Insurance Claims Director Core Responsibilities

The Insurance Claims Director oversees the claims process, ensuring efficiency and compliance across departments such as underwriting, customer service, and legal. This role requires a blend of technical knowledge, operational expertise, and strong problem-solving skills to navigate complex claims issues and enhance customer satisfaction. Effective communication and leadership abilities are crucial for fostering collaboration and achieving organizational goals. A well-structured resume can effectively highlight these qualifications, showcasing the candidate's readiness for the demands of the position.

Common Responsibilities Listed on Insurance Claims Director Resume

- Oversee the entire claims process from initiation to resolution.

- Develop and implement claims management strategies.

- Collaborate with underwriting and legal teams to ensure compliance.

- Analyze claims data to identify trends and improve processes.

- Train and mentor claims adjusters and staff.

- Manage budgets and resource allocation for the claims department.

- Handle escalated claims and customer complaints effectively.

- Prepare reports for executive management on claims performance.

- Ensure adherence to industry regulations and company policies.

- Foster relationships with external stakeholders, including vendors and legal representatives.

- Lead audits and quality assurance initiatives for claims handling.

High-Level Resume Tips for Insurance Claims Director Professionals

In the competitive landscape of the insurance industry, a well-crafted resume is not just a document; it is your personal marketing tool that can open doors to new opportunities. For Insurance Claims Director professionals, your resume serves as the first impression you make on potential employers, showcasing your unique blend of skills, experiences, and achievements. A strong resume should not only highlight your extensive knowledge of claims management but also vividly illustrate how your contributions have positively impacted previous organizations. This guide will provide practical and actionable resume tips specifically tailored for Insurance Claims Director professionals to help you stand out in the applicant pool.

Top Resume Tips for Insurance Claims Director Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases.

- Highlight your leadership experience and ability to manage teams effectively in the claims process.

- Showcase your expertise in claims regulations, compliance, and risk management specific to the insurance industry.

- Quantify your achievements, such as the percentage of claims processed accurately or improvements in claims resolution times.

- Include any specialized training or certifications related to claims adjustment or management.

- Demonstrate your proficiency with claims management software and other relevant technology.

- Emphasize your problem-solving skills by providing examples of how you resolved complex claims issues.

- Incorporate testimonials or references from previous employers to validate your skills and contributions.

- Utilize a clean, professional layout that ensures readability and makes key information stand out.

- Keep your resume concise, ideally one to two pages, focusing on the most relevant experience and accomplishments.

By implementing these tips, you can significantly enhance your resume, making it a powerful tool in your job search for an Insurance Claims Director position. A polished and targeted resume will not only showcase your qualifications but also demonstrate your commitment to excellence in the insurance claims field, thereby increasing your chances of landing that coveted interview.

Why Resume Headlines & Titles are Important for Insurance Claims Director

In the competitive landscape of insurance claims management, the role of an Insurance Claims Director is crucial for ensuring efficient claims processing, maintaining compliance, and enhancing customer satisfaction. A well-crafted resume headline or title serves as the first impression for hiring managers, encapsulating a candidate's core qualifications in a succinct and impactful phrase. It is essential that this headline is not only concise and relevant but also directly related to the job being applied for, as it can significantly influence the decision-making process of potential employers by drawing their attention immediately and summarizing the candidate's unique value proposition.

Best Practices for Crafting Resume Headlines for Insurance Claims Director

- Keep it concise: Aim for a headline of no more than 10-12 words.

- Be role-specific: Clearly state your position and relevant expertise.

- Highlight key strengths: Incorporate notable skills or accomplishments.

- Use strong action words: Begin with verbs to convey dynamism and leadership.

- Tailor to the job description: Reflect the specific requirements of the position.

- Avoid jargon: Use clear language that is easily understood by all readers.

- Focus on results: Emphasize outcomes that demonstrate your effectiveness.

- Make it compelling: Aim to evoke interest and curiosity from hiring managers.

