Collections Manager Core Responsibilities

A Collections Manager plays a crucial role in overseeing the debt collection process, ensuring timely payments while maintaining positive customer relationships. Key responsibilities include analyzing account data, coordinating with various departments such as sales and customer service, and developing effective collection strategies. Essential skills encompass technical expertise in collections software, operational efficiency, and strong problem-solving capabilities. These competencies directly contribute to the organization’s financial health, making a well-structured resume vital for showcasing such qualifications.

Common Responsibilities Listed on Collections Manager Resume

- Develop and implement collection strategies to maximize recovery rates.

- Oversee and train collections staff to ensure compliance with policies.

- Analyze customer accounts to identify delinquency trends.

- Collaborate with sales and customer service teams to resolve disputes.

- Maintain accurate records of collections activities and outcomes.

- Prepare and present regular reports on collections performance.

- Negotiate payment plans with customers to facilitate debt recovery.

- Ensure adherence to legal and regulatory requirements in collections.

- Monitor and evaluate the effectiveness of collection strategies.

- Handle escalated customer inquiries and complaints professionally.

- Utilize data analytics to drive improvements in collection processes.

High-Level Resume Tips for Collections Manager Professionals

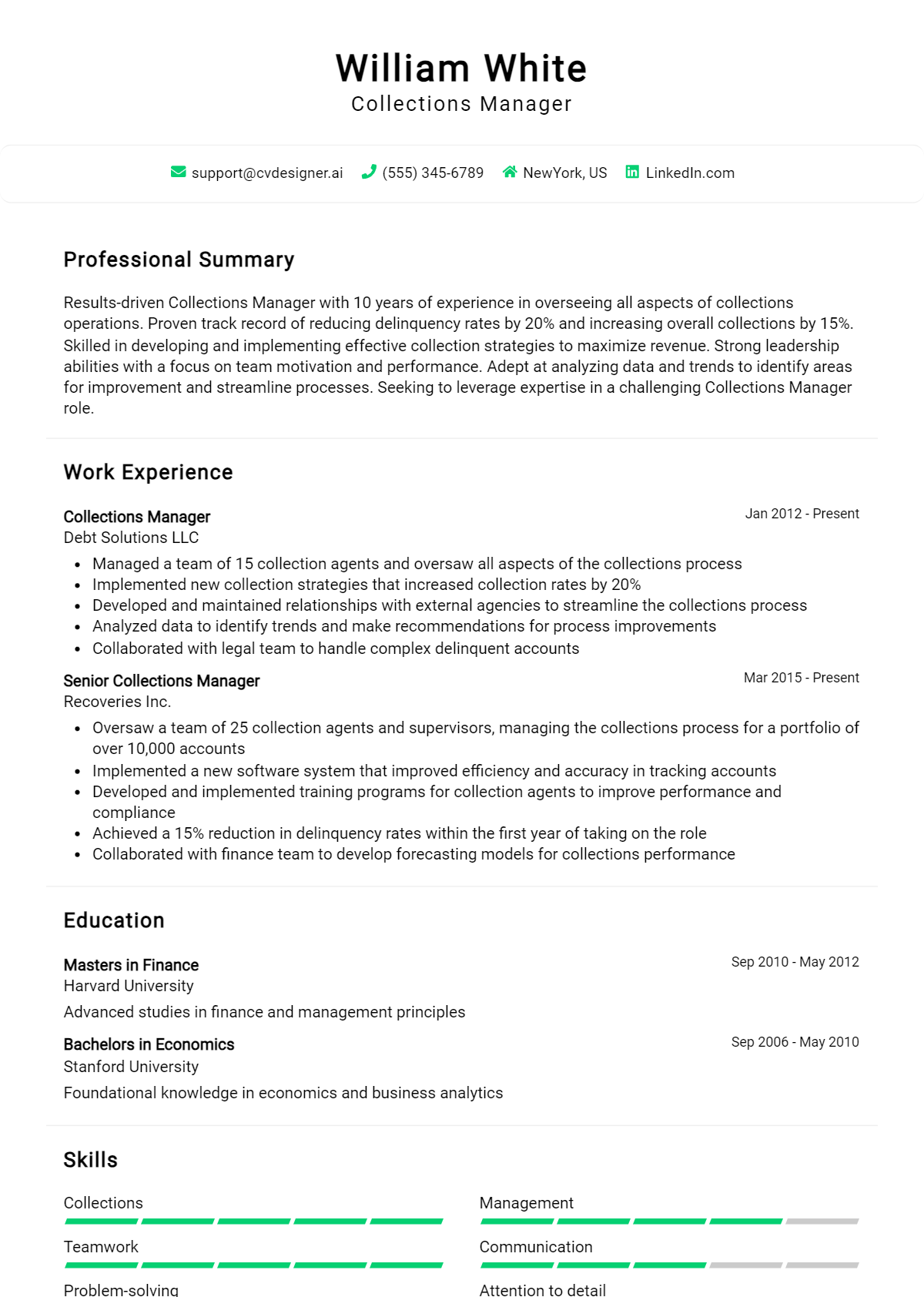

In today's competitive job market, a well-crafted resume is crucial for Collections Manager professionals looking to make a lasting impression on potential employers. Your resume serves as the first point of contact with hiring managers and must effectively showcase both your skills and achievements within the collections field. It’s not just a summary of your work history; it’s a strategic marketing tool that reflects your expertise in managing collections, negotiating with clients, and achieving financial targets. This guide will provide you with practical and actionable resume tips specifically tailored for Collections Manager professionals, ensuring you stand out in your pursuit of career advancement.

