26 Best Skills to Put on Your Merger Arbitrage Trader Resume [2025]

As a Merger Arbitrage Trader, possessing a unique set of skills is essential to navigate the complexities of financial markets during corporate mergers and acquisitions. This section will outline the key competencies and qualities that can enhance your resume, showcasing your ability to identify opportunities, manage risks, and execute trades effectively within this specialized field.

Best Merger Arbitrage Trader Technical Skills

Technical skills are crucial for a Merger Arbitrage Trader as they help in analyzing complex financial transactions, assessing risks, and making informed trading decisions. Proficiency in these skills can significantly enhance a trader's ability to identify profitable opportunities and execute trades efficiently.

Financial Modeling

Financial modeling is essential for assessing the valuation of companies involved in mergers or acquisitions. It helps traders forecast potential outcomes and make data-driven decisions.

How to show it: Demonstrate your experience by highlighting specific models you've built or leveraged, including any software used and the impact on trade outcomes.

Risk Analysis

Risk analysis involves evaluating the potential risks associated with merger arbitrage investments, helping traders to mitigate losses and make more informed decisions.

How to show it: Quantify your risk management success by detailing the percentage of risk reduction achieved in past trades or the effectiveness of strategies you implemented.

Statistical Analysis

Statistical analysis is vital for interpreting market data and trends, allowing traders to identify patterns that can inform their trading strategies.

How to show it: Provide examples of statistical tools or methodologies you’ve employed, along with any significant insights that led to profitable trades.

Market Research

In-depth market research helps traders understand the competitive landscape and the potential impact of mergers on stock prices, which is crucial for making informed trades.

How to show it: Highlight specific research projects you've conducted and their outcomes, emphasizing how your insights directly influenced trading decisions.

Valuation Techniques

Understanding various valuation techniques is important for assessing the fairness of merger offers and determining whether to enter into a trade.

How to show it: Mention particular valuation methods you are proficient in and any successful trades where valuation played a critical role.

Excel Proficiency

Advanced Excel skills are essential for modeling, analyzing data, and presenting findings in a clear manner for decision-making.

How to show it: Include specific Excel functions or tools you are adept with, and provide examples of how you've utilized them to enhance trading strategies.

Data Interpretation

The ability to interpret complex data sets is crucial for making quick and accurate trading decisions in the fast-paced environment of merger arbitrage.

How to show it: Describe scenarios where your data interpretation led to significant trading advantages, including any quantifiable results.

Regulatory Knowledge

A strong grasp of regulatory requirements and compliance is critical for navigating the legal aspects of mergers and acquisitions.

How to show it: Detail your understanding of relevant regulations and any instances where your knowledge protected your firm from potential pitfalls.

Portfolio Management

Skills in portfolio management are important for balancing risk and return across various merger arbitrage positions.

How to show it: Provide metrics related to your portfolio performance, illustrating your ability to optimize returns while managing risk.

Negotiation Skills

Effective negotiation skills can significantly impact the terms of a merger or acquisition, potentially leading to more favorable outcomes for investors.

How to show it: Highlight specific negotiations you've been involved in, noting any successful outcomes and their financial implications.

Quantitative Analysis

Quantitative analysis is essential for evaluating the financial health of companies and making precise predictions about stock performance post-merger.

How to show it: Outline your experience with quantitative tools and techniques, including any successful trades driven by your analyses.

Best Merger Arbitrage Trader Soft Skills

In the fast-paced world of merger arbitrage trading, possessing strong soft skills is as crucial as having technical expertise. These workplace skills enhance a trader's ability to navigate complex situations, communicate effectively with team members and stakeholders, and make informed decisions under pressure. Below are some of the top soft skills that can significantly contribute to a successful career as a Merger Arbitrage Trader.

Analytical Thinking

Analytical thinking allows traders to assess market conditions, evaluate risks, and interpret financial data effectively.

How to show it: Highlight instances where you analyzed market trends or identified investment opportunities that led to successful trades. Use specific metrics to quantify your impact.

Communication

Effective communication is vital for sharing insights and collaborating with teams and clients in the trading environment.

How to show it: Provide examples of how your communication skills facilitated successful negotiations or improved team collaboration. Mention any presentations or reports you created that influenced decision-making. [Communication](https://resumedesign.ai/communication-skills/)

Problem-solving

Problem-solving skills enable traders to devise strategies for overcoming challenges and adapting to market changes.

How to show it: Include specific examples of challenges you faced in trading and the innovative solutions you implemented. Quantify your results to demonstrate effectiveness. [Problem-solving](https://resumedesign.ai/problem-solving-skills/)

Time Management

Time management skills are essential for prioritizing tasks and making timely decisions in a dynamic trading environment.