Example Resume Headlines for Insurance Claims Director

Strong Resume Headlines

Results-Driven Insurance Claims Director with 15+ Years in Risk Management

Strategic Claims Leader: Enhancing Efficiency and Customer Satisfaction

Dynamic Insurance Claims Director Specializing in Process Optimization and Compliance

Proven Track Record in Reducing Claims Processing Time by 30%

Weak Resume Headlines

Insurance Claims Director

Experienced Professional in Insurance

Claims Director Seeking Opportunities

The strong headlines are effective because they not only specify the candidate's role and expertise but also highlight measurable achievements and skills relevant to the position. They create a sense of credibility and demonstrate the candidate's potential contributions to the employer. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity, providing no compelling reason for hiring managers to consider the candidate over others. A clear, impactful headline is essential in making a memorable first impression that encourages further exploration of the resume.

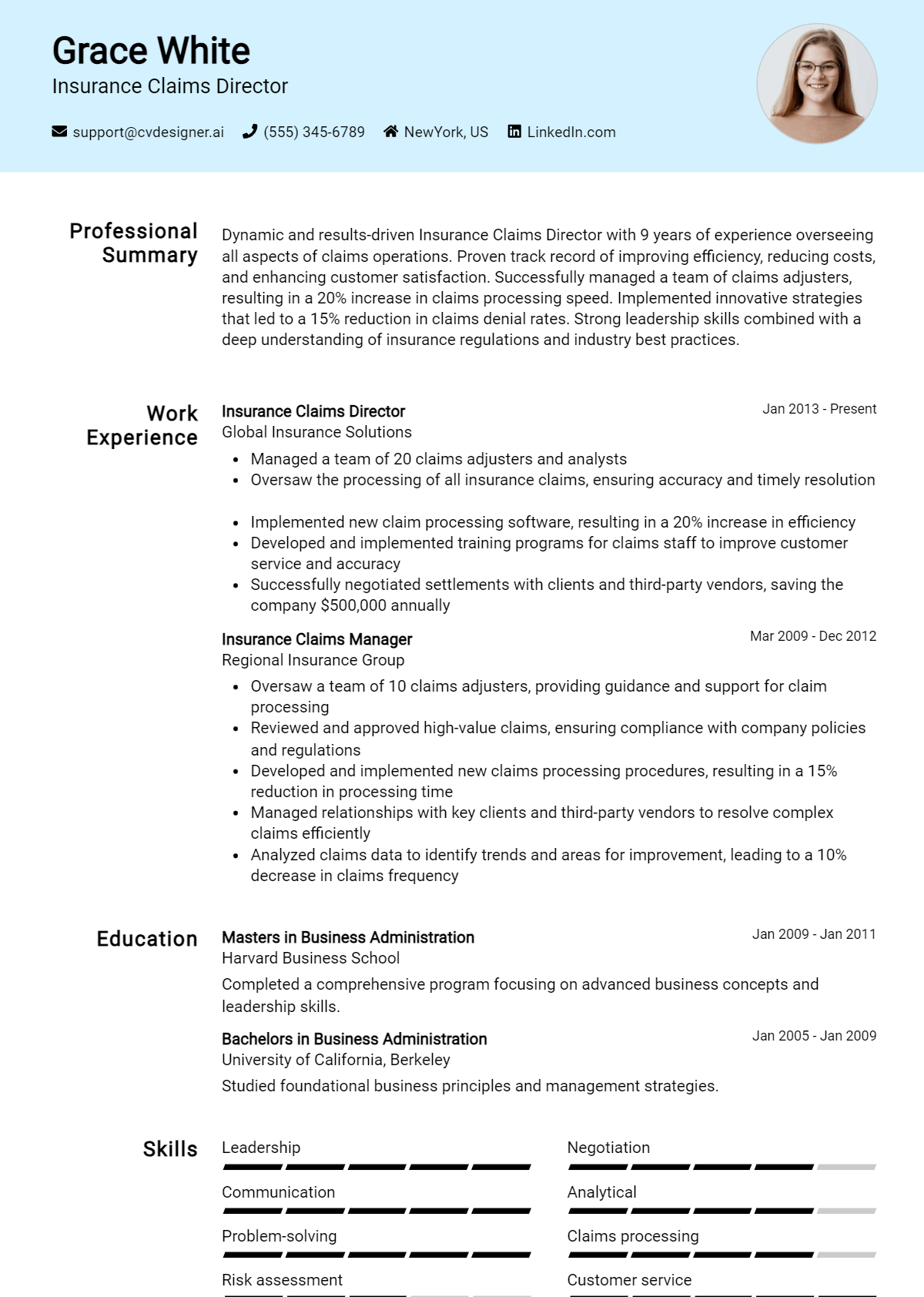

Writing an Exceptional Insurance Claims Director Resume Summary

Crafting a compelling resume summary is crucial for an Insurance Claims Director as it serves as the first impression for hiring managers. An exceptional summary succinctly highlights a candidate's key skills, relevant experience, and significant accomplishments, allowing them to quickly capture the attention of potential employers. In a competitive job market, a well-written summary should be concise yet impactful, tailored specifically to the job description, and designed to showcase why the candidate is uniquely qualified for the role.

Best Practices for Writing a Insurance Claims Director Resume Summary

- Quantify Achievements: Use numbers and percentages to highlight your impact, such as the percentage of claims processed or improved turnaround times.

- Focus on Skills: Emphasize key skills relevant to the role, such as risk assessment, negotiation, and regulatory compliance.

- Tailor to the Job Description: Customize your summary to align with the specific requirements and responsibilities outlined in the job posting.

