Loan Officer Core Responsibilities

A Loan Officer plays a vital role in the lending process, serving as a bridge between clients and financial institutions. Their core responsibilities include evaluating loan applications, analyzing financial data, and recommending suitable loan products. Essential skills encompass technical proficiency in financial software, operational knowledge of lending policies, and strong problem-solving abilities to address client concerns efficiently. These skills not only contribute to individual client satisfaction but also align with the organization’s goals. A well-structured resume can effectively showcase these competencies, enhancing career prospects in the financial sector.

Common Responsibilities Listed on Loan Officer Resume

- Evaluate loan applications and credit histories to determine eligibility.

- Analyze financial data and assess risk factors associated with loans.

- Provide clients with detailed information about loan products and terms.

- Assist clients in completing loan documentation and applications.

- Communicate with underwriters to facilitate the loan approval process.

- Develop and maintain relationships with real estate agents and clients.

- Monitor and manage loan portfolios to ensure compliance with regulations.

- Conduct market research to stay informed about lending trends.

- Educate clients on financial management and loan repayment strategies.

- Resolve client inquiries and issues throughout the loan process.

- Prepare and present loan proposals to potential clients.

- Stay updated on lending laws, regulations, and industry best practices.

High-Level Resume Tips for Loan Officer Professionals

In today's competitive job market, a well-crafted resume is essential for Loan Officer professionals seeking to make a memorable first impression on potential employers. Your resume serves as an introduction to your skills, experience, and achievements, making it crucial to present yourself effectively. A strong resume not only highlights your qualifications but also reflects your understanding of the industry and your ability to meet the needs of clients. In this guide, we will provide practical and actionable tips specifically tailored for Loan Officers, empowering you to create a resume that stands out and showcases your expertise.

Top Resume Tips for Loan Officer Professionals

- Tailor your resume to match the job description, emphasizing skills and experiences that align with the specific requirements of the position.

- Highlight relevant experience in the lending industry, including any specific roles such as mortgage lending, commercial lending, or consumer finance.

- Quantify your achievements by including specific numbers, such as the volume of loans processed, percentage of loan approvals, or revenue generated.

- Showcase industry-specific skills such as loan underwriting, risk assessment, customer service, and regulatory compliance.

- Include certifications and licenses relevant to the Loan Officer role, such as NMLS (Nationwide Multistate Licensing System) certification.

- Utilize action verbs to convey your contributions and achievements, making your resume more dynamic and engaging.

- Incorporate keywords from the job posting to improve your chances of passing through applicant tracking systems (ATS).

- Maintain a clean and professional format, using bullet points for easy readability and ensuring consistent font styles and sizes.

- Consider including a summary statement at the top of your resume that encapsulates your professional experience and career goals.

By implementing these tips, you can significantly increase your chances of landing a job in the Loan Officer field. A well-structured resume that effectively showcases your skills and achievements will not only grab the attention of hiring managers but also position you as a strong candidate in the competitive lending landscape.

Why Resume Headlines & Titles are Important for Loan Officer

In the competitive landscape of loan origination, a Loan Officer's resume must stand out to capture the attention of hiring managers. One of the most effective ways to achieve this is through a compelling resume headline or title. A strong headline serves as a concise summary of a candidate's key qualifications, immediately communicating their value proposition in just a few impactful words. It should be relevant to the position and tailored to the specific job being applied for, as this not only enhances readability but also demonstrates the candidate's understanding of the role. A well-crafted headline can be the difference between a resume that gets noticed and one that is overlooked.

Best Practices for Crafting Resume Headlines for Loan Officer

- Keep it concise: Aim for a headline that is brief and to the point, ideally no longer than 10 words.

- Be role-specific: Tailor your headline to reflect the specific job title you are applying for.

- Highlight key strengths: Focus on your top skills or accomplishments relevant to the Loan Officer position.

- Use action-oriented language: Start with strong action verbs or descriptive adjectives to convey confidence.

- Avoid jargon: Ensure that your headline is easily understandable and avoids industry-specific jargon that may confuse hiring managers.

- Showcase unique qualifications: Highlight what sets you apart from other candidates, such as certifications or specialized experiences.

