Mortgage Operations Manager Core Responsibilities

The Mortgage Operations Manager plays a crucial role in ensuring the smooth functioning of mortgage processes by bridging various departments such as underwriting, compliance, and customer service. This position requires strong technical skills to navigate mortgage software, operational expertise to streamline workflows, and problem-solving abilities to address challenges promptly. These competencies are essential for achieving organizational goals, making a well-structured resume vital for showcasing relevant qualifications and experiences effectively.

Common Responsibilities Listed on Mortgage Operations Manager Resume

- Oversee daily operations of the mortgage department to ensure efficiency.

- Collaborate with underwriting, compliance, and loan processing teams.

- Implement and refine operational processes to enhance productivity.

- Monitor and analyze performance metrics to identify improvement areas.

- Ensure compliance with regulatory requirements and internal policies.

- Train and mentor staff on best practices and industry standards.

- Resolve escalated issues and customer complaints effectively.

- Develop and maintain strong relationships with stakeholders and lenders.

- Prepare reports on operational performance for senior management.

- Lead initiatives for technology integration to improve operations.

- Conduct regular audits to ensure quality control in loan processing.

- Stay updated on market trends and changes in mortgage regulations.

High-Level Resume Tips for Mortgage Operations Manager Professionals

In the competitive landscape of mortgage operations, a well-crafted resume is crucial for professionals aiming to stand out to potential employers. As the first impression a candidate makes, the resume needs to effectively reflect not only their skills and qualifications but also their achievements and contributions in the mortgage industry. A strong resume serves as a strategic marketing tool that captures the essence of a candidate's professional journey, aligning it with the needs of hiring organizations. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Operations Manager professionals, helping you elevate your resume to new heights.

Top Resume Tips for Mortgage Operations Manager Professionals

- Tailor your resume to the specific job description by incorporating keywords and phrases that align with the role.

- Highlight relevant experience in mortgage operations, including overseeing loan processing, underwriting, and compliance.

- Quantify your achievements with specific metrics, such as the percentage of loans processed on time or the reduction of operational costs.

- Showcase your leadership skills by detailing your experience in managing teams and driving performance improvements.

- Include industry-specific certifications and training that demonstrate your expertise in mortgage operations.

- Utilize a clean and professional layout that enhances readability, ensuring your most important information stands out.

- Incorporate a summary statement at the top of your resume that encapsulates your qualifications and career goals.

- Emphasize your knowledge of relevant mortgage software and technology, showcasing your ability to adapt to industry changes.

- Keep your resume concise, ideally one to two pages, focusing on the most relevant experience and skills.

Implementing these tips can significantly increase your chances of landing a job in the Mortgage Operations Manager field. By presenting a polished and focused resume that clearly articulates your qualifications and successes, you position yourself as a compelling candidate ready to meet the demands of the role. Take the time to refine your resume, and you may find yourself one step closer to your next career opportunity.

Why Resume Headlines & Titles are Important for Mortgage Operations Manager

In the competitive landscape of mortgage operations, a Mortgage Operations Manager plays a pivotal role in overseeing the loan origination process, ensuring compliance, and enhancing operational efficiency. A well-crafted resume headline or title is crucial for candidates in this field as it serves as the first impression. A strong headline can immediately capture the attention of hiring managers, succinctly summarizing a candidate's key qualifications in an impactful phrase. It should be concise, relevant, and directly aligned with the job being applied for, setting the tone for the rest of the resume and differentiating the candidate from others.

Best Practices for Crafting Resume Headlines for Mortgage Operations Manager

- Keep it concise: Aim for no more than 10-12 words.

- Be role-specific: Clearly indicate your expertise in mortgage operations.

- Highlight key achievements: Incorporate measurable outcomes or results.

- Use industry keywords: Include terms that resonate with hiring managers.

- Showcase leadership skills: Emphasize your ability to manage teams and processes.

- Tailor for each application: Customize your headline to fit the specific job description.

- Maintain professionalism: Use a formal tone appropriate for the mortgage industry.

- Avoid buzzwords: Steer clear of clichés that can dilute your message.

Example Resume Headlines for Mortgage Operations Manager

Strong Resume Headlines

Results-Driven Mortgage Operations Manager with Over 10 Years of Experience in Streamlining Processes

Expert in Mortgage Compliance and Risk Management, Delivering Consistent Growth

Dynamic Leader in Mortgage Operations, Achieving 30% Increase in Loan Processing Efficiency

Innovative Mortgage Operations Manager Specialized in Team Development and Operational Excellence

Weak Resume Headlines

Mortgage Professional Seeking Employment

Experienced Manager in Finance

Hardworking Individual Looking for a Job in Mortgage Operations

The strong headlines are effective because they clearly communicate the candidate’s specific strengths and achievements, resonating with the needs of potential employers. They incorporate relevant industry language, making it easy for hiring managers to see how the candidate aligns with the role. On the other hand, the weak headlines lack specificity and fail to convey any unique value, making it difficult for candidates to stand out in a crowded job market. These vague titles do not provide any insight into the candidate's qualifications or the impact they could bring to the organization.

