28 Skills to Include in Your 2025 Collections Specialist Resume with Examples

As a Collections Specialist, having the right skills is essential for effectively managing accounts receivable and ensuring timely payments. In this section, we will outline the top skills that can enhance your resume and demonstrate your value to potential employers. These skills not only contribute to successful debt collection but also foster positive relationships with clients, ultimately benefiting the organization as a whole.

Best Collections Specialist Technical Skills

In the field of collections, technical skills are crucial for effectively managing accounts, analyzing data, and communicating with clients. A Collections Specialist must be equipped with a variety of technical competencies to navigate complex financial systems and ensure timely recovery of debts. Highlighting these skills on your resume can significantly increase your chances of landing your desired position.

Data Entry

Data entry skills are essential for accurately inputting and updating customer account information and payment records. Precision in data entry can prevent errors that may lead to delayed collections.

How to show it: Emphasize your speed and accuracy by including metrics such as "Achieved 99% accuracy in data entry for over 500 accounts monthly." This quantifies your ability and demonstrates your attention to detail.

Accounts Receivable Management

Managing accounts receivable is a core responsibility, involving tracking outstanding invoices and ensuring timely payments. Proficiency in this area helps maintain cash flow for the organization.

How to show it: Highlight your experience by stating, "Reduced outstanding receivables by 30% within six months through effective follow-up strategies."

Debt Collection Software

Familiarity with debt collection software is vital for streamlining the collections process, automating reminders, and tracking account statuses. Knowledge of specific software can set you apart from other candidates.

How to show it: List specific software you are proficient in, such as "Utilized XYZ Collections software to manage over 1,000 accounts efficiently."

Communication Skills

Strong verbal and written communication skills are necessary for negotiating payment plans and resolving disputes with clients. Effective communication can lead to better customer relationships and higher recovery rates.

How to show it: Provide examples, such as "Successfully negotiated payment plans with clients, resulting in a 25% increase in collection rates."

Financial Analysis

Understanding financial statements and metrics enables a Collections Specialist to identify trends and make informed decisions regarding account management and collections strategies.

How to show it: Include achievements like "Analyzed financial reports to identify overdue accounts, leading to a 15% increase in collections."

Customer Relationship Management (CRM)

Experience with CRM systems is important for maintaining relationships with clients and tracking interactions. A solid CRM strategy can enhance customer satisfaction and retention rates.

How to show it: Describe your role, such as "Managed client relationships using ABC CRM to streamline communications and improve follow-ups."

Regulatory Compliance

Knowledge of debt collection regulations, such as the Fair Debt Collection Practices Act (FDCPA), ensures that all collection activities are conducted legally and ethically.

How to show it: State your compliance skills, for example, "Ensured 100% compliance with FDCPA regulations, resulting in zero legal disputes."

Problem-Solving Skills

Strong problem-solving abilities allow Collections Specialists to handle client objections and find solutions that benefit both the client and the company.

How to show it: Provide examples like "Resolved 95% of client disputes on first contact, enhancing overall customer satisfaction."

Negotiation Skills

Effective negotiation skills are essential for reaching favorable agreements with clients regarding payment terms and amounts, which can lead to quicker recovery of funds.

How to show it: Illustrate your success, such as "Negotiated settlements that recovered 40% of overdue debts within three months."

Time Management

Excellent time management skills ensure that all accounts are handled in a timely manner, preventing further delays in collection and improving overall efficiency.

How to show it: Quantify your efficiency, for example, "Managed a portfolio of 300 accounts with an average follow-up time of less than 24 hours."

Microsoft Excel Proficiency

Proficiency in Microsoft Excel is crucial for tracking accounts, creating reports, and analyzing data trends. Excel skills can enhance your ability to organize and interpret financial information.

How to show it: Mention specific accomplishments, such as "Created Excel spreadsheets to track collections progress, improving reporting efficiency by 20%."