- Be Concise: Limit your summary to 3-5 sentences to maintain clarity and keep the reader engaged.

- Highlight Leadership: If applicable, mention your experience in managing teams or leading projects to showcase your leadership abilities.

- Showcase Industry Knowledge: Include relevant certifications, training, or knowledge of industry trends to demonstrate your expertise.

- Use Action Verbs: Start with powerful action verbs to create a strong, dynamic impression from the outset.

- Reflect Professionalism: Maintain a formal tone and avoid jargon to ensure your summary is accessible to a wider audience.

Example Insurance Claims Director Resume Summaries

Strong Resume Summaries

Results-driven Insurance Claims Director with over 10 years of experience in streamlining claims processes, achieving a 30% reduction in processing time, and enhancing customer satisfaction scores by 25% through effective team leadership and strategic initiatives.

Dynamic Insurance Claims Director with a proven track record of managing high-volume claims operations, overseeing a team of 50+ adjusters, and reducing claims costs by 15% while ensuring compliance with regulatory standards.

Detail-oriented Insurance Claims Director skilled in risk assessment and loss prevention, successfully implemented a new claims management system that increased efficiency by 40% and led to a 20% decrease in fraudulent claims.

Weak Resume Summaries

Experienced professional in the insurance industry looking for a new opportunity in claims management.

Insurance Claims Director with a diverse background seeking to leverage my skills in a challenging role.

The strong resume summaries effectively showcase quantifiable results and specific skills relevant to the Insurance Claims Director role, demonstrating the candidate's ability to impact key performance metrics. In contrast, the weak summaries lack specificity and measurable achievements, making it difficult for hiring managers to gauge the candidates' suitability for the position. By focusing on results and relevant experience, strong summaries create a compelling narrative that stands out in a competitive job market.

