Payroll Tax Specialist Core Responsibilities

A Payroll Tax Specialist plays a crucial role in ensuring accurate payroll tax processes, bridging finance, HR, and compliance departments. Key responsibilities include calculating payroll taxes, filing returns, and ensuring compliance with federal, state, and local regulations. Essential skills encompass technical proficiency in payroll systems, operational efficiency, and strong problem-solving capabilities. These competencies contribute significantly to organizational goals by mitigating tax-related risks. A well-structured resume highlighting these qualifications can effectively demonstrate the candidate’s value to potential employers.

Common Responsibilities Listed on Payroll Tax Specialist Resume

- Calculate and process payroll taxes for employees accurately.

- Prepare and file quarterly and annual payroll tax returns.

- Ensure compliance with federal, state, and local tax regulations.

- Resolve payroll tax discrepancies and issues with tax authorities.

- Maintain accurate payroll tax records and documentation.

- Conduct audits of payroll records to ensure accuracy.

- Communicate with employees regarding payroll tax-related inquiries.

- Implement and update payroll procedures as necessary.

- Provide support during internal and external audits.

- Stay updated on changes in payroll tax laws and regulations.

- Collaborate with HR and finance teams on payroll-related matters.

- Assist in developing payroll tax training for staff members.

High-Level Resume Tips for Payroll Tax Specialist Professionals

In the competitive field of payroll tax specialization, a well-crafted resume serves as your golden ticket to capturing the attention of potential employers. This document is often the first impression you make, and it needs to effectively reflect your skills, qualifications, and notable achievements in the field. A compelling resume not only highlights your technical expertise but also tells your professional story in a way that resonates with hiring managers. This guide will provide you with practical and actionable resume tips specifically tailored for Payroll Tax Specialist professionals, helping you to stand out in a crowded job market.

Top Resume Tips for Payroll Tax Specialist Professionals

- Tailor your resume for each job application by incorporating keywords from the job description.

- Highlight relevant experience in payroll processing, tax compliance, and regulatory knowledge.

- Quantify your achievements, such as the percentage of tax savings you've achieved for clients or enhancements in payroll accuracy.

- Showcase industry-specific skills, including proficiency in payroll software and knowledge of federal and state tax regulations.

- Include certifications or training related to payroll and taxation, which can set you apart from other candidates.

