Collections Coordinator Core Responsibilities

A Collections Coordinator plays a vital role in managing and optimizing the collections process within an organization. This position requires strong technical, operational, and problem-solving skills to effectively bridge the finance, sales, and customer service departments. Responsibilities include monitoring accounts receivable, communicating with clients, and implementing collection strategies. Mastery of these skills not only enhances cash flow but also supports the organization's overall financial health. A well-crafted resume can highlight these qualifications, demonstrating the candidate's value to potential employers.

Common Responsibilities Listed on Collections Coordinator Resume

- Manage and oversee collections activities for delinquent accounts.

- Communicate regularly with clients to follow up on outstanding payments.

- Analyze account data to identify trends and develop collection strategies.

- Coordinate with internal departments to resolve billing disputes.

- Prepare and maintain accurate records of collections activities.

- Utilize collection software and databases to track payments.

- Execute effective communication strategies for customer engagement.

- Ensure compliance with legal regulations regarding collections.

- Generate reports on collection metrics for management review.

- Assist in training team members on collection best practices.

- Implement improvements to enhance operational efficiency.

High-Level Resume Tips for Collections Coordinator Professionals

A well-crafted resume is essential for Collections Coordinator professionals, as it serves as the first impression to potential employers. In a competitive job market, your resume needs to effectively showcase your skills, achievements, and relevant experience in the collections field. A strong resume not only highlights your qualifications but also demonstrates your understanding of the industry and your ability to contribute to the company's success. This guide will provide practical and actionable resume tips specifically tailored for Collections Coordinator professionals, ensuring that your application stands out in the hiring process.

Top Resume Tips for Collections Coordinator Professionals

- Tailor your resume to each job description by using relevant keywords and phrases that match the employer's requirements.

- Highlight your experience with collections software and tools, as well as any specific industry regulations you are familiar with.

- Quantify your achievements by including metrics, such as the percentage of collections increased or the number of accounts successfully managed.

- Emphasize your communication skills, detailing how you've effectively interacted with clients to resolve payment issues.

- Showcase your problem-solving abilities by providing examples of how you’ve navigated challenging situations in collections.

- Include any relevant certifications or training that enhance your qualifications, such as credit and collections certifications.

- List your ability to work with cross-functional teams, highlighting collaboration with finance, sales, and customer service departments.

- Demonstrate your understanding of compliance and ethical standards in collections, showcasing your commitment to best practices.

- Keep your resume concise and focused, ideally within one page, to ensure that hiring managers can quickly assess your qualifications.

By implementing these tips, you can significantly enhance your resume and increase your chances of landing a job in the Collections Coordinator field. A well-structured resume that effectively showcases your relevant skills and experiences will not only attract the attention of hiring managers but also position you as a strong candidate capable of contributing to their organization's success.

Why Resume Headlines & Titles are Important for Collections Coordinator

In today's competitive job market, a Collections Coordinator plays a crucial role in managing accounts receivable, ensuring timely payments, and maintaining positive relationships with clients. The first opportunity to make a strong impression on hiring managers comes through the resume headline or title. A well-crafted headline can immediately capture attention and succinctly summarize a candidate's key qualifications in just a few impactful words. It should be concise, relevant, and directly related to the Collections Coordinator position, allowing candidates to stand out and effectively communicate their suitability for the role.

Best Practices for Crafting Resume Headlines for Collections Coordinator

- Be concise: Keep the headline brief, ideally under 10 words.

- Use role-specific keywords: Incorporate terms that reflect the Collections Coordinator position.

- Highlight key strengths: Focus on your most relevant skills or experiences.

- Avoid generic phrases: Steer clear of clichés and vague descriptions.

- Tailor to the job description: Customize the headline to match the specific job you are applying for.

- Include quantifiable achievements: If possible, mention specific results or accomplishments.

- Utilize action words: Start with strong verbs to convey confidence and proactivity.

- Reflect your professional brand: Ensure the headline aligns with your overall resume and personal brand.

Example Resume Headlines for Collections Coordinator

Strong Resume Headlines

Results-Driven Collections Coordinator with 5+ Years of Experience in Debt Recovery

Expert in Accounts Receivable Management and Customer Relations

Proven Track Record of Reducing Delinquency Rates by 30% in 12 Months

Weak Resume Headlines

Collections Coordinator Looking for a Job

Experienced Professional in Finance

The strong resume headlines presented above are effective because they are specific, emphasize relevant skills and achievements, and directly relate to the role of a Collections Coordinator. They communicate the candidate's value proposition clearly and concisely, making them memorable to hiring managers. In contrast, the weak headlines fail to impress due to their generic nature and lack of specificity, making it difficult for hiring managers to gauge the candidate's qualifications or unique contributions to the role.

