Actuary Core Responsibilities

An actuary plays a crucial role in assessing financial risks using mathematics, statistics, and financial theory. Key responsibilities include analyzing data to forecast future events, developing policies, and collaborating with various departments such as finance, underwriting, and risk management. Essential skills encompass technical proficiency in statistical software, operational insights to improve processes, and problem-solving abilities to devise effective solutions. These competencies contribute significantly to the organization's goals, making a well-structured resume vital in showcasing these qualifications.

Common Responsibilities Listed on Actuary Resume

- Conducting risk assessments and financial modeling.

- Analyzing statistical data to identify trends and forecasts.

- Developing pricing strategies for insurance products.

- Collaborating with underwriters and finance teams.

- Preparing reports and presentations for stakeholders.

- Ensuring compliance with regulations and standards.

- Performing scenario analysis and stress testing.

- Advising on investment strategies and portfolio management.

- Monitoring and evaluating financial performance.

- Utilizing actuarial software for data analysis.

- Communicating complex findings to non-technical audiences.

- Participating in continuous professional development and training.

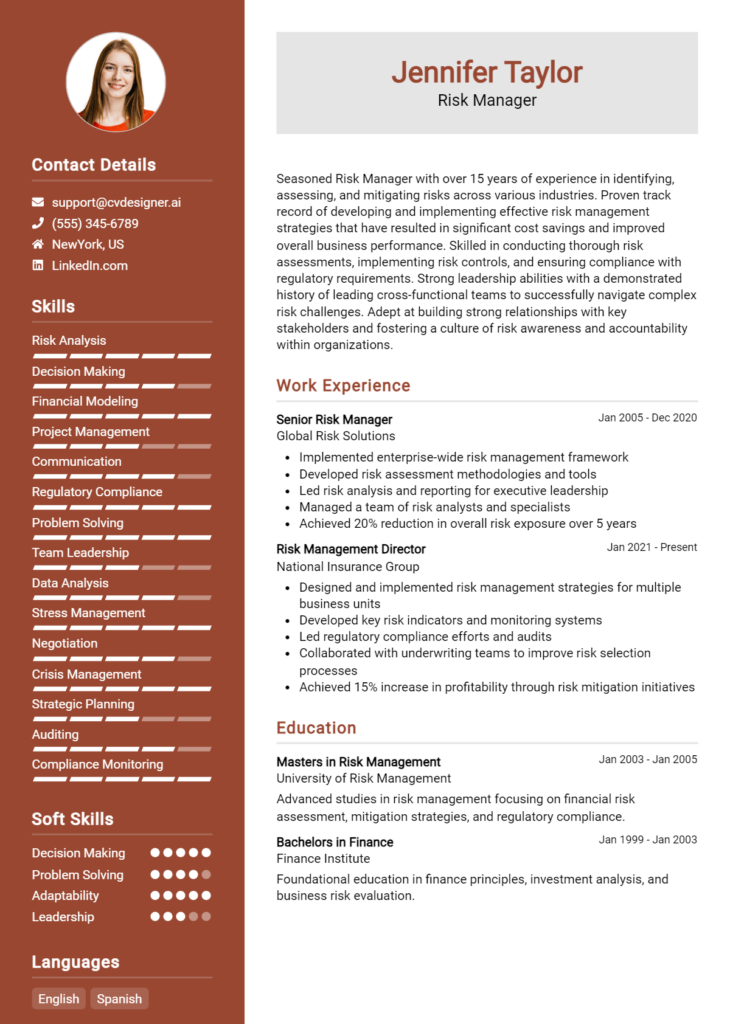

High-Level Resume Tips for Actuary Professionals

In the competitive field of actuarial science, a well-crafted resume is not just a formality; it’s a critical tool that can open doors to your next opportunity. As the first impression a potential employer has of you, your resume must effectively showcase your skills, experience, and achievements. For actuaries, this means not only demonstrating your analytical capabilities but also presenting your qualifications in a clear, concise, and compelling manner. In this guide, we will provide practical and actionable resume tips specifically tailored for Actuary professionals to help you stand out in a crowded job market.

Top Resume Tips for Actuary Professionals

- Tailor your resume to match the job description by using relevant keywords and phrases.