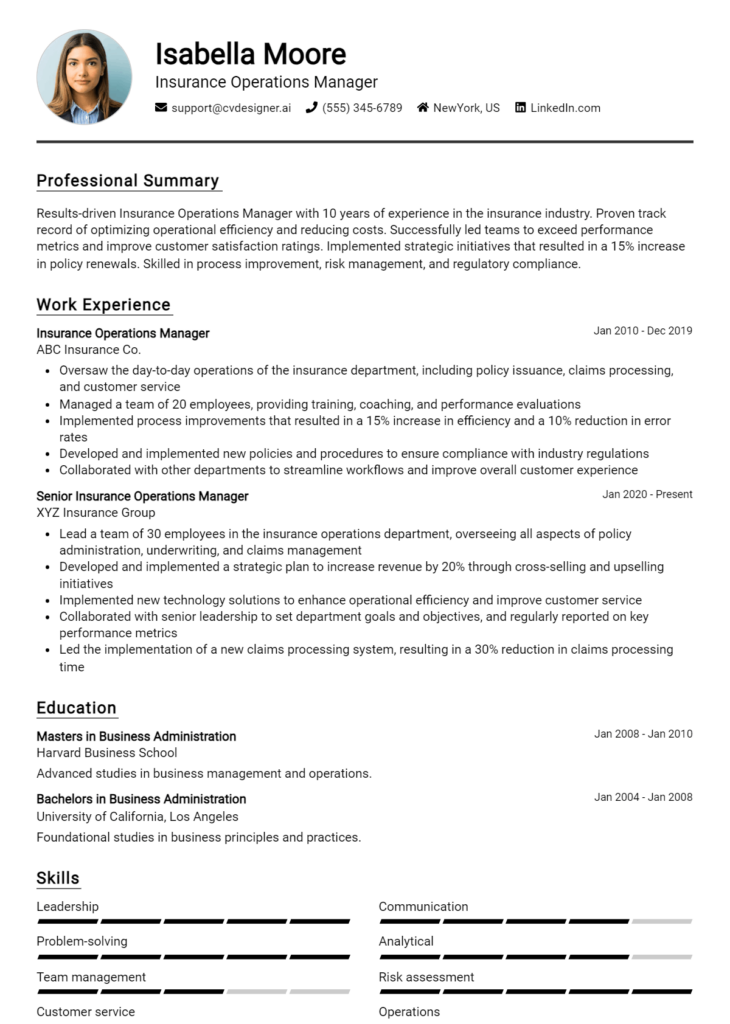

Work Experience Section for Insurance Claims Director Resume

The work experience section of an Insurance Claims Director resume is pivotal as it serves as a comprehensive showcase of the candidate’s professional journey, highlighting their technical skills, leadership capabilities, and track record of delivering high-quality outcomes. This section not only emphasizes the candidate’s ability to manage teams effectively but also illustrates their proficiency in the intricacies of the insurance claims process. By quantifying achievements and aligning experiences with industry standards, candidates can provide compelling evidence of their qualifications, making a strong case for their suitability for the role.

Best Practices for Insurance Claims Director Work Experience

- Highlight leadership roles and team management experiences to demonstrate your ability to guide and motivate teams.

- Use quantifiable metrics to showcase achievements, such as percentage increases in claims processing efficiency or reductions in claim settlement times.

- Align your experiences with industry standards and best practices to reinforce your expertise in the field.

- Include specific technical skills related to insurance claims processing software and regulatory compliance.

- Demonstrate collaboration by mentioning cross-functional team efforts and partnerships with other departments.

- Focus on outcomes by detailing successful projects and initiatives that you led or contributed to significantly.

- Tailor your experiences to the job description to ensure relevance and alignment with the employer's needs.

- Maintain clarity and conciseness in your descriptions to ensure your accomplishments stand out.

Example Work Experiences for Insurance Claims Director

Strong Experiences

- Directed a team of 15 claims professionals, leading to a 30% increase in claims resolution efficiency over 12 months through process optimization and training initiatives.

- Implemented a new claims management software that reduced processing time by 40%, significantly enhancing customer satisfaction ratings.

- Collaborated with the compliance department to ensure 100% adherence to state regulations, resulting in zero penalties over three consecutive audit periods.

- Launched a cross-departmental training program that improved communication between claims and underwriting teams, leading to a 25% reduction in claims disputes.

Weak Experiences

- Worked on various claims-related tasks without specifying outcomes or impact.

- Managed a team but did not articulate any specific improvements or achievements during that time.

- Participated in meetings about claims processes without detailing contributions or results.

- Assisted in claims processing but failed to mention any specific software or techniques used.

