Top 26 Loan Officer Resume Summaries in 2025

As a Loan Officer, establishing clear career objectives is essential for achieving professional growth and success in the competitive financial services industry. Setting specific, measurable, attainable, relevant, and time-bound (SMART) goals can help Loan Officers enhance their skills, expand their client base, and improve overall performance. In this section, we will explore the top career objectives that can guide Loan Officers in their pursuit of excellence and advancement in their careers.

Career Objectives for Fresher Loan Officer

- Detail-oriented graduate seeking a Loan Officer position to leverage strong analytical skills and customer service experience to assist clients in securing optimal loan solutions.

- A motivated individual aiming to start a career as a Loan Officer, utilizing excellent communication skills to build relationships and guide clients through the loan application process.

- Enthusiastic finance graduate eager to join a reputable financial institution as a Loan Officer, committed to delivering exceptional client service and achieving sales targets.

- Recent graduate with a strong foundation in financial analysis seeking to begin a career as a Loan Officer, dedicated to helping clients navigate loan options and improve financial literacy.

- Goal-oriented individual looking to secure a Loan Officer role to apply knowledge of lending processes and regulations while fostering strong client relationships.

- Aspiring Loan Officer with a passion for finance and customer service, seeking to assist clients in obtaining financing solutions that meet their needs efficiently and effectively.

- Detail-focused and customer-oriented professional aiming for a Loan Officer position to utilize strong problem-solving abilities and financial knowledge in assisting clients with loan applications.

- Driven finance graduate seeking a Loan Officer role to apply strong interpersonal skills and financial expertise, helping clients achieve their financial goals through tailored loan products.

- Recent finance graduate eager to contribute as a Loan Officer, with a strong interest in helping clients make informed borrowing decisions for personal and business needs.

- A dedicated and analytical individual looking to start a career as a Loan Officer, committed to providing personalized loan solutions and ensuring compliance with lending regulations.

- Ambitious finance professional seeking a Loan Officer position to leverage strong quantitative skills and a customer-first approach in facilitating loan approvals for diverse clientele.

Career Objectives for Experienced Loan Officer

- Dedicated Loan Officer with over 5 years of experience in mortgage lending, seeking to leverage expertise in client relations and financial analysis to drive loan origination and enhance customer satisfaction at a reputable financial institution.

- Results-oriented Loan Officer with a proven track record of exceeding sales targets, aiming to utilize strong negotiation skills and in-depth product knowledge to contribute to a dynamic lending team and support clients in achieving their financial goals.

- Detail-oriented Loan Officer with extensive experience in credit analysis, looking to apply comprehensive risk assessment skills to facilitate loan approval processes while ensuring compliance with regulatory standards and fostering long-term client relationships.

- Motivated Loan Officer with a solid background in residential lending, seeking to join a progressive organization where expertise in underwriting and personalized service can enhance the overall client experience and increase loan volume.

- Experienced Loan Officer skilled in developing tailored financing solutions, eager to bring analytical prowess and a customer-centric approach to a challenging role that fosters growth and supports borrowers through the lending process.

- Proficient Loan Officer with a deep understanding of market trends and lending products, aspiring to contribute to a collaborative team environment where strategic insights and exceptional service can optimize loan processing efficiency.

- Dynamic Loan Officer with a strong ability to cultivate relationships and assess client needs, aiming to leverage proven sales acumen and financial expertise to drive business growth and deliver outstanding loan solutions.

- Seasoned Loan Officer with over a decade of experience in both commercial and residential financing, seeking to utilize mentorship skills to guide junior team members while achieving individual and organizational sales goals.

- Accomplished Loan Officer known for building trust with clients and providing comprehensive loan advice, looking to join an innovative company where my analytical skills and customer service focus can lead to successful lending outcomes.

- Results-driven Loan Officer with a commitment to client education and transparency, aiming to enhance the lending experience by leveraging effective communication and problem-solving skills in a fast-paced financial environment.

Best Career Objectives for Loan Officer

- Detail-oriented Loan Officer with over five years of experience in mortgage lending, seeking to leverage strong analytical skills to provide clients with tailored loan solutions and enhance overall customer satisfaction.