- Highlight your actuarial exams and certifications prominently, as they are critical to your qualifications.

- Showcase relevant experience by detailing your roles in previous positions and how they relate to the job you’re applying for.

- Quantify your achievements with specific metrics, such as the percentage of risk reduction or cost savings you achieved.

- Include industry-specific skills such as proficiency in actuarial software (e.g., SAS, R, or Python) and statistical analysis.

- Emphasize teamwork and communication skills, as actuaries often collaborate with non-technical teams.

- Use a clean and professional layout that enhances readability and makes key information easily accessible.

- Incorporate a strong summary statement that encapsulates your experiences and goals as an actuary.

- Keep your resume concise, ideally one page, focusing on the most relevant information to the position.

By implementing these tips, you can significantly increase your chances of landing a job in the actuarial field. A well-structured resume that effectively communicates your unique skills and achievements will not only capture the attention of hiring managers but also set you apart from other candidates, paving the way for a successful career in actuarial science.

Why Resume Headlines & Titles are Important for Actuary

In the competitive field of actuarial science, a well-crafted resume headline or title serves as a powerful tool for job seekers. It acts as a first impression, capturing the attention of hiring managers and summarizing a candidate’s key qualifications in a succinct and impactful manner. A strong headline not only highlights relevant skills and experiences but also conveys the candidate’s professional identity, making it easier for hiring managers to quickly assess their fit for the role. To be truly effective, the headline should be concise, relevant, and directly aligned with the specific job being applied for, ensuring that it resonates with the requirements of the position.

Best Practices for Crafting Resume Headlines for Actuary

- Keep it concise—aim for one impactful phrase.

- Make it role-specific by incorporating key actuarial terminology.

- Highlight your strongest skills or experiences relevant to the job.

- Use quantifiable achievements when possible to add credibility.

- Avoid generic phrases; be unique to stand out.

- Align the headline with the job description to ensure relevance.

- Utilize action-oriented language to convey enthusiasm and proactivity.

- Test variations of your headline to see what resonates best.

Example Resume Headlines for Actuary

Strong Resume Headlines

"Detail-Oriented Actuary Specializing in Risk Assessment and Financial Modeling"

“Results-Driven Actuary with 5+ Years of Experience in Data Analysis and Predictive Analytics”

“Award-Winning Actuarial Analyst with Proven Success in Reducing Risk Exposure”

Weak Resume Headlines

“Actuary Looking for a Job”

“Experienced Professional”

Strong headlines are effective because they convey specific skills, experiences, and accomplishments that directly relate to the actuarial profession, making it clear to hiring managers why the candidate is a strong fit for the role. In contrast, weak headlines fail to impress due to their vagueness and lack of specific information; they do not provide any insight into the candidate's unique qualifications or value, which can result in being overlooked in favor of more compelling applicants.

