Mortgage Automation Specialist Core Responsibilities

A Mortgage Automation Specialist plays a crucial role in streamlining mortgage processes by bridging various departments such as underwriting, compliance, and IT. Key responsibilities include optimizing automated systems, ensuring data accuracy, and analyzing workflows to enhance efficiency. Strong technical skills in software applications, operational knowledge of mortgage processes, and exceptional problem-solving abilities are essential. These skills contribute significantly to the organization's goals by reducing processing times and improving service quality, making a well-structured resume vital for showcasing these qualifications effectively.

Common Responsibilities Listed on Mortgage Automation Specialist Resume

- Develop and implement automation strategies for mortgage processing.

- Collaborate with cross-functional teams to enhance system integration.

- Analyze and optimize existing workflows to improve efficiency.

- Ensure compliance with industry regulations and standards.

- Monitor system performance and troubleshoot issues as they arise.

- Train staff on new automation tools and processes.

- Maintain documentation of automated processes and updates.

- Conduct data analysis to identify trends and areas for improvement.

- Assist in the selection and implementation of software solutions.

- Provide technical support and guidance to users of automation systems.

- Evaluate the effectiveness of automation initiatives and report findings.

High-Level Resume Tips for Mortgage Automation Specialist Professionals

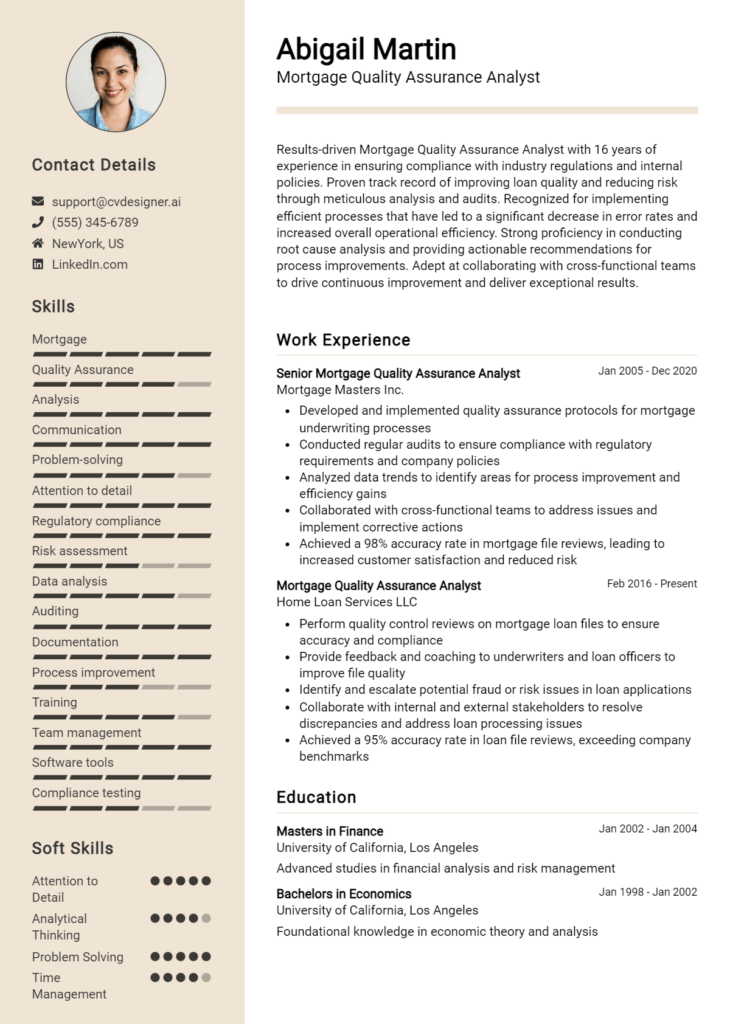

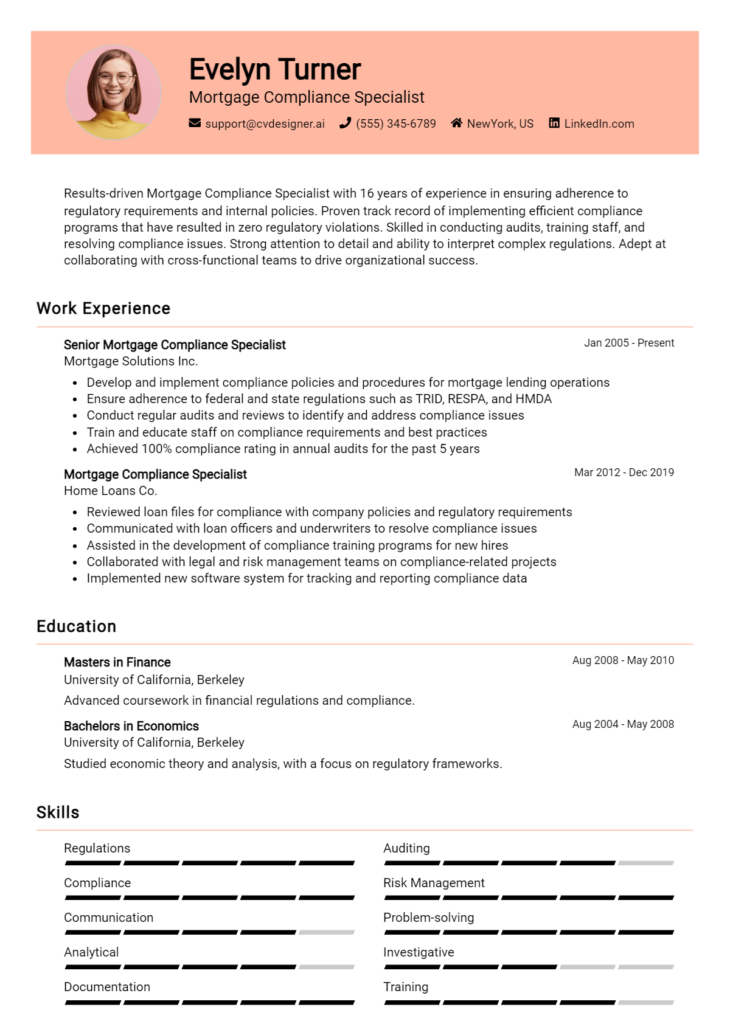

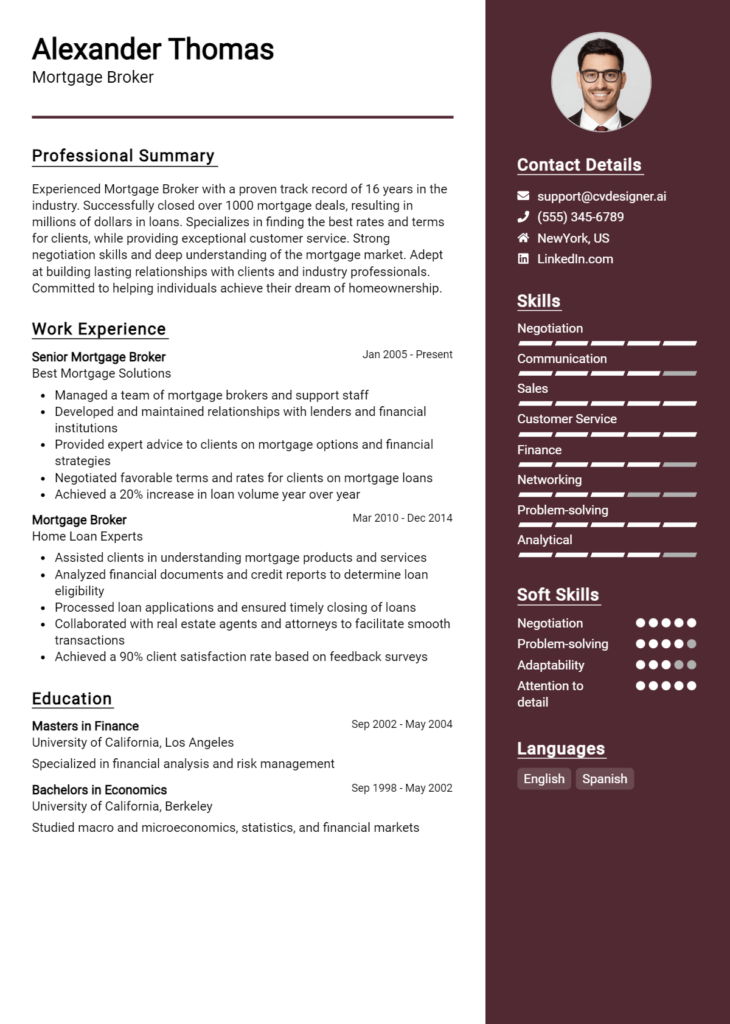

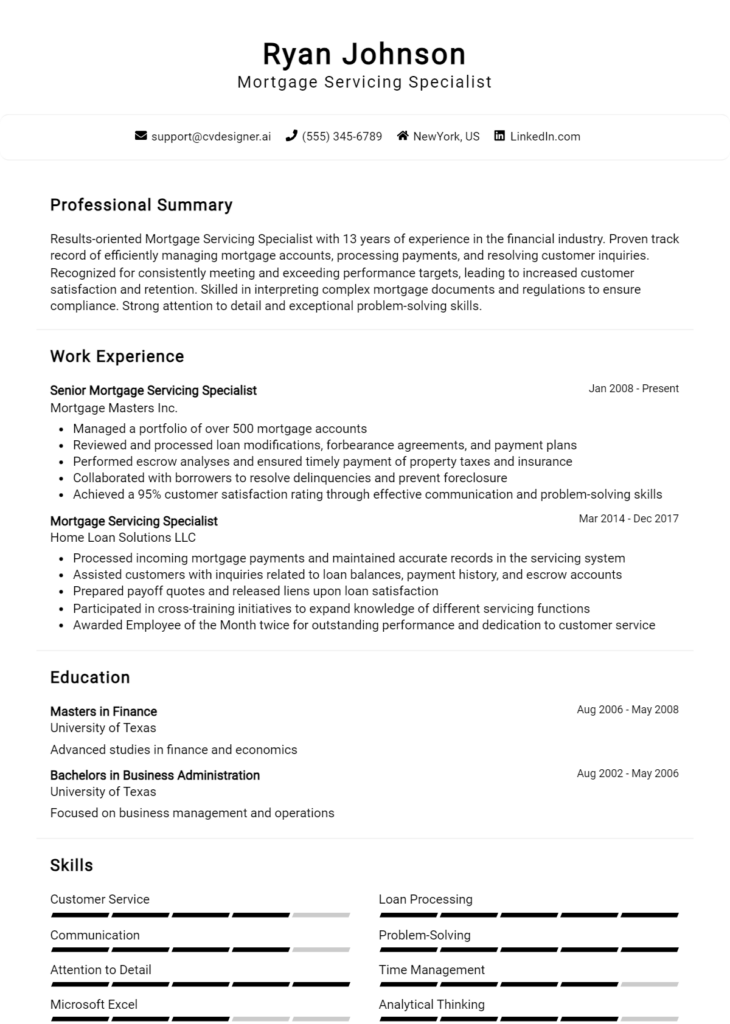

In the competitive landscape of mortgage automation, a well-crafted resume serves as a crucial tool for professionals aiming to make a lasting impression on potential employers. It is often the first glimpse hiring managers have into a candidate's qualifications and capabilities, making it essential to ensure that it reflects not only technical skills but also notable achievements. For Mortgage Automation Specialists, a resume should effectively convey expertise in automating mortgage processes and optimizing workflows. This guide will provide practical and actionable resume tips specifically tailored for professionals in the mortgage automation sector, helping candidates stand out in a crowded job market.