Top Resume Tips for Collections Manager Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that align with the specific requirements of the position.

- Highlight your relevant experience by focusing on past roles in collections, credit management, or related fields that demonstrate your expertise.

- Quantify your achievements with specific metrics, such as percentage of collections targets met, reduction in delinquent accounts, or improvement in recovery rates.

- Showcase industry-specific skills, such as knowledge of collection laws, dispute resolution, and proficiency in collections software or CRM systems.

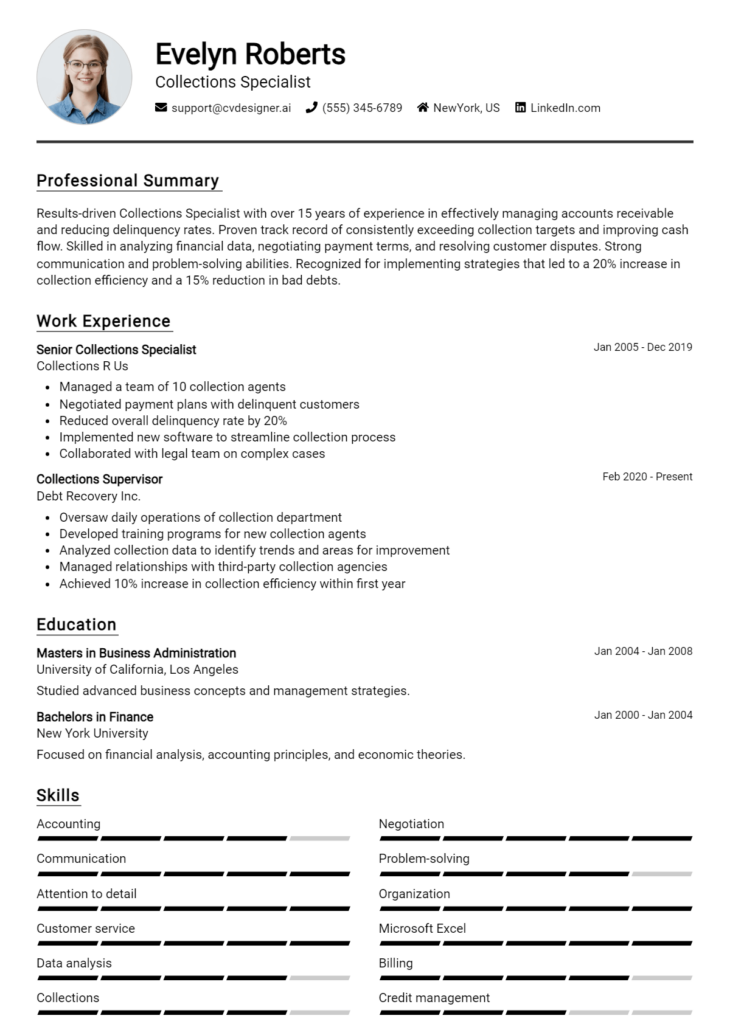

- Include a professional summary at the top of your resume that encapsulates your experience and value proposition as a Collections Manager.

- Utilize action verbs to describe your responsibilities and accomplishments, making your contributions stand out to prospective employers.

- Incorporate any relevant certifications or training that demonstrate your commitment to professional development in the collections industry.

- Ensure the layout of your resume is clean and easy to read, using clear headings, bullet points, and consistent formatting to guide the reader’s eye.

- Proofread your resume for any errors or typos, as attention to detail is crucial in the collections field where accuracy is paramount.

By implementing these tips, you can significantly enhance your chances of landing a job in the Collections Manager field. A well-structured and tailored resume not only highlights your qualifications but also demonstrates your professionalism and understanding of the industry, making you a compelling candidate in the eyes of potential employers.

Why Resume Headlines & Titles are Important for Collections Manager

In the competitive field of collections management, a well-crafted resume headline or title is crucial for standing out among a sea of applicants. A strong headline can instantly grab the attention of hiring managers, encapsulating a candidate's key qualifications and experiences in a single impactful phrase. It serves as a brief introduction that not only highlights the candidate's suitability for the role but also sets the tone for the rest of the resume. Therefore, it is essential that the headline remains concise, relevant, and directly related to the job being applied for, ensuring it resonates with the hiring team's expectations.

Best Practices for Crafting Resume Headlines for Collections Manager

- Keep it concise—aim for one to two impactful sentences.

- Make it role-specific by including the job title and relevant skills.

- Use action-oriented language to convey confidence and achievement.

- Incorporate key metrics or accomplishments to demonstrate success.

- Avoid jargon or overly complex language for clarity.

- Customize the headline for each application to align with the job description.

- Highlight unique strengths that differentiate you from other candidates.

