Top 26 Commercial Banker Resume Summaries in 2025

In the competitive field of commercial banking, having clear career objectives is essential for professional growth and success. These objectives not only guide bankers in their daily responsibilities but also help in aligning their aspirations with the strategic goals of their institutions. In the following section, we will explore the top career objectives that commercial bankers should consider to enhance their performance, advance their careers, and contribute effectively to their organizations.

Career Objectives for Experienced Commercial Banker

- Results-driven commercial banker with over 10 years of experience seeking to leverage expertise in financial analysis and relationship management to drive growth and profitability for a leading financial institution.

- Dedicated commercial banker aiming to apply extensive knowledge in credit risk assessment and portfolio management to enhance client satisfaction and achieve organizational objectives in a dynamic banking environment.

- Dynamic professional with a solid track record in securing business loans and fostering client relationships, seeking to contribute my strategic insight and industry expertise to a forward-thinking banking team.

- Experienced commercial banker focused on utilizing strong negotiation skills and market knowledge to expand the client base and maximize revenue for a reputable financial organization.

- Ambitious commercial banker with a passion for helping small and medium-sized enterprises thrive, looking to implement tailored financial solutions that drive business success and enhance client loyalty.

- Proficient commercial banker with expertise in financial modeling and risk management, seeking to leverage analytical skills to support decision-making processes and promote sustainable growth within a competitive market.

- Motivated commercial banker with a proven ability to exceed sales targets and enhance customer relationships, aspiring to join a renowned institution where I can contribute to strategic initiatives and growth plans.

- Detail-oriented commercial banker with a strong foundation in regulatory compliance and loan underwriting, looking to safeguard the institution's interests while fostering lasting client partnerships.

- Innovative commercial banker with over a decade of experience in diverse banking sectors, aiming to utilize my skills in team leadership and financial advisory to drive operational excellence and client success.

- Seasoned commercial banker specializing in cross-selling financial products, eager to utilize my client-centric approach and market insights to generate revenue and enhance customer satisfaction at a leading bank.

- Strategic thinker and experienced commercial banker, seeking to leverage my expertise in market analysis and relationship building to contribute to the growth and stability of a progressive financial institution.

Best Career Objectives for Commercial Banker

- Results-driven commercial banker with over five years of experience in financial analysis and client relationship management, seeking to leverage expertise to help clients achieve their financial goals while driving growth for the bank.

- Detail-oriented commercial banker aiming to utilize strong negotiation skills and industry knowledge to provide exceptional service and tailored financial solutions that enhance client satisfaction and loyalty.

- Dedicated commercial banker with a track record of success in portfolio management and risk assessment, looking to contribute to a dynamic team while fostering long-term partnerships with small to mid-sized businesses.

- Ambitious commercial banker with proficiency in credit analysis and loan structuring, seeking to apply analytical skills to identify opportunities for business growth and enhance profitability for both clients and the bank.

- Experienced commercial banker with expertise in cash management and treasury services, aiming to support clients in optimizing their financial operations and achieving operational efficiency through innovative banking solutions.

- Dynamic commercial banker with a passion for developing client relationships and providing strategic financial advice, seeking to utilize my skills in a fast-paced environment to drive business success and client satisfaction.

- Proactive commercial banker with strong communication and interpersonal skills, looking to leverage my ability to build trust and rapport to expand the bank's client base and enhance service offerings.

- Strategic thinker with a background in commercial lending and financial forecasting, eager to contribute to a leading bank by using my expertise to help clients navigate complex financial decisions and achieve their objectives.

- Client-focused commercial banker with a passion for helping businesses grow, seeking to combine my financial acumen and relationship management skills to create impactful banking solutions tailored to client needs.

- Results-oriented commercial banker with extensive experience in market analysis and business development, looking to leverage my skills to identify new opportunities and enhance the bank's competitive positioning.

