Mortgage Closer Core Responsibilities

A Mortgage Closer plays a vital role in the home financing process, acting as a bridge between loan officers, underwriters, and title companies. Key responsibilities include reviewing loan documents for accuracy, coordinating closing schedules, and ensuring compliance with legal requirements. Successful Mortgage Closers possess strong technical skills, operational expertise, and adept problem-solving abilities to navigate complex transactions. These skills are essential for achieving organizational goals, and a well-structured resume can effectively highlight these qualifications, enhancing job prospects.

Common Responsibilities Listed on Mortgage Closer Resume

- Review and verify loan documentation for accuracy and completeness

- Coordinate and schedule closing appointments with clients and title companies

- Ensure compliance with federal and state regulations

- Prepare closing disclosures and settlement statements

- Communicate with various departments to resolve issues

- Perform final audits of loan files before closing

- Assist clients with questions or concerns regarding closing

- Maintain accurate records of all transactions and communications

- Monitor timelines to ensure timely loan closings

- Provide exceptional customer service throughout the closing process

- Train and mentor junior staff on closing procedures

High-Level Resume Tips for Mortgage Closer Professionals

A well-crafted resume is crucial for Mortgage Closer professionals, as it serves as the first impression a candidate makes on potential employers. In the competitive landscape of the mortgage industry, your resume must effectively showcase your skills, achievements, and relevant experience to stand out among other applicants. It should not only reflect your qualifications but also convey your understanding of the intricacies of mortgage closing processes. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Closer professionals, helping you to create a compelling document that opens doors to new career opportunities.

Top Resume Tips for Mortgage Closer Professionals

- Tailor your resume to the specific job description by incorporating keywords and phrases from the posting.

- Highlight your relevant experience in mortgage closing, detailing your role in the process and any specific responsibilities.

- Quantify your achievements by including metrics, such as the number of loans closed or the percentage of error-free documents.

- Showcase industry-specific skills, such as knowledge of compliance regulations, loan processing software, and attention to detail.

- Include any certifications or training relevant to the mortgage industry to demonstrate your commitment to professional development.

- Utilize a professional format that emphasizes clarity and readability, including headings and bullet points for easy navigation.

- Incorporate a summary statement at the top of your resume that encapsulates your experience and value proposition as a Mortgage Closer.

- Use action verbs to describe your responsibilities and accomplishments, making your contributions clear and impactful.

- Include relevant keywords that hiring managers might use in searches to ensure your resume is easily discoverable.

By implementing these tips, you can significantly enhance your resume and increase your chances of landing a job in the Mortgage Closer field. A well-structured and targeted resume not only highlights your qualifications but also demonstrates your professionalism and understanding of the industry, making you a compelling candidate for potential employers.

Why Resume Headlines & Titles are Important for Mortgage Closer

In the competitive field of mortgage closing, a well-crafted resume is essential for standing out to potential employers. The role of a Mortgage Closer involves meticulous attention to detail, strong organizational skills, and a thorough understanding of loan documentation processes. A resume headline or title serves as the first impression a hiring manager has of a candidate, and a strong one can immediately grab their attention. It summarizes key qualifications in a concise and impactful phrase, making it easier for employers to quickly assess a candidate's fit for the position. Therefore, it is crucial for the headline to be relevant and directly related to the job being applied for, encapsulating the candidate's strengths and expertise at a glance.

Best Practices for Crafting Resume Headlines for Mortgage Closer

- Keep it concise: Aim for a headline that is short and to the point, ideally one line.

- Be role-specific: Tailor your headline to reflect the specific position of Mortgage Closer to show relevance.

- Highlight key qualifications: Use impactful language that showcases your most valuable skills and experiences.

- Use keywords: Incorporate industry-specific terms that align with the job description to pass through applicant tracking systems.

- Avoid buzzwords: Steer clear of clichés and vague phrases that do not add value to your resume.

- Showcase accomplishments: If possible, include a quantifiable achievement that demonstrates your expertise in mortgage closing.

- Maintain professionalism: Use a formal tone and ensure your headline aligns with industry standards.

- Be honest: Ensure your headline accurately represents your experience and qualifications without exaggeration.

