Commercial Banker Core Responsibilities

A Commercial Banker plays a crucial role in bridging the gap between clients and the bank, requiring strong technical, operational, and problem-solving skills. Key responsibilities include assessing creditworthiness, managing client relationships, and developing tailored financial solutions. This position demands collaboration across departments, ensuring seamless service delivery and compliance with regulations. A well-structured resume highlighting these skills not only showcases individual qualifications but also emphasizes the banker’s contribution to the organization’s overall goals and objectives.

Common Responsibilities Listed on Commercial Banker Resume

- Assessing and analyzing clients' financial needs and creditworthiness.

- Developing and maintaining strong client relationships.

- Creating customized financial solutions to meet client requirements.

- Performing risk assessments and due diligence on lending proposals.

- Collaborating with internal departments to facilitate service delivery.

- Monitoring client accounts and providing ongoing support.

- Staying updated on market trends and regulatory changes.

- Preparing detailed loan proposals and financial reports.

- Meeting sales targets and promoting bank products effectively.

- Conducting financial analysis and presenting findings to stakeholders.

- Ensuring compliance with banking regulations and policies.

- Participating in community outreach and networking events.

High-Level Resume Tips for Commercial Banker Professionals

In the competitive landscape of banking, a well-crafted resume is not just a formality—it's often the first impression a candidate makes on a potential employer. For Commercial Banker professionals, your resume serves as a powerful marketing tool that not only highlights your skills and achievements but also conveys your understanding of the financial industry and its nuances. A strong resume can set you apart from the competition, showcasing your ability to drive results and build client relationships. This guide will provide practical and actionable resume tips specifically tailored for Commercial Banker professionals, helping you to create a compelling narrative that resonates with hiring managers.

Top Resume Tips for Commercial Banker Professionals

- Tailor your resume to the job description by using relevant keywords and phrases that match the requirements of the position.

- Showcase your relevant experience in commercial banking, including roles in credit analysis, risk assessment, and client relationship management.

- Quantify your achievements by including specific metrics, such as the percentage increase in loan portfolio or the number of new clients acquired.

- Highlight industry-specific skills such as financial modeling, credit risk analysis, and knowledge of regulatory compliance.

- Use a clear and professional format that enhances readability, making it easy for hiring managers to quickly understand your qualifications.

- Include any relevant certifications, such as Chartered Financial Analyst (CFA) or Certified Commercial Banker (CCB), to demonstrate your commitment to the profession.

- Focus on your soft skills, such as communication, negotiation, and problem-solving abilities, which are crucial in building client relationships.

- Keep your resume concise, ideally one page, while ensuring it contains all relevant information without overwhelming the reader.

- Incorporate a strong summary statement at the top that encapsulates your experience and what you bring to the role.

By implementing these tips, you can significantly increase your chances of landing a job in the Commercial Banker field. A well-structured and targeted resume not only showcases your qualifications but also demonstrates your understanding of the banking industry's demands, positioning you as a strong candidate ready to contribute to a potential employer's success.

Why Resume Headlines & Titles are Important for Commercial Banker

In the competitive field of commercial banking, a well-crafted resume headline or title serves as a powerful tool to capture the attention of hiring managers. It acts as a concise summary of a candidate’s key qualifications and sets the tone for the entire resume. A strong headline not only highlights the candidate's relevant skills and experience but also conveys their professional identity in a single impactful phrase. This makes it essential for the headline to be concise, relevant, and directly aligned with the job being applied for, ensuring that the candidate stands out in a sea of applications.

Best Practices for Crafting Resume Headlines for Commercial Banker

- Keep it concise: Aim for a headline that is brief yet descriptive, ideally no more than 10-12 words.

- Be specific: Tailor the headline to the commercial banking role, mentioning relevant skills or areas of expertise.

- Use impactful language: Employ strong action verbs and industry-specific terminology to convey authority and competence.

- Highlight key achievements: If possible, include a notable achievement or quantifiable result that distinguishes you from other candidates.

- Avoid jargon: While it's important to be industry-relevant, avoid using overly technical jargon that may confuse hiring managers.

- Align with the job description: Incorporate keywords and phrases from the job posting to demonstrate your fit for the role.

- Showcase your unique value: Convey what sets you apart, whether it’s your extensive network, specialized knowledge, or proven track record.

- Maintain professionalism: Ensure the tone remains professional and aligns with the expectations of the banking industry.

Example Resume Headlines for Commercial Banker

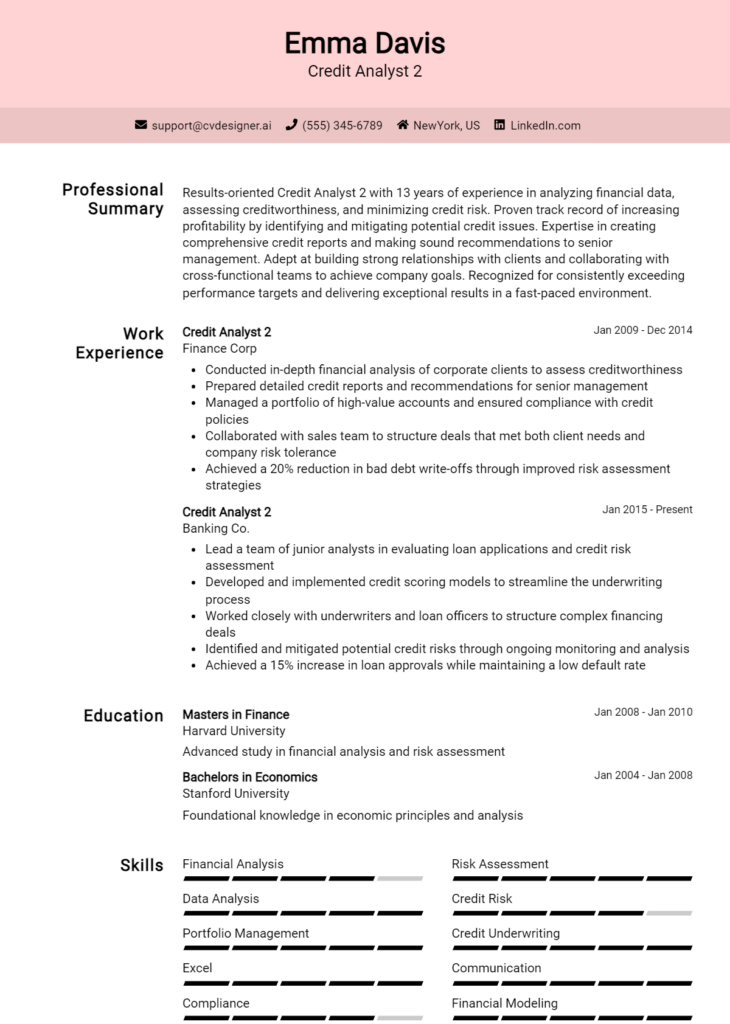

Strong Resume Headlines

Dynamic Commercial Banker with 10+ Years of Experience in Corporate Financing

Results-Driven Financial Advisor Specializing in Risk Management and Client Relations

Top-Performing Commercial Lender with a Proven Track Record of Increasing Loan Portfolio

Weak Resume Headlines

Banker Seeking New Opportunities

Experienced Professional in Finance

The strong headlines are effective because they are specific and clearly communicate the candidate’s expertise and accomplishments within the commercial banking field. They use impactful language and relevant details to create a memorable impression. In contrast, the weak headlines fail to impress due to their vagueness and lack of focus. They do not highlight any particular skills or achievements, making them generic and forgettable in a competitive job market.