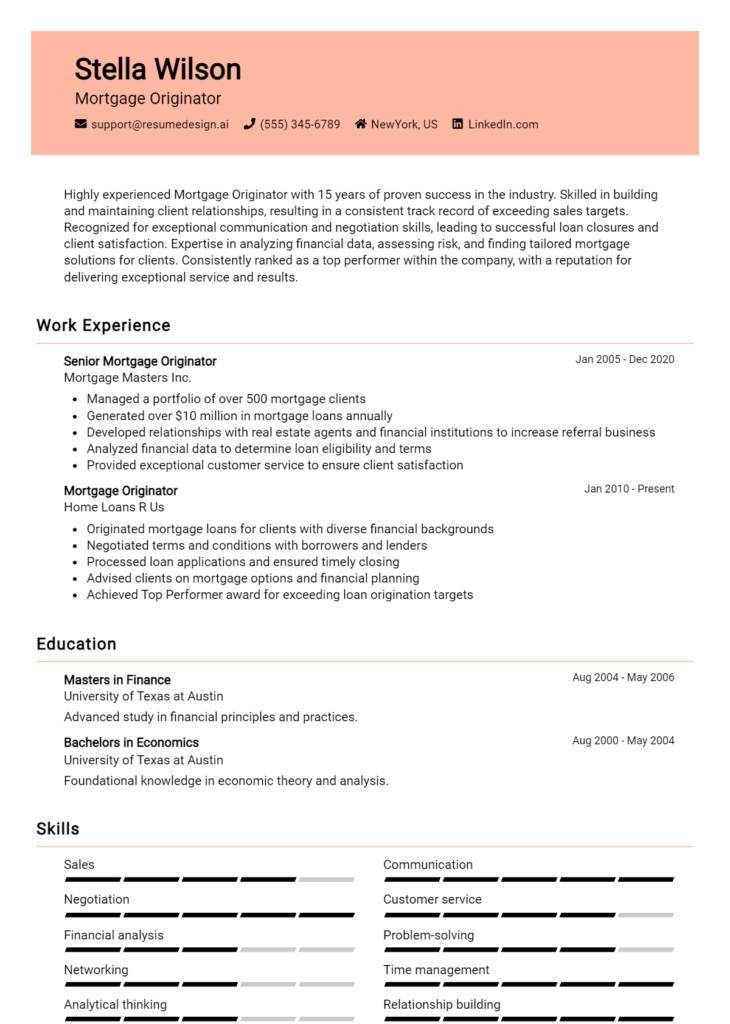

Writing an Exceptional Mortgage Operations Manager Resume Summary

A well-crafted resume summary is an essential component for a Mortgage Operations Manager seeking to stand out in a competitive job market. This concise paragraph serves as a powerful introduction, quickly capturing the attention of hiring managers by highlighting key skills, relevant experience, and notable accomplishments in mortgage operations. A strong summary not only showcases the candidate's qualifications but also sets the tone for the entire resume, making it imperative that it be impactful, succinct, and tailored to the specific job being applied for. By distilling the most critical aspects of their professional background, candidates can effectively convey their value proposition and increase their chances of securing an interview.

Best Practices for Writing a Mortgage Operations Manager Resume Summary

- Quantify achievements where possible to demonstrate impact, such as percentage increases in efficiency or revenue.

- Focus on key skills relevant to mortgage operations, including regulatory compliance, risk management, and team leadership.

- Tailor the summary for each specific job description to align with the employer's needs and expectations.

- Keep it concise, ideally between 3-5 sentences, to ensure clarity and maintain the reader's attention.

- Use powerful action verbs and industry-specific terminology to convey expertise and professionalism.

- Highlight unique accomplishments that set you apart from other candidates, such as awards or recognitions.

- Stay away from jargon that may not resonate with all hiring managers; aim for clarity and directness.

- Revise and refine the summary to eliminate any fluff, ensuring every word adds value.