- Ensure the headline reflects your professional brand and career goals.

Example Resume Headlines for Collections Manager

Strong Resume Headlines

Results-Driven Collections Manager with 10+ Years of Experience in Reducing Delinquency Rates by 30%

Dynamic Collections Professional Specializing in High-Volume Accounts and Strategic Recovery Solutions

Proven Track Record of Increasing Cash Flow and Enhancing Recovery Strategies in Collections Management

Weak Resume Headlines

Collections Manager Looking for Opportunities

Experienced in Collections

The strong resume headlines are effective because they clearly communicate the candidate’s specific skills, experience, and achievements, making a compelling case for their qualifications. They utilize quantifiable metrics and specific language that resonate with hiring managers. In contrast, the weak headlines fail to impress as they are vague and non-specific, lacking the necessary detail to convey the candidate's true value or differentiate them from others in the field. Such generic titles do not engage the reader and may lead to the resume being overlooked.

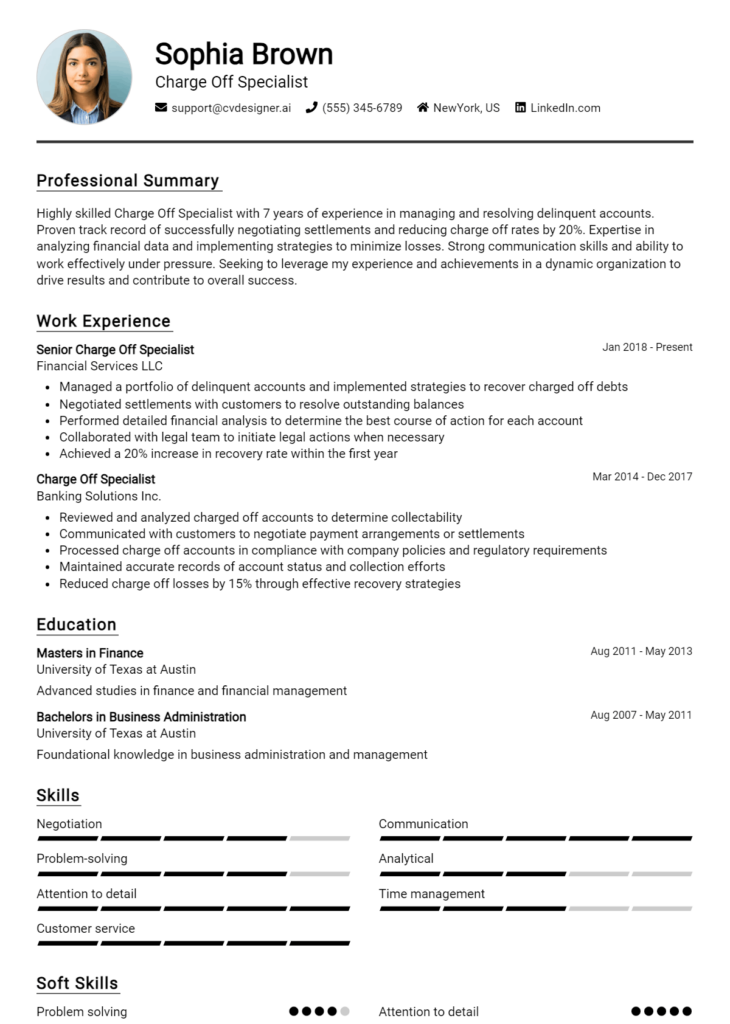

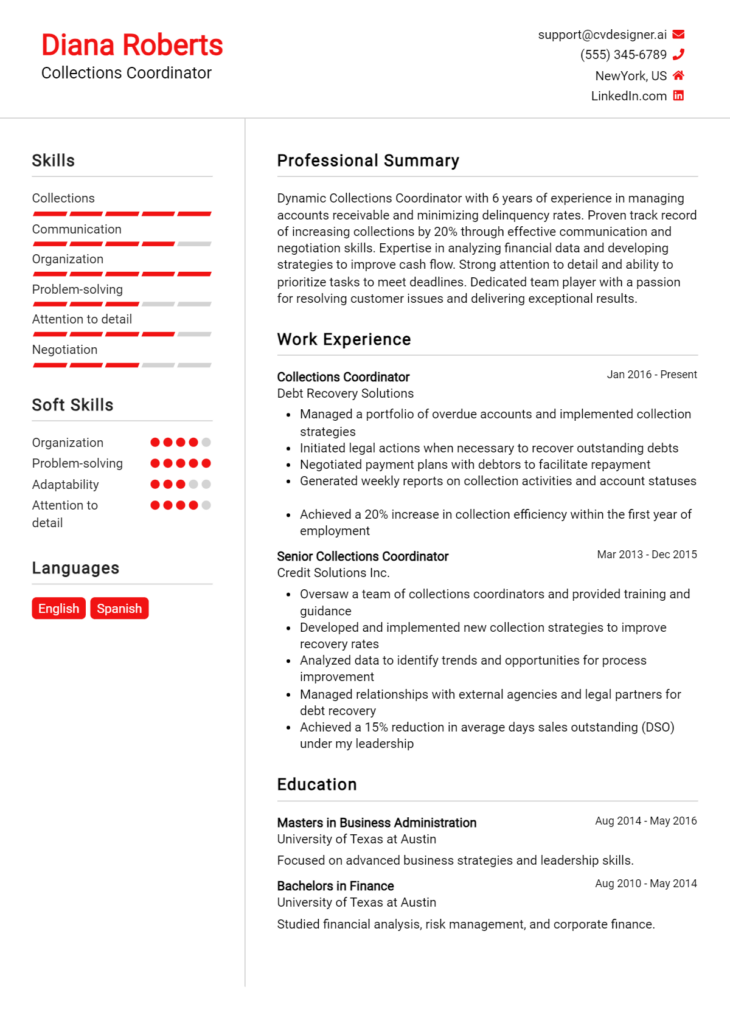

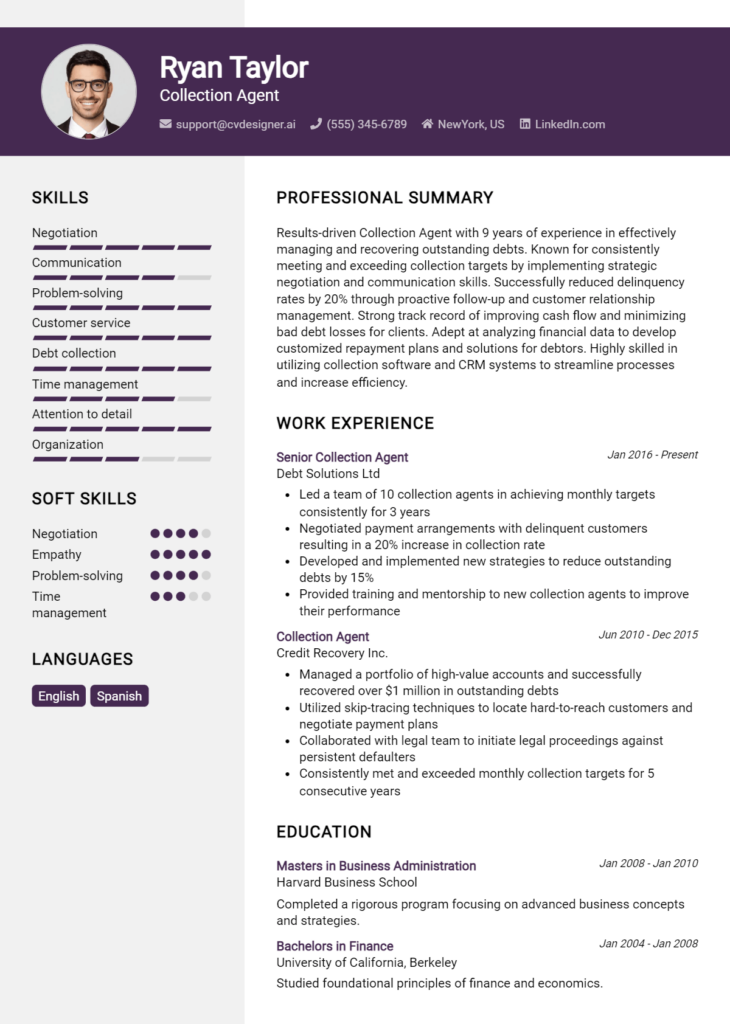

Writing an Exceptional Collections Manager Resume Summary

A resume summary is a critical component for a Collections Manager, serving as the first impression a hiring manager receives about a candidate. A well-crafted summary can quickly capture attention by highlighting key skills, relevant experience, and notable accomplishments tailored to the Collections Manager role. This concise and impactful statement should effectively communicate the candidate’s ability to manage collections, resolve disputes, and contribute to the financial health of the organization, ensuring they stand out in a competitive job market.

Best Practices for Writing a Collections Manager Resume Summary

- Quantify Achievements: Use numbers to showcase the impact of your work, such as percentage reductions in overdue accounts or dollar amounts collected.

- Focus on Relevant Skills: Highlight specific skills that are directly applicable to collections management, such as negotiation, communication, and analytical abilities.

- Tailor for the Job Description: Customize your summary to reflect the specific requirements and language used in the job listing.

- Be Concise: Aim for 2-4 sentences that capture your core competencies without unnecessary fluff.

- Use Action Verbs: Start sentences with strong action verbs to convey accomplishments and responsibilities effectively.

- Showcase Industry Knowledge: Include any relevant certifications or experiences that demonstrate your expertise in collections and finance.

- Highlight Problem-Solving Skills: Mention your ability to handle disputes and negotiate payment plans effectively.

Example Collections Manager Resume Summaries

Strong Resume Summaries

Results-driven Collections Manager with over 8 years of experience in reducing delinquency rates by 30% through strategic account management and effective negotiation techniques. Proven track record of collecting over $5 million in overdue accounts while maintaining positive client relationships.

Detail-oriented professional with a strong background in credit risk analysis and collections. Successfully implemented a new collections strategy that improved cash flow by 40%, leading to a significant reduction in bad debt.

