Distressed Securities Trader Core Responsibilities

A Distressed Securities Trader is responsible for analyzing and trading financially troubled securities, requiring a blend of technical acumen and operational insight. Key responsibilities include conducting thorough market research, assessing credit risk, and formulating trading strategies that bridge finance, risk management, and compliance departments. Strong problem-solving skills are essential to navigate complex market conditions. A well-structured resume that highlights these qualifications can effectively showcase a candidate's potential to contribute to the organization’s financial objectives.

Common Responsibilities Listed on Distressed Securities Trader Resume

- Analyze distressed securities and evaluate potential investment opportunities.

- Conduct thorough due diligence and credit analysis of target companies.

- Develop and implement trading strategies based on market trends.

- Monitor financial markets and economic indicators impacting distressed assets.

- Collaborate with risk management and compliance teams to ensure adherence to regulations.

- Maintain relationships with brokers, analysts, and institutional investors.

- Prepare detailed reports on market conditions and trading performance.

- Utilize financial modeling and valuation techniques to assess investment risks.

- Identify and execute arbitrage opportunities in distressed securities.

- Participate in negotiations for distressed asset acquisitions.

- Stay updated on legal and regulatory changes affecting distressed securities.

- Train and mentor junior traders and analysts within the team.

High-Level Resume Tips for Distressed Securities Trader Professionals

In the competitive world of finance, a well-crafted resume is essential for Distressed Securities Trader professionals. Your resume serves as the first impression you make on potential employers, showcasing your skills, experience, and achievements in a way that can set you apart from the crowd. It's crucial that your resume not only highlights your technical expertise but also tells a compelling story of your contributions to previous roles. This guide will provide practical and actionable resume tips specifically tailored for Distressed Securities Trader professionals, ensuring your document resonates with hiring managers and reflects your unique qualifications.

Top Resume Tips for Distressed Securities Trader Professionals

- Tailor your resume to each job description by using relevant keywords and phrases that align with the requirements of the position.

- Highlight your experience in distressed securities and related financial instruments, emphasizing your understanding of market dynamics.

- Quantify your achievements by including specific metrics, such as percentage returns on trades, number of successful transactions, or overall portfolio growth.

- Showcase your analytical skills by mentioning your proficiency in financial modeling and valuation techniques relevant to distressed assets.

- Include certifications or licenses, such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), to demonstrate your commitment to the profession.

- Focus on your ability to identify undervalued assets and articulate strategies you’ve successfully employed in previous trading roles.

- Mention any experience with distressed debt restructuring, as it highlights your knowledge of legal and financial processes in this niche market.

- Incorporate relevant software skills, such as proficiency in trading platforms and financial analysis tools, to illustrate your technical capabilities.

