34 Skills to Include in Your 2025 Actuary Resume with Examples

As an actuary, having a robust skill set is crucial to effectively analyze and interpret complex data related to financial risks and uncertainties. Employers seek candidates who possess a blend of technical expertise, analytical thinking, and strong communication abilities. In this section, we will explore the top skills that should be highlighted on your resume to demonstrate your qualifications and make a strong impression in the competitive field of actuarial science.

Best Actuary Technical Skills

Technical skills are essential for actuaries as they enable professionals to analyze data, assess risks, and provide strategic insights for businesses. These skills not only enhance problem-solving capabilities but also ensure accuracy and efficiency in the decision-making process. Below are some of the top technical skills that can significantly elevate your resume as an actuary.

Statistical Analysis

Statistical analysis forms the foundation of actuarial work, allowing actuaries to interpret data patterns and trends effectively. This skill is crucial for predicting future events and making informed decisions.

How to show it: Include specific examples of statistical methods you have applied, such as regression analysis or time series forecasting, along with the impact of your findings on business outcomes.

Risk Assessment

Risk assessment involves identifying, evaluating, and prioritizing risks, which is central to the actuarial profession. This skill helps in developing strategies to mitigate potential financial losses.

How to show it: Demonstrate your experience by detailing projects where you conducted comprehensive risk assessments and the quantitative metrics that illustrate the effectiveness of your risk management strategies.

Financial Modeling

Financial modeling is the process of creating representations of a company's financial performance. Actuaries use this skill to forecast revenues, expenses, and profitability under various scenarios.

How to show it: Highlight specific financial models you have developed, including any software tools used, and provide results that show improvements in financial forecasting accuracy.

Data Visualization

Data visualization is essential for presenting complex data in an understandable format. This skill allows actuaries to communicate insights effectively to stakeholders.

How to show it: Include examples of data visualization tools you are proficient in, such as Tableau or Power BI, and describe how your visualizations led to actionable insights for the organization.

Programming Proficiency

Proficiency in programming languages such as R, Python, or SAS is increasingly important for actuaries. This skill enables them to manipulate large datasets and automate processes.

How to show it: List the programming languages you are skilled in and provide examples of how you utilized these skills to enhance data analysis or streamline actuarial processes.

Regulatory Knowledge

Understanding regulatory requirements is crucial for actuaries to ensure compliance in financial reporting and risk assessments. This skill helps in navigating the legal landscape of insurance and finance.

How to show it: Detail any specific regulations you are familiar with and how your knowledge has contributed to compliance initiatives within your organization.

Predictive Modeling

Predictive modeling uses statistical techniques to forecast future events based on historical data. This skill is vital for actuaries in assessing risks and making data-driven predictions.

How to show it: Share examples of predictive models you have built, including the methodologies used and the accuracy of your forecasts compared to actual outcomes.

Excel Expertise

Excel remains a fundamental tool for actuaries, used for data analysis, financial modeling, and presentations. Advanced Excel skills can greatly enhance efficiency and accuracy in actuarial tasks.

How to show it: Specify any advanced Excel functions or tools you are proficient in, and give examples of how you have utilized these skills to improve reporting or analysis processes.

Communication Skills

Strong communication skills are essential for actuaries to convey complex concepts to non-technical stakeholders. This skill enhances collaboration and ensures that insights are understood and implemented.

How to show it: Include instances where your communication skills facilitated successful presentations or collaborations, and quantify any improvements in decision-making as a result.

Project Management

Project management skills help actuaries to oversee projects efficiently, ensuring that deadlines are met and objectives are achieved. This skill is crucial in managing multiple tasks and stakeholders.

How to show it: Highlight your experience in managing actuarial projects, including the scope, duration, and outcomes, along with any relevant certifications, such as PMP.

Best Actuary Soft Skills

In the competitive field of actuarial science, possessing strong soft skills is just as crucial as having technical expertise. While analytical abilities and mathematical knowledge form the foundation of an actuary's work, soft skills enhance communication, teamwork, and problem-solving capabilities. These skills can significantly impact an actuary's effectiveness in collaborating with clients and stakeholders, making them essential for career advancement.

Analytical Thinking

Analytical thinking allows actuaries to assess complex data, identify trends, and make informed decisions based on quantitative information.

How to show it: Highlight specific projects where you analyzed data sets to derive insights. Include metrics that demonstrate your impact, such as improved forecasting accuracy or reduced risk exposure.

