26 Collections Manager Skills for Your Resume: List Examples

As a Collections Manager, having the right skills is crucial for effectively overseeing the collections process and ensuring that accounts receivable are managed efficiently. This role requires a blend of analytical abilities, leadership qualities, and interpersonal skills to navigate the complexities of debt recovery while maintaining positive relationships with clients. In the following section, we will outline the top skills that can enhance your resume and help you stand out in this competitive field.

Best Collections Manager Technical Skills

In the role of a Collections Manager, possessing the right technical skills is crucial for effective debt recovery, team management, and financial reporting. These skills not only enhance operational efficiency but also contribute to maintaining positive relationships with clients and stakeholders. Below are some essential technical skills that can elevate a candidate's resume and showcase their capability in managing collections effectively.

Debt Recovery Strategies

Understanding various debt recovery strategies is vital for a Collections Manager. This skill helps in tailoring approaches based on debtor behavior and the type of debt.

How to show it: Include specific strategies you implemented that resulted in improved recovery rates, such as increasing recovery by 20% through a personalized follow-up system.

Data Analysis and Reporting

Proficiency in data analysis allows Collections Managers to assess collections performance and identify trends. This skill aids in making informed decisions.

How to show it: Demonstrate your ability by mentioning the use of data analysis tools and how it led to actionable insights, for example, improved collections efficiency by 30% through data-driven strategies.

CRM Software Proficiency

Familiarity with Customer Relationship Management (CRM) software is essential for tracking interactions and managing accounts effectively.

How to show it: State the specific CRM systems you have used and outline how effectively you managed customer accounts, such as reducing response time by 15% using CRM tools.

Regulatory Compliance Knowledge

Understanding the legal and regulatory frameworks surrounding collections is critical to ensure compliance and avoid legal issues.

How to show it: Highlight your knowledge of regulations such as the Fair Debt Collection Practices Act (FDCPA) and provide examples of how you ensured compliance in your previous roles.

Negotiation Skills

Strong negotiation skills are essential for resolving disputes and reaching agreements with debtors effectively.

How to show it: Quantify your success in negotiations by providing examples, such as successfully negotiating settlements that led to a 25% reduction in write-offs.

Financial Acumen

A solid understanding of financial principles helps in making sound decisions regarding collections and financial reporting.

How to show it: Demonstrate your financial acumen by mentioning how your financial strategies contributed to overall revenue growth, such as increasing annual revenue recovery by 15%.

Team Leadership

Effective team leadership fosters a positive work environment and improves team performance in collections.

How to show it: Illustrate your leadership experience by mentioning team size and results, such as leading a team that achieved the highest recovery rate in the company.

Customer Service Skills

Excellent customer service skills help in maintaining good relationships with clients while ensuring effective collections.

How to show it: Highlight how your approach to customer service improved client satisfaction scores, like achieving a 95% satisfaction rate in post-collection surveys.

Time Management

Strong time management skills enable Collections Managers to prioritize tasks and meet deadlines efficiently.

How to show it: Provide examples of how your time management led to improved productivity, such as handling 50% more cases within the same timeframe.

Conflict Resolution

Proficient conflict resolution skills are essential for addressing disputes and maintaining a positive working relationship with debtors.

How to show it: Showcase your conflict resolution successes by citing specific instances where you resolved disputes, leading to a 40% decrease in escalated cases.

Technical Proficiency with Collection Tools

Familiarity with various collection tools and software enhances efficiency in managing accounts and tracking payments.

How to show it: List the collection tools you are proficient in and highlight how utilizing these tools improved your team's collection performance.

For more insights into enhancing your resume with relevant technical skills, refer to [Technical Skills](https://resumedesign.ai/technical-skills/).

Best Collections Manager Soft Skills

In the role of a Collections Manager, possessing strong soft skills is essential for effectively managing relationships with clients, negotiating payments, and leading a team. These skills not only enhance communication and problem-solving abilities but also contribute to successful collections strategies, fostering a positive work environment.

Communication

Effective communication is vital for a Collections Manager to convey messages clearly and persuasively, whether in writing or verbally. This skill helps in negotiating payment terms and resolving disputes.

