Liquidity Manager Core Responsibilities

A Liquidity Manager plays a crucial role in ensuring an organization maintains sufficient cash flow to meet its obligations. This position requires strong technical, operational, and problem-solving skills to analyze financial data, forecast liquidity needs, and implement effective cash management strategies. Additionally, the Liquidity Manager acts as a bridge between finance, treasury, and risk management departments, enhancing communication and collaboration. A well-structured resume that highlights these qualifications can significantly impact career advancement and contribute to the organization's financial stability.

Common Responsibilities Listed on Liquidity Manager Resume

- Monitor and analyze daily cash flows and liquidity positions.

- Develop and implement cash management strategies.

- Collaborate with treasury and finance teams to optimize liquidity.

- Forecast future cash needs based on business operations.

- Identify and mitigate liquidity risks.

- Prepare reports for senior management on liquidity status.

- Ensure compliance with regulatory requirements related to liquidity.

- Manage relationships with banks and financial institutions.

- Utilize financial modeling tools to enhance decision-making.

- Assist in budgeting and financial planning processes.

- Conduct stress testing for liquidity scenarios.

- Provide insights on investment opportunities to optimize returns.

High-Level Resume Tips for Liquidity Manager Professionals

In today's competitive job market, a well-crafted resume is essential for Liquidity Manager professionals striving to make a strong first impression on potential employers. Your resume serves as the initial introduction to your qualifications, skills, and accomplishments, and it needs to effectively communicate your expertise in managing liquidity risk and ensuring optimal cash flow. A compelling resume not only showcases your relevant experience but also highlights your ability to contribute to the financial stability of an organization. This guide will provide practical and actionable resume tips specifically tailored for Liquidity Manager professionals to help you stand out in the hiring process.

Top Resume Tips for Liquidity Manager Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that match the employer's requirements.

- Highlight your experience in liquidity management, including any specific roles where you successfully managed cash flow and financial resources.

- Quantify your achievements with concrete numbers, such as the percentage increase in cash reserves or reductions in liquidity risk.

- Showcase your proficiency in industry-specific tools and software, such as treasury management systems or financial modeling software.

- Include certifications relevant to liquidity management, such as the Certified Treasury Professional (CTP) designation.

- Demonstrate your understanding of regulatory frameworks and compliance issues that affect liquidity management.

- Provide examples of strategic initiatives you led that improved liquidity positions or financial performance.

- Emphasize your analytical and problem-solving skills, particularly in relation to cash flow forecasting and risk assessment.

- Keep your resume concise and focused, ideally within one to two pages, while ensuring it is easy to read and visually appealing.

By implementing these tips, Liquidity Manager professionals can significantly enhance their resumes, thereby increasing their chances of landing a job in this specialized field. A strong resume that effectively communicates your skills and achievements can set you apart from other candidates and attract the attention of hiring managers looking for top talent.

Why Resume Headlines & Titles are Important for Liquidity Manager

In the competitive landscape of finance, the role of a Liquidity Manager is crucial for maintaining an organization’s financial health. As such, a well-crafted resume headline or title can serve as a powerful tool to capture the attention of hiring managers right from the start. A strong headline succinctly summarizes a candidate’s key qualifications and areas of expertise in a single impactful phrase, making it easier for recruiters to quickly assess fit for the role. It should be concise, relevant, and directly aligned with the job description, effectively setting the tone for the rest of the resume.

Best Practices for Crafting Resume Headlines for Liquidity Manager

- Keep it concise: Aim for one impactful phrase that summarizes your qualifications.

- Be specific: Use industry terminology and direct references to liquidity management.

- Highlight key skills: Incorporate essential skills such as cash flow analysis, risk management, or forecasting.

- Showcase experience: Mention years of experience or specific achievements in liquidity management.

- Use active language: Employ strong action verbs to convey competence and proactivity.

- Align with the job description: Tailor your headline to reflect the requirements listed in the job posting.

- Avoid jargon: Ensure the language is clear and accessible to a variety of readers.

- Make it memorable: Use unique phrases or metrics to stand out from other candidates.

Example Resume Headlines for Liquidity Manager

Strong Resume Headlines

"Results-Driven Liquidity Manager with Over 10 Years of Experience in Cash Flow Optimization"

“Strategic Liquidity Expert Specializing in Risk Assessment and Mitigation”

“Dynamic Financial Leader with Proven Track Record in Enhancing Liquidity Position by 30%”

“Detail-Oriented Liquidity Manager Skilled in Forecasting and Financial Modeling”

Weak Resume Headlines

“Looking for a Job in Finance”

“Experienced Manager”

The strong headlines listed above are effective because they are specific, quantifiable, and directly related to the role of a Liquidity Manager. Each headline highlights key skills or accomplishments that immediately convey the candidate's value. In contrast, the weak headlines fail to impress due to their vagueness and lack of relevant details, which do not provide hiring managers with any substantive information about the candidate’s qualifications or potential contributions to the organization.