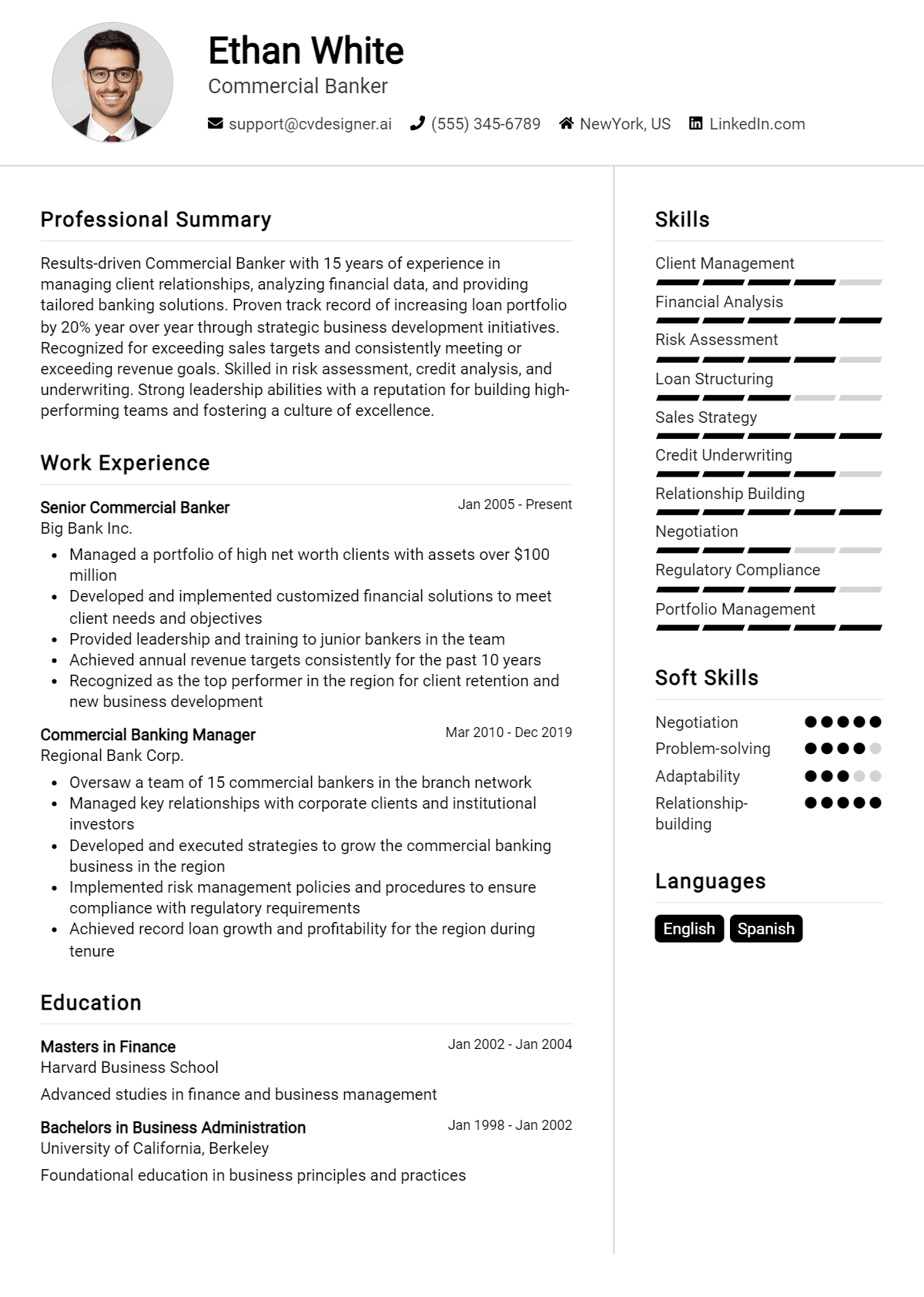

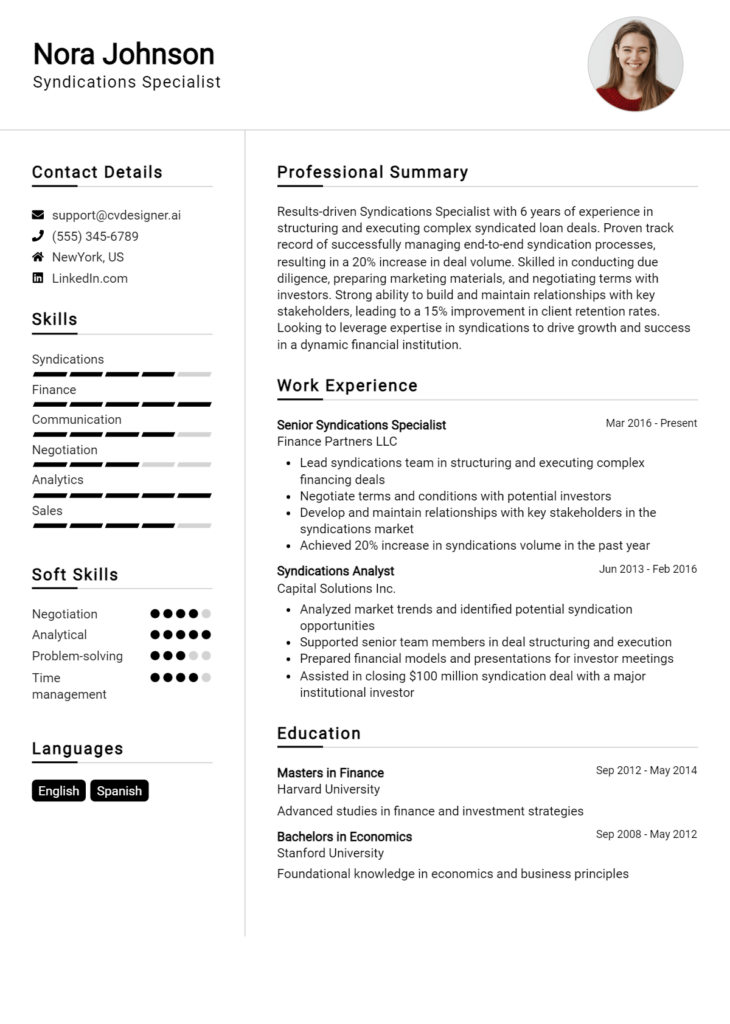

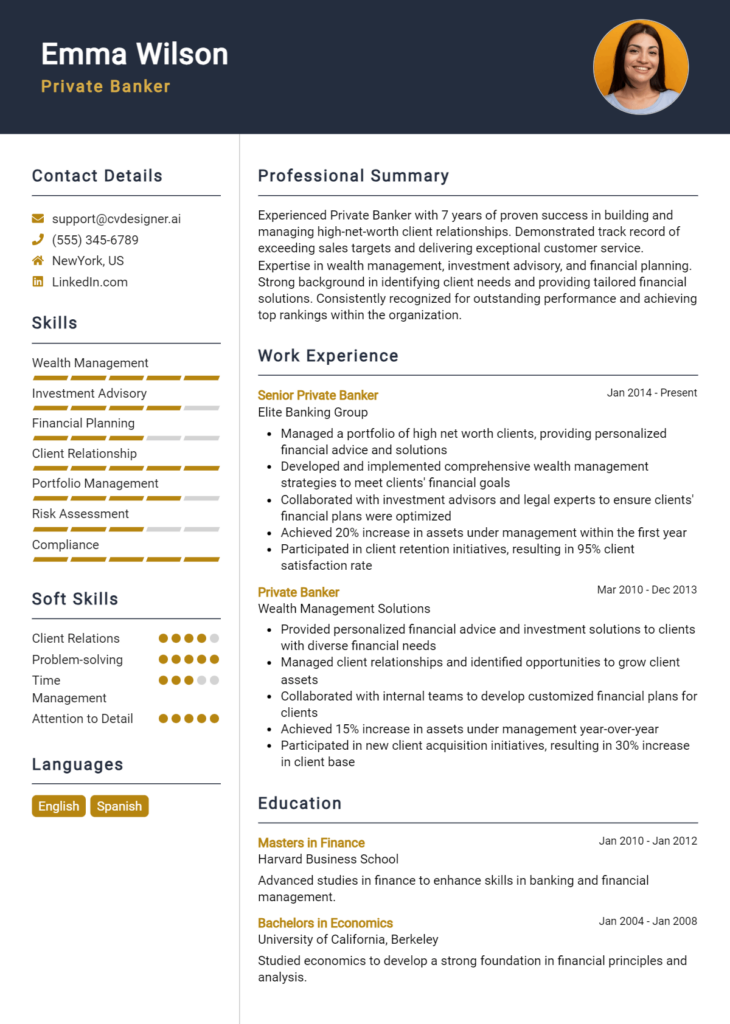

Writing an Exceptional Commercial Banker Resume Summary

A well-crafted resume summary is crucial for a Commercial Banker, as it serves as the first impression hiring managers have of a candidate. This concise section of a resume quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the specific requirements of the job. A strong summary is not only impactful but also tailored to resonate with the position being applied for, ensuring that the candidate stands out in a competitive field.

Best Practices for Writing a Commercial Banker Resume Summary

- Quantify Achievements: Use numbers and percentages to illustrate your success and impact, such as increasing loan origination by a specific percentage.

- Focus on Relevant Skills: Highlight skills that are directly applicable to the role, such as credit analysis, risk management, and client relationship management.