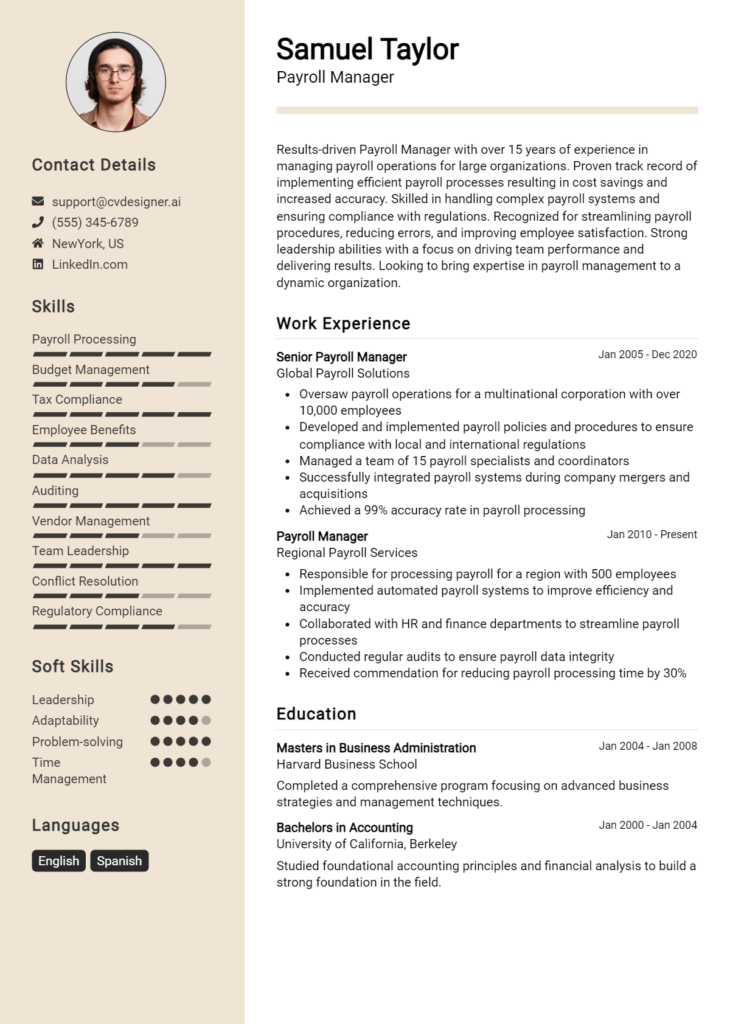

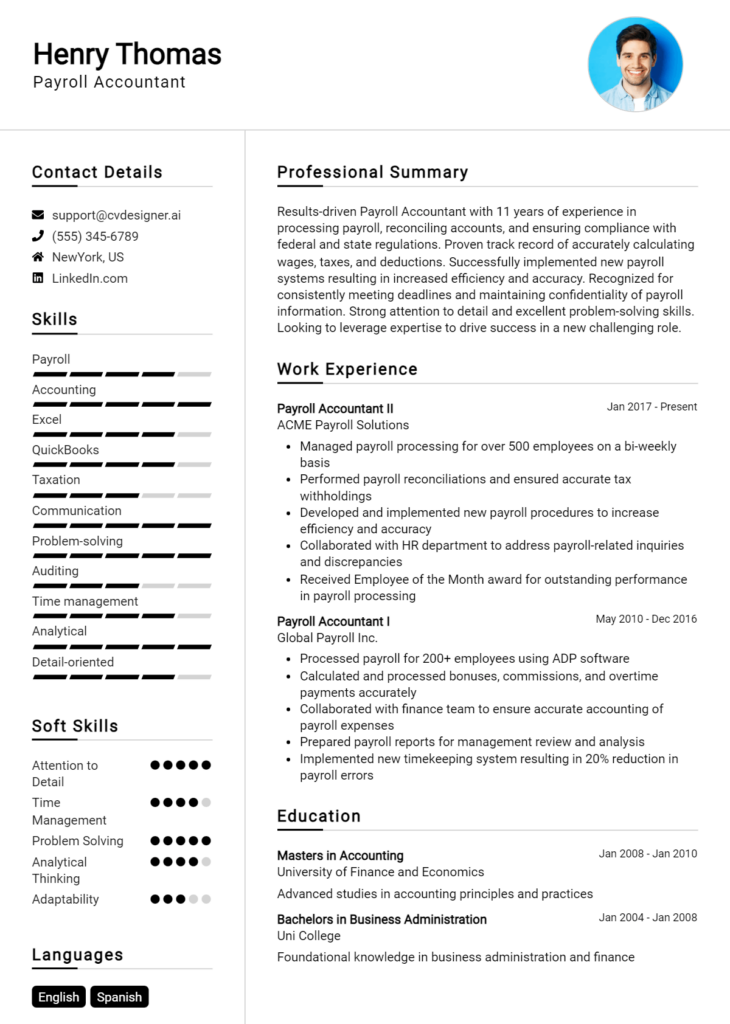

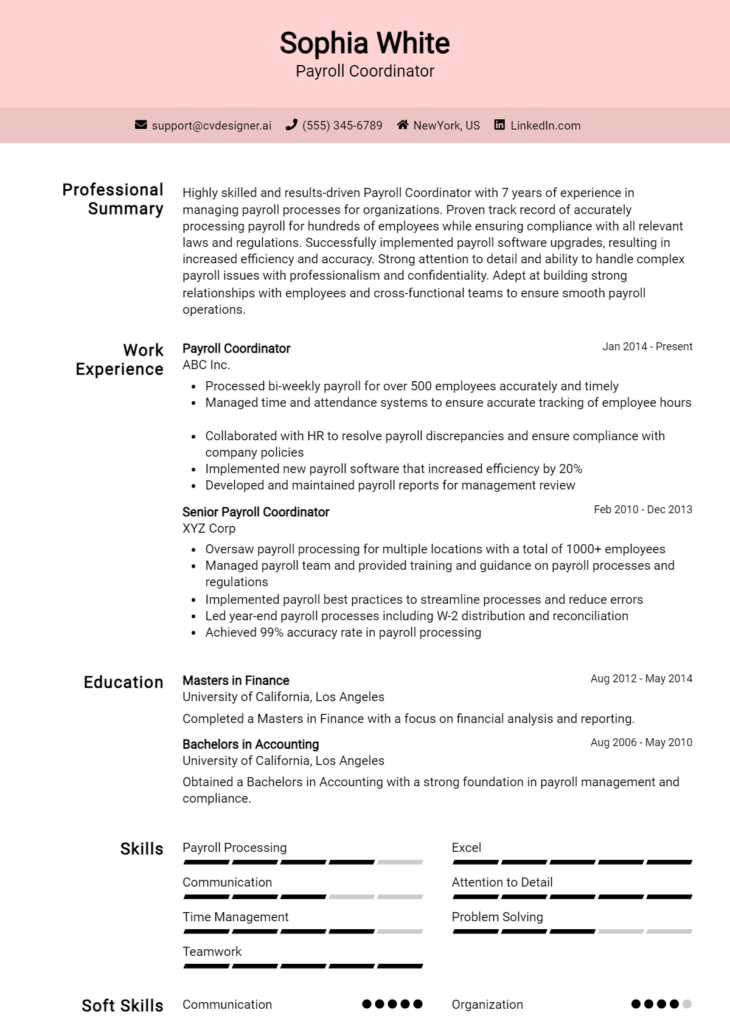

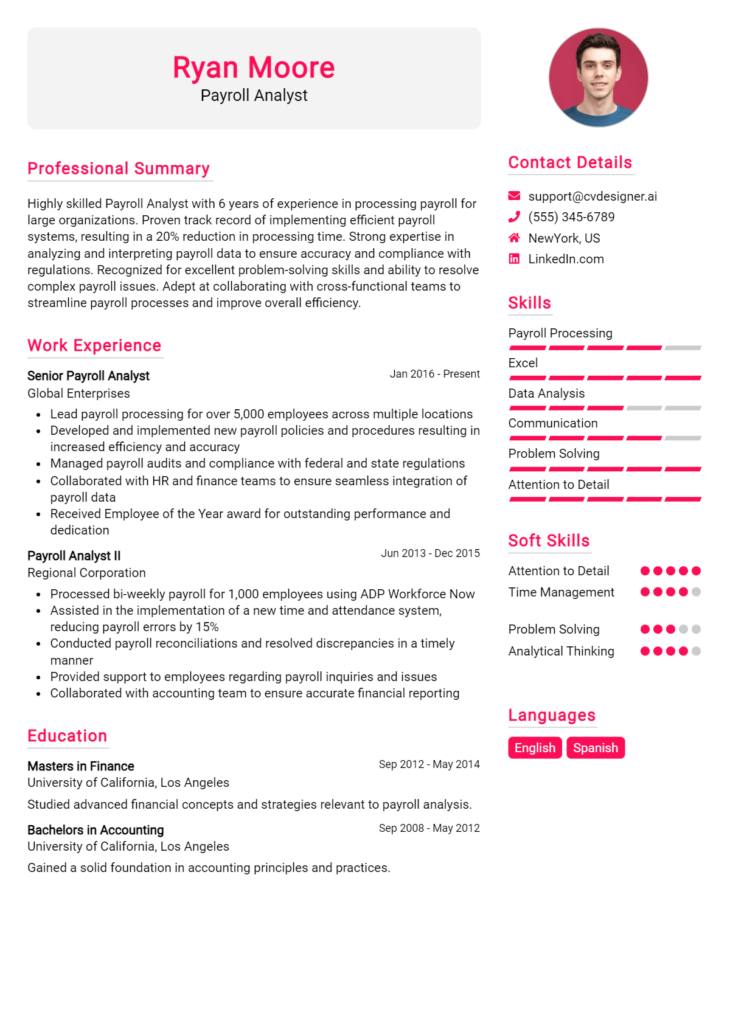

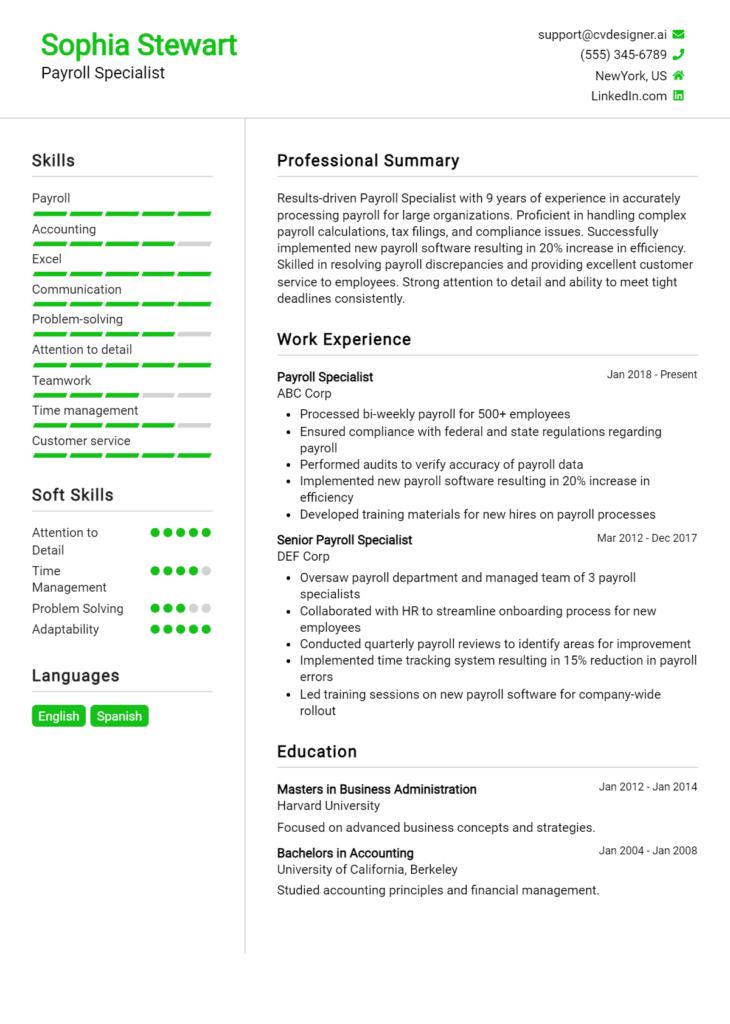

- Utilize a clean, professional layout that makes your resume easy to read and visually appealing.

- Incorporate action verbs to convey your contributions and responsibilities effectively.

- Provide examples of how you've improved processes or solved complex payroll issues in previous roles.

- Keep your resume to one or two pages, focusing on relevant and recent experience.

- Proofread your resume multiple times to eliminate any errors or inconsistencies that could undermine your professionalism.

By implementing these tips, you can significantly increase your chances of landing a job in the Payroll Tax Specialist field. A well-structured resume that showcases your unique qualifications and achievements will not only make a strong first impression but also position you as a standout candidate in a competitive job market.

Why Resume Headlines & Titles are Important for Payroll Tax Specialist

In the competitive field of payroll management, a Payroll Tax Specialist plays a critical role in ensuring compliance with tax regulations and managing payroll processes efficiently. Given the importance of this position, crafting a compelling resume headline or title is essential. A powerful headline can instantly capture the attention of hiring managers, succinctly summarizing a candidate's key qualifications and setting the tone for the entire resume. It should be concise, relevant, and directly aligned with the job being applied for, making it easier for employers to recognize the potential fit of the candidate within their organization.