Top Resume Tips for Mortgage Automation Specialist Professionals

- Tailor your resume to match the job description by incorporating relevant keywords and phrases.

- Highlight your experience with mortgage automation software and tools, detailing specific platforms you have used.

- Quantify your achievements by including metrics such as percentage improvements in efficiency or reductions in processing time.

- Showcase any certifications or training relevant to mortgage automation, emphasizing continuous professional development.

- Include a summary statement that captures your core competencies and career aspirations within the mortgage automation field.

- Demonstrate your problem-solving skills through examples of challenges you have overcome in previous roles.

- Highlight your ability to work collaboratively with cross-functional teams to enhance mortgage processes.

- List any industry-specific knowledge, such as regulatory compliance or risk management, that sets you apart from other candidates.

- Make sure your resume is visually appealing and easy to read, using clear headings and bullet points for organization.

- Proofread your resume for any spelling or grammatical errors to ensure professionalism and attention to detail.

By implementing these targeted resume tips, Mortgage Automation Specialists can significantly enhance their chances of landing a job in this dynamic field. A well-structured and thoughtfully crafted resume not only showcases technical abilities but also communicates the value a candidate can bring to prospective employers, thereby increasing the likelihood of securing an interview and ultimately, a position in the industry.

Why Resume Headlines & Titles are Important for Mortgage Automation Specialist

In the competitive field of mortgage automation, a Mortgage Automation Specialist plays a crucial role in streamlining processes and enhancing efficiency within mortgage operations. As hiring managers sift through numerous resumes, a compelling resume headline or title can serve as a powerful first impression. A strong headline summarizes a candidate's key qualifications in a concise and impactful phrase, immediately grabbing the attention of recruiters. This important component should be relevant to the specific job being applied for, showcasing the candidate's expertise and setting the tone for the rest of the resume.

Best Practices for Crafting Resume Headlines for Mortgage Automation Specialist

- Keep it concise: Aim for a headline that is clear and to the point, ideally no more than 10-12 words.

- Be role-specific: Tailor your headline to reflect the specific position of Mortgage Automation Specialist.

- Highlight key skills: Incorporate essential skills or certifications relevant to the mortgage automation field.

- Use action-oriented language: Start with strong verbs to convey your active contributions and achievements.

- Quantify achievements: Whenever possible, include numbers or metrics that demonstrate your impact in previous roles.

- Stay relevant: Ensure that every word in your headline directly relates to the job description and requirements.

- Showcase unique strengths: Identify what sets you apart from other candidates and integrate that into your headline.

- Avoid jargon: Use clear language that hiring managers can easily understand, steering clear of industry jargon that may not be universally recognized.

Example Resume Headlines for Mortgage Automation Specialist

Strong Resume Headlines

"Expert Mortgage Automation Specialist with 8+ Years of Process Optimization Experience"

“Results-Driven Mortgage Automation Specialist Specializing in Workflow Automation and Compliance”

“Innovative Mortgage Automation Expert with Proven Track Record of Reducing Processing Time by 30%”

Weak Resume Headlines

“Mortgage Specialist”

“Experienced Professional”

The strong headlines are effective because they immediately communicate the candidate's specific expertise, years of experience, and measurable achievements, making them stand out in a crowded field. In contrast, the weak headlines fail to make an impression due to their vagueness and lack of detail. They do not provide any insight into the candidate's qualifications or unique contributions, making it easy for hiring managers to overlook them in favor of more compelling options.

Writing an Exceptional Mortgage Automation Specialist Resume Summary

A well-crafted resume summary is essential for a Mortgage Automation Specialist, as it serves as a compelling introduction that quickly captures the attention of hiring managers. In a competitive job market, a strong summary succinctly highlights key skills, relevant experience, and notable accomplishments that align with the specific requirements of the role. By presenting a concise yet impactful overview, candidates can effectively convey their value proposition and encourage further review of their resumes, thereby increasing their chances of landing an interview.

Best Practices for Writing a Mortgage Automation Specialist Resume Summary

- Quantify Achievements: Use specific numbers and metrics to showcase your accomplishments, such as the percentage of process improvements or the number of loans processed.

- Focus on Relevant Skills: Highlight technical skills related to mortgage automation, such as familiarity with specific software or tools, and mention any certifications.

- Tailor for the Job Description: Customize your summary to reflect the key qualifications and responsibilities outlined in the job posting.

- Be Concise: Aim for 2-4 sentences that clearly convey your professional profile without unnecessary jargon.

- Use Action-Oriented Language: Start sentences with strong action verbs to convey your contributions and achievements effectively.

- Highlight Industry Knowledge: Demonstrating an understanding of the mortgage industry, regulations, and trends adds credibility to your summary.

- Showcase Soft Skills: Mention interpersonal skills like communication and teamwork, which are critical in collaborative environments.

- Include Keywords: Integrate relevant keywords from the job description to ensure your resume passes through applicant tracking systems (ATS).

