Top 29 Hard and Soft Skills for 2025 Mortgage Operations Manager Resumes

As a Mortgage Operations Manager, possessing a diverse skill set is crucial for effectively overseeing the mortgage process and ensuring smooth operations. This role requires a blend of technical knowledge, leadership abilities, and a keen understanding of the regulatory environment. In the following section, we will outline the top skills that can enhance your resume and make you a standout candidate in the competitive mortgage industry.

Best Mortgage Operations Manager Technical Skills

In the competitive field of mortgage operations, possessing strong technical skills is essential for a Mortgage Operations Manager. These skills not only enhance efficiency and accuracy in the loan processing cycle but also empower managers to lead teams effectively and ensure compliance with regulatory standards. Highlighting these skills on your resume can set you apart from other candidates and demonstrate your capability to drive the success of mortgage operations.

Loan Origination Software Proficiency

Understanding and using loan origination systems (LOS) is crucial for managing the loan application process efficiently. Familiarity with platforms such as Encompass or Calyx can streamline operations.

How to show it: List specific software you have used, and mention any improvements in application processing time or error reduction you achieved through effective use of these systems.

Compliance Knowledge

A deep understanding of federal and state regulations, including RESPA, TILA, and HMDA, ensures that your operations remain compliant. This knowledge is vital for minimizing legal risks.

How to show it: Include examples of successful audits or compliance training programs you led, along with any instances where your knowledge prevented potential violations.

Data Analysis and Reporting

Being skilled in analyzing data allows you to make informed decisions based on performance metrics. Proficiency in tools such as Excel or Tableau can enhance your reporting capabilities.

How to show it: Quantify your achievements by sharing specific metrics or reports you compiled that led to strategic improvements within the organization.

Project Management

Effective project management skills facilitate the coordination of various operations, ensuring that projects are completed on time and within budget. Familiarity with project management software can enhance these efforts.

How to show it: Provide examples of projects you managed, including timelines, budgets, and how your leadership contributed to successful outcomes.

Customer Relationship Management (CRM)

Utilizing CRM tools helps manage client interactions and enhance customer satisfaction. Knowledge of systems like Salesforce can improve lead tracking and customer service strategies.

How to show it: Highlight your experience with specific CRM systems and any metrics that demonstrate improved customer retention or satisfaction rates due to your initiatives.

Risk Management

Identifying and mitigating risks associated with mortgage operations is vital for maintaining operational integrity. This includes assessing potential fraud and credit risks.

How to show it: Detail instances where your risk management strategies successfully prevented losses or improved the overall security of operations.

Financial Analysis

The ability to analyze financial statements and assess borrowers' creditworthiness is essential for making informed lending decisions and managing loan portfolios.

How to show it: Include examples of analyses you've performed that influenced lending decisions, along with the resulting impact on loan performance.

Process Improvement

Skills in process improvement methodologies such as Lean or Six Sigma can enhance operational efficiency and reduce waste within mortgage processes.

How to show it: Share specific process improvements you implemented, including the before-and-after states and measurable outcomes such as time saved or costs reduced.

Underwriting Knowledge

A solid understanding of underwriting criteria and processes is essential for evaluating loan applications and making sound lending decisions.

How to show it: Discuss your experience with underwriting guidelines, including any instances where your decisions led to increased approval rates or reduced defaults.

Team Leadership and Training

Strong leadership skills are needed to manage teams effectively, guiding them through complex operations and promoting continuous professional development.

How to show it: Provide examples of training programs you've developed or led, along with the positive impact on team performance or morale.

Document Management and Filing Systems

Efficient document management is vital in mortgage operations to ensure that all necessary paperwork is processed and stored correctly, facilitating easy access and compliance.

How to show it: Describe your experience with specific document management systems and any organizational improvements you achieved through better filing practices.

