Merger Arbitrage Trader Core Responsibilities

A Merger Arbitrage Trader plays a crucial role in navigating complex financial transactions by analyzing merger and acquisition opportunities. This position requires a blend of technical expertise, operational acumen, and strong problem-solving skills to assess risks and execute trades effectively. Success hinges on collaboration across departments such as finance, research, and compliance, ensuring alignment with the organization’s strategic goals. A well-structured resume highlighting these competencies can significantly enhance career prospects in this dynamic field.

Common Responsibilities Listed on Merger Arbitrage Trader Resume

- Analyze merger and acquisition deals to identify arbitrage opportunities.

- Conduct financial modeling and valuation assessments.

- Monitor market trends and economic indicators affecting trades.

- Develop and implement trading strategies to optimize returns.

- Collaborate with legal and compliance teams to manage regulatory risks.

- Prepare detailed reports on trade performance and market analysis.

- Engage with investment banks and corporate clients for deal insights.

- Utilize quantitative analysis tools to assess trading risks and opportunities.

- Maintain relationships with brokers and trading platforms.

- Execute trades efficiently while adhering to risk management protocols.

- Stay updated on industry news and developments impacting mergers.

- Participate in team meetings to share insights and strategies.

High-Level Resume Tips for Merger Arbitrage Trader Professionals

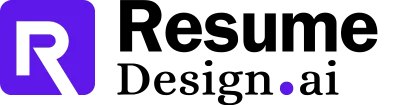

In the competitive landscape of finance, a well-crafted resume is essential for Merger Arbitrage Trader professionals looking to make a lasting impression on potential employers. As the first point of contact, your resume must effectively showcase not only your skills and qualifications but also your unique achievements in the field. A strong resume can set you apart from other candidates, reflecting your expertise in navigating complex financial transactions and demonstrating your value as a strategic thinker. This guide aims to provide practical and actionable resume tips specifically tailored for Merger Arbitrage Trader professionals, ensuring that your first impression is a powerful one.

Top Resume Tips for Merger Arbitrage Trader Professionals

- Tailor your resume to the specific job description by incorporating relevant keywords and phrases that align with the role.

- Highlight your relevant experience in merger arbitrage, including specific deals you've worked on and your role in those transactions.

- Quantify your achievements with concrete numbers, such as the percentage of returns generated or the total value of deals successfully closed.

- Showcase your analytical skills by detailing the methodologies and tools you used to assess merger opportunities.

- Include industry-specific skills, such as financial modeling, risk assessment, and regulatory knowledge, to demonstrate your expertise.

