Collections Specialist Core Responsibilities

A Collections Specialist is vital in managing and recovering overdue accounts, requiring strong communication, negotiation, and analytical skills. This role serves as a link between finance, customer service, and sales departments, ensuring that financial goals align with customer relations. Technical proficiency in collections software and data analysis, coupled with operational efficiency and problem-solving capabilities, are essential to identify issues and implement solutions effectively. A well-structured resume that highlights these qualifications can significantly enhance career prospects and support organizational success.

Common Responsibilities Listed on Collections Specialist Resume

- Contacting customers to collect overdue payments and resolve billing issues.

- Maintaining accurate records of accounts and payment history.

- Negotiating payment plans with customers to facilitate debt recovery.

- Analyzing account data to assess credit risk and develop collection strategies.

- Collaborating with sales and customer service teams to address customer concerns.

- Preparing reports on collection activities and account statuses.

- Monitoring and following up on payment commitments.

- Ensuring compliance with debt collection laws and company policies.

- Utilizing collections software to manage accounts and track progress.

- Identifying trends in payment behaviors for strategic planning.

- Providing exceptional customer service while collecting debts.

- Training and mentoring junior staff in collections practices.

High-Level Resume Tips for Collections Specialist Professionals

In the competitive field of collections, a well-crafted resume serves as your first and often only chance to make a lasting impression on potential employers. As a Collections Specialist, your resume must effectively showcase not just your skills but also your achievements in managing accounts, negotiating payments, and maintaining client relationships. A standout resume can differentiate you from other candidates, reflecting your qualifications and readiness to handle the complexities of debt recovery. This guide will provide practical and actionable resume tips specifically tailored for Collections Specialist professionals, equipping you with the tools to create a compelling document that opens doors to new opportunities.

Top Resume Tips for Collections Specialist Professionals

- Tailor your resume to the job description by including keywords and phrases that match the specific requirements of the role.

- Showcase relevant experience by detailing previous positions in collections or related fields, emphasizing your responsibilities and successes.

- Quantify your achievements with metrics, such as the percentage of accounts collected, reduction in overdue accounts, or improvements in payment turnaround time.

- Highlight industry-specific skills, such as knowledge of debt collection laws, customer service excellence, and proficiency with collections software.

- Include a strong summary or objective statement that clearly articulates your career goals and what you bring to the position.

- Utilize bullet points for clarity and conciseness, making your accomplishments easily scannable for hiring managers.

- Incorporate any relevant certifications, such as the Certified Collections Professional (CCP) designation, to enhance your qualifications.

- Demonstrate your soft skills, such as negotiation, communication, and problem-solving abilities, which are crucial for success in collections.

- Keep your formatting consistent and professional, ensuring your resume is easy to read and visually appealing.

By implementing these tips, you can significantly increase your chances of landing a job in the Collections Specialist field. A well-structured and targeted resume will not only highlight your qualifications but also convey your professionalism and dedication to potential employers, setting you on the path to success in your career.

Why Resume Headlines & Titles are Important for Collections Specialist

In the competitive field of collections, a candidate's resume must stand out, and one of the most effective ways to achieve this is through impactful resume headlines and titles. For a Collections Specialist, a strong headline serves as a powerful introduction that can immediately grab the attention of hiring managers. It succinctly summarizes a candidate's key qualifications and aligns them with the specific requirements of the job being applied for. A well-crafted headline should be concise, relevant, and directly related to the collections role, allowing candidates to showcase their unique value proposition right from the start.

Best Practices for Crafting Resume Headlines for Collections Specialist

- Keep it concise: Aim for one impactful phrase that captures your expertise.

- Be role-specific: Tailor the headline to reflect specific skills and experiences related to collections.

- Highlight key achievements: Incorporate metrics or accomplishments that demonstrate your success in previous roles.

- Use industry keywords: Include relevant terminology that hiring managers are likely to search for.

- Showcase your value: Focus on what you can bring to the organization rather than just your job title.

- Make it engaging: Use active language that conveys enthusiasm and professionalism.