The examples provided illustrate the stark contrast between strong and weak experiences. Strong experiences clearly define the candidate's impact through quantifiable results and specific initiatives, showcasing their leadership and technical expertise. In contrast, weak experiences lack detail and fail to demonstrate any measurable achievements or contributions, which diminishes the candidate's overall appeal. By focusing on concrete outcomes and relevant skills, candidates can effectively convey their value in the competitive field of insurance claims management.

Education and Certifications Section for Insurance Claims Director Resume

The education and certifications section of an Insurance Claims Director resume plays a crucial role in showcasing the candidate's academic background and professional qualifications. This section not only highlights relevant degrees and industry-recognized certifications but also demonstrates the candidate's commitment to continuous learning and professional development. By providing details about relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and alignment with the requirements of the job role, making a compelling case for their suitability in a competitive job market.

Best Practices for Insurance Claims Director Education and Certifications

- Prioritize industry-relevant degrees, such as a Bachelor's or Master's in Insurance, Business Administration, or Risk Management.

- Include certifications from recognized industry organizations, such as the Chartered Property Casualty Underwriter (CPCU) or Associate in Claims (AIC).

- Highlight any specialized training programs that focus on claims management or regulatory compliance.

- Provide relevant coursework that aligns with the responsibilities of an Insurance Claims Director, such as claims processing, risk assessment, or negotiation tactics.

- List ongoing education efforts, such as workshops or seminars, to demonstrate a commitment to staying updated with industry trends.

- Be selective and concise; focus on the most relevant qualifications and avoid listing outdated or unrelated degrees.

- Include the year of completion for degrees and certifications to show recent and relevant qualifications.

- Format this section clearly, using bullet points or tables for readability and quick reference.

Example Education and Certifications for Insurance Claims Director

Strong Examples

- Bachelor of Science in Risk Management, University of Insurance Studies, 2015

- Chartered Property Casualty Underwriter (CPCU), 2018

- Associate in Claims (AIC), 2016

- Certificate in Advanced Claims Management, National Insurance Institute, 2020

Weak Examples

- Bachelor of Arts in English Literature, University of Generic Studies, 2010

- Certification in Basic Computer Skills, 2012

- High School Diploma, 2008

- Outdated Certification in Life Insurance, 2010

The strong examples listed demonstrate relevant academic degrees and certifications that align with the responsibilities of an Insurance Claims Director, showcasing a solid foundation in risk management and claims processing. In contrast, the weak examples include irrelevant educational qualifications and outdated certifications that do not contribute to the candidate's credibility in the insurance claims field. These distinctions underscore the importance of selecting and presenting education and certifications that directly support the desired job role.

Top Skills & Keywords for Insurance Claims Director Resume

As an Insurance Claims Director, showcasing the right blend of skills on your resume is crucial for standing out in a competitive job market. Skills not only reflect your qualifications but also indicate your ability to manage claims processes effectively, lead teams, and enhance customer satisfaction. Highlighting both hard and soft skills can significantly impact your resume, demonstrating to potential employers your expertise and adaptability in the insurance industry. For more guidance on essential skills and how to articulate your work experience, continue reading.

Top Hard & Soft Skills for Insurance Claims Director

Hard Skills

- Risk Assessment

- Claims Processing Software Proficiency

- Regulatory Compliance Knowledge

- Data Analysis and Reporting

- Financial Acumen

- Policy Interpretation

- Negotiation Skills

- Quality Assurance Standards

- Claims Management Systems

- Fraud Detection Techniques

- Project Management

- Underwriting Principles

- Technical Writing

- Statistical Analysis

- Cost-Benefit Analysis

- Insurance Industry Knowledge

- Litigation Management

Soft Skills

- Leadership and Team Management

- Communication Skills

- Problem-Solving Aptitude

- Critical Thinking

- Empathy and Customer Service

- Conflict Resolution

- Decision-Making Skills

- Time Management

- Adaptability and Flexibility

- Attention to Detail

- Strategic Planning

- Relationship Building

- Negotiation and Persuasion

- Emotional Intelligence

- Coaching and Mentoring

- Initiative and Proactivity

- Interpersonal Skills

Stand Out with a Winning Insurance Claims Director Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my enthusiasm for the Insurance Claims Director position at [Company Name], as advertised on [where you found the job listing]. With over [X years] of experience in the insurance industry and a proven track record of managing high-volume claims operations, I am confident in my ability to lead your claims department towards achieving operational excellence and enhancing customer satisfaction. My extensive background in claims management, process optimization, and team leadership aligns well with the goals of [Company Name].

