Investment Banker Core Responsibilities

Investment bankers play a crucial role in facilitating financial transactions, requiring a blend of technical expertise, operational efficiency, and strong problem-solving skills. They bridge various departments by coordinating with clients, analysts, and legal teams to structure deals, conduct financial modeling, and assess market conditions. These competencies are vital for achieving the organization’s strategic goals, making a well-structured resume essential to highlight relevant experiences and qualifications effectively.

Common Responsibilities Listed on Investment Banker Resume

- Conducting financial analysis and valuation of companies.

- Developing financial models and forecasts.

- Preparing pitch books and presentations for client meetings.

- Assisting in mergers and acquisitions (M&A) transactions.

- Conducting due diligence and market research.

- Building and maintaining client relationships.

- Collaborating with legal and compliance teams on transactions.

- Identifying and pursuing new business opportunities.

- Monitoring market trends and financial news.

- Participating in negotiations and deal structuring.

- Managing project timelines and deliverables.

High-Level Resume Tips for Investment Banker Professionals

In the competitive world of investment banking, a well-crafted resume plays a pivotal role in setting candidates apart from the crowd. As the first impression a potential employer receives, your resume must not only showcase your skills and achievements but also reflect your understanding of the industry. A thoughtfully designed resume can highlight your capabilities, making it easier for recruiters to see the value you bring to their organization. This guide will provide practical and actionable resume tips specifically tailored for investment banker professionals, helping you to create a document that resonates with hiring managers and opens doors to new opportunities.

Top Resume Tips for Investment Banker Professionals

- Tailor your resume for each job application by carefully aligning your skills and experiences with the specific job description.

- Showcase relevant experience prominently, including internships and prior roles in finance, consulting, or related fields.

- Quantify your achievements with clear metrics, such as percentage increases in revenue or successful completion of high-stakes deals.

- Highlight industry-specific skills such as financial modeling, valuation techniques, and proficiency in analytical tools like Excel and Bloomberg.

- Keep your resume concise and focused, ideally limiting it to one page, while ensuring all critical information is included.

- Use strong action verbs to describe your responsibilities and accomplishments, demonstrating initiative and impact.

- Incorporate keywords from the job description to pass through applicant tracking systems and catch the attention of recruiters.

- Include relevant certifications, such as CFA or Series 7, to validate your expertise and commitment to the field.

- Utilize a clean and professional format, ensuring readability and organization to make it easy for hiring managers to scan your resume.

- Consider adding a brief summary at the top of your resume that encapsulates your professional identity and key qualifications.

Implementing these resume tips can significantly enhance your chances of landing a job in the investment banking field. By presenting your qualifications in a structured, impactful manner, you not only catch the attention of recruiters but also demonstrate your professionalism and readiness for the challenges of the industry. A well-optimized resume is your ticket to advancing your career in this highly competitive sector.

Why Resume Headlines & Titles are Important for Investment Banker

In the competitive field of investment banking, a well-crafted resume headline or title plays a crucial role in capturing the attention of hiring managers and recruiters. A strong headline serves as a succinct summary of a candidate's key qualifications, allowing them to stand out in a crowded applicant pool. It should be concise, relevant, and directly related to the position being applied for, effectively conveying the candidate's unique value proposition in just a few words. By utilizing an impactful headline, investment bankers can effectively communicate their expertise and make a memorable first impression.

Best Practices for Crafting Resume Headlines for Investment Banker

- Keep it concise: Aim for one to two lines that encapsulate your professional identity.

- Be role-specific: Tailor your headline to reflect the specific investment banking role you are applying for.

- Highlight key achievements: Include metrics or accomplishments that demonstrate your success in the field.

- Use industry keywords: Incorporate relevant terms that align with the investment banking sector to pass applicant tracking systems.

- Showcase your expertise: Focus on your strongest skills that are relevant to the job description.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

- Make it impactful: Use strong action verbs and assertive language to convey confidence.

- Revise for clarity: Ensure your headline is easy to read and free from grammatical errors.