Dedicated Collections Manager with expertise in leading teams to achieve record-high collection rates. Increased monthly collections by 25% within one year by streamlining processes and enhancing communication with clients.

Weak Resume Summaries

Experienced in collections and financial management. Good at communicating with clients and resolving issues.

Collections Manager with a background in managing accounts. Capable of handling various tasks related to collections.

The examples provided demonstrate a clear distinction between strong and weak resume summaries. Strong summaries are specific, quantifiable, and tailored to the role, showcasing measurable outcomes and relevant skills that appeal directly to hiring managers. In contrast, weak summaries lack detail, provide vague information, and do not effectively communicate the candidate’s achievements or relevance to the Collections Manager position.

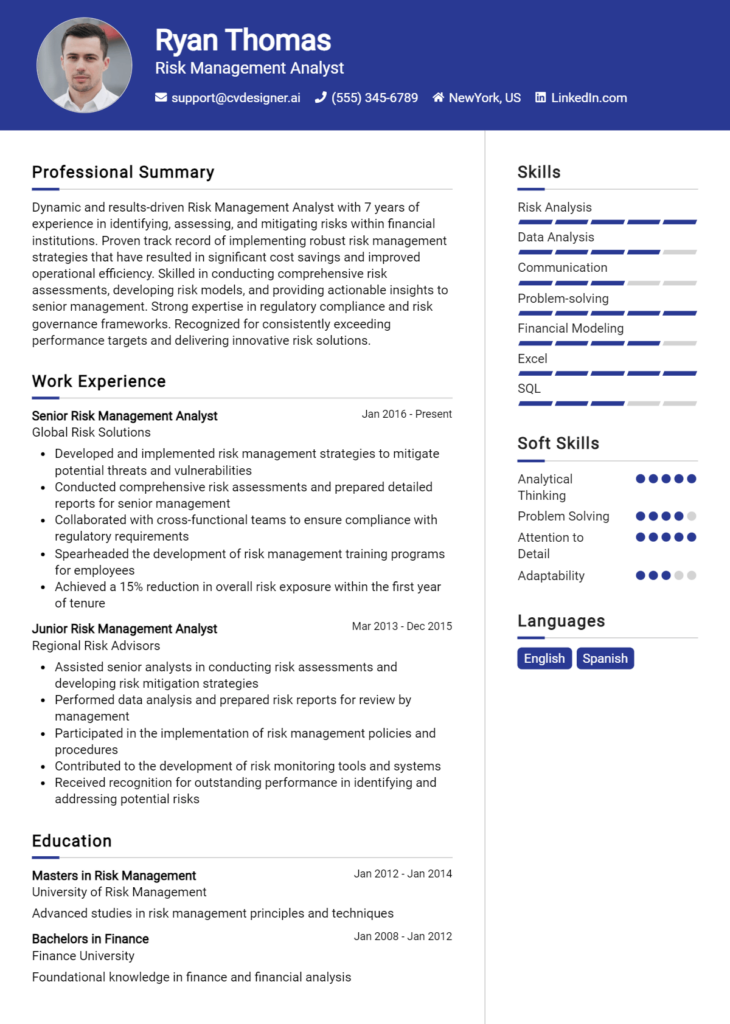

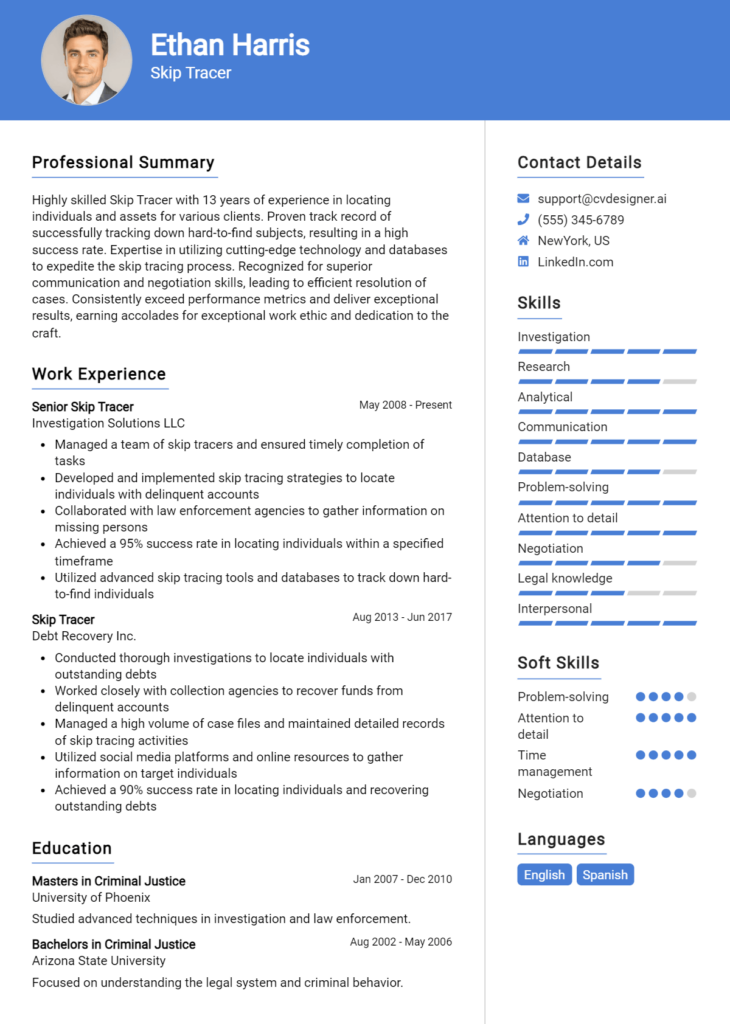

Work Experience Section for Collections Manager Resume

The work experience section of a Collections Manager resume is critical as it serves as a reflection of the candidate's capabilities and achievements in the field. This section not only highlights the technical skills acquired over the years but also showcases the ability to lead teams effectively and deliver high-quality results. By quantifying achievements and aligning experiences with industry standards, candidates can demonstrate their value to potential employers and distinguish themselves from the competition.

Best Practices for Collections Manager Work Experience

- Use specific metrics to quantify achievements, such as percentage of debt recovered or average collection time.

- Highlight leadership roles and responsibilities in managing teams, including any training or mentoring initiatives.

- Showcase technical skills relevant to collections, such as proficiency with specific software or tools.

- Align experiences with industry standards and best practices to demonstrate knowledge of current trends.

- Incorporate actionable language that illustrates your active role in achieving outcomes.

- Focus on collaboration and cross-departmental efforts that contributed to successful collections strategies.

- Provide context for your achievements to help employers understand the impact of your work.

- Tailor your work experience to the job description, emphasizing the most relevant experiences for the position.

Example Work Experiences for Collections Manager

Strong Experiences

- Increased debt recovery rates by 30% within one year by implementing a new collections strategy and training team members on best practices.

- Successfully managed a team of 15 collections agents, leading to a 25% reduction in average collection time through enhanced performance management techniques.

- Developed and integrated a new collections software solution that improved tracking accuracy and reporting capabilities, resulting in a 40% increase in operational efficiency.

- Collaborated with the finance department to revise payment plans, which led to a 20% increase in customer compliance rates.

Weak Experiences

- Responsible for managing collections tasks.

- Worked on a team to handle collections-related issues.

- Assisted in improving collections processes.

- Helped to recover debts when necessary.

The examples labeled as strong experiences are characterized by specific metrics, clear leadership roles, and demonstrated technical proficiency, providing a well-rounded view of the candidate’s capabilities. In contrast, the weak experiences lack detail and specificity, failing to convey the candidate's impact or contributions effectively. This stark difference illustrates the importance of presenting concrete achievements and responsibilities in a compelling manner.