Best Practices for Crafting Resume Headlines for Payroll Tax Specialist

- Keep it concise: Aim for a headline that is no more than 10-12 words.

- Be specific: Use terminology and keywords relevant to the payroll tax field.

- Highlight key qualifications: Emphasize your most notable skills and experiences.

- Tailor to the job description: Customize your headline based on the specific role you are applying for.

- Use action-oriented language: Start with strong verbs to convey confidence and proactivity.

- Include certifications or notable achievements: If applicable, mention relevant certifications that enhance your qualifications.

- Avoid jargon: Ensure your headline can be easily understood by those outside your specific field.

- Make it impactful: Aim to create a sense of urgency or significance in your headline.

Example Resume Headlines for Payroll Tax Specialist

Strong Resume Headlines

Expert Payroll Tax Specialist with 10+ Years of Compliance Experience

Detail-Oriented Payroll Tax Analyst Specializing in Multi-State Tax Regulations

Results-Driven Payroll Tax Professional with Proven Record in Reducing Liabilities

Certified Payroll Tax Specialist with Advanced Knowledge of IRS Regulations

Weak Resume Headlines

Payroll Tax Specialist

Experienced in Payroll

Looking for a Payroll Job

The strong headlines are effective because they provide clear, specific information about the candidate’s expertise and achievements, immediately conveying their value to potential employers. In contrast, the weak headlines fail to impress because they lack detail and do not differentiate the candidate from others. Generic phrases do not highlight unique strengths or qualifications, which can make it difficult for hiring managers to see the candidate's potential fit for the role.