Example Resume Headlines for Investment Banker

Strong Resume Headlines

Dynamic Investment Banker with 7+ Years of Experience in M&A and Capital Markets

Results-Driven Financial Analyst Specializing in Equity Research and Valuation

Strategic Thinker with Proven Track Record in IPOs and Debt Financing

Accomplished Investment Banker with Expertise in Risk Management and Portfolio Optimization

Weak Resume Headlines

Investment Banker Seeking New Opportunities

Finance Professional with Experience

Hardworking Individual in Banking

The strong headlines are effective because they are specific, highlight relevant skills, and showcase measurable achievements that resonate with hiring managers. They immediately communicate the candidate's unique strengths and suitability for the role. In contrast, the weak headlines lack clarity and specificity, failing to capture the essence of the candidate’s qualifications or differentiate them from other applicants. By avoiding generic phrases and instead focusing on impactful language, candidates can significantly enhance their chances of making a positive impression.

Writing an Exceptional Investment Banker Resume Summary

A well-crafted resume summary is crucial for Investment Bankers, as it serves as the first impression that hiring managers receive. This concise introduction offers a snapshot of a candidate's key skills, experience, and accomplishments that are directly relevant to the investment banking role. An impactful summary not only captures attention but also sets the stage for the rest of the resume, allowing candidates to stand out in a competitive field. It should be tailored to reflect the specific job description, ensuring that it resonates with the requirements and expectations of potential employers.

Best Practices for Writing a Investment Banker Resume Summary

- Quantify Achievements: Use numbers and percentages to highlight your accomplishments and demonstrate the impact of your work.

- Focus on Relevant Skills: Emphasize skills and expertise that are directly related to investment banking, such as financial modeling, valuation, and market analysis.

- Tailor for the Job Description: Customize your summary to align with the specific requirements and keywords mentioned in the job posting.

- Be Concise: Aim for 3-5 sentences that deliver maximum impact without overwhelming the reader.

- Highlight Industry Knowledge: Showcase your understanding of the financial markets and investment trends to position yourself as a knowledgeable candidate.

- Use Action-Oriented Language: Start sentences with strong action verbs to convey confidence and assertiveness.

- Include Leadership Experience: Mention any roles where you have led teams or projects, emphasizing your ability to drive results.

- Showcase Professional Certifications: If applicable, highlight any relevant licenses or certifications that establish your credibility in the field.

