23 Mortgage Servicing Specialist Skills for Your Resume in 2025

When crafting your resume for a Mortgage Servicing Specialist position, it's essential to highlight the skills that make you a strong candidate in the competitive mortgage industry. This role requires a unique blend of customer service, attention to detail, and financial knowledge. In the following section, we will outline the top skills that potential employers are looking for, ensuring that your resume stands out and effectively showcases your qualifications.

Best Mortgage Servicing Specialist Technical Skills

As a Mortgage Servicing Specialist, possessing strong technical skills is essential for efficiently managing mortgage accounts and ensuring compliance with industry regulations. These skills not only enhance your operational capabilities but also contribute to improved customer service and streamlined processes. Below are key technical skills that can help you excel in this role.

Loan Processing Software Proficiency

Expertise in loan processing software is crucial for managing mortgage applications and tracking loan statuses. Familiarity with platforms like Encompass or Calyx can significantly improve your efficiency.

How to show it: Highlight specific software you have used, mention the number of loans processed, and any improvements in turnaround times achieved due to your proficiency.

Regulatory Compliance Knowledge

A strong understanding of federal and state regulations governing mortgage lending is vital to ensure compliance and minimize legal risks.

How to show it: Detail any compliance training you’ve completed and quantify your contributions to audits or compliance checks that resulted in zero violations.

Data Analysis Skills

The ability to analyze financial data and mortgage metrics helps in identifying trends and making informed decisions that affect loan servicing operations.

How to show it: Include examples of data-driven decisions you made, such as improving collection rates or reducing delinquencies, and use specific figures to illustrate your impact.

Customer Relationship Management (CRM) Software

Proficiency in CRM systems allows you to maintain effective communication with clients and manage their loan accounts efficiently.

How to show it: List the CRM systems you’ve used, and provide metrics on customer satisfaction improvements or retention rates due to your management efforts.

Financial Literacy

Understanding financial principles is essential for explaining mortgage products to clients and helping them make informed decisions.

How to show it: Describe your ability to explain complex financial terms to clients and cite any positive feedback received from customers regarding clarity and understanding.

Loan Servicing Platforms

Experience with loan servicing platforms is critical for managing existing mortgages, including payment processing and account updates.

How to show it: Specify the platforms you’ve worked with and any efficiencies gained in servicing processes, such as reduced processing times or error rates.

Document Management Systems

Proficiency in document management systems is important for organizing and retrieving important mortgage documents in compliance with regulations.

How to show it: Illustrate your experience with specific systems and highlight any improvements in document retrieval times or reductions in lost documents.

Problem-Solving Skills

Strong problem-solving skills enable you to address client issues and operational challenges effectively, ensuring a smooth servicing experience.

How to show it: Provide examples of complex problems you resolved, including the methods used and the positive outcomes achieved, such as customer satisfaction or process improvements.

Risk Assessment Techniques

Understanding risk assessment techniques is vital for identifying potential issues before they escalate, particularly in loan modifications and collections.

How to show it: Detail your experience in assessing risks and the steps taken to mitigate them, providing metrics on default rates or loss reductions.

Time Management Skills

Effective time management is essential in a fast-paced mortgage servicing environment to meet deadlines and manage multiple accounts simultaneously.

How to show it: Share strategies you implemented to prioritize tasks and any measurable outcomes such as meeting all deadlines or improving workflow efficiency.

Communication Skills

Strong verbal and written communication skills are necessary for interacting with clients, colleagues, and stakeholders to convey complex information clearly.

How to show it: Highlight instances where your communication led to successful outcomes, such as resolving customer complaints or facilitating team collaborations.

Best Mortgage Servicing Specialist Soft Skills

In the role of a Mortgage Servicing Specialist, possessing a diverse set of soft skills is essential for effectively managing customer relationships and navigating complex processes. These skills not only enhance communication but also improve problem-solving abilities and foster teamwork, ensuring that both clients and colleagues receive the best service possible. Here are some key soft skills that can make a significant impact in this role:

Communication

Clear and effective communication is crucial in mortgage servicing, as it ensures that clients understand their options and the processes involved. It also helps in collaborating with team members and stakeholders.

How to show it: Highlight instances where you facilitated successful discussions with clients or resolved conflicts. Use metrics to demonstrate improved customer satisfaction or reduction in misunderstandings.

Problem-solving

Mortgage servicing often involves addressing complex issues that arise during the loan process. Strong problem-solving skills enable specialists to identify challenges quickly and develop effective solutions.

