23 Insurance Claims Director Skills for Your Resume in 2025

As an Insurance Claims Director, possessing a robust set of skills is essential for navigating the complexities of claims management and ensuring customer satisfaction. In this section, we will delve into the top skills that can enhance your resume and help you stand out in this competitive field. These skills not only reflect your expertise in claims processing and leadership but also highlight your ability to adapt to industry changes and drive operational excellence.

Best Insurance Claims Director Technical Skills

In the ever-evolving landscape of the insurance industry, possessing the right technical skills is crucial for an Insurance Claims Director. These skills not only enhance operational efficiency but also ensure compliance with regulations, improve customer satisfaction, and drive strategic initiatives. Below are essential technical skills that can significantly boost your resume and reflect your expertise in managing insurance claims.

Claims Management Software Proficiency

This skill involves using specialized software to manage claims processing and documentation effectively. Familiarity with platforms like Guidewire, Xactimate, or ClaimCenter is vital for streamlining operations.

How to show it: Highlight specific software you've used and the improvements you implemented or efficiencies gained, such as reducing claims processing time by X%.

Data Analysis and Reporting

Ability to analyze data trends and generate reports is essential for making informed decisions. This skill helps in identifying areas for improvement and optimizing claims processes.

How to show it: Quantify your achievements by mentioning how your analysis led to a X% increase in claim approval rates or reduced fraud instances.

Regulatory Compliance Knowledge

Understanding the legal and regulatory frameworks governing insurance claims is critical. This ensures that all processes adhere to industry standards and mitigate legal risks.

How to show it: Detail your experience with compliance audits and how you maintained a X% compliance rate across your department.

Risk Assessment and Management

Proficiency in evaluating risks associated with claims and implementing strategies to mitigate them is essential for protecting the company’s interests.

How to show it: Describe a specific instance where your risk management strategies led to a reduction in claims costs by X%.

Customer Relationship Management (CRM)

Effective use of CRM systems to manage client interactions and maintain relationships is key to enhancing customer satisfaction and loyalty.

How to show it: Provide metrics on customer satisfaction improvements or retention rates resulting from your CRM initiatives.

Fraud Detection Techniques

Knowledge of identifying and investigating fraudulent claims is critical for minimizing losses and protecting the company’s financial interests.

How to show it: Share statistics on how your fraud detection methods decreased fraudulent claims by X% during your tenure.

Project Management Skills

Ability to oversee claims projects from initiation to completion ensures that objectives are met on time and within budget.

How to show it: Include examples of successful projects you managed, particularly those that delivered results ahead of schedule or under budget, quantified by X%.

Communication and Negotiation Skills

Strong verbal and written communication skills are essential for interacting with clients, team members, and stakeholders effectively.

How to show it: Illustrate your negotiation successes, such as settlements that saved the company X% in costs.

Technical Writing Abilities

Crafting clear and concise documentation, including claims policies and procedures, is vital for ensuring compliance and clarity.

How to show it: Highlight a specific documentation project you completed that improved team understanding or process adherence, detailing the impact.

Team Leadership and Development

Leading and mentoring claims teams is fundamental to fostering a productive work environment and enhancing team skills.

How to show it: Quantify the improvements in team performance, such as a X% increase in productivity or a reduction in claims handling time under your leadership.

Insurance Industry Knowledge

A deep understanding of the insurance industry's products, services, and market trends is vital for effective claims management and strategic planning.

How to show it: Discuss your participation in industry seminars or training, and how this knowledge contributed to strategic initiatives that led to a X% growth in market share.

Best Insurance Claims Director Soft Skills

As an Insurance Claims Director, possessing strong soft skills is just as crucial as having technical expertise. These skills facilitate effective communication, enhance team dynamics, and improve problem-solving capabilities, all of which are vital in managing claims processes and ensuring customer satisfaction. Below are some of the top soft skills that should be highlighted on your resume to demonstrate your qualifications for this role.

Communication

Effective communication is key to managing relationships with clients, team members, and stakeholders. As an Insurance Claims Director, you must convey complex information clearly and persuasively.

How to show it: Include examples of how you successfully communicated claims processes to clients or led team meetings. Quantify your achievements by mentioning how your communication improved client satisfaction scores or reduced misunderstandings.

Problem-solving

In the insurance industry, unexpected challenges are common. Strong problem-solving skills enable you to address issues swiftly and effectively, ensuring minimal disruption to operations and client trust.

How to show it: Highlight specific instances where you identified and resolved claims-related issues. Use metrics to showcase how your solutions led to increased efficiency or reduced claim processing times.