Writing an Exceptional Collections Coordinator Resume Summary

A well-crafted resume summary is crucial for a Collections Coordinator as it serves as the first impression for hiring managers. This brief yet impactful section highlights the candidate's key skills, relevant experience, and notable accomplishments in collections management. By effectively summarizing their qualifications, candidates can quickly capture the attention of employers, demonstrating their suitability for the role. A strong summary should be concise and tailored to the specific job description, ensuring that it resonates with the needs and expectations of the hiring team.

Best Practices for Writing a Collections Coordinator Resume Summary

- Quantify achievements: Use numbers to showcase your impact (e.g., reduced delinquency rates by X%).

- Focus on relevant skills: Highlight skills directly related to collections and financial management.

- Tailor the summary: Customize it for each job application, aligning with the job description.

- Keep it concise: Aim for 2-4 sentences that pack a punch without being overly verbose.

- Use action verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Showcase industry knowledge: Include any specific knowledge of regulations or practices in collections.

- Emphasize soft skills: Mention interpersonal abilities, such as communication and negotiation skills.

- Highlight problem-solving capabilities: Demonstrate your ability to resolve disputes and manage difficult situations.

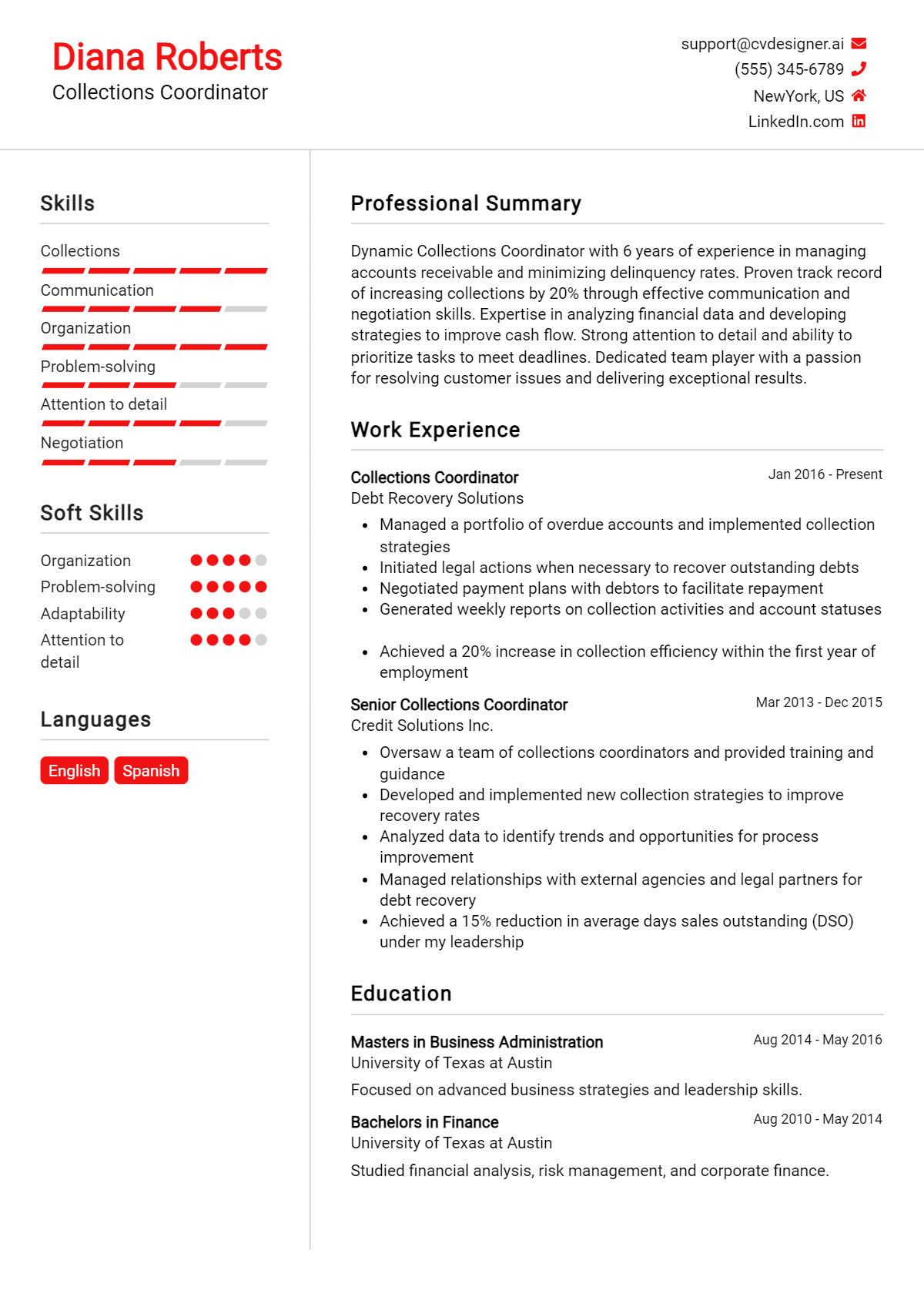

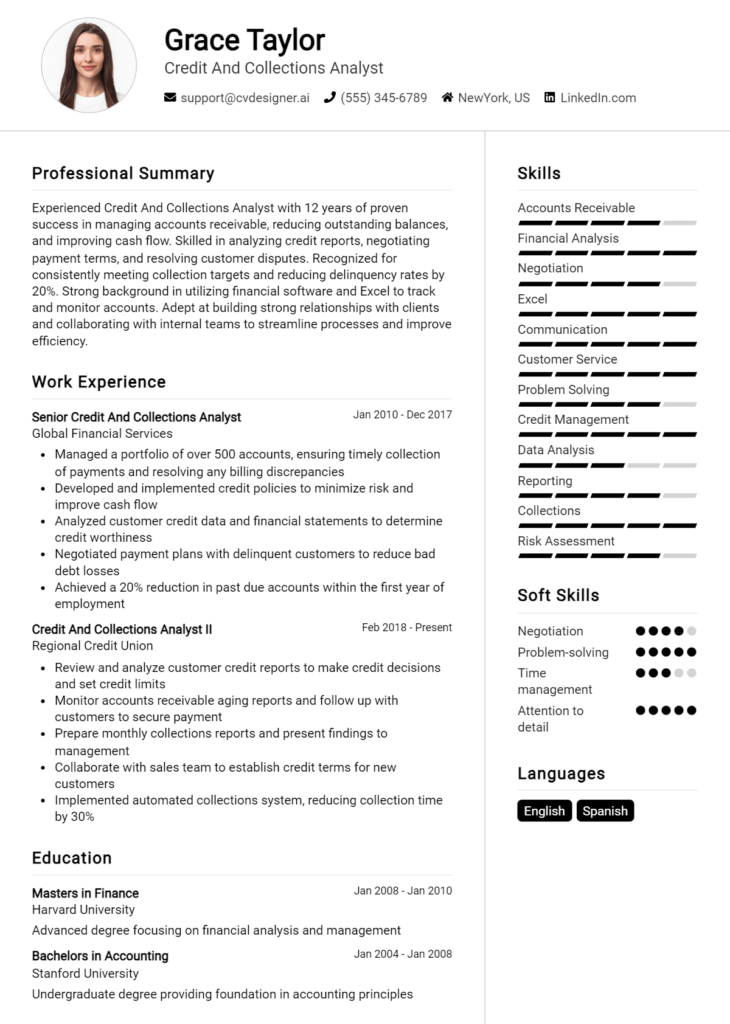

Example Collections Coordinator Resume Summaries

Strong Resume Summaries

Detail-oriented Collections Coordinator with over 5 years of experience in managing accounts receivables and reducing delinquency rates by 30%. Proven track record in negotiating payment plans and fostering positive client relationships, resulting in a 25% increase in collection efficiency.

Results-driven Collections Coordinator skilled in dispute resolution and financial analysis. Achieved a 40% reduction in overdue accounts through strategic follow-up processes and customer engagement. Proficient in utilizing CRM systems to streamline collections operations.