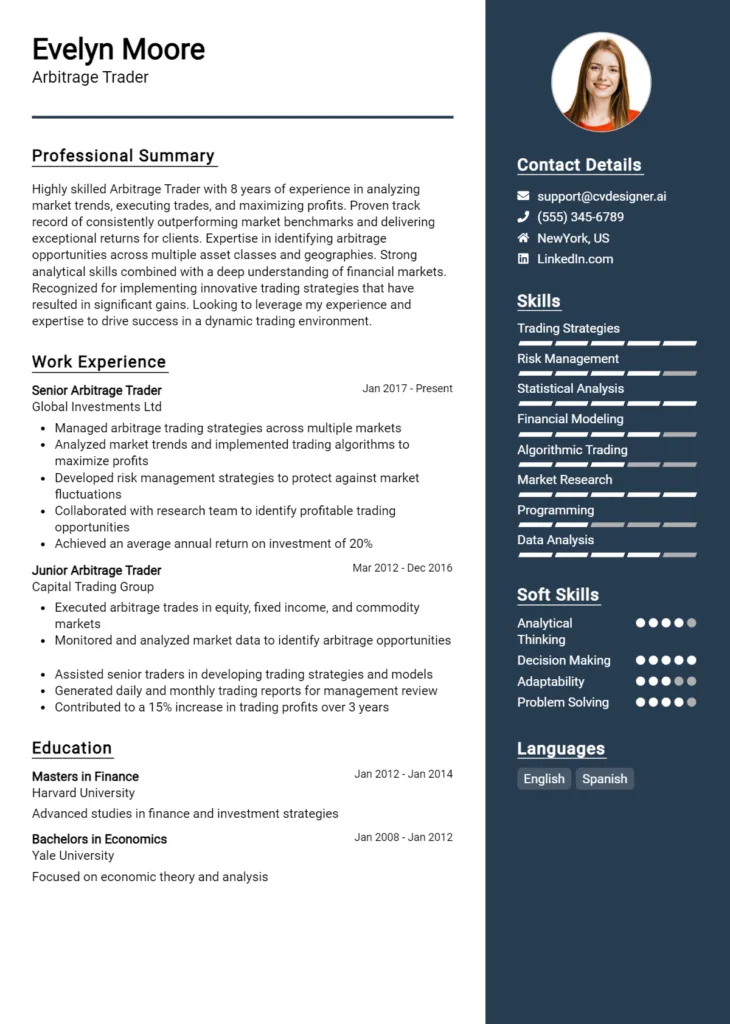

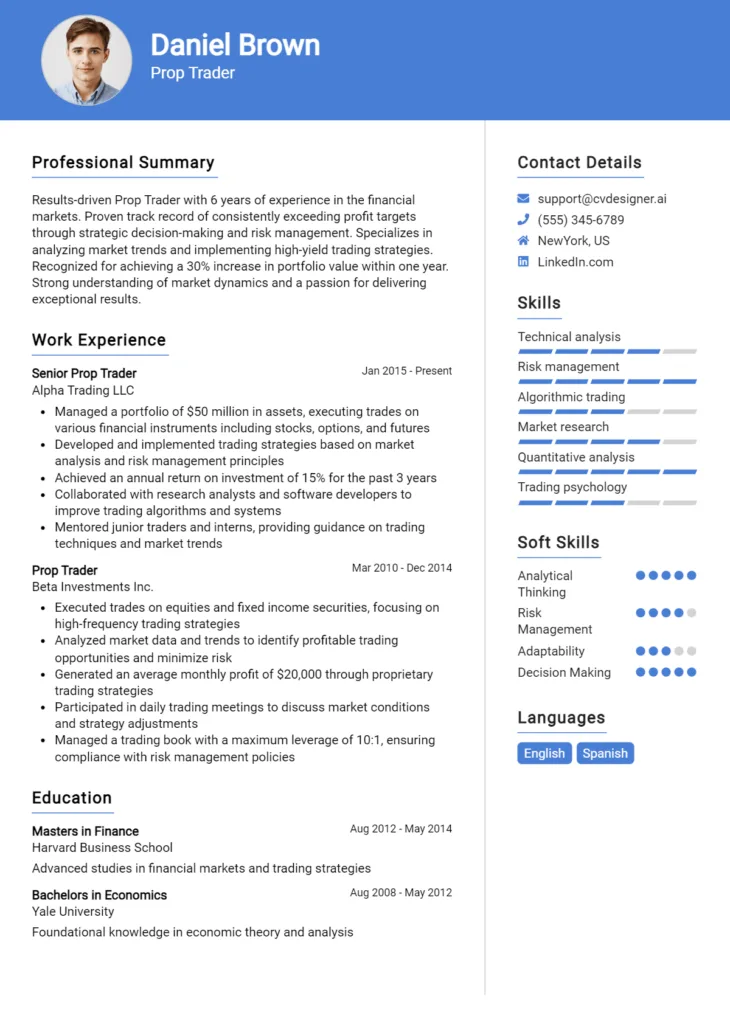

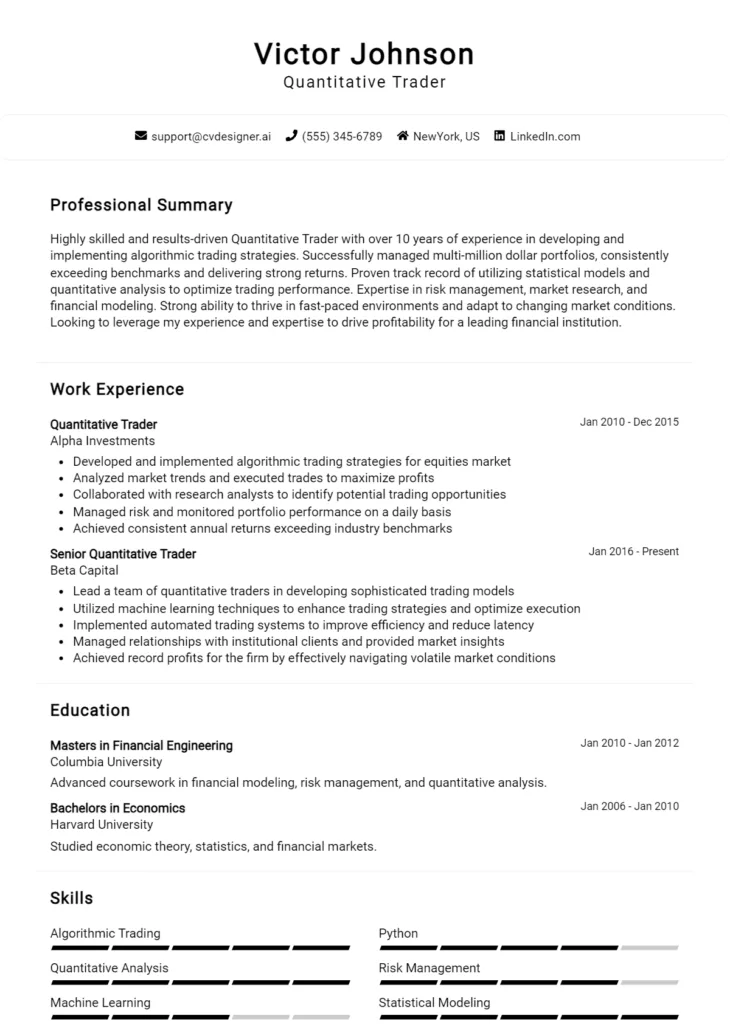

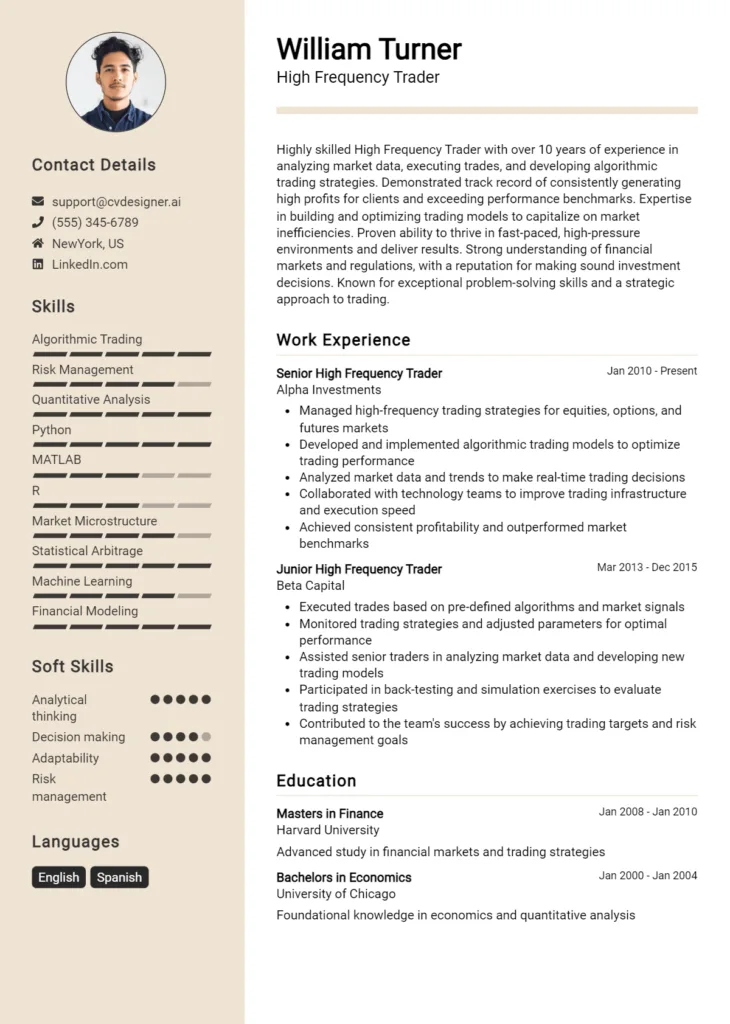

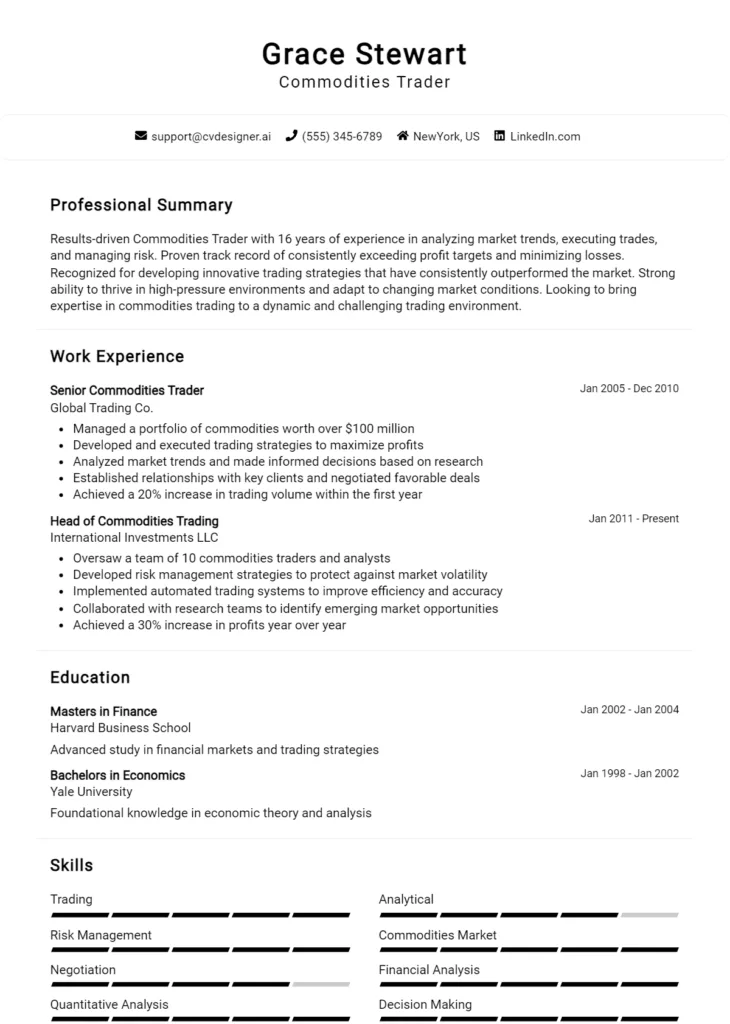

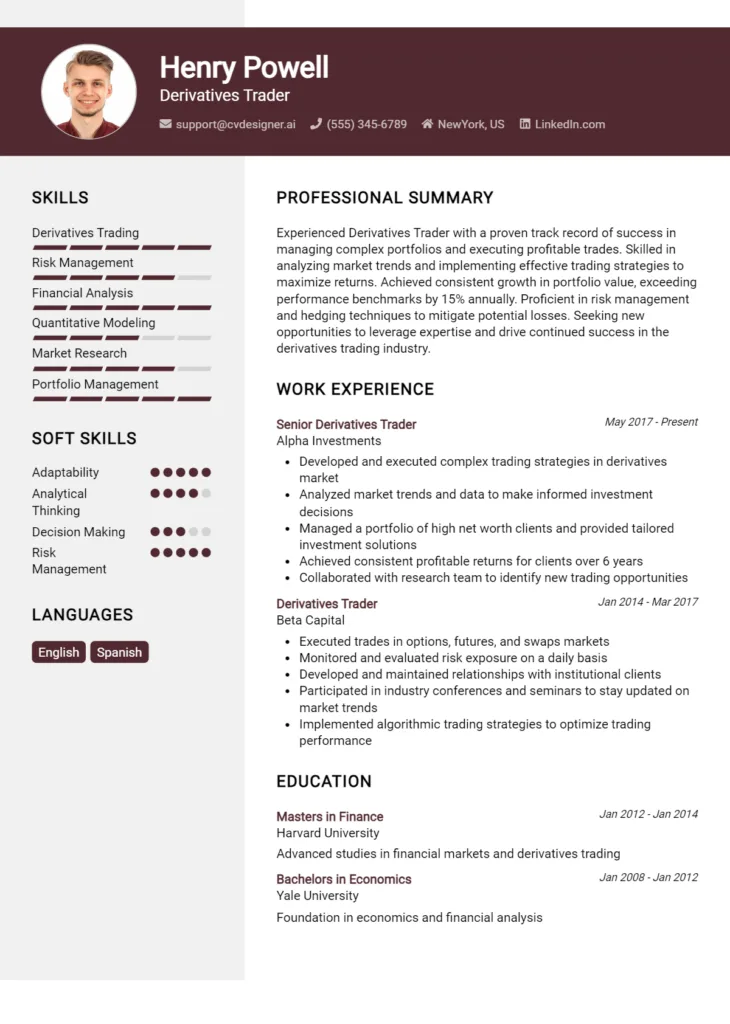

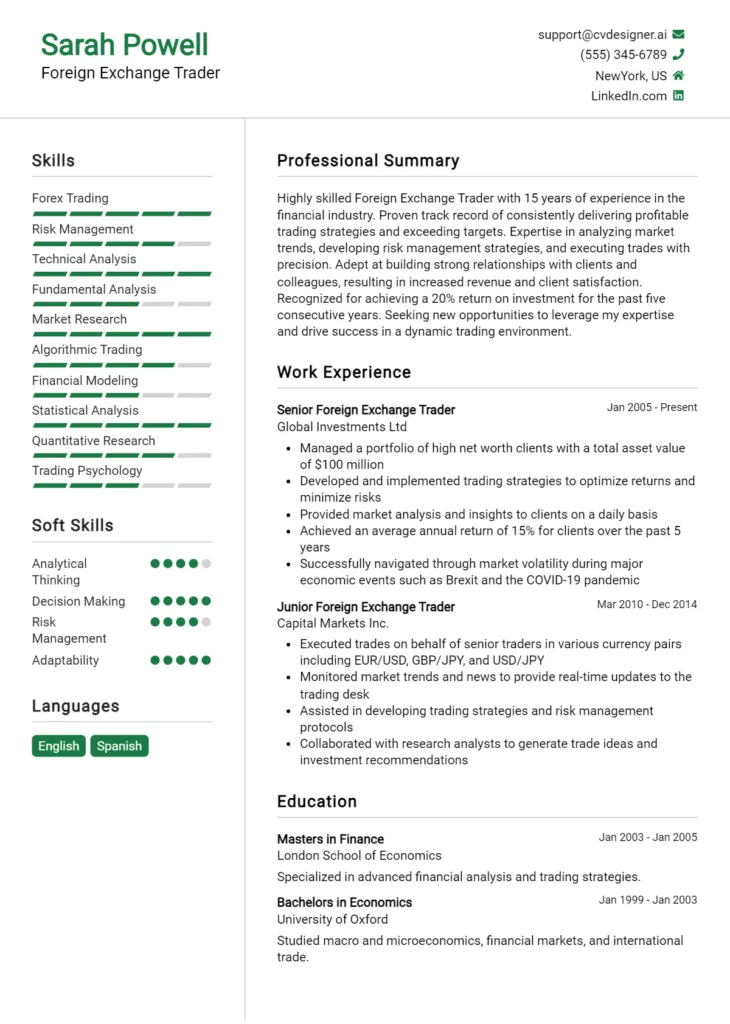

- Utilize a clean and professional format that enhances readability and allows key information to stand out.

- Incorporate a summary statement at the beginning of your resume that encapsulates your career highlights and aspirations.

- List relevant certifications or training, such as CFA or specialized courses in merger arbitrage, to bolster your qualifications.

- Keep your resume concise, ideally one page, focusing on the most relevant information to maintain the reader's attention.

By implementing these tailored resume tips, you can significantly increase your chances of landing a job in the Merger Arbitrage Trader field. A focused and polished resume will not only highlight your qualifications but also effectively communicate your potential to contribute to an organization’s success in navigating the complexities of merger transactions.

Why Resume Headlines & Titles are Important for Merger Arbitrage Trader

The role of a Merger Arbitrage Trader is both dynamic and competitive, demanding a resume that stands out in a crowded job market. Resume headlines and titles are essential components that can significantly influence hiring managers' first impressions. A strong headline serves as a powerful summary of a candidate's key qualifications, capturing their attention and inviting them to delve deeper into the resume. It should be concise, relevant, and directly related to the position being applied for, encapsulating the essence of the candidate's expertise and experience in merger arbitrage trading.

