27 Mortgage Closer Objectives and Summaries for 2025

As a Mortgage Closer, setting clear career objectives is essential for professional growth and success within the mortgage industry. These objectives not only guide your daily activities but also align with the overarching goals of your organization. In this section, we will explore the top career objectives that can help you excel in your role as a Mortgage Closer, enhancing your skills, efficiency, and contributions to the home financing process.

Career Objectives for Fresher Mortgage Closer

- Detail-oriented and motivated individual seeking a Mortgage Closer position to leverage strong organizational skills and knowledge of loan documentation to ensure timely and accurate closings.

- Recent finance graduate aiming to secure a Mortgage Closer role, utilizing excellent communication skills and a keen eye for detail to support a seamless closing process and enhance customer satisfaction.

- Enthusiastic professional eager to join a dynamic mortgage team as a Mortgage Closer, committed to providing exceptional service while ensuring compliance with all regulatory requirements.

- Goal-driven individual seeking a Mortgage Closer position to apply analytical skills and understanding of mortgage processes to facilitate smooth transactions and foster client relationships.

- Dedicated fresher with a strong foundation in mortgage lending and customer service, looking to contribute as a Mortgage Closer and assist clients in achieving their homeownership dreams.

- Ambitious individual aspiring to work as a Mortgage Closer, with a focus on accuracy and efficiency in processing loan documents to support a positive closing experience for clients.

- Motivated self-starter seeking a Mortgage Closer role to utilize problem-solving skills and attention to detail in managing closing processes and ensuring regulatory compliance.

- Recent graduate with a passion for real estate and finance, looking to begin a career as a Mortgage Closer, committed to delivering quality service and facilitating successful loan closings.

- Proactive individual aiming to secure a Mortgage Closer position, utilizing strong interpersonal skills to navigate client interactions and ensure timely and accurate mortgage closings.

- Detail-oriented fresher looking to join a reputable mortgage company as a Mortgage Closer, aiming to apply knowledge of mortgage documentation and closing procedures to enhance operational efficiency.

- Results-oriented professional seeking a Mortgage Closer position to apply strong organizational and communication skills in ensuring seamless transaction processes and maintaining client satisfaction.

Career Objectives for Experienced Mortgage Closer

- Detail-oriented Mortgage Closer with over 5 years of experience striving to enhance closing efficiency and accuracy while ensuring compliance with regulatory guidelines to facilitate smooth transactions for clients and lenders.

- Dedicated professional seeking to leverage extensive knowledge of mortgage products and closing processes to provide exceptional service and support, ensuring timely closings and high customer satisfaction within a dynamic team environment.

- Proactive Mortgage Closer aiming to utilize strong analytical skills and attention to detail to streamline closing procedures, reduce errors, and contribute to the overall success of the lending team in achieving their goals.

- Results-driven Mortgage Closer with a proven track record of managing multiple closings simultaneously, looking to apply expertise in document review and client communication to enhance operational efficiency and client relations.

- Experienced Mortgage Closer seeking to bring strong negotiation and problem-solving skills to a forward-thinking organization, focusing on creating positive experiences for clients while maintaining compliance and risk management standards.

- Motivated Mortgage Closer with a commitment to continuous improvement, eager to implement best practices in closing processes, ensuring accuracy and compliance, and fostering strong relationships with clients and real estate professionals.

- Skilled Mortgage Closer aiming to utilize comprehensive knowledge of loan documentation and closing procedures to ensure seamless transactions and client satisfaction while contributing to team success and company growth.

- Ambitious Mortgage Closer with expertise in closing coordination and regulatory compliance, seeking to advance career by taking on more complex transactions and mentoring junior team members to foster a collaborative work environment.

- Detail-focused Mortgage Closer with extensive experience in managing the closing process from start to finish, looking to apply exceptional organizational skills to enhance workflow efficiencies and ensure timely completions.

- Results-oriented Mortgage Closer seeking to leverage strong communication and relationship-building skills to facilitate successful closings while adhering to all industry regulations and standards for optimal client experiences.

- Accomplished Mortgage Closer aiming to utilize deep knowledge of mortgage regulations and customer service excellence to enhance closing processes and contribute positively to the organization's reputation and growth.