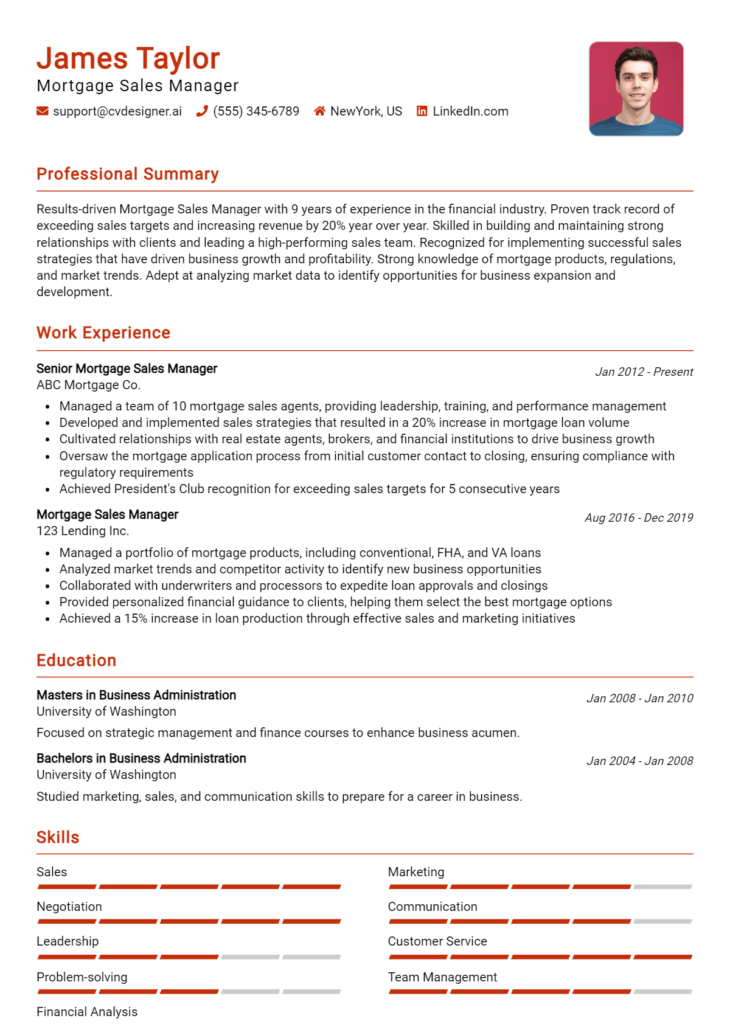

Example Resume Headlines for Mortgage Closer

Strong Resume Headlines

Detail-Oriented Mortgage Closer with 5+ Years of Experience in High-Volume Transactions

Results-Driven Mortgage Closer Specializing in Streamlining Closing Processes

Certified Mortgage Closer with Proven Track Record of Timely and Accurate Closings

Proficient Mortgage Closer with Expertise in Compliance and Documentation

Weak Resume Headlines

Just Another Mortgage Closer

Experienced in Mortgage Closing

The strong headlines are effective because they are specific, highlighting the candidate’s experience and skills in a way that speaks directly to the needs of potential employers. They convey a sense of professionalism and clarity, making it easy for hiring managers to understand the candidate's qualifications quickly. In contrast, the weak headlines fail to impress due to their vague nature and lack of detail; they do not provide any insight into the candidate’s unique strengths or distinguish them from other applicants, making it harder for them to stand out in a crowded field.

Writing an Exceptional Mortgage Closer Resume Summary

A well-crafted resume summary is crucial for a Mortgage Closer as it serves as the first point of contact between the candidate and hiring managers. A strong summary quickly captures attention by highlighting key skills, relevant experience, and significant accomplishments that align with the job role. It should be concise yet impactful, providing a snapshot of the candidate's qualifications tailored specifically to the position being applied for. This approach not only sets the tone for the rest of the resume but also increases the likelihood of making a positive impression in a competitive job market.

Best Practices for Writing a Mortgage Closer Resume Summary

- Quantify Achievements: Use specific numbers and metrics to showcase your impact in previous roles.

- Focus on Relevant Skills: Highlight skills that directly relate to the Mortgage Closer position, such as attention to detail, compliance knowledge, and customer service.

- Tailor to Job Description: Customize the summary to reflect the requirements and language used in the job posting.

- Be Concise: Keep the summary brief, ideally within 2-4 sentences, to maintain the reader's interest.