- Tailor to the Job Description: Customize your summary to reflect the specific qualifications and responsibilities listed in the job posting.

- Use Industry Terminology: Incorporate relevant jargon and terminology that demonstrate your familiarity with the banking sector.

- Keep It Concise: Aim for 3-5 sentences that succinctly summarize your qualifications without overwhelming the reader.

- Showcase Leadership and Teamwork: Include experiences that demonstrate your ability to lead projects or work collaboratively with teams.

- Highlight Customer Service Orientation: Emphasize your commitment to providing excellent service, which is vital in banking roles.

- Demonstrate Continued Professional Development: Mention any certifications or training that enhance your expertise in commercial banking.

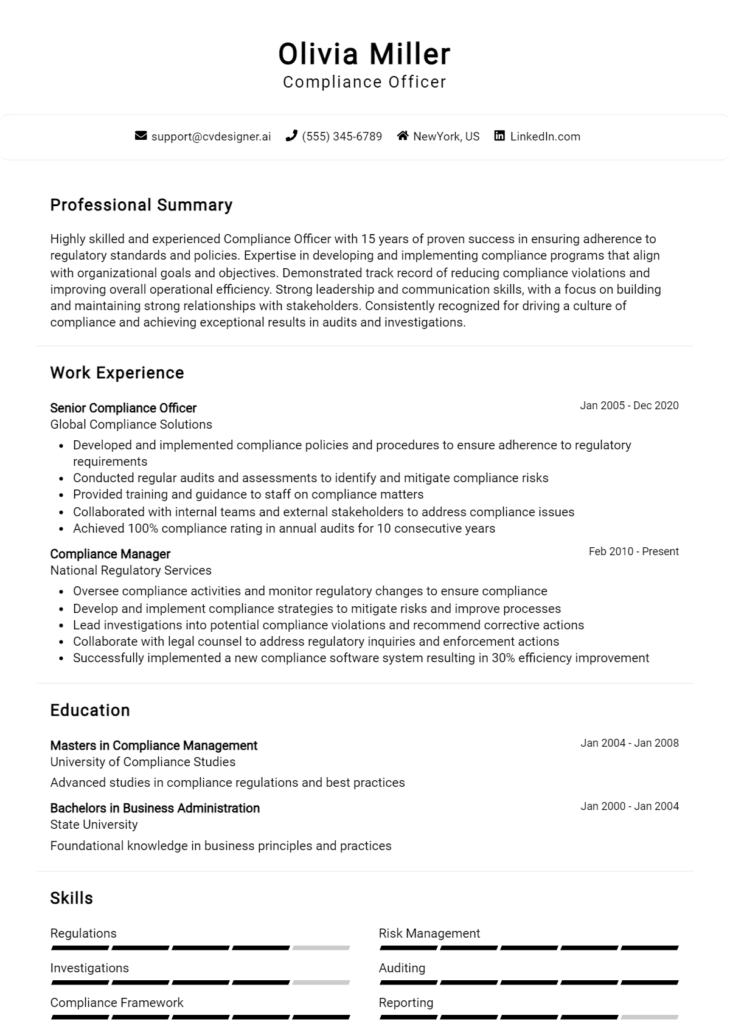

Example Commercial Banker Resume Summaries

Strong Resume Summaries

Results-driven Commercial Banker with over 10 years of experience in managing diverse loan portfolios, achieving a 25% increase in client retention through tailored financial solutions and exceptional service.