- Align with job description: Incorporate keywords from the job posting to create relevance and show that you meet the requirements.

- Test different versions: Experiment with various headlines to see which resonates best with your target audience.

Example Resume Headlines for Loan Officer

Strong Resume Headlines

"Experienced Loan Officer with 10+ Years in Residential Mortgages"

“Top-Performing Loan Officer Specializing in VA Loans and Client Relations”

“Dynamic Loan Officer with Proven Track Record in Increasing Approval Rates”

Weak Resume Headlines

“Loan Officer Seeking New Opportunities”

“Experienced Professional”

Strong headlines are effective because they immediately convey the candidate’s expertise and relevance to the position, making a clear and immediate impact on the hiring manager. In contrast, weak headlines lack specificity and fail to communicate the candidate's unique qualifications, resulting in a missed opportunity to engage potential employers. By using compelling and tailored headlines, candidates can significantly enhance their chances of standing out in a crowded job market.

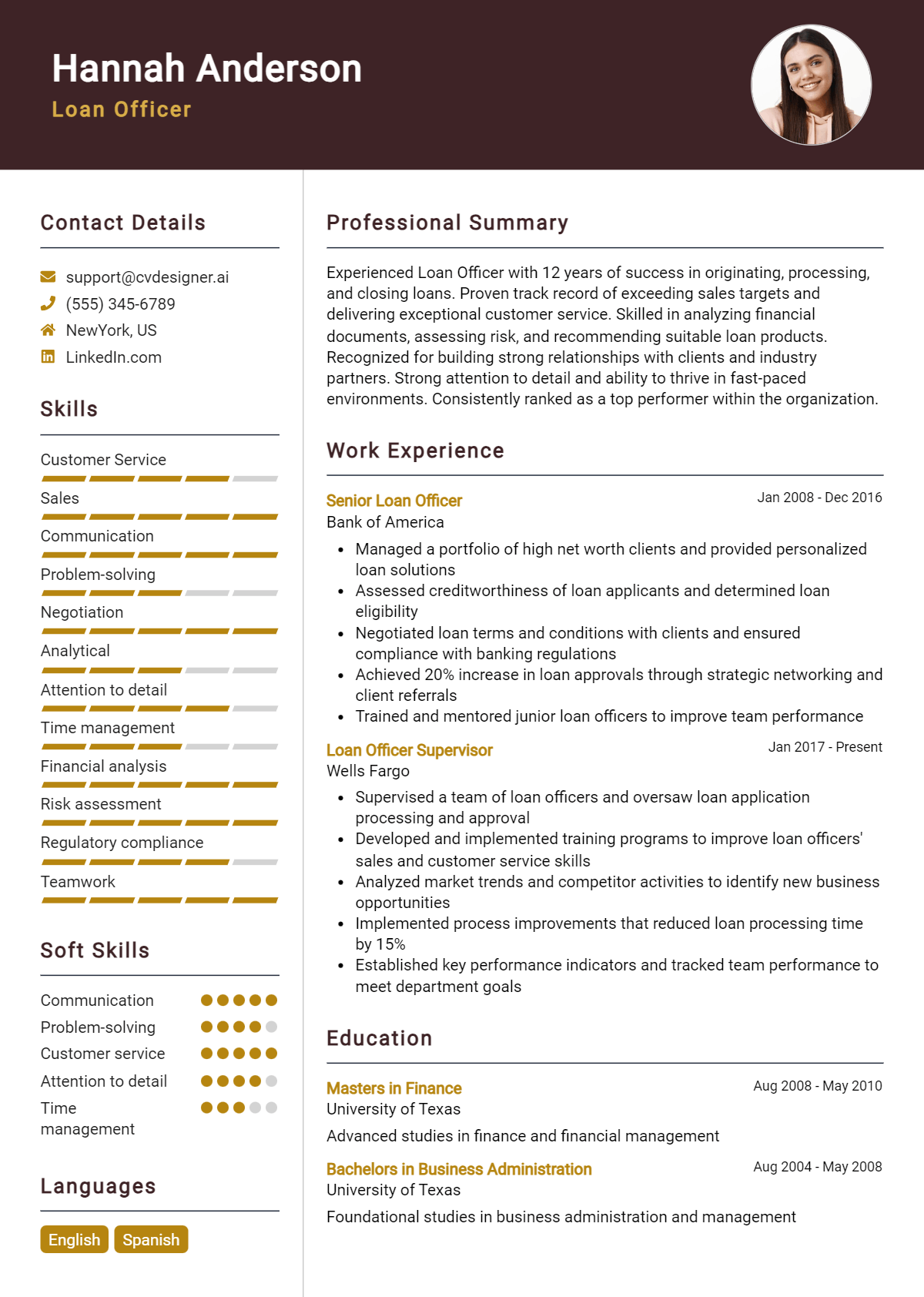

Writing an Exceptional Loan Officer Resume Summary

A well-crafted resume summary is essential for a Loan Officer looking to make a strong first impression on hiring managers. This brief yet impactful section serves as a snapshot of the candidate's key skills, relevant experience, and notable accomplishments, allowing them to quickly differentiate themselves from other applicants. A powerful summary not only captures attention but also sets the tone for the rest of the resume, making it vital to ensure that it is concise, tailored to the specific job description, and highlights the most pertinent qualifications for the role.

Best Practices for Writing a Loan Officer Resume Summary

- Quantify achievements: Use numbers to demonstrate your impact, such as loan volumes processed or percentage increases in client satisfaction.

- Highlight relevant skills: Focus on skills that are pertinent to the Loan Officer position, such as financial analysis, customer service, and compliance knowledge.

- Tailor your summary: Customize your resume summary to align with the specific job description and requirements of the position.