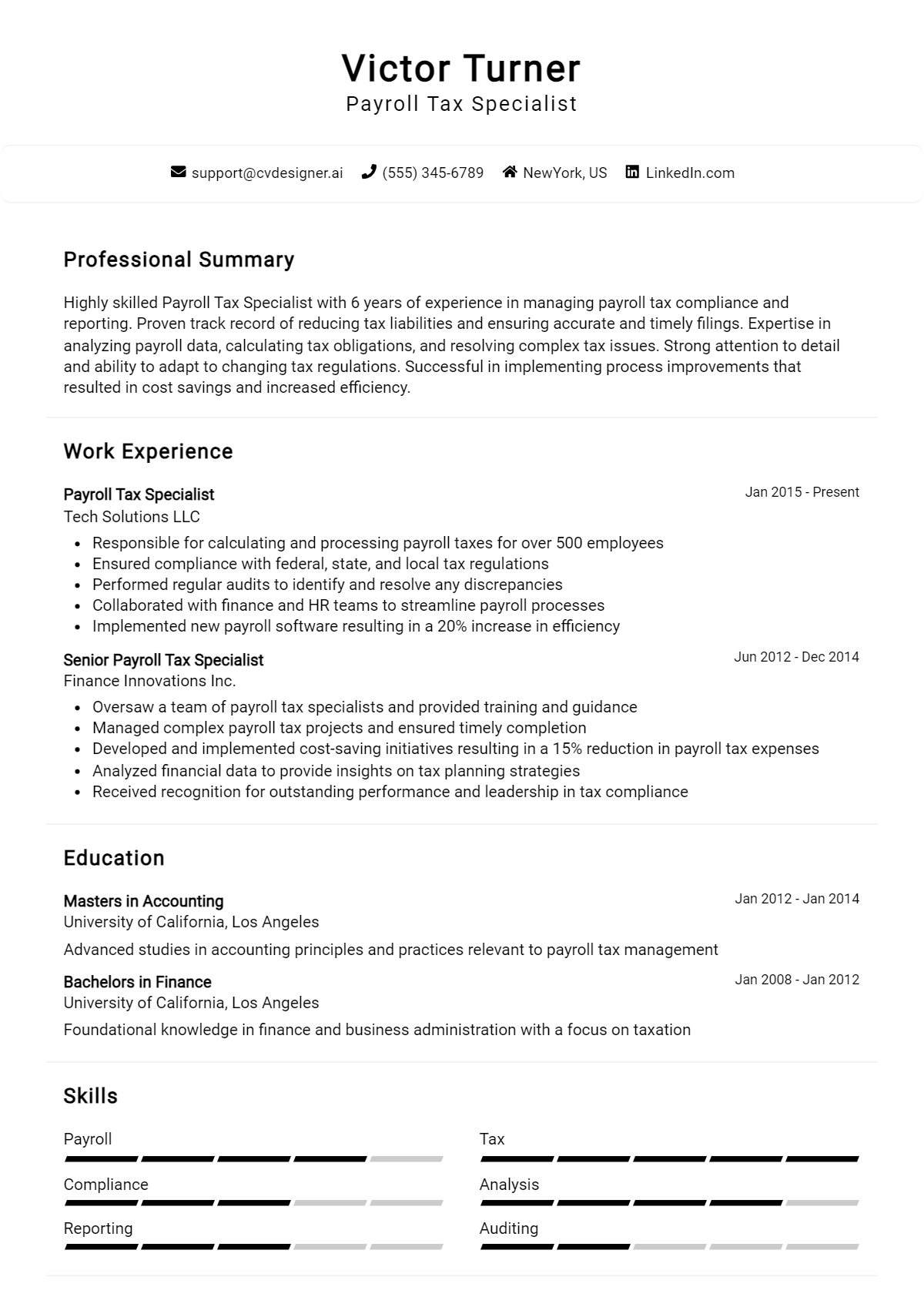

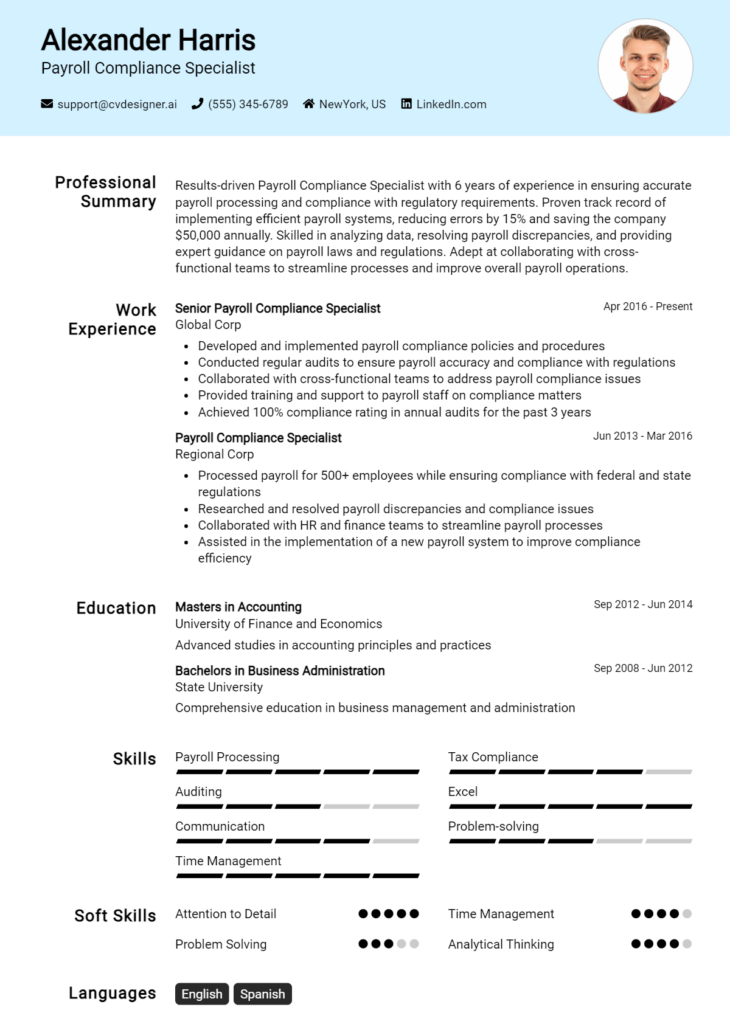

Writing an Exceptional Payroll Tax Specialist Resume Summary

A resume summary is a crucial component for a Payroll Tax Specialist, as it serves as the first impression a candidate makes on hiring managers. A well-crafted summary quickly captures attention by highlighting essential skills, relevant experience, and notable accomplishments tailored to the job at hand. In a competitive job market, a concise and impactful summary can differentiate a candidate from others, showcasing their qualifications and encouraging recruiters to delve deeper into their resumes.

Best Practices for Writing a Payroll Tax Specialist Resume Summary

- Be concise: Aim for 2-4 sentences that deliver a clear message.

- Quantify achievements: Use numbers and percentages to demonstrate your impact.

- Focus on relevant skills: Highlight specific skills that align with the job description.

- Tailor your summary: Customize the summary for each job application to reflect the role's requirements.

- Use action verbs: Start sentences with dynamic verbs to convey a strong sense of agency.

- Showcase certifications: Mention any relevant certifications or training related to payroll tax.

- Highlight industry knowledge: Include your understanding of regulations and compliance standards.

- Reflect professional demeanor: Ensure the tone is professional and confident to convey competence.

Example Payroll Tax Specialist Resume Summaries

Strong Resume Summaries

Detail-oriented Payroll Tax Specialist with over 5 years of experience managing payroll tax compliance for multi-state employers, successfully reducing audit discrepancies by 30% through meticulous record-keeping and proactive issue resolution.

Results-driven Payroll Tax Specialist with expertise in navigating complex tax regulations, achieving a 20% reduction in liabilities for clients through strategic tax planning and thorough compliance audits.

Dedicated Payroll Tax Specialist skilled in utilizing advanced software to ensure accurate tax reporting. Managed payroll for over 1,000 employees, leading to a 15% increase in processing efficiency while maintaining 100% compliance with local and federal tax laws.