In my previous role as Claims Manager at [Previous Company Name], I successfully directed a team of claims adjusters and support staff, overseeing a diverse portfolio that included property, auto, and liability claims. I implemented new claims processing strategies that reduced turnaround time by [X%], significantly increasing client satisfaction ratings. By fostering a collaborative environment and focusing on continuous training and development, I enabled my team to exceed performance metrics consistently, thereby contributing to a [X%] increase in claims processing efficiency.

I am particularly drawn to [Company Name] because of its commitment to innovation and customer-centric practices in the insurance sector. I believe that my strategic approach to claims management, combined with my ability to leverage technology for improved outcomes, would make a valuable addition to your leadership team. I am excited about the opportunity to drive initiatives that not only enhance operational performance but also align with the company's mission and values.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and vision for effective claims management can contribute to the continued success of [Company Name]. I am eager to bring my expertise in developing best practices and leading high-performing teams to your organization.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Insurance Claims Director Resume

When crafting a resume for the position of Insurance Claims Director, it's crucial to present your qualifications and experience in a compelling and professional manner. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can enhance your resume and better showcase your skills and achievements in the insurance industry. Here are some common mistakes to watch out for:

Vague Job Descriptions: Failing to provide specific details about your previous roles can leave hiring managers wondering about your actual responsibilities and accomplishments. Use quantifiable metrics and clear examples to illustrate your impact.

Ignoring Keywords: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Not including relevant industry keywords may result in your resume being overlooked. Research job descriptions to identify key terms.

Lengthy Resumes: A resume that is too long can overwhelm hiring managers. Aim to keep your resume concise, ideally one to two pages, focusing on your most relevant experiences and achievements.

Neglecting Formatting: A cluttered or unprofessional format can detract from your qualifications. Use consistent fonts, bullet points, and clear headings to improve readability and present a polished appearance.

Omitting Results: Simply listing duties without showcasing the outcomes can make your contributions seem insignificant. Emphasize your achievements and the results of your initiatives in previous roles.

Lack of Tailoring: Sending out a generic resume can be detrimental. Tailor your resume for each application to align your skills and experiences with the specific requirements of the job.

Poor Grammar and Spelling: Typos and grammatical errors can undermine your professionalism. Always proofread your resume multiple times or have someone else review it to catch any mistakes.

Excessive Jargon: While industry-specific terminology can demonstrate your expertise, overusing jargon may confuse readers. Strive for clarity and ensure that your qualifications are easily understood.

Conclusion

As an Insurance Claims Director, you play a pivotal role in managing and overseeing the claims process, ensuring that claims are handled efficiently and effectively while adhering to regulatory standards. Throughout this article, we’ve explored the essential skills and qualifications needed for this role, including leadership, analytical thinking, and a deep understanding of insurance policies and regulations. We highlighted the importance of developing strong communication skills for interacting with clients, insurance agents, and team members, as well as the need for strategic planning to enhance the overall performance of the claims department.

Moreover, we discussed the significance of leveraging technology to streamline claims processing and improve customer satisfaction. Emphasizing the necessity for continuous professional development, we suggested pursuing relevant certifications and staying updated with industry trends to remain competitive in this dynamic field.

In conclusion, if you're aspiring to become an Insurance Claims Director or looking to advance in your current position, it’s crucial to have a polished and professional resume that highlights your accomplishments and relevant experience. We encourage you to take action and review your Insurance Claims Director resume today. To assist you, explore our range of resources, including resume templates, a user-friendly resume builder, insightful resume examples, and customizable cover letter templates. Equip yourself with the tools you need to stand out in this competitive job market!