- Showcase Experience: Include years of experience and specific types of mortgage transactions handled.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Highlight Industry Knowledge: Mention familiarity with relevant laws, regulations, and best practices in the mortgage industry.

- Communicate Value Proposition: Clearly express how your skills and experience bring value to the prospective employer.

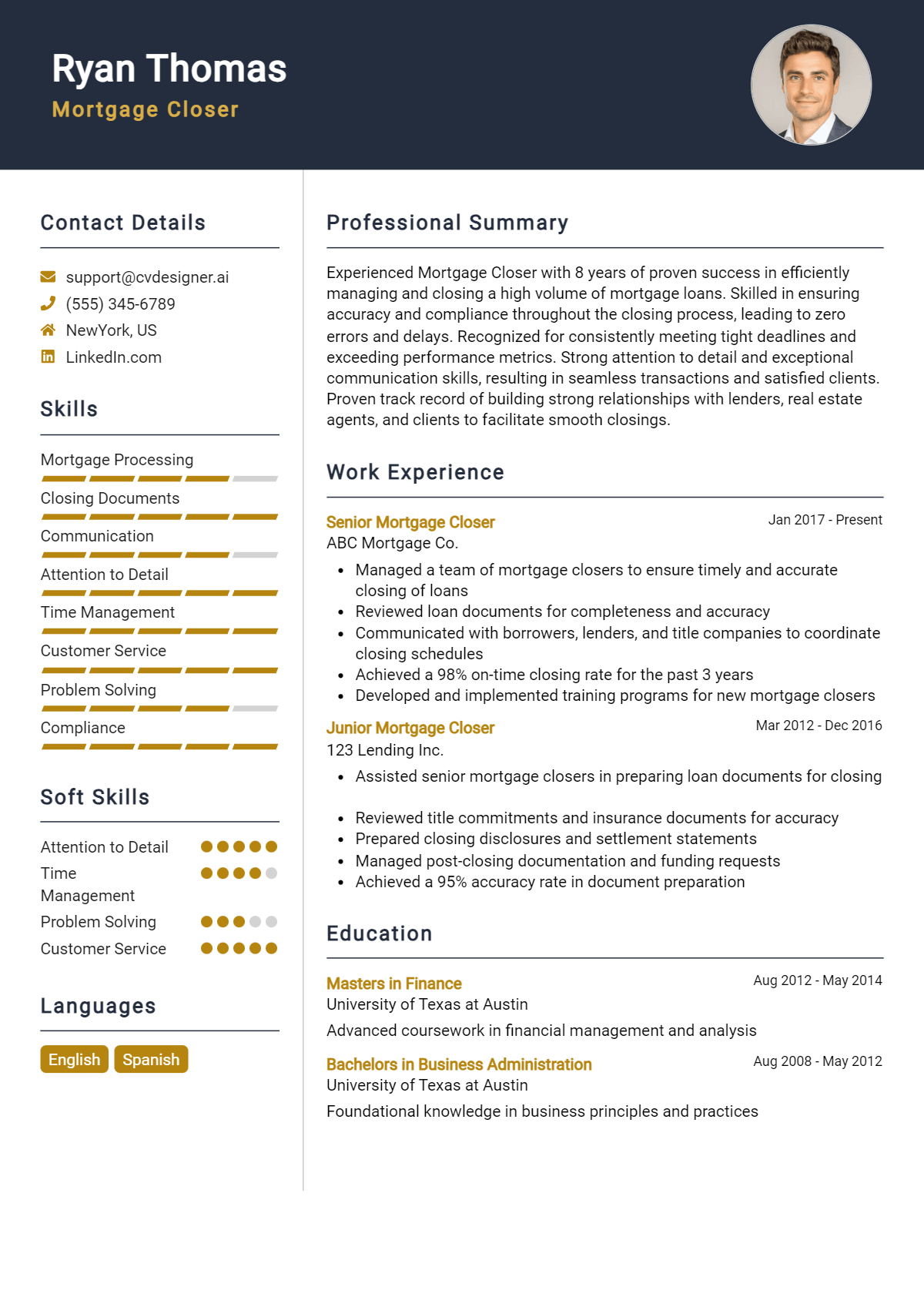

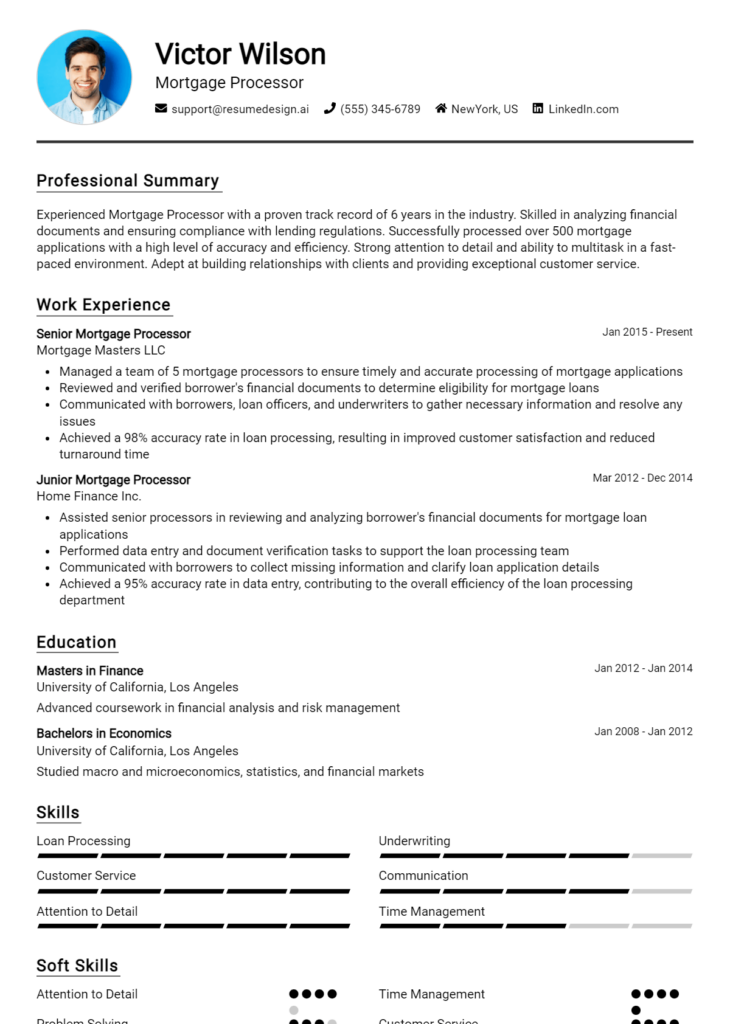

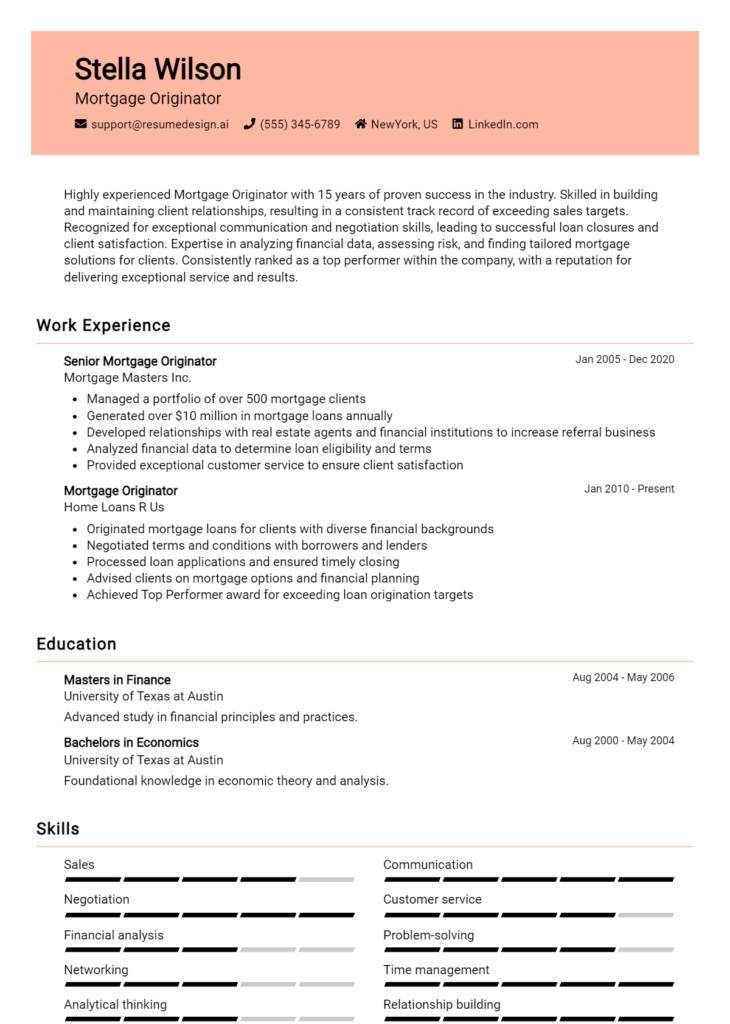

Example Mortgage Closer Resume Summaries

Strong Resume Summaries

Detail-oriented Mortgage Closer with over 5 years of experience in processing and closing residential loans. Successfully managed a portfolio of 200+ loans annually, achieving a 98% on-time closing rate while ensuring compliance with all regulatory requirements.

Results-driven Mortgage Closer with a proven track record of reducing closing times by 15% through streamlined processes and effective communication with stakeholders. Expertise in FHA and VA loans, with a strong commitment to exceptional customer service.