Weak Resume Summaries

Experienced Payroll Tax Specialist looking for a new opportunity to apply my skills.

Payroll tax professional with some experience in the field, seeking to contribute to a team.

The strong resume summaries are considered effective because they provide specific details about the candidate's experience, quantifiable achievements, and relevant skills directly related to the role of a Payroll Tax Specialist. In contrast, the weak summaries lack specificity and measurable outcomes, making them less compelling and failing to showcase the candidate's true value to potential employers.

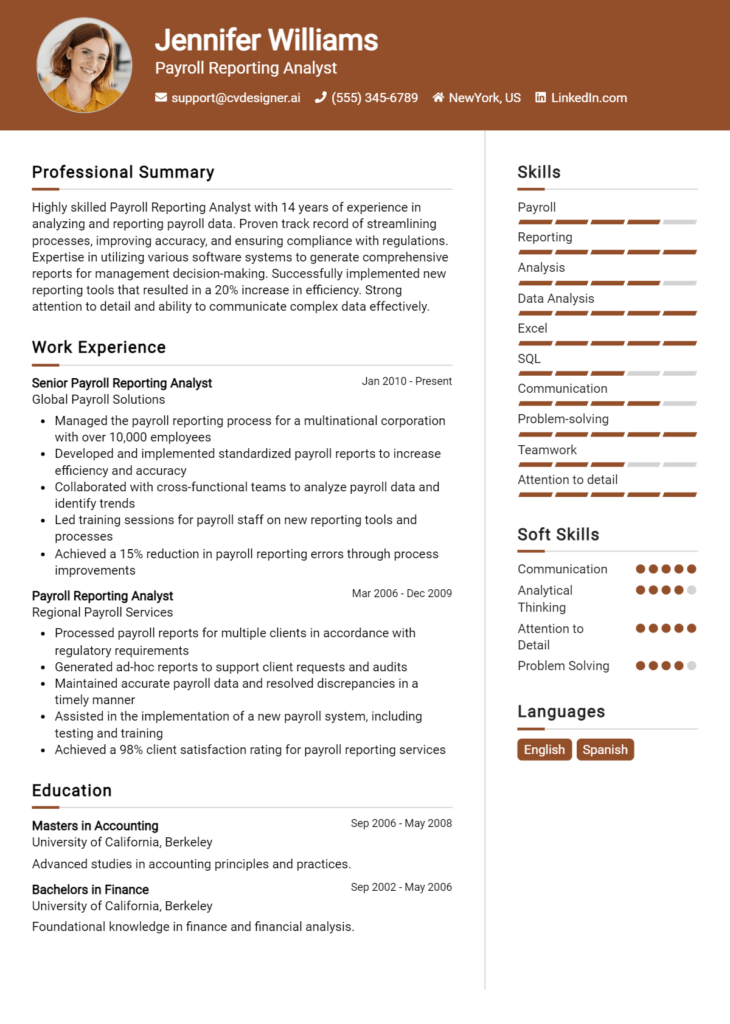

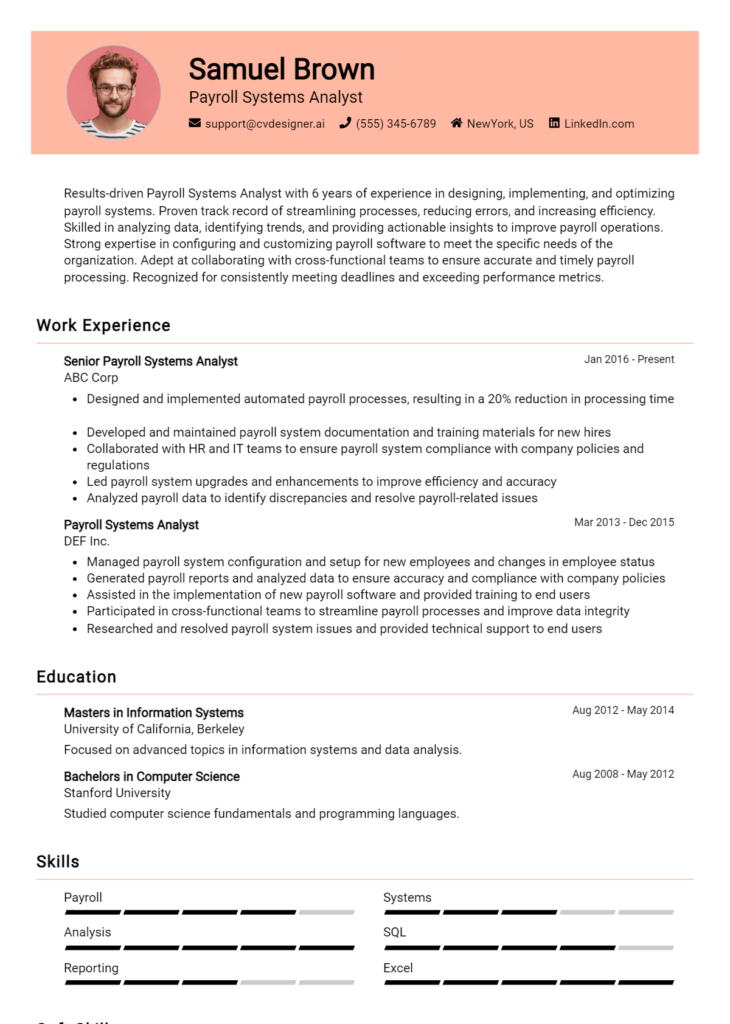

Work Experience Section for Payroll Tax Specialist Resume

The work experience section of a Payroll Tax Specialist resume is crucial as it serves as a comprehensive showcase of the candidate's technical skills and accomplishments. This section highlights the candidate's ability to navigate complex payroll tax regulations, manage teams effectively, and deliver high-quality results that align with industry standards. By quantifying achievements and demonstrating a clear understanding of payroll tax processes, candidates can distinguish themselves from others in the field. It is essential for this section to not only reflect the depth of experience but also to demonstrate how past roles have prepared the candidate for future challenges in payroll tax management.

Best Practices for Payroll Tax Specialist Work Experience

- Highlight specific technical skills related to payroll tax compliance and software proficiency.

- Quantify achievements with metrics such as reduced tax liabilities or improved processing times.

- Emphasize collaborative efforts, detailing how you worked with other departments to streamline payroll processes.

- Use action verbs to convey a sense of proactivity and leadership in achieving results.