- Results-driven Loan Officer aiming to utilize extensive knowledge of financial regulations and market trends to help clients secure favorable loan terms while ensuring compliance with industry standards.

- Dedicated Loan Officer with exceptional communication skills, looking to build strong client relationships and streamline the loan application process for a reputable financial institution.

- Motivated Loan Officer with a proven track record in loan origination, seeking to apply strategic sales techniques to expand the client base and increase loan volume at a growing mortgage company.

- Experienced Loan Officer with expertise in credit analysis and risk assessment, aiming to assist clients in achieving their financial goals while minimizing defaults and maximizing portfolio performance.

- Proactive Loan Officer seeking to combine customer service excellence and financial acumen to guide clients through the loan process and enhance the overall lending experience.

- Skilled Loan Officer with a strong background in underwriting and loan processing, looking to contribute to a dynamic team focused on delivering efficient and effective lending solutions.

- Client-focused Loan Officer with a passion for financial education, aiming to empower borrowers by providing clear guidance and resources throughout the home financing journey.

- Results-oriented Loan Officer with expertise in FHA and VA loans, seeking to assist diverse clientele in navigating financing options while maintaining high levels of customer engagement.

- Analytical Loan Officer with a commitment to integrity and transparency, looking to build trust with clients by providing honest assessments and personalized loan recommendations.