Example Investment Banker Resume Summaries

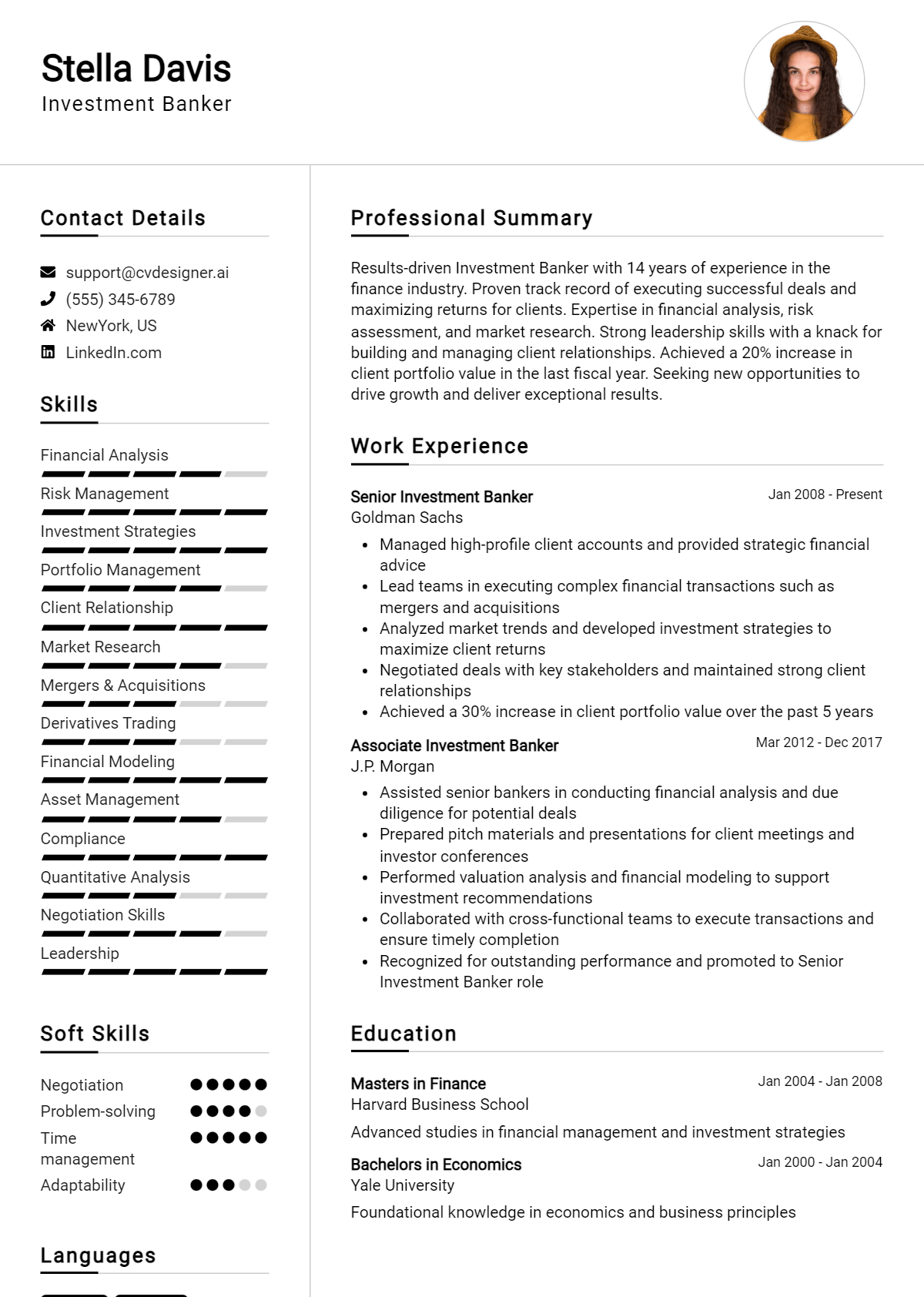

Strong Resume Summaries

Results-driven Investment Banker with over 5 years of experience in mergers and acquisitions, successfully facilitating transactions valued at over $500 million. Expertise in financial modeling and due diligence, combined with strong analytical skills, leading to a 30% increase in client satisfaction ratings.

Dynamic financial professional with a proven track record in capital markets and investment analysis. Achieved a 40% year-over-year growth in portfolio value through strategic investment recommendations and robust market research.

Detail-oriented Investment Banker specializing in corporate finance and advisory services. Played a key role in restructuring deals that generated $200 million in savings for clients, while developing financial models that improved decision-making processes.

Weak Resume Summaries

Experienced banker with knowledge of finance and investment practices. Seeking opportunities to contribute to a financial team.

Motivated professional with a background in banking. Looking to leverage skills in a challenging investment banking role.

The examples of strong resume summaries effectively highlight specific achievements, quantify results, and showcase relevant skills that directly relate to the investment banking field. They provide clear evidence of the candidate's capabilities and potential value to an employer. In contrast, the weak summaries lack detail and specificity, making them easily forgettable and failing to demonstrate the candidate's qualifications or impact in previous roles.

Work Experience Section for Investment Banker Resume

The work experience section of an Investment Banker resume is paramount for showcasing the candidate's technical skills, leadership capabilities, and the ability to deliver high-quality financial products. This section provides potential employers with insights into the candidate's practical experience, demonstrating how they have applied their knowledge in real-world scenarios. By quantifying achievements and aligning experiences with industry standards, candidates can effectively illustrate their contributions to previous roles, thereby enhancing their appeal in a competitive job market.

Best Practices for Investment Banker Work Experience

- Focus on quantifiable achievements, such as revenue generated or percentage increases in efficiency.

- Highlight specific technical skills relevant to the investment banking industry, such as financial modeling or market analysis.

- Emphasize teamwork and leadership roles in projects to showcase collaboration abilities.

- Use industry-specific terminology to align experience with professional standards.

- Provide context for each role, including the size of transactions or the scale of projects managed.

