25 Career Objectives for Liquidity Manager Resume in 2025

As a Liquidity Manager, defining clear career objectives is crucial for achieving success in this dynamic field. These objectives not only guide professional development but also align with the organization's financial strategy and risk management framework. In the following section, we will explore key career objectives that can help Liquidity Managers enhance their skills, contribute to their organizations, and navigate the complexities of financial markets effectively.

Career Objectives for Fresher Liquidity Manager

- Detail-oriented finance graduate seeking a Liquidity Manager position to utilize analytical skills in managing cash flow and optimizing liquidity strategies for a dynamic financial institution.

- A motivated individual aiming to contribute to liquidity management efforts while enhancing risk assessment and cash forecasting skills to support organizational objectives in a fast-paced environment.

- Recent finance major eager to apply strong quantitative analysis and financial modeling skills as a Liquidity Manager, ensuring optimal liquidity levels and compliance with regulatory standards.

- Ambitious finance professional looking to leverage academic knowledge in liquidity management to assist in cash flow optimization and enhance operational efficiency within a reputable organization.

- Enthusiastic graduate seeking an entry-level Liquidity Manager role, committed to applying problem-solving abilities and a strong understanding of market trends to improve liquidity strategies.

- A driven individual with a passion for finance, aiming to secure a Liquidity Manager position to develop expertise in liquidity risk management and contribute to overall financial stability.

- Finance graduate with strong analytical skills seeking to begin a career as a Liquidity Manager, focused on monitoring liquidity positions and developing effective cash management strategies.

- Detail-oriented and proactive individual aiming to join as a Liquidity Manager, utilizing knowledge of financial instruments to support accurate liquidity analysis and enhance decision-making processes.

- Recent graduate passionate about financial markets, seeking to apply skills in risk assessment and liquidity analysis as a Liquidity Manager to drive effective cash management practices.

- A finance enthusiast eager to begin a career as a Liquidity Manager, focusing on developing innovative liquidity strategies and ensuring adherence to best practices in financial management.

Career Objectives for Experienced Liquidity Manager

- Results-driven Liquidity Manager with over 10 years of experience seeking to optimize cash flow and enhance liquidity strategies, leveraging expertise in financial modeling and risk management to support organizational growth.

- Seasoned Liquidity Manager aiming to drive efficiency in liquidity operations by implementing innovative strategies and tools; committed to maximizing returns and minimizing risks in dynamic market conditions.

- Dynamic Liquidity Manager with extensive knowledge in regulatory compliance and cash forecasting, seeking to lead a talented team to achieve strategic financial objectives and improve overall liquidity management processes.

- Experienced Liquidity Manager focused on developing robust liquidity frameworks that align with corporate goals; eager to utilize analytical skills to enhance decision-making and foster sustainable financial practices.

- Ambitious Liquidity Manager with a proven track record in optimizing liquidity positions, looking to contribute to a forward-thinking organization by enhancing cash management practices and reducing financial risk.

- Strategic Liquidity Manager with a strong background in investment analysis and market trends, aiming to implement effective liquidity solutions that align with the organization’s long-term financial objectives.

- Detail-oriented Liquidity Manager seeking to leverage advanced data analysis and forecasting techniques to improve liquidity forecasting accuracy and ensure optimal capital allocation within the organization.

- Proactive Liquidity Manager with expertise in stakeholder communication and collaboration, aiming to enhance liquidity reporting systems and foster transparency in financial operations across departments.

- Highly analytical Liquidity Manager dedicated to balancing risk and return; looking to enhance liquidity strategies through innovative financial solutions and effective resource management in a challenging environment.

- Results-oriented Liquidity Manager with strong leadership skills, seeking to mentor and develop a high-performing team while driving initiatives that improve cash management effectiveness and organizational resilience.

- Expert Liquidity Manager with a focus on integrating technology into liquidity management processes; eager to support a digital transformation strategy that enhances operational efficiency and financial performance.

Best Career Objectives for Liquidity Manager

- Dynamic Liquidity Manager with 7+ years of experience in optimizing cash flow and managing liquidity risks, aiming to leverage analytical skills to enhance financial strategies and drive profitability in a leading financial institution.

- Results-oriented Liquidity Manager seeking to utilize expertise in cash management and regulatory compliance to improve liquidity forecasting processes and ensure optimal fund allocation for a progressive financial services firm.

- Dedicated professional with a strong background in liquidity management and financial analysis, looking to contribute to a team that prioritizes risk mitigation and enhances cash flow efficiency in a fast-paced environment.

