or efficiency.

Adaptability

The tax landscape is constantly changing, making adaptability a key skill. Payroll Tax Specialists must stay updated on legislation and adjust processes as necessary.

How to show it: Illustrate how you adapted to new tax laws or technology changes in your previous roles.

Integrity

Integrity is crucial in handling sensitive financial information. Employers need to trust that Payroll Tax Specialists will adhere to ethical standards and confidentiality.

How to show it: Discuss your commitment to ethical practices and how you maintained confidentiality in your previous positions.

Customer Service Orientation

Providing excellent customer service is important for addressing payroll inquiries and ensuring client satisfaction, especially in a role that involves tax-related issues.

How to show it: Share examples of how you resolved client issues or enhanced client relationships through effective service.

Conflict Resolution

Conflict may arise in payroll processing, especially with discrepancies in pay or tax deductions. Being skilled in conflict resolution helps maintain workplace harmony.

How to show it: Describe instances where you successfully mediated disputes or differences within a team or with clients.

Organizational Skills

Organizational skills help Payroll Tax Specialists manage large volumes of data and documentation efficiently, ensuring that everything is in order for audits and compliance.

How to show it: Detail how you organized payroll records or streamlined processes for better efficiency.

How to List Payroll Tax Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in a competitive job market. Highlighting your qualifications in the right sections can make a significant difference. There are three main areas to showcase your skills: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