Writing an Exceptional Liquidity Manager Resume Summary

A well-crafted resume summary is crucial for a Liquidity Manager as it serves as the first impression to hiring managers, succinctly encapsulating the candidate's key skills, relevant experience, and significant accomplishments. This brief yet impactful section can set the tone for the rest of the resume, highlighting the candidate’s ability to manage financial risks, optimize liquidity positions, and ensure compliance with regulatory requirements. A strong summary should be concise, tailored to the specific job description, and designed to grab the attention of hiring managers quickly, making a compelling case for why the candidate is the right fit for the role.

Best Practices for Writing a Liquidity Manager Resume Summary

- Quantify Achievements: Use numbers to demonstrate your impact, such as percentage increases in liquidity or reductions in costs.

- Focus on Relevant Skills: Highlight specific skills pertinent to liquidity management, such as cash flow forecasting, risk assessment, and regulatory compliance.

- Tailor the Summary: Customize your summary for each job application to align with the requirements and responsibilities outlined in the job description.

- Keep It Concise: Aim for 2-4 sentences that convey your qualifications without overwhelming details.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Highlight Key Accomplishments: Mention specific projects or initiatives that illustrate your contributions to previous employers.

- Maintain Professional Tone: Use industry-specific language and avoid overly casual phrasing to convey professionalism.

- Showcase Leadership: If applicable, emphasize any leadership roles or experiences in managing teams or projects related to liquidity management.