Example Mortgage Operations Manager Resume Summaries

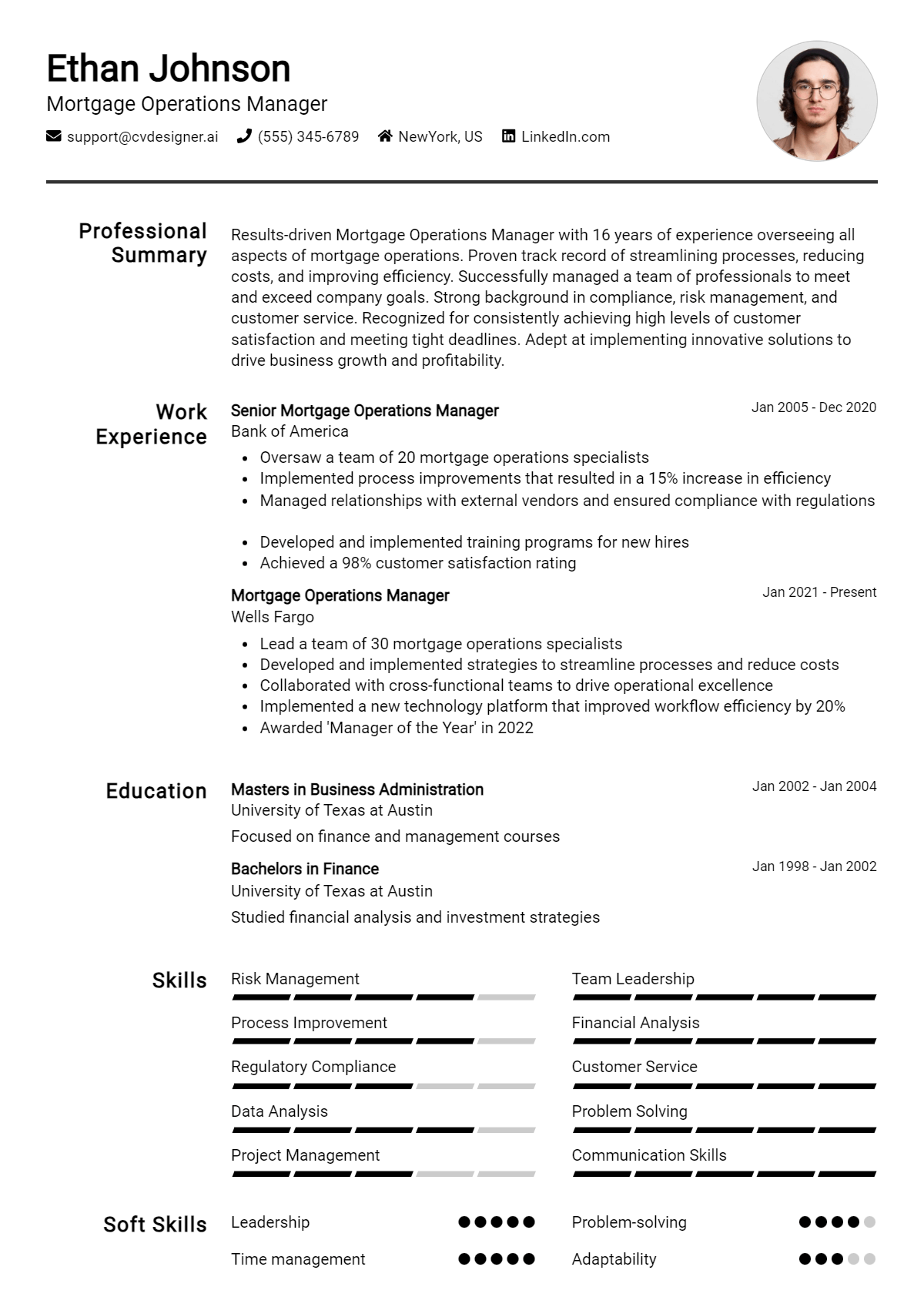

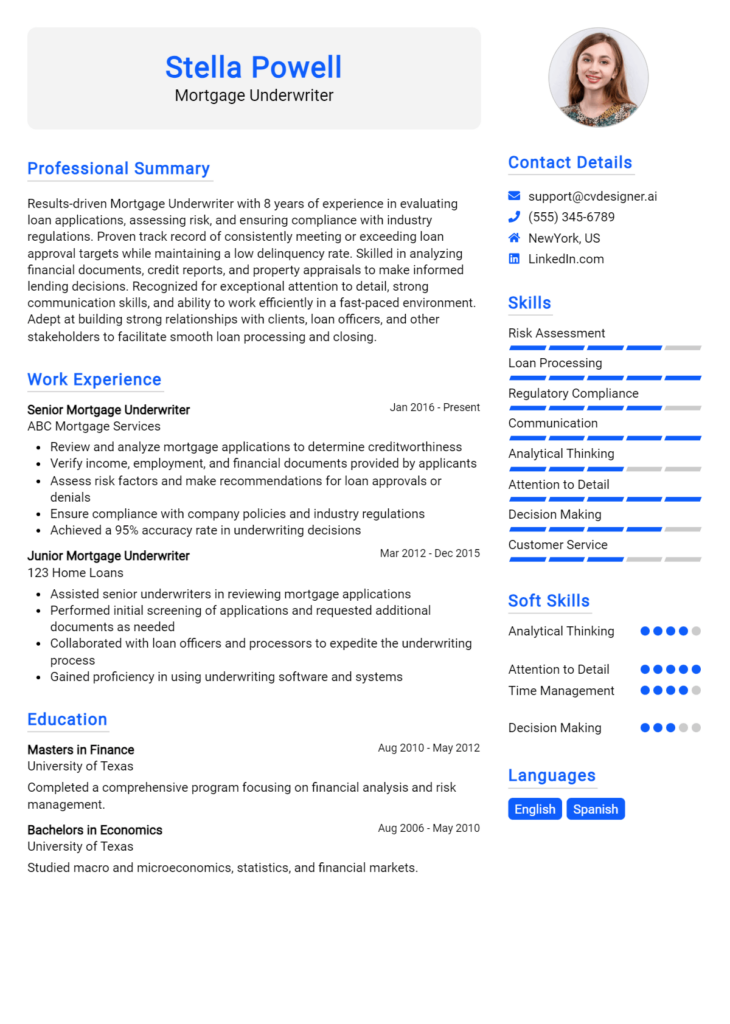

Strong Resume Summaries

Results-driven Mortgage Operations Manager with over 8 years of experience leading high-performing teams and streamlining loan processing operations. Successfully improved processing efficiency by 30% through the implementation of a new workflow system, significantly reducing turnaround times and enhancing customer satisfaction.

Dynamic Mortgage Operations Manager skilled in regulatory compliance and risk assessment, with a track record of closing over $200 million in mortgage loans annually. Recognized for developing training programs that improved team performance, leading to a 25% increase in loan approval rates within the first year.

Accomplished Mortgage Operations Manager with extensive expertise in optimizing operational processes and enhancing client experiences. Achieved a 40% reduction in loan processing times by introducing innovative technology solutions, resulting in a 15% growth in market share.

Weak Resume Summaries

Experienced manager in the mortgage industry who is looking for a new opportunity. I have worked in various roles and am familiar with many different processes.

Motivated professional with a background in mortgage operations. I believe I can contribute positively to your team and help improve operations.

The strong resume summaries are considered effective because they provide specific details about achievements, quantify results, and highlight relevant skills that directly relate to the Mortgage Operations Manager role. In contrast, the weak summaries lack detail and specificity, failing to convey the candidate's value or unique contributions to potential employers. By focusing on measurable outcomes and tailored skills, strong summaries create a compelling case for the candidate's fit for the position.