Best Practices for Crafting Resume Headlines for Merger Arbitrage Trader

- Keep it concise—aim for one impactful phrase.

- Use industry-specific terminology to demonstrate expertise.

- Highlight key skills relevant to merger arbitrage, such as analytical abilities or risk management.

- Incorporate quantifiable achievements, if possible.

- Avoid generic titles; tailor the headline to the specific job description.

- Utilize action-oriented language to convey confidence and proactivity.

- Ensure clarity—avoid jargon that may confuse the reader.

- Position the headline at the top of the resume for maximum visibility.

Example Resume Headlines for Merger Arbitrage Trader

Strong Resume Headlines

"Results-Driven Merger Arbitrage Trader with 7+ Years of Experience in High-Stakes Transactions"

“Expert in Identifying Investment Opportunities with Proven Record of 20% Annual Returns”

“Analytical Merger Arbitrage Specialist Skilled in Risk Assessment and Market Analysis”

Weak Resume Headlines

“Trader Looking for Opportunities”

“Finance Professional”

The strong headlines are effective because they clearly articulate the candidate's experience and skills while also demonstrating their achievements in the field of merger arbitrage. They provide specific information that can pique the interest of hiring managers and showcase the candidate's professional identity. In contrast, the weak headlines fail to impress due to their vagueness and lack of relevant detail; they do not convey any unique qualifications or standout experiences, making it easy for hiring managers to overlook them in favor of more compelling candidates.