Dedicated Collections Coordinator with expertise in regulatory compliance and risk management. Successfully implemented a new collections strategy that improved cash flow by 20% and decreased account aging by 15%. Strong communicator with a passion for resolving customer issues effectively.

Weak Resume Summaries

Experienced in collections and financial tasks. I have worked in various roles and am looking for a new opportunity.

Collections Coordinator with a solid background in customer service. Seeking to apply my skills in a challenging environment.

The strong resume summaries are effective because they include specific achievements, quantifiable results, and relevant skills that directly relate to the Collections Coordinator role. They demonstrate the candidate's capability and readiness to contribute to the organization. In contrast, the weak summaries lack detail, fail to provide measurable outcomes, and appear generic, which diminishes their impact and leaves hiring managers wanting more information about the candidate's qualifications.

Work Experience Section for Collections Coordinator Resume

The work experience section of a Collections Coordinator resume is essential in demonstrating a candidate's qualifications for the role. This section serves as a platform to showcase not only technical skills related to collections management but also the ability to lead teams effectively and deliver high-quality results. By highlighting specific achievements and aligning previous experiences with industry standards, candidates can present themselves as top contenders. Quantifying accomplishments, such as improved collection rates or reduced outstanding debts, further strengthens this section, making it a crucial element of the resume.

Best Practices for Collections Coordinator Work Experience

- Highlight specific technical skills relevant to collections processes, such as knowledge of software tools and data analysis.

- Quantify achievements with metrics, such as percentage of collections improved or reduction in aging accounts.