- Tailor the experience section to match the job description of the desired position.

- Include any relevant certifications or training that enhance technical expertise.

- Keep descriptions concise while ensuring they convey impact and results.

Example Work Experiences for Investment Banker

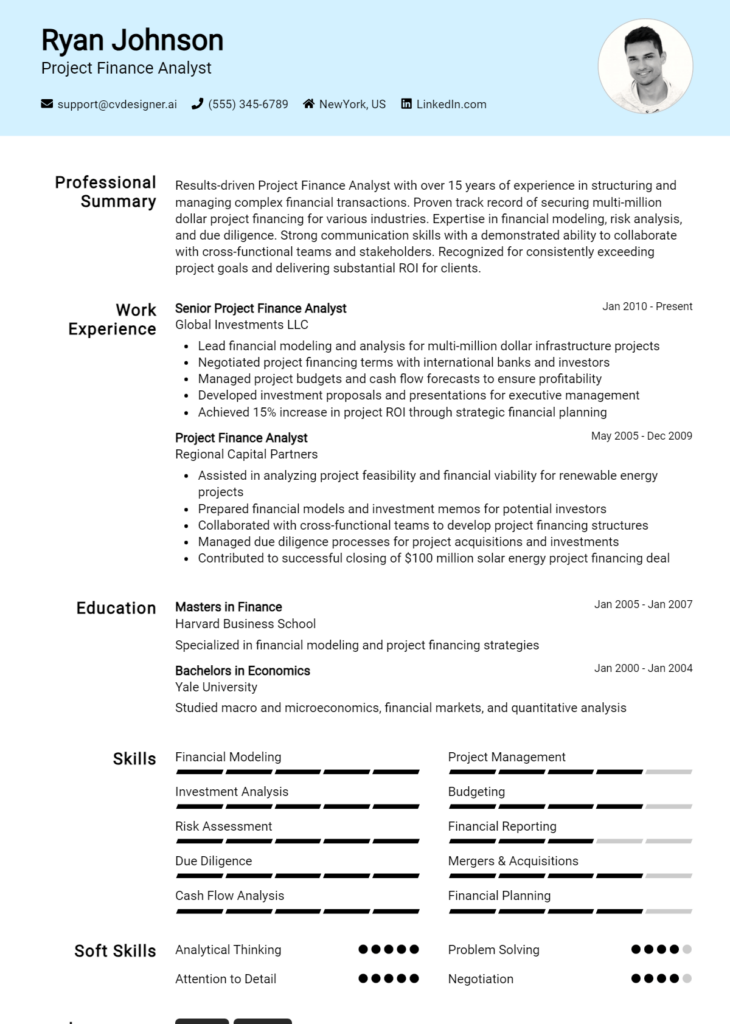

Strong Experiences

- Led a team of analysts in executing a $350 million merger, resulting in a 20% increase in market share for the client within the first year.

- Developed comprehensive financial models that contributed to a successful IPO, raising $150 million in capital for a tech startup.

- Collaborated with cross-functional teams to streamline due diligence processes, reducing project turnaround time by 30%.

- Managed a portfolio of high-net-worth clients, achieving a 15% average annual return on investments through strategic asset allocation.

Weak Experiences

- Worked on various financial projects.

- Assisted with client presentations and reports.

- Participated in team meetings and discussions.

- Helped with the analysis of financial data.

The examples provided are considered strong because they offer specific, quantifiable outcomes and highlight technical leadership and collaboration skills that are crucial in investment banking. In contrast, the weak experiences lack detail and impactful results, making them less compelling for potential employers. Strong experiences demonstrate a clear contribution to business success, while weak experiences fail to convey the candidate's value or expertise in the field.

Education and Certifications Section for Investment Banker Resume

The education and certifications section of an Investment Banker resume is crucial for demonstrating the candidate's academic credentials and commitment to professional development. This section serves as a testament to the candidate's expertise, showcasing their foundational knowledge acquired through rigorous academic programs, as well as industry-relevant certifications that signify their proficiency in financial analysis, investment strategies, and regulatory compliance. By including relevant coursework, specialized training, and recognized certifications, candidates can significantly enhance their credibility and align themselves with the expectations of potential employers in a competitive financial landscape.

