Mortgage Servicing Specialist Core Responsibilities

A Mortgage Servicing Specialist is pivotal in managing mortgage loans, ensuring seamless communication between borrowers, lenders, and various departments. They are responsible for processing payments, managing escrow accounts, and resolving customer inquiries, thus necessitating strong technical, operational, and problem-solving skills. These abilities not only enhance customer satisfaction but also align with the organization’s financial goals. A well-structured resume can effectively highlight these qualifications, showcasing the candidate's capacity to bridge functions and drive operational excellence.

Common Responsibilities Listed on Mortgage Servicing Specialist Resume

- Manage and process mortgage loan payments and disbursements.

- Maintain accurate mortgage account records and documentation.

- Coordinate with underwriting and loan origination teams to resolve discrepancies.

- Respond to borrower inquiries regarding loan status and payment options.

- Oversee escrow accounts and ensure timely tax and insurance payments.

- Conduct regular audits of loan files for compliance and accuracy.

- Implement and monitor mortgage servicing policies and procedures.

- Assist in the resolution of payment delinquencies and loan modifications.

- Prepare reports on loan servicing performance metrics.

- Collaborate with collection departments to manage defaulted loans.

- Provide training and support to new servicing staff.

High-Level Resume Tips for Mortgage Servicing Specialist Professionals

In the competitive field of mortgage servicing, a well-crafted resume serves as your first line of defense against the crowded job market. As a Mortgage Servicing Specialist, your resume is not just a list of past jobs; it is your chance to make a lasting impression on potential employers. It needs to reflect not only your skills and qualifications but also your achievements that demonstrate your ability to excel in the role. A strong resume will highlight your unique value proposition and set you apart from other candidates vying for the same position. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Servicing Specialist professionals, ensuring that your resume stands out for all the right reasons.

Top Resume Tips for Mortgage Servicing Specialist Professionals

- Tailor your resume to the specific job description, emphasizing the skills and experiences that align with the employer's needs.

- Showcase relevant experience in mortgage servicing, including loan processing, customer service, and compliance management.

- Quantify your achievements with specific metrics, such as the number of loans processed or customer satisfaction ratings.

- Highlight industry-specific skills, such as knowledge of mortgage products, regulatory requirements, and software proficiency.

- Utilize action verbs to convey your contributions effectively, making your experiences sound dynamic and impactful.

- Include certifications or training relevant to mortgage servicing, such as NMLS or other industry-recognized credentials.

- Keep the layout clean and professional, using bullet points for easy readability and ensuring consistent formatting throughout.

- Incorporate keywords from the job posting to optimize your resume for applicant tracking systems (ATS).

- Provide a summary statement at the top of your resume that encapsulates your professional identity and key skills.

By implementing these tips, you can significantly increase your chances of landing a job in the Mortgage Servicing Specialist field. A targeted and polished resume will not only demonstrate your qualifications but also convey your commitment to the profession, making you a compelling candidate for potential employers.

Why Resume Headlines & Titles are Important for Mortgage Servicing Specialist

In the highly competitive field of mortgage servicing, a well-crafted resume headline or title can make all the difference for a specialist looking to land their dream job. A strong headline serves as a powerful first impression, immediately grabbing the attention of hiring managers while summarizing a candidate's key qualifications in one impactful phrase. It is essential that these headlines are concise, relevant, and directly related to the job being applied for, as they not only highlight the candidate’s strengths but also set the tone for the rest of the resume.

Best Practices for Crafting Resume Headlines for Mortgage Servicing Specialist

- Keep it concise: Aim for a headline that is no more than 10-12 words.

- Be role-specific: Clearly indicate your expertise in mortgage servicing.

- Highlight key skills: Incorporate relevant skills that align with the job description.

- Showcase accomplishments: Mention notable achievements to demonstrate your value.

- Use action words: Start with strong verbs to convey confidence and proactivity.

- Tailor for each application: Customize your headline for the specific role you are applying for.

- Focus on results: Emphasize how your work has positively impacted previous employers or clients.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

