23 Investment Banker Skills for Your Resume in 2025

As an investment banker, possessing a robust set of skills is essential for success in a highly competitive and dynamic financial environment. In this section, we will explore the top skills that should be highlighted on your resume to attract potential employers and demonstrate your expertise. These skills not only reflect your technical abilities but also your capacity to navigate complex financial landscapes, build client relationships, and drive successful transactions.

Best Investment Banker Technical Skills

Technical skills are essential for investment bankers as they provide the analytical and quantitative abilities needed to assess financial data, conduct valuations, and develop strategic insights. Demonstrating these skills on your resume can significantly enhance your appeal to potential employers in this competitive field.

Financial Modeling

Financial modeling involves creating representations of a company's financial performance. This skill is crucial for forecasting revenues, expenses, and overall profitability.

How to show it: Include specific examples of models you have built, such as DCF or LBO models, and specify the outcomes they helped achieve, like funding secured or deal closures.

Valuation Techniques

Understanding various valuation methods, including DCF, comparable companies, and precedent transactions, is vital for determining the worth of a business.

How to show it: Quantify your experience by detailing the number of valuations performed and their impact on investment decisions, such as successful mergers or acquisitions.

Data Analysis

Data analysis helps in interpreting complex financial data to make informed decisions. Proficiency in tools like Excel, SQL, or Python can enhance this skill.

How to show it: Highlight specific projects where data analysis led to actionable insights, along with metrics that demonstrate improved performance or efficiency.

Financial Reporting

Creating and interpreting financial reports are foundational skills for investment bankers, enabling them to communicate findings to stakeholders effectively.

How to show it: Provide examples of reports you have prepared or contributed to, focusing on how they influenced strategic decisions or improved reporting processes.

Risk Assessment

Identifying and analyzing financial risks is crucial for investment success. This skill involves understanding market conditions and potential pitfalls.

How to show it: Detail specific risk assessments you have conducted, including how they safeguarded investments or led to the development of contingency plans.

Excel Proficiency

Advanced Excel skills are indispensable for modeling, analysis, and reporting in investment banking, allowing for efficient data manipulation and visualization.

How to show it: Enumerate the Excel functions and tools you are proficient in, along with examples of how you used them to streamline processes or drive results.

Market Research

Conducting thorough market research is essential for understanding industry trends and making informed investment decisions.

How to show it: Describe instances where your market research directly impacted investment strategies or led to successful client pitches.

Presentation Skills

Strong presentation skills are important for pitching ideas to clients and stakeholders, requiring the ability to convey complex financial information clearly.

How to show it: Highlight successful presentations you have delivered, especially those that led to client buy-in or successful fundraisings.

Negotiation Skills

Effective negotiation skills enable investment bankers to secure favorable terms for their clients during transactions and deal structuring.

How to show it: Quantify the results of your negotiation efforts, such as better pricing, terms achieved, or successful deal closures.

Regulatory Knowledge

Understanding financial regulations and compliance is critical to navigating the investment banking landscape and ensuring adherence to laws.

How to show it: Specify any relevant regulations you are familiar with and how your knowledge has mitigated risks or ensured compliance in previous roles.

How to List Investment Banker Skills on Your Resume

Effectively listing your skills on a resume is crucial to catching the attention of employers in the competitive field of investment banking. Highlighting your qualifications in three main sections—Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter—can set you apart from other candidates.