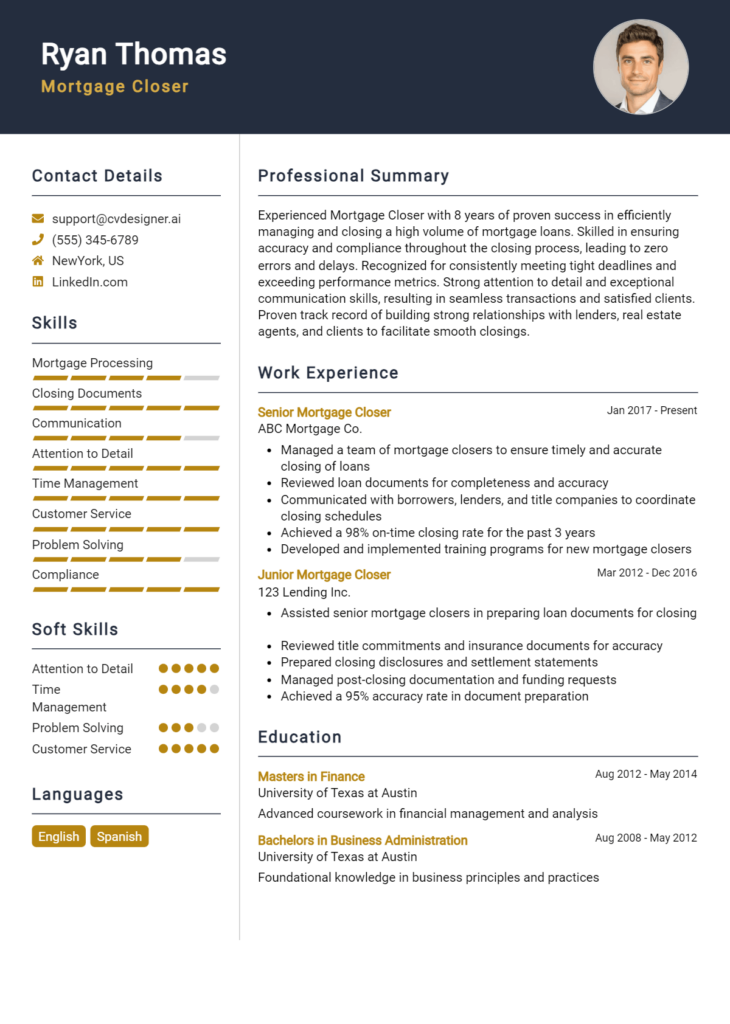

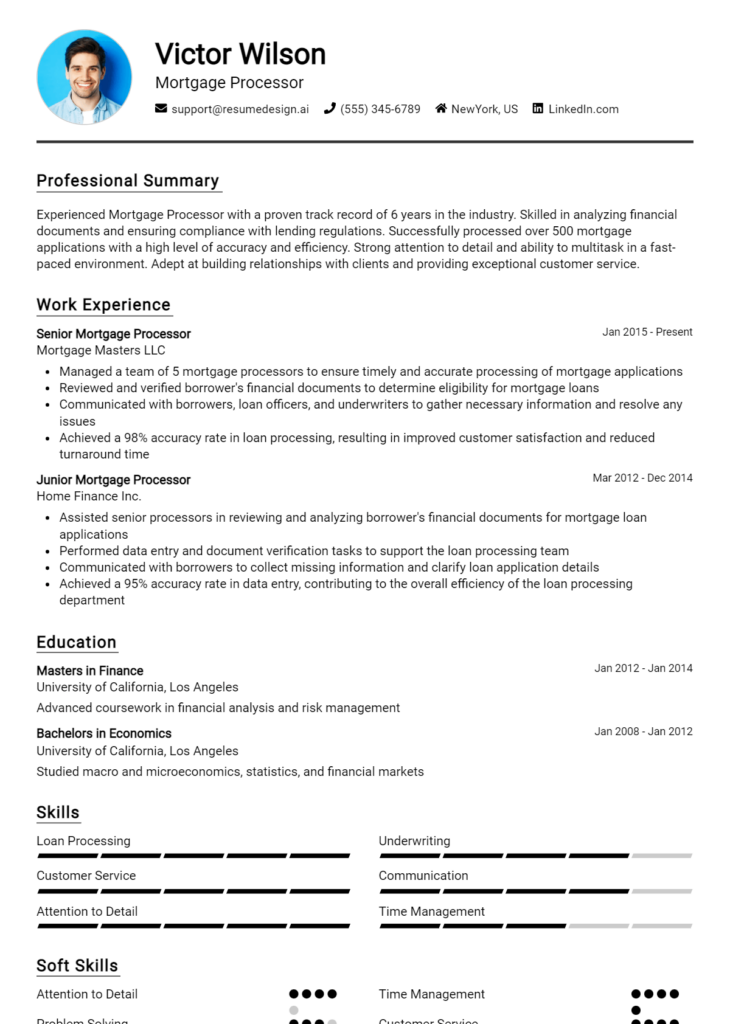

Work Experience Section for Mortgage Operations Manager Resume

The work experience section of a Mortgage Operations Manager resume plays a pivotal role in demonstrating the candidate's qualifications for the position. This section provides valuable insights into the candidate's technical skills, ability to manage teams effectively, and their history of delivering high-quality mortgage products. By quantifying achievements and aligning their experience with industry standards, candidates can present a compelling narrative that highlights their readiness to take on the challenges of this role. A well-crafted work experience section not only showcases past responsibilities but also underscores the impact of their contributions to organizational success.