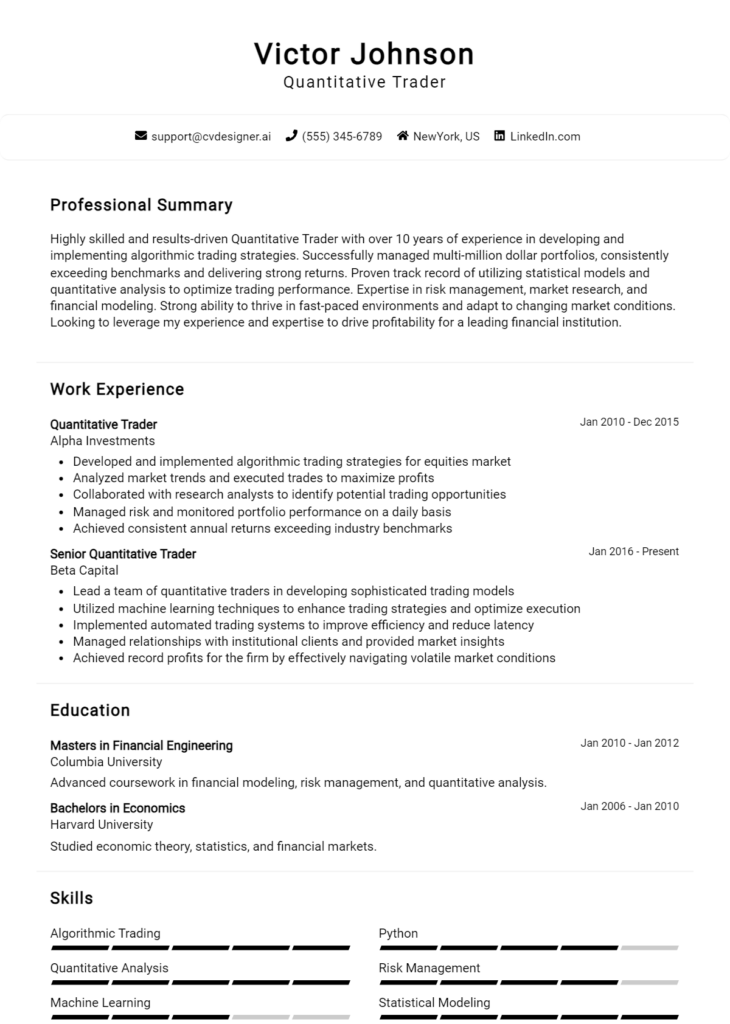

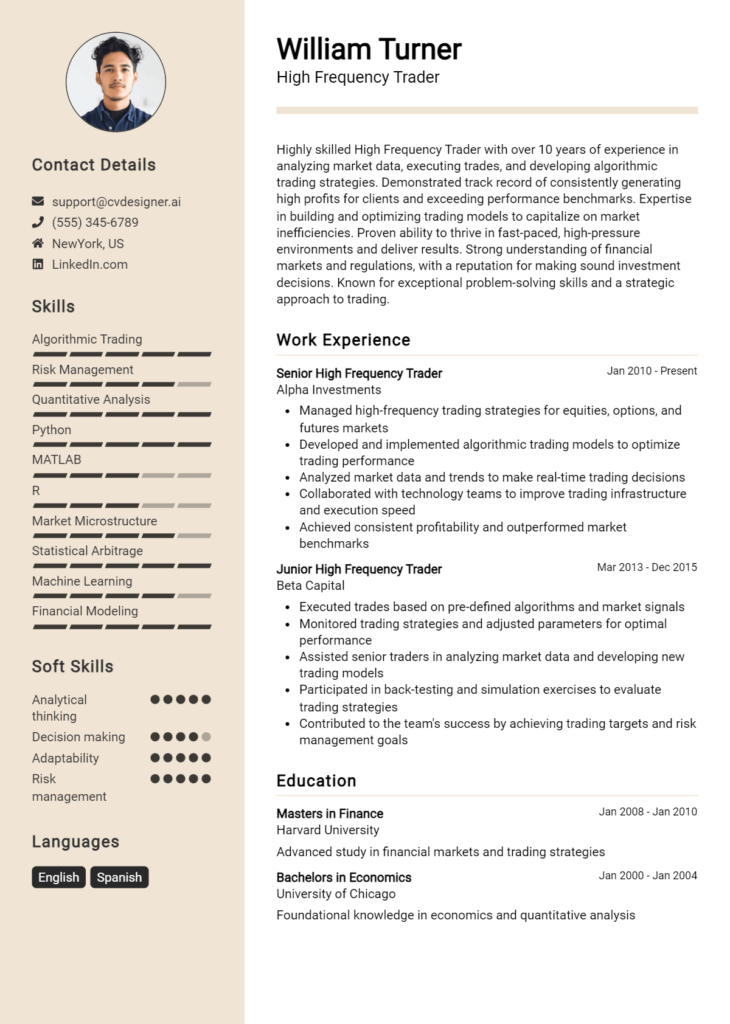

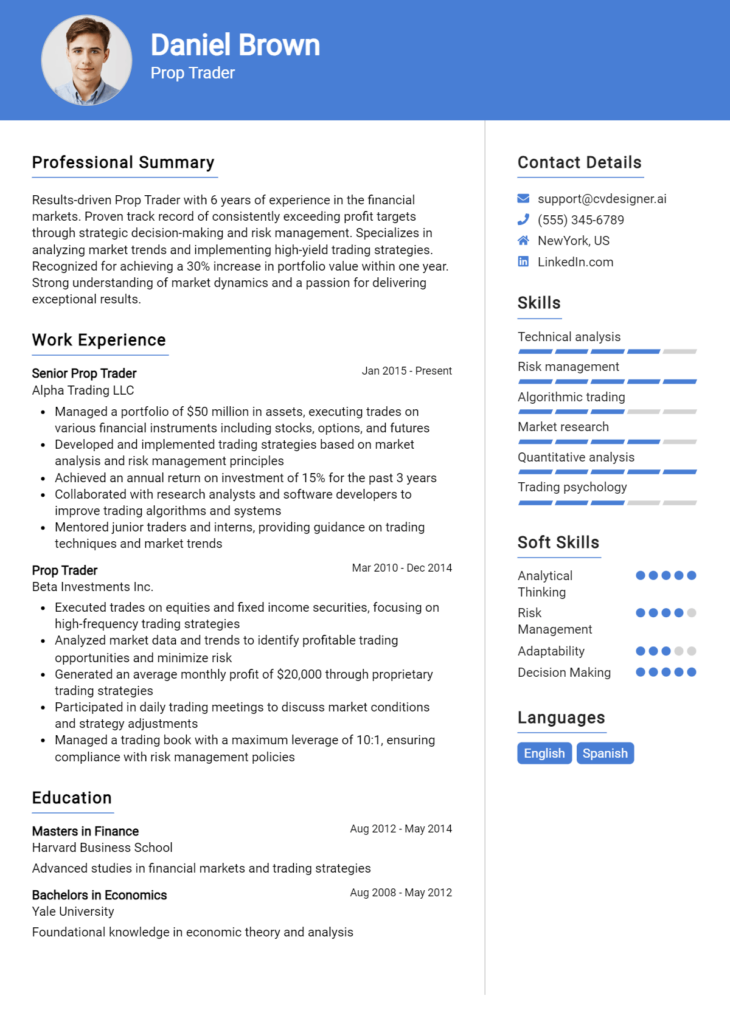

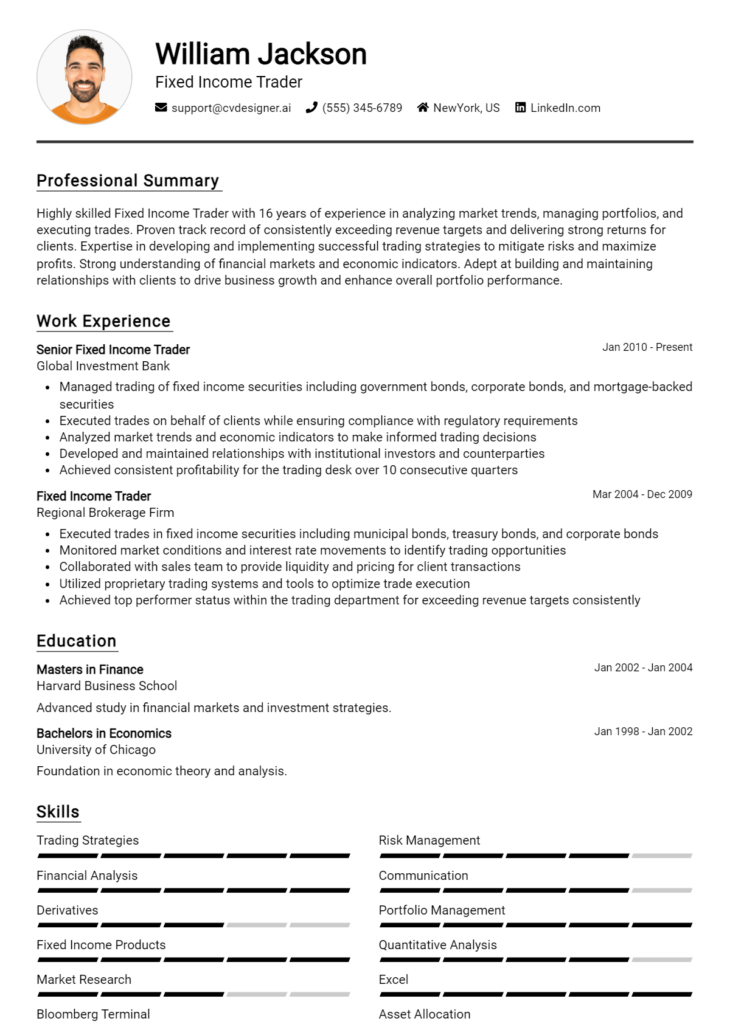

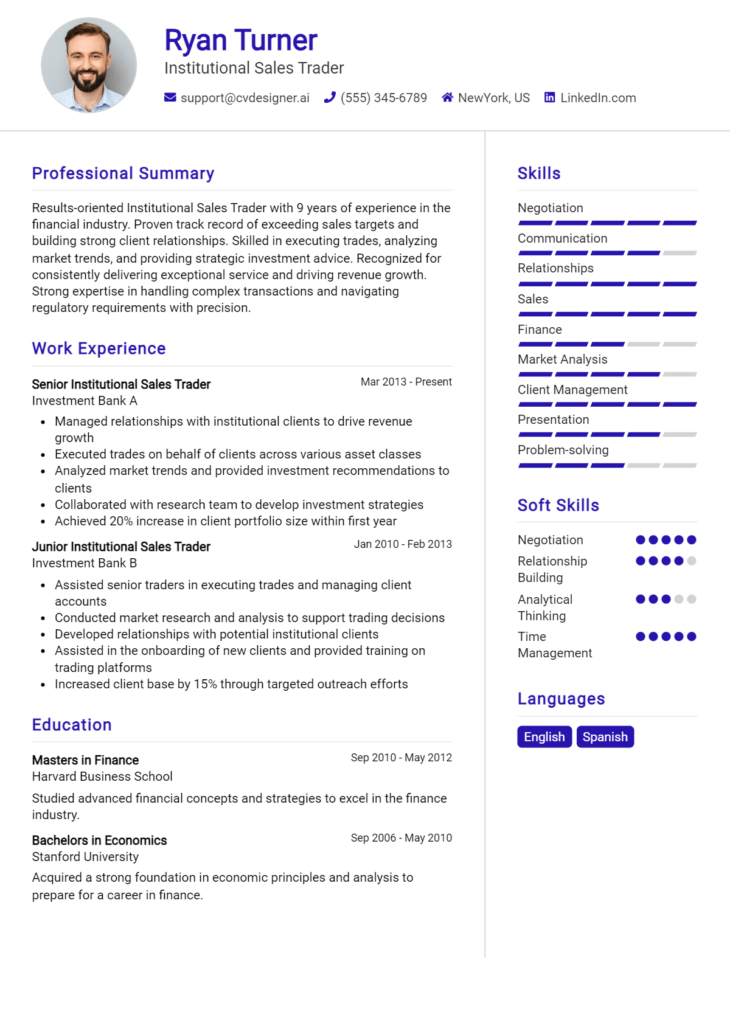

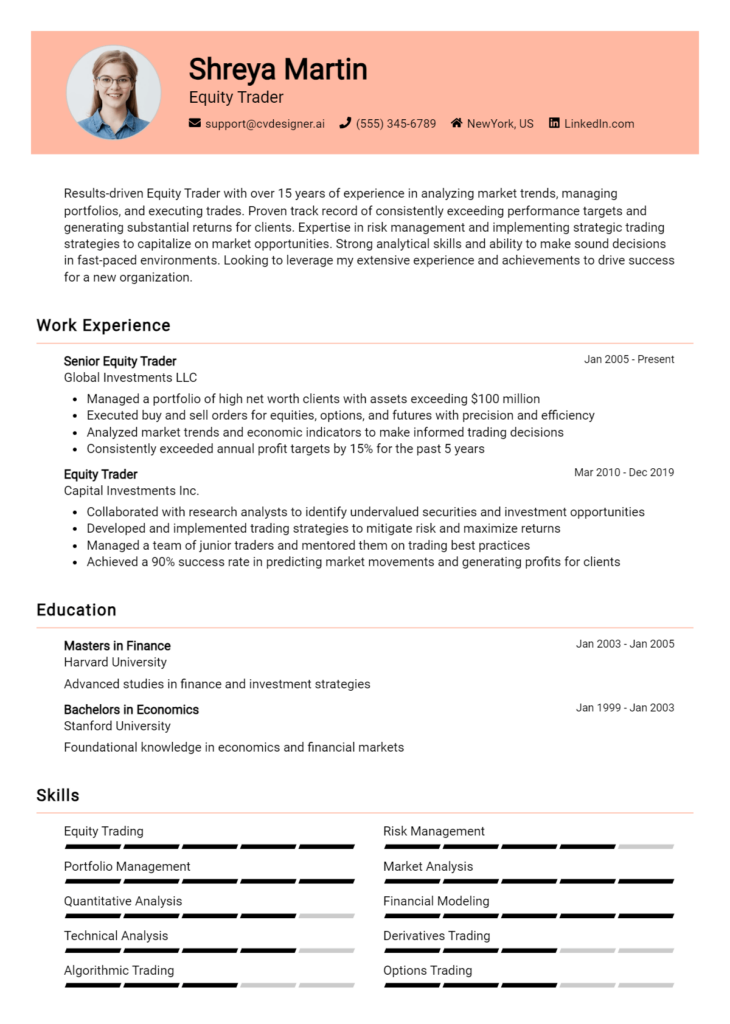

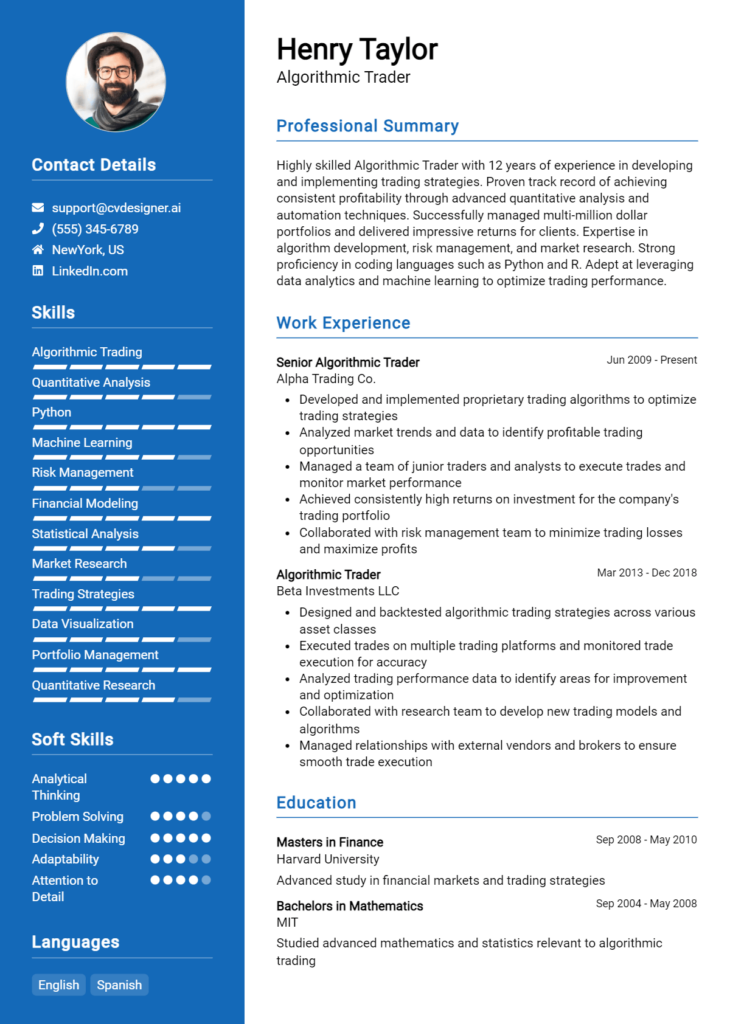

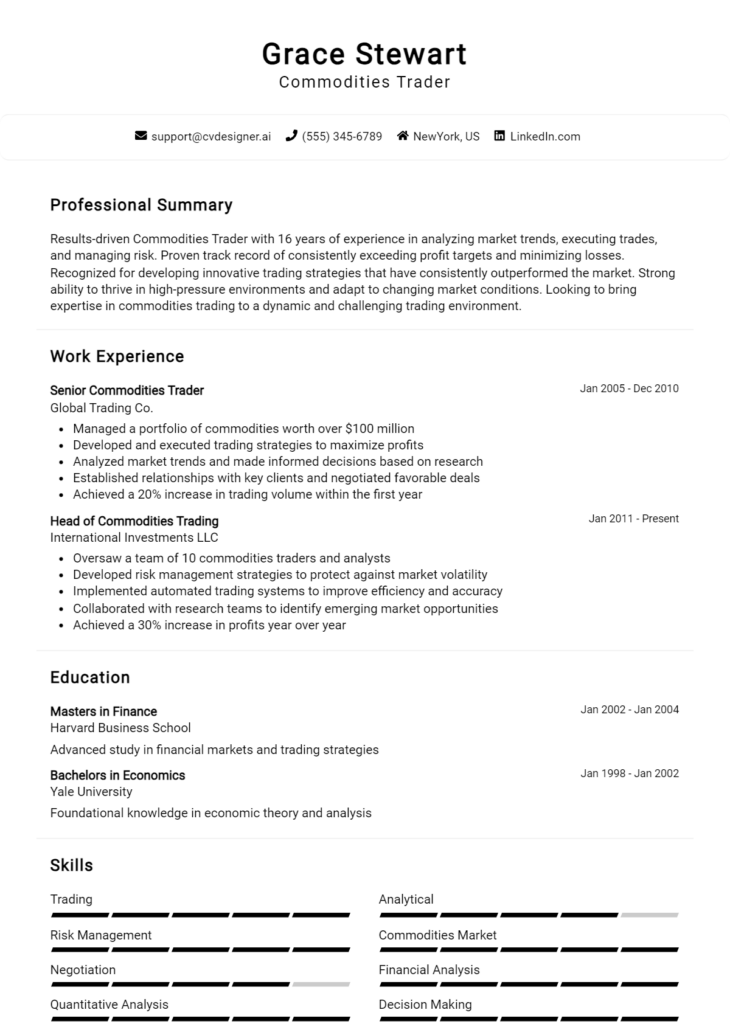

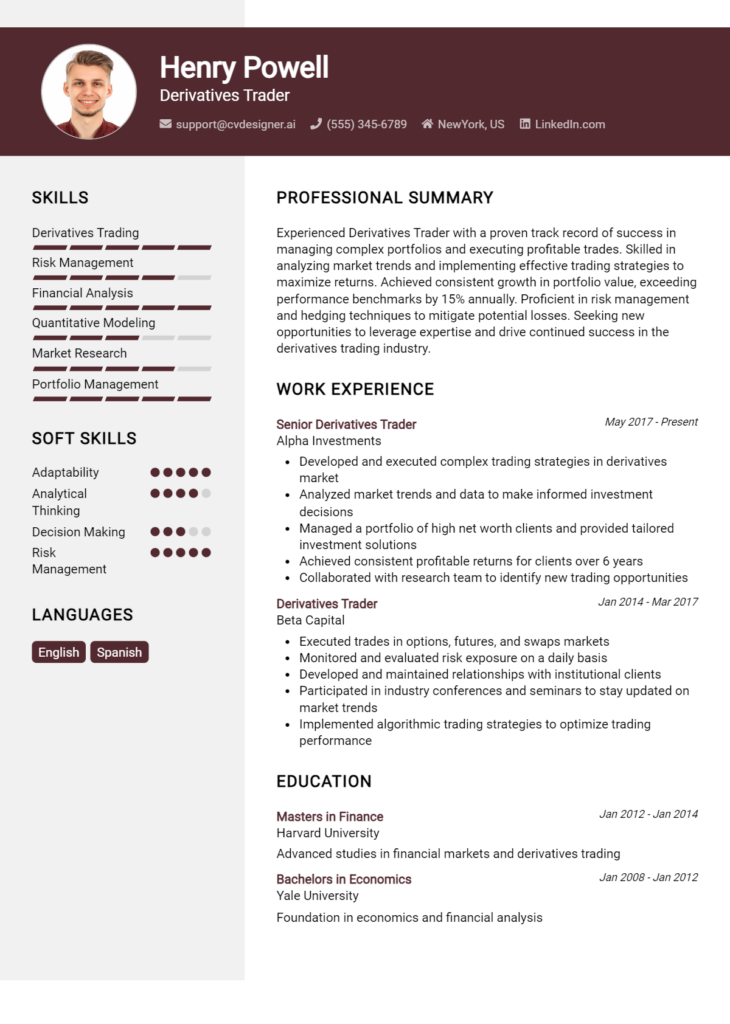

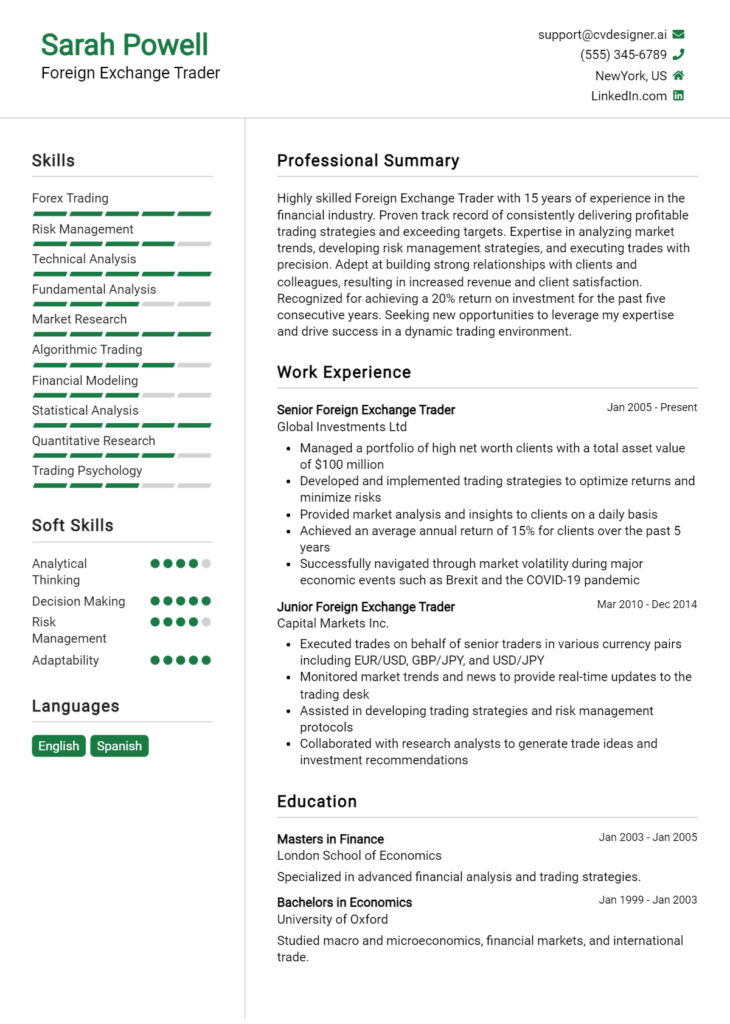

- Utilize a clean and professional format, ensuring that your resume is easy to read and highlights the most important information prominently.

- Maintain a consistent tone and style throughout your resume, reinforcing your professionalism and attention to detail.

By implementing these tips, you can significantly enhance your chances of landing a job as a Distressed Securities Trader. A well-structured and targeted resume will not only showcase your qualifications effectively but also demonstrate your understanding of the industry, making you a compelling candidate in the eyes of potential employers.

Why Resume Headlines & Titles are Important for Distressed Securities Trader

