26 Distressed Securities Trader Skills for Your Resume: List Examples

As a Distressed Securities Trader, possessing a unique set of skills is crucial for navigating the complexities of the financial markets. This role requires not only a strong understanding of financial analysis and market trends but also the ability to identify undervalued assets and assess the risk associated with distressed securities. In the following section, we will outline the top skills that can enhance your resume and demonstrate your expertise in trading distressed securities.

Best Distressed Securities Trader Technical Skills

Technical skills are vital for a Distressed Securities Trader, as they enable professionals to effectively analyze, evaluate, and capitalize on investment opportunities in distressed assets. Mastering these skills not only enhances trading performance but also showcases a trader's ability to navigate complex financial environments.

Financial Analysis

Financial analysis is crucial for assessing the viability of distressed securities. It involves examining financial statements, cash flow projections, and market conditions to make informed investment decisions.

How to show it: Quantify your analysis skills by including specific metrics, such as the percentage of successful trades based on your financial assessments, or highlight any models you developed that improved decision-making processes.

Risk Management

Effective risk management helps traders mitigate potential losses while maximizing returns. It involves identifying, analyzing, and prioritizing risks associated with distressed securities.

How to show it: Demonstrate your risk management expertise by providing examples of risk assessments you conducted and the impact these had on your trading outcomes, such as reduced volatility or loss mitigation.

Market Research

Thorough market research is essential for understanding the broader economic context and market trends that affect distressed securities. This skill aids in making informed trading decisions.

How to show it: Illustrate your market research capabilities by sharing insights from specific research projects, including how your findings influenced trading strategies and improved investment returns.

Valuation Techniques

Valuation techniques, such as discounted cash flow analysis and comparable company analysis, are key for estimating the intrinsic value of distressed securities, guiding traders in their investment choices.

How to show it: Highlight your proficiency in valuation techniques by mentioning successful valuations you performed that led to profitable trades or investments.

Financial Modeling

Financial modeling is the process of creating representations of a security's financial performance. Well-structured models are vital for forecasting and evaluating distressed assets.

How to show it: Include details about specific financial models you have developed, emphasizing their impact on trading decisions and any improvements in forecast accuracy.

Technical Analysis

Technical analysis involves analyzing statistical trends from trading activity, such as price movement and volume, to forecast future price movements of distressed securities.

How to show it: Quantify your technical analysis success by referencing specific patterns you identified that led to profitable trades or improved trade timing.

Credit Analysis

Credit analysis evaluates the creditworthiness of distressed securities, focusing on the issuer's ability to meet its debt obligations, which is critical for risk assessment.

How to show it: Provide examples of credit analyses you performed, particularly those that resulted in significant insights or influenced investment decisions positively.

Portfolio Management

Portfolio management involves overseeing a collection of investments, ensuring optimal asset allocation and diversification, which is crucial when dealing with distressed securities.

How to show it: Demonstrate your portfolio management skills by showcasing the performance metrics of portfolios you managed, emphasizing returns achieved relative to benchmarks.

Quantitative Analysis

Quantitative analysis uses mathematical and statistical techniques to evaluate securities, playing a pivotal role in identifying investment opportunities in distressed markets.

How to show it: Highlight any quantitative methods you employed and the resulting impact on your trading success, such as identifying undervalued securities based on data analysis.

Regulatory Knowledge

A strong understanding of financial regulations is essential for distressed securities traders to ensure compliance and navigate legal frameworks that govern trading activities.

How to show it: Illustrate your regulatory knowledge by mentioning any compliance initiatives you led or how your understanding of regulations positively impacted trading strategies.

Negotiation Skills

Negotiation skills are vital when dealing with distressed securities, as traders often need to negotiate terms with sellers or other stakeholders to secure favorable deals.

How to show it: Provide concrete examples of successful negotiations you conducted, including the terms you secured and the overall impact on your trading portfolio.

Best Distressed Securities Trader Soft Skills

In the fast-paced and high-stakes world of distressed securities trading, possessing strong soft skills is just as important as having technical expertise. These interpersonal skills can significantly enhance a trader's ability to navigate complex market situations, communicate effectively with team members and clients, and make swift, informed decisions. Below are some essential soft skills that every Distressed Securities Trader should highlight on their resume.

Analytical Thinking

Analytical thinking allows traders to assess and interpret data effectively, identify patterns, and make informed decisions based on market trends.

How to show it: Provide examples of how you analyzed specific securities or market conditions to make profitable trades. Quantify your results, such as percentage gains or losses avoided by your analysis.

Communication

Effective communication is vital for articulating complex ideas and strategies to clients and colleagues, as well as for negotiating deals.