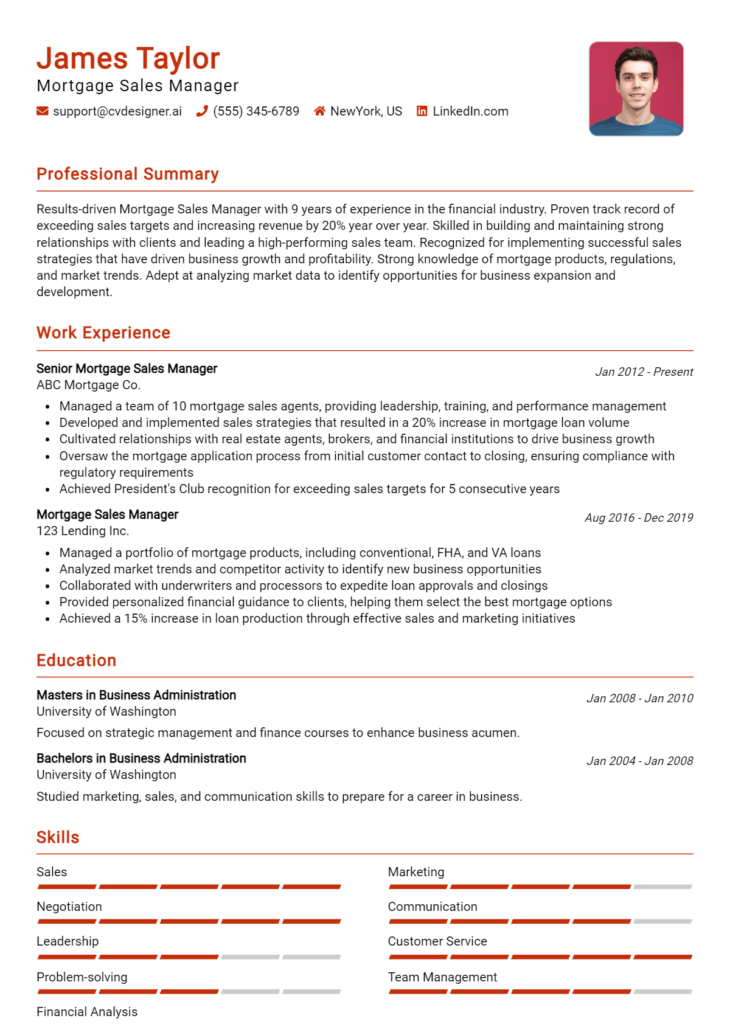

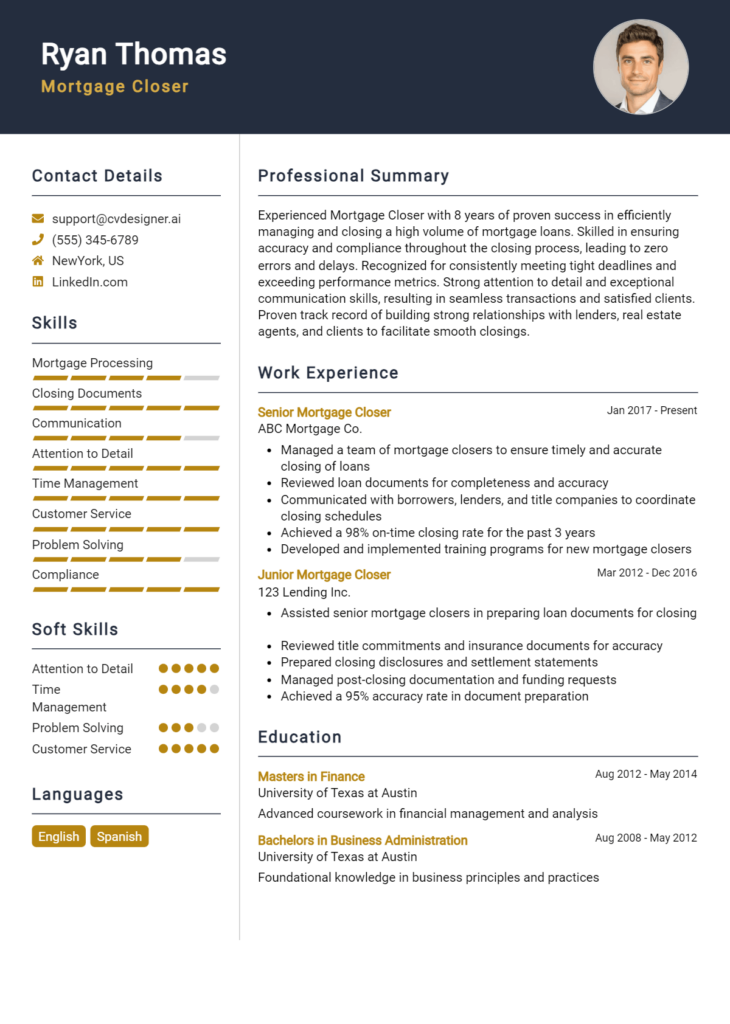

Example Resume Headlines for Mortgage Servicing Specialist

Strong Resume Headlines

Results-Driven Mortgage Servicing Specialist with 5+ Years of Experience in Loan Processing

Detail-Oriented Mortgage Servicing Expert Specializing in Customer Satisfaction and Compliance

Proficient Mortgage Servicing Specialist with Proven Track Record in Reducing Delinquency Rates

Experienced Mortgage Servicing Professional Focused on Streamlining Operations and Enhancing Client Experience

Weak Resume Headlines

Mortgage Servicing Specialist

Hardworking Individual Seeking a Job in Mortgage

Experienced Worker in Finance

The strong headlines are effective because they not only convey specific expertise and accomplishments but also utilize impactful language that resonates with hiring managers. They provide a clear snapshot of what the candidate brings to the table, enhancing their appeal. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity; they do not differentiate the candidate from others or give any insight into their unique qualifications, ultimately leaving hiring managers uninspired and uninterested.

Writing an Exceptional Mortgage Servicing Specialist Resume Summary

A well-crafted resume summary is crucial for a Mortgage Servicing Specialist as it serves as the first impression for hiring managers. This brief paragraph quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the position. A strong summary not only showcases the candidate's qualifications but also conveys their understanding of the role, making it easier for hiring managers to see their potential fit within the organization. It should be concise, impactful, and tailored specifically to the job description to effectively engage the reader.

Best Practices for Writing a Mortgage Servicing Specialist Resume Summary

- Quantify achievements to demonstrate impact and results.

- Focus on relevant skills and expertise specific to mortgage servicing.

- Tailor the summary to align with the job description and company values.

- Use strong action verbs to convey confidence and professionalism.

- Keep it concise, typically 2-4 sentences long.

- Highlight key certifications or licenses relevant to mortgage servicing.

- Showcase problem-solving abilities and customer service skills.

- Incorporate industry-specific terminology to demonstrate knowledge.