Best Practices for Mortgage Operations Manager Work Experience

- Emphasize technical expertise related to mortgage processing and compliance.

- Quantify results with metrics such as percentage increases in efficiency or decreases in processing times.

- Highlight leadership roles and team management capabilities.

- Showcase successful collaboration with cross-functional teams, such as underwriting and sales.

- Detail specific projects that led to improved customer satisfaction or revenue growth.

- Align your experience with industry standards and best practices in mortgage operations.

- Use action verbs to convey your contributions clearly and forcefully.

- Tailor your work experience to match the specific requirements of the job you are applying for.

Example Work Experiences for Mortgage Operations Manager

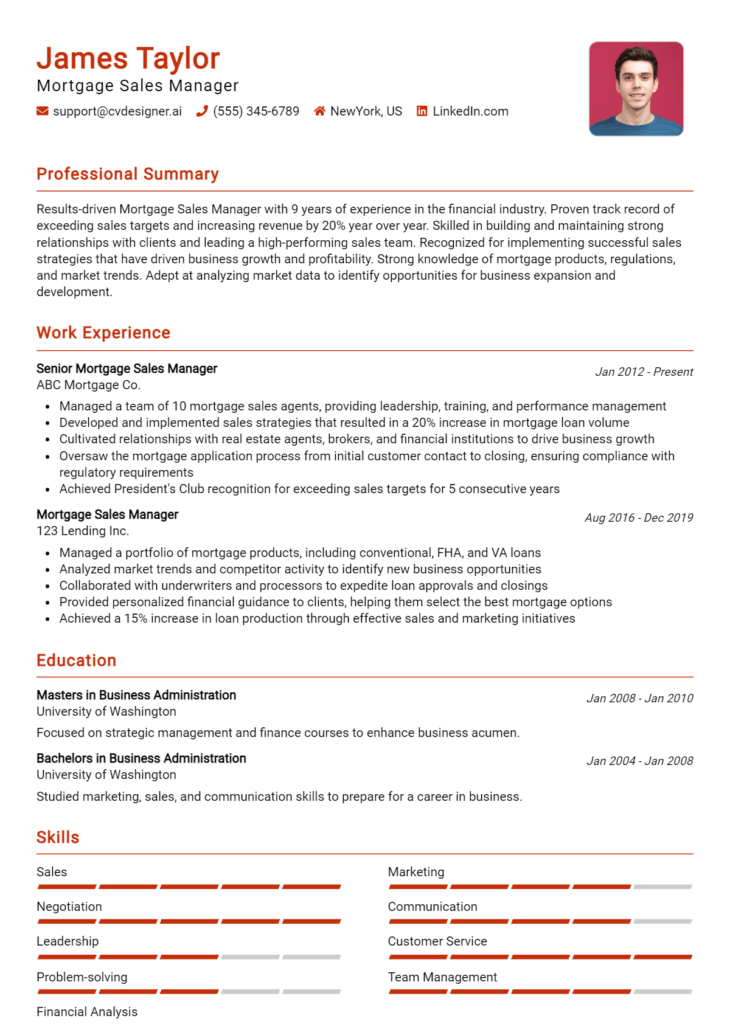

Strong Experiences

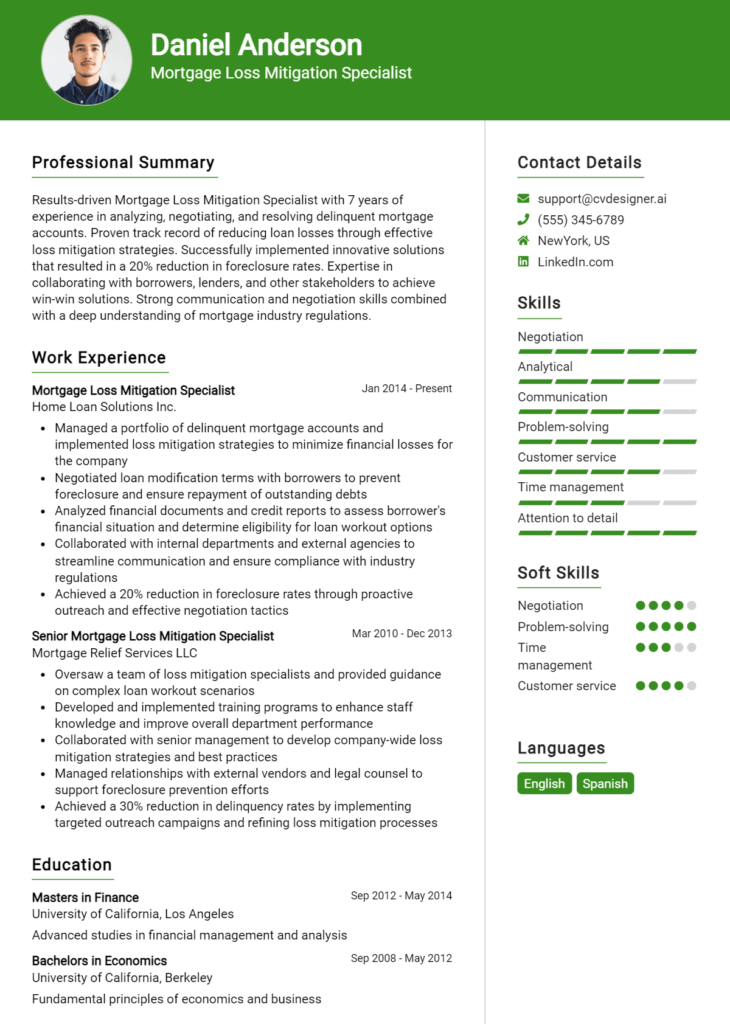

- Led a team of 15 mortgage processors, resulting in a 30% reduction in loan processing times through streamlined workflows and enhanced training programs.