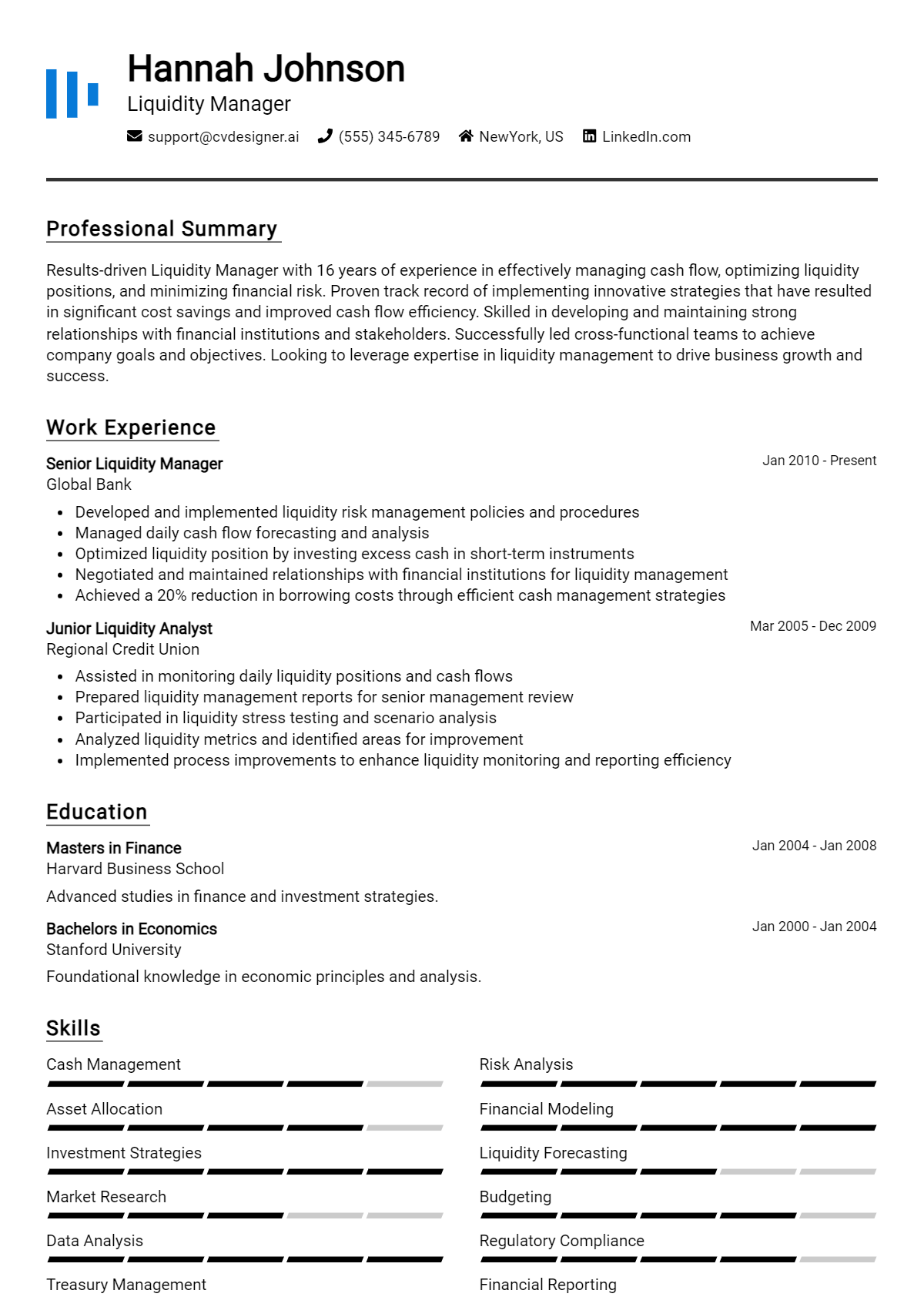

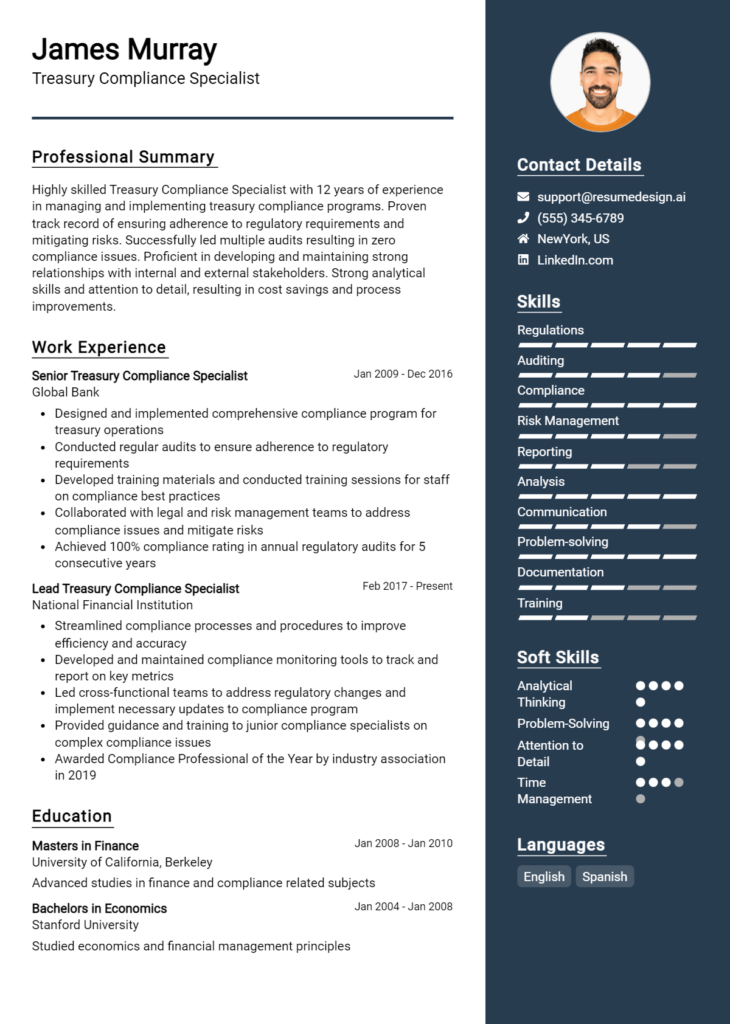

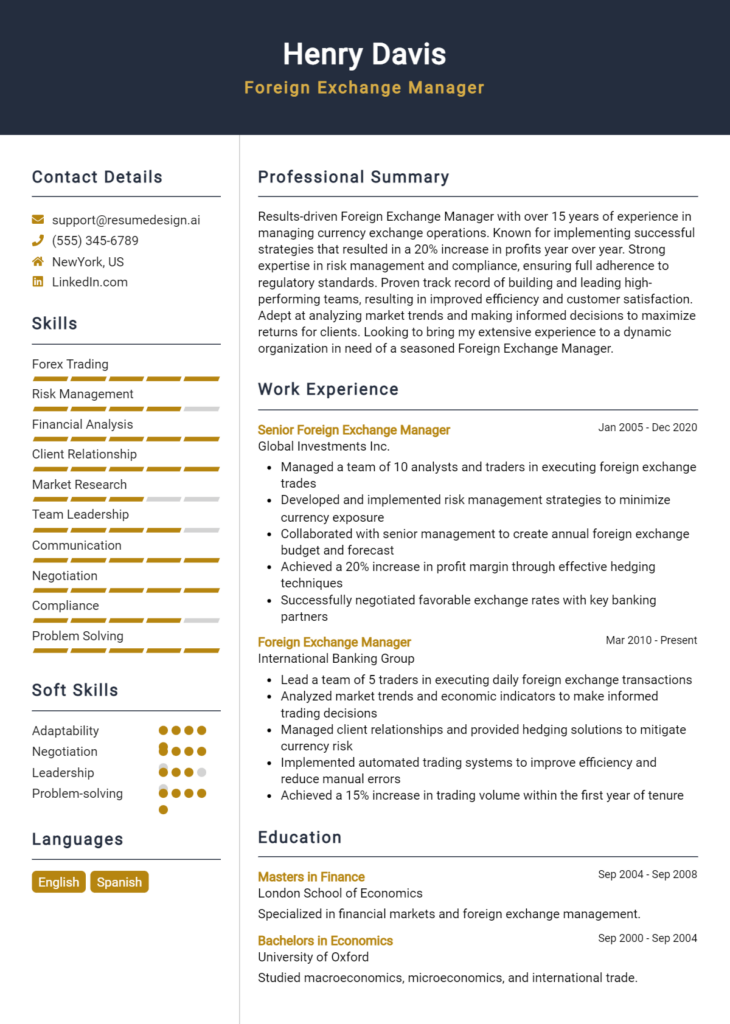

Example Liquidity Manager Resume Summaries

Strong Resume Summaries

Results-driven Liquidity Manager with over 8 years of experience optimizing cash flow and enhancing liquidity positions, achieving a 20% reduction in funding costs and improving risk management processes in compliance with regulatory standards.

Dynamic professional specializing in liquidity forecasting and cash management, recognized for implementing a new cash flow model that increased liquidity efficiency by 30%, facilitating strategic investments and business growth.

Experienced Liquidity Manager adept at developing and executing liquidity strategies, leading to a 15% improvement in cash reserves while ensuring compliance with financial regulations and enhancing stakeholder confidence.

Detail-oriented Liquidity Manager with a track record of successfully managing multi-million dollar cash portfolios, resulting in a 25% increase in cash availability and a 10% improvement in overall liquidity risk assessment.

Weak Resume Summaries

Experienced finance professional looking for a role in liquidity management.

Knowledgeable about cash flow and liquidity but seeking to gain more experience in the field.