Example Mortgage Automation Specialist Resume Summaries

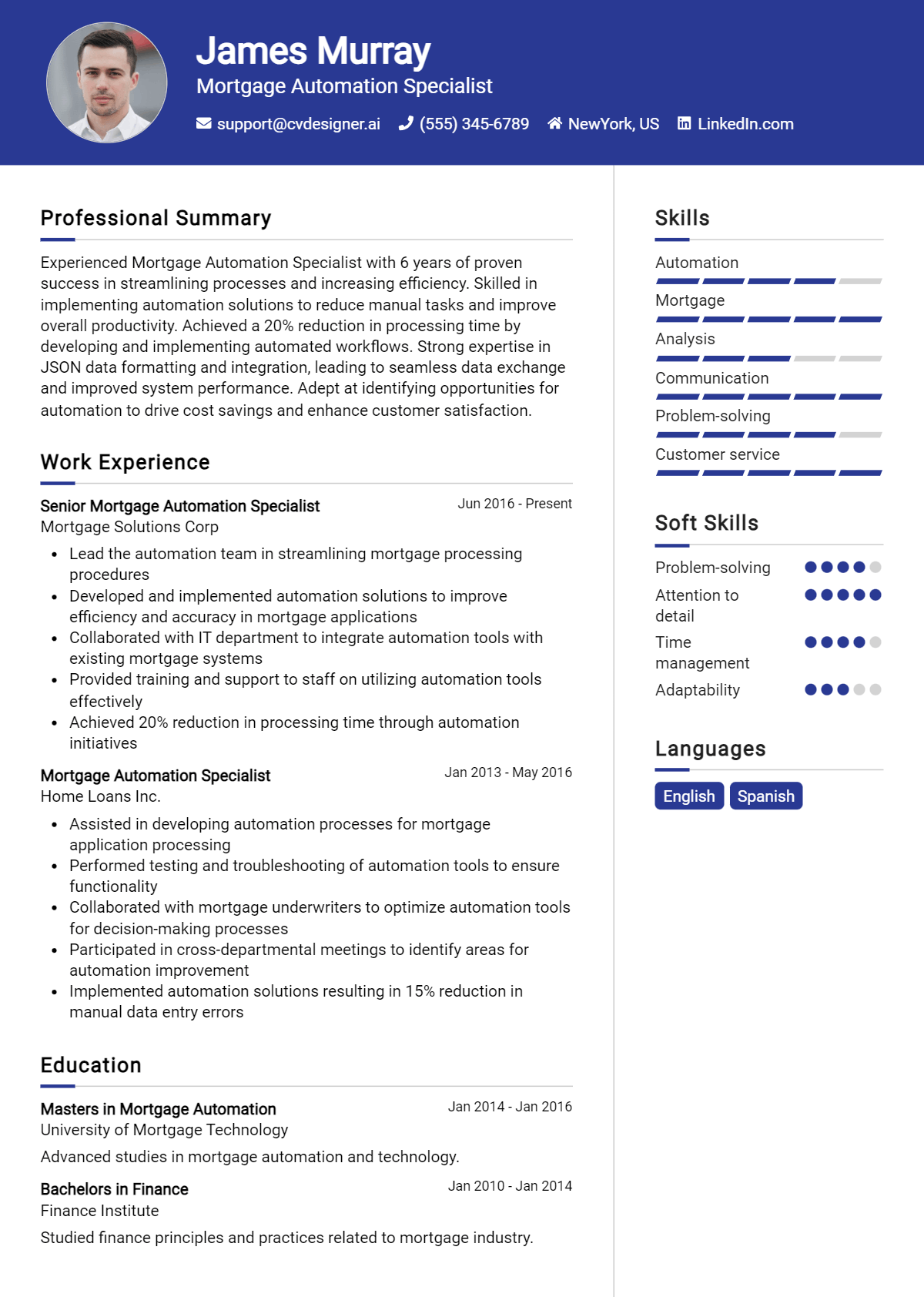

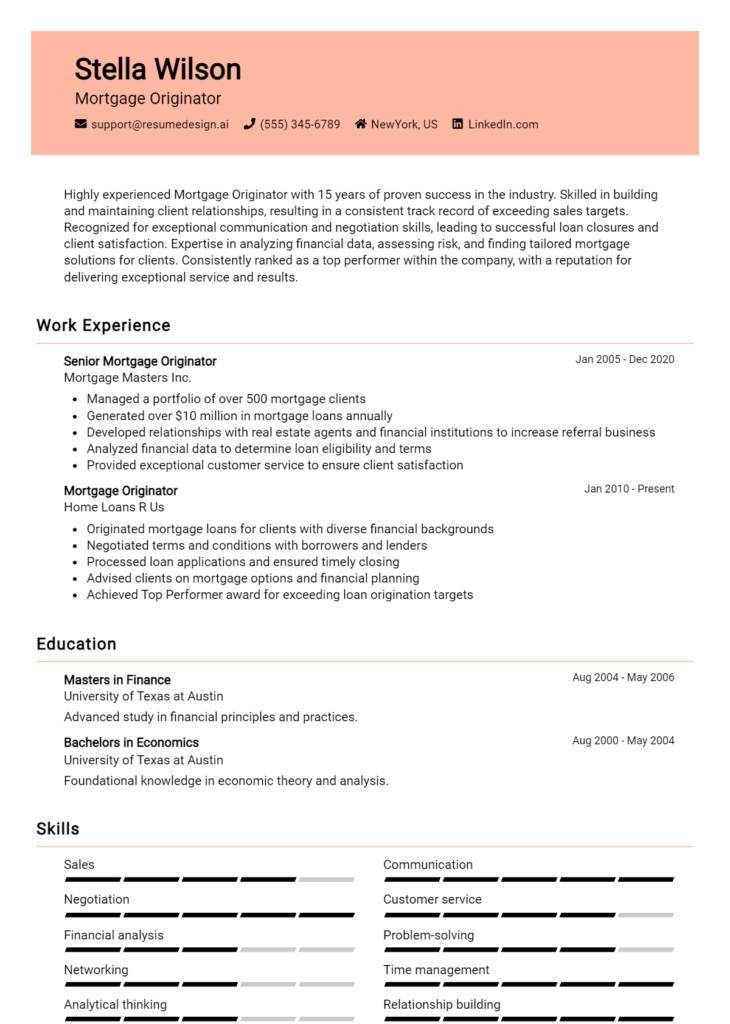

Strong Resume Summaries

Results-driven Mortgage Automation Specialist with over 5 years of experience optimizing loan processing workflows, achieving a 30% reduction in processing time. Proficient in utilizing Encompass and DocuSign, enhancing operational efficiency while ensuring compliance with industry regulations.

Detail-oriented Mortgage Automation Specialist with a track record of implementing automated solutions that increased loan approval rates by 25%. Skilled in data analysis and project management, facilitating seamless integration of technology into traditional mortgage processes.

Dynamic Mortgage Automation Specialist with expertise in developing automated reporting systems that decreased manual errors by 40%. Strong background in cross-functional collaboration and training teams on new automation software.

Weak Resume Summaries

Experienced mortgage professional looking for a new opportunity. I have worked with automation tools and understand the industry.

Motivated individual seeking to leverage skills in mortgage automation. I am adaptable and willing to learn new things.

The examples of strong resume summaries stand out due to their use of quantifiable achievements, relevant skills, and specific industry knowledge, making them compelling for hiring managers. In contrast, the weak summaries lack detail and specificity, making it difficult for employers to gauge the candidates' qualifications and potential impact on the organization. Strong summaries effectively communicate value, while weak summaries fail to create interest or demonstrate capability.

Work Experience Section for Mortgage Automation Specialist Resume

The work experience section of a Mortgage Automation Specialist resume is crucial as it provides a comprehensive overview of the candidate's professional journey, highlighting their technical skills and leadership abilities in delivering high-quality automation solutions within the mortgage industry. This section not only showcases how candidates have managed teams and projects but also emphasizes their capacity to achieve measurable outcomes. By quantifying achievements and aligning experiences with industry standards, candidates can effectively demonstrate their value to potential employers, making this section a key component of a successful resume.

Best Practices for Mortgage Automation Specialist Work Experience

- Focus on technical skills relevant to mortgage automation tools and software.

- Quantify achievements, such as increased efficiency or reduced processing times.

- Highlight leadership roles and collaboration with cross-functional teams.

- Use industry-specific terminology to align your experience with employer expectations.

- Detail specific projects and your role in their success to provide context.

- Showcase continuous improvement initiatives and their outcomes.

- Include certifications or training that enhance your technical expertise.

- Tailor your experience to match the job description of the position you’re applying for.