In the competitive world of finance, particularly in the niche area of distressed securities trading, a well-crafted resume headline or title is essential. This succinct phrase serves as the first impression for hiring managers, instantly capturing their attention and summarizing a candidate's key qualifications. A strong headline not only reflects the applicant's expertise but also aligns directly with the specific requirements of the role being applied for. By being concise and relevant, a compelling resume title can effectively differentiate a candidate from the competition and set the tone for the rest of the resume.

Best Practices for Crafting Resume Headlines for Distressed Securities Trader

- Keep it concise—ideally one to two lines.

- Make it role-specific to resonate with the position.

- Highlight key skills or achievements relevant to distressed securities.

- Use industry-specific terminology to demonstrate expertise.

- Avoid cliches and generic phrases that lack impact.

- Incorporate quantifiable results where possible.

- Tailor the headline for each job application.

- Maintain a professional tone that reflects the finance industry.

Example Resume Headlines for Distressed Securities Trader

Strong Resume Headlines

"Results-Driven Distressed Securities Trader with 10+ Years of Experience in High-Pressure Markets"

“Expert in Identifying Undervalued Assets: Proven Track Record in Distressed Debt Trading”

“Strategic Distressed Securities Trader: Achieved 30% ROI on Distressed Assets in 2022”

Weak Resume Headlines

“Trader Looking for Opportunities”

“Experienced Financial Professional”

The strong headlines are effective because they provide clear, specific information about the candidate's experience and skills, directly tied to the role of a distressed securities trader. They convey a sense of achievement and expertise, making it easy for hiring managers to recognize the value the candidate can bring to their firm. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail. They do not communicate the candidate's unique qualifications or demonstrate any tangible results, making it difficult for hiring managers to see why they should consider these applicants for the position.

Writing an Exceptional Distressed Securities Trader Resume Summary

A well-crafted resume summary is crucial for a Distressed Securities Trader, as it serves as the first impression for hiring managers. In the fast-paced world of finance, employers often sift