How to show it: Highlight instances where your communication skills led to successful negotiations or improved team collaboration. Use metrics to demonstrate the impact of your communication, such as increased client satisfaction or successful project completions.

Problem-solving

Strong problem-solving skills enable traders to quickly identify issues and develop strategic solutions in a volatile market environment.

How to show it: Detail specific challenges you faced in trading scenarios and the innovative solutions you implemented. Quantify your success through metrics, such as reduced risk or enhanced trading outcomes.

Time Management

Time management skills are essential for prioritizing tasks and making timely decisions, which can affect trading outcomes significantly.

How to show it: List examples of how you effectively managed multiple trades or projects under tight deadlines. Include specific timeframes and results achieved to showcase your efficiency.

Teamwork

Teamwork is crucial in trading environments where collaboration with other traders, analysts, and stakeholders can lead to better decision-making.

How to show it: Provide examples of successful projects or trades that required collaboration with others. Highlight your role and the positive outcomes, using team performance metrics to illustrate your contributions.

Adaptability

Adaptability allows traders to pivot strategies in response to shifting market conditions and unexpected events, ensuring they remain competitive.

How to show it: Share instances where you successfully adapted strategies in response to market changes. Quantify your adaptability's success with specific outcomes, like increased profitability or reduced losses.

Attention to Detail

A keen attention to detail helps traders spot discrepancies in data and trends that could influence trading decisions.

How to show it: Discuss examples where your attention to detail directly impacted trading decisions or outcomes. Quantify your results to illustrate the importance of this skill.

Emotional Intelligence

Emotional intelligence enables traders to manage their emotions and understand others' emotions, leading to better decision-making and team dynamics.

How to show it: Provide examples of how your emotional intelligence has helped you maintain composure in stressful situations or improved interactions with clients or colleagues. Highlight measurable outcomes from these interactions.

Negotiation Skills

Negotiation skills are essential for securing favorable terms and conditions when trading distressed securities.

How to show it: Detail successful negotiations you've conducted, emphasizing the terms you secured and the financial impact on your trades. Use specific figures to demonstrate your negotiation success.

Resilience

Resilience helps traders bounce back from losses and setbacks, maintaining focus and determination in the face of challenges.

How to show it: Share personal anecdotes of how you overcame significant trading losses or challenges. Highlight any resulting improvements in strategy or performance to show your resilience.

Networking

Networking skills are crucial for building relationships within the industry, which can lead to access to valuable information and opportunities.

How to show it: Include examples of networking events you've attended or professional relationships you've built that had a positive impact on your trading success. Use metrics to demonstrate growth or new opportunities created through networking.

How to List Distressed Securities Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers. A well-crafted skills section allows hiring managers to quickly identify your qualifications. Your skills can be highlighted in three main sections: the Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing Distressed Securities Trader skills in the introduction section gives hiring managers a quick overview of your qualifications and areas of expertise. This brief summary can set the tone for the rest of your resume.