- Keep it concise: Aim for 3-5 sentences that deliver a strong message without unnecessary detail.

- Use action verbs: Start sentences with dynamic verbs to convey your accomplishments and contributions effectively.

- Showcase industry knowledge: Mention familiarity with different loan types and lending regulations to demonstrate expertise.

- Include soft skills: Highlight interpersonal abilities, such as communication and negotiation skills, that are critical for building client relationships.

- Focus on the impact: Emphasize how your contributions positively affected clients and the organization.

Example Loan Officer Resume Summaries

Strong Resume Summaries

Detail-oriented Loan Officer with over 5 years of experience in mortgage lending, successfully closing over $50 million in loans while maintaining a 98% customer satisfaction rating. Proven ability to analyze client financials and recommend appropriate loan products that meet their needs.

Results-driven Loan Officer with expertise in conventional, FHA, and VA loans. Achieved a 30% increase in loan approvals through effective client engagement and thorough financial assessments, while ensuring compliance with all regulatory standards.

Dynamic Loan Officer with a track record of facilitating high-volume loan processing, achieving a personal best of $10 million in loans closed in a single quarter. Exceptional in building strong relationships with clients, leading to repeat business and referrals.

Weak Resume Summaries

Experienced in the loan industry and looking for a position as a Loan Officer. I have worked with clients and understand the role well.

Dedicated professional seeking a Loan Officer position. I have some experience in finance and customer service.

The strong resume summaries stand out because they provide specific achievements, quantifiable outcomes, and relevant skills that directly relate to the Loan Officer role. They illustrate the candidate's impact in previous positions and showcase their expertise in the field. In contrast, the weak summaries are vague and lack detail, failing to convey any measurable success or a clear understanding of the Loan Officer's responsibilities. This makes them less compelling to hiring managers who are looking for candidates who can demonstrate their value effectively.