To explore more about essential technical skills, visit the Technical Skills page.</p

Best Collections Specialist Soft Skills

In the role of a Collections Specialist, soft skills are essential for navigating the complexities of debt collection while maintaining positive client relationships. These skills help professionals communicate effectively, resolve issues, and manage their time efficiently, all of which contribute to successful collections outcomes.

Effective Communication

Effective communication is vital for conveying information clearly and persuasively to clients regarding their debts. It fosters understanding and promotes a positive dialogue.

How to show it: Highlight instances where you successfully resolved disputes through clear communication. Use specific examples of how your communication skills led to improved collections or strengthened relationships.

Empathy

Empathy allows Collections Specialists to understand and relate to clients' situations, which can lead to more productive conversations and better payment arrangements.

How to show it: Provide examples of how your empathetic approach resulted in successful negotiations or positive feedback from clients, emphasizing any measurable outcomes.

Problem-Solving

Strong problem-solving skills enable Collections Specialists to identify issues quickly and develop effective strategies to overcome obstacles in the debt recovery process.

How to show it: Demonstrate your problem-solving abilities by sharing specific challenges you faced and the creative solutions you implemented to achieve successful collections.

Time Management

Time management is crucial in collections, as it allows specialists to prioritize tasks and manage their workload efficiently to meet deadlines.

How to show it: Illustrate your time management skills by detailing how you organized your daily responsibilities and achieved or exceeded collection targets within set timeframes.

Negotiation Skills

Negotiation skills help Collections Specialists reach agreements that are acceptable to both parties, often resulting in higher recovery rates.

How to show it: Provide specific examples of successful negotiations, including the percentage of debts collected or payment plans established as a result of your efforts.

Attention to Detail

Attention to detail is necessary for accurately tracking payments, understanding client accounts, and avoiding errors in documentation and communication.

How to show it: Showcase your attention to detail by mentioning any processes you improved or errors you eliminated, along with the resulting impact on collections efficiency.

Resilience

Resilience allows Collections Specialists to handle rejection and setbacks positively, maintaining motivation and a focus on achieving their goals.

How to show it: Share experiences where your resilience led to eventual success in collections despite initial challenges, highlighting how you maintained persistence.

Teamwork

Teamwork is important for collaborating with other departments to resolve issues and optimize the collections process.

How to show it: Highlight any collaborative projects you've been involved in that improved collections strategies or outcomes, detailing your role and the results achieved.

Adaptability

Adaptability is essential in a dynamic collections environment, where regulations and client circumstances can change rapidly.

How to show it: Provide examples of how you adapted to changes in regulations, technology, or client needs, and how this adaptability benefited your collections efforts.

Conflict Resolution

Conflict resolution skills help Collections Specialists manage and resolve disputes effectively, maintaining professional relationships while achieving collection goals.

How to show it: Describe specific situations where you successfully resolved conflicts with clients or team members, and the positive outcomes that resulted from your actions.

Customer Service Orientation

A strong customer service orientation ensures that Collections Specialists treat clients with respect and understanding, fostering loyalty and cooperation.

How to show it: Include examples of how your customer service approach led to positive client interactions, improved recovery rates, or enhanced client satisfaction.

For further insights on enhancing your professional profile, explore our resources on Soft Skills, Communication, Problem-solving, Time Management, and Teamwork.

Best Collections Specialist Technical Skills

In the role of a Collections Specialist, possessing strong technical skills is crucial for effectively managing accounts, communicating with clients, and ensuring timely collection of debts. These skills not only enhance efficiency but also contribute to achieving targets and maintaining positive relationships with customers. Below are some essential technical skills for a Collections Specialist, along with tips on how to showcase them on your resume.

Debt Recovery Strategies

Understanding various debt recovery strategies helps in effectively negotiating payment plans and resolving outstanding debts.

How to show it: Highlight specific strategies you implemented that improved recovery rates, and quantify the results (e.g., "Increased recovery rate by 20% through personalized payment plans").

CRM Software Proficiency

Proficiency in Customer Relationship Management (CRM) software is essential for managing customer interactions and tracking collections progress.