Communication Skills

Effective communication is vital for actuaries, as they must convey complex information in a clear and concise manner to non-technical stakeholders.

How to show it: Provide examples of presentations or reports you've delivered. Quantify the audience size or the impact of your communication on decision-making processes.

Problem-Solving

Problem-solving skills enable actuaries to develop innovative solutions to challenging issues, ensuring that they can navigate uncertainties in their analyses.

How to show it: Describe specific problems you solved in previous roles, detailing the methodologies used and the positive outcomes achieved, such as cost savings or risk mitigation.

Attention to Detail

Attention to detail is critical for actuaries, as even minor errors in calculations can lead to significant financial implications.

How to show it: Share instances where your meticulousness prevented potential errors or oversights. Include metrics that reflect your accuracy, such as error rates in your reports.

Team Collaboration

Actuaries often work in teams, making collaboration skills essential for sharing knowledge, aligning goals, and ensuring project success.

How to show it: Illustrate your role in team projects, emphasizing contributions that led to successful outcomes. Mention any leadership roles or collaborative initiatives you spearheaded.

Adaptability

In a constantly evolving industry, adaptability helps actuaries adjust to new methodologies, regulations, and technologies.

How to show it: Provide examples of how you adapted to changes in your work environment or industry trends. Quantify the benefits gained from your flexibility, such as enhanced efficiency or improved service delivery.

Time Management

Effective time management ensures actuaries can meet deadlines while maintaining high-quality work across multiple projects.

How to show it: Detail how you prioritize tasks and manage your time effectively. Mention specific projects where you delivered results ahead of deadlines, along with any positive feedback received from stakeholders.

Critical Thinking

Critical thinking enables actuaries to evaluate different perspectives and make sound judgments based on available data.

How to show it: Discuss situations where you assessed various options and made strategic recommendations. Include the outcomes of those decisions and any measurable impacts on the organization.

Interpersonal Skills

Interpersonal skills are essential for building relationships with clients and colleagues, fostering a collaborative work environment.

How to show it: Include examples of successful interactions with clients or team members. Highlight any positive feedback received or improvements in client satisfaction as a result of your interpersonal effectiveness.

Creativity

Creativity allows actuaries to think outside the box and develop innovative models and solutions to complex problems.

How to show it: Share instances where your creative approach led to a successful project outcome. Quantify the impact of your creative solutions, such as revenue growth or enhanced risk assessment accuracy.