- Use action verbs to describe responsibilities and accomplishments, emphasizing proactive contributions.

- Demonstrate collaboration by mentioning teamwork or cross-departmental projects that improved collections outcomes.

- Align experience descriptions with industry standards and best practices to demonstrate familiarity with current trends.

- Focus on results-driven experiences that directly impacted the organization’s financial health.

- Include any relevant certifications or training that enhance your qualifications as a Collections Coordinator.

- Tailor work experience to the specific job description, ensuring alignment with the employer’s needs.

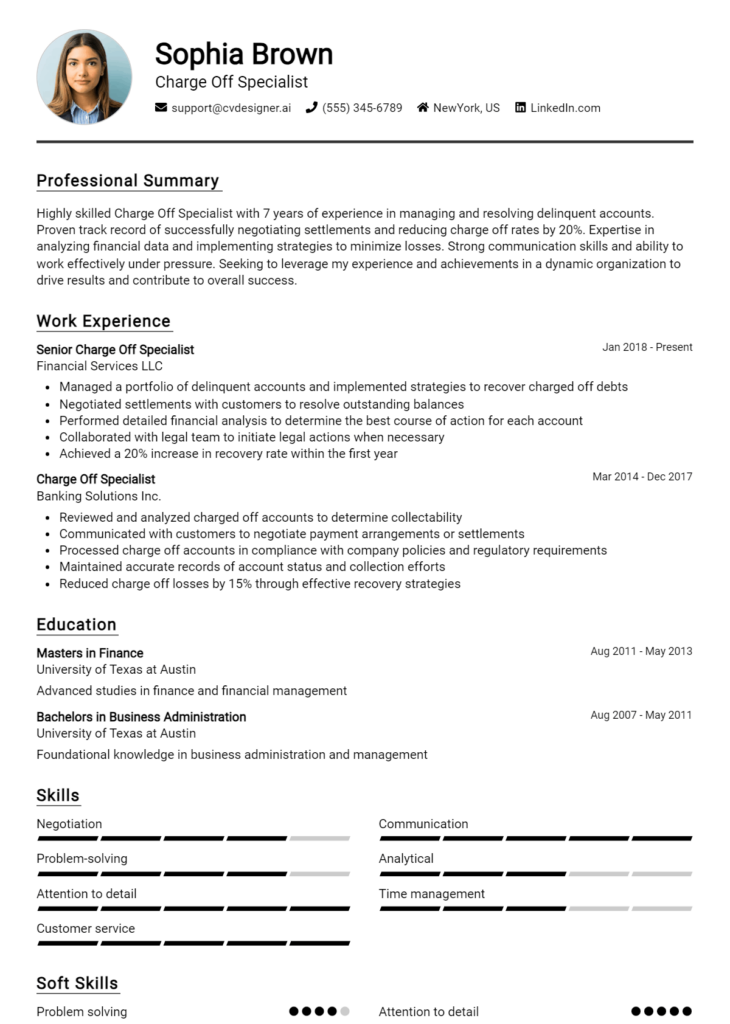

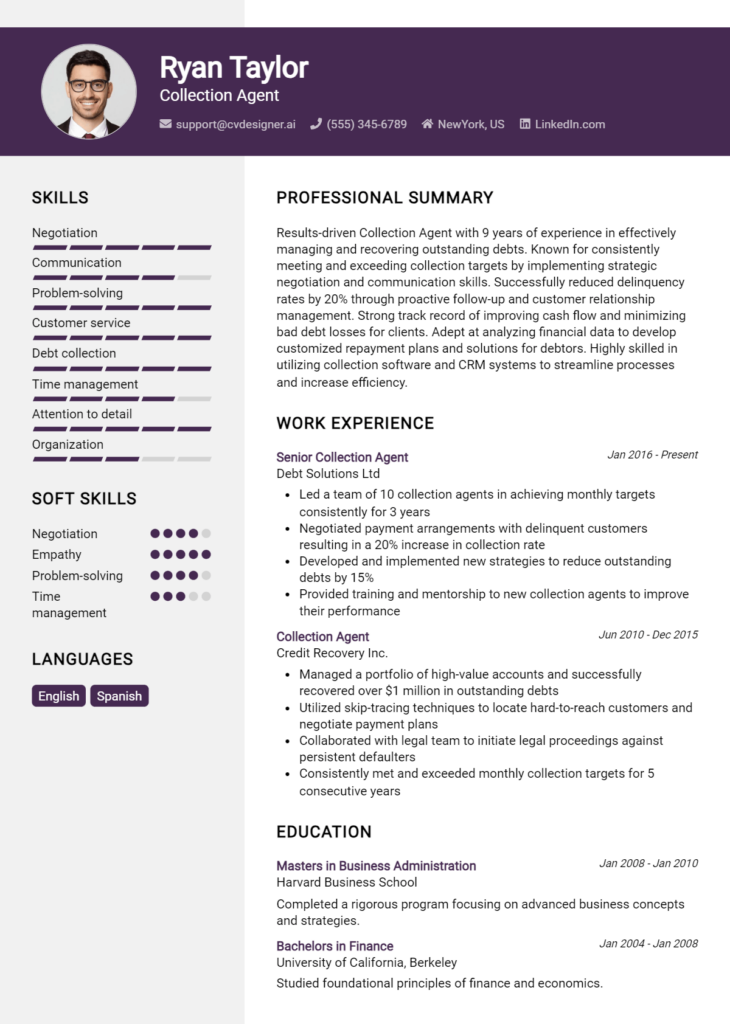

Example Work Experiences for Collections Coordinator

Strong Experiences

- Led a team of five in implementing a new collections software, resulting in a 30% increase in on-time payments within six months.

- Reduced aged receivables by 40% through the development and execution of targeted collection strategies over one fiscal year.

- Collaborated with the sales department to create a streamlined process for addressing customer disputes, decreasing resolution time by 25%.

- Trained and mentored junior staff in best practices for collections, contributing to a team performance improvement reflected in a 15% rise in overall productivity.

Weak Experiences

- Responsible for managing collections tasks and ensuring accounts were followed up.

- Worked with the team to address customer payments.