Dedicated Mortgage Closer with 7 years of experience in the financial services industry, specializing in conventional and jumbo loan products. Recognized for maintaining a 100% accuracy rate in documentation and compliance, contributing to a 30% increase in customer satisfaction ratings.

Weak Resume Summaries

I have experience in the mortgage industry and am looking for a position as a Mortgage Closer.

Mortgage Closer with some knowledge of loans and paperwork. I hope to find a job where I can help clients.

The examples provided highlight the stark differences between strong and weak resume summaries. Strong summaries effectively quantify achievements, display direct relevance to the Mortgage Closer role, and articulate the candidate’s unique skills and value. In contrast, weak summaries lack specificity, fail to demonstrate relevant experience, and do not convey a clear understanding of the role's requirements, making them less impactful to hiring managers.

Work Experience Section for Mortgage Closer Resume

The work experience section of a Mortgage Closer resume is crucial as it provides potential employers with a comprehensive view of a candidate's technical skills and hands-on experience in the mortgage industry. This section not only displays the candidate's ability to manage teams effectively but also highlights their commitment to delivering high-quality products within tight deadlines. By quantifying achievements and aligning past experiences with industry standards, candidates can significantly enhance their appeal and demonstrate their readiness to contribute positively to the organization’s goals.

Best Practices for Mortgage Closer Work Experience

- Focus on quantifiable results, such as the number of loans closed or percentage of error reduction.

- Highlight specific technical skills relevant to mortgage closing, such as familiarity with loan origination software.

- Emphasize experiences that showcase collaboration with other departments, such as underwriting or real estate agents.

- Use action verbs to describe responsibilities and achievements effectively.

- Tailor your experience to align with the job description, using relevant keywords.

- Include any certifications or training that enhance your qualifications as a Mortgage Closer.

- Showcase leadership roles in team projects or initiatives to demonstrate your ability to manage and motivate others.

- Keep descriptions concise while ensuring key accomplishments are clearly communicated.