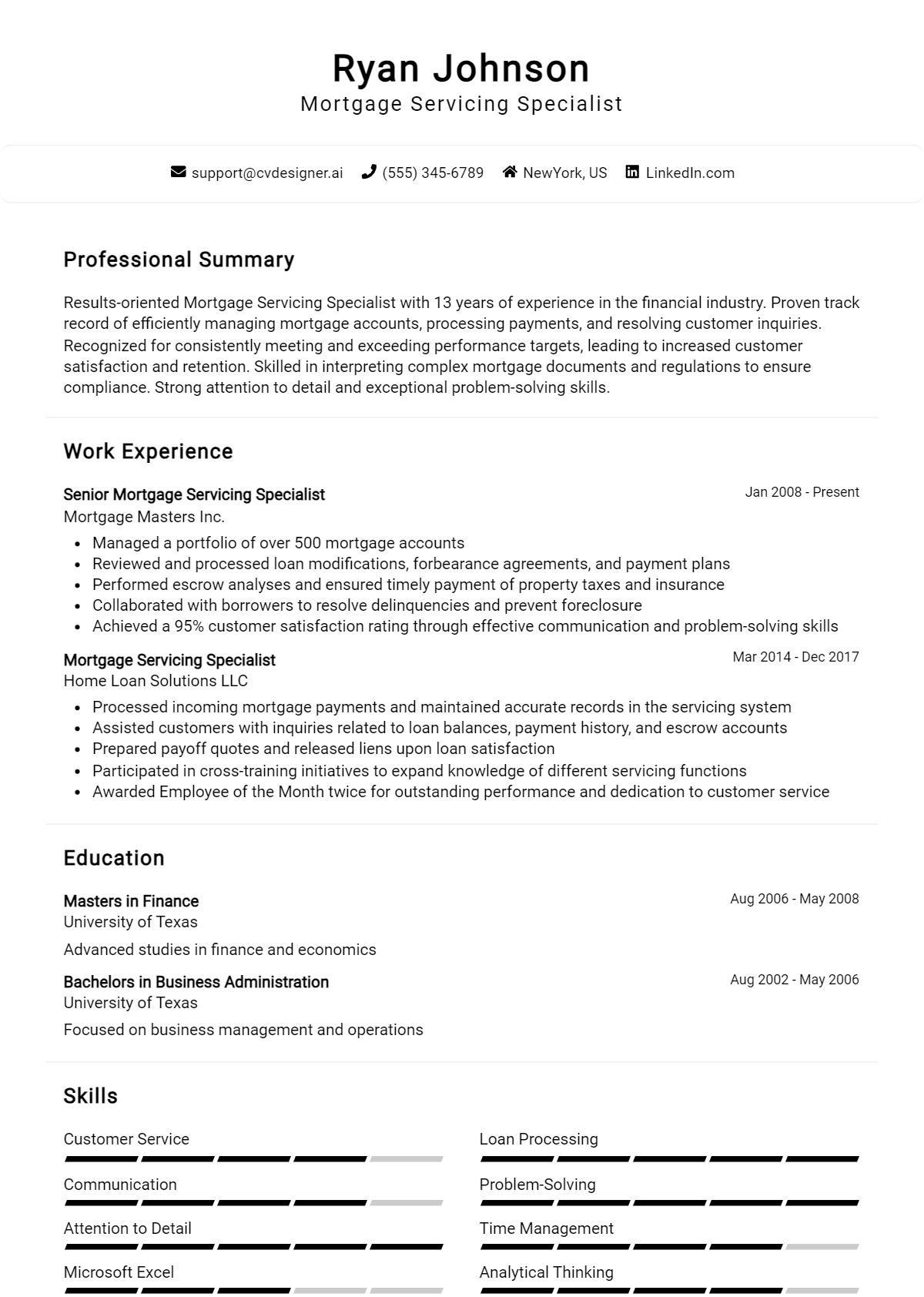

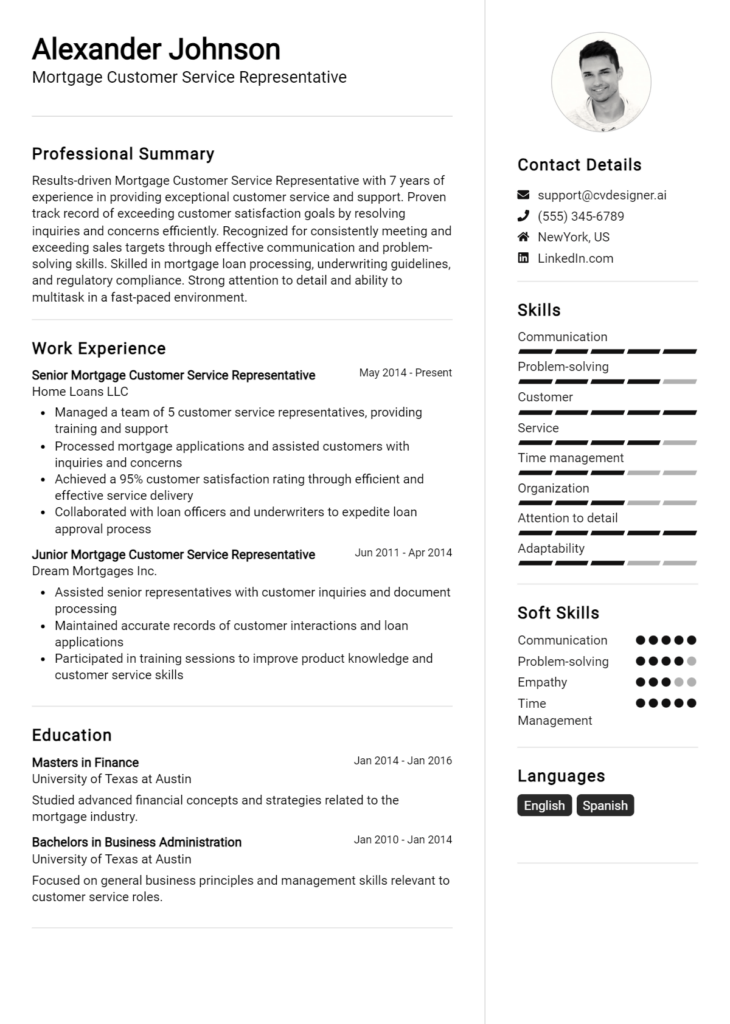

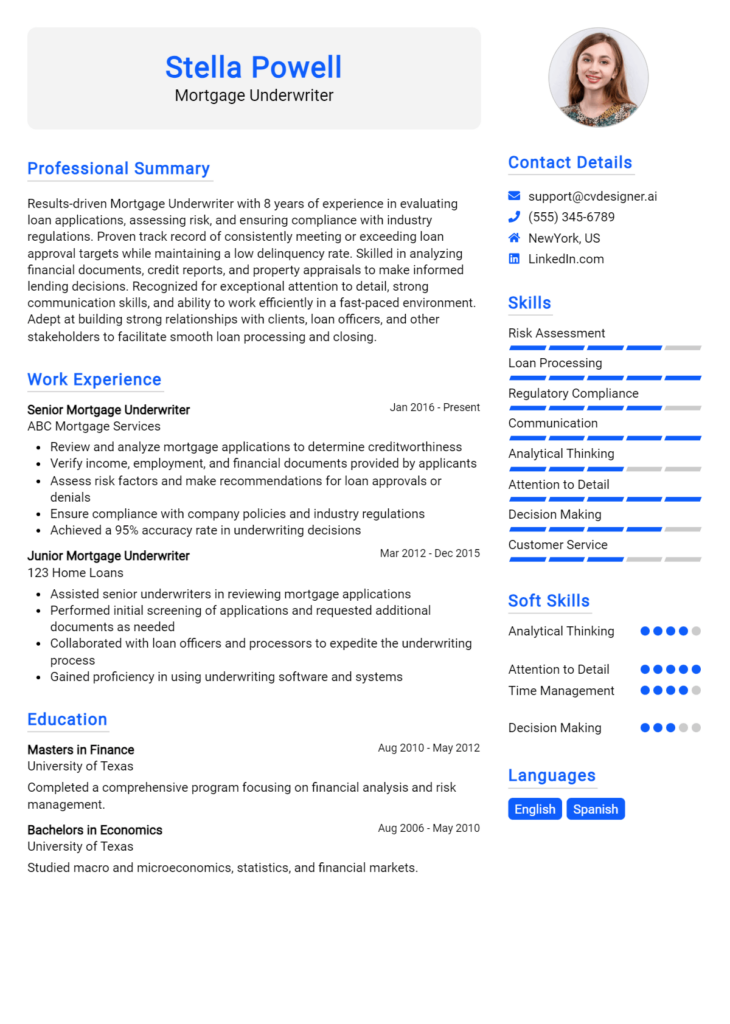

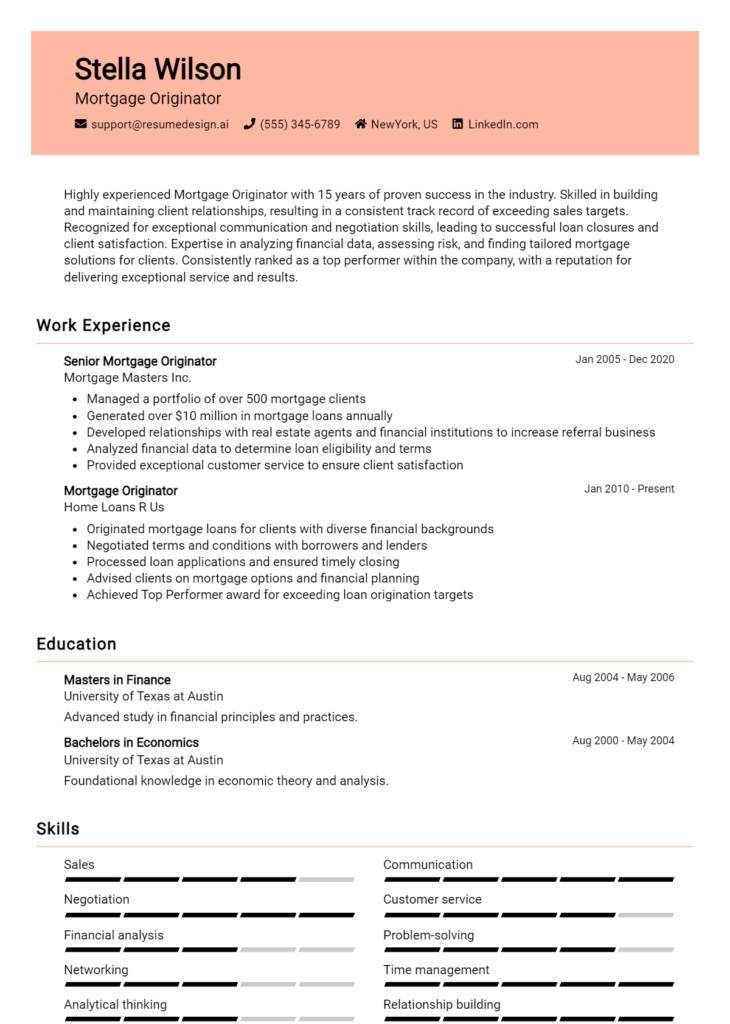

Example Mortgage Servicing Specialist Resume Summaries

Strong Resume Summaries

Results-driven Mortgage Servicing Specialist with over 5 years of experience in managing loan portfolios, ensuring compliance, and optimizing customer satisfaction. Successfully reduced processing time by 20% through streamlined workflows, leading to enhanced operational efficiency.

Detail-oriented Mortgage Servicing Specialist skilled in servicing over 200 mortgage accounts, with a proven track record of achieving a 95% customer satisfaction rating. Expert in analyzing loan documentation and resolving discrepancies swiftly.

Dedicated Mortgage Servicing Specialist with a comprehensive understanding of loan servicing regulations and practices. Achieved a 30% increase in on-time payments by implementing proactive customer engagement strategies.

Weak Resume Summaries

Experienced Mortgage Servicing Specialist looking for a new opportunity where I can use my skills.

Mortgage Servicing Specialist with knowledge of the industry and a desire to help customers.

The strong resume summaries stand out due to their specificity and quantifiable results, demonstrating the candidates' direct impact in previous roles. They highlight relevant skills and accomplishments that are tailored to the role of a Mortgage Servicing Specialist. In contrast, the weak summaries lack detail and do not provide any measurable outcomes or specific skills, making them too generic and less compelling for potential employers.

Work Experience Section for Mortgage Servicing Specialist Resume

The work experience section of a Mortgage Servicing Specialist resume is paramount, as it serves as a comprehensive showcase of the candidate's technical skills, leadership capabilities, and their track record of delivering high-quality products and services. This section not only highlights relevant industry experience but also illustrates the candidate's proficiency in managing teams, navigating complex mortgage servicing processes, and achieving measurable results. By quantifying achievements and aligning past experiences with industry standards, candidates can effectively demonstrate their value to potential employers and stand out in a competitive job market.

Best Practices for Mortgage Servicing Specialist Work Experience

- Focus on quantifiable results, such as percentage increases in efficiency or decreases in processing time.

- Highlight technical skills relevant to mortgage servicing, including software proficiency and regulatory knowledge.

- Demonstrate effective team management through specific examples of leadership and collaboration.

- Use industry-specific terminology to align your experience with current standards and expectations.

- Showcase problem-solving abilities by detailing challenges faced and solutions implemented.

- Include relevant certifications or training that enhance your technical expertise.

- Tailor your experience to the job description, emphasizing the most pertinent skills and achievements.

- Keep descriptions concise yet impactful, ensuring clarity in your accomplishments.