How to show it: List the CRM software you are experienced with, and mention how you utilized it to enhance customer tracking and follow-ups (e.g., "Utilized Salesforce to manage over 500 client accounts").

Financial Reporting Skills

Ability to generate and analyze financial reports is vital for assessing the effectiveness of collection efforts and informing decision-making.

How to show it: Provide examples of reports you generated and how they contributed to improved collection strategies (e.g., "Created monthly reports that identified trends leading to a 15% reduction in overdue accounts").

Negotiation Skills

Strong negotiation skills enable collections specialists to reach mutually beneficial agreements with clients while ensuring the company's interests are protected.

How to show it: Detail instances where your negotiation skills resulted in successful debt recoveries (e.g., "Successfully negotiated payment terms with 30% of clients, improving cash flow by $50,000").

Data Entry and Management

Accurate data entry and management are critical for maintaining up-to-date records of accounts and transactions.

How to show it: Emphasize your attention to detail in data management, and quantify your efficiency (e.g., "Achieved 99% accuracy in data entry for over 1,000 accounts").

Regulatory Knowledge

Familiarity with relevant laws and regulations regarding collections helps ensure compliance and protect the organization from legal issues.

How to show it: Discuss your knowledge of specific regulations (e.g., Fair Debt Collection Practices Act) and how it guided your collection practices (e.g., "Implemented practices that ensured compliance with FDCPA, reducing legal complaints to zero").

How to List Collections Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to potential employers. By strategically highlighting your abilities, you can provide hiring managers with a quick overview of your qualifications. There are three main sections where your skills can be showcased: the Resume Introduction, Work Experience, and Skills Section.

