27 Mortgage Automation Specialist Resume Skills That Stand Out in 2025

As a Mortgage Automation Specialist, possessing the right skills is crucial to streamline processes and enhance efficiency within the mortgage industry. In this section, we will outline the top skills that employers look for when hiring professionals in this role. These skills not only demonstrate your expertise in automation technologies but also highlight your ability to improve workflows, manage data effectively, and ensure compliance throughout the mortgage process.

Best Mortgage Automation Specialist Technical Skills

Technical skills are crucial for a Mortgage Automation Specialist, as they enable professionals to streamline processes, enhance efficiency, and improve customer experiences in the mortgage industry. A strong foundation in relevant technologies and methodologies can significantly impact productivity and the successful implementation of automation solutions.

Loan Origination Software (LOS)

Proficiency in Loan Origination Software is vital for managing the mortgage application process from start to finish, ensuring compliance and efficiency.

How to show it: Highlight your experience with specific LOS platforms and mention any improvements in processing time or accuracy that resulted from your use of these tools.

Document Management Systems (DMS)

Expertise in Document Management Systems helps in organizing, storing, and retrieving essential mortgage documents securely and efficiently.

How to show it: Include details about your role in implementing or optimizing a DMS and quantify the reduction in retrieval time or increased compliance rates.

Data Analysis and Reporting

Strong data analysis skills allow specialists to extract insights from mortgage data, identify trends, and make informed decisions to optimize processes.

How to show it: Demonstrate your analytical capabilities by providing examples of specific reports you generated and the impact those reports had on business strategies.

Process Automation Tools

Knowledge of process automation tools streamlines workflows, reduces manual tasks, and enhances overall efficiency in mortgage operations.

How to show it: List specific tools you have implemented and describe the percentage of time saved or errors reduced due to automation.

Regulatory Compliance Software

Familiarity with regulatory compliance software is essential for ensuring that all mortgage processes adhere to legal standards and regulations.

How to show it: Mention any compliance audits you successfully navigated and how the software contributed to maintaining compliance.

Customer Relationship Management (CRM) Systems

Proficiency in CRM systems enhances communication and relationship management with clients, leading to improved customer satisfaction and retention.

How to show it: Quantify your achievements in customer retention or satisfaction scores resulting from your effective use of CRM tools.

API Integration

Understanding API integration is crucial for connecting different software systems, enabling seamless data flow and improved operational efficiency.

How to show it: Describe specific integrations you have worked on, including how they enhanced system functionality or reduced processing times.

Workflow Automation

Expertise in workflow automation helps in designing and implementing automated workflows that enhance productivity and reduce errors in mortgage processing.

How to show it: Provide details on workflows you automated and quantify the results in terms of time saved or increased throughput.

Technical Troubleshooting

Technical troubleshooting skills are essential for identifying and resolving software or system issues that may arise during the automation process.

How to show it: Share examples of significant technical challenges you addressed and the positive outcomes achieved as a result of your interventions.

Database Management

Strong database management skills ensure that mortgage data is stored securely, is easily accessible, and can be analyzed effectively for decision-making.

How to show it: Highlight your experience with specific database technologies and any improvements in data retrieval speed or accuracy you achieved.

Project Management Software

Familiarity with project management software aids in organizing and tracking various automation projects within the mortgage sector.

How to show it: Discuss the projects you managed, including timelines and successful project completion rates, to showcase your project management capabilities.

How to List Mortgage Automation Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to potential employers. Highlighting specific skills can demonstrate your qualifications and suitability for the role. There are three main sections where you can showcase your skills: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