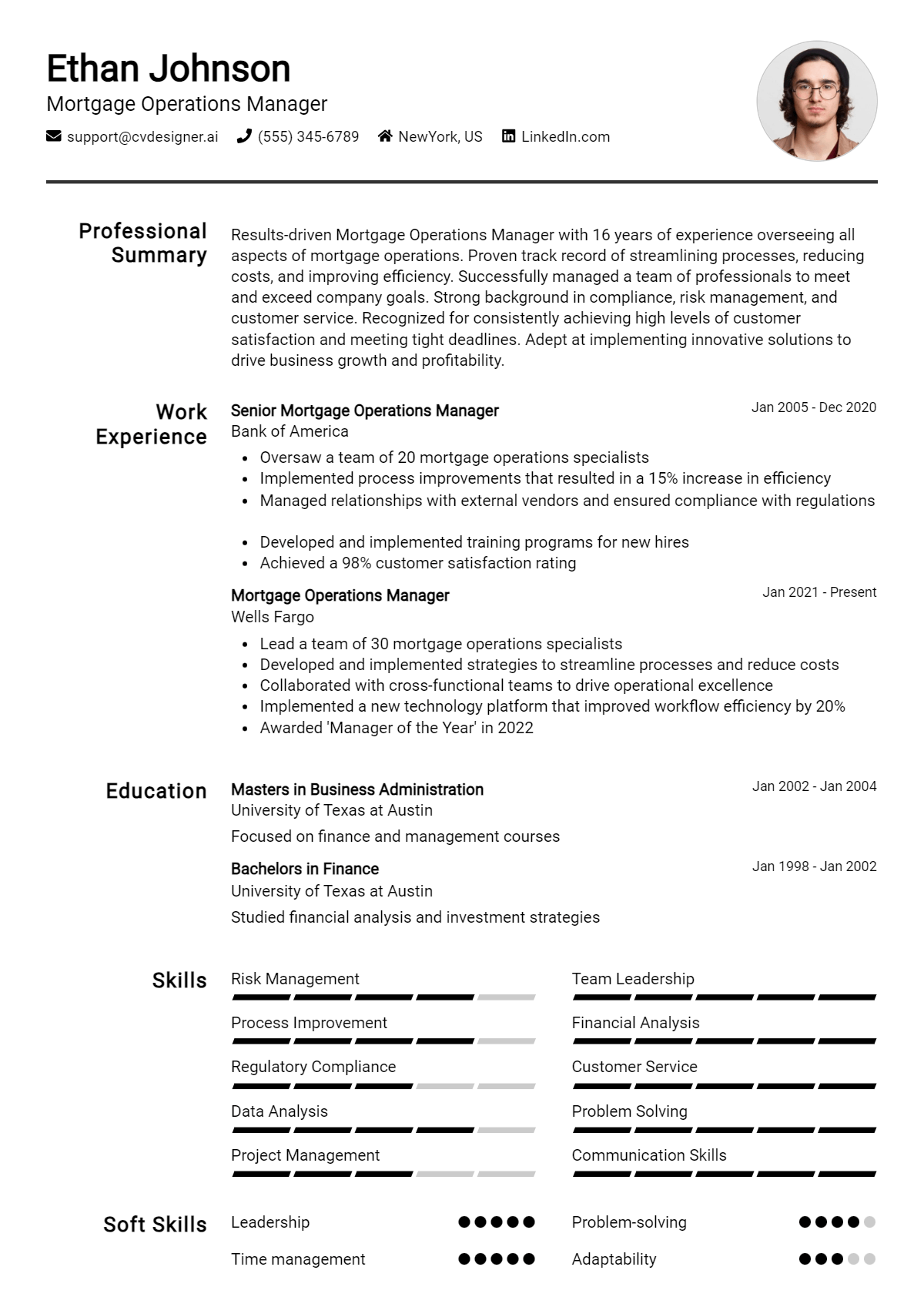

How to List Mortgage Operations Manager Skills on Your Resume

Effectively listing your skills on a resume is crucial for making a strong impression on potential employers. By clearly highlighting your qualifications, you can stand out among other candidates. There are three main sections where you can showcase your skills: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

In the introduction or summary section, showcasing your Mortgage Operations Manager skills provides hiring managers with a quick overview of your qualifications and expertise. This sets the tone for the rest of your resume.

Example

As a dedicated Mortgage Operations Manager with expertise in loan processing and team leadership, I am committed to enhancing operational efficiency and delivering excellent customer service in the mortgage industry.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Mortgage Operations Manager skills have been applied in real-world scenarios, illustrating your impact and accomplishments.

Example

- Led a team of 10 in streamlining the loan processing system, resulting in a 30% reduction in turnaround time.

- Implemented risk management strategies that decreased default rates by 15% over two years.

- Utilized data analysis to identify trends, improving customer satisfaction scores by 20%.

- Trained new staff on compliance regulations, leading to a 100% pass rate during audits.

for Resume Skills

The skills section of your resume can showcase both technical and transferable skills. It's important to include a balanced mix of hard and soft skills that strengthen your overall qualifications.

Example

- Loan Processing Expertise

- Team Leadership

- Data Analysis

- Risk Management

- Customer Service Excellence

- Compliance Regulations Knowledge

- Project Management

- Communication Skills

for Cover Letter

Your cover letter is an opportunity to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how those skills have positively impacted your previous roles.

Example

In my previous role, my ability to lead a team and streamline loan processing resulted in a significant boost in operational efficiency. By focusing on customer service excellence and compliance regulations, I ensured a seamless experience for clients while maintaining high industry standards.

Additionally, linking the skills mentioned in your resume to specific achievements in your cover letter can reinforce your qualifications for the job.

The Importance of Mortgage Operations Manager Resume Skills

In the competitive field of mortgage operations, a well-crafted resume is paramount for candidates aspiring to secure the role of Mortgage Operations Manager. Highlighting relevant skills not only showcases a candidate's qualifications but also aligns them with the specific requirements of the position. A strong skills section can make a significant difference in catching the attention of recruiters, demonstrating that the candidate possesses the necessary expertise to excel in this critical role.