- Assisted in paperwork related to collections and handled some customer inquiries.

- Participated in meetings regarding collections without clear contributions or outcomes.

The examples of work experience are considered strong because they include specific achievements with quantifiable results, demonstrating how the candidate made a tangible impact in previous roles. They also reflect leadership and collaboration, which are crucial for a Collections Coordinator. In contrast, the weak experiences lack detail and measurable outcomes, making them vague and unimpressive. They do not convey the candidate's contributions effectively or show any significant accomplishments, which could hinder their competitiveness in the job market.

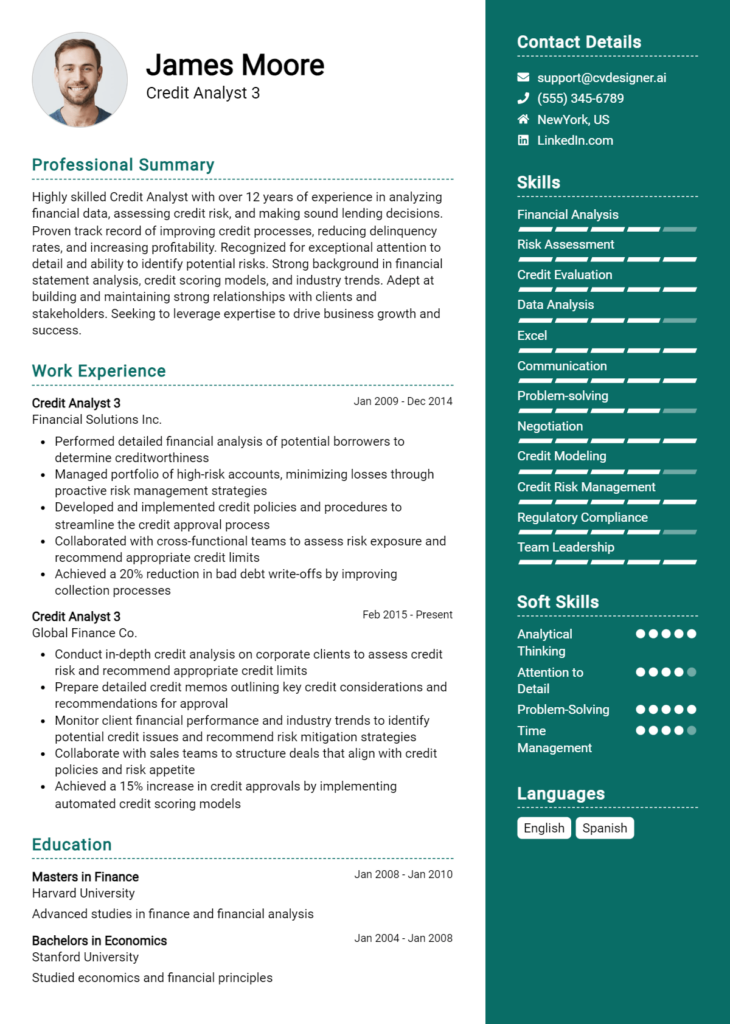

Education and Certifications Section for Collections Coordinator Resume

The education and certifications section of a Collections Coordinator resume plays a crucial role in establishing the candidate's qualifications and expertise in the field. This section not only highlights the academic background of the applicant but also showcases relevant industry certifications and continuous learning efforts that are essential for success in collections management. By providing details on relevant coursework, certifications, and any specialized training, candidates can greatly enhance their credibility and align their qualifications with the specific demands of the job role, demonstrating their commitment to professional growth and proficiency in collections practices.