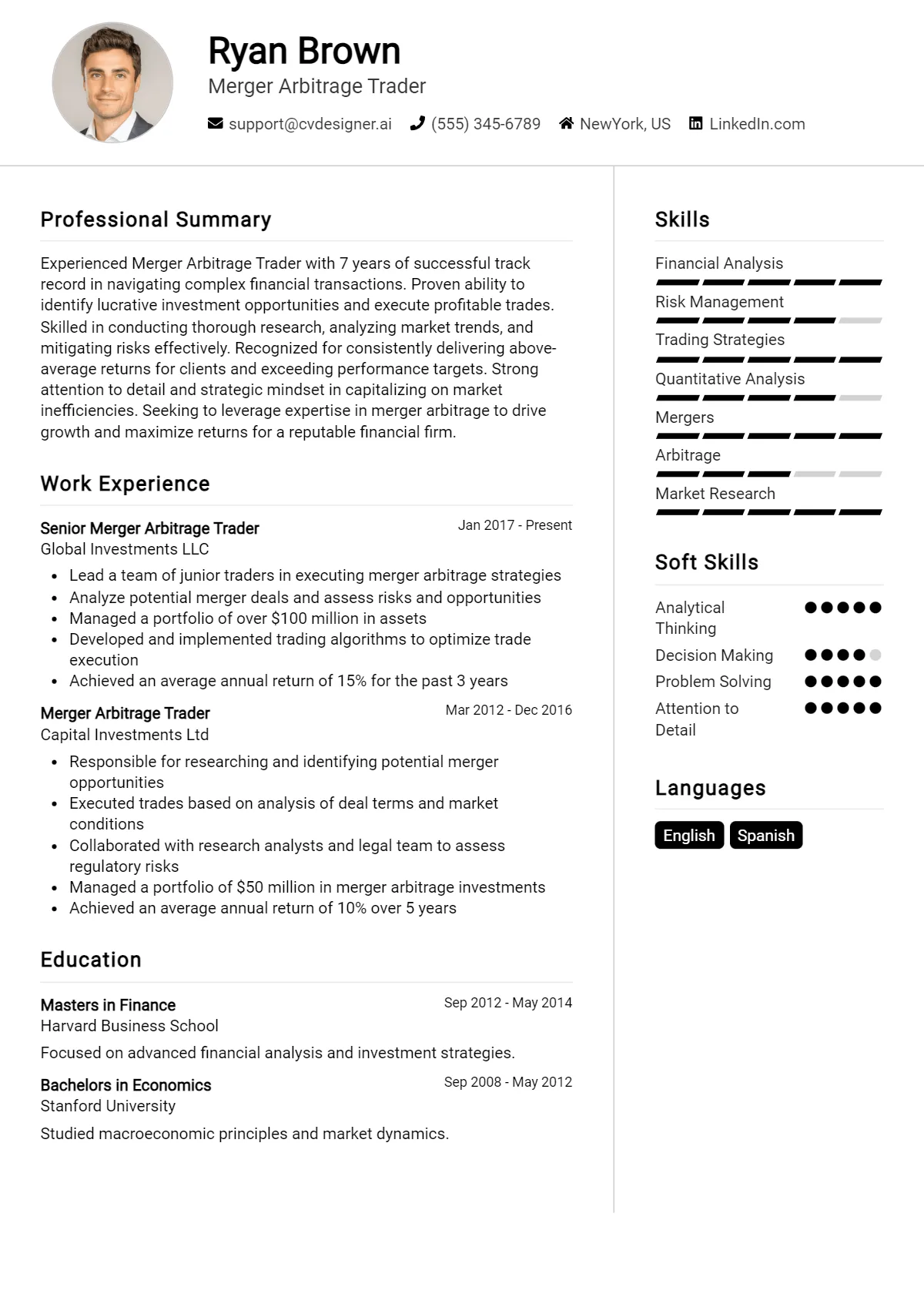

Writing an Exceptional Merger Arbitrage Trader Resume Summary

A well-crafted resume summary is essential for a Merger Arbitrage Trader as it serves as the first impression to hiring managers. This concise paragraph quickly captures attention by showcasing key skills, relevant experience, and noteworthy accomplishments that directly relate to the trading and financial analysis environment. An impactful summary not only highlights the candidate's strengths but also aligns with the specific job requirements, making it easier for hiring managers to see the potential value a candidate can bring to their organization. Therefore, a strong resume summary must be concise, engaging, and tailored specifically to the job being applied for.

Best Practices for Writing a Merger Arbitrage Trader Resume Summary

- Quantify achievements with specific metrics to demonstrate success.

- Highlight relevant skills such as financial modeling, risk assessment, and market analysis.

- Tailor the summary to match the job description and company goals.

- Use industry-specific terminology to show expertise and familiarity.

- Keep it concise, ideally within 3-4 sentences.

- Focus on unique value propositions that set you apart from other candidates.

- Incorporate keywords from the job listing to enhance visibility in applicant tracking systems.

- Highlight any relevant certifications or educational qualifications that add credibility.

Example Merger Arbitrage Trader Resume Summaries

Strong Resume Summaries

Dynamic Merger Arbitrage Trader with over 7 years of experience in executing complex trades and managing a portfolio worth $500 million. Increased annual ROI by 15% through meticulous financial analysis and strategic risk management.

Results-driven financial analyst specializing in merger arbitrage, with a proven track record of identifying profitable opportunities that led to a 20% increase in quarterly profits. Adept at employing quantitative techniques to assess market trends and risks.

Experienced Merger Arbitrage Trader with a strong background in equity research and a successful history of completing high-stakes transactions. Achieved a 30% growth in merger arbitrage profits over two consecutive years through innovative trading strategies.

Weak Resume Summaries

Merger Arbitrage Trader with experience in trading. Looking for opportunities to leverage skills in the finance industry.

Motivated trader with some experience in mergers and acquisitions. Seeking to apply my knowledge in a challenging environment.

The strong resume summaries are considered effective because they provide specific, quantifiable outcomes that directly relate to the role of a Merger Arbitrage Trader, showcasing not only experience but also measurable success. In contrast, the weak resume summaries lack detail and specificity, failing to communicate the candidate's true capabilities or achievements, making them less compelling to hiring managers.

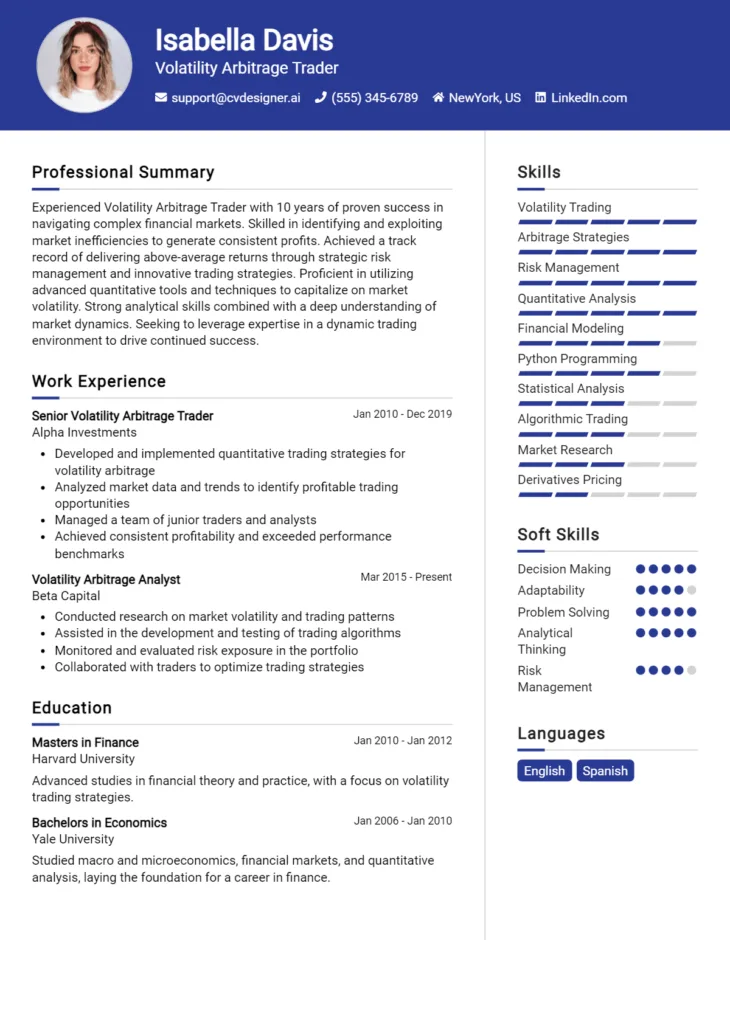

Work Experience Section for Merger Arbitrage Trader Resume

The work experience section of a Merger Arbitrage Trader resume serves as a critical component that highlights the candidate's technical expertise, leadership abilities, and capacity to produce high-quality results in a fast-paced financial environment. By detailing past roles and responsibilities, this section demonstrates the trader's familiarity with market dynamics, analytical skills, and decision-making capabilities. It is essential to quantify achievements wherever possible, as this not only showcases the trader's impact but also aligns their experience with industry standards, making the candidate more appealing to potential employers.