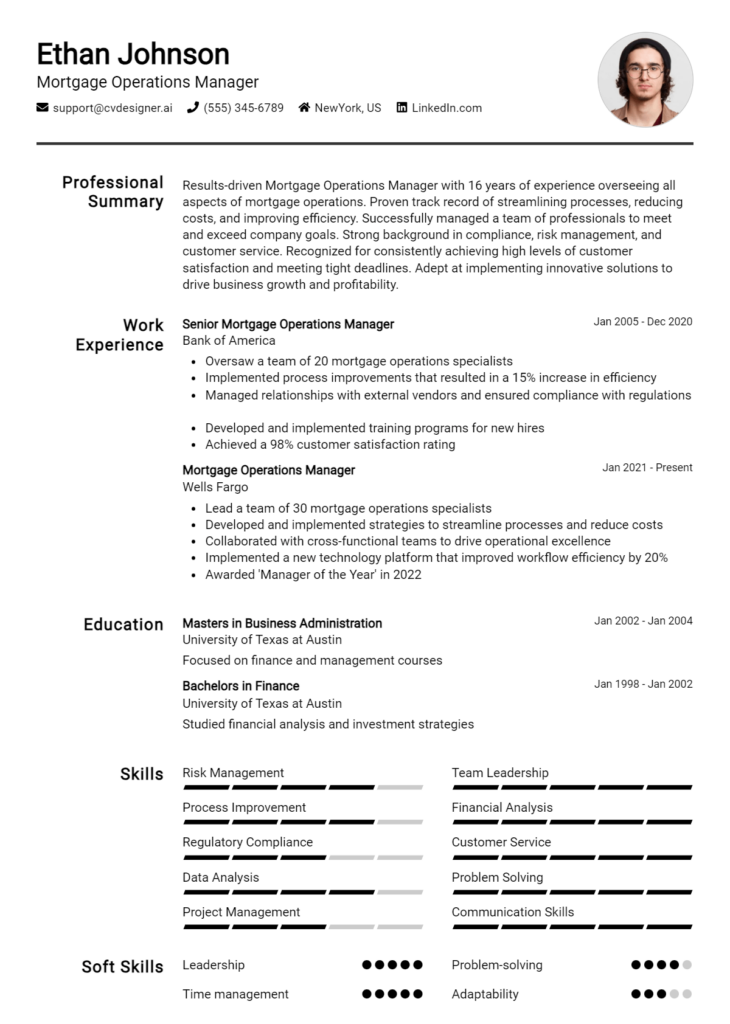

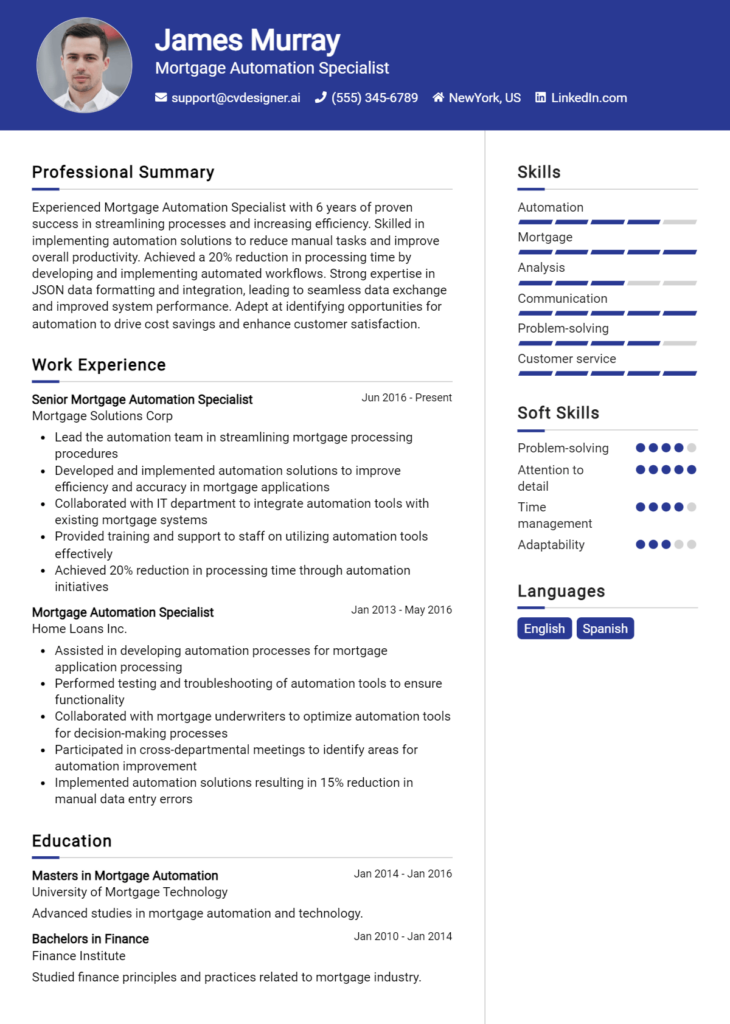

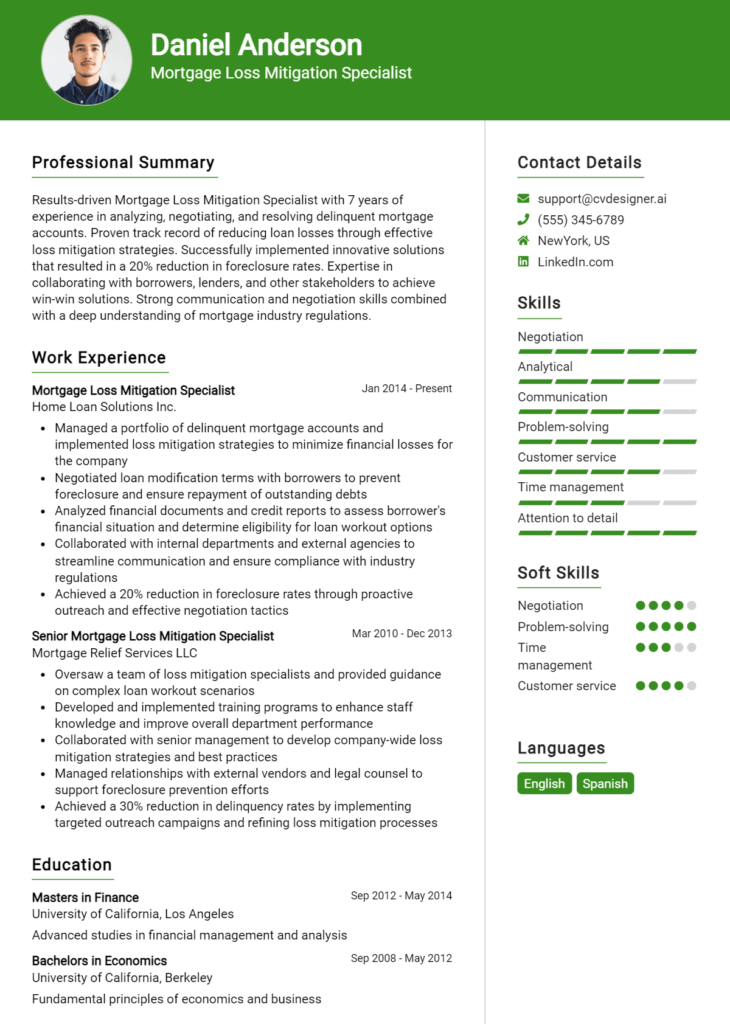

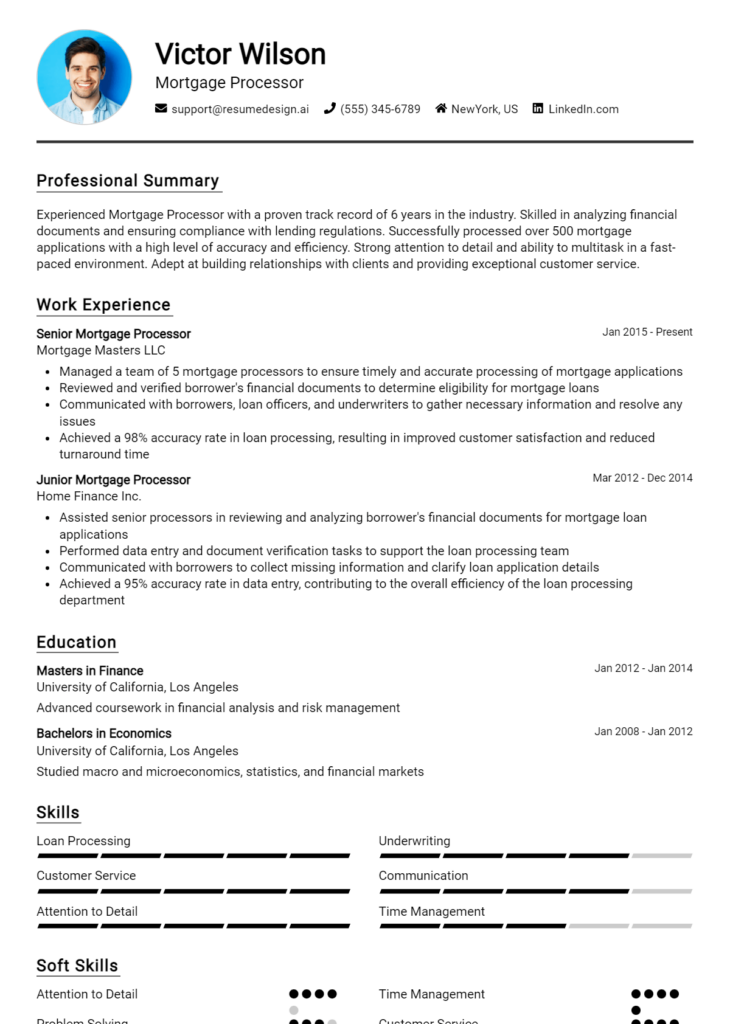

Example Work Experiences for Mortgage Servicing Specialist

Strong Experiences

- Led a cross-functional team to streamline the mortgage application process, resulting in a 30% reduction in processing time and a 15% increase in customer satisfaction ratings.

- Implemented a new loan servicing software that improved data accuracy by 25% and reduced manual entry errors, saving the company an estimated $50,000 annually.

- Managed a team of 10 mortgage specialists, fostering collaboration that led to a 40% boost in team productivity and achieving departmental goals ahead of schedule.

- Conducted training sessions on regulatory compliance, ensuring a 100% pass rate during audits and enhancing team knowledge of industry standards.

Weak Experiences

- Worked on mortgage applications in a team setting.

- Responsible for a variety of tasks related to loan servicing.

- Helped improve processes and customer service.

- Participated in training sessions and meetings.

The examples above are considered strong because they provide specific, quantifiable outcomes that clearly demonstrate the candidate's impact in their previous roles. They highlight leadership, technical expertise, and effective collaboration, which are all vital for a Mortgage Servicing Specialist. In contrast, the weak experiences lack detail and measurable results, making it difficult for potential employers to gauge the candidate's contributions and capabilities. By focusing on specifics and outcomes, candidates can significantly enhance the effectiveness of their work experience section.

Education and Certifications Section for Mortgage Servicing Specialist Resume

The education and certifications section of a Mortgage Servicing Specialist resume plays a crucial role in establishing the candidate's qualifications and expertise in the field. This section not only showcases the academic background that provides foundational knowledge but also highlights industry-relevant certifications and continuous learning efforts that demonstrate a commitment to professional development. By including relevant coursework, certifications, and any specialized training, candidates can significantly enhance their credibility and alignment with the job role, making a compelling case for their suitability to potential employers.

Best Practices for Mortgage Servicing Specialist Education and Certifications

- Prioritize relevant degrees, such as a Bachelor's degree in Finance, Business Administration, or a related field.

- Include industry-recognized certifications, such as the Mortgage Bankers Association (MBA) Certified Mortgage Servicing Professional (CMSP).

- List any specialized training or workshops that enhance your understanding of mortgage servicing operations.

- Detail relevant coursework that aligns with the skills required for the Mortgage Servicing Specialist role.

- Keep the section concise but informative, focusing on the most pertinent qualifications.

- Update the section regularly to reflect new certifications or educational achievements.

- Use clear and professional language to communicate your qualifications effectively.

- Consider including any continuing education credits that demonstrate ongoing professional development.