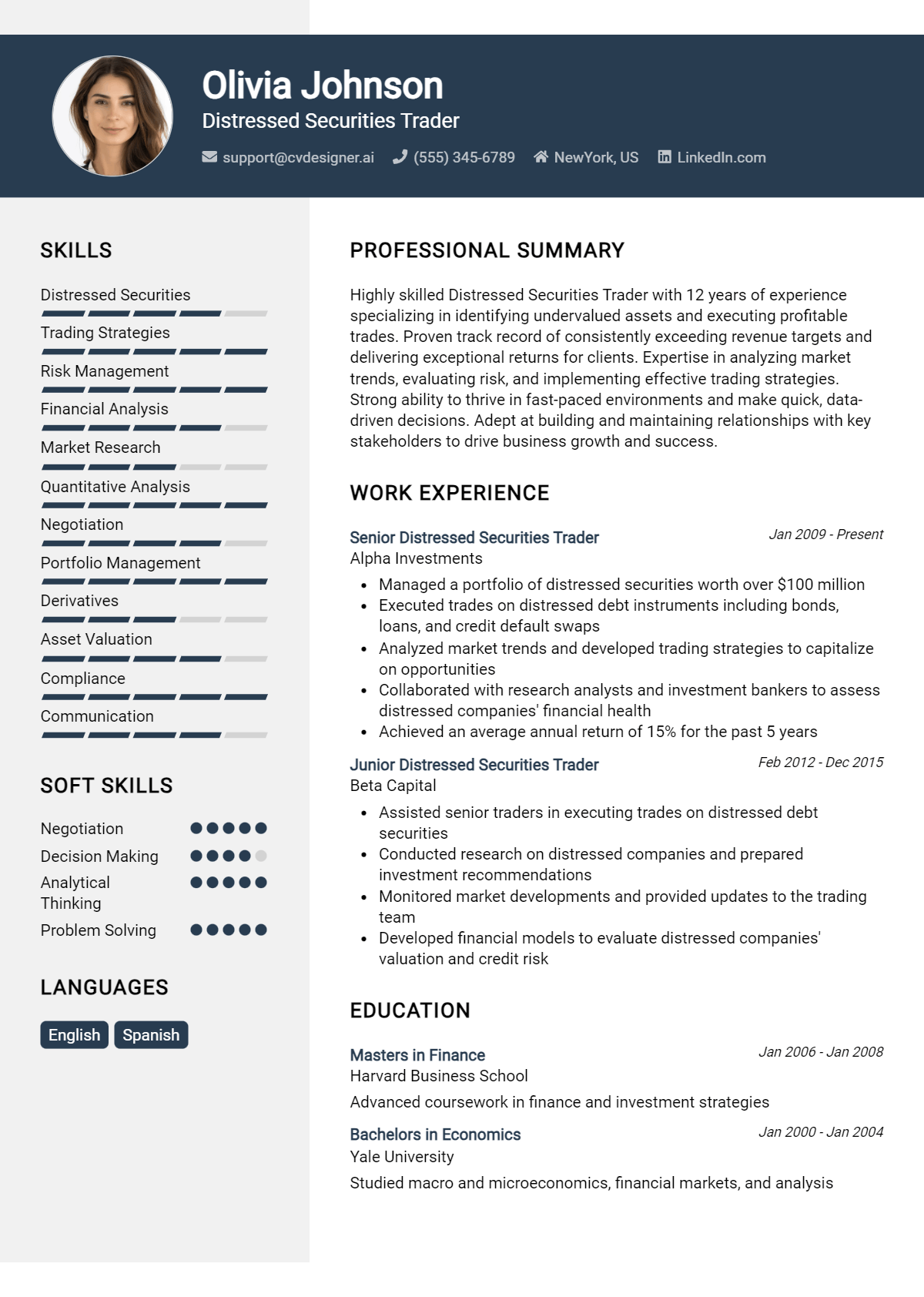

Example

Results-driven Distressed Securities Trader with expertise in credit analysis, risk management, and market research. Proven track record of generating alpha through strategic investments in distressed assets.

for Work Experience

The work experience section provides an excellent opportunity to demonstrate how your Distressed Securities Trader skills have been applied in real-world scenarios. Tailoring this section to reflect the specific skills mentioned in job listings can significantly enhance your appeal to employers.

Example

- Executed trades in distressed securities, leveraging analytical skills to assess market conditions and identify investment opportunities.

- Conducted thorough due diligence on distressed companies, resulting in informed decision-making and risk mitigation.

- Collaborated with cross-functional teams to develop investment strategies that improved portfolio performance by 15%.

- Utilized strong negotiation skills to secure favorable terms in distressed asset acquisitions.

for Skills

The skills section can showcase both technical and transferable skills, providing a balanced mix of hard and soft skills that strengthen your qualifications. Including a diverse range of skills can make your resume more appealing to potential employers.

Example

- Credit Analysis

- Risk Management

- Market Research

- Financial Modelling

- Negotiation

- Portfolio Management

- Strategic Planning

- Data Analysis

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can help demonstrate your fit for the role and how those skills have positively impacted your previous positions.

Example

In my previous role, my expertise in credit analysis and risk management enabled me to identify lucrative opportunities in distressed markets, yielding a 20% return on investment. I am excited to bring my strategic approach to your team, ensuring impactful contributions to your firm’s investment goals.

Encouraging candidates to link the skills mentioned in their resume to specific achievements in their cover letter further reinforces their qualifications for the job. For more information on highlighting [skills](https://resumedesign.ai/resume-skills/), [Technical Skills](https://resumedesign.ai/technical-skills/), and [work experience](https://resumedesign.ai/resume-work-experience/), consider exploring these resources.

The Importance of Distressed Securities Trader Resume Skills

Highlighting relevant skills in a Distressed Securities Trader resume is crucial for making a strong impression on recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also demonstrates their alignment with the specific requirements of the job. In a competitive field, emphasizing these skills can significantly enhance a candidate's visibility and appeal, increasing the chances of securing an interview.

- Demonstrates specialized knowledge: Including skills relevant to distressed securities trading shows that the candidate has a deep understanding of the nuances involved in this niche market, which is essential for making informed investment decisions.