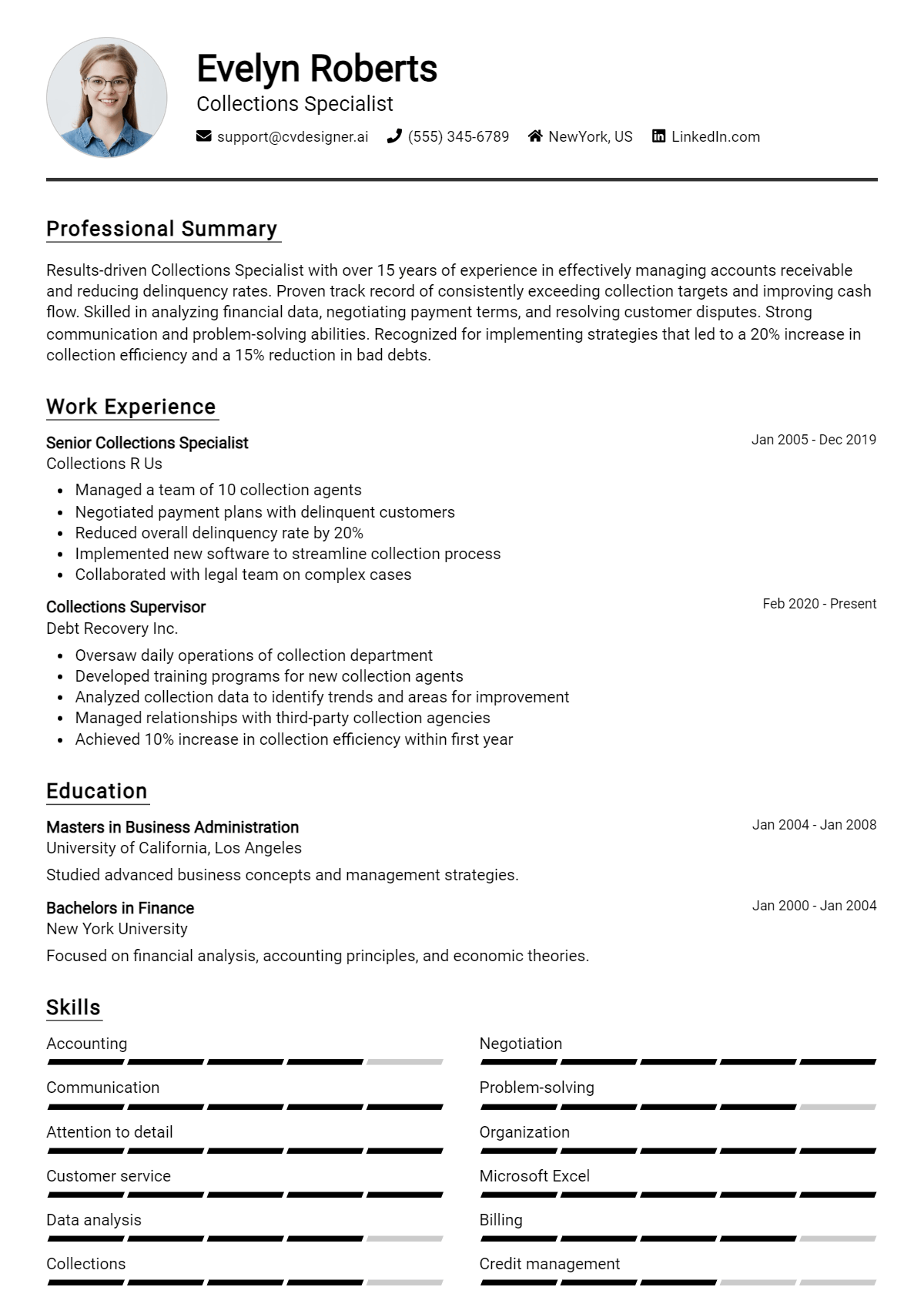

for Summary

Showcasing your Collections Specialist skills in the introduction (objective or summary) section is valuable as it offers hiring managers a snapshot of your qualifications right from the start.

Example

Results-driven Collections Specialist with expertise in debt recovery and customer communication. Proven track record of achieving collection goals while maintaining high customer satisfaction.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Collections Specialist skills have been applied in real-world scenarios.

Example

- Successfully negotiated payment plans with clients, resulting in a 30% increase in collections.

- Utilized CRM software to track and manage outstanding debts efficiently.

- Developed effective communication strategies to educate clients on their payment options.

- Collaborated with the legal department to initiate collection actions for delinquent accounts.

for Skills

The skills section can either showcase technical or transferable skills. Including a balanced mix of hard and soft skills will strengthen your overall qualifications.

Example

- Debt Recovery

- Negotiation Skills

- Customer Relationship Management (CRM)

- Data Analysis

- Time Management

- Effective Communication

- Problem Solving

- Attention to Detail

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resumes and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how those skills have positively impacted your previous roles.

Example

In my previous role as a Collections Specialist, my strong negotiation skills and ability to build customer relationships led to a significant reduction in outstanding debts by 25%. I am eager to leverage these skills to contribute to your team and achieve similar results.

Make sure to link the skills mentioned in your resume to specific achievements in your cover letter, reinforcing your qualifications for the job. For more information on how to effectively list your skills and showcase your work experience, explore the provided resources.

The Importance of Collections Specialist Resume Skills

Highlighting relevant skills on a Collections Specialist resume is crucial for candidates looking to make an impression on recruiters. A well-crafted skills section not only showcases your abilities but also aligns your qualifications with the specific job requirements. This alignment increases the chances of your resume being noticed and considered for further evaluation, setting you apart from other candidates.

- Demonstrates Expertise: A strong skills section reflects your expertise in various areas such as negotiation, customer service, and financial analysis, illustrating your capability to handle collections effectively.

- Aligns with Job Requirements: By tailoring your skills to match the job description, you show recruiters that you understand the role's demands and possess the necessary qualifications to succeed.

- Enhances Keyword Optimization: Many employers use applicant tracking systems (ATS) to filter resumes. Including relevant skills increases your chances of passing through these systems and getting noticed by hiring managers.