- Experienced Liquidity Manager focused on implementing innovative liquidity solutions and enhancing operational efficiency, aspiring to join a reputable organization committed to financial excellence and strategic growth.

- Proficient in liquidity risk assessment and cash flow optimization, seeking a challenging role as a Liquidity Manager to apply analytical skills in developing robust liquidity strategies for sustainable business success.

- Detail-oriented Liquidity Manager with a proven track record in regulatory compliance and cash flow analysis, aspiring to drive financial performance and liquidity optimization within a dynamic financial institution.

- Strategic thinker with 5+ years of experience in liquidity management, looking to leverage expertise in cash forecasting and fund management to support organizational goals and enhance liquidity positions.

- Analytical Liquidity Manager with extensive experience in financial modeling and liquidity forecasting, aiming to contribute to a forward-thinking organization by optimizing cash resources and enhancing fiscal stability.

- Accomplished Liquidity Manager skilled in risk management and financial analysis, seeking to join a collaborative team to develop effective liquidity strategies and support long-term business growth.

- Ambitious professional with a solid foundation in treasury management and liquidity optimization, looking to utilize strong analytical skills and industry knowledge to ensure effective cash management in a leading firm.

- Results-driven Liquidity Manager with expertise in cash flow optimization and compliance, aiming to utilize strategic insights to enhance liquidity frameworks and support financial decision-making in a growing company.