The examples provided illustrate the distinction between strong and weak resume summaries. Strong summaries are impactful, quantifying achievements and showcasing relevant skills that directly relate to the Liquidity Manager role. They convey specific accomplishments and demonstrate how the candidate has positively affected previous employers. In contrast, weak summaries lack detail, are vague, and do not provide any measurable outcomes or specific skills, making it difficult for hiring managers to see the candidate's potential value to their organization.

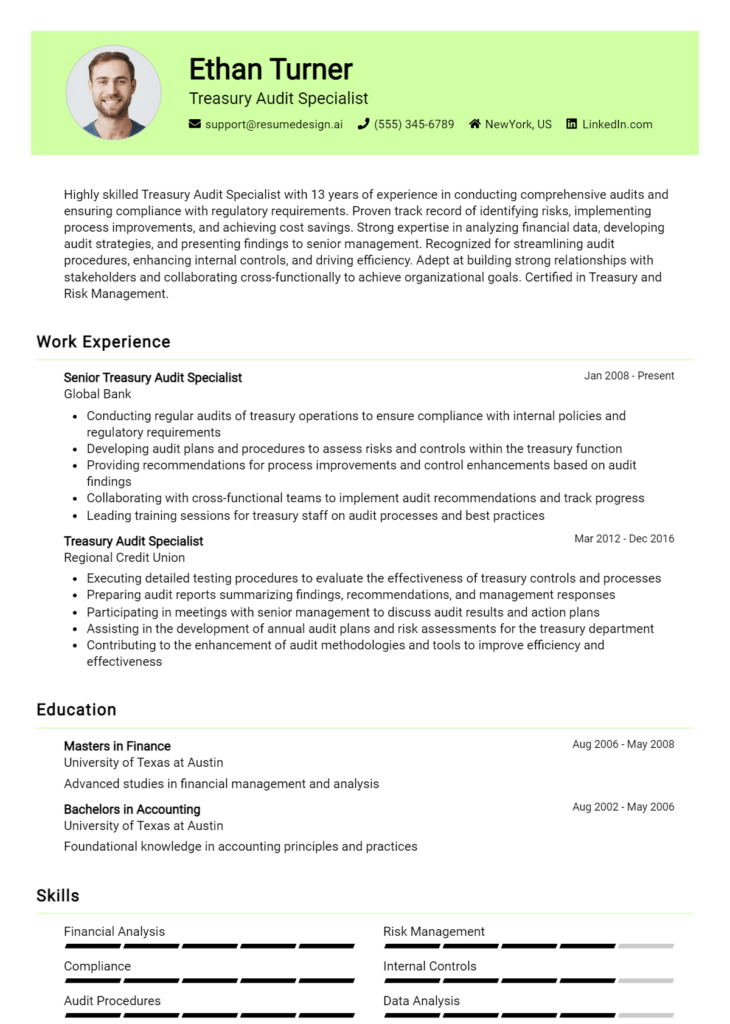

Work Experience Section for Liquidity Manager Resume

The work experience section of a Liquidity Manager resume is crucial for demonstrating the candidate's technical skills, leadership capabilities, and the ability to deliver high-quality financial products. This section not only provides evidence of past roles and responsibilities but also highlights the results achieved in those positions. By quantifying achievements—such as improvements in liquidity ratios, cost reductions, or successful team projects—candidates can effectively align their experience with industry standards, showcasing their value to potential employers.