Example Work Experiences for Mortgage Automation Specialist

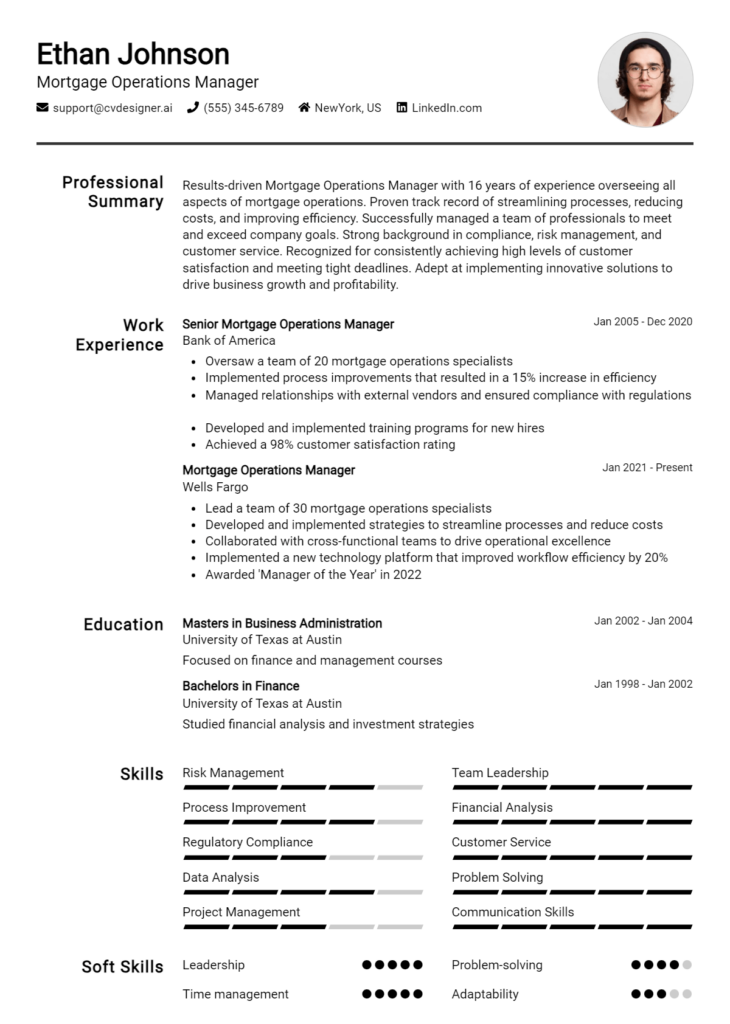

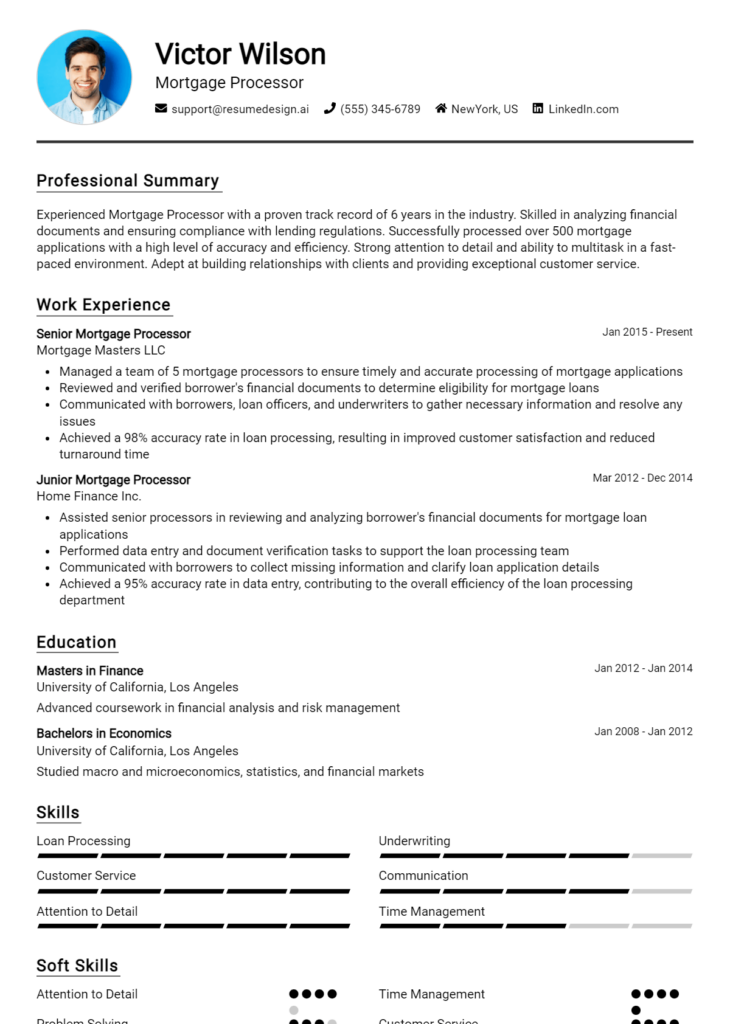

Strong Experiences

- Led a team of 5 in the implementation of an automated loan processing system that reduced turnaround time by 30%, resulting in a significant increase in customer satisfaction scores.

- Developed and executed a data migration plan that successfully transitioned over 100,000 records to a new mortgage management platform, increasing operational efficiency by 25%.

- Collaborated with IT and compliance teams to design and launch a new automated underwriting engine, which improved accuracy by 15% and decreased manual review time by 40%.

Weak Experiences

- Worked on various projects related to mortgage automation.

- Assisted in team efforts to improve processes.

- Involved in the implementation of new software.

The examples listed above are considered strong because they provide specific, quantifiable outcomes that illustrate the candidate's impact on their organization, showcasing both technical leadership and collaboration. In contrast, the weak experiences are vague and lack measurable results, failing to convey the candidate's true contributions or expertise in the field of mortgage automation.

Education and Certifications Section for Mortgage Automation Specialist Resume

The education and certifications section is a crucial component of a Mortgage Automation Specialist's resume, as it showcases the candidate's academic background, industry-relevant certifications, and commitment to continuous learning. This section not only highlights formal education but also emphasizes specialized training and relevant coursework that can significantly enhance the candidate's credibility and alignment with the job role. By providing detailed information about certification programs and educational experiences, candidates can effectively demonstrate their expertise and readiness to navigate the complexities of mortgage automation technologies.

Best Practices for Mortgage Automation Specialist Education and Certifications

- Include only relevant degrees and certifications that pertain to mortgage automation or related fields.

- Be specific about the certification body and the date of certification to establish credibility.

- List coursework that directly relates to mortgage processes, automation technologies, or financial analysis.

- Highlight advanced or specialized certifications, such as Certified Mortgage Automation Specialist (CMAS) or similar credentials.

- Use clear and concise formatting to ensure the section is easy to read and understand.

- Update the section regularly to reflect any new certifications or educational achievements.

- Consider including online courses or workshops that demonstrate ongoing professional development.

- Arrange the information in reverse chronological order for clarity and impact.