Best Practices for Investment Banker Education and Certifications

- Prioritize relevant degrees: List your degree(s) in finance, economics, or a related field prominently.

- Include industry-recognized certifications: Highlight certifications such as CFA, CPA, or CIMA that demonstrate your expertise.

- Detail relevant coursework: Mention specific courses that are pertinent to investment banking, such as corporate finance, financial modeling, and mergers and acquisitions.

- Showcase continuous learning: Include any ongoing education, workshops, or seminars that reflect your commitment to staying current in the industry.

- Use concise descriptions: Keep descriptions brief yet informative, focusing on the relevance to investment banking.

- Organize logically: Arrange your education and certifications in reverse chronological order to highlight your most recent qualifications first.

- Highlight honors and awards: If applicable, mention any academic honors or scholarships received that reflect your dedication and excellence.

- Tailor to the job description: Customize this section based on the specific requirements and preferences outlined in the job posting.

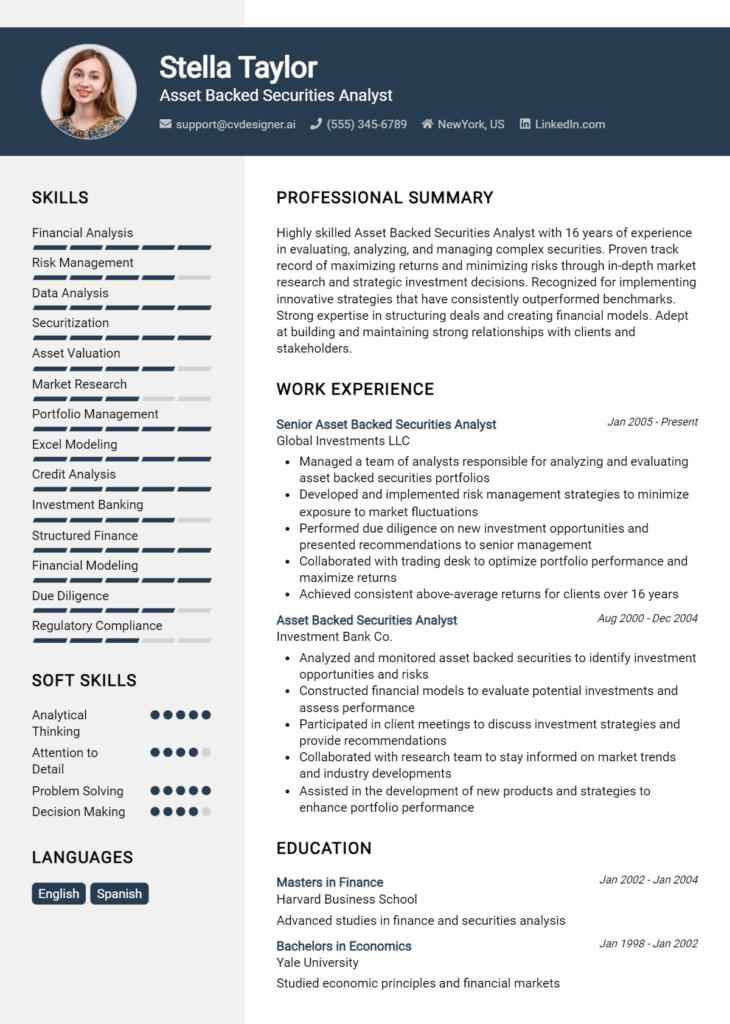

Example Education and Certifications for Investment Banker

Strong Examples

- MBA in Finance, Wharton School, University of Pennsylvania, 2022

- CFA Charterholder, CFA Institute, 2023

- Bachelor of Science in Economics, Harvard University, 2020

- Financial Modeling and Valuation Analyst (FMVA) Certification, Corporate Finance Institute, 2021

Weak Examples

- Bachelor of Arts in English Literature, University of California, 2015

- Certificate in Basic Cooking Techniques, Culinary Institute, 2020

- High School Diploma, Springfield High School, 2011

- Online Course: Introduction to Gardening, 2022

The strong examples listed above are considered strong because they directly relate to the skills and knowledge required for a career in investment banking, highlighting relevant degrees and certifications that are well-regarded within the industry. In contrast, the weak examples illustrate qualifications that are irrelevant to investment banking, showcasing a lack of focus on necessary financial expertise and professional development. Candidates should aim to present a clear and targeted educational background that enhances their suitability for the role.