Time Management

Managing multiple claims and deadlines requires excellent time management skills. As a director, prioritizing tasks effectively ensures that all claims are handled in a timely manner, which is essential for client satisfaction.

How to show it: Demonstrate your ability to meet tight deadlines by citing examples of projects where you successfully prioritized tasks. Include information on how your time management skills led to improved workflow or faster claim resolutions.

Teamwork

Leading a team of claims professionals necessitates strong teamwork skills. Collaborating effectively fosters a positive work environment and encourages collective problem-solving.

How to show it: Provide examples of how you facilitated teamwork within your department, such as leading cross-functional projects or mentoring team members. Mention any measurable outcomes that resulted from enhanced teamwork.

Empathy

Understanding the emotional impact of claims on clients is vital. Empathy allows you to address their concerns genuinely, fostering trust and loyalty.

How to show it: Share instances where your empathetic approach improved client relationships. Quantify outcomes, such as increased customer retention rates or positive feedback from clients.

Negotiation

Negotiation skills are essential for reaching fair settlements while maintaining positive relationships with clients and stakeholders.

How to show it: Detail your experience in negotiating claims settlements. Use metrics to show how your negotiation skills resulted in favorable outcomes for both the company and clients.

Adaptability

The insurance landscape is constantly changing. Adaptability allows you to respond effectively to new regulations and market conditions.

How to show it: Provide examples of how you've adapted to changes in the industry or company procedures. Quantify your success in implementing necessary changes and their impact on operations.

Critical Thinking

Critical thinking enables you to analyze situations thoroughly and make informed decisions that benefit both the organization and clients.

How to show it: Highlight specific instances where your critical thinking skills led to improved claims processing or resolution strategies. Include metrics that showcase the effectiveness of your decisions.

Leadership

As a director, strong leadership skills are essential for guiding your team and driving performance towards achieving organizational goals.

How to show it: Share examples of how your leadership led to team success, such as achieving targets or improving team morale. Quantify your impact through performance metrics.

Attention to Detail

In the claims process, attention to detail is crucial for identifying discrepancies and ensuring accurate settlements.

How to show it: Provide examples of how your attention to detail prevented potential errors or fraud. Quantify the impact of your thoroughness on claims accuracy and processing times.

Conflict Resolution

Conflict resolution skills are vital for addressing disputes that may arise during the claims process, ensuring satisfactory outcomes for all parties involved.

How to show it: Detail specific conflicts you successfully resolved and the positive outcomes that followed. Use metrics to demonstrate how your resolution strategies improved client satisfaction or reduced escalations.