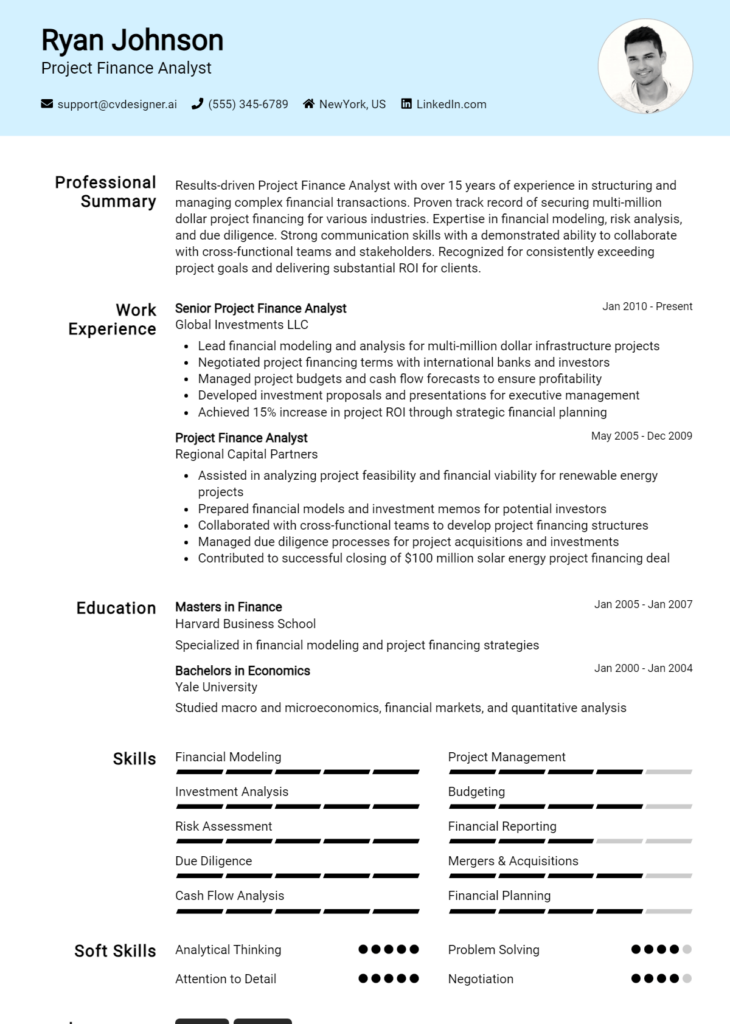

Work Experience Section for Loan Officer Resume

The work experience section of a Loan Officer resume is paramount in demonstrating a candidate's qualifications and suitability for the role. This section serves as a platform to highlight not only technical skills related to loan processing, underwriting, and compliance but also the candidate's ability to effectively manage teams and deliver high-quality financial products. By quantifying achievements and aligning past experiences with industry standards, candidates can significantly enhance their appeal to potential employers, showcasing their proven track record of success in the competitive financial services landscape.

Best Practices for Loan Officer Work Experience

- Highlight specific technical skills relevant to loan processing and underwriting.

- Quantify results with metrics such as loan volume, approval rates, and customer satisfaction scores.

- Emphasize collaborative experiences, illustrating your ability to work within teams and cross-functional groups.

- Use clear and impactful action verbs to describe your contributions and achievements.

- Focus on relevant experiences that align with the job description and industry standards.

- Include certifications and training that enhance your technical expertise and professionalism.

- Tailor your work experience to reflect the specific needs and goals of the hiring company.

- Showcase your problem-solving skills and how they contributed to successful outcomes.

Example Work Experiences for Loan Officer

Strong Experiences

- Managed a portfolio of over 200 clients, resulting in a 25% increase in loan approvals year-over-year through targeted outreach and relationship building.

- Streamlined the loan processing workflow, reducing average turnaround time from 30 days to 15 days, which improved customer satisfaction ratings by 40%.

- Led a team of 5 in the implementation of a new loan origination software, enhancing operational efficiency and increasing loan volume by 30% within the first quarter.

- Developed training materials for new loan officers, resulting in a 15% decrease in onboarding time and improved team performance metrics.

Weak Experiences

- Worked as a loan officer and handled various clients.

- Participated in team meetings to discuss loan applications.

- Assisted with paperwork related to loans.

- Gained experience in the financial industry.

The examples provided illustrate a clear distinction between strong and weak work experiences for a Loan Officer. Strong experiences demonstrate quantifiable outcomes, specific technical leadership, and effective collaboration, showcasing the candidate's value to potential employers. In contrast, weak experiences lack detail and measurable impact, failing to convey the candidate's skills and contributions in a meaningful way. By presenting strong experiences, candidates can effectively communicate their qualifications and readiness for the role.