- Align experience descriptions with current industry standards and regulatory requirements.

- Include relevant certifications or training that enhance your qualifications.

- Showcase problem-solving abilities by detailing challenges faced and solutions implemented.

- Maintain a clear and concise format for readability and impact.

Example Work Experiences for Payroll Tax Specialist

Strong Experiences

- Led a team of 5 in the successful implementation of a new payroll software system, resulting in a 30% reduction in processing time and improved accuracy in tax filings.

- Developed and executed quarterly tax compliance audits that identified discrepancies, leading to a $150,000 reduction in potential penalties.

- Collaborated with cross-functional teams to enhance payroll tax reporting processes, increasing efficiency and accuracy by 25%.

Weak Experiences

- Responsible for payroll tasks and related duties.

- Assisted in tax reporting, but did not track results.

- Worked on payroll systems, but the impact was not measured.

The examples listed as strong experiences are considered effective because they demonstrate quantifiable outcomes, such as specific percentages and dollar amounts, showcasing the candidate’s direct impact on the organization. They also highlight leadership and collaboration, essential skills for a Payroll Tax Specialist. In contrast, the weak experiences lack specificity and measurable results, making them less compelling and failing to convey the candidate's true capabilities and contributions to past employers.

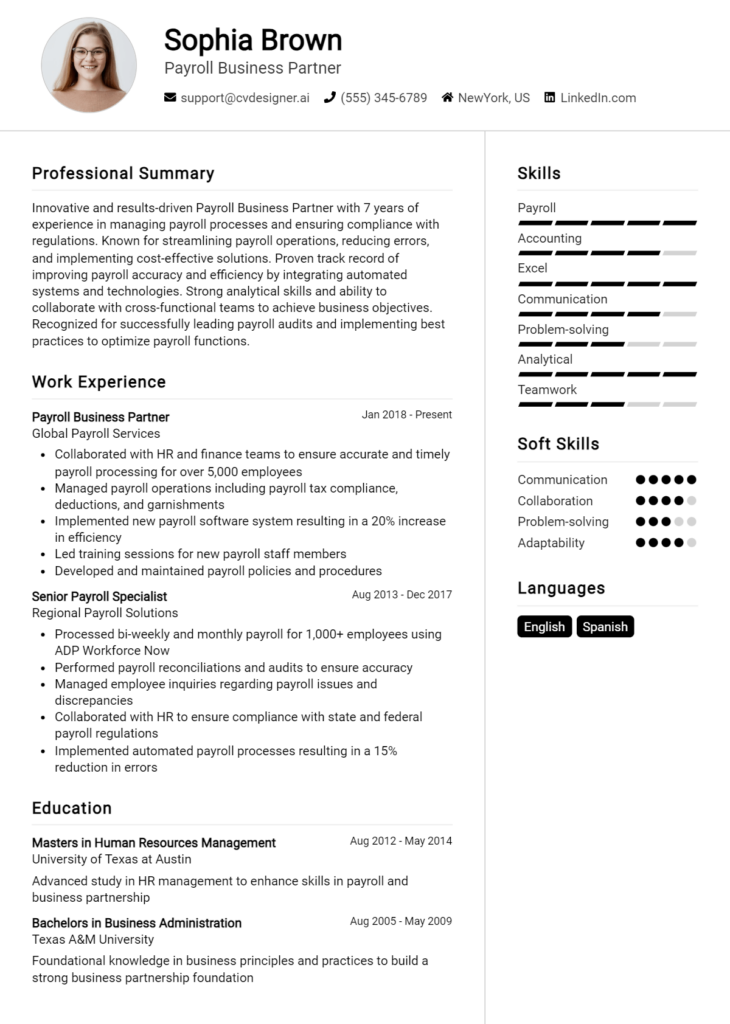

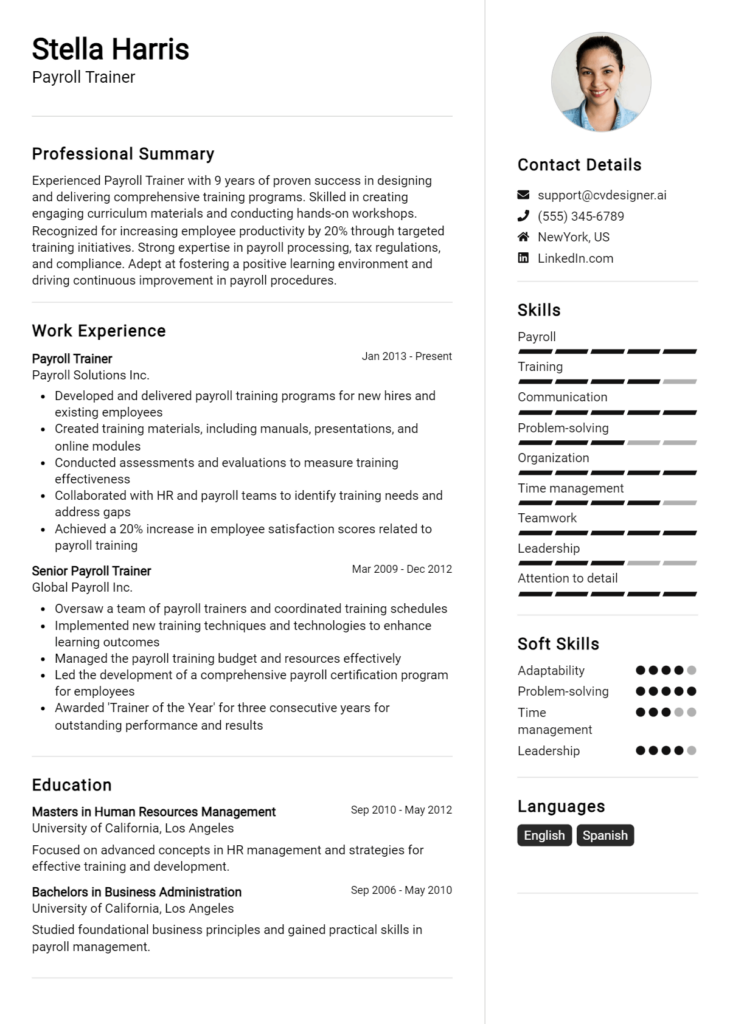

Education and Certifications Section for Payroll Tax Specialist Resume

The education and certifications section of a Payroll Tax Specialist resume plays a crucial role in showcasing a candidate's academic achievements, professional training, and commitment to ongoing education in the field of payroll and taxation. This section not only highlights relevant degrees and coursework but also emphasizes industry-recognized certifications that demonstrate a candidate's expertise and dedication to staying current with the latest tax laws and regulations. By providing detailed information about relevant education and specialized training, candidates can significantly enhance their credibility and align themselves with the requirements of the Payroll Tax Specialist role.