through numerous resumes, making it essential for candidates to quickly capture attention with a powerful summary that highlights key skills, relevant experience, and significant accomplishments. A strong summary should be concise, impactful, and specifically tailored to the job at hand, ensuring that it resonates with the requirements of the position and showcases the candidate’s unique value proposition.

Best Practices for Writing a Distressed Securities Trader Resume Summary

- Quantify Achievements: Use specific numbers to demonstrate your contributions (e.g., “Increased portfolio returns by 30% over two years”).

- Focus on Relevant Skills: Highlight skills that are directly applicable to distressed securities trading, such as financial analysis, risk management, and market research.

- Tailor to the Job Description: Customize your summary to reflect the specific requirements and language used in the job posting.

- Be Concise: Aim for 2-4 impactful sentences that deliver maximum information without unnecessary fluff.

- Showcase Industry Knowledge: Mention any relevant certifications, tools, or methodologies that demonstrate your expertise in distressed securities.

- Highlight Key Accomplishments: Include past successes that relate to distressed securities, such as successful trades or strategic investments.

- Use Action-Oriented Language: Start sentences with strong action verbs to convey enthusiasm and proactivity.

- Avoid Jargon: Ensure clarity by avoiding overly technical terms that may alienate readers unfamiliar with industry-specific language.

Example Distressed Securities Trader Resume Summaries

Strong Resume Summaries

Results-driven Distressed Securities Trader with over 7 years of experience in identifying undervalued assets and generating annual returns exceeding 25%. Proven track record in successfully navigating volatile markets and implementing strategic investment decisions.

Dynamic financial professional adept at distressed asset acquisition, with a history of increasing portfolio performance by 40% through rigorous analysis and market insights. Skilled in risk assessment and tailored investment strategies.

Accomplished Distressed Securities Trader with expertise in debt restructuring and corporate turnaround strategies. Successfully managed a $100M portfolio, achieving a 35% return on investment in a challenging economic climate.