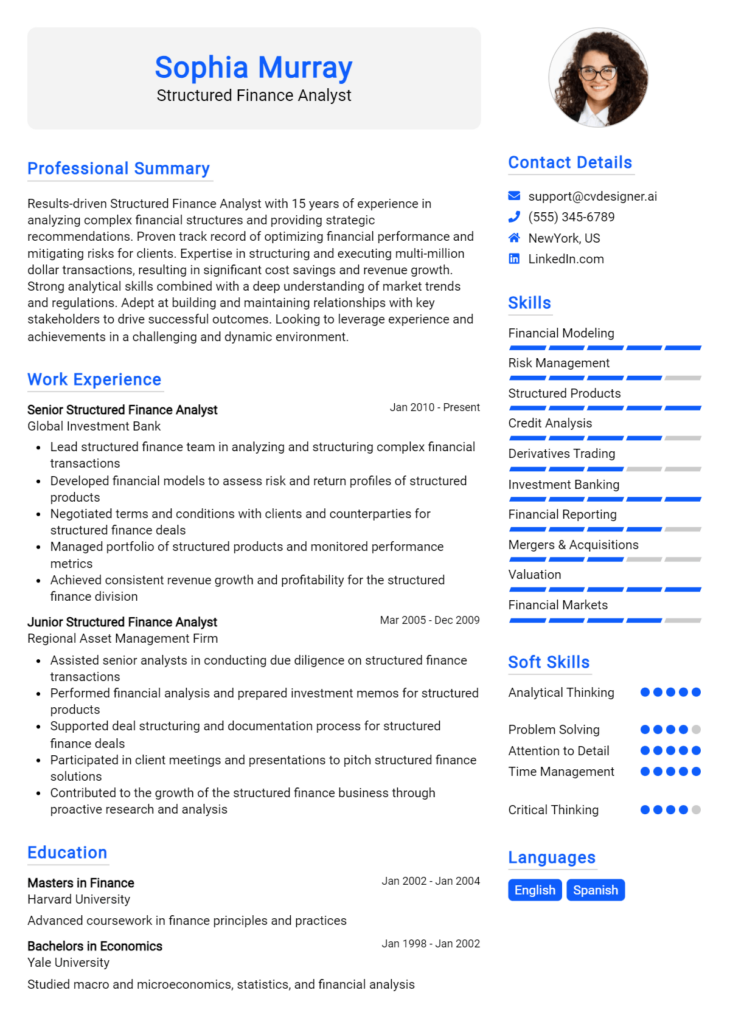

Education and Certifications Section for Loan Officer Resume

The education and certifications section of a Loan Officer resume is crucial as it showcases the candidate's academic background and professional qualifications. This section not only highlights relevant degrees and industry-recognized certifications but also reflects the candidate's commitment to continuous learning and professional development. By providing pertinent coursework, certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the requirements of the loan officer role. Employers often look for these indicators to assess a candidate's preparedness and expertise in the financial sector.

Best Practices for Loan Officer Education and Certifications

- Include only relevant degrees and certifications that pertain to the loan officer position.

- List your most recent education first, followed by older qualifications.

- Highlight any specialized training or workshops that enhance your skill set.

- Provide specific coursework that relates to finance, lending, or risk assessment.

- Emphasize any advanced or industry-recognized credentials, such as NMLS licenses.

- Use clear and concise language to describe your qualifications.

- Include dates of completion for certifications to demonstrate currency in the field.

- Tailor this section to match keywords from the job description for better alignment.

Example Education and Certifications for Loan Officer

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2020

- Certified Mortgage Advisor (CMA), National Association of Mortgage Advisors, 2021

- Advanced Loan Processing Course, Online Academy, Completed March 2022

- Real Estate Finance and Investment Analysis, Coursework included in Bachelor's Degree

Weak Examples

- Associate Degree in General Studies, Community College, Graduated June 2015

- Certification in Basic Computer Skills, Online Course, Completed 2018

- High School Diploma, City High School, Graduated 2010

- Outdated Mortgage Broker License, Issued 2015

The strong examples are considered effective because they are directly relevant to the loan officer position, showcasing specific degrees, industry-recognized certifications, and targeted coursework that align with the skills needed in the role. Conversely, the weak examples lack relevance to the job requirements, featuring outdated credentials or qualifications that do not enhance the candidate's suitability for a loan officer position. This distinction emphasizes the importance of selecting pertinent educational experiences and certifications that resonate with hiring managers in the financial industry.