Best Practices for Collections Coordinator Education and Certifications

- Focus on relevant degrees, such as a Bachelor’s in Finance, Business Administration, or Accounting.

- Include industry-recognized certifications, such as Certified Revenue Cycle Representative (CRCR) or Certified Credit and Collection Specialist (CCCS).

- Highlight any specialized training in collections software or regulatory compliance.

- List relevant coursework that demonstrates knowledge in credit management, debt recovery, or financial analysis.

- Ensure that all certifications are current and clearly indicate their expiration dates, if applicable.

- Use clear, concise language to describe educational accomplishments, avoiding jargon that may confuse hiring managers.

- Consider the format of the section; using bullet points can improve readability and highlight key information effectively.

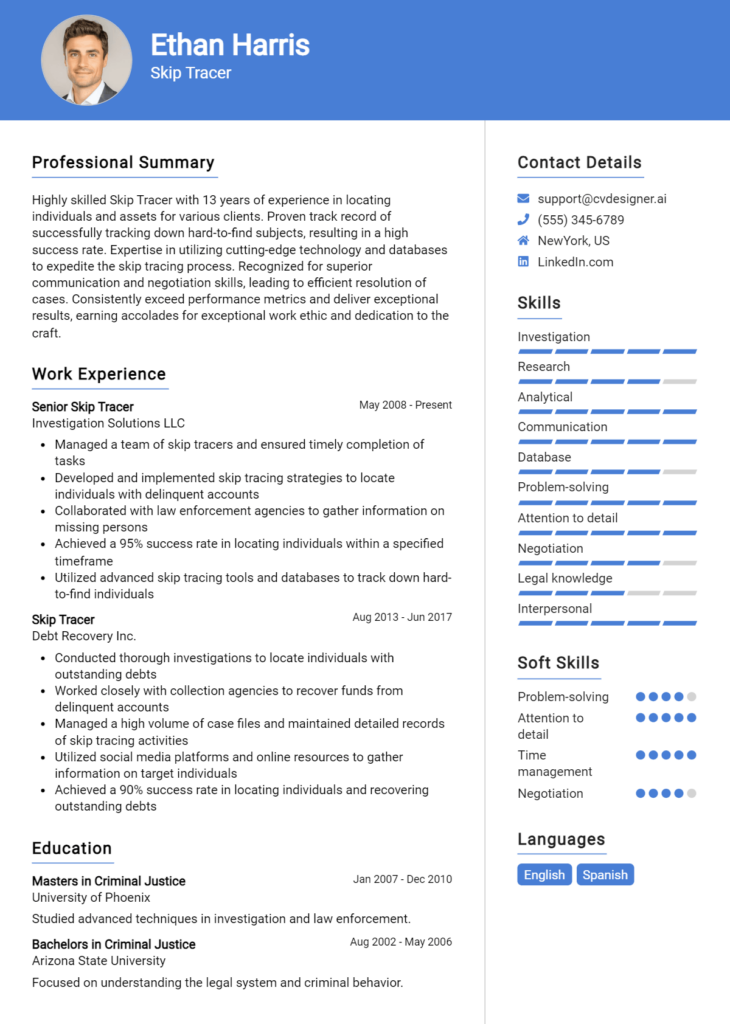

Example Education and Certifications for Collections Coordinator

Strong Examples

- Bachelor of Science in Finance, XYZ University, 2020

- Certified Revenue Cycle Representative (CRCR), 2022

- Coursework in Credit Management and Debt Recovery, ABC Community College, 2019

- Certification in Financial Compliance, National Association of Credit Management, 2021

Weak Examples

- Associate Degree in General Studies, Any College, 2018

- Certificate in Basic Computer Skills, Online Training, 2019

- High School Diploma, Local High School, 2015

- Outdated Certification in Basic Accounting Principles, 2010

The strong examples listed above are considered effective because they align closely with the requirements and expectations of a Collections Coordinator role, showcasing relevant degrees, current certifications, and applicable coursework. In contrast, the weak examples reflect qualifications that are either outdated, irrelevant to the collections field, or lack depth in terms of industry-specific knowledge. This clear distinction emphasizes the importance of relevance and timeliness in education and certification credentials for potential employers.