How to show it: Demonstrate your communication skills by including specific instances where you successfully negotiated payment terms or resolved conflicts. Use metrics, such as the percentage of successful negotiations or improved client satisfaction ratings, to quantify your achievements.

Problem-solving

Collections Managers often face complex situations that require innovative solutions. Strong problem-solving skills enable them to navigate challenges effectively and find ways to collect outstanding debts.

How to show it: Highlight your problem-solving skills by providing examples of difficult collections cases you successfully managed. Include details about the strategies you implemented and the outcomes achieved, such as reduced delinquency rates or increased collection efficiency.

Time Management

Managing multiple accounts and deadlines requires excellent time management skills. A Collections Manager must prioritize tasks effectively to ensure timely follow-ups and collections.

How to show it: Showcase your time management abilities by discussing how you organized your workflow to meet deadlines. Quantify your results, such as the number of accounts managed simultaneously or improvements in collection timelines.

Teamwork

As a Collections Manager, collaborating with other departments, such as finance and customer service, is essential. Strong teamwork skills foster better communication and support across teams.

How to show it: Illustrate your teamwork skills by detailing collaborative projects or initiatives you led. Provide examples of how your teamwork contributed to achieving organizational goals, including any measurable outcomes.

Empathy

Empathy allows a Collections Manager to understand clients' situations and foster positive relationships. This skill is crucial for negotiating and maintaining goodwill while collecting debts.

How to show it: Demonstrate empathy by sharing instances where understanding a client’s circumstances led to successful resolutions. Highlight feedback from clients or teams that reflect your ability to connect on a personal level.

Negotiation

Negotiation skills are essential for achieving favorable outcomes in collections. A Collections Manager must balance assertiveness with diplomacy to encourage timely payments.

How to show it: Show your negotiation prowess by providing specific examples of agreements reached with clients. Include metrics such as improved payment timelines or percentages of accounts settled through negotiation.

Adaptability

The ability to adapt to changing circumstances is crucial in the dynamic environment of collections. Collections Managers must be flexible in their approaches to different clients and situations.

How to show it: Highlight your adaptability by discussing how you adjusted strategies in response to changes in market conditions or client behaviors. Provide measurable outcomes that demonstrate the success of your adaptive strategies.

Attention to Detail

Attention to detail is critical for identifying discrepancies in accounts and ensuring accurate records. A Collections Manager must maintain precision to avoid errors that could impact collections.

How to show it: Demonstrate attention to detail by mentioning instances where your thoroughness led to uncovering errors or improving record accuracy. Quantify improvements in processes or reductions in disputes as a result.

Conflict Resolution

Conflict resolution skills are necessary to manage disputes effectively and maintain professional relationships with clients while ensuring debts are collected.

How to show it: Provide examples of conflicts you resolved successfully, detailing the strategies you employed and the outcomes achieved. Include metrics that illustrate your effectiveness in handling disputes.

Leadership

Leadership skills are vital for guiding a team, motivating staff, and driving performance in collections. A strong leader inspires confidence and fosters a collaborative environment.

How to show it: Highlight your leadership experience by discussing initiatives you led and their impact on team performance. Quantify results such as improved team metrics or enhanced morale as a result of your leadership.

Customer Service Orientation

A customer service orientation helps Collections Managers approach clients with a mindset of service, building rapport and trust while negotiating collections.

How to show it: Demonstrate your customer service

Best Collections Manager Technical Skills

In the role of a Collections Manager, possessing strong technical skills is essential for effectively managing accounts, optimizing recovery strategies, and ensuring compliance with financial regulations. These skills not only enhance efficiency but also contribute to achieving the organization's financial goals. Below are some of the key technical skills that can set a Collections Manager apart.

Debt Collection Software Proficiency

Understanding and utilizing debt collection software is crucial for tracking accounts, automating communication, and managing payment plans efficiently.

How to show it: Highlight your experience with specific software platforms in your resume, mentioning any improvements in collection rates or reductions in processing time due to your proficiency.

Data Analysis Skills

Being adept at analyzing collection data helps in identifying trends, measuring performance, and making informed decisions to improve collection strategies.