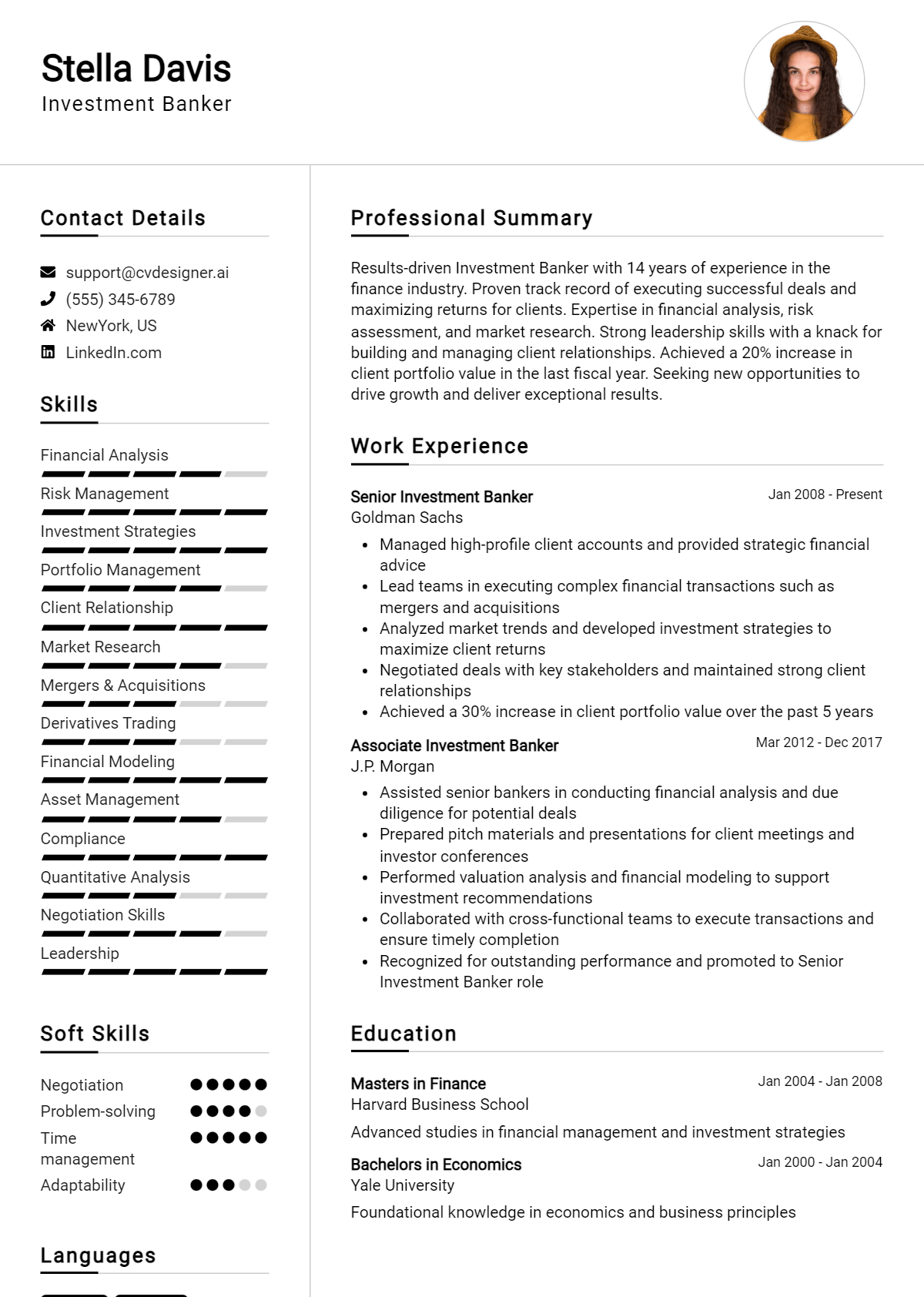

for Resume Summary

Showcasing Investment Banker skills in the introduction section gives hiring managers a quick overview of your qualifications and sets the tone for your resume.

Example

“Results-driven Investment Banker with expertise in financial modeling and risk assessment, dedicated to providing strategic insights and client-focused solutions to enhance business growth.”

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how Investment Banker skills have been applied in real-world scenarios.

Example

- Conducted comprehensive financial analysis to support major M&A transactions, resulting in a 20% increase in client portfolio value.

- Developed detailed financial models for forecasting and valuation, leading to successful investment recommendations.

- Collaborated with cross-functional teams to execute due diligence processes, ensuring compliance and risk mitigation.

- Maintained strong client relationships through effective communication and negotiation skills, achieving a 95% client retention rate.

for Resume Skills

The skills section can either showcase technical or transferable skills, emphasizing a balanced mix of hard and soft skills to present a well-rounded profile.

Example

- Financial Modeling

- Valuation Techniques

- Market Research

- Risk Assessment

- Client Relationship Management

- Strategic Planning

- Data Analysis

- Leadership Skills

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume while providing a more personal touch. Highlight 2-3 key skills that align with the job description and explain how those skills have positively impacted your previous roles.

Example

“In my previous role, my proficiency in financial modeling and strategic planning played a crucial part in identifying profitable investment opportunities, ultimately leading to substantial gains for our clients. I am eager to bring these skills to your team and contribute to achieving exceptional results.”

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For more information on how to effectively showcase your skills, highlight your technical skills, and detail your work experience, visit the provided links.

The Importance of Investment Banker Resume Skills

In the competitive field of investment banking, showcasing relevant skills on your resume is crucial for standing out to recruiters. A well-crafted skills section not only aligns candidates with job requirements but also highlights their unique qualifications and expertise. By effectively demonstrating their capabilities, candidates can capture the attention of hiring managers and increase their chances of securing an interview.

- Investment bankers often deal with complex financial instruments and require a strong grasp of quantitative analysis. Highlighting skills in financial modeling and valuation can set a candidate apart in a sea of applicants.

- Effective communication skills are essential in investment banking, where professionals must convey intricate financial concepts to clients and colleagues. Demonstrating strong verbal and written communication abilities can be a key differentiator.

