23 Collections Coordinator Skills for Your Resume in 2025

As a Collections Coordinator, possessing the right skills is crucial for effectively managing accounts receivable and ensuring that collections processes run smoothly. In this section, we will outline the top skills that are essential for a Collections Coordinator, which will not only enhance your resume but also position you as a strong candidate in the competitive job market. Understanding and highlighting these skills can make a significant difference in your ability to secure and excel in this role.

Best Collections Coordinator Technical Skills

Technical skills are essential for a Collections Coordinator, as they enable the efficient management of accounts, understanding of financial processes, and the use of specialized software. By showcasing relevant technical skills on your resume, you can demonstrate your capability to handle collections effectively and contribute to the financial health of the organization.

Accounts Receivable Management

This skill involves tracking and managing outstanding invoices and payments. A Collections Coordinator must be adept at ensuring timely collections to maintain cash flow.

How to show it: Highlight your experience in managing accounts receivable, specifying the percentage of overdue accounts you resolved or the time frame in which you improved collection rates.

Debt Recovery Techniques

Understanding various strategies for debt recovery is crucial. This skill helps in implementing effective communication and negotiation methods to recover outstanding debts.

How to show it: Include specific techniques you used and the success rate of your debt recovery efforts, such as the number of accounts collected within a certain period.

Financial Reporting

This involves analyzing financial data and producing reports that track collections and highlight trends. It is important for making informed decisions.

How to show it: Demonstrate your ability to create reports by mentioning the types of reports you generated and how they contributed to strategic decisions or improved processes.

Customer Relationship Management (CRM) Software

Proficiency in CRM software is essential for tracking interactions with clients and managing their accounts effectively.

How to show it: List the specific CRM tools you are proficient in and give examples of how you used them to enhance customer relationships or streamline collections.

Data Analysis

The ability to analyze data trends and patterns is vital for identifying issues in collections processes and making data-driven decisions.

How to show it: Quantify your analytical contributions by mentioning specific instances where your analysis led to measurable improvements in collections or operational efficiency.

Payment Processing Systems

Familiarity with various payment processing systems is important for efficiently managing transactions and resolving payment issues.

How to show it: Detail the systems you have experience with and any enhancements you made to the payment processing workflow that resulted in faster collections.

Communication Skills

Excellent written and verbal communication skills are essential for negotiating payment plans and maintaining positive relationships with clients.

How to show it: Provide examples of successful negotiations or communications that led to improved collection outcomes, including any metrics that highlight your success.

Regulatory Compliance Knowledge

Understanding the legal aspects of collections, including compliance with regulations such as the Fair Debt Collection Practices Act (FDCPA), is crucial.

How to show it: Highlight your knowledge of relevant regulations and any training or certifications you have completed that demonstrate your commitment to compliance.

Time Management

Effective time management ensures that collections tasks are prioritized and completed efficiently, allowing for a more organized approach to debt recovery.

How to show it: Share specific strategies you’ve implemented to manage your time effectively, along with any quantifiable outcomes, such as reducing overdue accounts by a certain percentage.

Negotiation Skills

Strong negotiation skills are necessary for reaching agreeable terms with clients while ensuring the organization’s financial interests are met.

How to show it: Provide examples of negotiation scenarios where you successfully reached a resolution, including the financial impact of those negotiations.

Technical Proficiency in Microsoft Excel

Excel is a key tool for managing data, creating spreadsheets, and analyzing financial information in collections work.

How to show it: Detail your proficiency level and specific functions you use, such as pivot tables or VLOOKUP, and how they helped you manage collections effectively.

For further information on technical skills, visit Technical Skills.

Best Collections Coordinator Soft Skills

Soft skills play a vital role in the success of a Collections Coordinator. These interpersonal attributes not only enhance communication and collaboration but also improve problem-solving capabilities and time management efficiency. As a Collections Coordinator, possessing a blend of these essential soft skills can significantly impact your effectiveness in managing accounts, resolving disputes, and maintaining positive relationships with clients.

Communication

Effective communication is crucial for a Collections Coordinator to convey information clearly and persuasively to clients and internal teams.

How to show it: Highlight instances where you successfully resolved disputes or negotiated payment plans. Use quantifiable metrics, such as the percentage of accounts you managed to collect within a specific timeframe, to demonstrate your communication effectiveness.

Problem-solving

The ability to identify issues and implement solutions is essential in collections, especially when dealing with difficult accounts or client disputes.

How to show it: Provide examples of challenges you faced in collections and how you resolved them. Use specific numbers to illustrate improvements, such as the reduction in overdue accounts after implementing a new strategy.

Time Management

Prioritizing tasks and managing time efficiently allows a Collections Coordinator to handle multiple accounts and deadlines effectively.

How to show it: Demonstrate your time management skills by showcasing how you balanced various tasks, such as managing collections while meeting reporting deadlines. Include any tools or methods you used to enhance your efficiency.