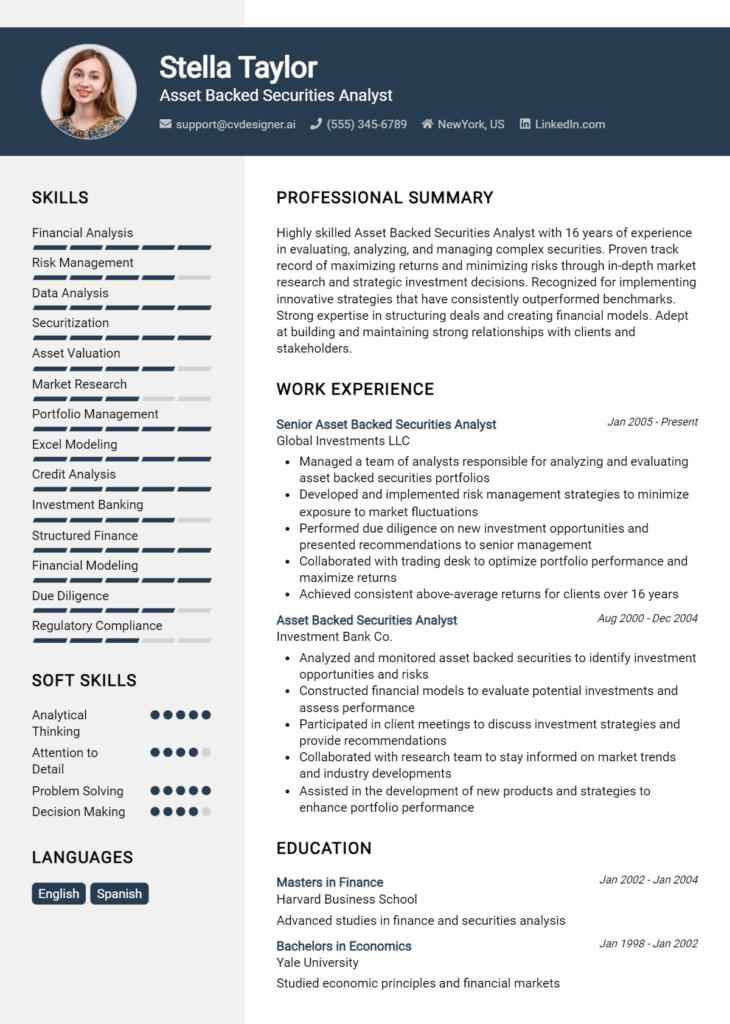

Top Skills & Keywords for Loan Officer Resume

As a Loan Officer, possessing the right skills is crucial for success in this competitive field. A well-crafted resume that highlights your abilities can significantly enhance your chances of landing interviews and securing employment. Skills not only demonstrate your qualifications but also offer insights into how you can contribute to a financial institution's goals. Both hard and soft skills play a vital role; hard skills showcase your technical expertise, while soft skills reflect your interpersonal abilities and customer service aptitude. By understanding and effectively presenting these skills on your resume, you can stand out to potential employers and convey that you are well-equipped to meet the demands of the role.

Top Hard & Soft Skills for Loan Officer

Soft Skills

- Excellent communication skills

- Strong analytical thinking

- Customer service orientation

- Problem-solving abilities

- Attention to detail

- Negotiation skills

- Time management

- Interpersonal skills

- Empathy

- Adaptability

Hard Skills

- Knowledge of loan products and services

- Proficiency in financial analysis

- Familiarity with credit regulations

- Experience with mortgage software

- Data entry and management

- Understanding of underwriting processes

- Risk assessment capabilities

- Compliance with lending laws

- Financial forecasting

- Proficiency in Microsoft Excel

For more insights on enhancing your resume, consider exploring additional skills and refining your work experience section to showcase your qualifications effectively.