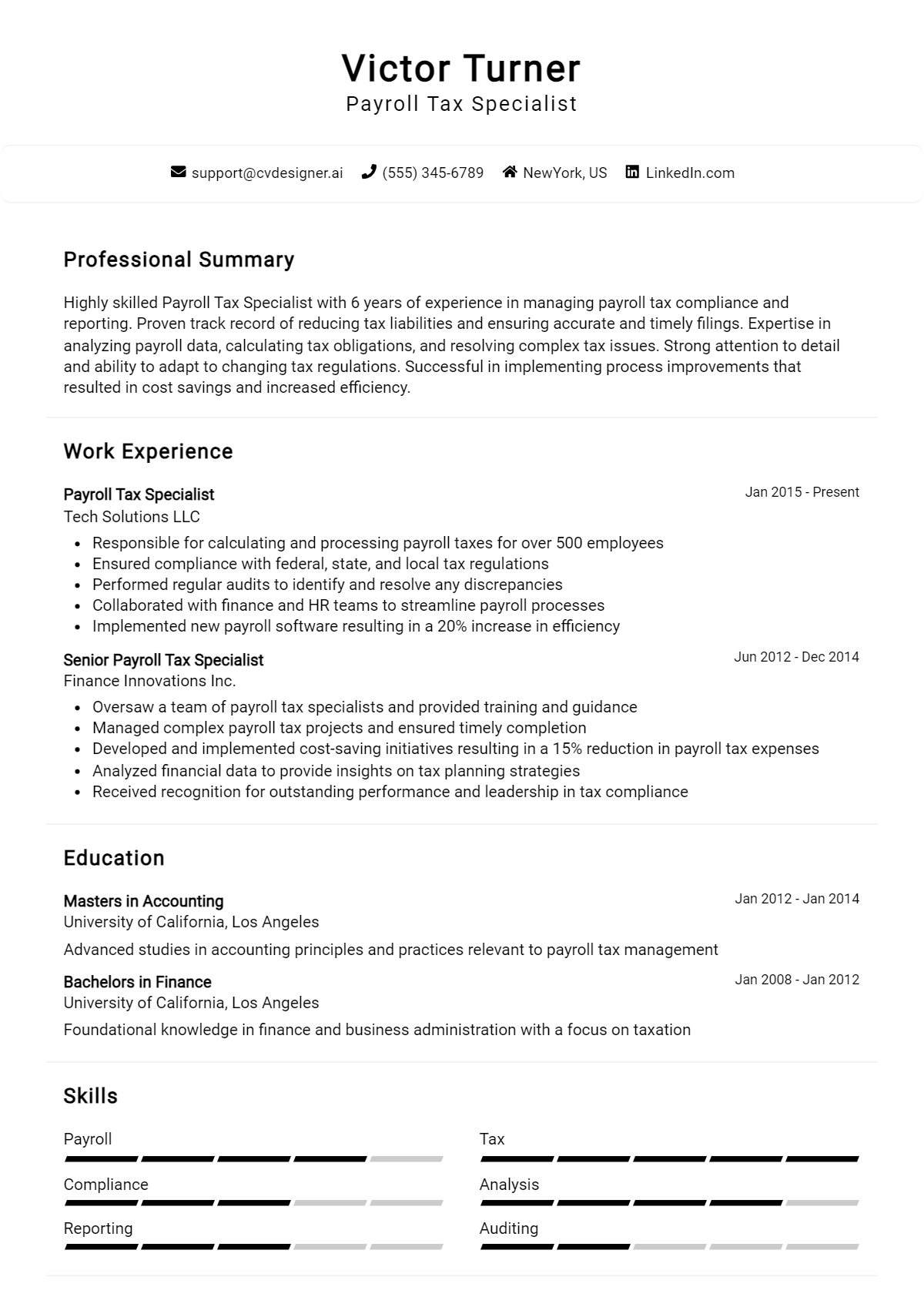

for Resume Summary

Showcasing Payroll Tax Specialist skills in your summary section provides hiring managers with a quick overview of your qualifications, allowing them to see your value at a glance.

Example

Results-driven Payroll Tax Specialist with expertise in compliance management, data analysis, and effective communication. Proven track record in optimizing payroll processes and ensuring accuracy in tax reporting.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Payroll Tax Specialist skills have been applied in real-world scenarios, showcasing your impact in previous roles.

Example

- Managed end-to-end payroll processing, ensuring 100% compliance with federal and state tax regulations.

- Conducted detailed data analysis to identify discrepancies, resulting in a 15% reduction in payroll errors.

- Collaborated with cross-functional teams to implement new payroll software, enhancing efficiency by 25%.

- Trained staff on payroll processes and effective communication strategies, leading to improved team performance.

for Resume Skills

The skills section can showcase a balanced mix of technical and transferable skills relevant to the Payroll Tax Specialist role. Including both hard and soft skills strengthens your overall qualifications.

Example

- Payroll Processing

- Tax Compliance

- Data Analysis

- Attention to Detail

- Time Management

- Effective Communication

- Problem-Solving

- Technical Skills

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how these skills have positively impacted your previous roles.

Example

With strong expertise in tax compliance and data analysis, I successfully reduced payroll discrepancies by implementing streamlined procedures in my previous position. My effective communication skills have enabled me to collaborate successfully with diverse teams, ensuring that payroll processes run smoothly and efficiently.

Linking the skills mentioned in your resume to specific achievements in your cover letter can reinforce your qualifications for the job. For more information on how to highlight your skills, develop your technical skills, and effectively present your work experience, refer to the provided resources.

The Importance of Payroll Tax Specialist Resume Skills

In the competitive job market, showcasing the right skills on a Payroll Tax Specialist resume is crucial for attracting the attention of recruiters. A well-structured skills section not only highlights a candidate's relevant expertise but also aligns their qualifications with the specific requirements of the job. This alignment makes it easier for hiring managers to see the value a candidate can bring to their organization.

- Demonstrating proficiency in payroll tax regulations is essential; it shows that the candidate is knowledgeable about compliance requirements and can navigate complex tax laws effectively.

- Highlighting technical skills, such as familiarity with payroll software, indicates that the candidate can efficiently manage payroll processes, reducing the likelihood of errors and saving time.

- Analytical skills are critical for a Payroll Tax Specialist, as they need to interpret data and resolve discrepancies. A strong skills section reflects the candidate's ability to analyze and enhance payroll operations.

- Excellent communication skills are vital for conveying complex tax information to employees and collaborating with other departments. Candidates must illustrate their capacity to communicate clearly and effectively.

- Detail-oriented candidates can prevent costly errors in payroll processing. Emphasizing attention to detail in the skills section reassures employers of the candidate's reliability and thoroughness.

- Problem-solving skills are crucial for addressing payroll-related issues quickly and efficiently. Candidates should showcase their ability to identify and rectify discrepancies as a core competency.

- Knowledge of state and federal payroll tax laws is indispensable; a candidate's understanding of various regulations can significantly impact compliance and financial accuracy.