How to show it: Provide examples of challenges you faced and the strategies you implemented to overcome them. Quantify the outcomes, such as reduced processing times or increased loan approval rates.

Time Management

Managing multiple accounts and requests requires excellent time management skills. Mortgage Servicing Specialists must prioritize tasks to meet deadlines and maintain the flow of operations.

How to show it: Detail how you organized your workload to meet deadlines or handled multiple projects simultaneously. Use specific examples that illustrate your ability to manage time effectively.

Teamwork

Collaborating with colleagues is vital in a mortgage servicing environment. Strong teamwork skills foster a supportive atmosphere and improve overall efficiency in handling client requests.

How to show it: Include examples of successful projects completed with team collaboration, emphasizing your role and contributions. Highlight any team achievements that led to improved service delivery.

Attention to Detail

Mortgage processes require meticulous attention to detail to ensure accuracy and compliance with regulations. This skill helps to avoid errors that could lead to financial loss or legal issues.

How to show it: Describe situations where your attention to detail prevented errors or enhanced the quality of work. Provide metrics, such as error rates before and after implementing thorough checks.

Customer Service Orientation

A strong focus on customer service is essential for building trust and maintaining long-term relationships with clients in the mortgage industry.

How to show it: Share specific customer service achievements, such as increased client retention rates or successful resolution of client complaints. Include feedback from clients that illustrates your commitment to service.

Adaptability

The mortgage industry is constantly evolving, and being adaptable is vital for responding to changes in regulations or market conditions.

How to show it: Provide examples of how you successfully adapted to changes in processes or regulations. Highlight your ability to learn new systems or tools quickly.

Negotiation Skills

Negotiating favorable terms for clients while ensuring compliance with policies is a key aspect of the mortgage service role.

How to show it: Detail any negotiations you have conducted that resulted in positive outcomes for both clients and the company. Use specific metrics to showcase your success rates in negotiations.

Empathy

Understanding clients' needs and concerns is crucial in mortgage servicing. Empathy helps build rapport and ensures that clients feel valued and understood.

How to show it: Include instances where your empathetic approach led to better client relationships or resolution of sensitive issues. Client testimonials can also support your claims.

Conflict Resolution

The ability to manage and resolve conflicts effectively is important in maintaining a positive workplace and ensuring client satisfaction.

How to show it: Share examples of conflicts you helped resolve, emphasizing your approach and the outcomes. Highlight any reductions in complaints or improvements in client feedback.

Organization

Staying organized is vital in managing documents, deadlines, and client information in a fast-paced mortgage environment.

How to show it: Demonstrate your organizational skills by providing examples of systems you implemented to streamline processes or track client information effectively.

How to List Mortgage Servicing Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to potential employers, especially in the competitive field of mortgage servicing. Highlighting your skills in three key sections—Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter—can significantly enhance your chances of being noticed by hiring managers.

for Resume Summary

Showcasing Mortgage Servicing Specialist skills in the summary section offers hiring managers a quick insight into your qualifications and suitability for the role. This brief overview sets the tone for the rest of your resume.