Dynamic banking professional skilled in credit risk assessment and loan origination, successfully increasing annual loan production by $5 million while maintaining a default rate of less than 1%.

Detail-oriented Commercial Banker with expertise in portfolio management and client relationship building, recognized for boosting client satisfaction scores by 30% through proactive communication and problem-solving strategies.

Accomplished banker with a proven track record in developing and executing strategic financial plans, resulting in a 40% growth in small business loans within two years, while enhancing operational efficiency.

Weak Resume Summaries

Experienced banker looking for new opportunities in commercial banking.

Talented professional with some experience in finance and banking interested in helping clients.

The strong examples are considered effective because they provide specific achievements, quantifiable results, and relevant skills that demonstrate the candidate's impact and expertise in commercial banking. In contrast, the weak examples lack detail, specificity, and outcomes, making them too generic and less compelling to hiring managers.

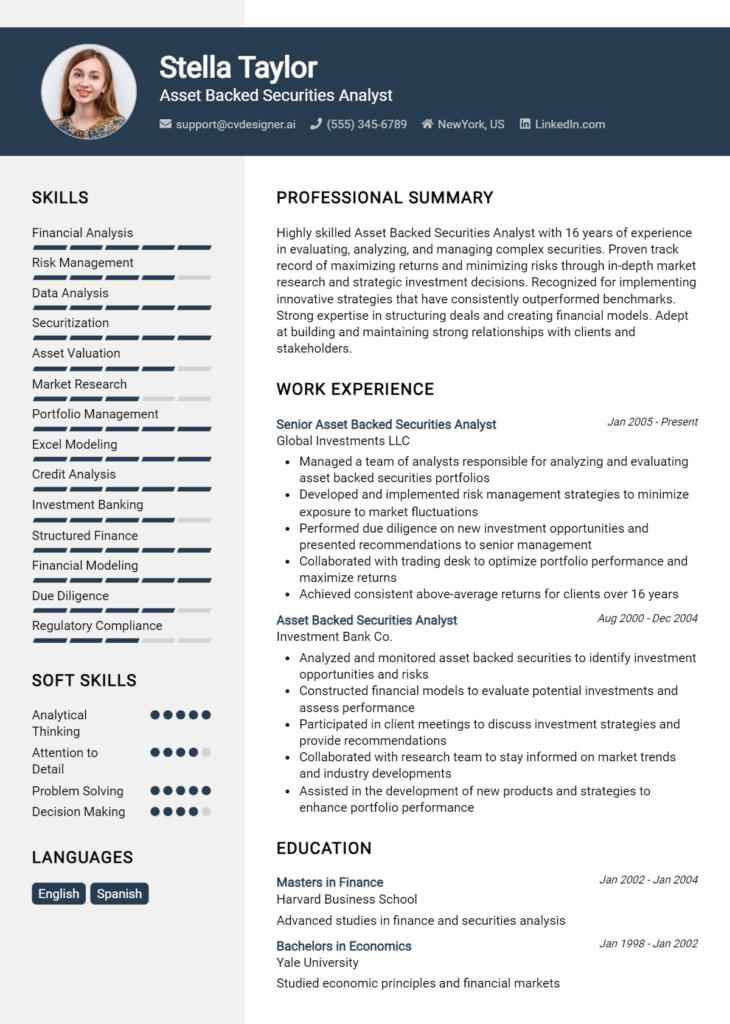

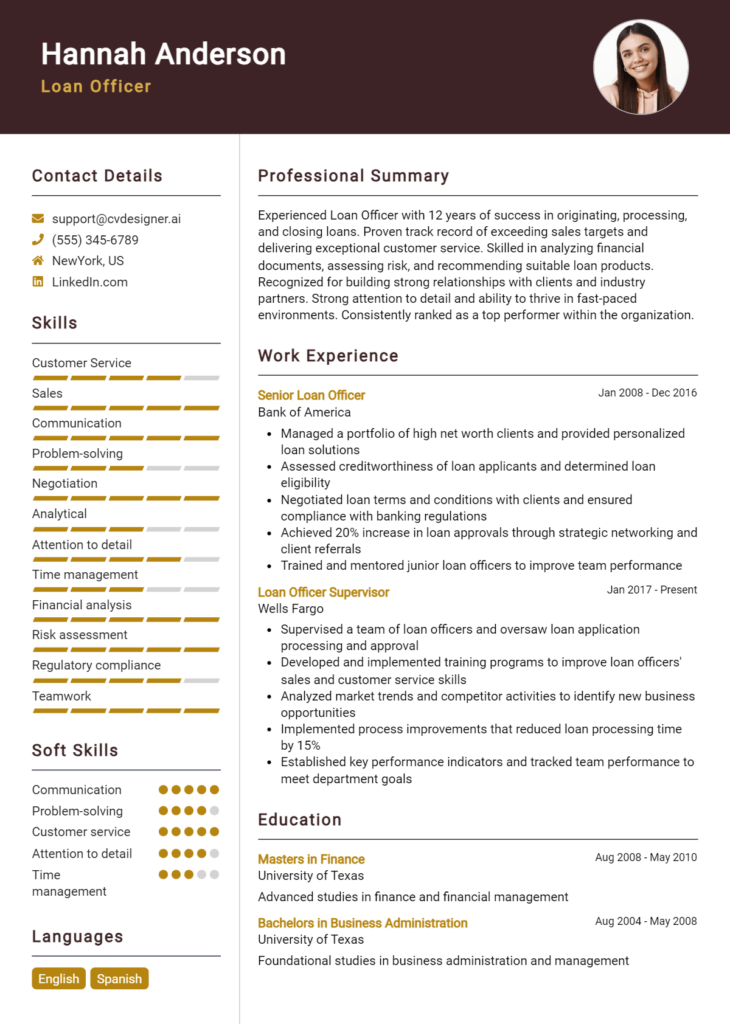

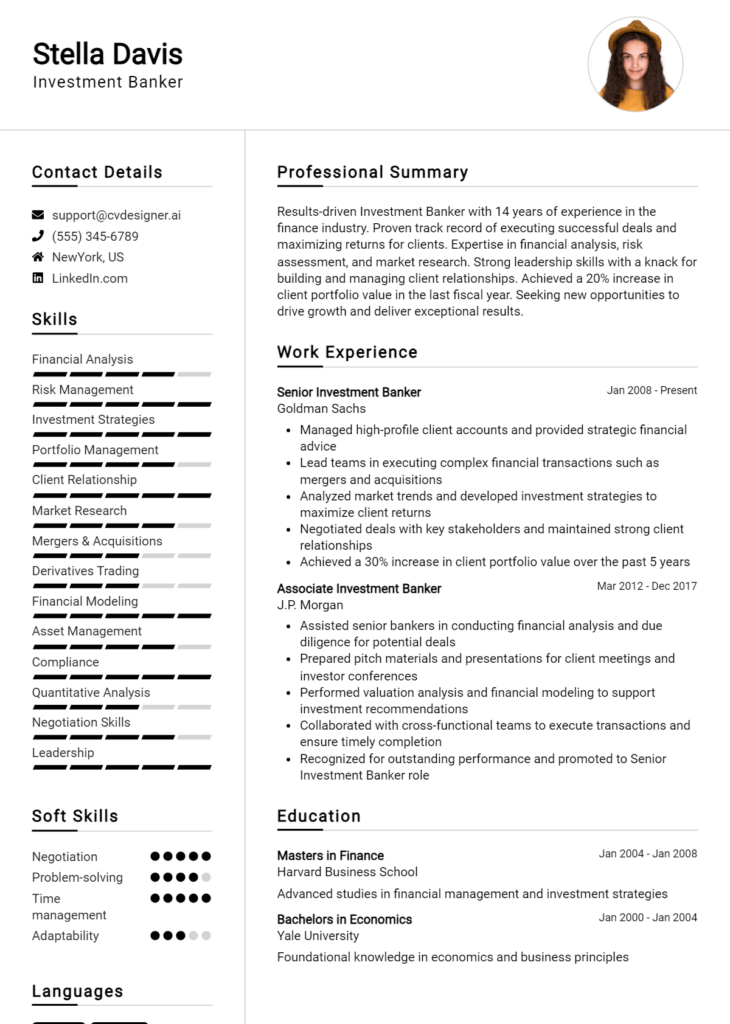

Work Experience Section for Commercial Banker Resume

The work experience section of a Commercial Banker resume is critical for demonstrating a candidate's capabilities in a highly competitive field. This section serves as a platform to showcase technical skills, such as financial analysis, risk assessment, and regulatory compliance, while also highlighting leadership abilities in managing teams and delivering high-quality financial products and services. By quantifying achievements and aligning past experiences with industry standards, candidates can effectively illustrate their contributions and value to potential employers.