Teamwork

Collaboration with colleagues, finance teams, and external partners is essential for a smooth collections process.

How to show it: Share examples of successful projects you completed as part of a team. Highlight your role and the impact of teamwork on achieving collection goals.

Empathy

Understanding clients' situations and showing empathy can help build rapport and facilitate smoother negotiations.

How to show it: Include instances where your empathetic approach led to successful outcomes, such as resolving a client's concerns or agreeing on a repayment plan.

Attention to Detail

Being detail-oriented helps in tracking payments, managing records, and ensuring compliance with regulations.

How to show it: Highlight your ability to maintain accurate records and the processes you implemented to avoid errors. Use specific examples of how attention to detail improved your collection results.

Negotiation

Strong negotiation skills enable a Collections Coordinator to reach mutually agreeable solutions with clients.

How to show it: Discuss your experience in negotiating payment terms or settlements and provide metrics showing how these negotiations positively impacted collection rates.

Resilience

The ability to bounce back from setbacks is vital in collections, where rejection and challenges are common.

How to show it: Illustrate your resilience by sharing stories of how you handled difficult situations and continued to achieve your collection goals despite obstacles.

Adaptability

The collections landscape can change rapidly, requiring a coordinator to adapt to new regulations, technologies, and client needs.

How to show it: Provide examples of how you adapted to changes in the industry or your organization, and the positive outcomes that resulted from your adaptability.

Interpersonal Skills

Building relationships with clients and colleagues is essential for effective collections and fostering cooperation.

How to show it: Demonstrate your interpersonal skills by sharing feedback from colleagues or clients and examples of successful relationship-building efforts that led to improved collection outcomes.

Critical Thinking

Analyzing situations and making informed decisions is key to successful collections management.

How to show it: Provide examples of how your critical thinking skills led to effective decision-making in complex collections scenarios, and quantify the results of those decisions.

Best Collections Coordinator Technical Skills

Technical skills are crucial for a Collections Coordinator as they enhance the efficiency and effectiveness of debt recovery processes. Proficiency in various tools and techniques not only facilitates accurate tracking of accounts but also aids in maintaining positive client relationships while ensuring compliance with regulations.

Debt Recovery Software Proficiency

Being adept with debt recovery software, such as FICO Debt Manager or CBE, allows Collections Coordinators to manage accounts effectively and streamline the recovery process.

How to show it: Highlight specific software tools you have used, detailing your role in optimizing their use. Mention any improvements in recovery rates or efficiency as a result of your expertise.

Data Analysis Skills

Data analysis is essential for identifying trends in payment behavior and understanding when and how to approach clients for collections. This skill aids in making informed decisions based on financial data.

How to show it: Include examples of how your analysis led to actionable insights, such as reducing overdue accounts by a certain percentage or improving collection timelines.

Communication Skills

Effective communication is vital for negotiating payment arrangements and resolving disputes. It helps in maintaining a professional relationship while persuading clients to fulfill their obligations.

How to show it: Quantify your success by mentioning the number of successful negotiations or the percentage of disputes resolved amicably during your tenure.

Regulatory Knowledge

Understanding relevant laws and regulations, such as the Fair Debt Collection Practices Act (FDCPA), ensures that collections are conducted ethically and legally, minimizing the risk of litigation.

How to show it: Demonstrate your knowledge by noting any training or certifications in compliance and how it has positively impacted your collections process.

CRM Systems Familiarity

Familiarity with Customer Relationship Management (CRM) systems can enhance the management of customer interactions and streamline the collections process.

How to show it: Specify any CRM systems you have used and detail how your usage improved customer engagement or collection outcomes.

Time Management

Strong time management skills enable Collections Coordinators to prioritize tasks effectively, ensuring timely follow-up on overdue accounts and optimizing workflow.

How to show it: Provide examples of how your time management led to improved collection timelines or reduced the average days accounts remain overdue.