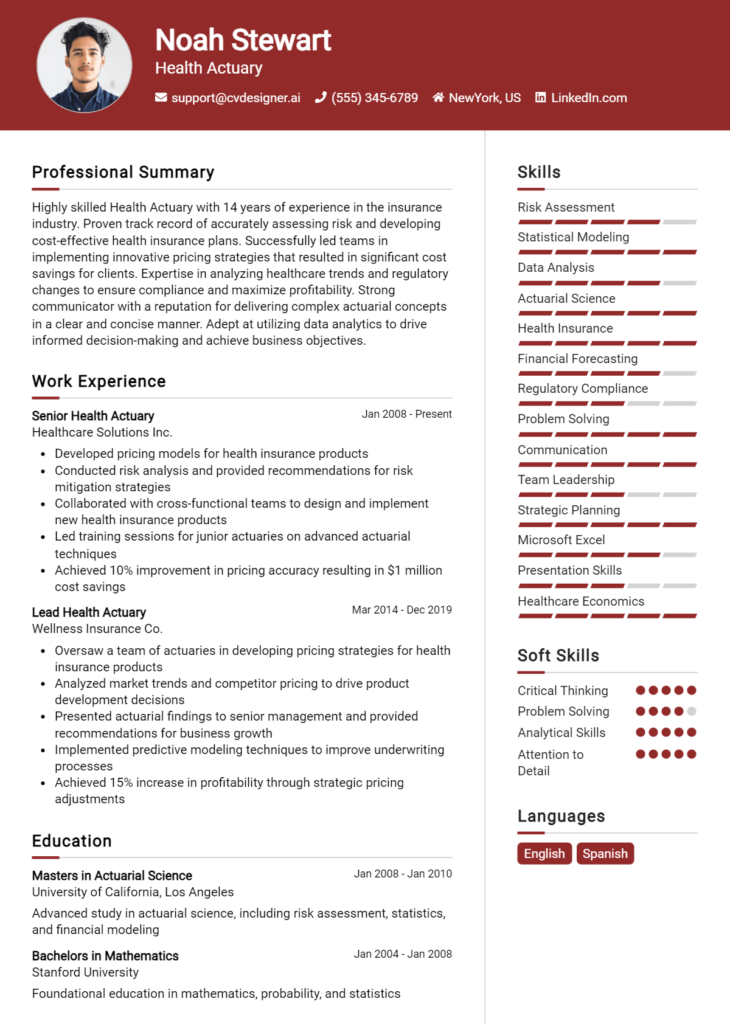

Writing an Exceptional Actuary Resume Summary

A resume summary is a crucial component for actuaries looking to make a strong impression on hiring managers. It serves as a powerful introduction that quickly highlights key skills, relevant experience, and notable accomplishments in the field of actuarial science. A well-crafted summary not only captures the attention of decision-makers but also sets the tone for the rest of the resume. It should be concise, impactful, and tailored to the specific job the candidate is applying for, ensuring that it aligns with the company’s needs and expectations.

Best Practices for Writing a Actuary Resume Summary

- Quantify Achievements: Use numbers to demonstrate the impact of your work, such as percentage improvements or cost savings.

- Focus on Key Skills: Highlight specific actuarial skills that are relevant to the job, such as risk assessment, data analysis, or financial modeling.

- Tailor for the Job Description: Customize your summary to reflect the qualifications and experiences that are most relevant to the specific position you are applying for.

- Be Concise: Aim for 3-4 sentences that deliver your message clearly and effectively, avoiding unnecessary jargon.

- Showcase Professional Experience: Mention your years of experience and any notable employers or projects that enhance your credibility.

- Incorporate Industry Keywords: Use terminology from the job description to improve the chances of passing through applicant tracking systems.

- Highlight Certifications: If applicable, include any relevant certifications, such as Fellow of the Society of Actuaries (FSA) or Associate of the Society of Actuaries (ASA).

- Reflect Your Career Goals: Convey your aspirations within the actuarial field to show alignment with the company’s vision.

Example Actuary Resume Summaries

Strong Resume Summaries

Dynamic actuary with over 7 years of experience in risk assessment and financial modeling, successfully reducing insurance claim payouts by 20% through innovative predictive analytics. Licensed ASA with a strong background in data analytics and proficiency in R and Python.

Results-driven actuary with a proven track record of developing effective pricing strategies, contributing to a 15% increase in profitability for a leading insurance provider. Expert in using statistical methods to assess risk and inform business decisions.

Detail-oriented actuarial analyst with 5+ years in the pension sector, recognized for optimizing investment strategies that led to a 30% return on investments. Proficient in Excel and data visualization tools, dedicated to enhancing financial performance.

Weak Resume Summaries

Actuary with some experience in the field looking for a new opportunity. Skilled in various actuarial tasks.

Motivated individual seeking a position as an actuary. Knowledgeable about data and analytics, but no specific accomplishments mentioned.

The examples above illustrate the distinction between strong and weak resume summaries. Strong summaries effectively use quantifiable results and specific skills relevant to the actuarial profession, creating a compelling narrative that aligns with job requirements. In contrast, weak summaries lack detail, specificity, and measurable achievements, resulting in a vague representation of the candidate's qualifications and potential value to the employer.