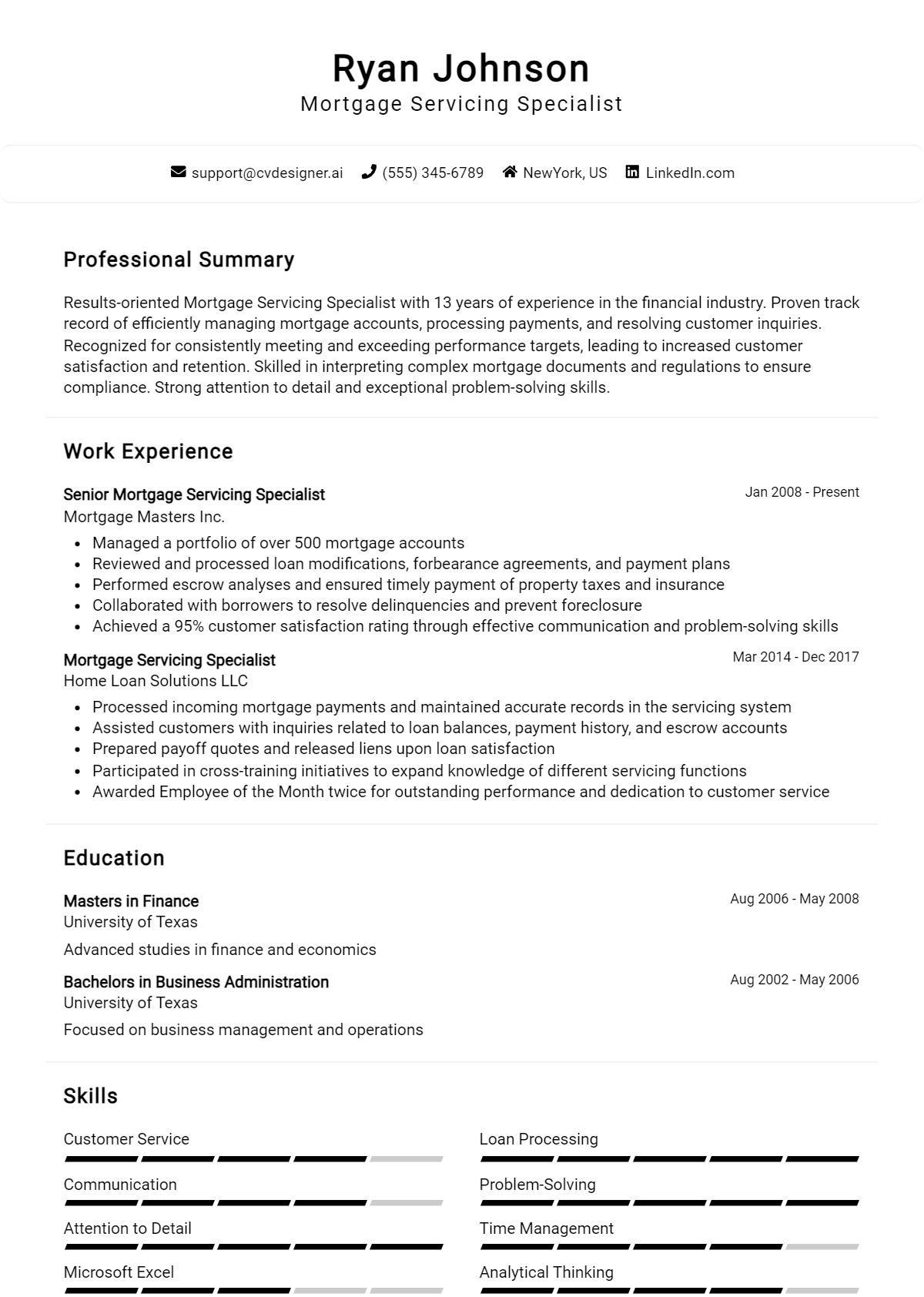

Example

As a dedicated Mortgage Servicing Specialist with expertise in loan processing, customer service, and regulatory compliance, I am passionate about delivering exceptional service and ensuring smooth loan management for clients.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Mortgage Servicing Specialist skills have been applied in real-world scenarios. It's essential to match your experience with the specific skills mentioned in job listings.

Example

- Processed and managed over 200 mortgage accounts, ensuring accuracy and compliance with federal regulations.

- Delivered outstanding customer service by addressing client inquiries and resolving issues efficiently.

- Collaborated with cross-functional teams to enhance operational workflows, resulting in a 15% reduction in processing time.

- Trained new staff on mortgage servicing software and industry best practices, improving team productivity.

for Resume Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills is essential to demonstrate your overall qualifications as a Mortgage Servicing Specialist.

Example

- Loan Processing

- Regulatory Compliance

- Customer Relationship Management

- Data Analysis

- Problem Solving

- Time Management

- Attention to Detail

- Effective Communication

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how you've utilized those skills in previous roles.

Example

In my previous position, my ability to deliver exceptional customer service directly contributed to a 20% increase in client satisfaction scores. Additionally, my expertise in loan processing enabled me to streamline operations, resulting in a significant reduction in turnaround times.

Be sure to link the skills mentioned in your resume to specific achievements in your cover letter, reinforcing your qualifications for the job.

The Importance of Mortgage Servicing Specialist Resume Skills

Highlighting relevant skills on a Mortgage Servicing Specialist resume is crucial for capturing the attention of recruiters and hiring managers. A well-crafted skills section not only showcases a candidate's qualifications but also aligns them with the specific requirements of the job. This tailored approach enables candidates to demonstrate their value and increases their chances of being selected for interviews.

- Demonstrates Expertise: Including pertinent skills reflects a deep understanding of the mortgage servicing industry, showcasing the candidate's expertise and enhancing their credibility in the eyes of employers.

- Aligns with Job Requirements: A targeted skills section ensures alignment with the job description, making it easier for recruiters to see how a candidate meets the specific needs of their organization.

- Enhances Visibility: Many companies use Applicant Tracking Systems (ATS) to filter resumes. By incorporating relevant keywords and skills, candidates improve their chances of passing these automated screenings.