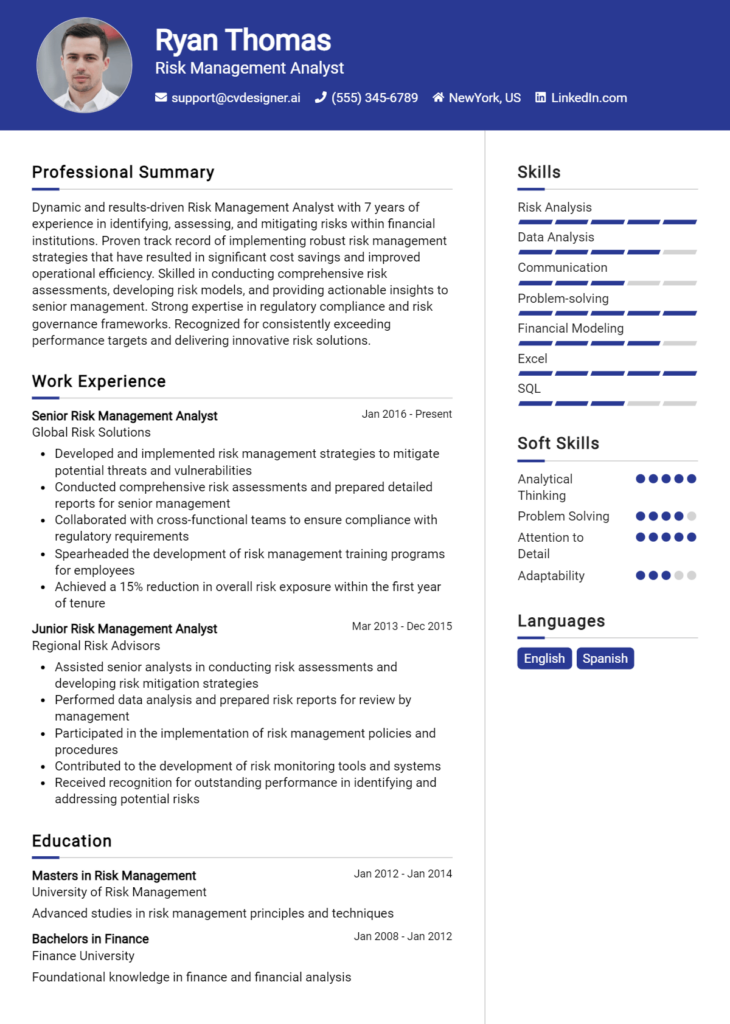

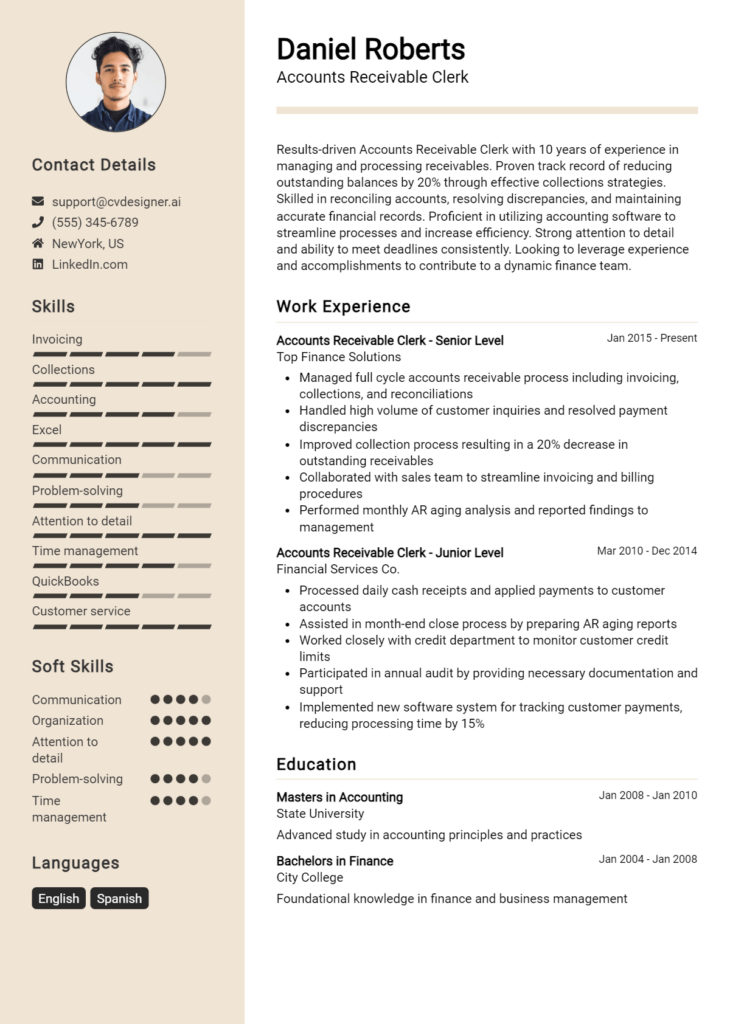

Top Skills & Keywords for Collections Coordinator Resume

In the competitive field of collections, a well-crafted resume is crucial for standing out to potential employers. For a Collections Coordinator, showcasing both hard and soft skills is essential to demonstrate the ability to manage accounts effectively, communicate with clients, and resolve disputes. Skills not only illustrate your capabilities but also reflect your understanding of the industry and your readiness to contribute to the organization. A solid combination of these skills will enhance your resume, making it more appealing to hiring managers and increasing your chances of landing the job.