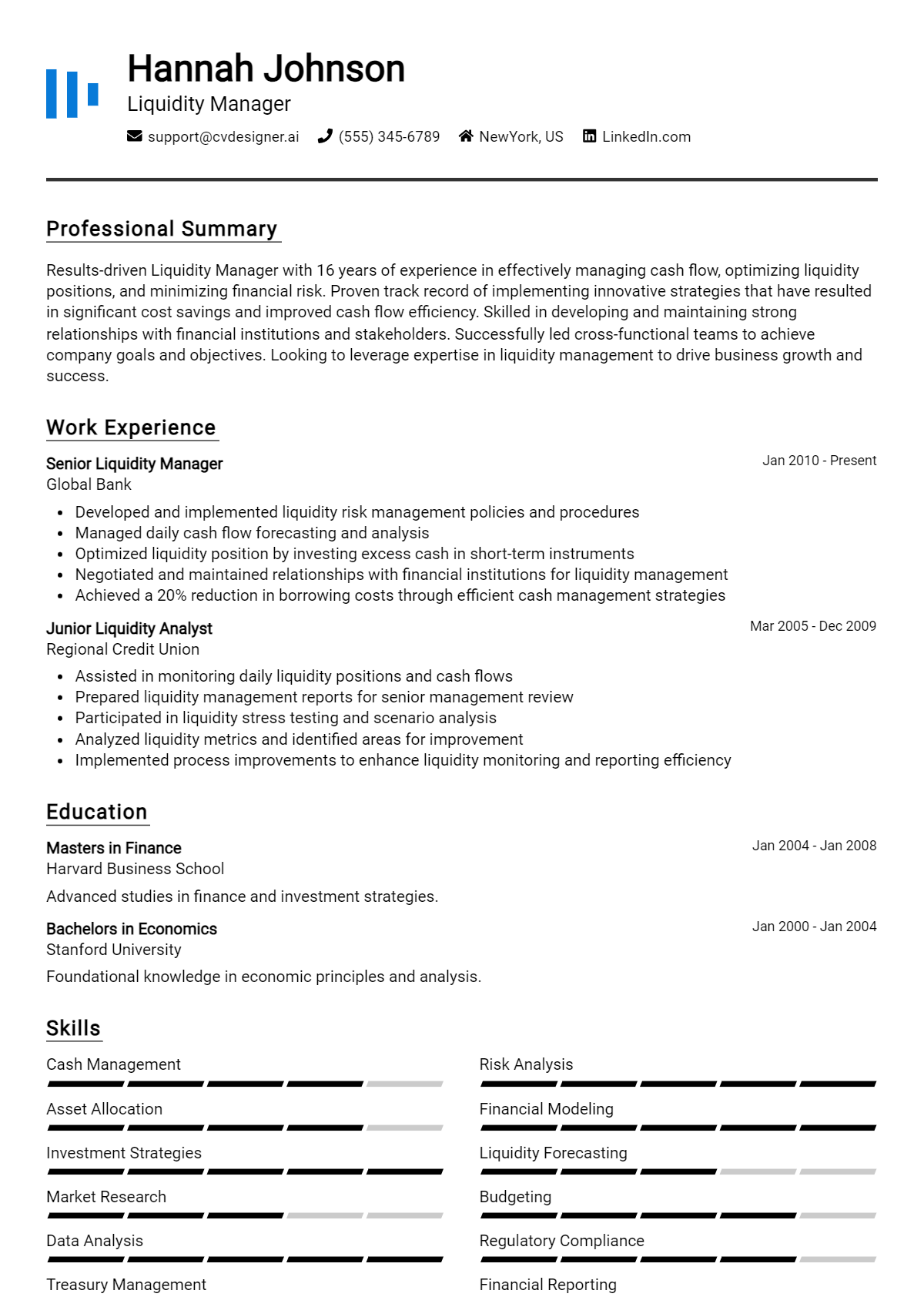

Best Liquidity Manager Resume Summary Samples

- Results-driven Liquidity Manager with over 7 years of experience in optimizing cash flow and managing liquidity risk. Proven track record in developing strategies that enhance liquidity while ensuring compliance with regulatory requirements.

- Detail-oriented Liquidity Manager skilled in financial forecasting and cash management. Adept at analyzing market trends to devise effective liquidity strategies that support organizational growth and stability.

- Dynamic Liquidity Manager with a strong background in treasury operations and funding strategies. Recognized for improving liquidity ratios by 20% through innovative cash management solutions and cross-functional collaboration.

- Strategic Liquidity Manager boasting over a decade of experience in financial analysis and liquidity planning. Excellent communicator with a history of influencing senior management decisions through data-driven insights.

- Experienced Liquidity Manager with expertise in liquidity risk assessment and mitigation. Successfully led initiatives that enhanced liquidity positions by implementing robust monitoring systems and reporting frameworks.

- Proactive Liquidity Manager known for effective stakeholder engagement and relationship management. Proven ability to optimize working capital and enhance cash flow through negotiation and strategic planning.

- Analytical Liquidity Manager with extensive experience in developing liquidity policies and procedures. Successfully managed a portfolio of assets with a focus on maximizing return while minimizing risk.

- Innovative Liquidity Manager with a strong focus on process improvement and automation. Delivered a 30% reduction in liquidity costs by streamlining cash management processes and implementing new technologies.

- Skilled Liquidity Manager with a comprehensive understanding of financial markets and instruments. Expertise in liquidity forecasting and scenario analysis to support optimal decision-making in dynamic environments.

- Dedicated Liquidity Manager with a successful track record in crisis management and liquidity planning. Recognized for developing contingency funding plans that safeguarded against market volatility.

- Highly motivated Liquidity Manager with strong analytical and problem-solving skills. Proven ability to lead teams in achieving liquidity objectives while maintaining regulatory compliance and operational efficiency.

When crafting a resume objective for a Liquidity Manager position, it is essential to create a concise and impactful statement that highlights your relevant skills, experience, and career goals. A well-structured objective should not only showcase your expertise in liquidity management but also align with the specific requirements of the job you are applying for. Begin by identifying key attributes that make you an ideal candidate, and then express your commitment to contributing to the organization's financial stability and efficiency. Tailor your objective to reflect your unique qualifications and set a positive tone for the rest of your resume.

How to Write a Liquidity Manager Resume Objective

- Start with a strong opening: Begin your objective with a powerful statement that captures your professional identity, such as "Results-driven Liquidity Manager with over X years of experience..."

- Highlight relevant experience: Mention specific experience in liquidity management, risk assessment, or financial analysis, emphasizing achievements that demonstrate your capabilities.

- Include key skills: Incorporate essential skills related to liquidity management, such as cash flow forecasting, regulatory compliance, and financial modeling.

- Align with the job description: Tailor your objective to reflect the specific needs and values of the employer, using keywords from the job listing.

- Express your career goals: Clearly state your intention to contribute to the organization’s success, showing how your goals align with the company’s mission.

- Keep it concise: Limit your objective to 1-2 sentences to ensure clarity and maintain the reader's attention.

- Review and revise: Edit your objective for grammar and clarity, ensuring it effectively reflects your professional image and aspirations.

Key Skills to Highlight in Your Liquidity Manager Resume Objective

Emphasizing relevant skills in your resume objective is crucial for capturing the attention of hiring managers. A well-crafted objective highlights your expertise, showcases your suitability for the role, and sets the tone for the rest of your application. By focusing on key skills, you demonstrate your ability to manage liquidity effectively and contribute to the financial health of the organization.