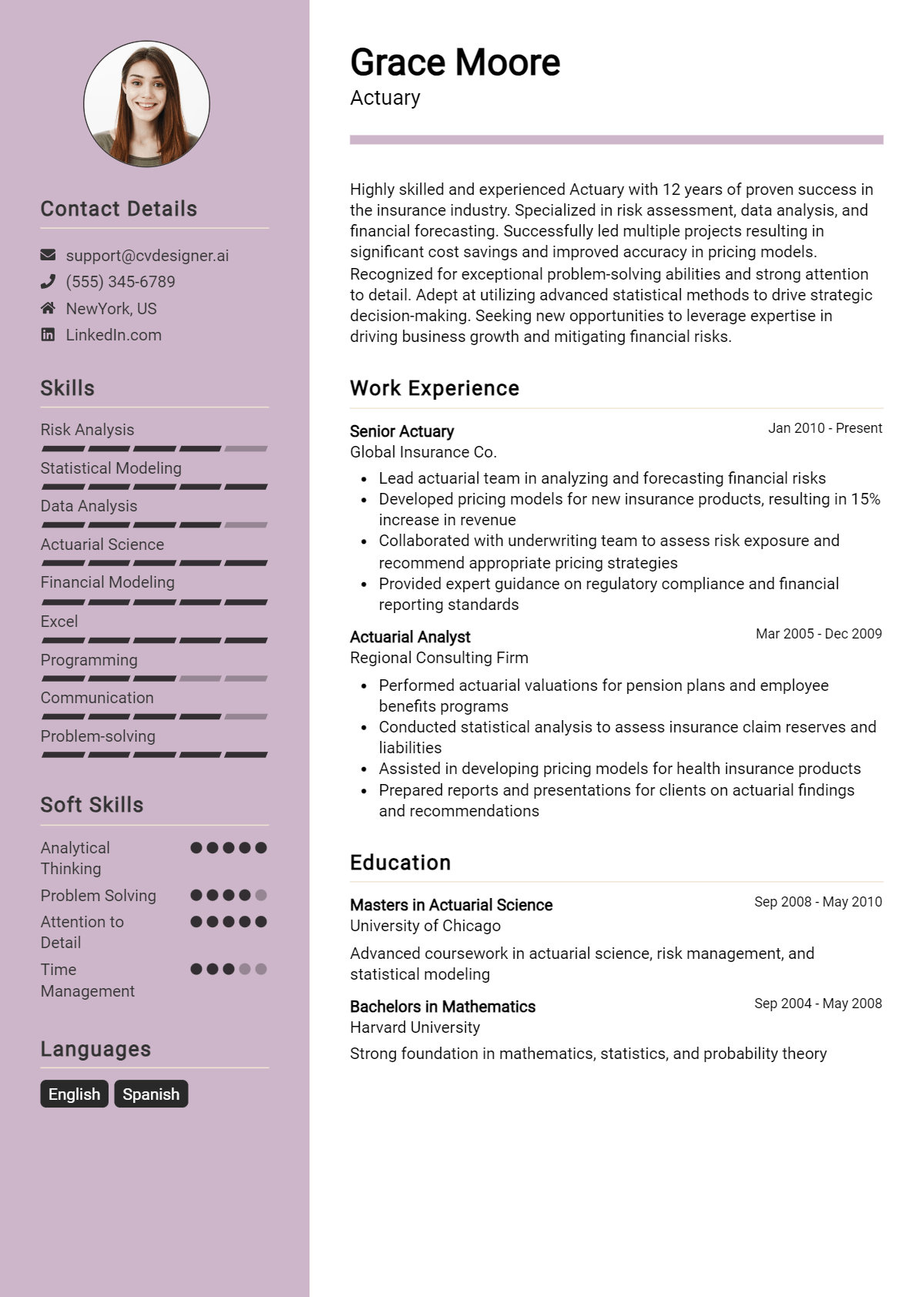

How to List Actuary Skills on Your Resume

Effectively listing your skills on a resume is crucial to capturing the attention of potential employers. Highlighting your qualifications in a clear and structured manner can set you apart from other candidates. There are three main sections where you can showcase your skills: the Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing Actuary skills in your introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications, making it easier for them to assess your fit for the role.

Example

Results-driven actuary with expertise in statistical analysis and risk assessment. Proven track record of developing financial models to optimize business strategies and enhance profitability.

for Work Experience

The work experience section is an excellent opportunity to demonstrate how your Actuary skills have been applied in real-world scenarios, showcasing your impact on previous employers.

Example

- Conducted in-depth risk analysis to inform critical business decisions, leading to a 15% reduction in potential losses.

- Developed and implemented predictive modeling techniques that improved the accuracy of financial forecasts.

- Collaborated with cross-functional teams to assess insurance policies, ensuring compliance with regulatory standards.

- Utilized strong communication skills to present complex actuarial findings to stakeholders, facilitating informed decision-making.

for Skills

The skills section can either showcase technical or transferable skills, and it is essential to include a balanced mix of hard and soft skills that strengthen your overall qualifications.

Example

- Statistical Analysis

- Risk Management

- Predictive Modeling

- Data Interpretation

- Financial Forecasting

- Problem Solving

- Attention to Detail

- Effective Communication

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how those skills have positively impacted your previous roles.

Example

In my previous roles, my strong skills in risk assessment and predictive modeling have enabled me to develop strategies that significantly minimized financial risks while maximizing profitability. I am eager to bring this expertise to your team and contribute to your success.

Linking the skills mentioned in your resume to specific achievements in your cover letter will further reinforce your qualifications for the job.

The Importance of Actuary Resume Skills

Highlighting relevant skills on an actuary resume is crucial for candidates aiming to secure a position in this competitive field. A well-crafted skills section not only helps candidates stand out to recruiters but also aligns their qualifications with the specific job requirements. This alignment can significantly increase the chances of being noticed in a crowded applicant pool, showcasing the candidate's suitability for the role effectively.

- Demonstrates Technical Expertise: Actuaries work with complex mathematical models and statistical analysis. A clear skills section highlights proficiency in these areas, reassuring employers of the candidate's technical capabilities.

- Aligns with Job Requirements: Many actuary positions have specific skill sets that employers look for. By tailoring the skills section to these requirements, candidates can illustrate their direct fit for the role.