Top Skills & Keywords for Investment Banker Resume

In the competitive field of investment banking, showcasing the right skills on your resume can be the key differentiator that sets you apart from other candidates. Employers are looking for individuals who not only possess a strong understanding of financial markets and instruments but also demonstrate a blend of analytical thinking, effective communication, and teamwork. Highlighting both hard and soft skills on your resume can give potential employers a comprehensive view of your capabilities, ensuring that you present yourself as a well-rounded candidate suited for the fast-paced, dynamic environment of investment banking.

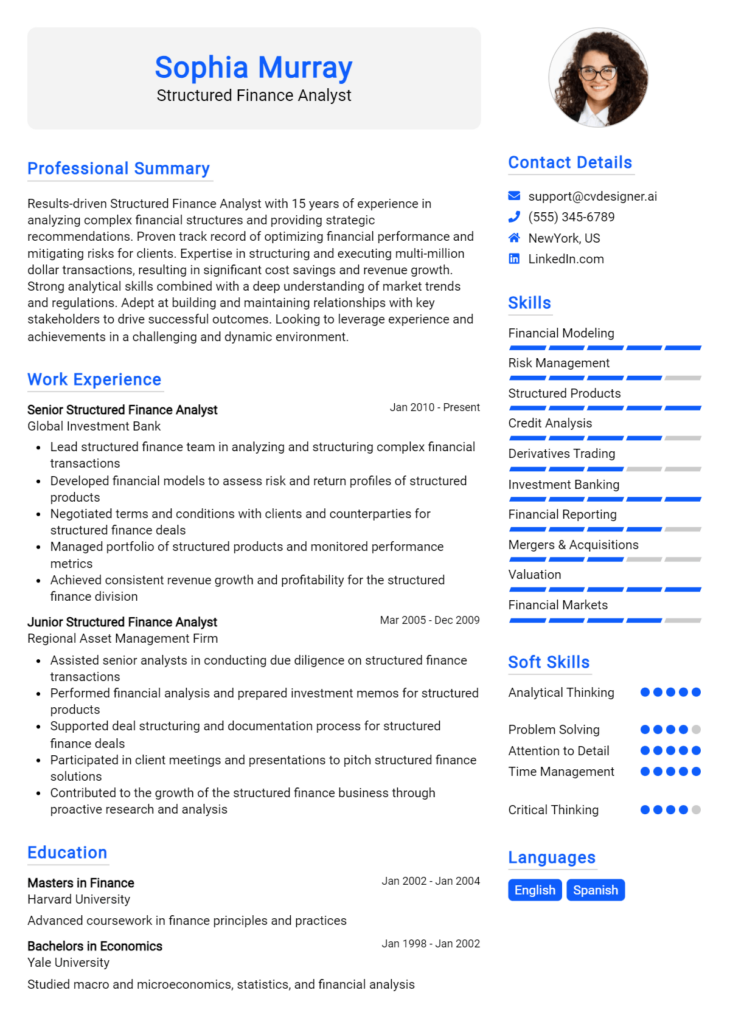

Top Hard & Soft Skills for Investment Banker

Soft Skills

- Strong Communication Skills

- Analytical Thinking

- Team Collaboration

- Problem-Solving Ability

- Time Management

- Attention to Detail

- Adaptability

- Client Relationship Management

- Negotiation Skills

- Leadership

Hard Skills

- Financial Modeling

- Valuation Techniques

- Mergers and Acquisitions (M&A)

- Equity Research

- Debt Structuring

- Risk Management

- Financial Statement Analysis

- Excel Proficiency

- Knowledge of Investment Strategies

- Regulatory Compliance

For more insights on how to effectively integrate these skills into your resume, as well as tips for detailing your work experience, be sure to explore the provided links. By strategically emphasizing both your technical and interpersonal skills, you can enhance your resume and increase your chances of securing a position in this competitive industry.