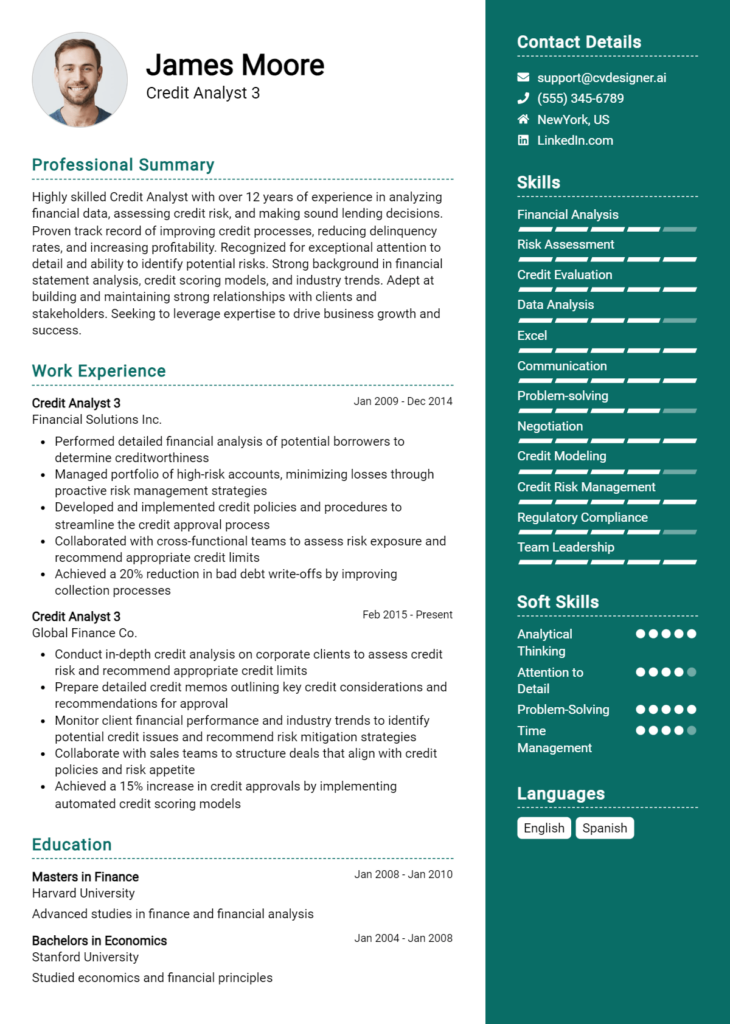

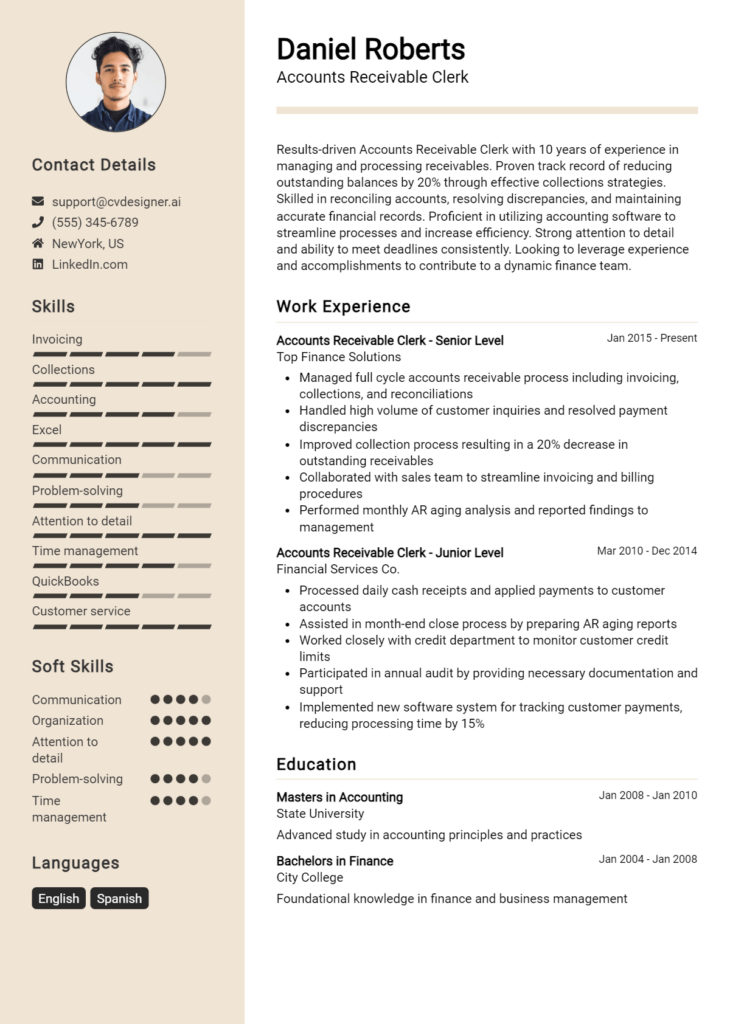

Education and Certifications Section for Collections Manager Resume

The education and certifications section of a Collections Manager resume is crucial for showcasing a candidate's academic achievements, relevant certifications, and commitment to continuous professional development. This section serves as a vital platform to highlight how a candidate's educational background aligns with the demands of the Collections Manager role. By detailing relevant coursework, industry-recognized certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their preparedness for the challenges of the position. Providing this information not only highlights the qualifications that make a candidate stand out but also reflects their dedication to staying current in a constantly evolving field.

Best Practices for Collections Manager Education and Certifications

- Prioritize relevance: Include degrees and certifications that specifically relate to collections management, finance, or business.

- Detail your coursework: Highlight any relevant classes that provide deeper insights into collections, credit management, or financial regulations.

- List industry-recognized certifications: Include certifications from reputable organizations that are respected in the collections field.

- Include continuing education: Show a commitment to lifelong learning through workshops, seminars, or recent courses related to collections management.

- Be specific with dates: Provide graduation dates and certification completion dates to convey your timeline of education and professional growth.

- Highlight advanced degrees: If applicable, emphasize any master's degrees or specialized diplomas that enhance your qualifications.

- Use clear formatting: Ensure that your education and certifications are easily readable and well-organized to improve overall resume presentation.