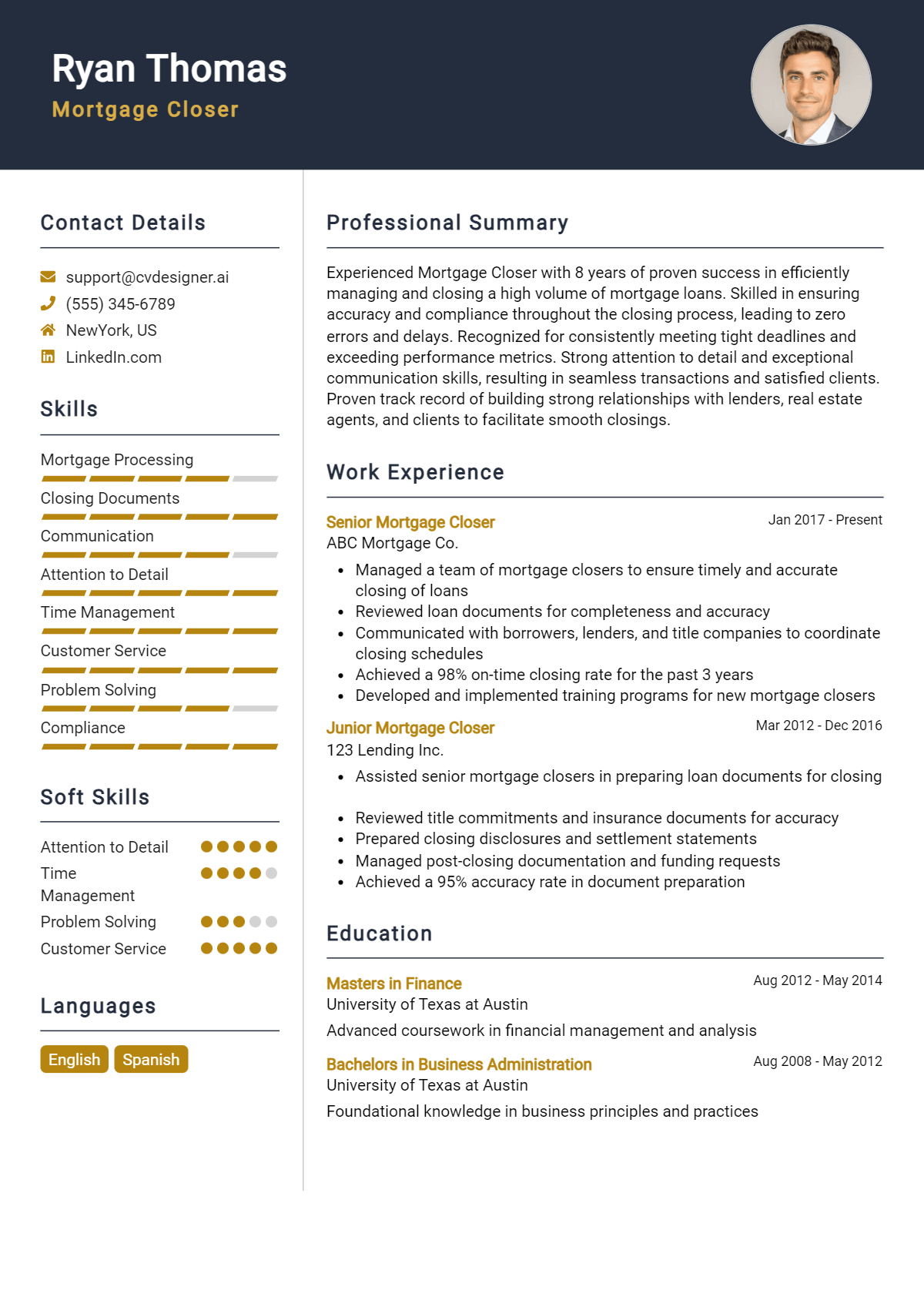

Best Mortgage Closer Resume Objective Examples

- Detail-oriented Mortgage Closer with over 5 years of experience in finalizing loan documents and facilitating smooth closings. Seeking to leverage strong organizational skills and knowledge of mortgage processes to enhance efficiency at ABC Lending Solutions.

- Results-driven Mortgage Closer skilled in coordinating with clients and lenders to ensure accurate and timely closings. Aiming to contribute my expertise in regulatory compliance and document preparation to XYZ Mortgage Company’s growing team.

- Dedicated professional with a robust background in mortgage processing and closing. Eager to utilize my strong attention to detail and excellent communication skills to streamline closing processes and enhance client satisfaction at DEF Financial Services.