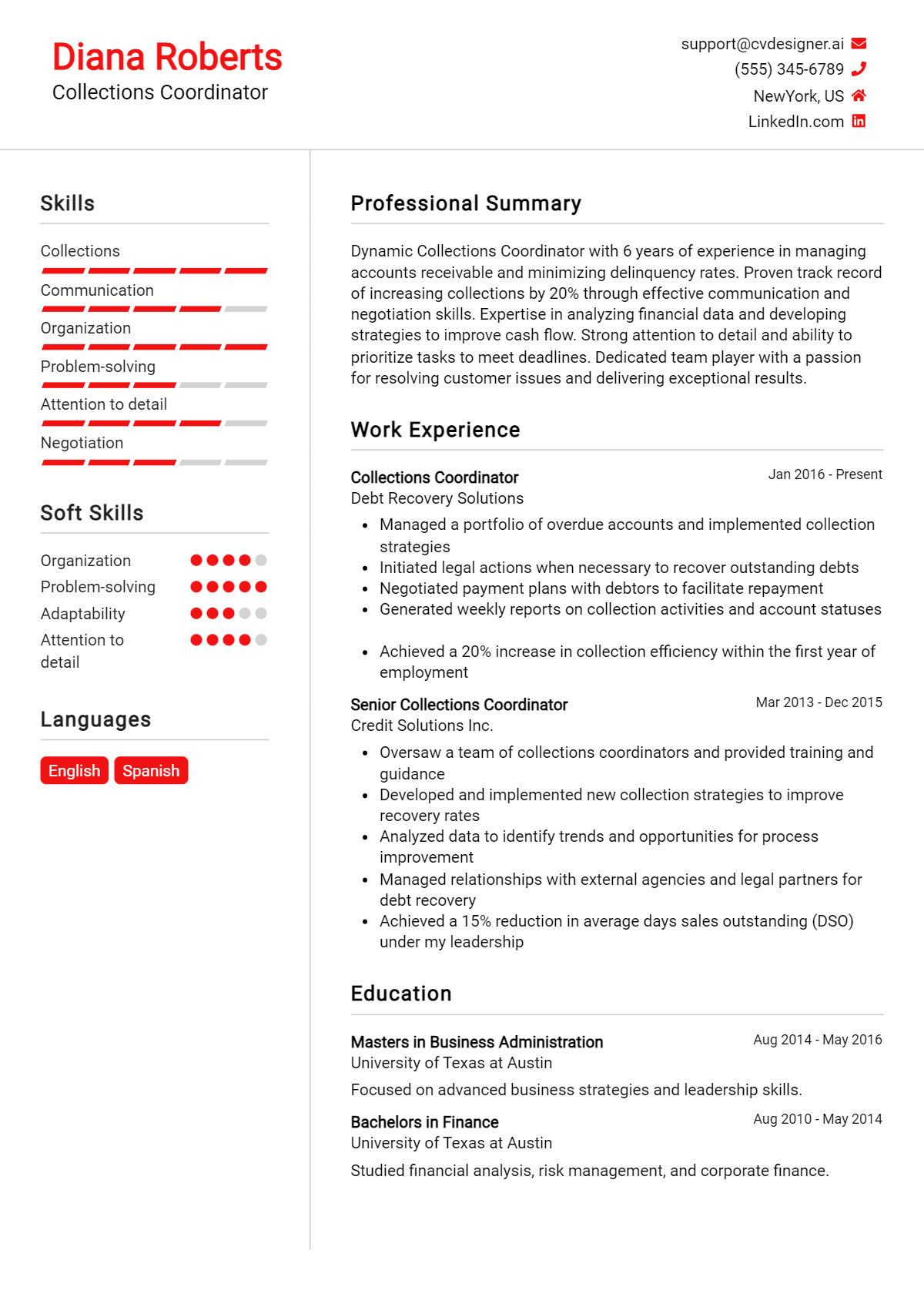

How to List Collections Coordinator Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in a competitive job market. A well-structured resume allows hiring managers to quickly assess your qualifications. There are three main sections where you can highlight your skills: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing your Collections Coordinator skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and expertise.

Example

Dedicated and detail-oriented Collections Coordinator with expertise in accounts receivable management, customer relationship building, and dispute resolution. Proven ability to streamline collections processes and enhance cash flow through effective communication and negotiation skills.

for Work Experience

The work experience section is the perfect opportunity to demonstrate how your Collections Coordinator skills have been applied in real-world scenarios.

Example

- Managed a portfolio of over 200 accounts, reducing overdue receivables by 30% through effective follow-up and negotiation.

- Utilized CRM software to track customer interactions, enhancing customer satisfaction and retention rates.

- Collaborated with cross-functional teams to resolve billing disputes, improving resolution time by 40%.

- Conducted training sessions for team members on best practices for collections, fostering a culture of accountability and performance.

for Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills is essential for demonstrating your overall qualifications.

Example

- Accounts Receivable Management

- Customer Relationship Management (CRM)

- Effective Communication

- Data Analysis

- Negotiation Skills

- Problem Solving

- Time Management

- Attention to Detail

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can emphasize how those skills have positively impacted your previous roles.

Example

In my previous role as a Collections Coordinator, I successfully utilized my negotiation skills to resolve outstanding accounts, leading to a 25% increase in timely payments. My background in customer relationship management has enabled me to foster strong connections with clients, ensuring a respectful and effective collections process.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Collections Coordinator Resume Skills

Highlighting relevant skills on a Collections Coordinator resume is crucial for candidates seeking to make a positive impression on recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also demonstrates their alignment with the specific requirements of the job. This strategic emphasis can significantly enhance the chances of standing out in a competitive job market.