How to show it: Include examples of how your data analysis led to actionable insights, such as increased recovery rates or decreased delinquencies, and quantify your results.

Regulatory Compliance Knowledge

A solid understanding of legal regulations governing debt collection ensures that operations comply with laws, mitigating risks and protecting the organization.

How to show it: Demonstrate your knowledge by mentioning specific regulations you comply with and any training or certifications you have obtained in this area.

Communication Skills

Strong verbal and written communication skills are vital for negotiating with clients, resolving disputes, and maintaining professional relationships.

How to show it: Provide examples of successful negotiations or conflict resolutions, and quantify improvements in client relationships or customer satisfaction ratings.

CRM System Management

Proficiency in customer relationship management (CRM) systems aids in maintaining organized records, tracking customer interactions, and improving follow-up processes.

How to show it: Detail your experience with CRM systems, including any enhancements you've made to data management processes that resulted in improved efficiency or customer satisfaction.

Financial Acumen

A strong grasp of financial principles enables Collections Managers to assess credit risks, evaluate payment plans, and make sound financial decisions.

How to show it: Discuss your financial analysis capabilities and any specific outcomes, such as decreased write-offs or improved cash flow, that directly resulted from your financial strategies.

How to List Collections Manager Skills on Your Resume

Effectively listing skills on your resume is crucial for standing out to employers in the competitive job market. A well-structured skills presentation can significantly enhance your chances of being noticed. There are three main sections where you can highlight your skills: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing Collections Manager skills in your introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This helps to immediately convey your expertise and value to the organization.