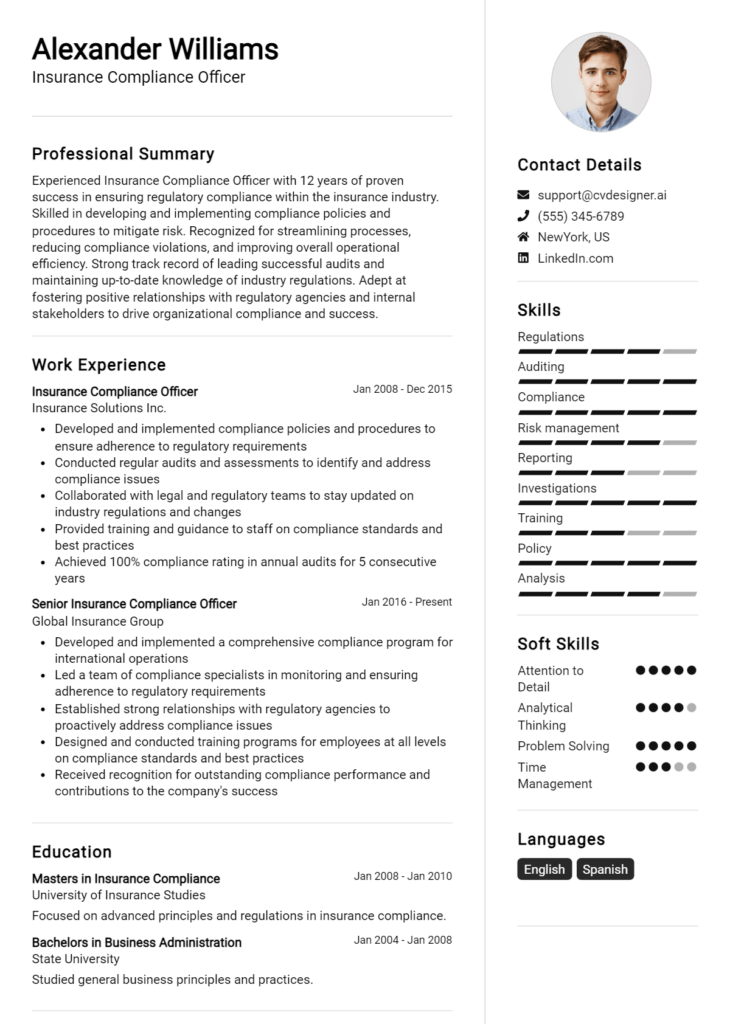

Work Experience Section for Actuary Resume

The work experience section of an actuary resume is pivotal in demonstrating the candidate's technical skills, leadership capabilities, and commitment to delivering high-quality products. This section serves as a platform for showcasing the practical application of statistical and analytical skills, as well as the ability to manage teams effectively. By quantifying achievements and aligning work experience with industry standards, candidates can clearly illustrate their value to potential employers, making it essential to craft this section thoughtfully and strategically.

Best Practices for Actuary Work Experience

- Highlight specific technical skills relevant to actuarial science, such as proficiency in statistical software (e.g., R, Python, SAS).

- Quantify achievements with metrics (e.g., reduced risk by X%, improved efficiency by Y%).

- Emphasize collaboration by detailing team projects and cross-functional initiatives.

- Use action verbs to convey strong contributions (e.g., developed, led, analyzed).

- Tailor the experience descriptions to align with the job description and industry standards.

- Include relevant certifications or professional development courses to enhance credibility.

- Showcase leadership roles and responsibilities, particularly in managing teams or projects.

- Maintain a clear and concise format for easy readability and impact.

Example Work Experiences for Actuary

Strong Experiences

- Led a team of 5 actuaries to develop a new pricing model that decreased premium rates by 15% while maintaining profitability, resulting in a 20% increase in customer retention.

- Utilized advanced predictive modeling techniques to identify risk factors, leading to a 30% reduction in loss ratios over two years.

- Collaborated with cross-departmental teams to streamline the reporting process, reducing the turnaround time for quarterly reports by 25% and enhancing data accuracy.

Weak Experiences

- Worked on various projects related to data analysis.

- Assisted in preparing reports and presentations for senior management.

- Participated in team meetings to discuss actuarial practices.

The examples labeled as strong highlight specific achievements, quantifiable results, and effective collaboration, which provide a clear picture of the candidate's capabilities. In contrast, the weak experiences lack detail and substance, failing to convey the candidate's impact or technical expertise. Strong experiences demonstrate measurable outcomes and leadership, while weak experiences are vague and do not showcase the candidate’s true potential.