- Showcases Problem-Solving Abilities: Actuaries are often tasked with solving intricate problems. Highlighting skills such as analytical thinking and critical reasoning reflects a candidate's ability to tackle challenges effectively.

- Indicates Proficiency with Software Tools: Familiarity with industry-specific software, such as SAS or R, is essential for actuaries. Listing these skills shows that a candidate is prepared to hit the ground running.

- Enhances Communication Skills: Actuaries must convey complex concepts to non-technical audiences. Including skills related to communication and presentation can set candidates apart as effective team players.

- Reflects Continuous Learning: The field of actuarial science is ever-evolving. Demonstrating a commitment to ongoing education and skill enhancement indicates a candidate's dedication to professional growth.

- Builds Professional Confidence: A well-articulated skills section can boost a candidate's confidence as they prepare for interviews, knowing they have clearly outlined their strengths and abilities.

How To Improve Actuary Resume Skills

In the ever-evolving field of actuarial science, it is crucial for professionals to continuously enhance their skills to remain competitive and effective in their roles. As the industry adapts to new technologies, regulations, and market conditions, actuaries must be proactive in developing their expertise. This not only improves job performance but also enhances career advancement opportunities.

- Stay Updated with Industry Trends: Regularly read industry publications and participate in webinars to keep abreast of the latest developments in actuarial science.

- Pursue Continuing Education: Enroll in relevant courses and obtain certifications that can deepen your knowledge and broaden your skill set.

- Practice Data Analysis: Enhance your statistical and analytical skills by working on real-world datasets and using statistical software tools.

- Network with Professionals: Join actuarial associations and attend conferences to connect with peers and learn from their experiences.

- Enhance Technical Skills: Familiarize yourself with programming languages such as R or Python, which are increasingly important for data analysis in actuarial work.

- Develop Communication Skills: Work on your ability to clearly communicate complex ideas to non-technical stakeholders through presentations and reports.

- Seek Mentorship: Find a mentor in the field who can provide guidance, share insights, and help you navigate your career path.

Frequently Asked Questions

What are the essential skills needed for an actuary's resume?

Essential skills for an actuary's resume include strong analytical and mathematical abilities, proficiency in statistical software, and a solid understanding of finance and economics. Additionally, communication skills are crucial, as actuaries must effectively convey complex concepts to non-technical stakeholders. Problem-solving skills and attention to detail are also vital, enabling actuaries to analyze data and provide accurate recommendations.

How important is computer proficiency for an actuary?

Computer proficiency is extremely important for an actuary, as they frequently use specialized software and programming languages such as R, Python, or SQL to analyze data and perform complex calculations. Familiarity with spreadsheet software like Microsoft Excel is also essential for modeling and data manipulation. Demonstrating technical skills on a resume can make candidates more competitive in the job market.

Should I include certifications on my actuary resume?

Yes, including relevant certifications on your actuary resume is highly recommended. Certifications from recognized professional organizations, such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS), demonstrate your commitment to the profession and validate your expertise. Highlighting passed exams or completed modules can significantly enhance your credibility and appeal to potential employers.

What role does experience play in an actuary's resume?

Experience plays a critical role in an actuary's resume, showcasing your ability to apply theoretical knowledge in practical situations. Employers often look for candidates with relevant internship or work experience in actuarial roles, as this indicates a strong understanding of the industry and its challenges. Highlighting specific projects or achievements can further illustrate your capabilities and contributions to previous employers.

How can I demonstrate problem-solving skills on my actuary resume?

To demonstrate problem-solving skills on your actuary resume, include specific examples of challenges you faced in previous roles and the analytical methods you employed to overcome them. Use quantifiable results to showcase your effectiveness, such as improvements in efficiency or cost reductions achieved through your solutions. Describing your thought process and the impact of your decisions can effectively convey your problem-solving abilities to potential employers.

Conclusion

Including actuarial skills in your resume is crucial for demonstrating your expertise and value to potential employers. By showcasing relevant skills such as data analysis, risk assessment, and mathematical proficiency, you not only stand out among other candidates but also illustrate your capability to contribute significantly to an organization. Remember, a well-crafted resume can open doors to remarkable opportunities. So, take the time to refine your skills and enhance your job application to pave the way for a successful career in actuarial science.

For additional resources, check out our resume templates, utilize our resume builder, explore resume examples, and customize your applications with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.