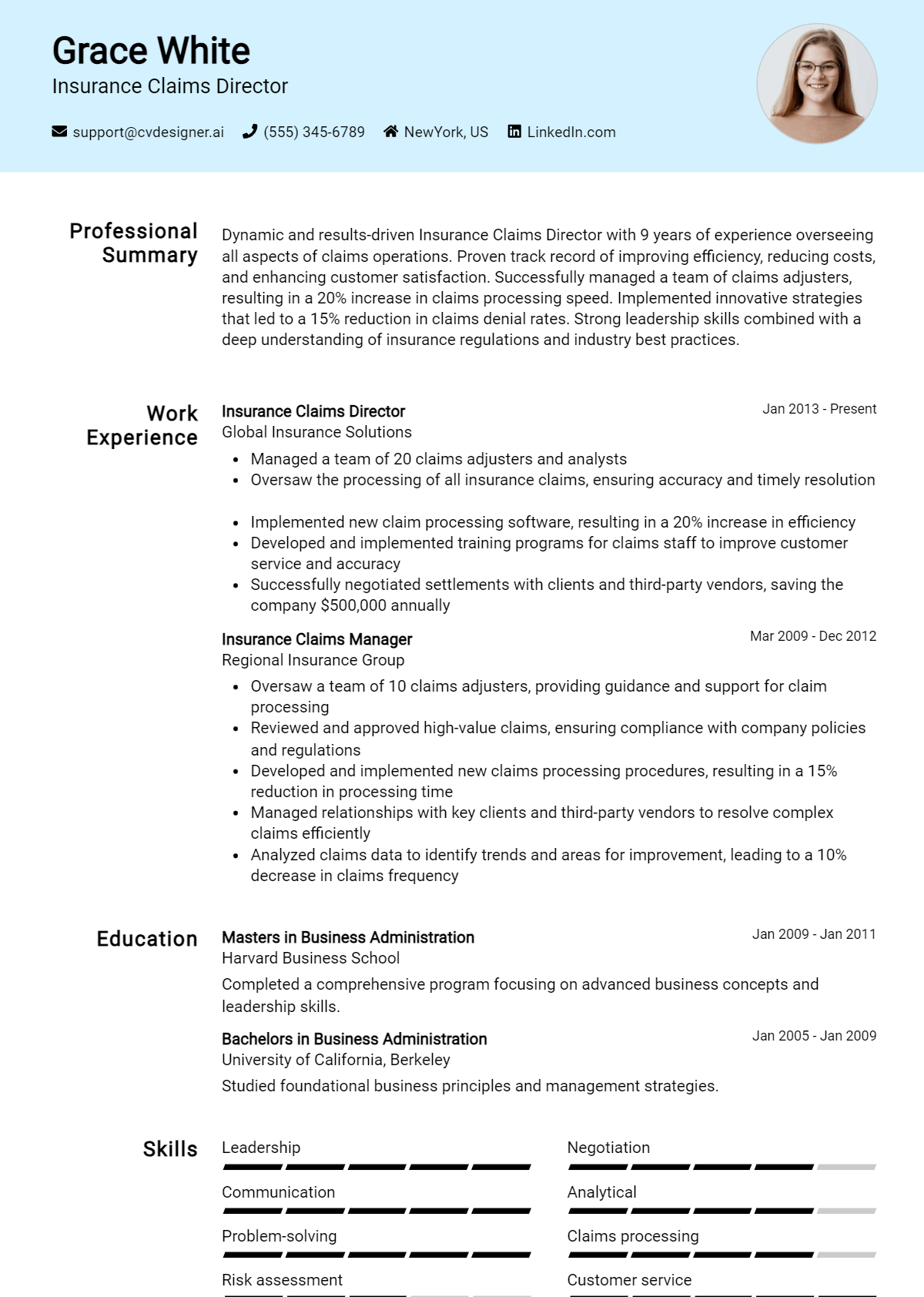

How to List Insurance Claims Director Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in the competitive field of insurance claims. By highlighting your qualifications in three main sections—Resume Summary, Resume Work Experience, and Resume Skills Section, along with your Cover Letter—you can present a comprehensive picture of your expertise and value as a candidate.

for Resume Summary

Showcasing your Insurance Claims Director skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

Dynamic Insurance Claims Director with expertise in claims management, regulatory compliance, and team leadership. Proven track record in optimizing processes and enhancing customer satisfaction to drive organizational success.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Insurance Claims Director skills have been applied in real-world scenarios, illustrating your impact in previous roles.

Example

- Led a team of 15 in processing insurance claims, improving efficiency by 30% through streamlined workflows.

- Developed and implemented training programs for new hires, enhancing compliance with industry regulations.

- Utilized data analysis to identify trends, resulting in a 25% reduction in fraudulent claims.

- Negotiated settlements with clients, ensuring high levels of customer satisfaction and retention.

for Resume Skills

Your skills section can either showcase technical or transferable skills. It's important to include a balanced mix of hard and soft skills to create a well-rounded profile.

Example

- Claims Management

- Regulatory Compliance

- Data Analysis

- Customer Service Excellence

- Team Leadership

- Negotiation Skills

- Risk Assessment

- Process Improvement

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume while providing a more personal touch. Highlighting 2-3 key skills that align with the job description can help demonstrate how those skills have positively impacted your previous roles.

Example

As an experienced Insurance Claims Director, my expertise in claims management and regulatory compliance has led to significant improvements in processing times and customer satisfaction in my previous roles. I am excited about the opportunity to bring these skills to your organization and drive success.

Make sure to link the skills mentioned in your resume to specific achievements in your cover letter, reinforcing your qualifications for the job.

The Importance of Insurance Claims Director Resume Skills

Highlighting relevant skills in the resume of an Insurance Claims Director is crucial for making a strong impression on potential employers. A well-crafted skills section not only showcases a candidate's qualifications but also demonstrates their alignment with the specific demands of the role. By effectively communicating their expertise, candidates can differentiate themselves from the competition and increase their chances of securing an interview.

- Effective Communication: Strong communication skills are essential for an Insurance Claims Director, as they must convey complex information clearly to clients, team members, and stakeholders. This skill helps in building trust and fostering relationships within the organization.

- Analytical Thinking: The ability to analyze claims data and trends is vital. This skill enables the director to make informed decisions, develop strategies for risk management, and improve the overall claims process.

- Leadership and Management: As a leader, the Insurance Claims Director must inspire and guide their team. Demonstrating leadership skills in a resume shows that the candidate can effectively manage resources and drive team performance.