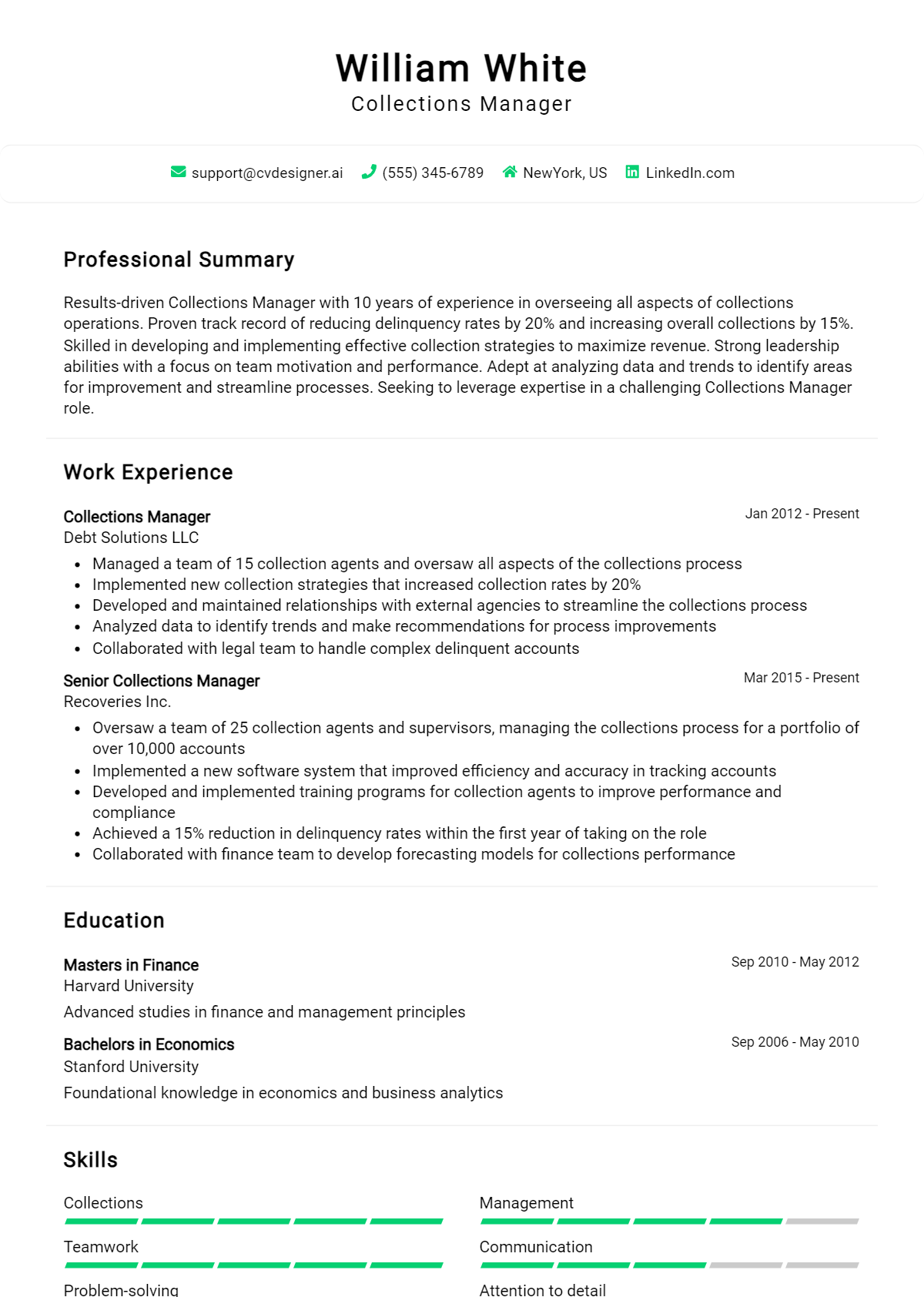

Example

Results-driven Collections Manager with expertise in debt recovery, negotiation, and team leadership. Proven ability to improve collection rates and enhance customer relations through effective strategies.

for Work Experience

The work experience section is the perfect opportunity to demonstrate how your Collections Manager skills have been applied in real-world scenarios. Highlighting specific examples helps employers understand your practical experience and effectiveness.

Example

- Successfully implemented a new collections strategy that increased recovery rates by 25% within six months.

- Trained and supervised a team of 10, fostering a collaborative work environment that improved overall productivity.

- Utilized advanced data analysis techniques to identify trends and develop targeted collection processes.

- Resolved customer disputes with a focus on customer service, resulting in a 30% decrease in escalated cases.

for Skills

The skills section can effectively showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your overall qualifications and appeal to potential employers.

Example

- Debt Recovery

- Negotiation Skills

- Team Leadership

- Financial Reporting

- CRM Software Proficiency

- Data Analysis

- Customer Relationship Management

- Conflict Resolution

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and add a personal touch. Highlighting 2-3 key skills that align with the job description can showcase how your expertise has positively impacted your previous roles.

Example

In my previous role as a Collections Manager, my strong negotiation skills and ability to foster team collaboration led to a 40% increase in successful collections. By implementing data-driven strategies, I enhanced our approach and improved overall customer satisfaction.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job and creates a compelling narrative for your application.

The Importance of Collections Manager Resume Skills

For a Collections Manager, showcasing relevant skills on a resume is crucial for making a strong impression on recruiters. A well-structured skills section not only highlights a candidate's qualifications but also aligns them with the specific demands of the job. By emphasizing the right skills, candidates can differentiate themselves from the competition and demonstrate their ability to contribute effectively to a company's financial health.

- Demonstrating strong communication skills is essential for a Collections Manager, as it enables effective interactions with clients and team members. Clear communication can help resolve disputes and negotiate payment plans, ultimately leading to improved collections.

- Proficiency in financial software and tools is critical for managing accounts receivable and tracking payments. Being adept in these technologies enhances efficiency and accuracy, allowing for timely follow-ups and reporting.

- Analytical skills are vital for assessing the creditworthiness of clients and identifying patterns in payment behavior. A Collections Manager who can analyze data effectively can make informed decisions that improve collections strategies.

- Knowledge of relevant laws and regulations surrounding debt collection is important for ensuring compliance. This knowledge protects the company from legal issues and fosters a fair collection process.

- Leadership abilities are key for managing a team of collectors. A successful Collections Manager should inspire and motivate their team, fostering a productive work environment that enhances overall performance.

- Time management skills are necessary for prioritizing tasks and meeting deadlines. A Collections Manager must juggle multiple accounts and ensure that follow-ups are conducted promptly to maximize collections.