- Highlights Transferable Skills: Candidates often come from diverse backgrounds. Emphasizing transferable skills, such as communication and problem-solving, can help bridge the gap between previous experiences and the mortgage servicing role.

- Builds Confidence: A strong skills section can boost a candidate's confidence during interviews, as they can clearly articulate their strengths and how they can contribute to the company’s success.

- Facilitates Networking: Clearly defined skills make it easier for professionals in the industry to connect and engage with candidates, potentially leading to referrals and job opportunities.

- Sets Candidates Apart: In a competitive job market, a well-defined skills section can differentiate candidates, showcasing unique abilities and experiences that might resonate with hiring managers.

For further assistance in crafting your resume, explore various Resume Samples that can inspire your skills section and overall layout.

How To Improve Mortgage Servicing Specialist Resume Skills

In the dynamic field of mortgage servicing, continuous improvement of skills is essential for staying competitive and providing exceptional service to clients. The mortgage industry is constantly evolving due to changes in regulations, technology, and customer expectations. By enhancing your skills, you not only boost your employability but also contribute to better customer experiences and operational efficiencies.

- Stay updated on industry regulations and compliance by regularly attending training sessions and webinars.

- Enhance your customer service skills through role-playing scenarios and feedback from peers or supervisors.

- Familiarize yourself with the latest mortgage servicing software and tools to improve efficiency and accuracy.

- Develop strong analytical skills by practicing data interpretation and financial analysis relevant to mortgage servicing.

- Join professional organizations or online forums to network with other professionals and learn from their experiences.

- Seek mentorship from experienced mortgage servicing specialists to gain insights and guidance on best practices.

- Regularly review and update your resume to reflect new skills and accomplishments, ensuring it remains relevant in the job market.

Frequently Asked Questions

What are the essential skills required for a Mortgage Servicing Specialist?

A Mortgage Servicing Specialist should possess strong analytical skills to manage and evaluate loan accounts efficiently. Attention to detail is crucial for ensuring accuracy in documentation and compliance with regulations. Additionally, excellent communication skills are necessary for interacting with clients and addressing their inquiries, while problem-solving abilities help in resolving issues related to payment processing and customer concerns.

How important is knowledge of mortgage regulations for a Mortgage Servicing Specialist?

Knowledge of mortgage regulations is vital for a Mortgage Servicing Specialist, as it ensures compliance with federal and state laws. Familiarity with regulations such as RESPA (Real Estate Settlement Procedures Act) and TILA (Truth in Lending Act) enables specialists to guide clients accurately and avoid legal issues. Staying updated on regulatory changes is essential for maintaining the integrity of the servicing process and protecting the interests of both the lender and borrower.

What software skills should a Mortgage Servicing Specialist have?

Proficiency in mortgage servicing software, such as Fiserv or Black Knight, is essential for a Mortgage Servicing Specialist. Familiarity with customer relationship management (CRM) systems and Microsoft Office Suite, particularly Excel for data analysis, is also important. These software skills enable specialists to manage loan portfolios effectively, track payment histories, and generate reports for performance evaluation.

How does customer service play a role in the responsibilities of a Mortgage Servicing Specialist?

Customer service is a fundamental aspect of a Mortgage Servicing Specialist's role, as they often serve as the primary point of contact for borrowers. Providing exceptional service includes addressing inquiries, resolving issues promptly, and ensuring a positive customer experience throughout the loan servicing process. Strong interpersonal skills and empathy are crucial for building trust and maintaining long-term relationships with clients.

What role does teamwork play in the effectiveness of a Mortgage Servicing Specialist?

Teamwork is integral to the effectiveness of a Mortgage Servicing Specialist, as they frequently collaborate with other departments such as underwriting, collections, and compliance. Effective communication and cooperation among team members enhance workflow efficiency and help in resolving complex issues more effectively. A collaborative approach ensures that all aspects of mortgage servicing are handled seamlessly, benefiting both the organization and its clients.

Conclusion

Incorporating the skills of a Mortgage Servicing Specialist into your resume is essential for demonstrating your expertise and value in the mortgage industry. By showcasing relevant skills, candidates can differentiate themselves from the competition and appeal to potential employers who are looking for knowledgeable professionals to enhance their teams. Take the time to refine your skills and present them effectively in your job application, as this can significantly impact your chances of landing your desired position.

For additional resources to help you create an impressive resume, check out our resume templates, utilize our resume builder, explore resume examples, and consider our cover letter templates. Remember, every step you take toward improving your application is a step closer to your dream job!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.