Best Practices for Liquidity Manager Work Experience

- Highlight technical expertise in liquidity management tools and methodologies.

- Quantify achievements with specific metrics to demonstrate impact.

- Emphasize leadership roles in managing teams and cross-departmental collaboration.

- Use industry-standard terminology to align with job requirements.

- Focus on results-driven statements that showcase problem-solving skills.

- Include relevant certifications or training to enhance credibility.

- Tailor the work experience to match the specific job description and company needs.

- Keep descriptions concise while ensuring clarity and relevance.

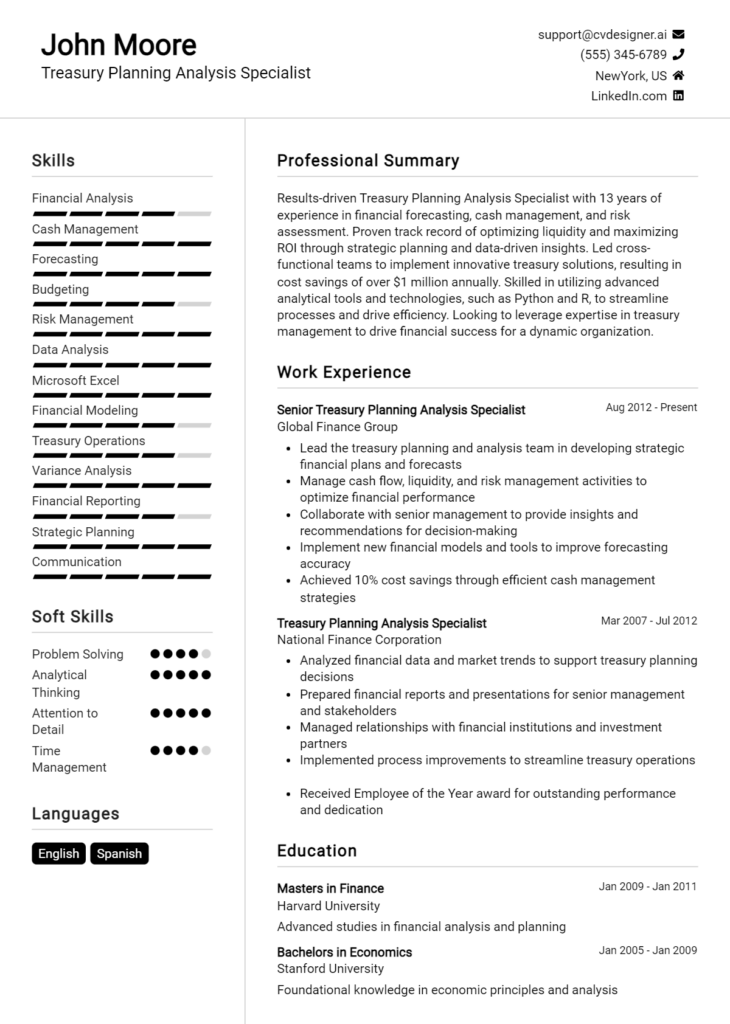

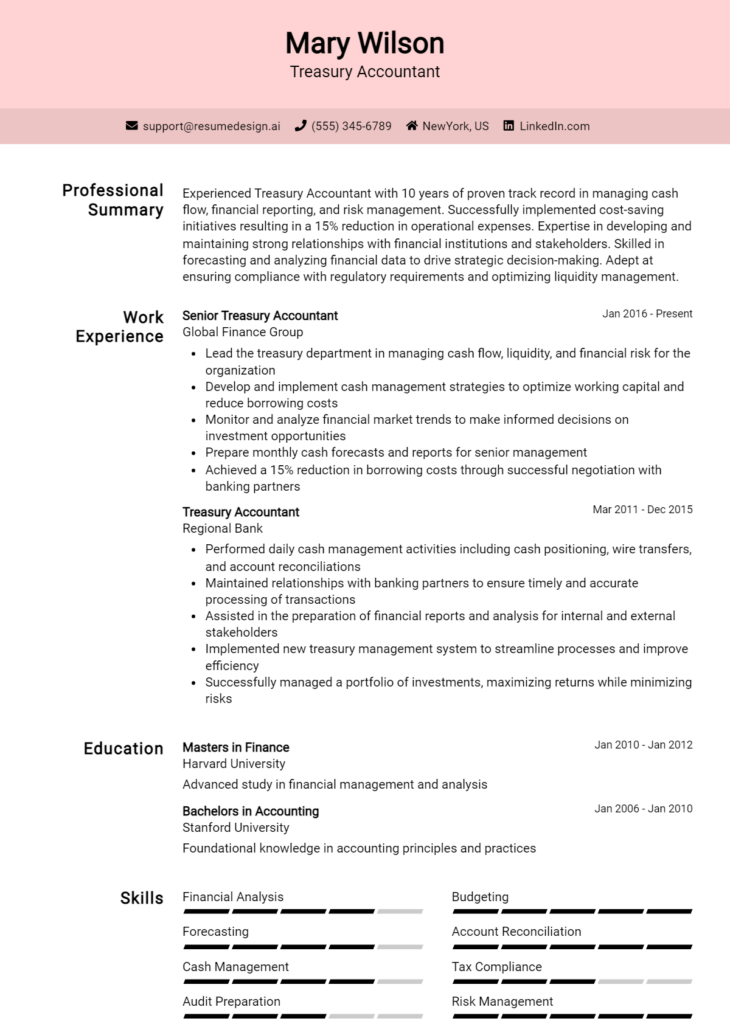

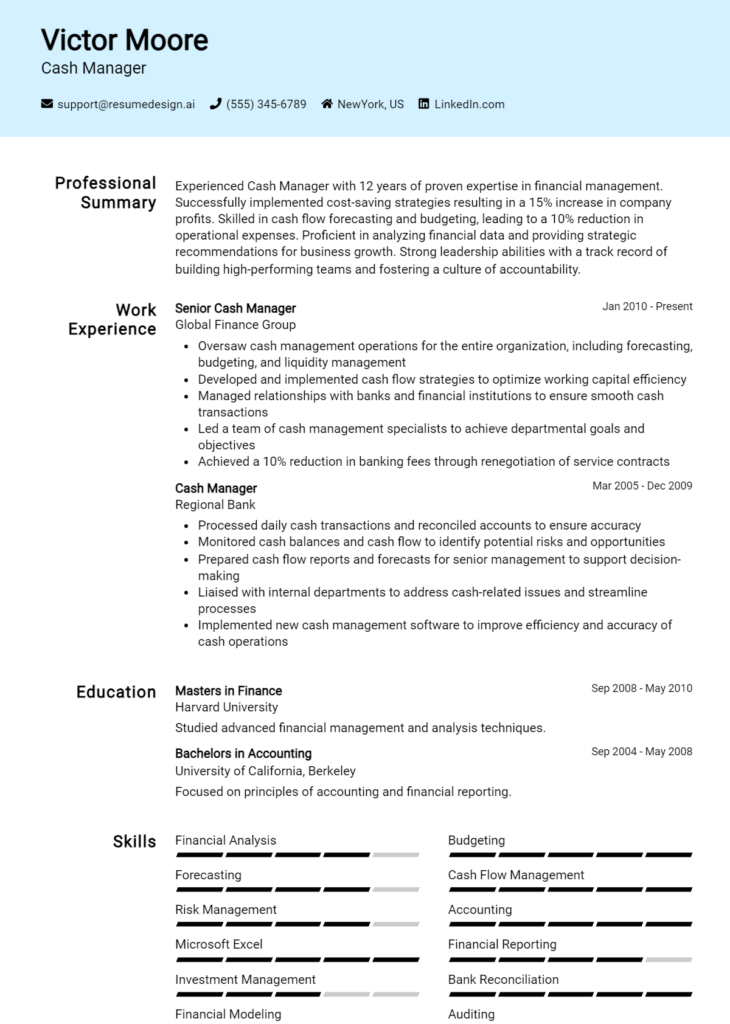

Example Work Experiences for Liquidity Manager

Strong Experiences

- Led a cross-functional team to optimize liquidity management processes, resulting in a 25% reduction in excess cash reserves and improved return on investments.

- Implemented a new liquidity forecasting model that improved accuracy by 40%, enabling better strategic decision-making for cash flow management.

- Collaborated with treasury and finance teams to streamline cash management operations, achieving a cost savings of $500,000 annually through enhanced cash flow visibility.

- Managed a team of analysts to develop and execute liquidity stress testing scenarios, ensuring compliance with regulatory requirements and improving risk assessment protocols.

Weak Experiences

- Responsible for managing liquidity and cash flow.

- Worked on various projects related to liquidity without specifying outcomes.

- Assisted in team activities to support liquidity management.

- Participated in meetings discussing liquidity strategies.

The examples categorized as strong experiences effectively highlight specific achievements, showcasing the candidate's ability to deliver quantifiable results and demonstrate leadership in technical projects. In contrast, the weak experiences lack detail and measurable outcomes, making it difficult for potential employers to assess the candidate's contributions and capabilities. By focusing on impactful results and concrete responsibilities, candidates can significantly enhance their appeal in the competitive field of liquidity management.