How to show it: Demonstrate your ability to manage multiple trades or projects simultaneously by providing examples of how you met deadlines and achieved goals efficiently. [Time Management](https://resumedesign.ai/time-management-skills/)

Teamwork

Teamwork is crucial in trading, as collaboration with colleagues can lead to better insights and decision-making.

How to show it: Share experiences where you successfully collaborated with team members on trading strategies or projects. Highlight any leadership roles or contributions to team success. [Teamwork](https://resumedesign.ai/teamwork-skills/)

Adaptability

Adaptability is vital for adjusting strategies in response to market fluctuations or unexpected events.

How to show it: Provide examples of how you adjusted your trading strategies in response to changing market conditions. Highlight the outcomes of your adaptability.

Attention to Detail

Attention to detail ensures accuracy in analyzing financial data and executing trades.

How to show it: Emphasize your meticulous approach to data analysis and how it led to successful trades. Include any processes you improved to enhance accuracy.

Risk Management

Risk management skills help traders assess and mitigate potential losses, ensuring more stable returns.

How to show it: Discuss your experience in developing and implementing risk management strategies. Quantify the results of these strategies on your overall trading performance.

Negotiation Skills

Strong negotiation skills can lead to better terms and conditions in trades and partnerships.

How to show it: Share specific examples of successful negotiations you conducted that resulted in favorable outcomes. Highlight any metrics that demonstrate your effectiveness.

Emotional Intelligence

Emotional intelligence helps traders manage stress and build positive relationships with colleagues and clients.

How to show it: Provide examples of how you maintained composure under pressure and effectively navigated interpersonal dynamics in the workplace.

Strategic Thinking

Strategic thinking enables traders to formulate long-term plans that align with market trends and personal goals.

How to show it: Highlight strategies you developed and implemented that resulted in successful trades or portfolio growth. Use data to illustrate your strategic impact.

How to List Merger Arbitrage Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to potential employers. A well-structured skills section can showcase your qualifications, making it easier for hiring managers to see your fit for the role. There are three main sections where skills can be highlighted: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