Example Work Experiences for Mortgage Closer

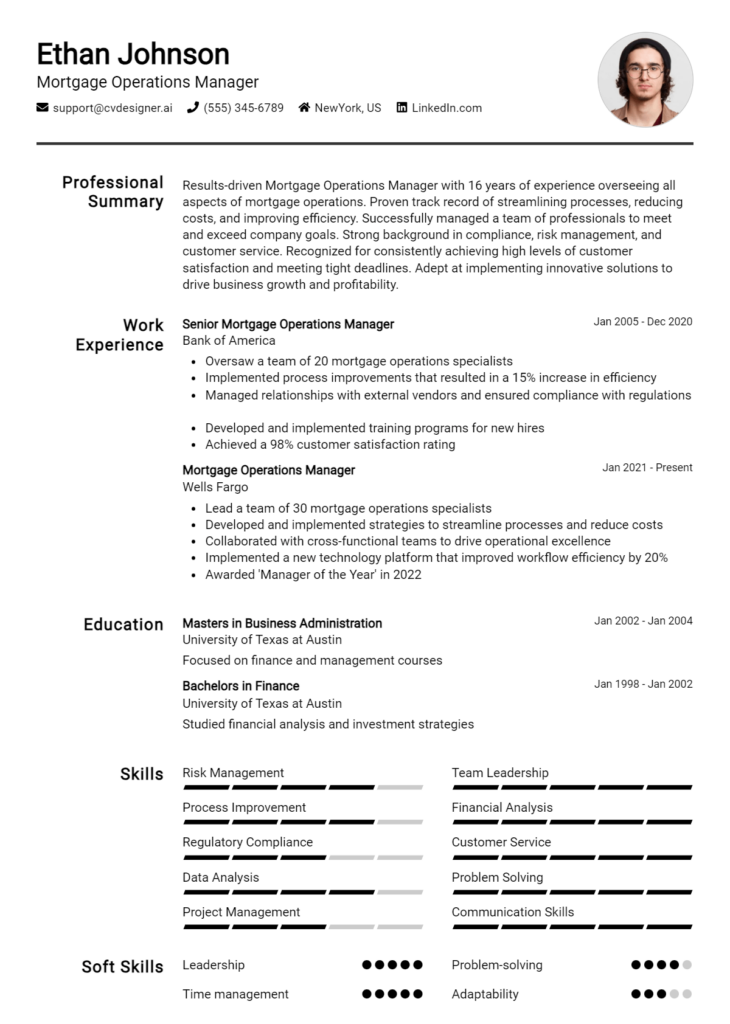

Strong Experiences

- Successfully closed over 200 mortgage loans in one year, achieving a 98% accuracy rate in documentation and compliance.

- Led a team of 5 closers to streamline the closing process, resulting in a 30% decrease in turnaround time.

- Implemented a new loan tracking system that improved communication between departments, reducing processing errors by 25%.

- Coordinated with real estate agents and clients to facilitate seamless closings, enhancing customer satisfaction ratings to 95%.

Weak Experiences

- Worked on closing loans and ensured everything was done properly.

- Assisted in the mortgage process and completed various tasks.

- Helped coworkers with closing-related issues when needed.

- Involved in paperwork and communication with clients occasionally.

The examples provided illustrate a clear distinction between strong and weak experiences. Strong experiences are characterized by specific, quantifiable outcomes and demonstrate leadership and collaboration, showcasing the candidate's impact in previous roles. In contrast, weak experiences lack detail and measurable results, making it difficult for employers to assess the candidate's true capabilities and contributions to the mortgage closing process.

Education and Certifications Section for Mortgage Closer Resume

The education and certifications section of a Mortgage Closer resume plays a vital role in showcasing a candidate's academic background and professional qualifications. This section not only highlights relevant degrees and certifications but also demonstrates the candidate's commitment to continuous learning and professional development within the mortgage industry. Including pertinent coursework, specialized training, and industry-recognized credentials can significantly enhance a candidate's credibility, aligning their qualifications with the specific requirements of the Mortgage Closer role.

Best Practices for Mortgage Closer Education and Certifications

- Include relevant degrees such as a Bachelor's in Finance, Business Administration, or a related field.

- List industry-recognized certifications, such as the National Mortgage License System (NMLS) certification.

- Provide details on specialized training in mortgage processing, underwriting, or closing procedures.

- Highlight any continuing education courses that reflect updated industry practices and regulations.

- Focus on coursework that directly relates to mortgage laws, compliance, and financing options.

- Use clear and concise language to describe credentials, avoiding unnecessary jargon.

- Arrange the information in reverse chronological order to showcase the most recent education and certifications first.

- Emphasize any honors or recognitions received during academic or certification pursuits.