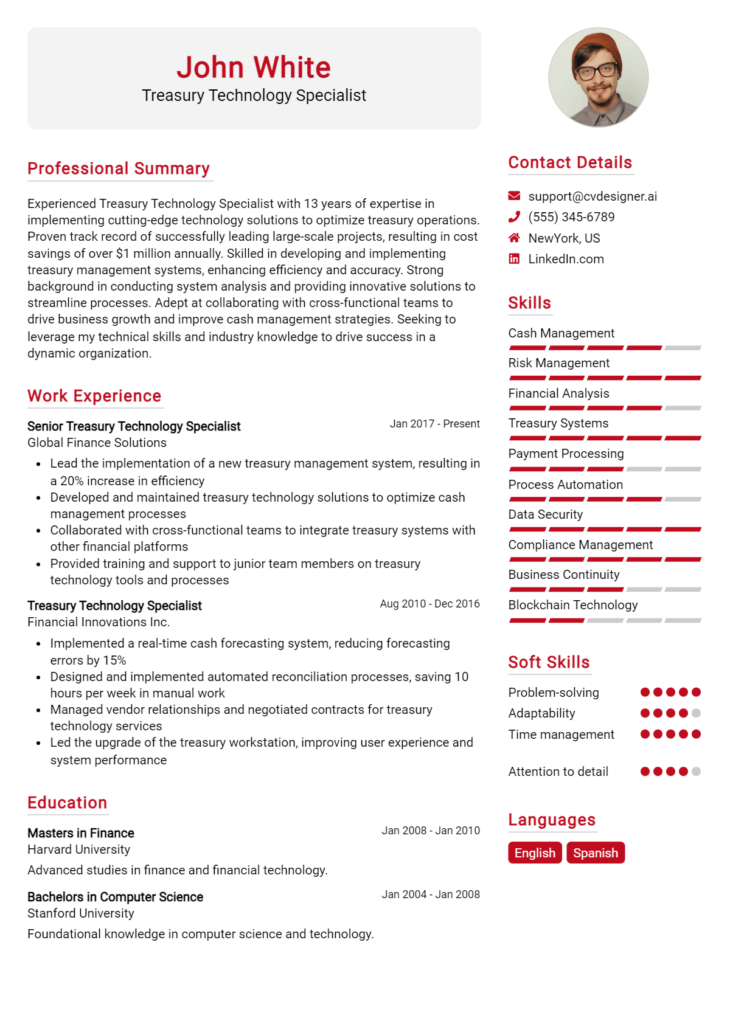

Education and Certifications Section for Liquidity Manager Resume

The education and certifications section of a Liquidity Manager resume plays a crucial role in showcasing a candidate’s academic foundation, specialized knowledge, and commitment to ongoing professional development. This section not only highlights relevant degrees and industry-recognized certifications, but also emphasizes the candidate's efforts in continuous learning, which is essential in the ever-evolving financial landscape. By providing detailed information about relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the Liquidity Manager role.

Best Practices for Liquidity Manager Education and Certifications

- Prioritize relevant degrees such as Finance, Economics, or Business Administration.

- Include industry-recognized certifications like CFA, FRM, or CTP.

- Provide details on relevant coursework that directly relates to liquidity management.

- Highlight any specialized training programs that enhance skills pertinent to liquidity management.

- Focus on the most recent and applicable educational experiences to demonstrate up-to-date knowledge.

- Use clear and concise language to describe certifications and their relevance.

- Include any continuing education courses or workshops that showcase a commitment to professional growth.

- List certifications in order of relevance and importance to the Liquidity Manager role.

Example Education and Certifications for Liquidity Manager

Strong Examples

- MBA in Finance, University of Chicago – Focus on Financial Risk Management

- CFA (Chartered Financial Analyst) – Level II Candidate

- Certification in Treasury Management (CTP) – Association for Financial Professionals

- Coursework in Advanced Liquidity Management – Online Finance Academy

Weak Examples

- Bachelor's Degree in English Literature – University of California

- Certification in Basic Bookkeeping – Local Community College

- High School Diploma – Graduated in 2010

- Outdated CFA Level I Certification from 2015

The examples provided illustrate the distinction between strong and weak educational qualifications and certifications. Strong examples showcase relevant degrees and certifications that align with the responsibilities of a Liquidity Manager, emphasizing specialized knowledge and commitment to the field. In contrast, weak examples reflect outdated or irrelevant qualifications that do not contribute to the candidate’s suitability for the role, making them less impactful in the competitive job market.

Top Skills & Keywords for Liquidity Manager Resume

As a Liquidity Manager, possessing the right skills is crucial to effectively navigate the complexities of financial markets and ensure the organization maintains adequate liquidity levels. A well-crafted resume showcasing both hard and soft skills can significantly enhance your chances of landing a desired position in this competitive field. The skills listed not only highlight your technical capabilities but also your ability to collaborate, lead, and think critically under pressure. Employers look for candidates who can adapt to evolving market conditions while managing risk effectively, making it essential to present a balanced mix of skills that reflect both your expertise in liquidity management and your interpersonal strengths.