- Consider your audience: Tailor the language and tone to align with the company's culture and values.

- Avoid clichés: Stay away from overused phrases that don’t provide any real insight into your qualifications.

Example Resume Headlines for Collections Specialist

Strong Resume Headlines

"Results-Driven Collections Specialist with 5+ Years of Experience in Reducing Delinquency Rates by 30%"

“Proactive Collections Expert Specializing in Negotiation and Conflict Resolution”

“Detail-Oriented Collections Professional with Proven Track Record of Exceeding Collections Targets”

Weak Resume Headlines

“Collections Specialist”

“Experienced in Finance”

Strong headlines are effective because they immediately convey the candidate's specialized skills and achievements, making it easy for hiring managers to recognize their potential value to the organization. In contrast, weak headlines fail to impress because they lack specificity and do not highlight any unique strengths or relevant experiences, making it difficult for candidates to differentiate themselves from others in a competitive job market.

Writing an Exceptional Collections Specialist Resume Summary

Writing a compelling resume summary is crucial for a Collections Specialist as it serves as the first impression for hiring managers. A well-crafted summary effectively highlights key skills, relevant experience, and notable accomplishments, allowing candidates to quickly demonstrate their fit for the role. Given the competitive nature of the job market, a strong summary should be concise yet impactful, tailored specifically to the job description, and designed to capture the attention of hiring managers within seconds.

Best Practices for Writing a Collections Specialist Resume Summary

- Quantify Achievements: Use numbers to demonstrate your impact, such as the percentage of accounts collected or the total amount recovered.

- Focus on Relevant Skills: Highlight specific skills like negotiation, communication, and financial analysis that are essential for the role.

- Tailor to Job Description: Customize your summary to align with the requirements and responsibilities listed in the job posting.

- Keep It Concise: Aim for 2-4 sentences that deliver maximum information without overwhelming the reader.

- Highlight Industry Experience: Mention years of experience in collections or finance to establish credibility.

- Include Soft Skills: Emphasize interpersonal skills such as empathy and conflict resolution, which are vital in collections.

- Showcase Problem-Solving Abilities: Mention instances where you successfully resolved disputes or improved collection processes.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and dynamism.