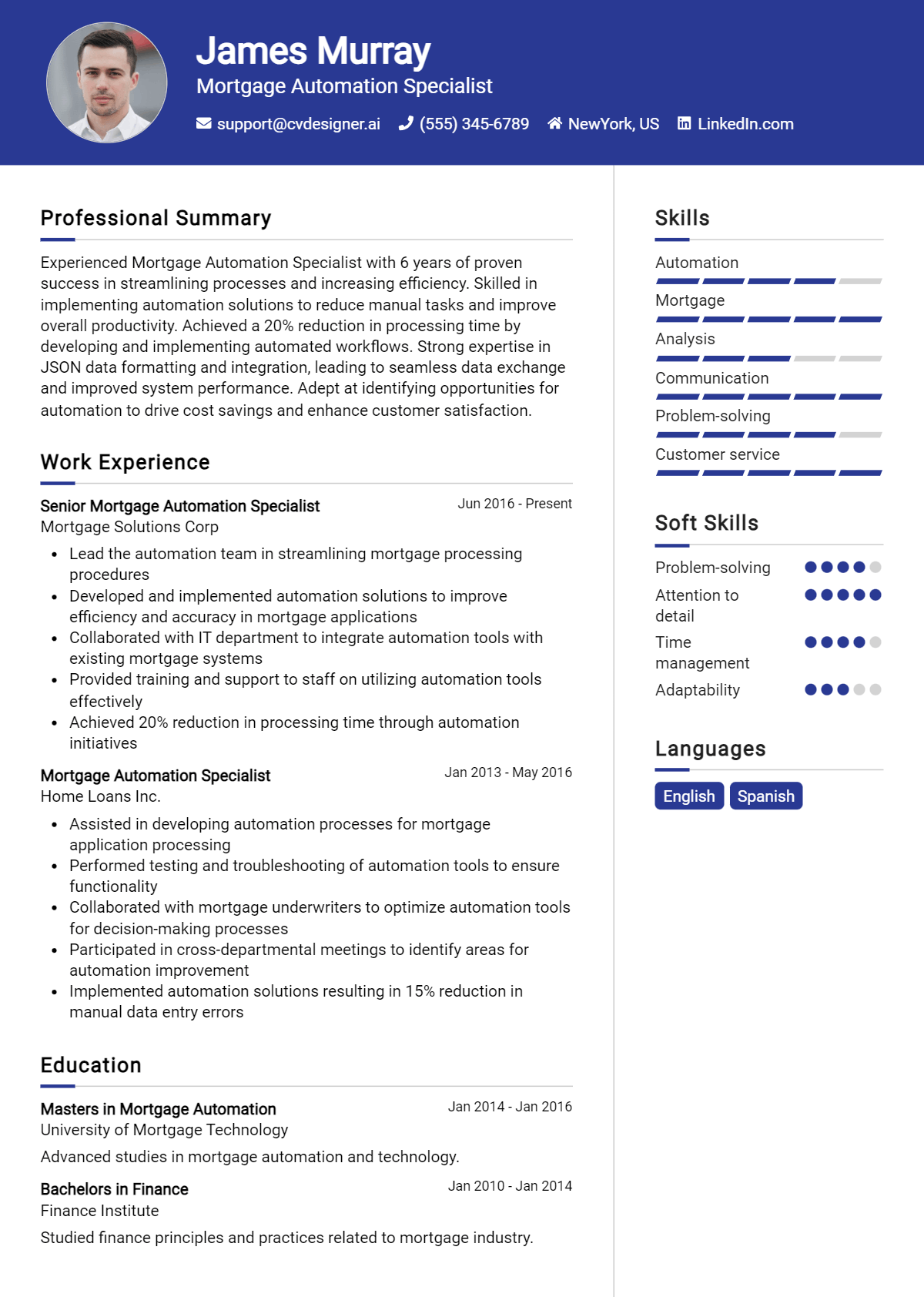

for Resume Summary

Showcasing Mortgage Automation Specialist skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

As a dedicated Mortgage Automation Specialist with expertise in process optimization and data analysis, I leverage automation tools to improve workflow efficiency, resulting in enhanced customer satisfaction and reduced processing times.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Mortgage Automation Specialist skills have been applied in real-world scenarios, showcasing your ability to deliver results.

Example

- Implemented automated mortgage processing systems, reducing manual errors by 30% and improving turnaround time.

- Collaborated with cross-functional teams to enhance customer relationship management processes, leading to a 20% increase in client retention.

- Utilized data analytics to identify trends and optimize workflows, resulting in a 15% cost reduction.

- Led training sessions on automation software for team members, enhancing overall department efficiency.

for Resume Skills

The skills section can showcase both technical and transferable skills. It's essential to include a balanced mix of hard and soft skills to strengthen your overall qualifications.

Example

- Mortgage Processing Software

- Data Analysis and Reporting

- Project Management

- Customer Relationship Management (CRM)

- Regulatory Compliance

- Process Automation

- Team Collaboration

- Problem Solving

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can reinforce your fit for the position.

Example

With a profound ability in data analysis and process automation, I have successfully implemented strategies that improved workflow efficiency in my previous roles. My project management skills ensured timely project completion, contributing to overall organizational success.

It's beneficial to connect the skills mentioned in your resume to specific achievements in your cover letter, reinforcing your qualifications for the job.

The Importance of Mortgage Automation Specialist Resume Skills

In the competitive field of mortgage automation, showcasing relevant skills on your resume is crucial for standing out to recruiters. A well-crafted skills section not only highlights your qualifications but also aligns your expertise with the specific requirements of the job. By effectively communicating your abilities, you improve your chances of being noticed and considered for roles that demand precision and technical proficiency in mortgage processing.

- Demonstrating technical proficiency in mortgage automation tools can set you apart from other candidates. Employers are looking for specialists who are not only familiar with these platforms but can also leverage them to enhance efficiency and accuracy in the mortgage process.