- Effective communication skills are essential for Mortgage Operations Managers, as they need to convey complex information clearly to clients, team members, and stakeholders, ensuring a smooth process throughout the mortgage journey.

- Strong leadership abilities help in managing teams effectively, fostering a collaborative work environment, and driving productivity, which is crucial in meeting tight deadlines and ensuring customer satisfaction.

- Proficient knowledge of mortgage products and regulations is vital; it ensures compliance with industry standards and helps managers guide their teams in offering the best solutions to clients.

- Analytical skills are key in assessing market trends and evaluating risk factors, enabling managers to make informed decisions that align with company goals and customer needs.

- Attention to detail minimizes errors in documentation and processes, which is critical in the mortgage industry where precision can significantly impact loan approvals and customer trust.

- Problem-solving skills enable Mortgage Operations Managers to address challenges swiftly and effectively, ensuring that any issues that arise during the mortgage process are resolved without impacting the client experience.

- Project management capabilities help in overseeing multiple loans and ensuring that all tasks are completed on time, facilitating better workflow and enhancing operational efficiency.

- Customer service orientation is crucial for building relationships with clients, understanding their needs, and ensuring a positive experience throughout the mortgage process.

For more insights on crafting an effective resume, check out these Resume Samples.

How To Improve Mortgage Operations Manager Resume Skills

In the fast-paced world of mortgage operations, it is essential for professionals to continuously enhance their skills to stay competitive and effective in their roles. With the mortgage industry constantly evolving due to regulatory changes, technology advancements, and shifting market dynamics, an Operations Manager must be proactive in their professional development. By improving your skills, you not only increase your value to your organization but also position yourself for career advancement and new opportunities.

- Stay Informed on Industry Regulations: Regularly review updates from regulatory bodies to ensure compliance and understand how changes may impact operations.

- Enhance Technical Proficiency: Familiarize yourself with the latest mortgage software and tools to streamline processes and improve efficiency.

- Develop Leadership Skills: Participate in leadership training programs to enhance your ability to manage teams and drive performance.

- Network with Industry Peers: Join professional associations and attend industry conferences to share best practices and learn from others' experiences.

- Engage in Continuous Education: Take relevant courses or certifications in mortgage banking, project management, or business administration to bolster your knowledge base.

- Seek Feedback: Regularly request feedback from colleagues and supervisors to identify areas for improvement and build on your strengths.

- Implement Process Improvements: Analyze current workflows and identify opportunities for efficiency gains, documenting your successes to showcase on your resume.

Frequently Asked Questions

What are the key skills required for a Mortgage Operations Manager?

A successful Mortgage Operations Manager should possess strong leadership abilities, excellent communication skills, and a solid understanding of mortgage processing and underwriting. Proficiency in managing teams, optimizing workflows, and ensuring compliance with industry regulations is crucial. Additionally, analytical skills to evaluate processes and metrics, as well as customer service expertise, are essential for enhancing client satisfaction and operational efficiency.

How important is compliance knowledge for a Mortgage Operations Manager?

Compliance knowledge is critical for a Mortgage Operations Manager, as the mortgage industry is heavily regulated. A deep understanding of federal and state regulations, such as RESPA, TILA, and ECOA, ensures that the organization adheres to legal standards and avoids costly penalties. This expertise not only protects the company but also fosters trust with clients and stakeholders.

What role does technology play in the skills of a Mortgage Operations Manager?

In today’s fast-paced mortgage environment, technology plays a vital role in streamlining operations. A Mortgage Operations Manager should be adept at using mortgage processing software, data management systems, and CRM tools to enhance productivity and accuracy. Familiarity with emerging technologies such as automation and AI can also provide a competitive edge in improving service delivery and operational efficiency.

How can leadership skills impact a Mortgage Operations Manager's effectiveness?

Leadership skills are fundamental for a Mortgage Operations Manager as they directly influence team performance and morale. Effective leaders inspire their teams, fostering a collaborative environment that encourages innovation and problem-solving. Strong leadership also involves mentoring team members, providing constructive feedback, and managing conflicts, all of which contribute to a more engaged and productive workforce.

What are the best practices for improving customer service in mortgage operations?

Improving customer service in mortgage operations requires a commitment to transparency, responsiveness, and empathy. A Mortgage Operations Manager should implement best practices such as regular training for staff, utilizing customer feedback to enhance services, and ensuring clear communication throughout the loan process. By prioritizing the customer experience and addressing concerns promptly, organizations can build lasting relationships and enhance their reputation in the market.

Conclusion

Including the relevant skills of a Mortgage Operations Manager in your resume is crucial for demonstrating your expertise and value to potential employers. By effectively showcasing these skills, candidates can stand out in a competitive job market and attract the attention of hiring managers looking for qualified professionals. Remember, a well-crafted resume can open doors to exciting opportunities, so take the time to refine your skills and enhance your job application.

To help you in your journey, consider exploring our resume templates, utilizing our resume builder, reviewing resume examples, and crafting compelling cover letter templates. Embrace the process and watch your career flourish!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.