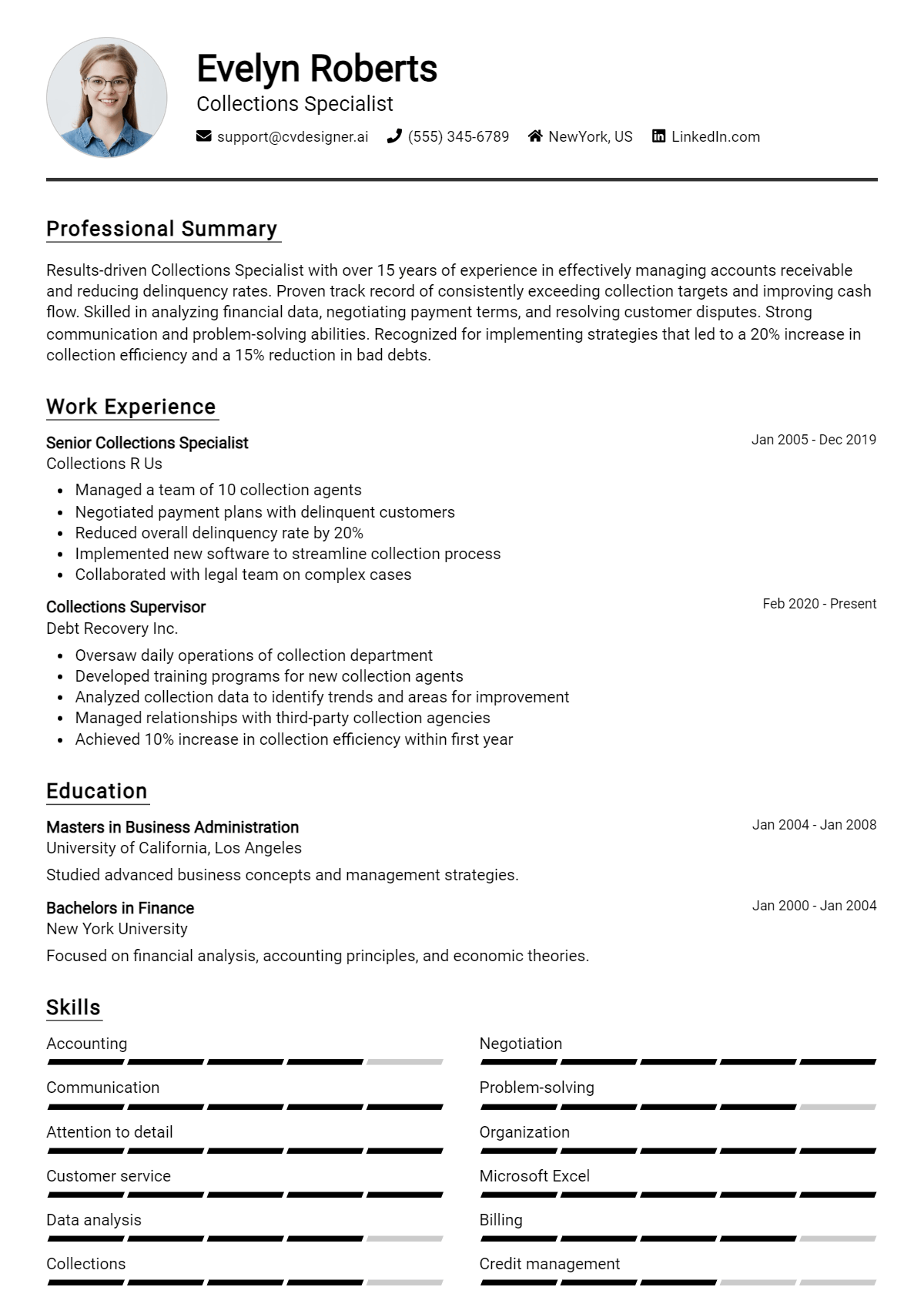

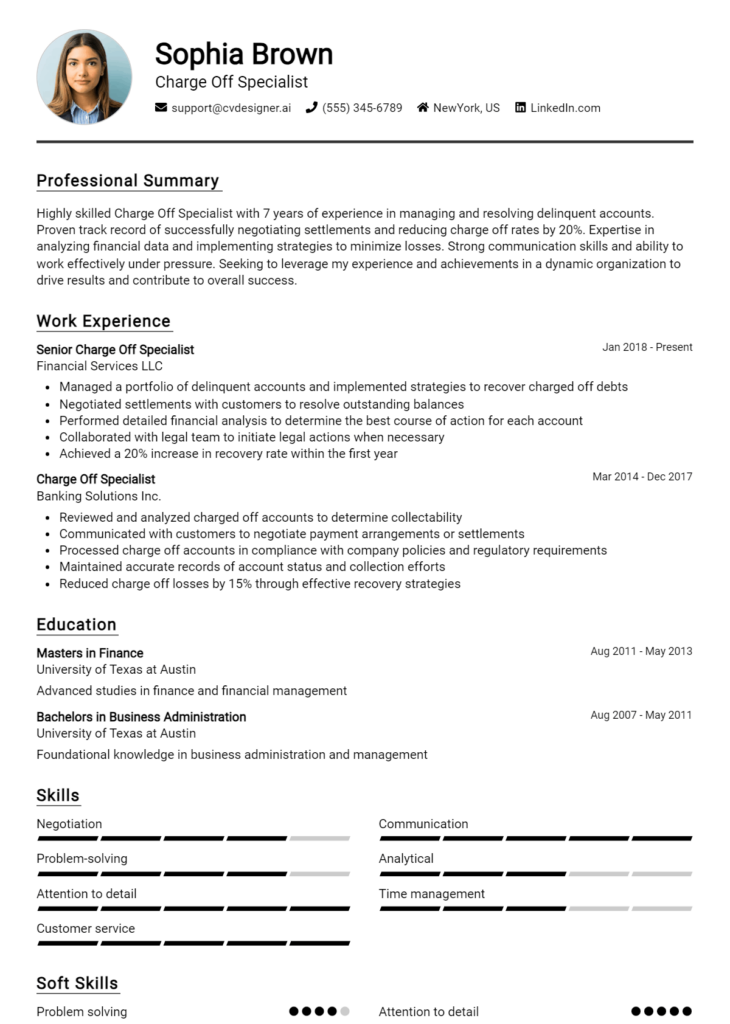

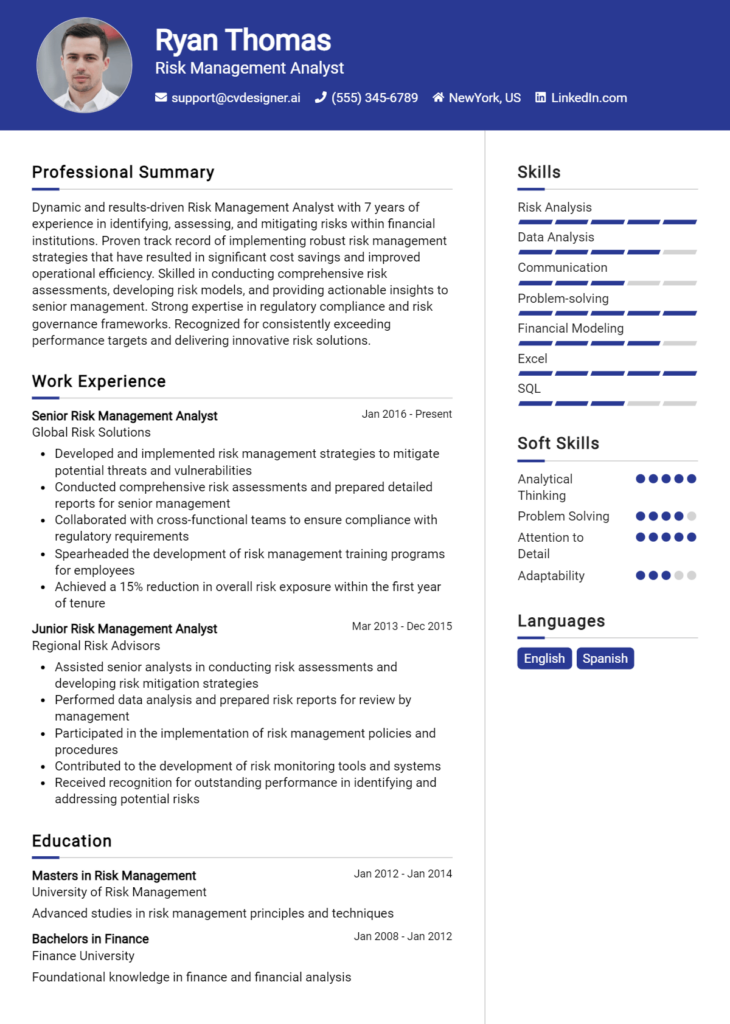

Example Collections Specialist Resume Summaries

Strong Resume Summaries

Results-driven Collections Specialist with over 5 years of experience in recovering delinquent accounts, achieving a 95% success rate in collections, and recovering over $2 million in outstanding debt. Skilled in negotiation and conflict resolution, with a proven ability to maintain positive client relationships while driving results.

Dedicated Collections Specialist with a track record of reducing overdue accounts by 30% through targeted outreach and effective communication strategies. Expertise in utilizing advanced financial software and analytics to streamline collection processes, ensuring compliance with industry regulations.

Proactive Collections Specialist with 4 years of experience in B2B collections, recognized for exceeding monthly collection goals by an average of 20%. Strong analytical skills coupled with a customer-centric approach, leading to improved customer satisfaction and retention.

Weak Resume Summaries

Collections Specialist with experience in the field. Good at talking to people and solving problems.

I have worked in collections and am familiar with the necessary duties. I am a reliable worker.