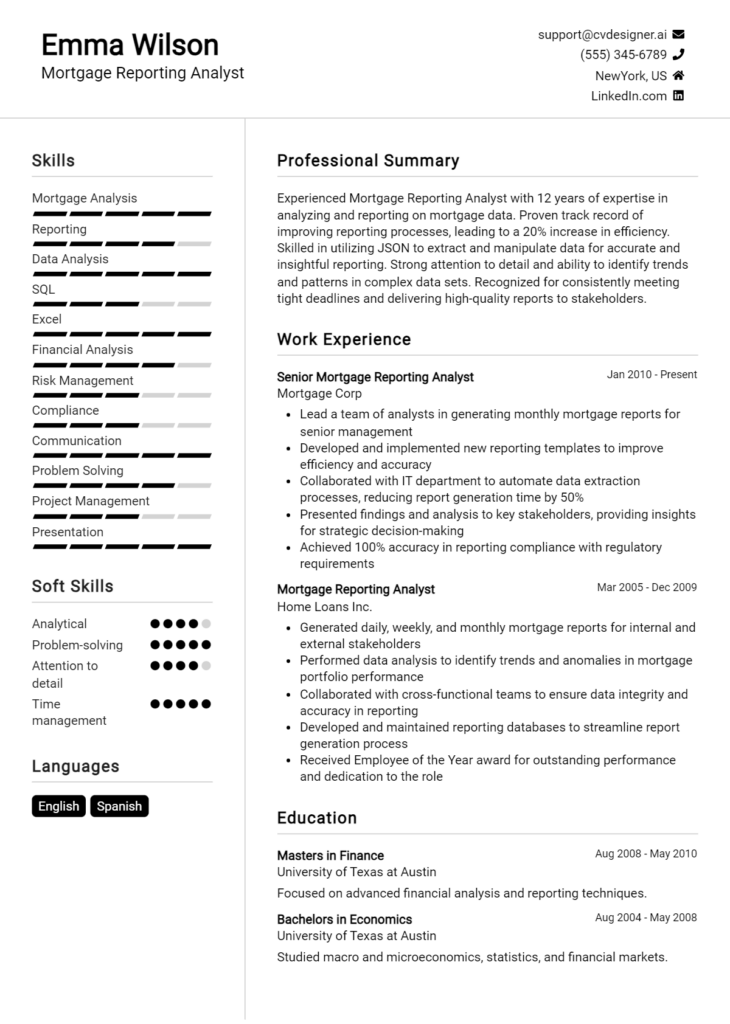

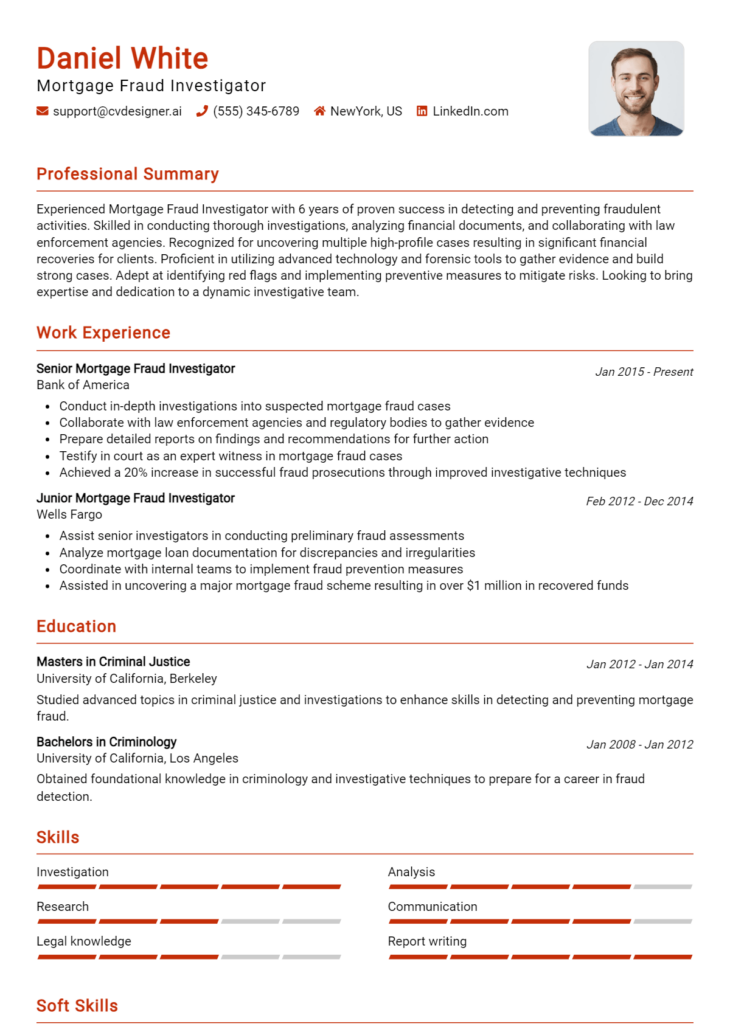

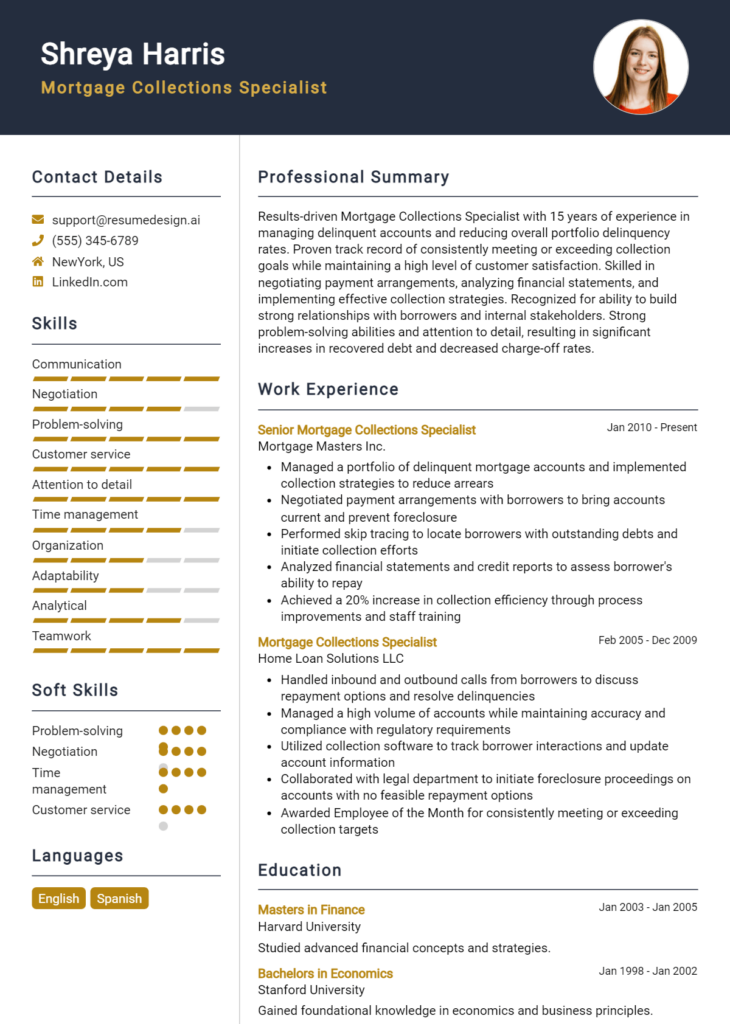

Example Education and Certifications for Mortgage Servicing Specialist

Strong Examples

- Bachelor of Science in Finance, University of XYZ, May 2021

- Certified Mortgage Servicing Professional (CMSP), Mortgage Bankers Association, 2022

- Advanced Mortgage Servicing Course, National Association of Mortgage Bankers, 2023

- Coursework in Risk Management and Loan Servicing Practices, completed at ABC University

Weak Examples

- Associate Degree in General Studies, Community College, 2018

- Certification in Basic Accounting (outdated), 2015

- High School Diploma, Graduated 2010

- Unrelated certification in Customer Service, 2016

The examples above illustrate the distinction between strong and weak qualifications for a Mortgage Servicing Specialist. Strong examples are directly related to the mortgage servicing field, showcasing relevant degrees and certifications that enhance the candidate's credibility. In contrast, weak examples present qualifications that are either outdated, irrelevant to the role, or do not reflect a level of expertise that aligns with industry standards, potentially diminishing the candidate's appeal to employers.