- Highlighting your understanding of compliance and regulatory standards is essential. A Mortgage Automation Specialist must ensure that automated processes align with legal requirements, which helps mitigate risks for the organization.

- Showcasing your analytical skills reflects your ability to evaluate and improve existing automation processes. This capability is vital in identifying areas for streamlining operations and enhancing overall productivity.

- Effective communication skills are imperative for a Mortgage Automation Specialist, as you'll need to collaborate with various stakeholders. Articulating technical concepts to non-technical team members is key to successful project implementation.

- Project management skills indicate your ability to oversee automation projects from inception to completion. Highlighting your experience in managing timelines, resources, and team dynamics can greatly enhance your appeal to potential employers.

- By emphasizing your problem-solving abilities, you demonstrate your potential to tackle complex challenges that arise within automated systems. Employers value specialists who can think critically and devise solutions under pressure.

- Including proficiency in data analysis and reporting is important. Being able to extract insights from data generated through automation can drive decision-making and enhance the performance of mortgage-related processes.

- Lastly, showcasing adaptability to new technologies and tools is vital in a rapidly changing industry. Employers seek specialists who are willing to learn and evolve alongside emerging trends in mortgage automation.

For more insights and examples, check out Resume Samples.

How To Improve Mortgage Automation Specialist Resume Skills

In the rapidly evolving field of mortgage automation, it is crucial for specialists to continuously enhance their skills to stay competitive and effective. As technology advances and the industry adapts, having up-to-date knowledge and capabilities can significantly impact your performance and career growth. By focusing on skill improvement, you can not only increase your value to employers but also ensure that you are equipped to handle the complexities of modern mortgage processes.

- Attend industry workshops and conferences to stay informed about the latest trends and tools in mortgage automation.

- Enroll in online courses or certifications focused on mortgage technology and automation software.

- Network with other professionals in the field through forums and social media platforms to share insights and best practices.

- Practice using various mortgage automation tools and software to gain hands-on experience and improve your technical proficiency.

- Stay updated on regulatory changes and compliance requirements to ensure your automation processes are aligned with industry standards.

- Seek feedback from colleagues and supervisors to identify areas for improvement and develop a personalized skill enhancement plan.

- Regularly review and update your resume to reflect new skills and accomplishments, showcasing your commitment to professional growth.

Frequently Asked Questions

What key skills should a Mortgage Automation Specialist include in their resume?

A Mortgage Automation Specialist should highlight skills such as proficiency in mortgage software applications, strong analytical abilities, and knowledge of mortgage regulations. Additionally, showcasing experience in process improvement, automation tools, and data management will demonstrate the candidate's capability to streamline operations and enhance efficiency in the mortgage process.

How important is experience with automation tools for a Mortgage Automation Specialist?

Experience with automation tools is crucial for a Mortgage Automation Specialist, as these tools are essential for optimizing workflows and reducing manual tasks. Familiarity with platforms like Robotic Process Automation (RPA), workflow management systems, and customer relationship management (CRM) software can significantly enhance a candidate's value, showcasing their ability to implement technology that improves productivity and accuracy in mortgage processing.

What soft skills are beneficial for a Mortgage Automation Specialist?

In addition to technical skills, soft skills such as problem-solving, communication, and teamwork are vital for a Mortgage Automation Specialist. The ability to effectively communicate with various stakeholders, including loan officers and IT teams, ensures smooth project implementation. Moreover, strong analytical and critical thinking skills help in troubleshooting issues and developing innovative solutions to improve mortgage processes.

How can a Mortgage Automation Specialist demonstrate their impact on previous employers?

A Mortgage Automation Specialist can illustrate their impact by quantifying their achievements in previous roles. This can include metrics such as reduced processing times, increased accuracy rates, or cost savings resulting from automation initiatives. Providing specific examples of successful projects or process improvements in the resume can effectively convey the tangible benefits they brought to their previous employers.

What certifications or training can enhance a Mortgage Automation Specialist's resume?

Certifications in project management, mortgage banking, or specific automation tools can significantly enhance a Mortgage Automation Specialist's resume. Certifications such as the Certified Mortgage Banker (CMB) designation or training in automation software platforms can demonstrate a commitment to professional development and expertise in the field, making a candidate more attractive to potential employers.

Conclusion

Including Mortgage Automation Specialist skills in your resume is essential for showcasing your expertise in a competitive job market. By highlighting relevant skills, you not only differentiate yourself from other candidates but also demonstrate your value to potential employers who seek efficiency and innovation in their mortgage processes. Remember, a well-crafted resume can open doors to new opportunities, so take the time to refine your skills and present them effectively in your application.

For additional resources to enhance your job application, explore our resume templates, utilize our resume builder, check out resume examples, and consider our cover letter templates. Empower yourself with the tools you need to succeed!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.