- Highlights analytical abilities: Proficiency in financial analysis and valuation techniques is vital in distressed securities trading. A resume that showcases these skills indicates the candidate's capability to assess and capitalize on market opportunities.

- Indicates risk management expertise: Distressed securities trading often involves high risk. Candidates who emphasize their skills in risk assessment and management can show recruiters that they are prepared to navigate the complexities of this field.

- Reflects strong negotiation skills: Successful traders must be adept negotiators, especially when dealing with distressed assets. Highlighting this competency can set candidates apart as effective communicators and deal-makers.

- Shows adaptability and resilience: The ability to adapt to rapidly changing market conditions is critical in distressed trading. Candidates who showcase these traits can demonstrate their capacity to thrive in dynamic environments.

- Exhibits teamwork and collaboration: Trading often requires working in teams and collaborating with other professionals. Skills that illustrate a candidate’s ability to work well with others can be a significant asset in this role.

- Validates technical proficiencies: In today's trading environment, familiarity with trading platforms and analytical software is essential. Highlighting these technical skills can enhance a candidate's profile in the eyes of recruiters.

- Enhances overall market knowledge: A comprehensive understanding of market trends, economic indicators, and industry developments is crucial. Including these skills can indicate a candidate’s commitment to staying informed and relevant in the field.

For more insights on crafting an effective resume, check out these Resume Samples.

How To Improve Distressed Securities Trader Resume Skills

In the fast-paced and often unpredictable world of distressed securities trading, continuously improving your skills is essential for staying competitive and making informed investment decisions. As market conditions change and new financial instruments emerge, traders must adapt and enhance their expertise to effectively navigate the complexities of distressed assets. Here are some actionable tips to help you improve your skills and strengthen your resume in this specialized field:

- Stay updated on market trends by subscribing to financial news outlets and analysis platforms.

- Enhance your financial modeling skills through online courses or workshops that focus on distressed asset valuation.

- Network with industry professionals and attend conferences to gain insights and share best practices.

- Develop a strong understanding of bankruptcy laws and restructuring processes to better assess distressed companies.

- Practice risk assessment techniques to improve your ability to make quick, informed trading decisions.

- Utilize trading simulation software to refine your trading strategies without financial risk.

- Seek mentorship from experienced traders to gain practical insights and guidance on navigating the distressed securities market.

Frequently Asked Questions

What are the key skills needed for a Distressed Securities Trader?

A successful Distressed Securities Trader should possess strong analytical skills, allowing them to evaluate distressed assets effectively. Proficiency in financial modeling and valuation techniques is crucial, along with a deep understanding of credit markets and bankruptcy processes. Additionally, negotiation skills and the ability to make quick decisions under pressure are essential in this fast-paced trading environment.

How important is financial modeling for a Distressed Securities Trader?

Financial modeling is a critical skill for a Distressed Securities Trader as it helps in assessing the potential recovery value of distressed assets. Traders must construct detailed models to simulate various scenarios and outcomes, enabling them to make informed trading decisions. Mastery of financial models allows traders to identify undervalued securities and strategize effectively on potential investments.

What role does risk management play in distressed securities trading?

Risk management is paramount in distressed securities trading due to the inherent volatility and uncertainty associated with distressed assets. Traders must employ robust risk assessment techniques to evaluate potential losses and implement strategies to mitigate risks. This includes diversifying their portfolio, setting stop-loss orders, and continually monitoring market conditions to protect against adverse movements.

How does market knowledge influence a Distressed Securities Trader's performance?

In-depth market knowledge significantly enhances a Distressed Securities Trader's performance by informing them of trends, regulatory changes, and macroeconomic factors that impact distressed securities. This understanding allows traders to anticipate market shifts, identify lucrative opportunities, and react swiftly to emerging situations, ultimately leading to more successful trading outcomes.

What soft skills are beneficial for a Distressed Securities Trader?

In addition to technical skills, soft skills play an important role in the success of a Distressed Securities Trader. Strong communication skills are vital for articulating complex ideas and strategies to clients and team members. Emotional resilience is also crucial, as traders must cope with the pressures of rapid decision-making and the potential for significant financial loss, while maintaining a clear focus on their trading goals.

Conclusion

Incorporating Distressed Securities Trader skills into your resume is essential for demonstrating your expertise in a specialized and competitive field. By effectively showcasing these relevant skills, you not only differentiate yourself from other candidates but also illustrate the unique value you can bring to potential employers. Remember, a well-crafted resume that highlights your abilities can significantly enhance your job application.

Take the time to refine your skills and tailor your resume to stand out in the job market. For further assistance, explore our resume templates, utilize our resume builder, check out resume examples, and create impactful cover letter templates to bolster your application process.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.