- Analytical thinking is a critical skill in investment banking, as it enables professionals to assess market trends and investment opportunities. Emphasizing analytical prowess can show recruiters that a candidate can make data-driven decisions.

- Team collaboration is vital in investment banking projects, which often involve cross-functional teams. Showcasing teamwork skills can indicate a candidate's ability to work effectively within a group and contribute to collective goals.

- Attention to detail is paramount in investment banking, where mistakes can lead to significant financial repercussions. Highlighting meticulousness can assure employers of a candidate's reliability in handling sensitive financial information.

- Networking skills can greatly enhance an investment banker’s career. By showcasing the ability to build and maintain relationships, candidates can demonstrate their potential to generate business and foster client loyalty.

- Adaptability is crucial in the fast-paced world of finance. Candidates who can highlight their flexibility and ability to thrive in changing environments can appeal to employers looking for resilient team members.

- Understanding regulatory frameworks is essential for investment bankers to navigate compliance effectively. Showcasing knowledge of relevant laws and regulations can indicate a candidate's preparedness for the role.

For more insights and examples, check out [Resume Samples](https://resumekraft.com/resume-samples/).

How To Improve Investment Banker Resume Skills

In the competitive world of investment banking, continuously improving your skills is essential for career advancement and success. The financial industry is constantly evolving, and staying ahead of the curve can enhance your capabilities, make you more attractive to employers, and increase your earning potential. Here are some actionable tips to help you refine your investment banking skills:

- Enroll in finance-related courses or certifications to deepen your understanding of financial instruments and markets.

- Stay updated with industry news and trends by following financial publications and websites.

- Network with professionals in the field to gain insights and learn from their experiences.

- Practice your analytical skills by working on financial modeling and valuation exercises.

- Enhance your presentation skills to effectively communicate complex financial information to clients and stakeholders.

- Develop strong Excel skills, as proficiency in this tool is crucial for data analysis and financial modeling.

- Seek mentorship from experienced investment bankers who can provide guidance and feedback on your career development.

Frequently Asked Questions

What are the essential skills needed for an investment banker’s resume?

Investment bankers should highlight a mix of analytical, communication, and financial skills on their resumes. Essential skills include financial modeling, valuation techniques, and proficiency in Excel and other financial software. Additionally, strong quantitative abilities, attention to detail, and the capacity to work under pressure are crucial. Soft skills such as effective communication and negotiation skills are also important, as investment bankers need to present complex information clearly to clients and colleagues.

How important is financial modeling expertise on an investment banker’s resume?

Financial modeling expertise is a critical skill for investment bankers and should be prominently featured on their resumes. This skill demonstrates the ability to create representations of a company's financial performance, which is essential for tasks such as mergers and acquisitions, capital raising, and corporate valuations. Employers look for candidates who can build and interpret complex financial models, as these are integral in making informed investment decisions and advising clients effectively.

Should communication skills be emphasized in an investment banker’s resume?

Yes, communication skills are vital for investment bankers and should be emphasized on their resumes. The role requires frequent interaction with clients, colleagues, and other stakeholders, making it essential to convey information clearly and persuasively. Strong written communication skills are necessary for preparing reports, presentations, and pitch books, while verbal skills are crucial for client meetings and negotiations. Highlighting communication skills can differentiate a candidate in a competitive job market.

What role does teamwork play in investment banking, and how should it be presented on a resume?

Teamwork is fundamental in investment banking as projects often involve collaboration among various departments and professionals. Candidates should demonstrate their ability to work effectively in teams on their resumes by providing examples of successful group projects or experiences in team-oriented environments. Phrases such as "collaborated with cross-functional teams" or "led a team of analysts in a financial modeling project" can help illustrate this skill and its importance in achieving common goals.

How can one showcase analytical skills on an investment banker’s resume?

Analytical skills are a cornerstone of investment banking and should be clearly showcased on a resume. Candidates can highlight their analytical capabilities by detailing experiences involving data analysis, financial forecasting, and market research. Including specific examples of how they used analytical skills to solve problems, improve processes, or deliver insights can make a significant impact. Metrics and outcomes related to analytical projects will further strengthen this presentation and demonstrate a results-oriented mindset.

Conclusion

Including Investment Banker skills in your resume is essential for demonstrating your expertise and suitability for the role. By showcasing relevant skills, candidates can significantly differentiate themselves from others, illustrating the value they bring to potential employers. Remember, a well-crafted resume that highlights your unique abilities can open doors to exciting opportunities in the competitive finance industry.

Take the time to refine your skills and create a standout job application that reflects your capabilities and ambition. Utilize our resume templates, resume builder, resume examples, and cover letter templates to help you on your journey towards landing your dream job!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.