Weak Resume Summaries

Motivated trader looking for opportunities in the finance sector with some experience in distressed securities.

Experienced financial professional with knowledge of distressed assets and looking to contribute to a team.

The strong resume summaries are considered effective because they demonstrate specific achievements, quantify results, and align closely with the desired skills for a Distressed Securities Trader role. They provide concrete examples of the candidate's impact in previous roles, showcasing their ability to excel in the position. In contrast, the weak summaries lack specificity, fail to quantify results, and do not convey a strong sense of expertise or relevance, making them less appealing to hiring managers.

Work Experience Section for Distressed Securities Trader Resume

The work experience section of a Distressed Securities Trader resume is crucial as it serves as a comprehensive overview of the candidate's relevant expertise in a highly specialized field. This section allows candidates to showcase their technical skills in trading distressed securities, their capability to manage teams effectively, and their commitment to delivering high-quality results. By quantifying achievements and aligning their experience with industry standards, candidates can clearly demonstrate their value to potential employers, making it easier for them to stand out in a competitive job market.

Best Practices for Distressed Securities Trader Work Experience

- Highlight specific technical skills relevant to distressed securities trading, such as financial modeling and risk assessment.

- Use quantifiable results to illustrate achievements, such as percentage increases in portfolio performance or revenue generated.

- Detail collaborative projects that demonstrate teamwork and leadership in high-pressure environments.

- Incorporate industry-specific terminology to resonate with hiring managers and applicant tracking systems.

- Focus on outcomes and contributions rather than just responsibilities to emphasize impact.

- Tailor experiences to align with the requirements of the job description, showcasing the most relevant skills and achievements.

- Include any certifications or training that enhance your credibility and knowledge in distressed securities trading.

- Keep descriptions concise and impactful, ensuring clarity and readability for quick assessments.

Example Work Experiences for Distressed Securities Trader

Strong Experiences

- Led a distressed asset acquisition team that successfully identified and purchased underperforming securities, resulting in a 35% increase in portfolio value over 18 months.

- Implemented advanced financial modeling techniques that improved risk assessment accuracy, contributing to a 20% reduction in investment losses.

- Collaborated with cross-functional teams to develop a trading strategy that outperformed market benchmarks by 15% during a volatile economic period.

- Trained and mentored junior traders, enhancing team performance and cohesion, which led to a 40% improvement in trade execution efficiency.

Weak Experiences

- Responsible for trading distressed securities.

- Worked on various financial projects.

- Helped the team achieve some results.

- Participated in meetings regarding trading strategies.

The examples listed above illustrate the distinction between strong and weak experiences. Strong experiences provide specific, quantifiable achievements and demonstrate a clear impact on the organization's success, showcasing the candidate's technical expertise and leadership skills. In contrast, weak experiences lack detail and measurable outcomes, making them less compelling and failing to demonstrate the candidate's true capabilities or contributions to the field of distressed securities trading.

Education and Certifications Section for Distressed Securities Trader Resume

The education and certifications section of a Distressed Securities Trader resume is crucial in demonstrating the candidate's academic background, industry-relevant certifications, and commitment to continuous learning. This section serves to reinforce the candidate's expertise in the complex and dynamic field of distressed securities, showcasing their foundational knowledge as well as specialized skills that are essential for success in this role. By including relevant coursework, recognized certifications, and specialized training programs, candidates can significantly enhance their credibility and align themselves with the specific requirements of the job, making a strong case for their qualifications to potential employers.

Best Practices for Distressed Securities Trader Education and Certifications

- Focus on relevant degrees such as Finance, Economics, or Business Administration.

- Include industry-recognized certifications like the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM).

- Highlight any specialized training in distressed asset valuation or restructuring.

- Provide detailed descriptions of relevant coursework to illustrate in-depth knowledge.

- Keep the section concise while ensuring all information is pertinent to distressed securities trading.

- Update certifications regularly to reflect ongoing education and adaptation to industry changes.

- Consider including any participation in workshops, seminars, or conferences related to distressed securities.

- Emphasize academic honors or awards that showcase exceptional performance in finance-related subjects.

Example Education and Certifications for Distressed Securities Trader

Strong Examples

- MBA in Finance, Columbia University, 2021

- Chartered Financial Analyst (CFA), Level II Candidate

- Specialized Certification in Distressed Securities Valuation, NYU Stern School of Business

- Relevant Coursework: Advanced Financial Analysis, Corporate Restructuring, Risk Management

Weak Examples

- Bachelor of Arts in History, University of California, 2010

- Certificate in Basic Accounting, Local Community College

- High School Diploma, Graduated 2005

- Outdated Certification in General Business Management, 2015

The strong examples are considered relevant because they reflect advanced academic achievements and certifications that directly relate to the demands of a Distressed Securities Trader. They demonstrate a thorough understanding of finance and specialized skills necessary for the role. In contrast, the weak examples highlight qualifications that lack specificity and relevance to distressed securities, showcasing outdated information or unrelated fields of study which do not support the candidate's suitability for the position.

Top Skills & Keywords for Distressed Securities Trader Resume

In the competitive field of distressed securities trading, having the right skills is essential for success. A well-crafted resume that highlights both hard and soft skills can significantly improve a candidate's chances of landing a desirable position. Proficient knowledge of financial instruments, analytical abilities, and negotiation prowess are just a few examples of the skills that employers are looking for. Additionally, soft skills such as communication and adaptability can set a trader apart in a dynamic and fast-paced environment. By focusing on the essential skills required for a Distressed Securities Trader, candidates can create a compelling narrative that showcases their qualifications and readiness for the challenges of the role.