Best Practices for Commercial Banker Work Experience

- Highlight relevant technical skills, such as credit analysis, portfolio management, and financial modeling.

- Quantify achievements with specific metrics, such as percentage growth in loan portfolios or reductions in default rates.

- Demonstrate leadership by showcasing team management experiences and successful project completions.

- Align experiences with industry standards and best practices to show familiarity with current trends.

- Use action verbs to convey a proactive approach and impact in previous roles.

- Include collaborative efforts in cross-functional teams to emphasize teamwork and communication skills.

- Tailor the work experience section to reflect the requirements of the specific job being applied for.

- Focus on results-driven statements that provide a clear picture of past performance.

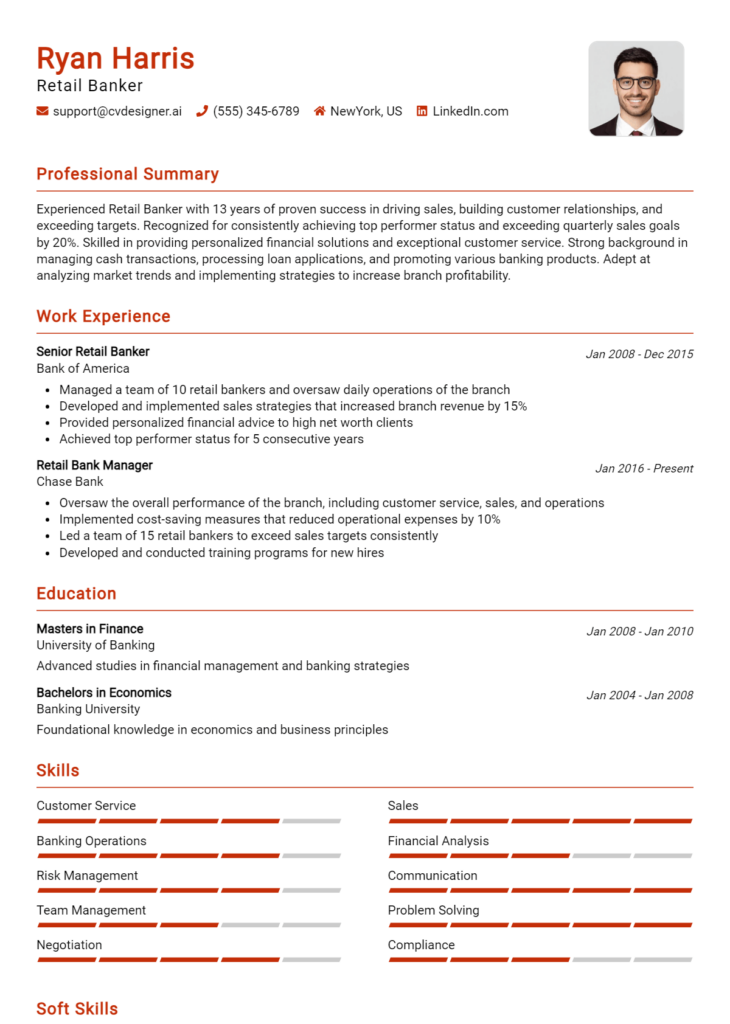

Example Work Experiences for Commercial Banker

Strong Experiences

- Led a team of 5 analysts in restructuring a $200 million loan portfolio, resulting in a 15% reduction in delinquency rates over 12 months.

- Developed comprehensive financial models that increased the accuracy of risk assessments, leading to a 20% improvement in loan approval rates.

- Implemented a new compliance tracking system that reduced regulatory breaches by 30%, enhancing the bank's reputation and operational efficiency.

- Collaborated with cross-functional teams to launch a new credit product, achieving $50 million in sales within the first year.

Weak Experiences

- Responsible for managing customer accounts and ensuring satisfaction.

- Worked with the team to process loan applications and gather information.

- Participated in meetings about various banking products.

- Helped with various tasks related to financial services.