Education and Certifications Section for Actuary Resume

The education and certifications section of an actuary resume is crucial for establishing the candidate's qualifications and expertise in the field. This section not only showcases the academic background that has equipped the candidate with essential analytical and quantitative skills but also highlights industry-relevant certifications that demonstrate a commitment to professional excellence. Furthermore, it reflects continuous learning efforts, which are vital in a field characterized by evolving regulations and methodologies. By providing relevant coursework, certifications, and any specialized training, candidates can significantly enhance their credibility and align themselves with the specific requirements of the job role.

Best Practices for Actuary Education and Certifications

- Prioritize relevant degrees such as a Bachelor’s or Master’s in Actuarial Science, Mathematics, or Statistics.

- Highlight industry-recognized certifications from organizations such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

- Include relevant coursework that underscores expertise in areas like risk management, financial mathematics, and statistical analysis.

- Detail any specialized training or workshops that align with the actuarial profession.

- Use clear formatting to differentiate between degrees, certifications, and coursework for better readability.

- Keep the section updated with the latest qualifications and remove any outdated or irrelevant information.

- Consider adding honors or awards received during academic pursuits to further enhance credibility.

- Tailor the content to align with the specific requirements of the job being applied for, emphasizing the most pertinent qualifications.

Example Education and Certifications for Actuary

Strong Examples

- Bachelor of Science in Actuarial Science, University of XYZ, 2021

- Associate of the Society of Actuaries (ASA), 2022

- Completed coursework in Advanced Probability and Risk Theory

- Certification in Predictive Analytics from ABC Institute, 2023

Weak Examples

- Bachelor of Arts in History, University of ABC, 2018

- Certification in Basic First Aid, 2020

- Completed a course in Creative Writing

- Outdated certification in Microsoft Office Suite, 2015

The examples are considered strong because they directly relate to the skills and knowledge required for an actuary, showcasing relevant degrees, recognized certifications, and applicable coursework that align with industry standards. Conversely, the weak examples fail to demonstrate relevance to the actuarial profession, highlighting degrees and certifications that do not support the candidate's capabilities in statistical analysis, risk assessment, or financial mathematics, ultimately undermining their suitability for the role.