Top Hard & Soft Skills for Distressed Securities Trader

Soft Skills

- Strong Communication Skills

- Analytical Thinking

- Emotional Intelligence

- Adaptability

- Negotiation Skills

- Team Collaboration

- Problem-Solving Abilities

- Time Management

- Resilience Under Pressure

- Attention to Detail

Hard Skills

- Financial Modeling

- Risk Analysis

- Knowledge of Bankruptcy Law

- Valuation Techniques

- Market Research

- Securities Analysis

- Trading Software Proficiency

- Data Analysis Tools

- Portfolio Management

- Regulatory Compliance

For a comprehensive overview of the necessary skills for your resume, check out more information on skills. Additionally, consider how your work experience can further demonstrate these capabilities to potential employers.

Stand Out with a Winning Distressed Securities Trader Cover Letter

Dear [Hiring Manager's Name],

I am excited to apply for the Distressed Securities Trader position at [Company Name], as advertised on [where you found the job listing]. With a solid background in financial markets and a keen understanding of distressed assets, I am confident in my ability to contribute effectively to your trading team. My experience in analyzing complex financial situations and identifying undervalued opportunities has equipped me with the skills necessary to excel in this role.

In my previous role at [Previous Company Name], I successfully managed a portfolio of distressed securities, consistently achieving a strong return on investment through thorough research and strategic trading practices. I have developed a robust analytical framework for assessing risk and value, allowing me to make informed decisions in volatile market conditions. My ability to interpret financial statements, perform credit analysis, and conduct thorough due diligence has enabled me to identify profitable trading opportunities that others may overlook.

What sets me apart is my passion for distressed securities and my commitment to staying ahead of market trends. I actively engage with industry publications, attend conferences, and network with professionals to ensure I am informed about the latest developments in the distressed market space. I thrive in fast-paced environments and am adept at developing trading strategies that align with both short-term gains and long-term value creation.

I am excited about the possibility of bringing my expertise to [Company Name] and contributing to your team’s success. I look forward to the opportunity to discuss how my skills and experiences align with the goals of your organization. Thank you for considering my application; I hope to speak with you soon.

Sincerely,

[Your Name]

[Your Contact Information]

Common Mistakes to Avoid in a Distressed Securities Trader Resume

Crafting a resume as a Distressed Securities Trader requires a keen understanding of both the financial sector and the specific skills that set you apart in this niche market. However, many candidates fall into common pitfalls that can undermine their chances of landing an interview. Avoiding these mistakes can enhance the clarity and impact of your resume, ensuring it effectively showcases your qualifications and experience in the competitive field of distressed securities.

Vague Job Descriptions: Using generic language in job descriptions can make your experience seem less impactful. Be specific about your responsibilities and achievements, focusing on quantifiable results.

Ignoring Relevant Skills: Failing to highlight relevant skills such as financial analysis, risk management, and market research can lead to a missed opportunity. Tailor your skills section to emphasize those most pertinent to distressed securities trading.

Lack of Industry Terminology: Not incorporating industry-specific terminology can make your resume less compelling. Use appropriate jargon to demonstrate your familiarity with distressed assets and trading strategies.

Overly Lengthy Resume: Including every job you’ve ever had can dilute the focus. Keep your resume concise, ideally one page, emphasizing only the most relevant experiences and achievements.

Neglecting Education and Certifications: Omitting key educational qualifications or certifications, such as a CFA or relevant finance degree, can make your resume less competitive. Ensure this information is prominently displayed.

Poor Formatting: Using inconsistent fonts, sizes, or layout can detract from the professionalism of your resume. Stick to a clean, organized format that enhances readability.

Lack of Tailoring for Each Application: Submitting the same resume for every job can be detrimental. Tailor your resume for each specific position by aligning your experience with the job description.

Focusing Too Much on Responsibilities: Listing responsibilities without showcasing your achievements can weaken your resume. Highlight specific accomplishments and how they positively impacted your previous employers.

Conclusion

As a Distressed Securities Trader, you play a crucial role in identifying and capitalizing on investment opportunities in financially troubled companies. Your expertise in analyzing market trends, understanding complex financial instruments, and making swift trading decisions is essential for navigating this challenging landscape. Key skills include financial modeling, risk assessment, and a deep understanding of market psychology. Additionally, strong negotiation abilities and the capacity to work under pressure are vital for success in this fast-paced environment.

Given the competitive nature of this field, having a standout resume is imperative. Ensure your resume highlights your analytical skills, trading experience, and relevant accomplishments. Tailoring your resume to showcase your expertise in distressed securities will make you more attractive to potential employers.

To enhance your job application, consider utilizing available tools that can help you present your qualifications effectively. Explore resume templates that offer professional designs tailored for finance roles. You can also use the resume builder to create a polished document that reflects your unique skills and experiences. For inspiration, check out resume examples specific to distressed securities trading. Additionally, don’t forget the importance of a compelling introduction with a cover letter template that can set you apart from other candidates.

With the right tools and a strong focus on your unique qualifications, you can craft a resume that effectively communicates your value as a Distressed Securities Trader. Now is the perfect time to review and refine your resume to ensure you are ready to seize your next opportunity in this dynamic industry.