- Analytical commercial banker with a commitment to providing excellent customer service, seeking to utilize my experience in financial modeling and risk management to help clients make informed financial decisions.

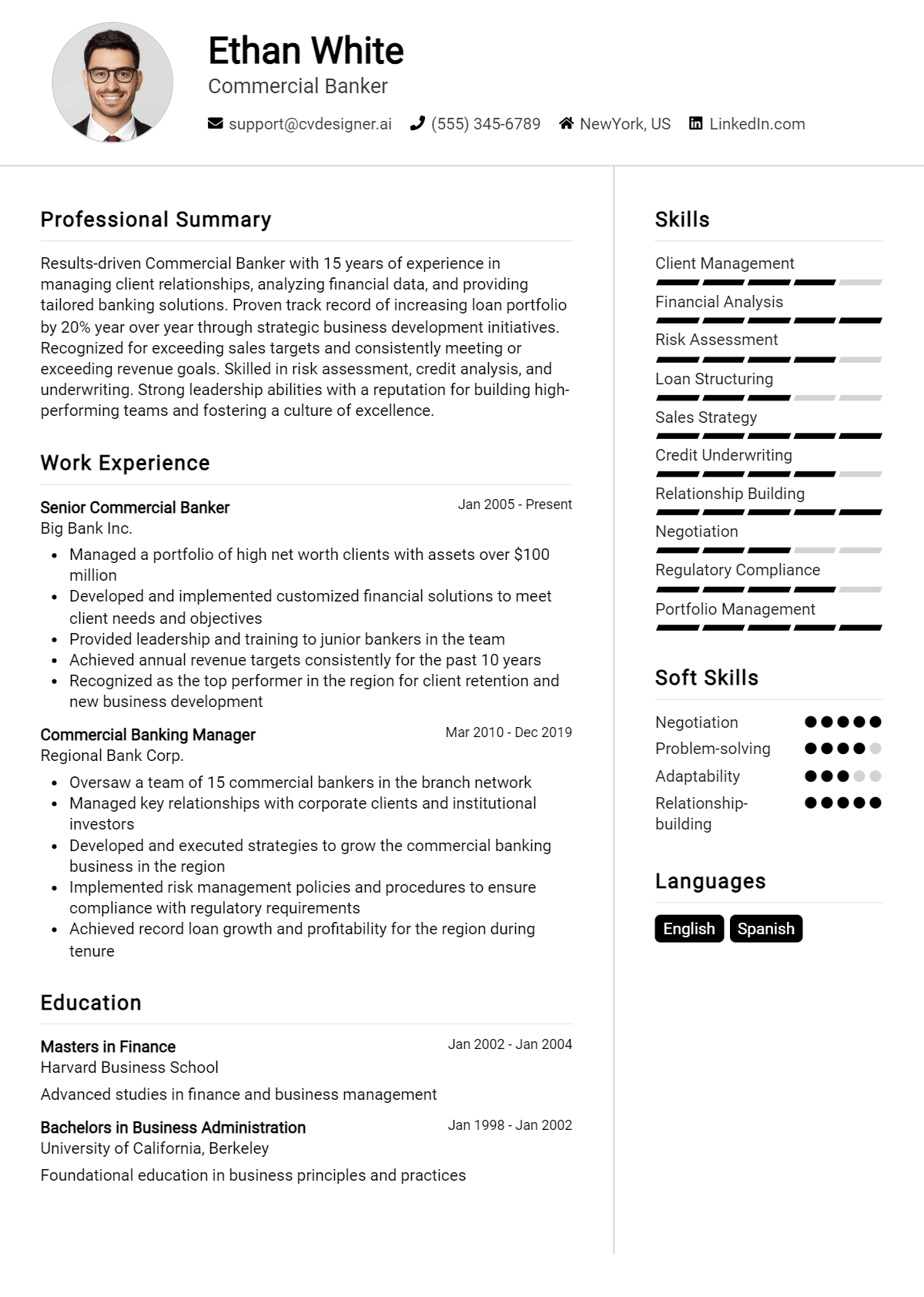

Best Commercial Banker Resume Summary Samples

- Results-driven Commercial Banker with over 8 years of experience in managing client portfolios, providing tailored financial solutions, and enhancing customer satisfaction. Proven track record of increasing loan origination by 25% through relationship building and strategic planning.