- Proficient Mortgage Closer with a comprehensive understanding of real estate transactions and closing procedures. Aspiring to apply my analytical skills and experience in risk assessment to optimize closing operations at GHI Mortgage Group.

- Motivated Mortgage Closer with 4+ years of experience in managing closing schedules and documentation. Seeking to join JKL Home Loans to improve processing timelines while ensuring compliance with all local and federal regulations.

- Experienced Mortgage Closer adept at building strong relationships with clients and industry professionals. Looking to bring my negotiation skills and attention to detail to MNO Lending Partners, ensuring efficient and accurate loan closings.

- Enthusiastic Mortgage Closer with a passion for customer service and a proven track record in facilitating successful closings. Aiming to contribute my strong problem-solving skills and mortgage knowledge to PQR Financial Solutions.

- Skilled Mortgage Closer with a solid foundation in finance and a keen eye for detail. Excited to join STU Mortgage Advisors, where I can apply my expertise in loan documentation and compliance to enhance the closing process.

Best Mortgage Closer Resume Summary Samples

- Detail-oriented Mortgage Closer with over 5 years of experience in finalizing loan documents and ensuring compliance with regulations. Proven track record of reducing closing times by 20% through effective communication and organization. Adept at managing multiple files while maintaining accuracy and customer satisfaction.

- Dedicated Mortgage Closer with 7 years of experience in the financial services industry. Expertise in reviewing loan applications, coordinating with lenders, and resolving discrepancies. Recognized for exceptional problem-solving skills and a commitment to delivering a smooth closing process for clients.

- Results-driven Mortgage Closer with a strong background in residential and commercial loans. 6+ years of experience in preparing and executing closing documents, ensuring compliance with state and federal regulations. Known for building positive relationships with clients and stakeholders to enhance the closing experience.

- Experienced Mortgage Closer with over 8 years of demonstrated success in managing the closing process from contract to funding. Skilled in title examinations and regulatory compliance, with a history of achieving a 95% customer satisfaction rating. Excellent communicator with a focus on details.

- Motivated Mortgage Closer with 4 years of experience in mortgage processing and closing. Proficient in utilizing closing software and maintaining up-to-date knowledge of industry regulations. Recognized for streamlining processes and improving turnaround time on closings by 15%.

- Highly organized Mortgage Closer with a passion for customer service and a background in loan documentation. 5+ years of experience in closing residential mortgages, ensuring timely and accurate completion of all necessary paperwork. Strong analytical skills and attention to detail.

- Proficient Mortgage Closer with 6 years of experience in conducting closings and managing documentation for various loan types. Effective in liaising between borrowers, lenders, and title companies to ensure seamless transactions. Known for dedication to compliance and risk management.

- Dynamic Mortgage Closer with a comprehensive understanding of the mortgage closing process and a strong customer service orientation. Over 5 years of experience in closing residential loans and resolving title issues. Proven ability to work under pressure while maintaining high accuracy levels.

- Skilled Mortgage Closer with 7 years of experience in managing loan closings and ensuring compliance with all applicable regulations. Strong negotiation skills and a commitment to providing excellent service to clients and lenders alike, resulting in a 30% increase in referral business.

Simple Objective for Mortgage Closer Resume

- Detail-oriented Mortgage Closer with over 5 years of experience in closing residential and commercial loans. Proven track record of ensuring compliance and accuracy in documentation while maintaining high customer satisfaction.

- Results-driven Mortgage Closer skilled in analyzing loan documentation and coordinating with lenders and clients. Adept at managing closing processes efficiently while ensuring all regulatory requirements are met.

- Experienced Mortgage Closer with a strong background in real estate transactions and loan processing. Committed to delivering exceptional service and facilitating smooth closings, leveraging excellent communication and organizational skills.

- Highly organized Mortgage Closer with 4+ years in the industry, specializing in timely closings and thorough documentation review. Recognized for enhancing workflow processes and maintaining positive relationships with clients and real estate agents.

- Dedicated Mortgage Closer with extensive knowledge of loan products and regulations. Successfully facilitated over 200 closings, demonstrating strong attention to detail and excellent problem-solving abilities to address any issues that arise.

Writing a strong resume objective is crucial for a Mortgage Closer, as it provides a brief yet impactful summary of your qualifications and career goals. A well-structured objective should highlight your relevant experience, showcase your skills in handling mortgage closings, and express your enthusiasm for the role. To create an effective resume objective, focus on clarity, conciseness, and alignment with the job description. Here’s how to craft a compelling Mortgage Closer resume objective:

How to Write a Mortgage Closer Resume Objective

- Start with a strong opening statement that includes your job title and years of experience in the mortgage industry.