- Negotiation skills are crucial, as Collections Managers often need to reach agreements that are beneficial for both the company and the client. Effective negotiation can lead to higher recovery rates and better client relationships.

- Problem-solving abilities are essential for navigating challenging situations with clients. A Collections Manager must be able to think critically and develop creative solutions to overcome obstacles in the collection process.

For more information on creating effective resumes, visit what is resume.

How To Improve Collections Manager Resume Skills

In the ever-evolving field of collections management, continuously improving your skills is crucial for staying competitive and effective in your role. As a Collections Manager, your ability to adapt to new technologies, regulations, and best practices can significantly impact your team's performance and the overall financial health of your organization. Enhancing your skill set not only boosts your career prospects but also ensures that you are providing the best possible service to your clients and stakeholders.

- Participate in industry-related workshops and seminars to stay updated on the latest trends and techniques in collections management.

- Enroll in online courses that focus on negotiation skills, conflict resolution, and financial analysis to enhance your expertise.

- Join professional organizations, such as the ACA International, to network with peers and gain access to valuable resources and training opportunities.

- Utilize software and tools designed for collections management to improve efficiency and accuracy in your work.

- Seek feedback from colleagues and supervisors to identify areas for improvement and implement constructive changes.

- Stay informed about legal regulations and compliance requirements related to collections to ensure your practices adhere to current standards.

- Read books and articles focused on leadership and team management to develop your skills in guiding and motivating your team effectively.

Frequently Asked Questions

What are the essential skills for a Collections Manager?

A Collections Manager should possess strong communication skills, both verbal and written, to effectively interact with clients and team members. Analytical skills are crucial for assessing collection strategies and understanding financial reports. Additionally, leadership abilities are important for managing the collections team and motivating them to meet targets. Proficiency in negotiation and conflict resolution is also key, as it helps in addressing disputes with clients while maintaining positive relationships.

How important is experience in financial services for a Collections Manager?

Experience in financial services is highly beneficial for a Collections Manager, as it provides a solid understanding of financial principles, credit management, and risk assessment. Familiarity with industry regulations and compliance issues is essential to ensure that collection practices adhere to legal standards. This background allows a Collections Manager to develop effective strategies that align with the goals of the organization while minimizing risks associated with collections.

What software skills should a Collections Manager have?

Proficiency in various software applications is crucial for a Collections Manager. Familiarity with customer relationship management (CRM) systems, data analysis tools, and collection management software is important for tracking accounts and managing workflows. Additionally, knowledge of spreadsheet programs, such as Microsoft Excel, is essential for analyzing data and generating reports. Being tech-savvy enables a Collections Manager to streamline processes and improve efficiency within the team.

How can a Collections Manager improve team performance?

A Collections Manager can enhance team performance by providing regular training and development opportunities to improve skills and knowledge. Setting clear goals and performance metrics helps staff understand expectations and fosters accountability. Encouraging open communication and feedback creates a positive work environment where team members feel valued and motivated. Implementing incentive programs for achieving collection targets can also drive performance and contribute to team morale.

What role does customer service play in collections management?

Customer service is a vital aspect of collections management, as it directly impacts the relationship between the company and its clients. A Collections Manager should emphasize a customer-centric approach, ensuring that team members communicate respectfully and empathetically with clients. This approach not only facilitates successful collections but also helps maintain long-term relationships and fosters a positive reputation for the organization. Balancing assertiveness in collections with excellent customer service can lead to better recovery rates and client satisfaction.

Conclusion

Including Collections Manager skills in your resume is essential for making a strong impression on potential employers. By effectively showcasing your relevant skills, you not only highlight your qualifications but also differentiate yourself from other candidates. This value can significantly enhance your chances of landing an interview and ultimately securing the job you desire. Remember, refining your skills and presenting them well can transform your job application into a powerful tool for career advancement. Take the time to invest in yourself, and watch as opportunities unfold.

For more resources to enhance your job application, check out our resume templates, create your personalized document with our resume builder, explore a variety of resume examples, and craft the perfect introduction with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.