Best Practices for Payroll Tax Specialist Education and Certifications

- Include degrees that are directly related to accounting, finance, or taxation.

- List industry-recognized certifications such as Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC).

- Highlight relevant coursework that pertains to payroll taxes, accounting principles, and compliance.

- Provide details on any specialized training or workshops attended related to payroll processing and tax regulations.

- Use a clear and organized format for listing educational credentials to enhance readability.

- Include the date of completion for certifications to indicate your most current qualifications.

- Emphasize any continuing education courses that keep you updated on changes in tax laws.

- Prioritize the most relevant qualifications at the top of the section to catch the employer's attention.

Example Education and Certifications for Payroll Tax Specialist

Strong Examples

- Bachelor of Science in Accounting, University of XYZ, May 2020

- Certified Payroll Professional (CPP), American Payroll Association, Obtained July 2021

- Fundamental Payroll Certification (FPC), American Payroll Association, Obtained January 2022

- Coursework in Payroll Tax Compliance, University of ABC, Completed Spring 2021

Weak Examples

- Bachelor of Arts in English Literature, University of DEF, May 2018

- Certificate in Office Administration, Obtained December 2019

- High School Diploma, Graduated 2015

- Outdated Certification in QuickBooks, Obtained 2017

The examples provided illustrate a clear distinction between strong and weak educational and certification qualifications for a Payroll Tax Specialist. Strong examples are relevant and recent, showcasing degrees and certifications directly aligned with payroll and taxation. These qualifications demonstrate a commitment to the field and a solid foundation in industry practices. Conversely, weak examples highlight irrelevant degrees and outdated certifications that do not contribute to the candidate's qualifications for the role, ultimately diminishing their appeal to potential employers.