- Implemented a new loan origination system that improved compliance tracking accuracy by 25%, resulting in a 15% decrease in audit findings over two years.

- Collaborated with the sales and underwriting teams to develop a customer feedback program that increased customer satisfaction scores by 20%.

- Managed a portfolio of high-value loans, achieving a 98% on-time closing rate, contributing to a 10% increase in annual revenue.

Weak Experiences

- Responsible for overseeing mortgage operations.

- Worked with other departments on various projects.

- Helped improve processing times.

- Participated in team meetings and discussions.

The strong experiences are considered effective because they provide clear, quantifiable results that demonstrate the candidate's impact and leadership within the mortgage operations field. They articulate specific achievements and responsibilities that align with the expectations for a Mortgage Operations Manager. Conversely, the weak experiences lack detail and measurable outcomes, making it difficult for potential employers to gauge the candidate's contributions or skills, thus failing to create a compelling case for their qualifications.

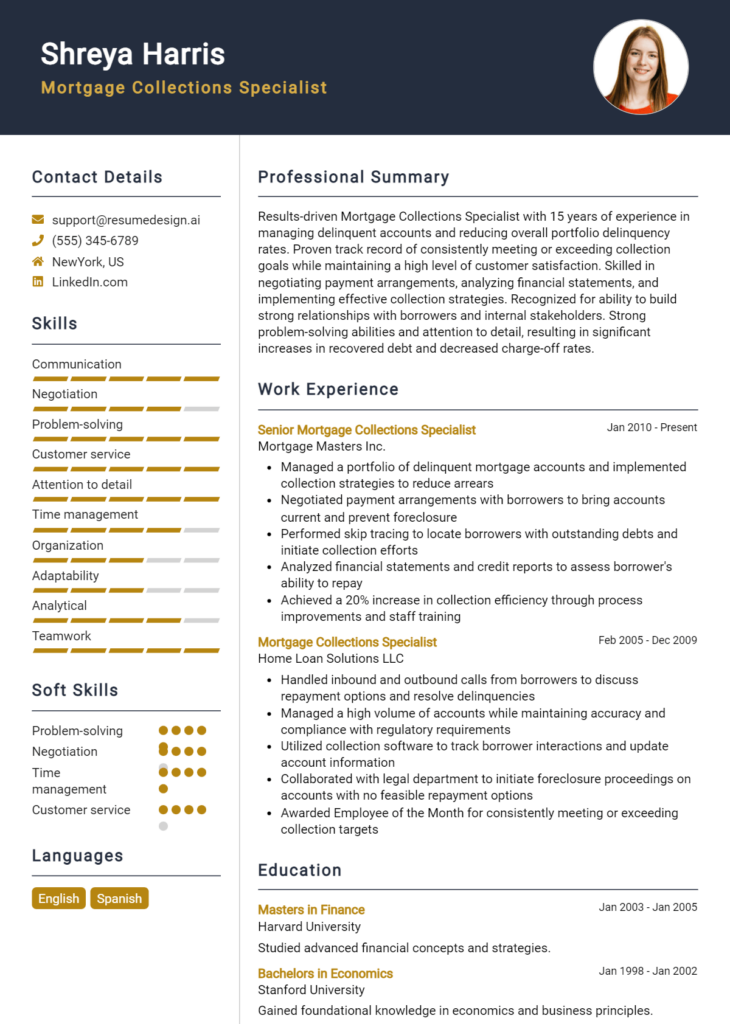

Education and Certifications Section for Mortgage Operations Manager Resume

The education and certifications section of a Mortgage Operations Manager resume is critical as it serves to showcase the candidate's academic background, relevant industry certifications, and commitment to continuous learning. This section not only highlights formal education but also underscores specialized training and relevant coursework that can significantly enhance the candidate's credibility. By providing detailed information about educational qualifications and certifications, candidates can effectively demonstrate their alignment with the job role and their preparedness to handle the complexities of mortgage operations.

Best Practices for Mortgage Operations Manager Education and Certifications

- Prioritize relevant degrees in finance, business administration, or a related field.

- Include industry-recognized certifications such as Certified Mortgage Banker (CMB) or Mortgage Loan Originator (MLO).

- Detail relevant coursework that covers key mortgage operations topics, such as risk management, loan processing, and compliance.

- List any specialized training programs or workshops attended that are pertinent to mortgage operations.

- Use clear and concise formatting to enhance readability and ensure easy access to important information.

- Keep the section up-to-date with the latest certifications or educational advancements.

- Highlight advanced degrees (e.g., MBA) to showcase advanced knowledge and leadership capability.

- Include online courses or certifications from reputable institutions that demonstrate commitment to ongoing professional development.