Best Practices for Merger Arbitrage Trader Work Experience

- Highlight technical skills related to financial modeling, valuation techniques, and risk management.

- Quantify achievements, such as percentage returns on trades or successful deal closures, to illustrate the impact made.

- Use action verbs to convey leadership and initiative in projects and team settings.

- Detail collaboration experiences, emphasizing teamwork and communication with cross-functional units.

- Include relevant certifications or training that bolster technical expertise in merger arbitrage.

- Focus on results-driven experiences that demonstrate a proactive approach to problem-solving.

- Tailor language and accomplishments to reflect industry-specific terminology and standards.

- Maintain clarity and conciseness to ensure easy readability and engagement from hiring managers.

Example Work Experiences for Merger Arbitrage Trader

Strong Experiences

- Led a team of 5 traders in executing merger arbitrage strategies that yielded an average annual return of 15% over three years, exceeding industry benchmarks.

- Developed and implemented a proprietary valuation model that improved accuracy in deal assessments, resulting in a 20% increase in successful trade executions.

- Collaborated with legal and compliance teams to navigate regulatory challenges, ensuring 100% adherence to guidelines during high-stakes transactions.

- Managed a portfolio of merger deals worth over $500 million, achieving a 30% reduction in risk exposure through strategic diversification.

Weak Experiences

- Worked as a trader on various deals without specifying outcomes or contributions.

- Participated in team meetings to discuss merger strategies but did not drive any initiatives.

- Assisted in the evaluation of market conditions with little mention of specific techniques or results.

- Involved in the trading process without quantifying achievements or detailing responsibilities.

The examples provided illustrate the stark contrast between strong and weak experiences. Strong experiences are characterized by clear, measurable outcomes and specific contributions that showcase the candidate's technical skills and leadership capabilities. They reflect a proactive approach and a results-oriented mindset. In contrast, weak experiences lack detail and quantifiable results, making them less impactful and failing to convey the candidate's true potential in the role of a Merger Arbitrage Trader.

Education and Certifications Section for Merger Arbitrage Trader Resume

The education and certifications section of a Merger Arbitrage Trader resume plays a crucial role in establishing a candidate's qualifications and expertise in this specialized field. This section effectively highlights the candidate's academic background, showcasing degrees in relevant disciplines such as finance, economics, or business. Additionally, it reflects the candidate's commitment to continuous learning through industry-recognized certifications and specialized training. By providing relevant coursework, certifications, and any additional professional development, candidates can significantly enhance their credibility and demonstrate a strong alignment with the requirements of the Merger Arbitrage Trader role.

Best Practices for Merger Arbitrage Trader Education and Certifications

- Focus on degrees in finance, economics, or related fields to establish a strong academic foundation.

- Include industry-recognized certifications such as CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst).

- Highlight relevant coursework that specifically pertains to mergers, acquisitions, and financial analysis.

- Keep the details concise but informative, ensuring clarity on the relevance of each qualification.

- Showcase any specialized training programs or workshops related to merger arbitrage and trading strategies.

- Consider including honors or distinctions received during academic pursuits to stand out from other candidates.

- Regularly update this section to reflect any new certifications or relevant courses completed.

- Use a clear format that makes it easy for hiring managers to quickly assess qualifications.

Example Education and Certifications for Merger Arbitrage Trader

Strong Examples

- MBA in Finance, New York University Stern School of Business

- CFA Charterholder, CFA Institute

- Certificate in Mergers and Acquisitions, New York Institute of Finance

- Bachelor of Science in Economics, University of Chicago

Weak Examples

- Associate Degree in General Studies, Community College

- Certification in Basic Accounting Principles, Local Training Center

- Bachelor of Arts in Sociology, University of California

- High School Diploma, Anytown High School

The strong examples are considered relevant because they directly align with the skills and knowledge needed for a Merger Arbitrage Trader, demonstrating a solid foundation in finance and specialized understanding of mergers and acquisitions. In contrast, the weak examples lack relevance to the trading and finance sectors, showcasing outdated or unrelated qualifications that do not support the candidate’s fit for the role.

Top Skills & Keywords for Merger Arbitrage Trader Resume

In the highly competitive field of merger arbitrage trading, having the right skills is crucial for success. A well-crafted resume that highlights both hard and soft skills can set a candidate apart in the eyes of potential employers. Skills not only demonstrate a trader's technical abilities and market knowledge but also reflect their capacity to navigate the complexities of financial transactions and maintain professionalism in high-pressure environments. Understanding which skills are essential can greatly enhance a candidate's appeal and effectiveness in securing desired positions in this niche area of finance.