Top Hard & Soft Skills for Liquidity Manager

Soft Skills

- Strong analytical skills

- Excellent communication abilities

- Leadership and team management

- Problem-solving aptitude

- Attention to detail

- Adaptability and flexibility

- Critical thinking

- Time management

- Strategic thinking

- Relationship building

Hard Skills

- Cash flow forecasting

- Financial modeling

- Risk assessment and management

- Knowledge of financial regulations

- Proficiency in liquidity management software

- Data analysis and interpretation

- Investment strategies

- Understanding of market trends

- Treasury management

- Reporting and compliance

By emphasizing these skills in your resume, you can effectively showcase your qualifications and readiness for the challenges faced by a Liquidity Manager. Additionally, highlighting relevant work experience can further reinforce your capabilities and suitability for the role.

Stand Out with a Winning Liquidity Manager Cover Letter

I am writing to express my interest in the Liquidity Manager position at [Company Name], as advertised on [Where You Found the Job Posting]. With a robust background in financial management and a proven track record in optimizing liquidity strategies, I am excited about the opportunity to contribute to your team. My experience in analyzing market trends and developing comprehensive liquidity frameworks aligns perfectly with the skills required for this role.

In my previous position at [Previous Company Name], I successfully managed a multi-million-dollar liquidity portfolio, implementing risk management strategies that enhanced cash flow forecasting and improved overall financial stability. By leveraging advanced financial modeling techniques and collaborating with cross-functional teams, I was able to identify potential liquidity gaps and develop actionable plans that resulted in a 15% increase in operational efficiency. My analytical mindset, combined with my proactive approach, allowed me to navigate complex regulatory environments while ensuring compliance and mitigating risks.

What sets me apart as a candidate is my commitment to continuous improvement and my ability to foster strong relationships with stakeholders. I believe that effective communication is crucial in managing liquidity, and I pride myself on my ability to convey complex financial concepts in a clear and concise manner. I am eager to bring my expertise in liquidity management and my passion for financial excellence to [Company Name], helping to drive strategic initiatives and support your organizational goals.

Thank you for considering my application. I am excited about the possibility of discussing how my skills and experiences align with the needs of your team. I look forward to the opportunity to contribute to [Company Name] and support its continued success in the financial sector.

Common Mistakes to Avoid in a Liquidity Manager Resume

When crafting a resume for a Liquidity Manager position, it's crucial to present your skills and experiences effectively. However, many candidates make common mistakes that can undermine their chances of landing an interview. By avoiding these pitfalls, you can create a resume that highlights your qualifications and aligns with the expectations of hiring managers in the finance industry.

Lack of Quantifiable Achievements: Failing to include specific metrics or results can make your contributions seem vague. Use numbers to demonstrate how you improved liquidity ratios or reduced risk.

Overly Technical Language: While industry jargon can showcase expertise, excessive technical language may alienate hiring managers. Strive for clarity and ensure your resume is accessible to a broader audience.

Ignoring Keywords: Not incorporating relevant keywords from the job description can lead to your resume being overlooked by applicant tracking systems (ATS). Tailor your resume to reflect the qualifications and skills mentioned in the job posting.

Inconsistent Formatting: A disorganized resume can distract from your qualifications. Ensure consistent font styles, sizes, and spacing to create a professional appearance.

Generic Objective Statements: Using a one-size-fits-all objective statement fails to convey your specific interest in the role. Customize your objective to reflect your passion and goals related to liquidity management.

Neglecting Soft Skills: While technical skills are vital, soft skills such as communication, teamwork, and problem-solving are equally important. Highlighting these skills can set you apart from other candidates.

Omitting Relevant Certifications: Not mentioning relevant certifications, such as CFA or FRM, can be a missed opportunity to showcase your professional development. Include any certifications that enhance your candidacy.

Too Much Focus on Job Duties: Listing job duties without context can make your resume blend in with others. Focus on your accomplishments and the impact of your work rather than simply describing your responsibilities.

Conclusion

As a Liquidity Manager, your role is vital in ensuring that your organization maintains adequate liquidity to meet its obligations while optimizing cash flow. Key responsibilities include monitoring cash positions, forecasting liquidity needs, managing banking relationships, and implementing strategies to mitigate liquidity risk. A successful Liquidity Manager must possess strong analytical skills, a deep understanding of financial markets, and the ability to communicate effectively with stakeholders.

In this competitive job market, having a standout resume is crucial. Your resume should highlight your relevant experience, specialized skills, and accomplishments in liquidity management. Ensure that you tailor your resume to reflect the specific requirements of the positions you are applying for, showcasing your expertise in cash flow analysis, risk management, and strategic financial planning.

To enhance your job application, consider reviewing your Liquidity Manager resume today. Tools such as resume templates, resume builder, resume examples, and cover letter templates are available to help you craft a professional and impactful resume that stands out to potential employers. Take action now and ensure your resume reflects your qualifications and readiness for your next career opportunity!