- Detail-oriented Commercial Banker with expertise in credit analysis and risk management, possessing a strong background in commercial lending. Successfully closed over $50 million in loans, contributing to a 15% growth in regional market share.

- Dynamic Commercial Banker with a decade of experience in developing and executing financial strategies for businesses. Exceptional skills in client relations and financial forecasting, resulting in a 30% increase in client retention rates.

- Experienced Commercial Banker with a focus on small business lending and portfolio management. Recognized for exceeding sales targets by 40% and building strong community relationships to drive business growth.

- Accomplished Commercial Banker with a proven ability to analyze market trends and develop innovative financial products. Successfully led a team that achieved a 20% increase in loan portfolio within one year.

- Strategic Commercial Banker with over 5 years of experience in financial consulting and business development. Expertise in negotiating complex loan agreements, resulting in an average deal size growth of 35%.

- Proactive Commercial Banker skilled in relationship management and financial analysis. Achieved a 50% increase in cross-selling financial services by effectively understanding client needs and delivering customized solutions.

- Dedicated Commercial Banker with strong analytical skills and a focus on compliance. Successfully identified and mitigated financial risks, leading to a 10% reduction in default rates within the lending portfolio.

- Motivated Commercial Banker with experience in corporate finance and investment strategies. Developed strategic partnerships that led to a 25% increase in new business opportunities and enhanced client engagement.

- Innovative Commercial Banker with expertise in treasury management and cash flow optimization. Successfully implemented new financial processes that improved operational efficiency by 30% and increased client satisfaction.

- Client-focused Commercial Banker with a strong background in financial advisory services. Recognized for delivering high-quality service and personalized financial solutions, contributing to a 40% increase in client referrals.

When crafting a resume objective for a Commercial Banker position, it's essential to convey your career goals, relevant skills, and the value you bring to potential employers. A well-structured objective should be concise, targeted, and tailored specifically to the banking sector, showcasing your understanding of financial products, client relationship management, and risk assessment. By clearly outlining your professional aspirations and how they align with the bank's objectives, you can create a compelling introduction to your resume that captures the hiring manager's attention.

How to Write a Commercial Banker Resume Objective

- Identify your career goals: Clearly define what you aim to achieve in your role as a Commercial Banker, such as enhancing client relationships or driving loan growth.

- Highlight relevant experience: Mention any prior banking experience, internships, or roles that relate directly to commercial banking.

- Showcase your skills: Include key skills relevant to commercial banking, such as financial analysis, credit assessment, or portfolio management.

- Tailor to the employer: Research the bank or financial institution you’re applying to and incorporate specific values or goals that resonate with their mission.

- Be concise and specific: Keep your objective to one or two sentences, focusing on the most critical information without unnecessary jargon.

- Use action-oriented language: Start with strong verbs to convey confidence and proactivity, such as “seeking,” “driving,” or “enhancing.”

- Review and revise: After drafting your objective, read it over to ensure clarity, relevance, and alignment with your overall resume.

Key Skills to Highlight in Your Commercial Banker Resume Objective

When crafting your resume objective for a Commercial Banker position, it's crucial to emphasize relevant skills that align with the demands of the role. Highlighting these skills not only showcases your qualifications but also demonstrates your understanding of the industry's requirements and your ability to contribute effectively to the organization.