Top Hard & Soft Skills for Collections Coordinator

Soft Skills

- Strong communication skills

- Excellent negotiation abilities

- Conflict resolution

- Attention to detail

- Time management

- Empathy and customer service orientation

- Problem-solving skills

- Adaptability

- Team collaboration

- Organization

Hard Skills

- Proficiency in collections software

- Knowledge of financial regulations

- Data entry and database management

- Credit analysis

- Proficient in Microsoft Office Suite (Excel, Word, etc.)

- Familiarity with accounting principles

- Reporting and analytics

- Ability to maintain accurate records

- Knowledge of debt recovery processes

- Understanding of legalities related to collections

By incorporating these skills into your resume, along with relevant work experience, you'll be better positioned to capture the interest of potential employers and demonstrate your value as a Collections Coordinator.

Stand Out with a Winning Collections Coordinator Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Collections Coordinator position at [Company Name], as advertised on [Job Board/Company Website]. With a strong background in accounts receivable management and a proven track record of improving collection processes, I am excited about the opportunity to contribute to your team. My experience in maintaining positive client relationships while ensuring timely payments aligns well with the objectives of your organization.

In my previous role at [Previous Company Name], I successfully managed a portfolio of over 200 accounts, achieving a collection rate of 95% within the first 30 days of the billing cycle. My approach combines proactive communication with clients and meticulous record-keeping, allowing me to identify potential issues before they escalate. I implemented a new tracking system that streamlined our collections process, reducing the average days sales outstanding (DSO) by 15%. I am eager to bring this proactive mindset and innovative problem-solving skills to [Company Name], where I can help enhance your collection strategies.

I am particularly drawn to this role at [Company Name] due to your commitment to maintaining customer satisfaction while ensuring financial integrity. I believe that my experience in negotiating payment plans and resolving disputes can contribute to a more efficient collections process, ultimately benefiting both the company and its clients. I am adept at utilizing various software tools for managing accounts and analyzing data, which I believe will further support your team's objectives.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am excited about the possibility of contributing to [Company Name] and would appreciate the chance to interview at your earliest convenience.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Collections Coordinator Resume

When crafting a resume for the role of a Collections Coordinator, it's essential to avoid common pitfalls that can hinder your chances of making a strong impression on potential employers. A well-structured resume should highlight your relevant skills and experiences while also presenting your qualifications in a clear and professional manner. However, many candidates make mistakes that can detract from the effectiveness of their resumes. Here are some common mistakes to steer clear of:

Vague Job Descriptions: Failing to provide specific details about previous roles can leave employers guessing about your actual responsibilities and achievements.

Ignoring Keywords: Not including industry-specific keywords can result in your resume being overlooked by applicant tracking systems (ATS) that many companies use to filter candidates.

Overloading with Information: Including excessive details or unrelated job experiences can clutter your resume and distract from your core qualifications.

Poor Formatting: A resume that is difficult to read due to inconsistent formatting, font choices, or layout can create a negative impression and hinder the reader's ability to find key information.

Neglecting Achievements: Focusing solely on duties rather than quantifiable achievements can make your application less compelling. Highlighting metrics, such as reduced overdue accounts or improved collection rates, can demonstrate your effectiveness.

Using Clichés: Phrases like "hardworking" or "team player" can come across as generic. Instead, use specific examples to illustrate your skills and contributions.

Typos and Grammatical Errors: Submitting a resume with spelling mistakes or grammatical errors can signal a lack of attention to detail, which is critical in a collections role.

Not Tailoring the Resume: Sending out a generic resume without customizing it for the specific job can result in missed opportunities. Tailoring your resume to align closely with the job description can make a significant difference.

Conclusion

In conclusion, the role of a Collections Coordinator is vital in ensuring that a company maintains healthy cash flow and manages its accounts receivable effectively. Key responsibilities include monitoring overdue accounts, communicating with clients to facilitate payments, and collaborating with internal teams to resolve disputes. A successful Collections Coordinator must possess strong communication skills, attention to detail, and a solid understanding of financial processes.

If you're looking to advance your career in this field or simply want to enhance your job prospects, it's crucial to have a polished and targeted resume. Take the time to review and update your Collections Coordinator resume to highlight your relevant skills and experiences effectively.

To assist you in this task, consider utilizing available resources such as resume templates, a resume builder, and resume examples that can guide you in crafting a standout resume. Additionally, don’t forget to explore cover letter templates to complement your application. Start refining your resume today and take the next step toward your career goals!