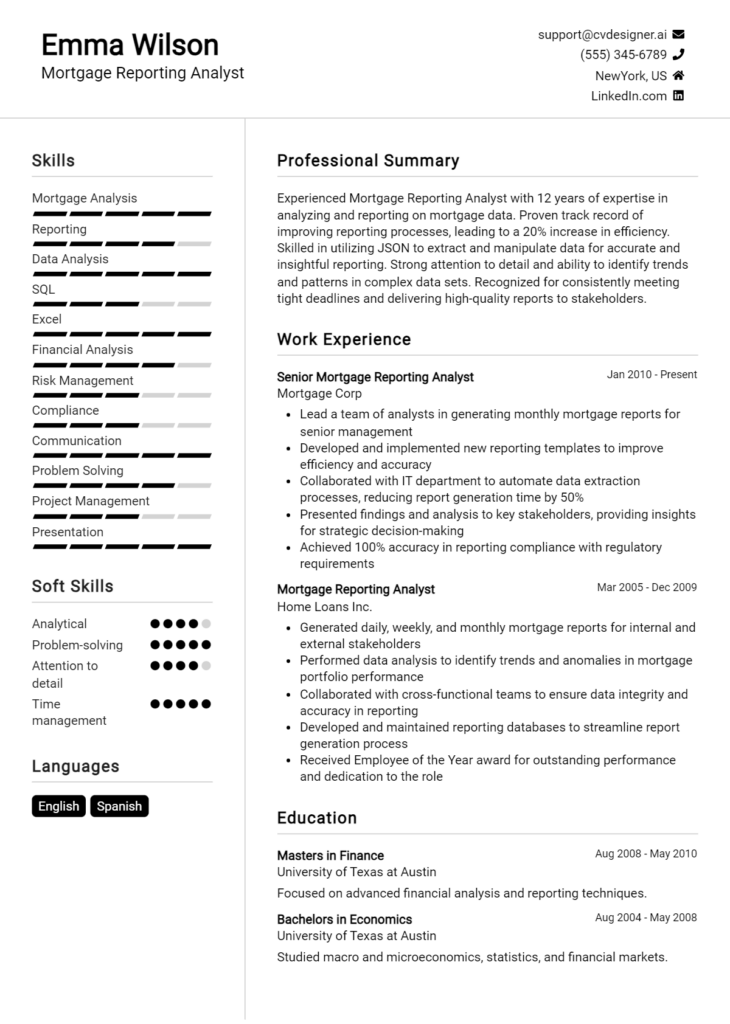

Example Education and Certifications for Mortgage Closer

Strong Examples

- Bachelor of Science in Finance, University of XYZ, 2020

- National Mortgage License System (NMLS) Certification, 2021

- Certification in Mortgage Processing, ABC Institute, 2022

- Completed coursework in Real Estate Law and Mortgage Financing, University of XYZ

Weak Examples

- Associate Degree in General Studies, Community College, 2015

- Certification in Basic Computer Skills, Online Course, 2019

- High School Diploma, Graduated 2010

- Outdated Mortgage Broker License, Expired 2020

The examples provided are considered strong because they are directly relevant to the Mortgage Closer role, featuring recognized degrees and certifications that demonstrate expertise in the field. They reflect a clear commitment to the mortgage industry and align with current requirements. Conversely, the weak examples are deemed inadequate due to their irrelevance or expiration, lacking a direct connection to the skills and knowledge needed for success as a Mortgage Closer.

Top Skills & Keywords for Mortgage Closer Resume

When crafting a resume for a Mortgage Closer position, highlighting the right skills is crucial for standing out to potential employers. A well-structured resume that showcases both hard and soft skills can demonstrate your expertise in the field, while also showcasing your ability to collaborate and communicate effectively with clients and colleagues. Mortgage Closers play a vital role in the loan process, ensuring that all documents are accurate and in compliance with regulations. By emphasizing relevant skills, you not only align your qualifications with the job requirements but also enhance your chances of landing an interview.

Top Hard & Soft Skills for Mortgage Closer

Soft Skills

- Attention to Detail

- Communication Skills

- Problem-Solving Abilities

- Time Management

- Customer Service Orientation

- Teamwork and Collaboration

- Adaptability

- Negotiation Skills

- Critical Thinking

- Interpersonal Skills

- Organization

- Conflict Resolution

- Stress Management

- Empathy

- Decision Making

Hard Skills

- Knowledge of Mortgage Regulations

- Proficiency in Loan Processing Software

- Data Entry and Management

- Document Review and Analysis

- Financial Analysis

- Familiarity with Title and Escrow Processes

- Understanding of Underwriting Guidelines

- Risk Assessment

- Microsoft Office Suite Proficiency

- Record Keeping and Documentation

- Compliance Management

- Knowledge of Real Estate Transactions

- Loan Closing Procedures

- Familiarity with Legal Terminology

- Credit Analysis

- Financial Reporting

- Electronic Signature Software

- Knowledge of Appraisal Processes

By focusing on these skills and showcasing relevant work experience, you can create a compelling resume that effectively communicates your qualifications for the Mortgage Closer role.