- A strong skills section allows candidates to quickly convey their expertise in collections processes, demonstrating their capability to manage accounts effectively and resolve outstanding debts efficiently.

- Incorporating industry-specific skills can help candidates align with the job description, making it easier for recruiters to see how their qualifications match the needs of the organization.

- Skills such as communication, negotiation, and conflict resolution are vital for a Collections Coordinator, as they directly relate to interactions with clients and the resolution of payment issues.

- Highlighting technical skills, such as proficiency in collections software and data analysis tools, shows candidates are equipped to handle the demands of the role and can leverage technology to improve efficiency.

- Demonstrating knowledge of relevant laws and regulations related to collections can set candidates apart, indicating their capability to navigate legal frameworks while maintaining ethical standards in debt recovery.

- Including soft skills, such as attention to detail and time management, highlights a candidate's ability to work independently and prioritize tasks effectively, which is essential in a fast-paced collections environment.

- Recruiters often look for candidates who can adapt to changing situations; showcasing flexibility and problem-solving skills can illustrate a candidate's readiness to handle unexpected challenges in collections.

- Finally, a well-organized skills section makes the resume visually appealing and easy to read, allowing recruiters to quickly identify key qualifications that align with their hiring needs.

For more information on creating effective resumes, visit what is resume.

How To Improve Collections Coordinator Resume Skills

In the ever-evolving landscape of finance and customer relations, it is crucial for Collections Coordinators to continuously enhance their skills. Improving your abilities not only boosts your resume but also increases your effectiveness in managing collections, fosters better relationships with clients, and contributes to the overall success of your organization. Here are some actionable tips to help you improve your skills in this role:

- Attend workshops or webinars focused on collections strategies and customer service to stay updated with industry trends.

- Enhance your communication skills through public speaking courses or online classes to effectively negotiate and resolve disputes.

- Familiarize yourself with the latest software and tools used in collections management to streamline your processes.

- Seek feedback from supervisors or colleagues on your performance to identify areas for improvement.

- Join professional organizations related to collections and finance to network and learn from industry experts.

- Read books and articles on negotiation techniques and conflict resolution to strengthen your problem-solving abilities.

- Practice active listening skills to better understand client concerns and improve engagement during collections calls.

Frequently Asked Questions

What are the key skills needed for a Collections Coordinator?

A successful Collections Coordinator should possess strong communication and negotiation skills, as they frequently interact with clients to resolve payment issues. Additionally, attention to detail is essential for tracking payments and maintaining accurate records. Proficiency in financial software and databases also plays a crucial role in managing accounts effectively. Furthermore, problem-solving abilities and a thorough understanding of credit and collection laws are important to ensure compliance and minimize risks.

How important is attention to detail in a Collections Coordinator role?

Attention to detail is vital for a Collections Coordinator, as the role involves handling sensitive financial information and tracking numerous accounts. Mistakes in data entry or record-keeping can lead to significant financial discrepancies and strained client relationships. By meticulously reviewing accounts and payment histories, a Collections Coordinator can ensure accuracy and uphold the integrity of the collections process.

What role does communication play in collections coordination?

Effective communication is crucial for a Collections Coordinator, as it involves liaising with clients to discuss outstanding payments and resolve disputes. Clear and professional communication can foster positive relationships, which can increase the likelihood of successful collections. Additionally, the ability to articulate payment terms and negotiate resolutions while maintaining a courteous demeanor is essential in this role.

What software skills are beneficial for a Collections Coordinator?

A Collections Coordinator should be proficient in various financial software and CRM systems that facilitate tracking accounts and managing collections. Familiarity with accounting software (e.g., QuickBooks, SAP) and Excel for data analysis is important. Additionally, knowledge of automated collections systems can enhance efficiency and accuracy in managing overdue accounts and generating reports.

How can problem-solving skills benefit a Collections Coordinator?

Problem-solving skills are essential for a Collections Coordinator, as they often face complex situations involving overdue accounts, payment disputes, and client communication challenges. The ability to analyze a situation, identify potential solutions, and implement effective strategies can lead to quicker resolutions and improved collection rates. This skill set also helps in maintaining client relationships by addressing concerns proactively and finding mutually agreeable solutions.

Conclusion

Incorporating Collections Coordinator skills into your resume is vital for demonstrating your expertise and suitability for the role. By showcasing relevant skills such as communication, organization, and negotiation, candidates can significantly enhance their visibility to potential employers and set themselves apart in a competitive job market. Remember, presenting your capabilities effectively not only highlights your qualifications but also illustrates the value you can bring to an organization.

As you refine your skills and tailor your application, embrace the opportunity to create a compelling narrative about your professional journey. With dedication and the right tools, such as our resume templates, resume builder, resume examples, and cover letter templates, you can elevate your job application and move closer to your career aspirations. Keep pushing forward, and success will surely follow!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.