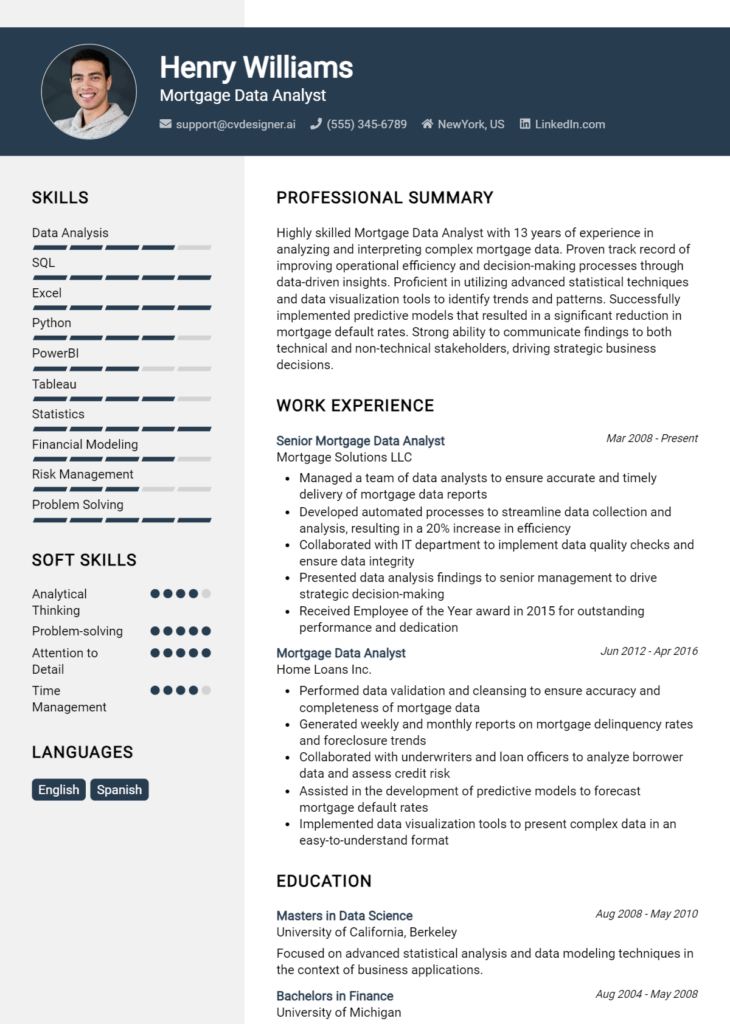

Top Skills & Keywords for Mortgage Servicing Specialist Resume

A well-crafted resume for a Mortgage Servicing Specialist is crucial for standing out in a competitive job market. The inclusion of relevant skills not only highlights your qualifications but also demonstrates your ability to navigate the complexities of the mortgage industry. Potential employers are keen to identify candidates who possess both hard and soft skills, as these attributes are essential for managing client relationships, ensuring compliance, and processing mortgage transactions efficiently. By showcasing the right blend of skills, you can effectively communicate your readiness to contribute to a dynamic mortgage servicing team.

Top Hard & Soft Skills for Mortgage Servicing Specialist

Soft Skills

- Strong communication skills

- Customer service orientation

- Attention to detail

- Problem-solving abilities

- Time management

- Adaptability

- Conflict resolution

- Team collaboration

- Analytical thinking

- Empathy

- Active listening

- Negotiation skills

- Organizational skills

- Relationship building

- Critical thinking

Hard Skills

- Knowledge of mortgage products and services

- Proficiency in mortgage servicing software

- Understanding of regulatory compliance and guidelines

- Loan processing and underwriting experience

- Financial analysis

- Data entry and management

- Familiarity with credit reports and scoring

- Risk assessment

- Payment processing

- Ability to create and maintain records

- Proficient in Microsoft Office Suite

- Knowledge of foreclosure processes

- Document review and management

- Familiarity with industry best practices

- Experience with customer relationship management (CRM) systems

By integrating these skills into your resume, along with your work experience, you can present yourself as a well-rounded candidate ready to excel in the role of Mortgage Servicing Specialist.

Stand Out with a Winning Mortgage Servicing Specialist Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Mortgage Servicing Specialist position at [Company Name] as advertised on [Job Board/Company Website]. With a solid background in mortgage servicing and a commitment to providing exceptional customer service, I am confident in my ability to contribute effectively to your team. My experience includes managing loan accounts, processing payments, and resolving customer inquiries, all while ensuring compliance with regulatory guidelines.

In my previous role at [Previous Company Name], I successfully handled a diverse portfolio of mortgage accounts, where I was responsible for managing loan modifications, payment processing, and customer communication. My attention to detail and analytical skills enabled me to identify discrepancies promptly, ensuring accurate account management. I am particularly proud of my ability to streamline processes that improved efficiency and reduced turnaround times for customer inquiries, thereby enhancing overall client satisfaction.

I am passionate about helping customers navigate the complexities of their mortgage servicing needs. I believe that clear communication and empathy are essential in this role, and I have consistently received positive feedback from clients for my ability to explain intricate financial concepts in a straightforward manner. I am excited about the opportunity to bring my skills and dedication to [Company Name], where I can make a meaningful impact on your clients' experiences.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am eager to contribute to your team and help enhance the service quality for your valued customers.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Mortgage Servicing Specialist Resume

When crafting a resume for the position of a Mortgage Servicing Specialist, it's essential to present your qualifications and experience in a clear and compelling manner. However, many candidates make common mistakes that can undermine their chances of landing an interview. By avoiding these pitfalls, you can enhance your resume and better showcase your suitability for the role. Below are some prevalent errors to watch out for:

Lack of Specificity: Failing to provide specific examples of your accomplishments can weaken your resume. Instead of vague statements, quantify your achievements (e.g., "Managed a portfolio of 150 loans with a 98% customer satisfaction rate").

Ignoring Keywords: Not including industry-specific keywords can hurt your chances of getting noticed by Applicant Tracking Systems (ATS) that many companies use. Research job descriptions to identify key terms relevant to mortgage servicing.

Overly Complex Language: Using jargon or overly complicated phrases can make your resume difficult to read. Aim for clear, concise language that conveys your qualifications effectively.

Inconsistent Formatting: A resume with inconsistent formatting can be distracting. Maintain uniform font sizes, bullet points, and spacing throughout to create a professional appearance.

Neglecting Soft Skills: While technical skills are crucial, overlooking soft skills such as communication, problem-solving, and customer service can be a mistake. Highlighting these skills can demonstrate your ability to work effectively with clients.

Listing Duties Instead of Achievements: Simply listing your job duties without highlighting your achievements can make your resume blend in. Focus on what you accomplished in each role rather than just what you were responsible for.

Failing to Tailor Your Resume: Sending a generic resume for every application can be detrimental. Tailor your resume to match the specific job description, emphasizing the experience and skills that align with the role.

Omitting Education and Certifications: Failing to include relevant education or certifications can be a missed opportunity. Ensure you list any degrees, licenses, or certifications that pertain to mortgage servicing, as these can enhance your candidacy.

Conclusion

As a Mortgage Servicing Specialist, you play a crucial role in managing mortgage accounts and ensuring customer satisfaction. Throughout this article, we delved into the essential skills required for this role, including proficiency in mortgage regulations, excellent communication abilities, and strong problem-solving skills. We also highlighted the importance of attention to detail and the ability to work with diverse clients and their unique financial situations.

In conclusion, if you're looking to advance in your career as a Mortgage Servicing Specialist or secure a new position, it’s vital to have a standout resume that accurately reflects your skills and experiences. Take the time to review your resume and ensure it showcases your qualifications effectively.

To assist you in this endeavor, we recommend utilizing various resources available to enhance your resume. Explore our resume templates, which can guide you in structuring your document professionally. If you’re looking for a more tailored approach, consider our resume builder to create a personalized resume that highlights your strengths. Additionally, check out our resume examples for inspiration on how to present your experiences. Don’t forget the importance of a compelling introduction; our cover letter templates can help you craft the perfect letter to accompany your resume.

Take action today and elevate your job application materials to stand out in the competitive field of mortgage servicing!