- Stay updated: Regularly revise this section to include the latest credentials and educational experiences relevant to the field.

Example Education and Certifications for Collections Manager

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2020

- Certified Collections Specialist (CCS), Collections Certification Institute, Completed March 2022

- Advanced Coursework in Credit Risk Management, University of ABC, Completed December 2021

- Certified Revenue Cycle Representative (CRCR), Healthcare Financial Management Association, Completed June 2023

Weak Examples

- Associate Degree in General Studies, Community College of XYZ, Graduated May 2015

- Certification in Basic Computer Skills, Online Learning Platform, Completed January 2020

- High School Diploma, Anytown High School, Graduated June 2012

- Certificate in Office Management, Unaccredited Institution, Completed August 2018

The examples provided are considered strong because they clearly relate to the skills and knowledge required for a Collections Manager, showcasing relevant degrees and certifications that enhance the candidate's expertise in the field. In contrast, the weak examples lack relevance to the role of a Collections Manager, featuring outdated or non-industry-specific qualifications that do not demonstrate a commitment to professional growth or alignment with the responsibilities of the job.

Top Skills & Keywords for Collections Manager Resume

As a Collections Manager, possessing a robust set of skills is vital for navigating the complexities of debt recovery and managing client relationships. A well-crafted resume that highlights both soft and hard skills can significantly enhance your candidacy in this competitive field. Employers seek individuals who can not only execute collection strategies effectively but also build rapport with clients and team members. Demonstrating proficiency in these areas can set you apart from other candidates and illustrate your capability to contribute positively to the organization’s financial health.