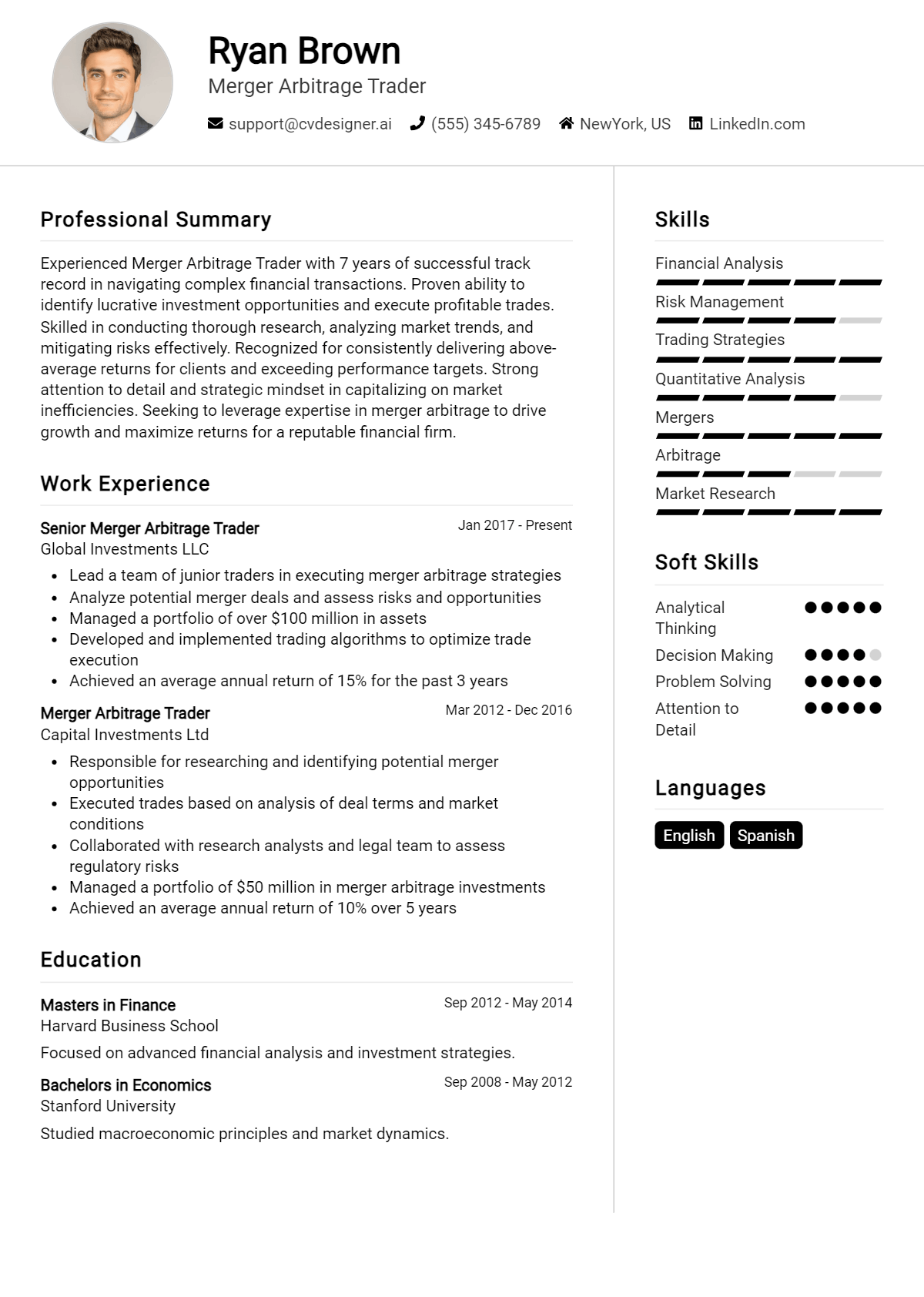

for Resume Summary

Showcasing your Merger Arbitrage Trader skills in the introduction section provides hiring managers with a quick overview of your qualifications and sets the tone for your resume.

Example

As a dedicated Merger Arbitrage Trader with strong analytical skills and a proven track record in risk assessment, I excel in identifying strategic opportunities that drive profitability.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Merger Arbitrage Trader skills have been applied in real-world scenarios, showcasing your contributions and achievements.

Example

- Executed merger arbitrage strategies leading to a 20% increase in portfolio returns over two years.

- Conducted thorough financial analysis to evaluate the viability of potential merger candidates.

- Utilized quantitative modeling techniques to assess market risks and inform trading decisions.

- Collaborated with cross-functional teams to develop comprehensive risk management frameworks.

for Resume Skills

The skills section can showcase both technical and transferable skills, emphasizing a balanced mix of hard and soft skills that strengthen your overall qualifications for the Merger Arbitrage Trader role.

Example

- Strong analytical skills

- Quantitative modeling

- Financial analysis

- Risk assessment

- Market research

- Strategic decision-making

- Team collaboration

- Effective communication

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resumes and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate your suitability for the role.

Example

In my previous role, my strong analytical skills enabled me to identify lucrative merger opportunities, resulting in a 15% growth in our trading portfolio. Coupled with my risk assessment expertise, I consistently mitigated potential losses and enhanced profitability.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job, making a compelling case for your candidacy.

The Importance of Merger Arbitrage Trader Resume Skills

In the highly competitive field of finance, particularly in merger arbitrage trading, showcasing relevant skills on a resume is crucial for candidates aiming to capture the attention of recruiters. A well-crafted skills section not only highlights an applicant's qualifications but also aligns their capabilities with the specific demands of the job. By effectively communicating their expertise, candidates can demonstrate their value and increase their chances of landing an interview.

- Demonstrates Analytical Skills: A strong set of analytical skills is essential in merger arbitrage trading. Highlighting these abilities shows recruiters that the candidate can assess complex financial data, identify trends, and make informed decisions in high-pressure situations.

- Indicates Risk Management Proficiency: Employers seek traders who can manage risk effectively. Including risk management skills on a resume reflects a candidate's understanding of market volatility and their ability to implement strategies that protect investments.

- Showcases Financial Acumen: A deep understanding of financial instruments and market dynamics is vital for success in this role. By emphasizing financial acumen, candidates can position themselves as knowledgeable professionals who can navigate intricate deals with ease.

- Highlights Negotiation Skills: Successful merger arbitrage traders often need to negotiate terms and conditions. Demonstrating strong negotiation skills on a resume indicates that the candidate can advocate for favorable outcomes in complex transactions.

- Reflects Team Collaboration: Merger arbitrage is often a team effort, requiring collaboration with various stakeholders. By showcasing teamwork and communication skills, candidates can illustrate their ability to work effectively within a group, enhancing productivity and results.

- Exhibits Attention to Detail: The fast-paced nature of trading demands precision and accuracy. Candidates should emphasize their attention to detail to reassure recruiters that they can analyze and execute trades without making costly mistakes.