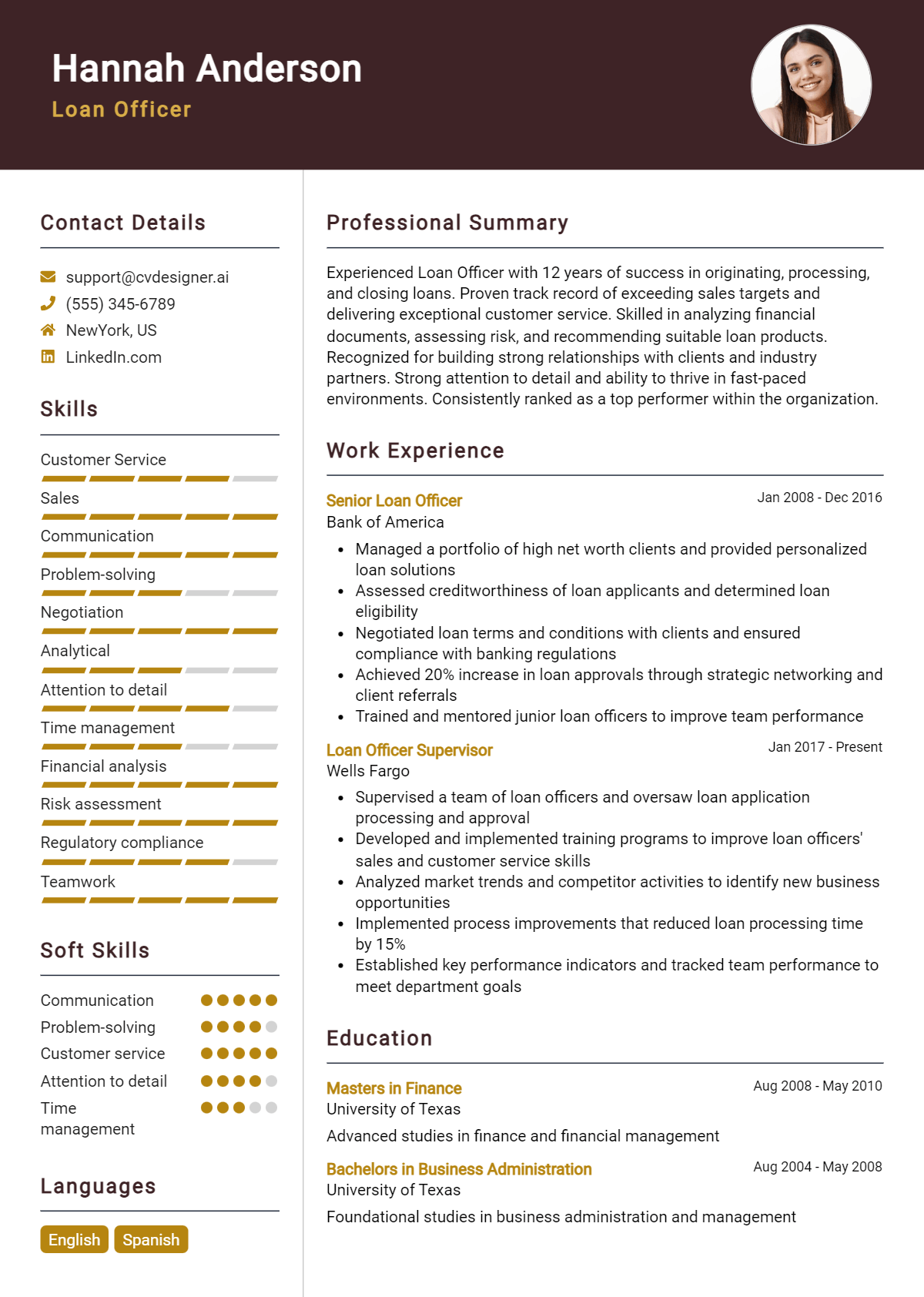

Best Loan Officer Resume Summary Samples

- Detail-oriented Loan Officer with over 5 years of experience in mortgage lending. Proven track record of exceeding sales goals and building strong client relationships, leveraging strong analytical skills to assess borrower eligibility.

- Results-driven Loan Officer with a background in finance and customer service. Expertise in processing loan applications and securing favorable terms, consistently achieving a 95% client satisfaction rate through effective communication and problem-solving.

- Dedicated Loan Officer with 7 years of experience in residential and commercial lending. Skilled in evaluating creditworthiness and financial history, successfully closing loans with a 90% approval rate, and maintaining compliance with regulations.

- Experienced Loan Officer with a strong background in underwriting and risk assessment. Recognized for ability to streamline processes and enhance client experience, leading to a 30% increase in repeat business.

- Motivated Loan Officer with 4 years of experience in personal and auto loans. Strong negotiation skills and financial acumen, having closed over $10 million in loans in the past year while maintaining a high level of accuracy.

- Dynamic Loan Officer with expertise in government-backed loans and first-time homebuyer programs. Proven ability to educate clients on their options, resulting in a 40% rise in loan applications year-over-year.

- Customer-focused Loan Officer with extensive experience in loan origination and processing. Known for cultivating lasting relationships with clients and real estate agents, achieving a 20% increase in referral business.

- Strategic Loan Officer with 6 years of experience in commercial lending. Adept at identifying client needs and providing tailored financing solutions, consistently achieving top performance in loan volume and client retention.

- Knowledgeable Loan Officer with a strong background in credit analysis and financial planning. Excels in guiding clients through the loan process, having successfully assisted over 200 clients in securing financing within tight deadlines.

- Proficient Loan Officer with a passion for helping clients achieve their financial goals. Skilled in market analysis and loan structuring, recognized for innovative solutions that resulted in a 15% reduction in approval times.

- Accomplished Loan Officer with a commitment to ethical lending practices and community service. Over 8 years of experience in the industry, known for implementing successful outreach programs that increased loan accessibility for underserved populations.

Writing a strong resume objective is essential for a Loan Officer as it sets the tone for your application and highlights your key qualifications. To structure an effective resume objective, focus on your professional goals and align them with the needs of the employer. A well-crafted objective should succinctly convey your experience, skills, and what you can contribute to the organization. Begin with a clear statement of your career aspirations, followed by a brief mention of your relevant qualifications and how they can benefit the company.

How to Write a Loan Officer Resume Objective

- Start with a clear career goal that reflects your intentions for the position.

- Include specific qualifications or years of experience that highlight your expertise in loan processes.

- Mention any relevant certifications or licenses, such as NMLS registration.

- Focus on the skills that are most applicable to the Loan Officer role, like communication or financial analysis.

- Tailor your objective to the job description by incorporating keywords from the posting.

- Keep it concise, ideally one to two sentences, to maintain the reader's attention.

- Conclude with how your contributions can help the employer achieve their goals, emphasizing a mutual benefit.

Key Skills to Highlight in Your Loan Officer Resume Objective

Emphasizing relevant skills in your resume objective is crucial for capturing the attention of hiring managers. A well-crafted objective showcases your qualifications and aligns your capabilities with the needs of the lending institution. Highlighting key skills not only demonstrates your expertise but also illustrates your potential contributions to the organization.