Top Hard & Soft Skills for Collections Manager

Hard Skills

- Proficient in collections software and CRM systems

- Knowledge of debt collection laws and regulations

- Financial analysis and reporting

- Data entry and management

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint)

- Understanding of credit reports and scoring

- Risk assessment and management

- Negotiation and settlement strategies

- Payment processing and invoicing

- Budgeting and forecasting expertise

- Knowledge of bankruptcy processes

- Familiarity with Fair Debt Collection Practices Act (FDCPA)

- Ability to create and implement collection policies

- Experience with skip tracing techniques

Soft Skills

- Strong communication skills

- Excellent interpersonal skills

- Conflict resolution abilities

- Empathetic listening

- Strong analytical thinking

- Time management and organizational skills

- Attention to detail

- Team leadership and motivation

- Problem-solving capabilities

- Customer service orientation

- Resilience and adaptability

- Ability to work under pressure

- Negotiation and persuasion skills

- Relationship-building skills

For more insights on how to effectively showcase your skills and work experience, consider tailoring your resume to reflect the specific competencies that align with the Collections Manager role.

Stand Out with a Winning Collections Manager Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Collections Manager position at [Company Name], as advertised on [Job Board/Company Website]. With over [X years] of experience in credit and collections, coupled with a proven track record of enhancing collection processes and improving cash flow, I am confident in my ability to contribute significantly to your team. My expertise in managing collections teams, analyzing financial data, and developing strategic initiatives aligns perfectly with the goals of your organization.

In my previous role at [Previous Company Name], I successfully led a team of [X] collection specialists, implementing streamlined processes that reduced the average collection period by [X%]. By leveraging data analytics, I identified trends and developed targeted strategies that not only improved recovery rates but also maintained positive relationships with clients. My approach emphasizes communication and customer service, ensuring that collections are handled compassionately yet effectively. I believe that fostering strong relationships with clients is key to successful collections.

I am particularly drawn to [Company Name] because of your commitment to [specific company value or initiative], and I am eager to bring my experience in collections management to further enhance your financial operations. I am adept at training and mentoring team members, and I am excited about the opportunity to lead and inspire a team that values collaboration and excellence. My goal is to ensure that [Company Name] continues to thrive financially while maintaining its reputation for outstanding customer service.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences can contribute to the success of your collections department. I am excited about the possibility of working together to achieve remarkable results for [Company Name].

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Collections Manager Resume

When crafting a resume for a Collections Manager position, it's crucial to present your skills and experience effectively to stand out in a competitive job market. However, many candidates make common mistakes that can undermine their qualifications. Avoiding these pitfalls can significantly enhance your chances of landing an interview. Here are some frequent errors to steer clear of when writing your resume:

Generic Objective Statements: Using vague or generic objectives doesn't convey your specific goals or how you can benefit the company. Tailor your objective to reflect the role you’re applying for.

Overloading with Jargon: While industry-specific terminology can demonstrate expertise, excessive jargon can alienate hiring managers. Use clear language that conveys your experience without overwhelming the reader.

Neglecting Quantifiable Achievements: Failing to include measurable accomplishments, such as the percentage of debt recovered or the number of accounts managed, misses an opportunity to showcase your effectiveness in previous roles.

Ignoring Relevant Skills: Omitting critical skills that are pertinent to collections management, like negotiation or conflict resolution, can result in your resume being overlooked. Always align your skills with the job description.

Using a One-Size-Fits-All Format: A resume that is not tailored to the job can make you seem disinterested. Customize your resume format, content, and keywords for each application.

Inconsistent Formatting: Inconsistent fonts, bullet points, and spacing can make your resume look unprofessional. Ensure a clean, uniform layout to enhance readability.

Lack of Professional Summary: Skipping a professional summary means missing a chance to provide a snapshot of your career and skills. A strong summary can grab the hiring manager's attention early on.

Failure to Proofread: Spelling and grammatical errors can create a negative impression. Always proofread your resume multiple times and consider having someone else review it for clarity and accuracy.

Conclusion

As a Collections Manager, your role is crucial in ensuring the financial health of your organization. You oversee the collections process, manage a team of collectors, and implement strategies to minimize outstanding debts. Throughout this article, we discussed the key responsibilities of a Collections Manager, which include maintaining relationships with clients, negotiating payment plans, analyzing collection reports, and ensuring compliance with relevant laws and regulations.

We also highlighted the importance of communication skills, analytical thinking, and leadership qualities in excelling in this position. With the growing reliance on technology in the finance sector, familiarity with collections software and data analysis tools can give you the edge in your role.

In conclusion, if you're aiming to step up your career as a Collections Manager, it's essential to have a polished resume that showcases your skills and experiences effectively. We encourage you to review your Collections Manager resume and ensure it reflects your capabilities and achievements.

To assist you in this process, there are valuable resources available, including resume templates, a user-friendly resume builder, diverse resume examples, and well-crafted cover letter templates. Take action today to enhance your application materials and elevate your career prospects!