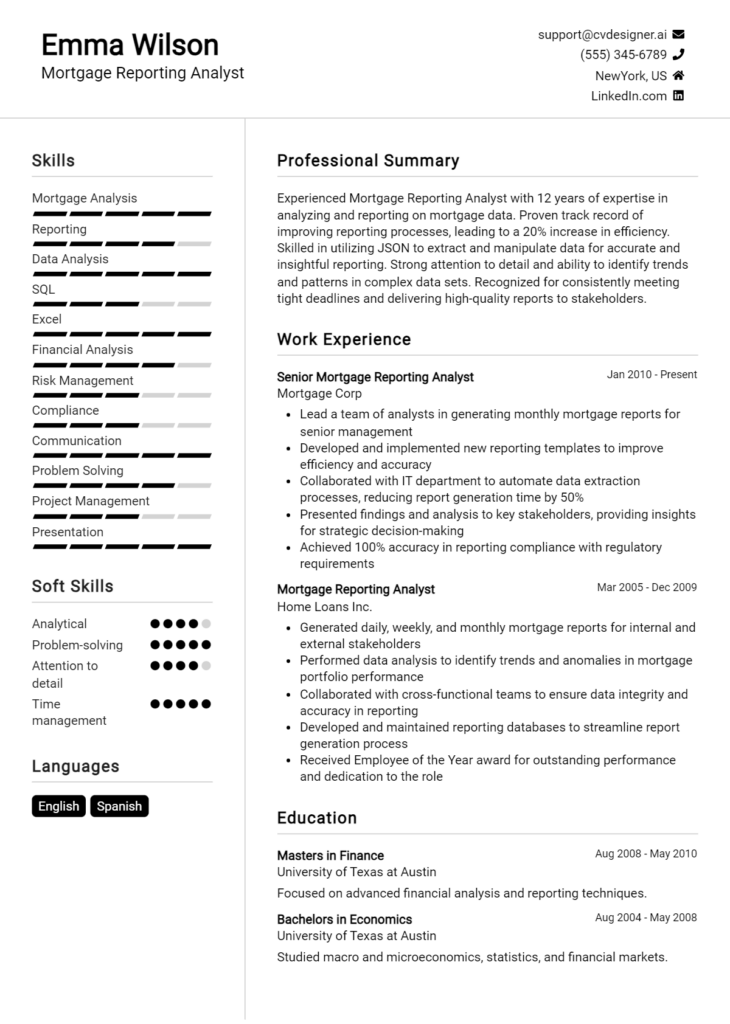

Example Education and Certifications for Mortgage Operations Manager

Strong Examples

- Bachelor of Science in Finance, University of XYZ, 2015

- Certified Mortgage Banker (CMB), Mortgage Bankers Association, 2021

- Advanced Certificate in Mortgage Risk Management, National Association of Mortgage Professionals, 2020

- Coursework in Real Estate Finance and Loan Processing, University of XYZ, 2014

Weak Examples

- Associate Degree in General Studies, Community College, 2013

- Certification in Basic Computer Skills, Online Training Institute, 2018

- High School Diploma, City High School, 2010

- Outdated certification in Mortgage Origination, acquired in 2010

The strong examples are considered effective because they directly relate to the responsibilities and requirements of a Mortgage Operations Manager, showcasing relevant degrees and recognized certifications that enhance professional credibility. In contrast, the weak examples highlight qualifications that lack relevance to the mortgage industry or are outdated, failing to substantiate the candidate’s expertise in mortgage operations, which can detract from their overall appeal to potential employers.

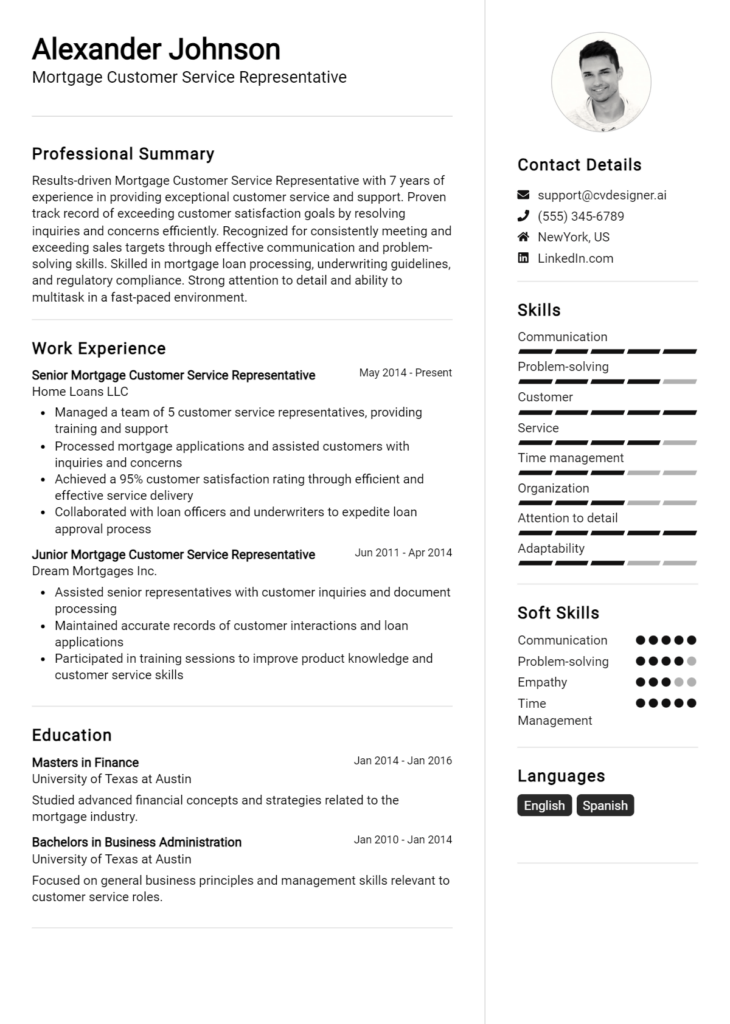

Top Skills & Keywords for Mortgage Operations Manager Resume

As a Mortgage Operations Manager, presenting a well-crafted resume is crucial to stand out in a competitive job market. The right combination of skills not only showcases your qualifications but also demonstrates your ability to manage complex processes and lead teams effectively. Highlighting both hard and soft skills is essential, as they reflect your technical expertise in mortgage operations as well as your interpersonal abilities that contribute to better team dynamics and client relationships. By emphasizing these skills, you can effectively convey your value to potential employers and increase your chances of landing an interview.