Stand Out with a Winning Mortgage Closer Cover Letter

As a dedicated and detail-oriented professional with over five years of experience in the mortgage industry, I am excited to apply for the Mortgage Closer position at [Company Name]. My extensive background in processing loans, coupled with my strong organizational skills and commitment to providing exceptional customer service, positions me as an ideal candidate to contribute effectively to your team. I have a proven track record of successfully managing the closing process from start to finish, ensuring compliance with all regulations while maintaining clear communication with clients, lenders, and real estate agents.

In my previous role at [Previous Company Name], I was responsible for coordinating the closing of over 100 mortgage loans annually. By utilizing my keen attention to detail, I consistently ensured that all documentation was accurate and complete, which resulted in a 98% satisfaction rate among clients. My ability to work under pressure and manage tight deadlines has equipped me with the skills necessary to thrive in a fast-paced environment. Additionally, I am well-versed in using various mortgage processing software, which allows me to streamline operations and enhance overall efficiency.

Collaboration is key in the mortgage closing process, and I pride myself on my ability to foster strong working relationships with all stakeholders involved. I believe that my proactive communication style and problem-solving skills enable me to navigate challenges effectively, ensuring that all parties are informed and aligned throughout the closing process. I am particularly drawn to [Company Name] because of its commitment to innovation and customer satisfaction, and I am eager to bring my expertise in closing to help achieve these goals.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my experience and skills align with the needs of your team. I am excited about the prospect of contributing to [Company Name] and helping clients realize their homeownership dreams through a seamless closing experience.

Common Mistakes to Avoid in a Mortgage Closer Resume

When crafting a resume for the role of a Mortgage Closer, it's essential to present yourself in the best light possible. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a more effective and professional resume that highlights your skills and experience in the mortgage industry.

Vague Job Descriptions: Failing to provide specific details about your previous roles can leave hiring managers unsure of your qualifications. Use quantifiable achievements to demonstrate your impact in past positions.

Ignoring Relevant Skills: Many candidates overlook the importance of tailoring their resumes to the job description. Make sure to highlight skills that are specifically relevant to mortgage closing, such as attention to detail, communication, and knowledge of regulations.

Poor Formatting: A cluttered or unorganized resume can be off-putting. Use a clean, professional layout with clear headings and bullet points to enhance readability.

Typos and Grammatical Errors: Mistakes in spelling or grammar can create an impression of carelessness. Always proofread your resume or consider having someone else review it before submission.

Overloading with Jargon: While industry-specific terminology can showcase your expertise, using too much jargon can confuse the reader. Strike a balance by ensuring your resume is accessible and understandable.

Not Including Certifications: In the mortgage industry, relevant certifications can set you apart from other candidates. Be sure to list any licenses or certifications, such as NMLS, prominently on your resume.

Neglecting Soft Skills: While technical skills are crucial, soft skills such as problem-solving and interpersonal communication are equally important for a Mortgage Closer. Highlight these attributes to showcase your well-rounded abilities.

Lack of Customization: Sending out a generic resume can diminish your chances of standing out. Customize your resume for each application to reflect the specific requirements and values of the company you are applying to.

Conclusion

As a Mortgage Closer, you play a crucial role in the home buying process, ensuring that all documents are accurate and processing the closing of loans efficiently. Your responsibilities include reviewing loan documents, coordinating with various parties, and ensuring compliance with legal regulations. Being detail-oriented and possessing strong communication skills are essential traits for success in this role.

To excel as a Mortgage Closer, it's important to highlight your relevant experience and skills in your resume. Showcase your attention to detail, understanding of mortgage processes, and ability to work under pressure. Additionally, emphasizing your teamwork and collaboration skills can help demonstrate your capability to liaise effectively with lenders, real estate agents, and clients.

Now is the perfect time to review your Mortgage Closer resume to ensure it reflects your qualifications and showcases your strengths. Consider utilizing resources available to you, such as resume templates, a resume builder, resume examples, and cover letter templates. These tools can help you create a professional and compelling resume that stands out to potential employers. Take action today to enhance your career opportunities in the mortgage industry!