- Strong communication skills

- Customer service orientation

- Financial analysis and underwriting knowledge

- Attention to detail

- Problem-solving abilities

- Time management and organizational skills

- Knowledge of loan products and regulations

- Sales and negotiation skills

Common Mistakes When Writing a Loan Officer Resume Objective

Creating a compelling resume objective is essential for a loan officer seeking to stand out in a competitive job market. A well-crafted objective can highlight your qualifications and set the tone for your entire application. However, common mistakes can undermine its effectiveness. Here are some pitfalls to avoid:

- Being Too Vague: Using generic phrases like "seeking a challenging position" fails to convey your specific goals and intentions. This lack of clarity can make you seem unfocused and unprepared for the role.

- Focusing on What You Want Instead of What You Offer: An objective that centers on your personal desires, such as "I want to grow my career," shifts attention away from the value you can bring to the employer. Instead, emphasize how your skills can benefit the organization.

- Using Clichés: Phrases like "hardworking" or "team player" are overused and add little to your objective. They can make your resume blend in with others, rather than standing out with unique qualities and achievements.

- Neglecting to Tailor the Objective: A one-size-fits-all approach can be detrimental. Failing to customize your objective for each application means missing the chance to align your skills and experiences with the specific requirements of the job.

- Writing in the Third Person: Using third-person language, such as "John Smith seeks a loan officer position," can come across as impersonal. Writing in the first person creates a stronger connection and makes your objective feel more genuine.

- Making it Too Long: A lengthy objective can lose the reader's attention. Keep it concise and focused, ideally one to two sentences, to ensure that the most critical information is easily digestible.

- Omitting Relevant Keywords: Failing to include industry-specific terms can prevent your resume from passing through applicant tracking systems (ATS). Incorporating keywords from the job description not only improves your chances of being noticed but also shows your familiarity with the field.

Frequently Asked Questions

What is a loan officer resume objective?

A loan officer resume objective is a brief statement at the top of your resume that outlines your career goals and highlights your relevant skills and experience in the lending industry. It serves as an introduction to your qualifications and is designed to grab the attention of hiring managers, making it clear how you can contribute to their organization.

Why is a strong resume objective important for loan officers?

A strong resume objective is crucial for loan officers because it sets the tone for your entire resume. It provides a snapshot of your professional identity and showcases your understanding of the financial services field. By emphasizing your skills, such as customer service, financial analysis, and communication, you can distinguish yourself from other candidates and demonstrate your suitability for the role.

How long should a loan officer resume objective be?

Your loan officer resume objective should ideally be 1-2 sentences long, or about 30-50 words. This length is sufficient to convey your main career goals and key qualifications without overwhelming the reader. Keeping it concise ensures that hiring managers can quickly grasp your intentions and the value you bring to the position.

What key skills should be mentioned in a loan officer resume objective?

In a loan officer resume objective, it is important to mention key skills such as strong analytical abilities, excellent communication skills, attention to detail, and a thorough understanding of loan products and regulations. Highlighting these skills not only demonstrates your expertise but also shows that you are well-equipped to handle the responsibilities of the role.

Can I customize my resume objective for different loan officer positions?

Yes, you should definitely customize your resume objective for different loan officer positions. Tailoring your objective to align with the specific requirements and responsibilities listed in the job description helps you stand out as a candidate. By incorporating relevant keywords and emphasizing the skills that meet the needs of the employer, you increase your chances of getting noticed during the hiring process.

Conclusion

In summary, crafting a targeted and impactful resume objective is crucial for aspiring Loan Officers. A well-written objective not only highlights your unique skills and experiences but also captures the attention of recruiters, allowing you to make a strong first impression in a competitive job market. By focusing on what makes you a valuable candidate, you can effectively convey your professional goals and align them with the needs of potential employers.

We encourage you to utilize the tips and examples provided in this guide to refine your resume objective. Remember, a powerful objective can set you apart and pave the way for your success in the loan industry. Take the time to perfect your resume, and don't forget to explore our resume templates, resume builder, resume examples, and cover letter templates to enhance your application further.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.