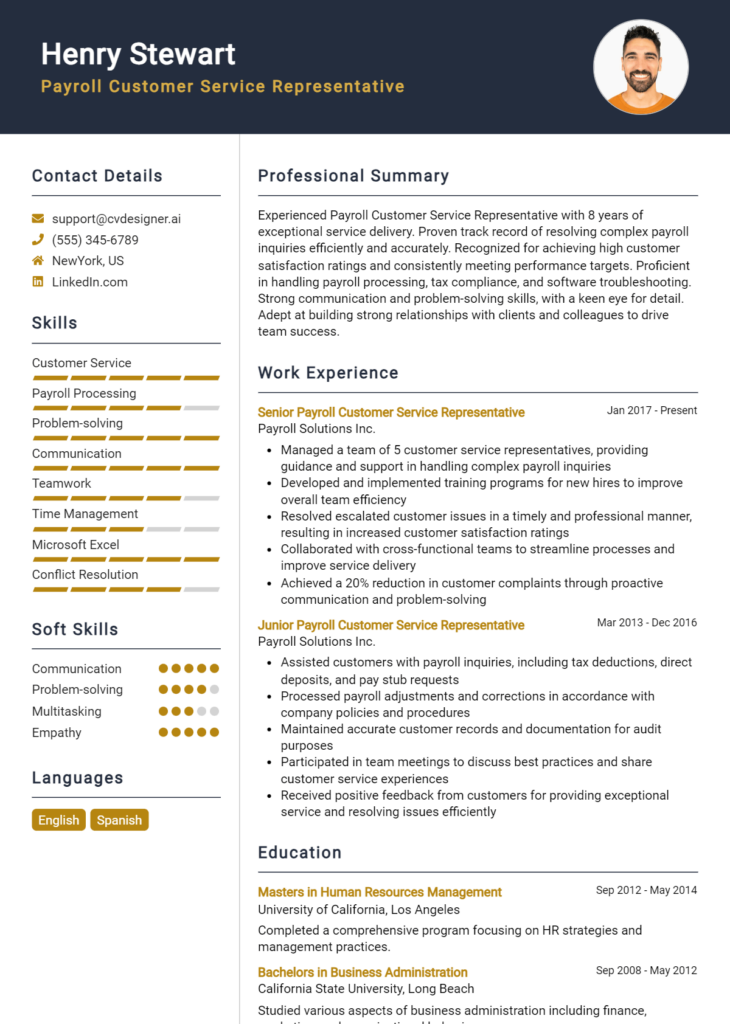

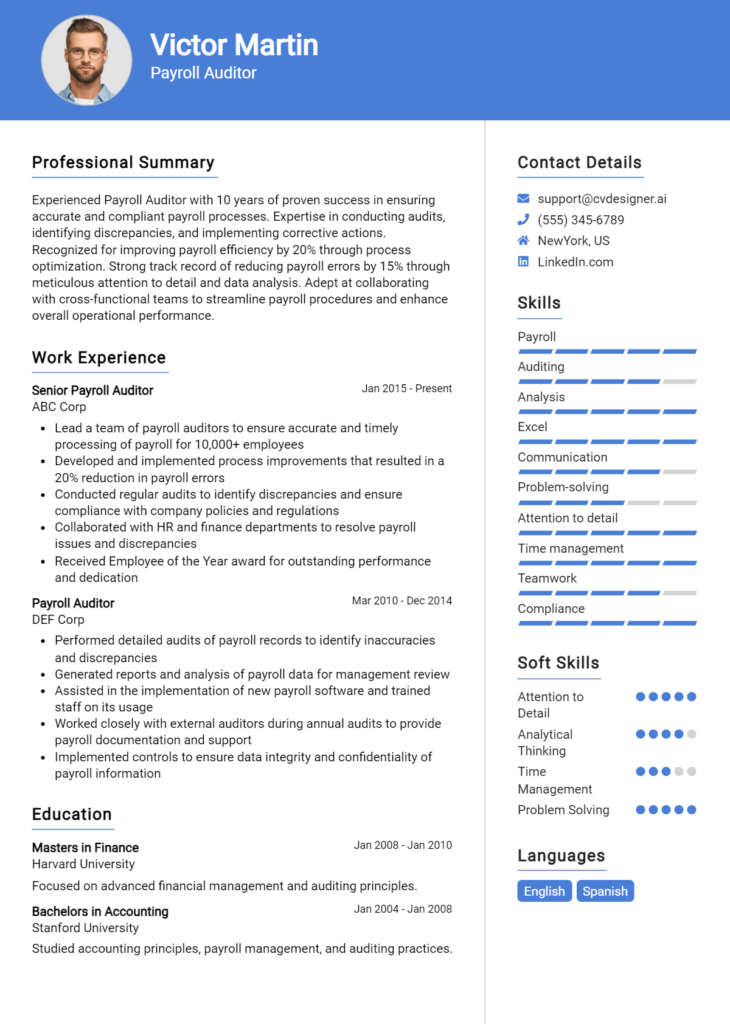

Top Skills & Keywords for Payroll Tax Specialist Resume

A well-crafted resume is crucial for a Payroll Tax Specialist, as it showcases not only technical expertise but also the interpersonal skills necessary for success in this role. Skills serve as a powerful indicator of a candidate's ability to navigate the complex landscape of payroll taxation, ensuring compliance with ever-evolving laws and regulations. Employers are keen to see a blend of hard and soft skills that demonstrate a candidate’s proficiency in payroll processing, tax calculations, and communication, making it essential to highlight these competencies effectively. By showcasing relevant skills, candidates can increase their chances of standing out in a competitive job market.

Top Hard & Soft Skills for Payroll Tax Specialist

Hard Skills

- Tax Compliance Knowledge

- Payroll Processing Systems (e.g., ADP, Paychex)

- Proficiency in Accounting Software (e.g., QuickBooks, SAP)

- Understanding of Federal and State Tax Regulations

- Experience with Tax Audits

- Data Analysis and Reporting

- Record Keeping and Documentation

- Knowledge of Wage and Hour Laws

- Tax Return Preparation

- Familiarity with ERP Systems

Soft Skills

- Attention to Detail

- Strong Analytical Skills

- Effective Communication

- Time Management

- Problem-Solving Abilities

- Adaptability to Change

- Team Collaboration

- Customer Service Orientation

- Ethical Judgment and Integrity

- Organizational Skills

For more information on skills and how to highlight your work experience, be sure to explore additional resources.

Stand Out with a Winning Payroll Tax Specialist Cover Letter

As a dedicated Payroll Tax Specialist with over five years of experience in managing payroll tax compliance and reporting, I am excited to submit my application for this position at [Company Name]. My extensive knowledge of federal, state, and local tax laws, combined with my strong analytical skills, ensures that I can effectively navigate the complexities of payroll tax regulations while maintaining accuracy and efficiency in all processes.

In my previous role at [Previous Company Name], I successfully managed the payroll tax function for a diverse workforce, ensuring timely and accurate filings for over 1,000 employees. I implemented a streamlined process for reviewing and reconciling tax liabilities, which resulted in a 20% reduction in discrepancies and improved compliance rates. My proactive approach to staying updated on tax law changes allowed my team to adapt quickly, minimizing risks and ensuring that our payroll practices remained compliant with evolving regulations.

I am particularly drawn to [Company Name] because of its commitment to fostering a culture of continuous improvement and innovation. I believe my ability to analyze and interpret complex payroll tax data, along with my strong communication skills, would make me a valuable addition to your team. I am eager to bring my expertise in payroll tax strategy and compliance to [Company Name] and contribute to your ongoing success.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the goals of [Company Name]. I am excited about the possibility of contributing to your team and helping to enhance your payroll tax processes.

Common Mistakes to Avoid in a Payroll Tax Specialist Resume

When crafting a resume for the role of a Payroll Tax Specialist, it’s crucial to present a polished and professional image that accurately showcases your qualifications and experience. However, many candidates often make common mistakes that can undermine their chances of landing an interview. By avoiding these pitfalls, you can create a more effective and compelling resume that highlights your expertise in payroll tax compliance, reporting, and analysis.

Neglecting Keywords: Failing to include relevant keywords from the job description can lead to your resume being overlooked by applicant tracking systems (ATS). Tailor your resume by integrating specific terms related to payroll taxes and compliance.

Overloading with Jargon: While specific terminology is important, using excessive jargon can make your resume difficult to read. Strive for a balance that communicates your knowledge while remaining accessible to hiring managers.

Lack of Quantifiable Achievements: Simply listing job responsibilities without quantifying your achievements can diminish the impact of your experience. Use numbers and metrics to illustrate your contributions, such as "reduced payroll tax discrepancies by 20%."

Ignoring Formatting Consistency: Inconsistent formatting, such as varying font sizes or styles, can distract from your content. Ensure that your resume has a uniform layout, with clear headings and bullet points for readability.

Omitting Relevant Experience: Sometimes candidates focus too much on their most recent jobs and neglect to include earlier positions that may be relevant. Include all pertinent experience that demonstrates your skills and knowledge in payroll tax processes.

Using a Generic Objective Statement: A generic objective statement can make your resume blend in with the crowd. Personalize your objective to reflect your specific interest in the Payroll Tax Specialist role and how you can contribute to the organization.

Neglecting Professional Development: Failing to mention any certifications, training, or continued education in payroll tax regulations can make your resume less competitive. Highlight relevant certifications such as CPP (Certified Payroll Professional) or any specialized training.

Not Proofreading: Typos and grammatical errors can create a negative impression and suggest a lack of attention to detail. Always thoroughly proofread your resume or have someone else review it to catch any mistakes before submission.

Conclusion

As a Payroll Tax Specialist, your role is critical in ensuring that payroll processes comply with federal, state, and local regulations. You are responsible for calculating payroll taxes accurately, filing tax forms on time, and maintaining records that are essential for audits and compliance. Your expertise also extends to advising on tax-related issues, addressing discrepancies, and keeping up-to-date with changes in tax laws and regulations.

In this article, we have covered the essential skills and qualifications needed for a Payroll Tax Specialist, including an in-depth understanding of payroll systems, tax regulations, and attention to detail. We also discussed the importance of effective communication and analytical skills in managing payroll tax matters.

As you reflect on your career journey and the insights provided, it’s an excellent time to review your Payroll Tax Specialist resume. Ensure that it effectively highlights your skills, accomplishments, and experience in the field. To assist you in this process, there are various tools available that can help elevate your resume. Explore our resume templates to find a layout that suits your style, utilize our resume builder for a user-friendly experience, check out resume examples for inspiration, and create a compelling narrative with our cover letter templates. Take action today to ensure your resume stands out in the competitive job market!