- Cash Flow Management

- Financial Risk Analysis

- Liquidity Forecasting

- Regulatory Compliance Knowledge

- Investment Analysis

- Banking Relationships

- Data Analysis and Reporting

- Strategic Financial Planning

Common Mistakes When Writing a Liquidity Manager Resume Objective

Crafting an effective resume objective is essential for standing out in the competitive field of liquidity management. A well-written objective can capture the attention of hiring managers and clearly communicate your career goals and qualifications. However, there are common mistakes that candidates often make, which can undermine the effectiveness of their resume objective. Avoiding these pitfalls will enhance your chances of making a strong impression.

- Being Too Vague: Using generic phrases like “seeking a challenging position” fails to specify your role and intentions. This lack of clarity can make it difficult for employers to see your fit for the position.

- Overly Long Objectives: An excessively long resume objective can dilute your message. Keep it concise—ideally one to two sentences—to maintain focus and ensure your key points are communicated effectively.

- Focusing on Personal Gain: Objectives that emphasize what you want from the job rather than what you can offer the employer can come off as self-serving. Instead, highlight how your skills will benefit the organization.

- Using Jargon or Buzzwords: Overloading your objective with industry jargon or trendy buzzwords can make it sound insincere or unfocused. Stick to clear, straightforward language that reflects your qualifications and experience.

- Neglecting Specific Skills or Experiences: Failing to mention relevant skills or experiences related to liquidity management can result in missed opportunities. Tailor your objective to showcase your specific qualifications that align with the job description.

- Not Tailoring the Objective: Using a one-size-fits-all objective can undermine your application. Always customize your resume objective for each job to demonstrate your genuine interest and alignment with the company’s goals.

- Ignoring Company Culture: Not considering the company’s culture or values in your objective can lead to a disconnect. Research the organization and incorporate elements that reflect their mission or vision, showing that you are a good cultural fit.

Frequently Asked Questions

What is a Liquidity Manager Resume Objective?

A Liquidity Manager Resume Objective is a brief statement at the beginning of a resume that outlines the candidate's career goals and highlights their qualifications for the liquidity management role. It serves to capture the attention of hiring managers by emphasizing relevant skills, experiences, and the candidate's commitment to optimizing liquidity strategies within an organization.

Why is a strong resume objective important for a Liquidity Manager?

A strong resume objective is crucial for a Liquidity Manager because it sets the tone for the rest of the resume and provides a snapshot of the candidate's professional aspirations and expertise. It helps differentiate the applicant from others by succinctly showcasing their unique value proposition and understanding of liquidity management principles, which can influence the hiring decision positively.

What key skills should be included in a Liquidity Manager Resume Objective?

In a Liquidity Manager Resume Objective, key skills to include are financial analysis, cash flow management, risk assessment, strategic planning, and knowledge of regulatory compliance. Highlighting these skills demonstrates the candidate's ability to effectively manage liquidity and navigate the complexities of financial markets, making them a strong contender for the position.

How can I tailor my resume objective for a specific Liquidity Manager job?

To tailor your resume objective for a specific Liquidity Manager job, research the company and review the job description to identify the skills and experiences they value most. Incorporate relevant keywords and phrases from the job posting into your objective, and align your career goals with the company's objectives to demonstrate how you can contribute to their success.

Can a Liquidity Manager Resume Objective be longer than two sentences?

While it's generally recommended that a Liquidity Manager Resume Objective be concise—typically one to two sentences—if necessary, it can be slightly longer to include essential details. However, it is important to maintain clarity and focus, ensuring that the objective remains impactful and effectively communicates your qualifications and aspirations without becoming overly verbose.

Conclusion

In summary, creating a targeted and impactful resume objective is essential for Liquidity Managers looking to make their mark in the competitive finance industry. A well-crafted objective not only highlights your skills and experiences but also serves as a compelling introduction that captures the attention of recruiters. By clearly articulating your career goals and the value you bring to potential employers, you can ensure that your resume stands out and leaves a lasting impression.

As you refine your resume objective using the tips and examples provided, remember that this is your opportunity to showcase your unique qualifications. Embrace the challenge, and take the time to tailor your objective to align with the job you desire. With dedication and focus, you can create a resume that effectively communicates your strengths. For additional resources, feel free to explore our resume templates, resume builder, resume examples, and cover letter templates. Good luck on your journey to securing your ideal position as a Liquidity Manager!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.