The strong resume summaries are considered effective because they provide specific achievements and quantifiable results, showcasing the candidate's direct relevance to the role. They use action-oriented language and highlight key skills, making a compelling case for the candidate's candidacy. In contrast, the weak summaries lack detail, specificity, and quantifiable outcomes, making them generic and unremarkable, which fails to capture the attention of hiring managers.

Work Experience Section for Collections Specialist Resume

The work experience section of a Collections Specialist resume is crucial as it effectively illustrates a candidate's journey and capabilities in the collections field. This section not only highlights technical skills related to debt recovery and negotiation but also showcases the ability to manage teams and deliver high-quality results. Employers look for quantifiable achievements that demonstrate the candidate's impact on previous organizations, making it essential to align experience with industry standards and metrics. By presenting clear, measurable outcomes, candidates can differentiate themselves in a competitive job market.

Best Practices for Collections Specialist Work Experience

- Highlight relevant technical skills, such as proficiency in collections software and CRM systems.

- Quantify achievements by including specific metrics, such as percentage of debts collected or reduction in delinquency rates.

- Demonstrate collaborative efforts by mentioning teamwork or cross-departmental projects that enhanced collections processes.

- Use action verbs to convey a sense of initiative and impact in previous roles.

- Tailor experiences to align with the job description, emphasizing the most relevant roles and accomplishments.

- Include any leadership roles or responsibilities that showcase ability to manage and mentor teams effectively.

- Showcase problem-solving skills by providing examples of challenges faced and solutions implemented.

- Keep descriptions concise and focused, avoiding jargon that may dilute the impact of the experience.

Example Work Experiences for Collections Specialist

Strong Experiences

- Successfully increased collections by 25% year-over-year by implementing a new follow-up strategy that improved customer engagement and payment rates.

- Led a team of five in a project that reduced account delinquency by 30%, utilizing data analysis to identify and target high-risk accounts.

- Developed and executed a training program for new hires, resulting in a 40% faster onboarding process and improved team performance metrics.

- Collaborated with the finance department to streamline the invoicing process, reducing errors by 15% and accelerating cash flow.

Weak Experiences

- Responsible for collections and managed accounts.

- Worked with a team to handle customer inquiries.

- Participated in meetings about collections strategies.

- Helped improve some processes in the department.

The examples provided highlight the difference between strong and weak experiences based on their specificity and impact. Strong experiences are distinguished by quantifiable results, clear leadership roles, and collaborative efforts that illustrate a candidate's value. In contrast, weak experiences lack detail and measurable outcomes, rendering them less compelling to potential employers. By focusing on tangible achievements and demonstrating technical expertise, candidates can effectively convey their qualifications for a Collections Specialist role.