Example Education and Certifications for Mortgage Automation Specialist

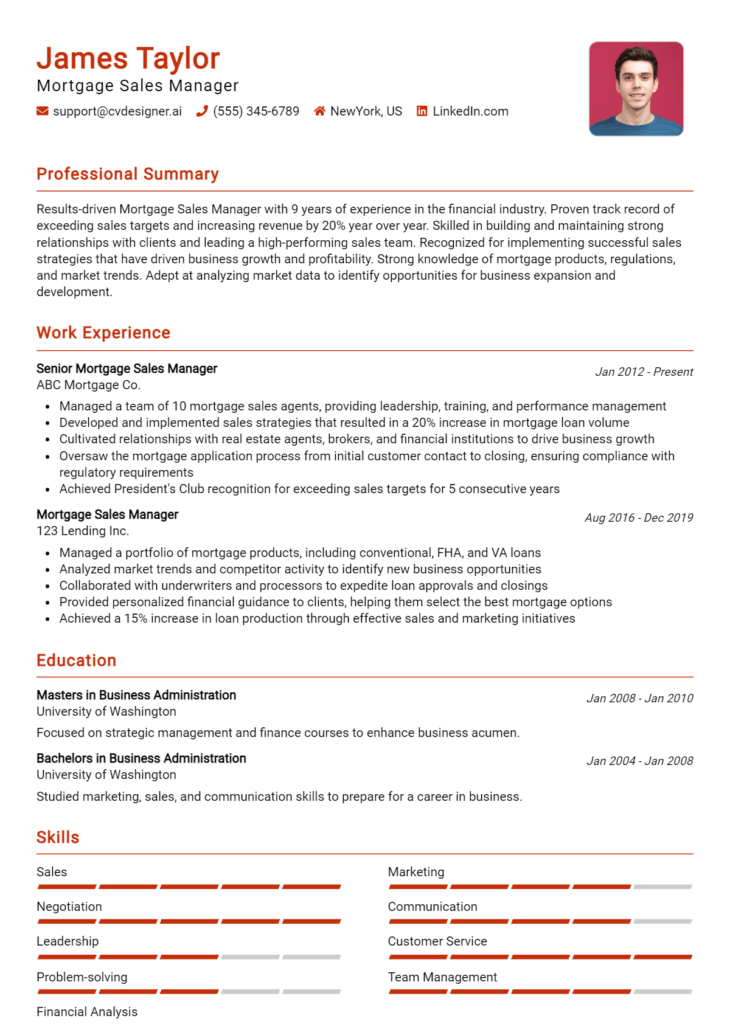

Strong Examples

- Bachelor of Science in Finance, University of California, 2018

- Certified Mortgage Automation Specialist (CMAS), National Mortgage Professionals, 2021

- Coursework in Mortgage Banking and Automation Technologies, Online Learning Platform, 2022

- Advanced Certificate in Data Analytics for Financial Services, ABC Institute, 2020

Weak Examples

- Associate Degree in General Studies, Community College, 2015

- Certification in Basic Computer Skills, Online Course, 2019

- High School Diploma, Anytown High School, 2014

- Outdated Mortgage Broker License, Expired 2020

The strong examples are considered effective because they directly relate to the responsibilities and skills required for a Mortgage Automation Specialist, showcasing relevant education and recognized certifications that indicate expertise in the field. In contrast, the weak examples reflect qualifications that are either outdated, too general, or not specifically aligned with mortgage automation, which can detract from the candidate's overall appeal in a competitive job market.

Top Skills & Keywords for Mortgage Automation Specialist Resume

In the competitive field of mortgage automation, having the right skills on your resume can significantly enhance your chances of landing an interview. Employers look for candidates who not only possess technical expertise but also demonstrate strong interpersonal and problem-solving abilities. A well-rounded Mortgage Automation Specialist should showcase a blend of hard and soft skills that reflect their capability to streamline processes, improve efficiencies, and foster client relationships. Highlighting these skills effectively can set you apart from other applicants, allowing you to present yourself as a comprehensive solution to potential employers. For more insights on how to enhance your skills section, consider the specific requirements of the role.