- Financial Analysis and Reporting

- Client Relationship Management

- Risk Assessment and Management

- Credit Analysis and Underwriting

- Negotiation and Persuasion Skills

- Regulatory Compliance Knowledge

- Market Research and Competitive Analysis

- Excellent Communication and Interpersonal Skills

Common Mistakes When Writing a Commercial Banker Resume Objective

Writing an effective resume objective is crucial for making a strong first impression as a commercial banker. A well-crafted objective can highlight your skills, experience, and aspirations, setting you apart from other candidates. However, common mistakes can detract from its impact and fail to capture the attention of hiring managers. Here are some pitfalls to avoid:

- Being Too Vague: An objective that lacks specificity fails to communicate your unique qualifications. Phrases like "seeking a challenging position" do not provide insight into your skills or the value you bring, diminishing the objective's effectiveness.

- Overly Generic Statements: Using a one-size-fits-all approach can make your resume blend in with others. Tailoring your objective to the specific job and company can showcase your genuine interest and alignment with their goals.

- Focusing on Personal Goals Rather Than Employer Needs: An objective that emphasizes what you want rather than what you can offer to the employer can come across as self-centered. Shift the focus to how your skills and experience can benefit the organization.

- Using Clichés or Buzzwords: Phrases like "hardworking" or "team player" are often overused and can dilute your message. Instead, aim for concrete examples of your qualifications to make a more memorable impression.

- Neglecting to Mention Relevant Skills: Failing to highlight key skills relevant to commercial banking, such as financial analysis or relationship management, can leave hiring managers questioning your fit for the role.

- Making It Too Long: An objective that stretches beyond a couple of sentences can lose the reader's attention. Keep it concise and focused to ensure it delivers a powerful message without unnecessary detail.

- Ignoring the Job Description: Not aligning your objective with the specific requirements and responsibilities outlined in the job description can signal a lack of attention to detail. Tailoring your objective to reflect the job's needs is essential for demonstrating your suitability.

Frequently Asked Questions

What is the purpose of a resume objective for a Commercial Banker?

The resume objective for a Commercial Banker serves as a brief summary of your career goals and intentions, tailored specifically to the position you are applying for. It helps potential employers quickly understand your professional aspirations and how they align with the bank's objectives. A well-crafted objective can set the tone for your entire resume and make a positive first impression.

How long should a resume objective be?

A resume objective should be concise, ideally one to two sentences long, or around 30-50 words. This brevity allows you to communicate your goals efficiently without overwhelming the reader. The objective should focus on your skills and what you can bring to the role rather than being overly detailed or lengthy.

What should I include in my Commercial Banker resume objective?

Your resume objective should include key elements such as your relevant experience, specific skills related to commercial banking, and a clear statement of your career goals. Highlighting your expertise in areas like client relationship management, financial analysis, or lending solutions will make your objective more impactful and relevant to the position.

Is it necessary to customize my resume objective for each job application?

Yes, customizing your resume objective for each job application is essential. Tailoring your objective to reflect the specific requirements and values of the bank you are applying to demonstrates your genuine interest in the position and shows that you have taken the time to understand the role. This personalization can significantly enhance your chances of getting noticed by hiring managers.

What are some common mistakes to avoid when writing a resume objective?

Common mistakes to avoid include using vague language, being overly generic, or focusing too much on what you want rather than what you can offer the employer. Additionally, avoid clichés and jargon that may not resonate with the hiring team. Instead, aim for a clear, specific, and engaging objective that highlights your unique qualifications and aligns with the job requirements.

Conclusion

In summary, crafting a targeted and impactful resume objective is essential for aspiring commercial bankers. A well-written objective not only highlights your relevant skills and experiences but also helps you stand out to recruiters, making a strong first impression that can set you apart from other candidates.

By utilizing the tips and examples provided in this guide, you can refine your resume objective and enhance your chances of landing an interview. Remember, your resume is your first opportunity to showcase your qualifications, so make it count!

Stay motivated and take the next step in your career journey by exploring our resume templates, using our resume builder, checking out resume examples, and creating compelling cover letter templates to support your application process.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.