Stand Out with a Winning Loan Officer Cover Letter

As a dedicated and results-driven loan officer with over five years of experience in the financial services industry, I am excited to apply for the loan officer position at [Company Name]. My background in helping clients navigate the complexities of the lending process, paired with my commitment to providing exceptional customer service, makes me a perfect fit for your team. I am particularly drawn to [Company Name] because of its reputation for innovation and customer-centric approach in the mortgage industry.

Throughout my career, I have developed a strong proficiency in assessing clients’ financial situations, recommending appropriate loan products, and guiding them through each step of the application process. At my previous position with [Previous Company Name], I successfully managed a portfolio of over 200 clients, achieving a 95% approval rate on loan applications. My ability to build rapport and trust with clients has not only resulted in repeat business but also numerous referrals, contributing to a 30% increase in my annual loan volume.

I am also well-versed in the latest lending regulations and compliance standards, ensuring that all transactions meet legal requirements while maintaining a high level of customer satisfaction. My analytical skills enable me to evaluate credit reports, income statements, and other financial documents effectively, which helps in providing the best recommendations to clients. I am eager to bring my expertise in loan origination and my passion for helping individuals achieve their financial goals to [Company Name].

I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. Thank you for considering my application. I am excited about the possibility of contributing to [Company Name] and helping clients achieve their dreams of homeownership.

Common Mistakes to Avoid in a Loan Officer Resume

When applying for a position as a loan officer, your resume serves as your first impression and can significantly influence your chances of landing an interview. Crafting a compelling resume requires attention to detail and an understanding of the industry. However, many candidates make common mistakes that can undermine their qualifications and reduce their appeal to potential employers. Here are some common pitfalls to avoid in your loan officer resume:

Vague Job Descriptions: Failing to provide specific details about your previous job roles can leave hiring managers unclear about your actual experience and skills. Use quantifiable achievements to illustrate your contributions.

Lack of Relevant Keywords: Many employers use applicant tracking systems (ATS) to filter resumes. Not including industry-specific keywords related to loan processing, underwriting, or customer service can lead to your resume being overlooked.

Ignoring Formatting Consistency: Inconsistent fonts, bullet points, or spacing can make your resume appear unprofessional. Maintain uniformity throughout to enhance readability and present a polished image.

Omitting Education and Certifications: As a loan officer, relevant education and certifications (like NMLS licensing) are crucial. Neglecting to mention these qualifications can make you seem less credible.

Using a Generic Objective Statement: A one-size-fits-all objective statement can dilute your resume's impact. Tailor your objective to reflect your specific goals and how they align with the prospective employer’s needs.

Focusing Solely on Duties, Not Achievements: Simply listing your job responsibilities can fail to highlight your impact. Instead, emphasize accomplishments and metrics that showcase your ability to drive results.

Neglecting Soft Skills: While technical skills are important, loan officers also need strong interpersonal abilities. Ignoring soft skills like communication, negotiation, and problem-solving can overlook vital aspects of your candidacy.

Overloading with Irrelevant Information: Including unrelated work experience or personal details can distract from your qualifications. Keep your resume focused on relevant experiences that showcase your fit for the loan officer role.

Conclusion

As we conclude our exploration of the essential qualities and responsibilities of a Loan Officer, it’s clear that a successful career in this field requires a unique blend of skills, including strong communication, financial acumen, and customer service expertise. Loan Officers play a critical role in guiding clients through the loan application process, assessing their financial situations, and recommending suitable loan products to meet their needs.

In today's competitive job market, having a standout resume is crucial for aspiring Loan Officers. It’s important to highlight not only your relevant experience but also the specific skills that set you apart from other candidates.

To ensure your resume effectively showcases your qualifications, take advantage of the available resources. Consider using resume templates to create a polished and professional look. A resume builder can streamline the process, allowing you to focus on content while the tool handles formatting. Additionally, reviewing resume examples can provide you with inspiration and guidance on how to structure your own document. Don’t forget the importance of a strong cover letter—explore our collection of cover letter templates for ideas on how to make a compelling first impression.

Take action today by reviewing and updating your Loan Officer resume to ensure it reflects your best self. With the right tools and resources, you can present a powerful case for your candidacy and open doors to exciting career opportunities.