The examples provided illustrate the distinction between strong and weak experiences. Strong experiences are characterized by specific achievements that quantify success and demonstrate leadership and collaboration, effectively showcasing the candidate's value. In contrast, weak experiences lack detail and measurable outcomes, making them less impactful and failing to convey the candidate's true capabilities in the commercial banking sector.

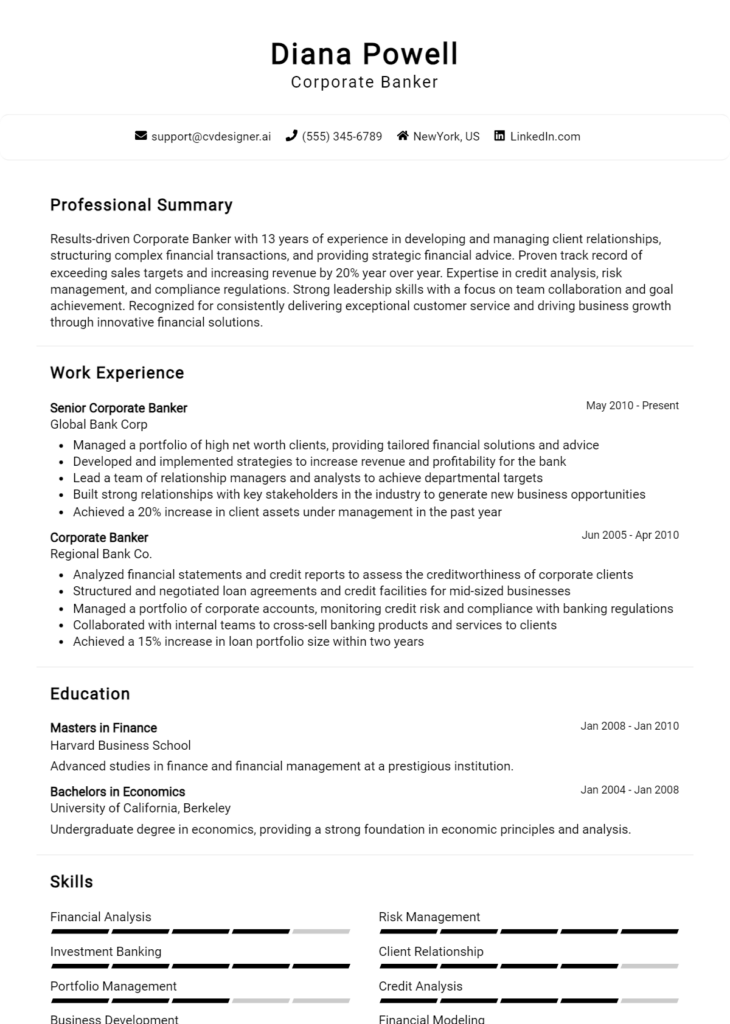

Education and Certifications Section for Commercial Banker Resume

The education and certifications section of a Commercial Banker resume is crucial as it serves as a testament to the candidate's academic foundation and qualifications in the financial sector. This section not only highlights relevant degrees but also showcases industry-specific certifications and continuous learning efforts, demonstrating the candidate's commitment to professional development. By providing pertinent coursework and specialized training, candidates can significantly enhance their credibility and align themselves with the requirements of the job role, making a compelling case for their suitability in the competitive banking industry.

Best Practices for Commercial Banker Education and Certifications

- Highlight degrees relevant to finance, business, or economics prominently.

- Include industry-recognized certifications, such as Chartered Financial Analyst (CFA) or Certified Commercial Banker (CCB).

- Detail relevant coursework that aligns with the skills required for commercial banking.

- List any specialized training programs or workshops that enhance banking expertise.

- Use a clear format, ensuring that the most impressive qualifications are easily identifiable.

- Keep the information concise, focusing on qualifications that are recent and applicable.

- Consider including honors or awards received during academic pursuits to stand out.

- Regularly update this section to reflect ongoing education and professional development.

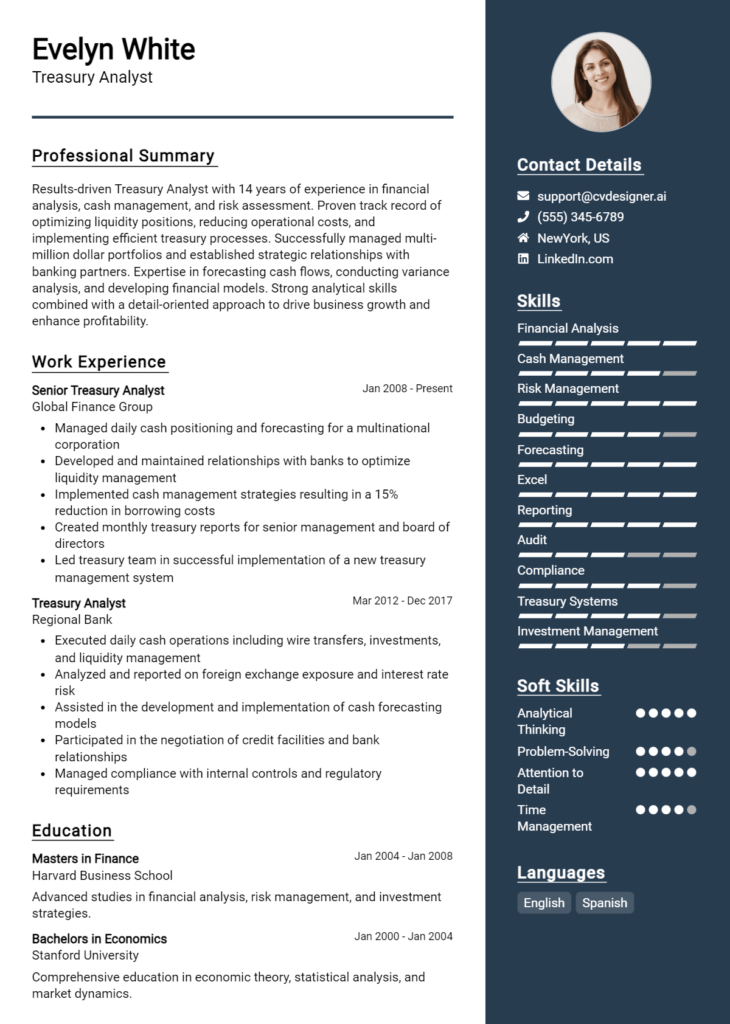

Example Education and Certifications for Commercial Banker

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated 2020

- Chartered Financial Analyst (CFA), Level II Candidate, Expected Completion 2024

- Certified Commercial Banker (CCB), American Bankers Association, 2021

- Advanced Commercial Lending Workshop, Completed 2022

Weak Examples

- Bachelor of Arts in History, University of ABC, Graduated 2010

- Certification in Basic Computer Skills, 2015

- High School Diploma, Graduated 2005

- Online Course in Creative Writing, Completed 2020

The strong examples are considered effective because they directly align with the qualifications and skills necessary for a Commercial Banker role, showcasing relevant educational achievements and industry-recognized credentials. In contrast, the weak examples lack relevance to the banking sector, featuring outdated or unrelated qualifications that do not contribute to the candidate's credibility in the field of commercial banking.