- Attention to Detail: A keen eye for detail is crucial in the insurance industry. Candidates should highlight their ability to review claims carefully, identify discrepancies, and ensure compliance with regulations, which ultimately protects the company from potential losses.

- Negotiation Skills: The ability to negotiate effectively with clients and vendors is a key component of the role. Strong negotiation skills can lead to favorable outcomes for the company while maintaining client satisfaction.

- Technological Proficiency: Familiarity with claims management software and data analysis tools is increasingly important. Highlighting technological skills can demonstrate a candidate's ability to leverage technology for improved efficiency in claims processing.

- Regulatory Knowledge: Understanding the legal and regulatory landscape of the insurance industry is essential. Candidates should emphasize their knowledge of relevant laws and regulations to showcase their preparedness for compliance-related challenges.

- Customer Service Orientation: A strong focus on customer service is crucial for building positive relationships with clients. Highlighting this skill demonstrates a candidate's commitment to client satisfaction and retention.

For more examples and tips on crafting your resume, check out [Resume Samples](https://resumekraft.com/resume-samples/).

How To Improve Insurance Claims Director Resume Skills

In the ever-evolving landscape of the insurance industry, it is crucial for an Insurance Claims Director to continuously enhance their skills. Staying updated with the latest trends, technologies, and regulatory changes not only sharpens your competitive edge but also improves the overall efficiency and effectiveness of your claims management processes. Here are some actionable tips to help you improve your skills:

- Engage in ongoing education and training programs related to insurance claims management and leadership.

- Network with other professionals in the industry to share insights and best practices.

- Attend workshops and conferences focused on the latest technologies in claims processing and management.

- Seek mentorship from experienced leaders in the insurance field to gain valuable perspectives.

- Regularly review and analyze claims data to identify trends and areas for improvement in your processes.

- Enhance your communication and negotiation skills through courses and practical experiences.

- Stay informed about legal and regulatory changes affecting the insurance industry to ensure compliance and risk management.

Frequently Asked Questions

What key skills should be highlighted in an Insurance Claims Director's resume?

An Insurance Claims Director's resume should emphasize leadership skills, strategic planning, and comprehensive knowledge of insurance policies and claims processes. Additionally, showcasing expertise in risk assessment, regulatory compliance, and negotiation techniques can set a candidate apart. Proficiency in data analysis and claims management systems is also essential, as is the ability to foster strong relationships with stakeholders and team members.

How important is experience in the insurance industry for this role?

Experience in the insurance industry is crucial for an Insurance Claims Director, as it provides the knowledge necessary to navigate complex claims situations and understand the nuances of various policies. This background helps in effectively managing teams and making informed decisions that impact both the company and its clients. Candidates with extensive experience are often more adept at identifying trends and implementing best practices.

What soft skills are valuable for an Insurance Claims Director?

Soft skills such as strong communication, problem-solving, and leadership abilities are invaluable for an Insurance Claims Director. These skills facilitate effective team management and foster a collaborative environment. Additionally, emotional intelligence is essential for addressing client concerns and navigating sensitive situations, while adaptability is key in a constantly evolving industry.

How can an Insurance Claims Director demonstrate their ability to improve claims processes?

An Insurance Claims Director can demonstrate their capability to enhance claims processes by detailing specific accomplishments on their resume, such as successful implementation of new technologies, process streamlining, or improvements in claim resolution times. Quantifying these achievements with metrics, such as reduced processing costs or increased customer satisfaction rates, can provide tangible evidence of their impact on operational efficiency.

What role does compliance play in the skills required for an Insurance Claims Director?

Compliance is a fundamental aspect of an Insurance Claims Director's responsibilities, as they must ensure that the claims process adheres to legal and regulatory standards. Skills in compliance management, including familiarity with relevant laws and best practices, are essential. Highlighting experience in audits, training staff on compliance issues, and implementing policies that promote ethical practices can significantly enhance a candidate's resume.

Conclusion

Incorporating the skills of an Insurance Claims Director in your resume is crucial for standing out in a competitive job market. By showcasing relevant skills, candidates not only demonstrate their expertise but also convey their potential value to prospective employers. Highlighting these competencies can significantly enhance your job application and increase your chances of landing an interview.

Remember, continuous refinement of your skills can make a substantial difference in your career journey. Take the initiative to develop your abilities and craft a compelling application that truly reflects your qualifications. For additional resources, consider exploring our resume templates, utilizing our resume builder, reviewing resume examples, and accessing our cover letter templates to elevate your application process. Good luck on your path to success!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.