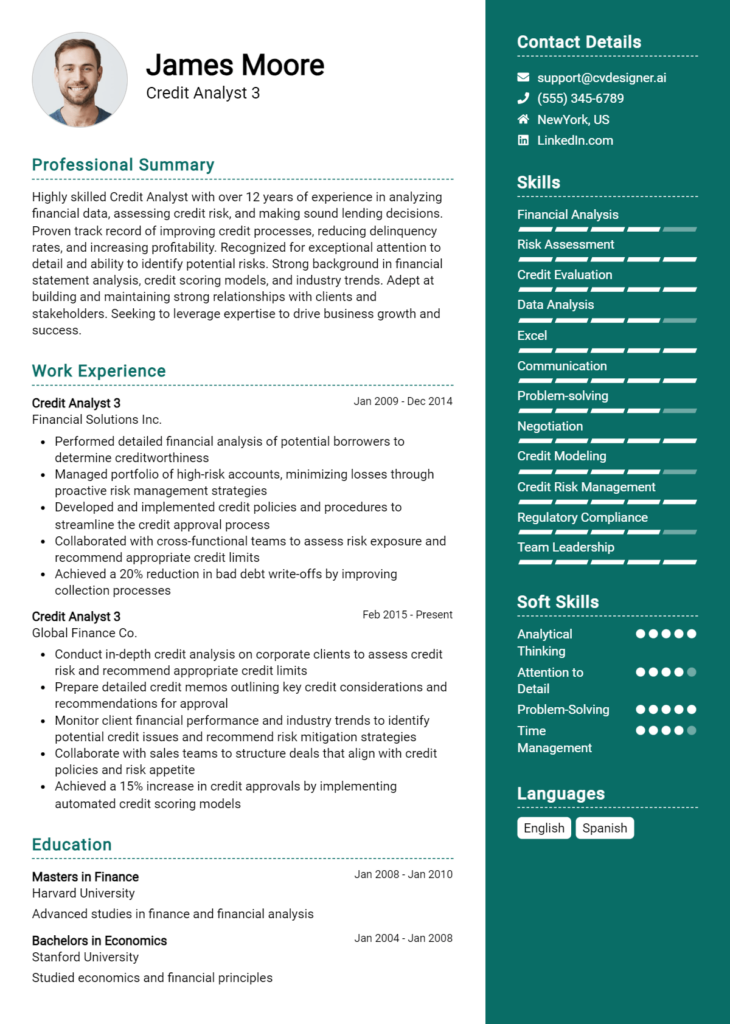

Education and Certifications Section for Collections Specialist Resume

The education and certifications section of a Collections Specialist resume is crucial as it provides potential employers with insights into the candidate's academic background and relevant training. This section not only highlights the formal education that equips candidates with essential skills but also showcases industry-specific certifications that demonstrate a commitment to continuous learning and professional development. By including relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and align themselves more closely with the demands of the job role.

Best Practices for Collections Specialist Education and Certifications

- Prioritize relevance: Focus on degrees and certifications directly related to finance, accounting, or collections.

- Be specific: Include detailed information about your degree, such as the major and institution.

- Highlight advanced credentials: If applicable, emphasize advanced certifications like Certified Collections Specialist (CCS) or similar.

- Include relevant coursework: Mention specific courses that are applicable to collections, such as credit management or consumer protection laws.

- Show continuous learning: List any ongoing education or training programs that enhance your skills in collections.

- Format consistently: Use a clear and professional format for presenting your educational background and certifications.

- Use dates effectively: Include graduation dates and certification completion dates to show the recency of your education and training.

- Consider online courses: Include relevant online certifications from recognized platforms to showcase adaptability and commitment to learning.

Example Education and Certifications for Collections Specialist

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2021

- Certified Collections Specialist (CCS), National Association of Credit Management, Earned June 2022

- Coursework: Consumer Credit and Collections Management, Risk and Credit Analysis

- Certification in Negotiation Techniques, Online Learning Platform, Completed August 2023

Weak Examples

- Associate Degree in General Studies, Community College of ABC, Graduated May 2010

- Certification in Basic Computer Skills, Local Community Center, Completed January 2018

- Bachelor of Arts in English Literature, University of DEF, Graduated June 2019

- High School Diploma, High School of GHI, Graduated May 2007

The examples provided are considered strong because they directly relate to the collections field, demonstrating both relevant educational background and specialized training that aligns with the job requirements. In contrast, the weak examples reflect degrees and certifications that lack relevance to the collections role, suggesting a misalignment with the necessary skills and knowledge for a Collections Specialist position. Candidates should strive to present educational qualifications that directly contribute to their ability to perform in the role effectively.

Top Skills & Keywords for Collections Specialist Resume

A well-crafted resume for a Collections Specialist position is crucial for standing out in a competitive job market. The skills you highlight not only demonstrate your qualifications but also reflect your ability to effectively manage accounts, communicate with clients, and resolve disputes. Potential employers look for specific skills that indicate a candidate's capability to handle collections tasks, maintain positive relationships with clients, and contribute to the financial health of the organization. By focusing on both hard and soft skills, you can present a comprehensive picture of your expertise and enhance your chances of landing an interview.