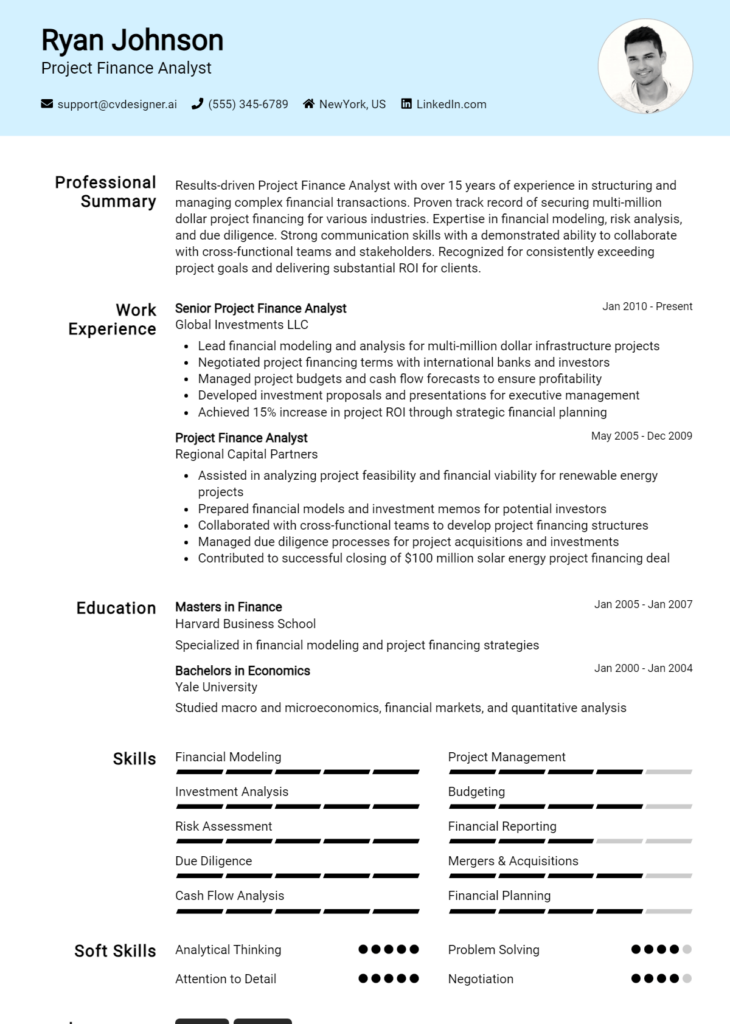

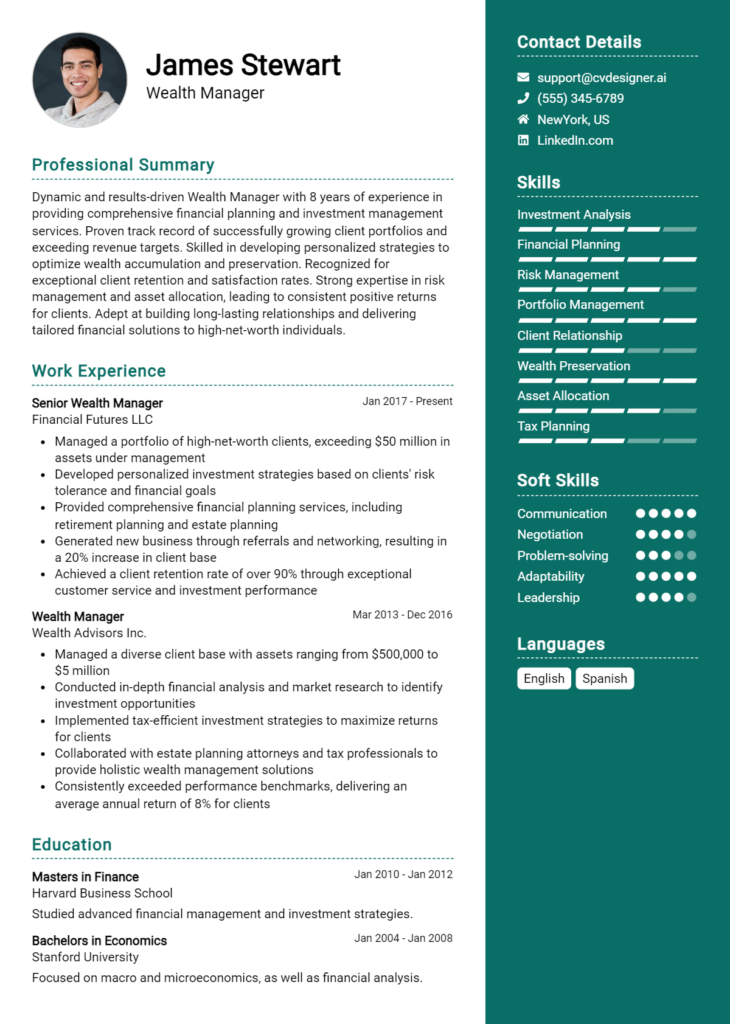

Top Skills & Keywords for Commercial Banker Resume

In the competitive field of commercial banking, a well-crafted resume that highlights relevant skills is essential for standing out to potential employers. Skills not only showcase your qualifications but also demonstrate your ability to meet the demands of the role effectively. A strong combination of both hard and soft skills will reflect your comprehensive understanding of the banking industry, your capacity to build relationships with clients, and your acumen in financial analysis and risk management. When tailoring your resume, it is crucial to emphasize these skills to position yourself as a strong candidate in the commercial banking sector.

Top Hard & Soft Skills for Commercial Banker

Soft Skills

- Relationship Management

- Communication Skills

- Problem-Solving Abilities

- Customer Service Orientation

- Negotiation Skills

- Attention to Detail

- Analytical Thinking

- Adaptability

- Team Collaboration

- Time Management

- Strategic Thinking

- Leadership Abilities

- Conflict Resolution

- Emotional Intelligence

- Networking Skills

Hard Skills

- Financial Analysis

- Risk Assessment

- Credit Analysis

- Loan Underwriting

- Portfolio Management

- Regulatory Compliance

- Market Research

- Data Analysis

- Financial Modeling

- Knowledge of Banking Software

- Sales and Marketing Strategies

- Investment Strategies

- Accounting Principles

- Cash Flow Management

- Understanding of Financial Products

- Business Development Techniques

By integrating these skills into your resume and highlighting relevant work experience, you can create a compelling profile that demonstrates your readiness for a successful career in commercial banking.