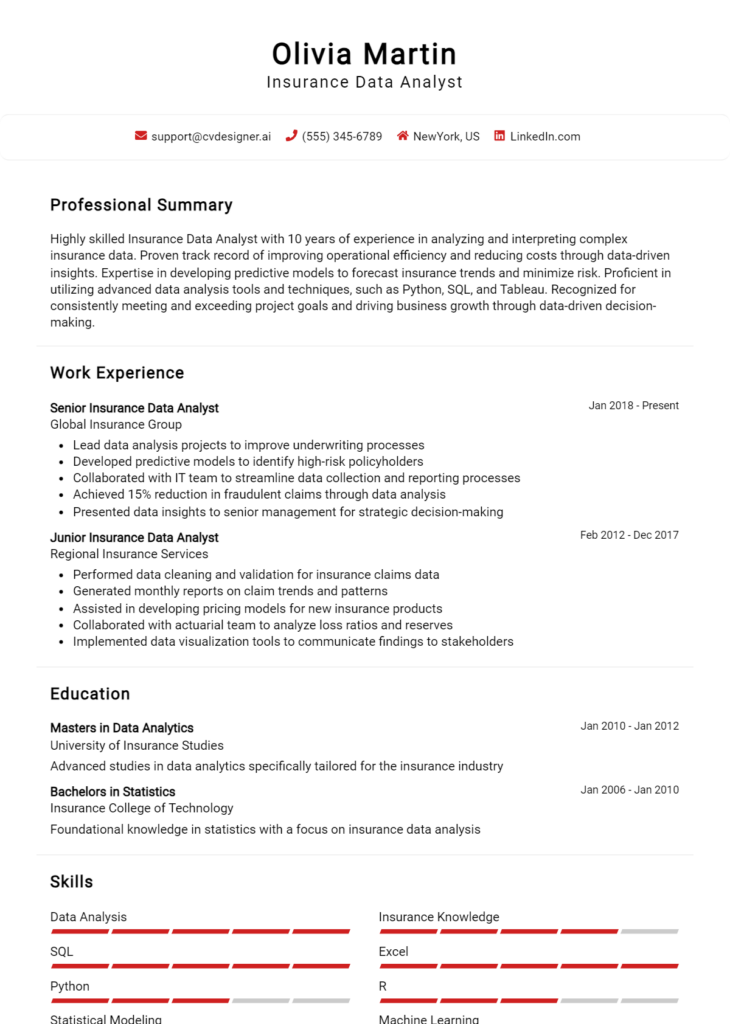

Top Skills & Keywords for Actuary Resume

In the competitive field of actuarial science, having a well-crafted resume is crucial for standing out to potential employers. Skills play a pivotal role in showcasing your expertise and competencies, making them essential components of your resume. Whether you are a seasoned professional or a recent graduate, highlighting both your soft and hard skills effectively can demonstrate your value to employers. A well-rounded skill set not only reflects your technical abilities but also your capacity to communicate, collaborate, and solve problems in a dynamic work environment. Therefore, understanding the key skills required for an actuary role is vital for creating a compelling resume that aligns with industry expectations.

Top Hard & Soft Skills for Actuary

Hard Skills

- Statistical Analysis

- Risk Assessment Models

- Financial Reporting

- Data Interpretation

- Actuarial Software Proficiency (e.g., SAS, R, Excel)

- Forecasting Techniques

- Insurance Principles

- Regulatory Compliance

- Mathematics Proficiency

- Predictive Modeling

- Investment Strategies

- Economic Theory

- Programming Languages (e.g., Python, VBA)

- Database Management

- Valuation Techniques

- Loss Reserving

- Pricing Analysis

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Communication Skills

- Team Collaboration

- Time Management

- Critical Thinking

- Adaptability

- Decision-Making

- Presentation Skills

- Interpersonal Skills

- Leadership Abilities

- Creativity

- Negotiation Skills

- Conflict Resolution

- Empathy

- Client Relationship Management

By emphasizing the right skills and relevant work experience, you can create a resume that effectively showcases your qualifications and makes a strong impression on hiring managers in the actuarial field.

Stand Out with a Winning Actuary Cover Letter

I am writing to express my interest in the Actuary position at [Company Name] as advertised on [Job Board/Company Website]. With a strong foundation in mathematics and statistics, combined with my recent experience in risk assessment and financial modeling, I am confident in my ability to contribute to your team’s success. Having earned my degree in Actuarial Science from [University Name] and passed [specific actuarial exams], I possess the analytical skills and technical knowledge necessary to excel in this role.

During my previous role at [Previous Company Name], I successfully developed predictive models that improved our risk assessment strategies, resulting in a 15% reduction in claim costs over a two-year period. My experience in utilizing advanced statistical techniques and software, such as R and Python, has equipped me to analyze complex data sets and generate actionable insights. I am particularly proud of a project where I collaborated with cross-functional teams to implement new methodologies that enhanced our pricing strategies, demonstrating my ability to communicate complex concepts clearly and effectively.

I am particularly drawn to [Company Name] due to its commitment to innovation and excellence in the actuarial field. I admire your focus on leveraging technology to enhance decision-making processes and improve client outcomes. I am eager to bring my expertise in data analysis and risk management to your organization, contributing to your mission of delivering optimal solutions in a fast-evolving market.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am excited about the prospect of contributing to your team and helping drive the future success of your actuarial services.

Conclusion

As we conclude our exploration of the actuary profession, it's essential to highlight the critical skills and qualifications necessary for success in this field. An actuary combines mathematical expertise, statistical analysis, and business acumen to assess risk and inform decision-making in insurance, finance, and other sectors. Key competencies include proficiency in mathematics and statistics, strong analytical abilities, and excellent communication skills to convey complex information effectively.

Additionally, actuaries often hold professional certifications, which not only validate their expertise but also enhance their marketability. The demand for skilled actuaries continues to grow, making this an opportune time for those in the field or aspiring to enter it.

If you're looking to stand out in this competitive landscape, now is the perfect time to review and update your Actuary Resume. Ensure that it reflects your qualifications, experiences, and the specific skills that employers are seeking. Utilize tools like resume templates, resume builder, resume examples, and cover letter templates to create a polished and professional application that highlights your strengths.

Don't miss the opportunity to make a great first impression with your resume. Take action today and equip yourself with the necessary tools to advance your career as an actuary!