Stand Out with a Winning Investment Banker Cover Letter

I am writing to express my interest in the Investment Banker position at [Company Name], as advertised on [Job Board/Company Website]. With a solid foundation in finance, extensive experience in financial modeling, and a proven track record in executing high-value transactions, I am excited about the opportunity to contribute to your esteemed team. My passion for investment banking and my analytical skills have equipped me to thrive in fast-paced environments while delivering exceptional results for clients.

During my tenure at [Previous Company Name], I successfully led a team in analyzing market trends and identifying lucrative investment opportunities, resulting in a 30% increase in portfolio performance over two years. My role involved conducting in-depth financial analyses, preparing pitch books, and presenting strategic recommendations to senior management and clients. I excel in building and maintaining relationships with stakeholders, ensuring that their needs are met with precision and professionalism. This experience has honed my ability to work collaboratively under pressure while maintaining a keen eye for detail.

I am particularly drawn to [Company Name] due to its innovative approach to investment banking and commitment to client success. I am eager to bring my expertise in mergers and acquisitions, equity research, and risk analysis to your team. I am confident that my proactive mindset and analytical skills will contribute significantly to [Company Name]'s continued growth and reputation in the industry. Thank you for considering my application; I look forward to the opportunity to discuss how my background, skills, and enthusiasm align with the goals of your organization.

Common Mistakes to Avoid in a Investment Banker Resume

When crafting a resume for an investment banking position, it's crucial to present oneself in the best light possible. A well-structured resume can be the difference between landing an interview and being overlooked. However, many candidates make common mistakes that can hinder their chances. Here are some pitfalls to avoid when creating your investment banker resume:

Generic Objective Statement: Using a one-size-fits-all objective can make your resume feel impersonal. Tailor your objective to reflect your specific career goals and the value you bring to the firm.

Lack of Quantifiable Achievements: Failing to include measurable accomplishments can weaken your impact. Use numbers and percentages to highlight your contributions, such as "increased revenue by 20% in one year."

Excessive Jargon and Acronyms: Overloading your resume with industry jargon can confuse hiring managers, especially if they are not deeply familiar with specific terms. Aim for clarity and conciseness instead.

Ignoring Formatting Consistency: A visually cluttered or inconsistent format can detract from your professionalism. Use a clean layout, consistent font sizes, and spacing to make your resume easy to read.

Overemphasis on Responsibilities: Merely listing job duties without emphasizing your role's impact can make your resume bland. Focus on how you excelled in your duties and the outcomes of your actions.

Neglecting Soft Skills: While technical skills are essential in investment banking, soft skills like teamwork, communication, and problem-solving are equally valuable. Highlight these attributes to present a well-rounded profile.

Too Lengthy or Too Short: A resume that is too long may overwhelm recruiters, while one that is too short might not provide enough information. Aim for a concise format that adequately showcases your experience and skills within one page.

Inclusion of Irrelevant Information: Adding unrelated work experience can dilute the strength of your resume. Focus on experiences and skills that directly relate to investment banking to maintain relevance.

Conclusion

As an Investment Banker, your role is pivotal in advising clients on financial strategies, facilitating mergers and acquisitions, and managing large-scale financial transactions. Throughout your career, you'll need to demonstrate analytical skills, attention to detail, and a strong understanding of market dynamics. Additionally, effective communication and interpersonal skills are crucial as you will often work closely with clients and stakeholders.

In this competitive field, a standout resume is essential to showcase your expertise and achievements. Highlight your educational background, relevant work experience, and any certifications that enhance your qualifications. Don't forget to include specific examples of successful transactions or projects you've managed, as quantifiable results can significantly strengthen your profile.

To ensure your resume effectively captures your skills and experiences, take the time to review and refine it. Utilize available resources to assist you in this process. Explore resume templates to get a head start, or use the resume builder for a customized approach. You can also look at resume examples for inspiration and check out cover letter templates to complement your application materials.

Now is the perfect time to take action. Review your Investment Banker resume to ensure it reflects your strengths and positions you as a top candidate in this dynamic industry.