- Illustrates Market Knowledge: A comprehensive understanding of market trends and economic indicators is critical for merger arbitrage traders. Highlighting this knowledge can set candidates apart, demonstrating their ability to anticipate market movements and make strategic decisions.

- Conveys Technical Proficiency: Familiarity with trading platforms and financial modeling tools is essential in this field. Including technical skills on a resume not only shows a candidate's capability to leverage technology but also their adaptability to evolving market landscapes.

For more insights and examples, check out [Resume Samples](https://resumekraft.com/resume-samples/).

How To Improve Merger Arbitrage Trader Resume Skills

In the dynamic world of finance, particularly in merger arbitrage trading, continuously improving your skills is crucial to staying competitive and effective. As market conditions change and new strategies emerge, enhancing your expertise not only boosts your resume but also increases your chances of making informed decisions that lead to successful trades. Here are some actionable tips to help you improve your skills in this specialized field:

- Stay Informed: Regularly read financial news, reports, and analysis to understand market trends and the implications of mergers and acquisitions.

- Enhance Analytical Skills: Take online courses or workshops that focus on financial modeling and data analysis to sharpen your ability to evaluate potential trades.

- Network with Industry Professionals: Attend finance-related events and join professional organizations to connect with other traders and share insights and strategies.

- Utilize Trading Simulators: Practice your skills in a risk-free environment by using trading simulators that allow you to test your strategies without financial exposure.

- Learn from Experience: Review your past trades to identify what worked and what didn’t. This reflection can guide your future trading decisions.

- Refine Your Risk Management Techniques: Study various risk management strategies to better protect your capital and enhance your overall trading performance.

- Engage in Continuous Education: Consider pursuing advanced degrees or certifications in finance or investment to deepen your knowledge and credentials.

Frequently Asked Questions

What are the essential skills required for a Merger Arbitrage Trader?

A successful Merger Arbitrage Trader should possess strong analytical skills, allowing them to assess financial statements and market conditions effectively. Proficiency in financial modeling and valuation techniques is crucial, as it helps in predicting the outcomes of mergers and acquisitions. Additionally, traders should have excellent risk management skills to navigate the inherent uncertainties in merger arbitrage transactions.

How important is knowledge of financial markets for a Merger Arbitrage Trader?

Knowledge of financial markets is vital for a Merger Arbitrage Trader, as it provides a solid foundation for understanding how mergers and acquisitions can impact stock prices. Familiarity with market trends, liquidity factors, and regulatory environments enables traders to make informed decisions and react swiftly to changing conditions, ultimately enhancing their trading strategies.

What role does quantitative analysis play in merger arbitrage trading?

Quantitative analysis plays a significant role in merger arbitrage trading by allowing traders to utilize mathematical models and statistical techniques to evaluate potential trades. This analytical approach helps in identifying pricing inefficiencies and estimating probable outcomes of merger deals. By applying quantitative methods, traders can optimize their portfolios and improve their overall trading performance.

How do communication skills factor into the role of a Merger Arbitrage Trader?

Communication skills are essential for a Merger Arbitrage Trader, as they often need to collaborate with colleagues, analysts, and other stakeholders to gather insights and share findings. Effective communication helps in articulating complex ideas clearly and persuasively, which is crucial when presenting trading strategies or discussing market conditions. Strong interpersonal skills also foster teamwork and collaboration within trading environments.

What technical skills are beneficial for a Merger Arbitrage Trader?

Technical skills are highly beneficial for a Merger Arbitrage Trader, particularly proficiency in trading platforms and financial software. Familiarity with tools such as Bloomberg or FactSet can enhance data analysis and streamline the research process. Additionally, coding skills in languages like Python or R can aid in developing algorithms for trading strategies, improving efficiency and accuracy in executing trades.

Conclusion

Including Merger Arbitrage Trader skills in your resume is crucial for standing out in a competitive job market. By effectively showcasing relevant skills such as analytical thinking, strategic decision-making, and risk assessment, candidates can demonstrate their value to potential employers looking for expertise in this specialized area. Remember, a well-crafted resume can make a significant difference in your job application process.

So take the time to refine your skills and ensure your resume reflects your strengths. With the right approach and tools, such as [resume templates](https://resumedesign.ai/resume-templates/), [resume builder](https://app.resumedesign.ai/), [resume examples](https://resumedesign.ai/resume-examples/), and [cover letter templates](https://resumedesign.ai/cover-letter-templates/), you can elevate your application and set yourself on the path to success. Keep pushing forward!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.