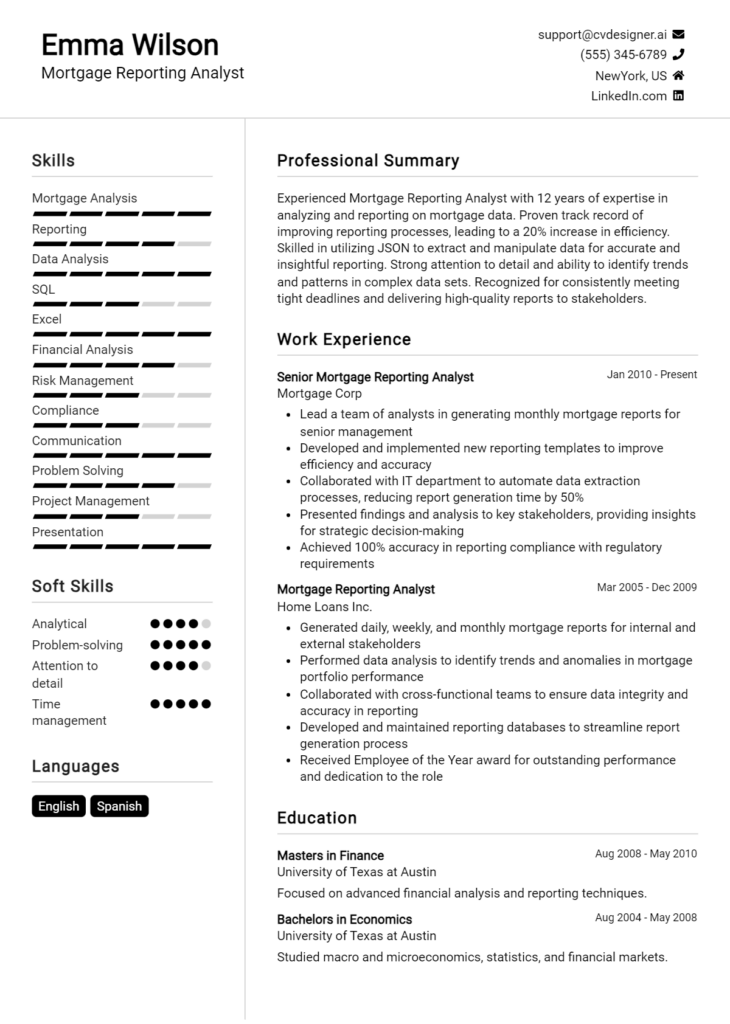

Top Hard & Soft Skills for Mortgage Automation Specialist

Soft Skills

- Attention to Detail

- Communication Skills

- Problem-Solving

- Adaptability

- Team Collaboration

- Time Management

- Customer Service Orientation

- Analytical Thinking

- Critical Thinking

- Negotiation Skills

- Empathy

- Conflict Resolution

- Initiative

- Flexibility

- Decision Making

Hard Skills

- Mortgage Processing Software Proficiency

- Automated Workflow Systems

- Data Analysis and Reporting

- Regulatory Compliance Knowledge

- CRM Systems Experience

- Loan Origination Systems

- Technical Writing

- Project Management

- Basic Coding/Scripting Knowledge

- Database Management

- Risk Assessment Techniques

- Quality Assurance Standards

- Financial Modeling

- Business Process Mapping

- Electronic Document Management Systems

- Cybersecurity Awareness

- Performance Metrics Analysis

These skills not only showcase your qualifications but also demonstrate your commitment to enhancing the mortgage automation process. For more information on how to effectively present your work experience, consider how these skills have been applied in your previous roles.

Stand Out with a Winning Mortgage Automation Specialist Cover Letter

As a dynamic and detail-oriented Mortgage Automation Specialist with over five years of experience in streamlining the mortgage process through technology, I am excited to apply for the position at [Company Name]. My background in automating workflows and enhancing customer experiences aligns perfectly with your mission to provide seamless mortgage solutions. I am particularly impressed by your commitment to innovation in the mortgage industry, and I am eager to contribute to your team by leveraging my expertise in automation tools and data analysis.

In my previous role at [Previous Company Name], I successfully implemented an automated mortgage processing system that reduced application turnaround time by 30%. By collaborating with cross-functional teams, I identified key bottlenecks in the workflow and developed tailored automation solutions that increased efficiency and accuracy. My proficiency in software such as Encompass and Salesforce, combined with my ability to analyze data trends, enabled me to create a more responsive and customer-centric mortgage experience. I am dedicated to using technology to enhance operational efficiency and drive positive outcomes for both the company and its clients.

Additionally, my strong communication skills and ability to work collaboratively with various stakeholders have allowed me to conduct impactful training sessions for team members on new automation tools. I believe that fostering a culture of continuous improvement is essential for success, and I am passionate about empowering colleagues to embrace technology in their daily operations. I am excited about the opportunity to bring this mindset to [Company Name] and play a pivotal role in your ongoing efforts to innovate and improve the mortgage process.

Thank you for considering my application. I am looking forward to the possibility of discussing how my skills and experiences can contribute to the success of [Company Name] as a Mortgage Automation Specialist. I am eager to help shape the future of mortgage processing and drive efficiencies that enhance customer satisfaction.

Common Mistakes to Avoid in a Mortgage Automation Specialist Resume

When crafting a resume for the role of a Mortgage Automation Specialist, it's crucial to present your skills and experiences effectively. However, many candidates fall into common pitfalls that can diminish the impact of their application. Avoiding these mistakes can significantly enhance your chances of standing out in a competitive job market, ensuring that your resume accurately reflects your qualifications and expertise in mortgage automation.

Neglecting Relevant Keywords: Failing to include industry-specific keywords can result in your resume being overlooked by Applicant Tracking Systems (ATS). Tailor your document to incorporate terms that align with mortgage automation.

Overloading with Technical Jargon: While it's essential to demonstrate your technical knowledge, using excessive jargon can alienate hiring managers. Strike a balance by explaining complex concepts in simple terms.

Ignoring Quantifiable Achievements: Merely listing job duties without quantifying your accomplishments can make your resume less compelling. Use metrics to showcase your impact, such as improvements in processing time or increases in customer satisfaction.

Lack of Tailoring for Each Application: Sending out a generic resume for multiple positions can hurt your chances. Customize your resume for each application to reflect the specific skills and experiences that align with the job description.

Omitting Soft Skills: Focusing solely on technical skills often overlooks the importance of soft skills like communication and problem-solving. Highlighting these abilities can show your well-roundedness as a candidate.

Using an Unprofessional Format: A cluttered or unprofessional layout can detract from your content. Ensure your resume is clean, organized, and easy to read, using consistent formatting throughout.

Not Including Relevant Certifications: Missing out on listing relevant certifications, such as those related to mortgage automation software, can weaken your resume. Highlight any certifications that validate your expertise in the field.

Failing to Proofread: Typos or grammatical errors can create a negative impression. Always proofread your resume multiple times or ask a friend to review it to ensure it's error-free.

Conclusion

As we conclude our exploration of the Mortgage Automation Specialist role, we’ve highlighted the essential skills and qualifications necessary for success in this dynamic field. From understanding the intricacies of mortgage processes to leveraging cutting-edge technology for automation, it’s clear that this position plays a pivotal role in enhancing operational efficiency and improving customer experiences.

To ensure you stand out in this competitive job market, it's crucial to have a polished resume that effectively showcases your expertise and achievements. We encourage you to take the time to review your Mortgage Automation Specialist resume and make updates where necessary.

To assist you in this process, a variety of resources are available at your fingertips. You can explore resume templates to find designs that suit your style, utilize the resume builder for a user-friendly experience, check out resume examples for inspiration, and don’t forget to create a compelling first impression with engaging cover letter templates.

Take action today and elevate your resume to reflect your potential as a Mortgage Automation Specialist!