- Proficiency in data management ensures that sensitive payroll information is handled securely and accurately, reflecting the candidate's commitment to confidentiality and integrity.

For additional help, check out various Resume Samples that can provide guidance on structuring your skills section effectively.

How To Improve Payroll Tax Specialist Resume Skills

In the ever-evolving field of payroll and taxation, it's crucial for Payroll Tax Specialists to continuously enhance their skills. Keeping up with changes in tax laws, regulations, and technology not only ensures compliance but also positions you as a valuable asset to your organization. By improving your skills, you can increase your effectiveness in managing payroll tax responsibilities and advance your career prospects in this competitive field.

- Stay updated on tax regulations: Regularly review changes in federal, state, and local tax laws to ensure compliance and accuracy in payroll processing.

- Enhance software proficiency: Familiarize yourself with payroll software and tax compliance tools to improve efficiency and accuracy in your work.

- Attend professional development workshops: Participate in seminars, webinars, or workshops focused on payroll tax topics to expand your knowledge and network with industry professionals.

- Obtain relevant certifications: Consider pursuing certifications such as Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC) to validate your expertise.

- Practice analytical skills: Develop your analytical abilities to better identify discrepancies in payroll data and understand the implications of tax regulations.

- Join professional associations: Become a member of organizations like the American Payroll Association (APA) to access resources, training, and networking opportunities.

- Seek mentorship: Connect with experienced Payroll Tax Specialists who can provide guidance, share best practices, and offer insights into career advancement.

Frequently Asked Questions

What are the essential skills required for a Payroll Tax Specialist?

A Payroll Tax Specialist should possess strong analytical skills to accurately interpret tax codes and regulations. Proficiency in payroll software and systems is crucial for managing payroll processing effectively. Attention to detail is essential to minimize errors in calculations and compliance, while strong organizational skills help maintain accurate records. Additionally, communication skills are important for liaising with employees and government agencies regarding payroll-related inquiries.

How does knowledge of tax laws benefit a Payroll Tax Specialist?

Having a thorough understanding of federal, state, and local tax laws is vital for a Payroll Tax Specialist, as it allows them to ensure compliance and avoid costly penalties for the company. This knowledge enables them to accurately calculate tax withholdings, file tax returns, and stay updated on any changes in legislation that could impact payroll processes. It also empowers them to provide informed guidance to management and employees about tax-related issues.

Why is data accuracy important in payroll tax processing?

Data accuracy is critical in payroll tax processing because even minor errors can lead to significant financial repercussions, such as underpayment or overpayment of taxes. Incorrect data can also result in penalties or interest charges from tax authorities, damaging the company's reputation and financial standing. A Payroll Tax Specialist must employ meticulous attention to detail to ensure all payroll data is accurate and compliant with applicable laws.

What software skills should a Payroll Tax Specialist have?

A Payroll Tax Specialist should be proficient in using payroll processing software, such as ADP, Paychex, or QuickBooks, to manage payroll efficiently. Familiarity with spreadsheet software like Microsoft Excel is also crucial for data analysis and reporting. Additionally, knowledge of tax compliance software can streamline the filing process and ensure adherence to regulations. Strong computer skills enhance a specialist's ability to analyze payroll data and generate reports accurately.

How can a Payroll Tax Specialist stay updated on tax regulations?

To stay updated on tax regulations, a Payroll Tax Specialist should engage in continuous education through professional development courses, webinars, and seminars focused on payroll and tax law changes. Subscribing to industry newsletters, joining professional associations, and participating in networking events can also provide valuable insights into regulatory updates. Staying informed allows specialists to adapt processes and ensure compliance with the latest tax requirements.

Conclusion

Including Payroll Tax Specialist skills in your resume is crucial for demonstrating your expertise in a highly specialized field. By showcasing relevant skills, you not only differentiate yourself from other candidates but also highlight the value you can bring to potential employers. This attention to detail can significantly enhance your job application, making you a more attractive candidate in a competitive market.

As you refine your skills and present your qualifications effectively, remember that every step you take brings you closer to your career goals. Stay motivated and dedicated to improving your expertise for a successful job application journey.

For additional resources, consider exploring our resume templates, utilizing our resume builder, reviewing resume examples, and crafting your cover letter with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.