- Highlight key skills relevant to the Mortgage Closer role, such as attention to detail, communication skills, and knowledge of mortgage regulations.

- Emphasize your familiarity with closing processes, including document preparation and compliance checks.

- Mention any specialized training or certifications related to mortgage closing that you possess.

- Express your career goals and how they align with the company’s mission or values to demonstrate your commitment.

- Keep the objective concise, ideally no more than 2-3 sentences, to ensure it remains impactful.

- Tailor the objective for each application to reflect the specific requirements and preferences outlined in the job description.

Key Skills to Highlight in Your Mortgage Closer Resume Objective

Emphasizing relevant skills in your resume objective is crucial for capturing the attention of hiring managers and demonstrating your qualifications for the role of a Mortgage Closer. A well-crafted objective showcases your expertise, aligns with the job requirements, and sets the tone for the rest of your resume.

- Attention to Detail

- Strong Analytical Skills

- Knowledge of Mortgage Regulations

- Effective Communication Skills

- Proficiency in Loan Processing Software

- Time Management Abilities

- Customer Service Orientation

- Problem-Solving Skills

Common Mistakes When Writing a Mortgage Closer Resume Objective

Writing a compelling resume objective is essential for a Mortgage Closer, as it sets the tone for the entire application and highlights the candidate's qualifications right from the start. Avoiding common mistakes can significantly enhance the impact of your resume and help you stand out in a competitive job market.

- Using vague language that fails to specify skills or experiences.

- Focusing on personal goals instead of how you can benefit the employer.

- Including irrelevant information that does not pertain to the Mortgage Closer role.

- Writing a generic objective that could apply to any job instead of tailoring it to the mortgage industry.

- Neglecting to mention quantifiable achievements or specific qualifications.

- Making grammatical errors or typos that undermine professionalism.

- Failing to convey enthusiasm or a genuine interest in the role and the company.

Frequently Asked Questions

What should be included in a Mortgage Closer resume objective?

A Mortgage Closer resume objective should succinctly highlight your relevant experience, skills, and career goals related to the mortgage closing process. It should emphasize your ability to manage and complete loan documentation efficiently, your attention to detail, and your knowledge of compliance regulations. A well-crafted objective can set the tone for the rest of your resume and make a strong first impression on potential employers.

How long should a Mortgage Closer resume objective be?

Typically, a Mortgage Closer resume objective should be one to two sentences long. It should be concise yet impactful, clearly conveying your career aspirations and relevant skills without overwhelming the reader. A focused objective helps hiring managers quickly understand your qualifications and what you bring to the role.

Can I customize my Mortgage Closer resume objective for different job applications?

Yes, customizing your Mortgage Closer resume objective for different job applications is highly recommended. Tailoring your objective to reflect the specific requirements and responsibilities of each position can demonstrate your genuine interest in the role and show that you possess the skills and experience that the employer is seeking. This approach can significantly enhance your chances of being noticed by recruiters.

What skills should be highlighted in a Mortgage Closer resume objective?

In a Mortgage Closer resume objective, it's important to highlight skills such as knowledge of loan documentation, attention to detail, strong organizational abilities, and proficiency in relevant software. Additionally, mentioning skills related to client communication and problem-solving can further strengthen your objective, showcasing your capability to handle the complexities of the closing process effectively.

Is it necessary to include a resume objective for a Mortgage Closer position?

While not strictly necessary, including a resume objective for a Mortgage Closer position can be beneficial, especially if you are a recent graduate or changing careers. An objective provides a snapshot of your qualifications and career aspirations, helping to guide the reader's understanding of your resume. It can be particularly useful in emphasizing your fit for the role and making your application stand out.

Conclusion

In summary, crafting a targeted and impactful resume objective is crucial for those seeking a position as a Mortgage Closer. This guide has outlined the key elements necessary for creating an effective objective that not only highlights your qualifications but also resonates with potential employers. A well-written objective can significantly help candidates stand out to recruiters and create a strong first impression, setting the tone for the rest of the resume.

We encourage you to utilize the tips and examples provided to refine your resume objective, ensuring it effectively showcases your strengths and aspirations. Remember, a compelling objective can be the difference between landing an interview and being overlooked. Good luck as you move forward in your job search!

For additional resources, feel free to explore our resume templates, utilize our resume builder, check out various resume examples, and enhance your application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.