- Showcases Transferable Skills: Collections Specialists often possess transferable skills such as communication and problem-solving. Highlighting these skills can demonstrate your versatility and adaptability in various situations.

- Builds Confidence: A well-defined skills section not only enhances your resume but also boosts your confidence in interviews, as you will be prepared to discuss your strengths and how they can benefit the company.

- Reflects Professional Development: Listing skills can indicate your commitment to professional development, especially if you include any relevant certifications or training that you have completed.

- Facilitates Discussion Points: Skills highlighted in your resume can serve as conversation starters during interviews, allowing you to elaborate on your experiences and how they relate to the position.

- Improves Overall Presentation: A focused skills section contributes to the overall organization and readability of your resume, making it easier for recruiters to quickly identify your qualifications.

For more information on crafting a resume, you can visit what is resume.

How To Improve Collections Specialist Resume Skills

In the dynamic field of collections, continuously improving your skills is essential for success. As a Collections Specialist, you are responsible for managing accounts, communicating with clients, and ensuring timely payments. Enhancing your skill set not only increases your effectiveness in these tasks but also makes you a more attractive candidate to potential employers. Here are some actionable tips to help you improve your skills and enhance your resume:

- Attend workshops and training sessions focused on negotiation and communication skills.

- Familiarize yourself with the latest collection software and tools to streamline your workflow.

- Practice active listening techniques to better understand clients' needs and concerns.

- Stay updated on relevant laws and regulations regarding debt collection to ensure compliance.

- Develop strong analytical skills by reviewing and interpreting financial data effectively.

- Enhance your customer service skills to maintain positive relationships with clients during the collection process.

- Join professional organizations related to collections to network and learn from industry experts.

Frequently Asked Questions

What key skills should a Collections Specialist include on their resume?

A Collections Specialist should highlight skills such as strong communication, negotiation abilities, problem-solving skills, and attention to detail. Proficiency in accounting software and databases, as well as knowledge of relevant laws and regulations related to debt collection, are also essential. Additionally, showcasing organizational skills and the ability to handle stressful situations can make a resume stand out.

How important is experience in customer service for a Collections Specialist?

Experience in customer service is very important for a Collections Specialist, as it equips them with the skills to handle client interactions effectively. This includes the ability to empathize with customers while remaining firm in negotiations and managing collections. Strong customer service skills can help in building rapport, which can lead to more successful resolution of outstanding debts.

Should a Collections Specialist highlight technical skills on their resume?

Yes, it is crucial for a Collections Specialist to highlight technical skills on their resume. Familiarity with collection software, CRM systems, and data entry processes are valuable in today’s digital environment. Demonstrating proficiency in Microsoft Excel and other data analysis tools can also show potential employers that you can efficiently manage and analyze account information.

What soft skills are valuable for a Collections Specialist?

Soft skills are incredibly valuable for a Collections Specialist. Key soft skills include effective communication, empathy, patience, and resilience. The ability to remain calm and professional under pressure, as well as strong interpersonal skills, will help facilitate difficult conversations with clients. Additionally, a Collections Specialist should possess a keen sense of ethical judgment to navigate sensitive situations appropriately.

How can a Collections Specialist demonstrate their problem-solving skills on a resume?

A Collections Specialist can demonstrate their problem-solving skills on a resume by providing specific examples of challenges they’ve faced and the strategies they employed to overcome them. For instance, mentioning instances where creative solutions led to successful debt recovery or improved payment plans can showcase their ability to think critically and act decisively. Quantifying results, such as the percentage of successful collections, can further strengthen these claims.

Conclusion

Including Collections Specialist skills on your resume is crucial in demonstrating your expertise and suitability for the role. By showcasing relevant skills, you not only highlight your qualifications but also set yourself apart from other candidates, providing tangible value to potential employers. As you prepare your application, take the time to refine and emphasize these skills to enhance your chances of landing the job you desire. Remember, every step you take towards improving your resume is a step closer to your career goals!

For additional resources, explore our resume templates, utilize our resume builder, check out resume examples, and craft the perfect application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.