Top Hard & Soft Skills for Collections Specialist

Soft Skills

- Excellent communication skills

- Strong negotiation abilities

- Customer service orientation

- Active listening skills

- Problem-solving aptitude

- Empathy and patience

- Time management and organizational skills

- Attention to detail

- Adaptability and flexibility

- Teamwork and collaboration

Hard Skills

- Knowledge of collection laws and regulations

- Proficiency in accounting software

- Data entry and database management

- Familiarity with credit reporting practices

- Experience in handling payment processing

- Ability to analyze financial statements

- Proficient in Microsoft Office Suite (Excel, Word, Outlook)

- Understanding of debt recovery strategies

- Skills in using collection management systems

- Knowledge of dispute resolution techniques

By incorporating these skills into your resume, you can effectively showcase your qualifications as a Collections Specialist. Additionally, providing detailed examples of your work experience will further solidify your expertise in the field.

Stand Out with a Winning Collections Specialist Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Collections Specialist position at [Company Name] as advertised on [Job Posting Source]. With over [X years] of experience in accounts receivable and collections, I have honed my skills in managing overdue accounts while maintaining positive relationships with clients. I am excited about the opportunity to contribute my expertise in effective debt recovery strategies and customer service excellence to your team.

In my previous role at [Previous Company Name], I successfully reduced outstanding receivables by [X%] through proactive follow-up and negotiation techniques. I developed tailored payment plans that accommodated clients’ needs while ensuring timely collections, which resulted in improved cash flow for the company. My attention to detail and analytical skills allow me to identify trends in payment behaviors, enabling me to implement solutions that not only resolve current issues but also prevent future delinquencies.

I am particularly drawn to [Company Name] because of its commitment to fostering long-term client relationships and its innovative approach to collections. I believe that my ability to communicate effectively, coupled with my proficiency in [relevant software or tools], will allow me to contribute positively to your team. I am eager to bring my background in collections and customer service to [Company Name] and help maintain the company’s reputation for excellence.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am excited about the possibility of contributing to [Company Name] and am available for an interview at your earliest convenience.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Collections Specialist Resume

When crafting a resume for the role of a Collections Specialist, it's essential to present your qualifications and experiences in a clear and compelling manner. However, many candidates inadvertently make mistakes that can hinder their chances of landing an interview. By being aware of these common pitfalls, you can create a more effective resume that highlights your skills and suitability for the position.

Vague Job Descriptions: Using generic phrases like "responsible for collections" without specifying achievements or metrics can make your resume blend into the background.

Ignoring Relevant Skills: Failing to highlight specific skills such as negotiation, communication, and financial analysis can leave hiring managers questioning your fit for the role.

Overloading with Jargon: While industry-specific terminology is important, overusing jargon can confuse or alienate readers who may not be familiar with every term.

Omitting Quantifiable Achievements: Not including concrete results (e.g., "reduced delinquency rates by 20%") makes it difficult to demonstrate your impact in previous roles.

Neglecting Formatting: A cluttered or poorly organized layout can detract from your qualifications; using clear headings and bullet points enhances readability.

Lack of Tailoring: Submitting a one-size-fits-all resume without customizing it for the specific job can signal a lack of genuine interest in the position.

Failure to Proofread: Spelling and grammatical errors can undermine your professionalism; always proofread to ensure a polished final product.

Excessive Length: A resume that is too lengthy can overwhelm hiring managers; aim for concise, relevant information that fits within one to two pages.

Conclusion

As a Collections Specialist, your role is crucial in managing accounts receivable, ensuring timely payments, and maintaining positive relationships with clients. Key responsibilities include tracking outstanding invoices, communicating with customers regarding their accounts, negotiating payment plans, and collaborating with other departments to resolve issues. Strong analytical skills, attention to detail, and effective communication are essential attributes for success in this position.

In reviewing your resume for a Collections Specialist role, it's important to highlight relevant experience, showcase your problem-solving abilities, and demonstrate your proficiency with collection software and tools. Tailoring your resume to align with the specific job requirements can significantly enhance your chances of landing an interview.

Now is the perfect time to ensure your resume stands out! Take advantage of the wealth of resources available to you. Explore resume templates to find the perfect format, use the resume builder to create a polished document, and check out resume examples for inspiration. Don’t forget to utilize cover letter templates to complement your application. Revise your Collections Specialist resume today and take the next step towards advancing your career!