Top Hard & Soft Skills for Mortgage Operations Manager

Soft Skills

- Leadership

- Communication

- Problem-solving

- Time management

- Team collaboration

- Customer service orientation

- Adaptability

- Critical thinking

- Conflict resolution

- Attention to detail

Hard Skills

- Knowledge of mortgage regulations

- Loan underwriting processes

- Risk assessment

- Data analysis

- Financial reporting

- Project management

- Proficiency in mortgage software (e.g., Encompass, Calyx)

- Compliance management

- Budgeting and forecasting

- Quality control processes

For more insights into how to effectively incorporate these skills into your resume, as well as tips on showcasing your work experience, consider exploring additional resources.

Stand Out with a Winning Mortgage Operations Manager Cover Letter

As an accomplished Mortgage Operations Manager with over eight years of experience in streamlining processes, enhancing customer satisfaction, and leading high-performing teams, I am excited to apply for the position at [Company Name]. My extensive background in mortgage underwriting, compliance, and operations management has equipped me with the tools necessary to drive efficiency and contribute to the overall success of your organization. I am particularly drawn to [Company Name]'s commitment to innovation and exceptional service, values that resonate deeply with my professional philosophy.

In my previous role at [Previous Company Name], I successfully led a team of 25 mortgage professionals, implementing new technologies and processes that reduced processing times by 30% while ensuring compliance with all regulatory requirements. By fostering a culture of continuous improvement and accountability, I empowered my team to excel in their roles, resulting in a significant increase in customer satisfaction scores. My data-driven approach ensures that I can analyze key performance indicators to identify areas for enhancement, allowing me to make informed decisions that positively impact the bottom line.

I am particularly skilled in developing and executing training programs that enhance team capabilities and improve operational workflows. My ability to collaborate effectively with cross-functional teams, including sales, underwriting, and compliance, has proven instrumental in achieving organizational goals and maintaining high standards of excellence. I thrive in fast-paced environments and am adept at managing multiple projects simultaneously, ensuring timely and successful completion.

I am eager to bring my expertise in mortgage operations and my passion for team development to [Company Name]. I believe my proactive approach and dedication to driving operational excellence align perfectly with your vision for growth. I look forward to the opportunity to discuss how my skills and experiences can contribute to the continued success of your organization. Thank you for considering my application.

Common Mistakes to Avoid in a Mortgage Operations Manager Resume

When crafting a resume for the position of Mortgage Operations Manager, it’s essential to present a polished and professional document that highlights your skills and experience in the mortgage industry. However, many candidates make common mistakes that can undermine their chances of landing an interview. Avoiding these pitfalls will help you create a compelling resume that effectively showcases your qualifications.

Neglecting Industry-Specific Terminology: Failing to use relevant jargon and terminology can make your resume seem generic. Incorporate terms like "loan underwriting," "risk assessment," and "regulatory compliance" to demonstrate your expertise.

Overloading with Irrelevant Information: Including unrelated work experience can clutter your resume and distract from your qualifications. Focus on roles and achievements that directly relate to mortgage operations.

Using a One-Size-Fits-All Approach: Sending out the same resume for every application can diminish your chances of getting noticed. Tailor your resume to highlight experiences and skills that match the specific requirements of the job description.

Lack of Quantifiable Achievements: Simply listing job duties can make your resume bland. Use metrics and specific outcomes, such as "increased loan processing efficiency by 30%" to illustrate your contributions.

Poor Formatting and Presentation: A cluttered or unprofessional layout can detract from the content of your resume. Use clear headings, bullet points, and consistent fonts to enhance readability.

Ignoring Soft Skills: Focusing solely on technical skills can give an incomplete picture of your abilities. Highlight essential soft skills such as leadership, communication, and problem-solving that are critical for a managerial role.

Omitting Keywords for Applicant Tracking Systems (ATS): Many employers use ATS to filter resumes. Failing to include relevant keywords from the job posting can result in your resume being overlooked.

Not Including Relevant Certifications or Training: Certifications like the Mortgage Bankers Association (MBA) designations or other relevant training can set you apart. Make sure to highlight these credentials prominently on your resume.

Conclusion

As a Mortgage Operations Manager, your role is pivotal in overseeing the mortgage process, ensuring compliance, optimizing workflows, and enhancing customer satisfaction. Key responsibilities include managing loan processors, coordinating with underwriters, and implementing efficient systems to streamline operations. Additionally, strong leadership and communication skills are essential to foster a productive team environment and maintain relationships with clients and stakeholders.

In today's competitive job market, having an outstanding resume is crucial to showcase your expertise and achievements effectively. As you reflect on your career in mortgage operations, consider updating your resume to highlight your specific skills and accomplishments that align with the demands of potential employers.

Take action now! Review your Mortgage Operations Manager resume and ensure it stands out. Utilize resources such as resume templates, resume builder, resume examples, and cover letter templates to create a professional and compelling representation of your qualifications. Don't miss the opportunity to make a strong impression in your job search!