Top Hard & Soft Skills for Merger Arbitrage Trader

Soft Skills

- Analytical Thinking

- Attention to Detail

- Strong Communication Skills

- Decision-Making Ability

- Problem-Solving Skills

- Adaptability

- Team Collaboration

- Time Management

- Emotional Intelligence

- Negotiation Skills

Hard Skills

- Financial Modeling

- Risk Assessment and Management

- Valuation Techniques

- Familiarity with Regulatory Requirements

- Knowledge of Derivatives and Options

- Data Analysis and Interpretation

- Proficiency in Trading Platforms

- Quantitative Analysis

- Portfolio Management

- Understanding of M&A Processes

For a deeper dive into how to optimize your resume, check out our resources on skills and work experience.

Stand Out with a Winning Merger Arbitrage Trader Cover Letter

I am writing to express my interest in the Merger Arbitrage Trader position at your esteemed firm. With a solid background in finance and a keen understanding of market dynamics, I am excited about the opportunity to apply my skills in identifying and capitalizing on arbitrage opportunities in the rapidly evolving landscape of mergers and acquisitions. My experience in quantitative analysis and risk management, coupled with my passion for strategic trading, positions me uniquely to contribute to your team’s success.

In my previous role as a financial analyst at [Previous Company Name], I honed my analytical skills by conducting in-depth research and due diligence on various merger transactions. I developed a robust framework for evaluating deal structures, assessing risk factors, and forecasting potential outcomes, which led to the successful execution of several high-profile trades. Utilizing a combination of statistical modeling and market sentiment analysis, I was able to generate consistent alpha while managing portfolio volatility. My ability to analyze complex financial data and draw actionable insights has consistently driven my success in this field.

Collaboration and communication are essential in the fast-paced environment of merger arbitrage trading. I thrive in team settings and have successfully collaborated with cross-functional teams to enhance trading strategies and streamline processes. My proactive approach in sharing insights and market intelligence has fostered an environment of continuous improvement. I am particularly drawn to your firm’s commitment to innovation and excellence, and I am eager to contribute my expertise in developing and executing merger arbitrage strategies that align with your firm’s objectives.

I am excited about the opportunity to bring my skills and experience to your team and to further develop my career as a Merger Arbitrage Trader. I am confident that my analytical mindset, combined with my passion for trading and commitment to achieving results, will make a meaningful impact at [Company Name]. Thank you for considering my application; I look forward to the possibility of discussing how I can contribute to your success.

Common Mistakes to Avoid in a Merger Arbitrage Trader Resume

When crafting a resume for a Merger Arbitrage Trader position, it's essential to present your skills and experiences in a way that effectively highlights your qualifications. However, many candidates fall into common traps that can undermine their chances of landing an interview. Avoiding these pitfalls can significantly enhance the impact of your resume, making it easier for hiring managers to see your potential as a valuable asset to their trading team.

Neglecting to Quantify Achievements: Failing to include specific metrics or results from previous trading experiences can make it difficult for employers to gauge your effectiveness. Use percentages, dollar amounts, or other quantifiable results to demonstrate your success.

Using Vague Language: Phrases like "responsible for" or "worked on" do not convey the depth of your contributions. Instead, opt for action-oriented language that clearly illustrates your role and impact in previous positions.

Ignoring Relevant Skills: Some candidates forget to tailor their resumes to include skills specifically relevant to merger arbitrage, such as financial modeling, risk assessment, or industry analysis. Make sure to highlight your relevant expertise prominently.

Overly Complex Terminology: While it's important to demonstrate your knowledge, using overly technical jargon can alienate readers who may not be familiar with certain terms. Aim for a balance that showcases your expertise while remaining accessible.

Failing to Customize for Each Application: Sending out a generic resume can be detrimental. Customizing your resume to reflect the specific requirements and culture of the firm you're applying to can help you stand out.

Not Highlighting Collaborative Experience: Merger arbitrage often involves teamwork and collaboration. Omitting experiences that showcase your ability to work effectively with others can be a missed opportunity to demonstrate your interpersonal skills.

Omitting Certifications or Relevant Education: In the finance sector, relevant certifications (like CFA or MBA) can enhance your credibility. Ensure that your education and any additional qualifications are prominently displayed.

Ignoring the Importance of a Clean Format: A cluttered or poorly organized resume can distract from your qualifications. Use clear headings, bullet points, and a consistent format to ensure readability and professionalism.

Conclusion

As we explored the role of a Merger Arbitrage Trader, it became clear that this position demands a unique blend of analytical skills, market knowledge, and strategic thinking. Successful traders must be adept at evaluating potential mergers and acquisitions, understanding the nuances of deal structures, and managing risk effectively. The ability to interpret market signals and execute trades promptly can significantly impact profitability.

Moreover, networking and staying informed about industry trends and regulatory changes are crucial for staying ahead in this competitive field. A robust resume that highlights relevant experience, quantitative skills, and successful trading strategies is essential for standing out to potential employers.

Now is the perfect time to review your Merger Arbitrage Trader Resume. Make sure it reflects your expertise and achievements in this dynamic area. To assist you in this process, consider utilizing the following resources:

- Explore a variety of resume templates that can help you create a professional and polished document.

- Try out our intuitive resume builder to streamline the process of crafting your resume.

- Check out resume examples to gain inspiration and see how others in your field present their qualifications.

- Don’t forget to complement your resume with a compelling cover letter using our cover letter templates.

Take action today and ensure your resume reflects the expertise and skills that are vital for a successful career as a Merger Arbitrage Trader!