Stand Out with a Winning Commercial Banker Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Commercial Banker position at [Company Name] as advertised on [where you found the job listing]. With a solid background in financial services and a proven track record of building strong client relationships, I am eager to contribute my expertise in commercial lending and financial analysis to your esteemed institution. I believe my skills align well with the requirements of this role, and I am excited about the opportunity to help [Company Name] continue to thrive in a competitive market.

In my previous position as a Commercial Banker at [Previous Company Name], I successfully managed a diverse portfolio of clients, ranging from small businesses to large corporations. My ability to assess financial needs and provide tailored solutions resulted in a 30% increase in loan origination over two years. I pride myself on my analytical skills, which have enabled me to conduct thorough credit analyses and risk assessments. Furthermore, my proactive approach to client engagement has fostered deep trust and loyalty, ensuring long-term partnerships that benefit both the client and the bank.

I am particularly drawn to [Company Name] because of its commitment to innovation and customer service excellence. I admire your approach to understanding the unique needs of each business and providing customized financial solutions. I am excited about the possibility of bringing my insights into market trends and my strong negotiation skills to your team. I am confident that my experience in developing strategic relationships and my dedication to delivering results would make me a valuable asset to [Company Name].

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am eager to contribute to your team and help drive success in the commercial banking sector.

Sincerely,

[Your Name]

[Your Contact Information]

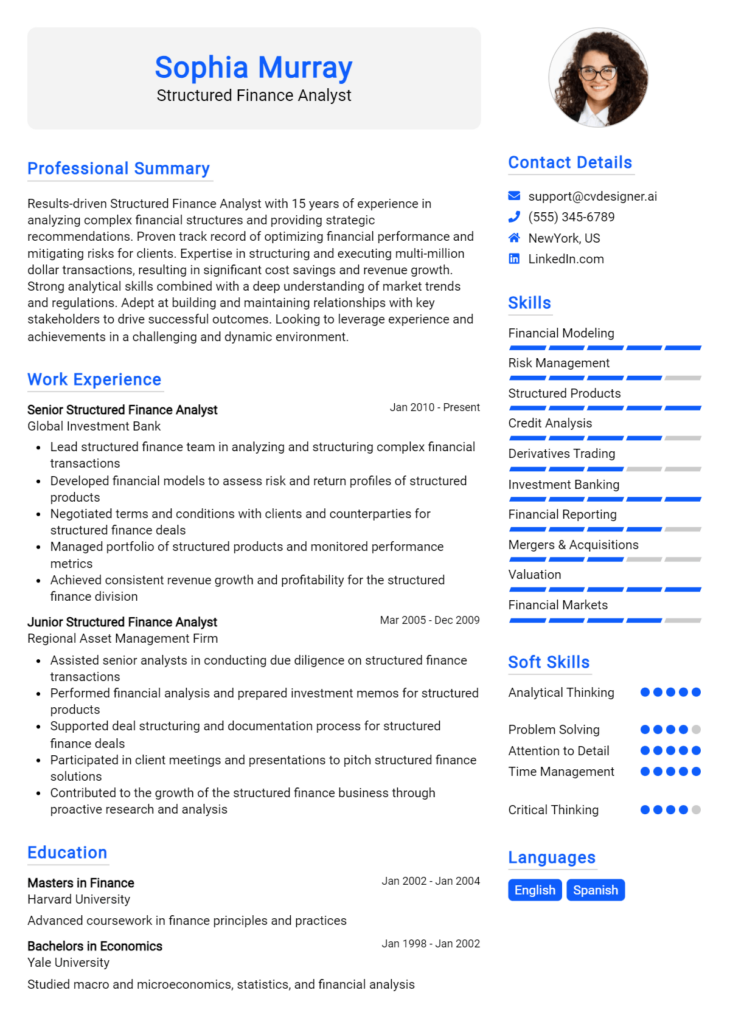

Common Mistakes to Avoid in a Commercial Banker Resume

When crafting a resume for a Commercial Banker position, it's crucial to present a polished and professional image that highlights your skills and experience. However, many candidates make common mistakes that can undermine their chances of landing an interview. Understanding these pitfalls can help you create a compelling resume that stands out in a competitive job market. Here are some common mistakes to avoid:

Generic Objective Statement: Using a vague or generic objective statement can make your resume blend in with the rest. Tailor your objective to reflect your specific career goals and how they align with the prospective employer.

Lack of Quantifiable Achievements: Failing to include quantifiable results can weaken your resume. Use metrics and specific outcomes to demonstrate your impact, such as "increased loan portfolio by 30% in one year."

Inconsistent Formatting: Inconsistent fonts, sizes, and spacing can make your resume look unprofessional. Stick to a clean, organized format with uniform headings and bullet points.

Overly Complex Language: Using jargon or overly complex terminology can confuse hiring managers. Aim for clear and concise language that communicates your experience effectively.

Neglecting Relevant Skills: Overlooking essential skills specific to commercial banking can be detrimental. Highlight skills such as financial analysis, risk assessment, and relationship management that are crucial for the role.

Failing to Tailor for Each Application: Sending out a one-size-fits-all resume is a missed opportunity. Customize your resume for each job application to reflect the specific requirements and responsibilities outlined in the job description.

Omitting Professional Development: Ignoring your commitment to ongoing education and professional development can be a mistake. Include relevant certifications, training, or workshops that showcase your dedication to the field.

Ignoring Proofreading: Spelling and grammatical errors can detract from the professionalism of your resume. Always proofread your document, or ask someone else to review it, to catch any mistakes before submitting.

Conclusion

As a Commercial Banker, your role is pivotal in fostering relationships with clients, assessing their financial needs, and providing tailored banking solutions. Throughout this article, we’ve explored the essential skills and qualifications required for success in this field, including financial acumen, exceptional communication skills, and a deep understanding of the banking industry. We also discussed the importance of networking and staying informed about market trends to better serve your clients.

To ensure you stand out in the competitive job market, it’s crucial to have a polished resume that highlights your relevant experience and achievements. Take a moment to review your Commercial Banker resume and ensure it reflects your strengths and career aspirations effectively.

To assist you in this process, consider utilizing available tools such as resume templates, which can help you structure your information clearly. You can also leverage a resume builder to create a professional-looking document quickly and efficiently. For inspiration, check out resume examples that suit your specific role, and don’t forget the value of a well-crafted cover letter using our cover letter templates.

Take action today and enhance your Commercial Banker resume to align with your career goals!