Top 27 Wealth Manager Resume Skills with Examples for 2025

In the competitive field of wealth management, showcasing the right skills on your resume is essential to stand out to potential employers and clients. Wealth managers need a unique blend of financial acumen, interpersonal abilities, and strategic thinking to effectively manage client portfolios and provide tailored financial advice. In the following section, we will outline the top skills that should be highlighted on your resume to demonstrate your expertise and suitability for this dynamic role.

Best Wealth Manager Technical Skills

In the competitive field of wealth management, possessing strong technical skills is essential for effectively managing clients' financial portfolios and delivering tailored investment strategies. These skills not only enhance a Wealth Manager's ability to analyze market trends but also build client trust through informed decision-making.

Investment Analysis

Investment analysis involves evaluating various investment opportunities to determine their potential returns and risks. This skill is crucial for making informed recommendations to clients.

How to show it: Highlight specific investment strategies you developed and their impact on client portfolios.

Portfolio Management

Portfolio management entails the selection, prioritization, and ongoing management of investment assets to meet specific financial goals. Mastery in this area can lead to optimal asset allocation for clients.

How to show it: Detail the size and performance of portfolios you've managed, emphasizing growth percentages.

Financial Modeling

Financial modeling involves creating representations of a client's financial situation to forecast future performance. This skill is essential for strategic planning and investment decisions.

How to show it: Provide examples of models you've built and how they influenced client decisions or outcomes.

Risk Management

Risk management focuses on identifying and mitigating potential losses in investment portfolios. This skill is vital for protecting clients' assets and ensuring long-term stability.

How to show it: Quantify risks you've mitigated and illustrate the resulting financial impact on client portfolios.

Tax Planning

Tax planning involves strategizing to minimize tax liabilities while maximizing investment returns. A sound understanding of tax implications can enhance overall client satisfaction.

How to show it: Showcase tax savings achieved for clients through your recommendations and strategies.

Market Research

Market research entails analyzing economic trends and market conditions to inform investment strategies. This skill enables Wealth Managers to make data-driven decisions.

How to show it: Include specific research projects and their outcomes in terms of client success or investment performance.

Financial Planning Software

Proficiency in financial planning software is essential for creating comprehensive financial plans and simulations. It streamlines client reporting and enhances accuracy.

How to show it: List software tools you are proficient in and describe how you utilized them to improve client engagement.

Asset Allocation

Asset allocation is the strategy of distributing investments among various asset categories to balance risk and reward. This skill is critical for diversifying client portfolios effectively.

How to show it: Discuss how your asset allocation strategies have led to improved returns for clients.

Client Relationship Management (CRM) Software

Utilizing CRM software helps Wealth Managers maintain and enhance client relationships through organized communication and personalized service.

How to show it: Describe how you used CRM tools to increase client retention and satisfaction metrics.

Compliance Knowledge

Understanding regulatory compliance is essential to ensure that all financial practices adhere to legal standards, protecting both the firm and clients.

How to show it: Provide examples of compliance initiatives you led and their impact on the firm's operations.

Financial Statement Analysis

Financial statement analysis involves evaluating a company's financial statements to assess its performance and viability, crucial for making informed investment decisions.

How to show it: Highlight specific analyses conducted and how they informed client investment strategies.

Best Wealth Manager Soft Skills

In the competitive field of wealth management, possessing strong soft skills is just as crucial as technical knowledge. These interpersonal abilities enable wealth managers to build trust, communicate effectively with clients, and navigate complex financial situations, ultimately leading to better client satisfaction and retention. Here are some essential soft skills for a successful wealth manager:

Communication

Effective communication is vital for wealth managers to clearly convey complex financial concepts to clients, ensuring they understand their investment strategies and options.

How to show it: Highlight instances where you successfully communicated intricate financial information to clients, perhaps through presentations or reports.

Problem-solving

Wealth managers often face unexpected challenges that require quick thinking and innovative solutions to meet clients' needs and expectations.

How to show it: Provide examples of how you identified and resolved financial issues for clients, showcasing the impact of your solutions.

Time Management

Managing multiple clients and their diverse portfolios requires exceptional time management skills to prioritize tasks efficiently and meet deadlines.

How to show it: Demonstrate your ability to manage time effectively by detailing how you balanced client needs with your workload.

Teamwork

Collaboration with colleagues and other financial professionals is essential for wealth managers to provide comprehensive services to clients.

How to show it: Include examples of successful collaborations on projects or cases that resulted in positive client outcomes.

Empathy

Understanding clients' emotional and financial concerns allows wealth managers to provide tailored advice and build long-lasting relationships.

How to show it: Share stories that illustrate your ability to understand and address clients' feelings and concerns during financial planning discussions.

Adaptability

The financial landscape is constantly changing, and wealth managers must be able to adjust their strategies accordingly to better serve their clients.

How to show it: Demonstrate how you adapted to market changes or client needs, mentioning specific strategies you implemented.

Negotiation

Wealth managers often negotiate terms and conditions on behalf of their clients, making strong negotiation skills essential for achieving optimal outcomes.

How to show it: Detail successful negotiations you conducted, highlighting the benefits secured for your clients.

Critical Thinking

Wealth managers must analyze various financial data and scenarios, requiring strong critical thinking skills to make informed recommendations.

How to show it: Provide examples of how your critical thinking led to successful investment strategies or financial planning outcomes.

Attention to Detail

Precision is key in wealth management, where minor errors can lead to significant financial repercussions for clients.

How to show it: Highlight your track record of accuracy by mentioning specific tasks where attention to detail prevented potential issues.

Relationship Building

Strong relationships with clients foster loyalty and trust, making relationship-building skills imperative for wealth managers.

How to show it: Share examples of how you cultivated long-term client relationships and the positive impact on client retention.

Sales Skills

Wealth managers often need to sell their services and investment ideas, making sales skills important for business growth.

How to show it: Quantify your sales achievements or growth metrics that resulted from your efforts in promoting services.

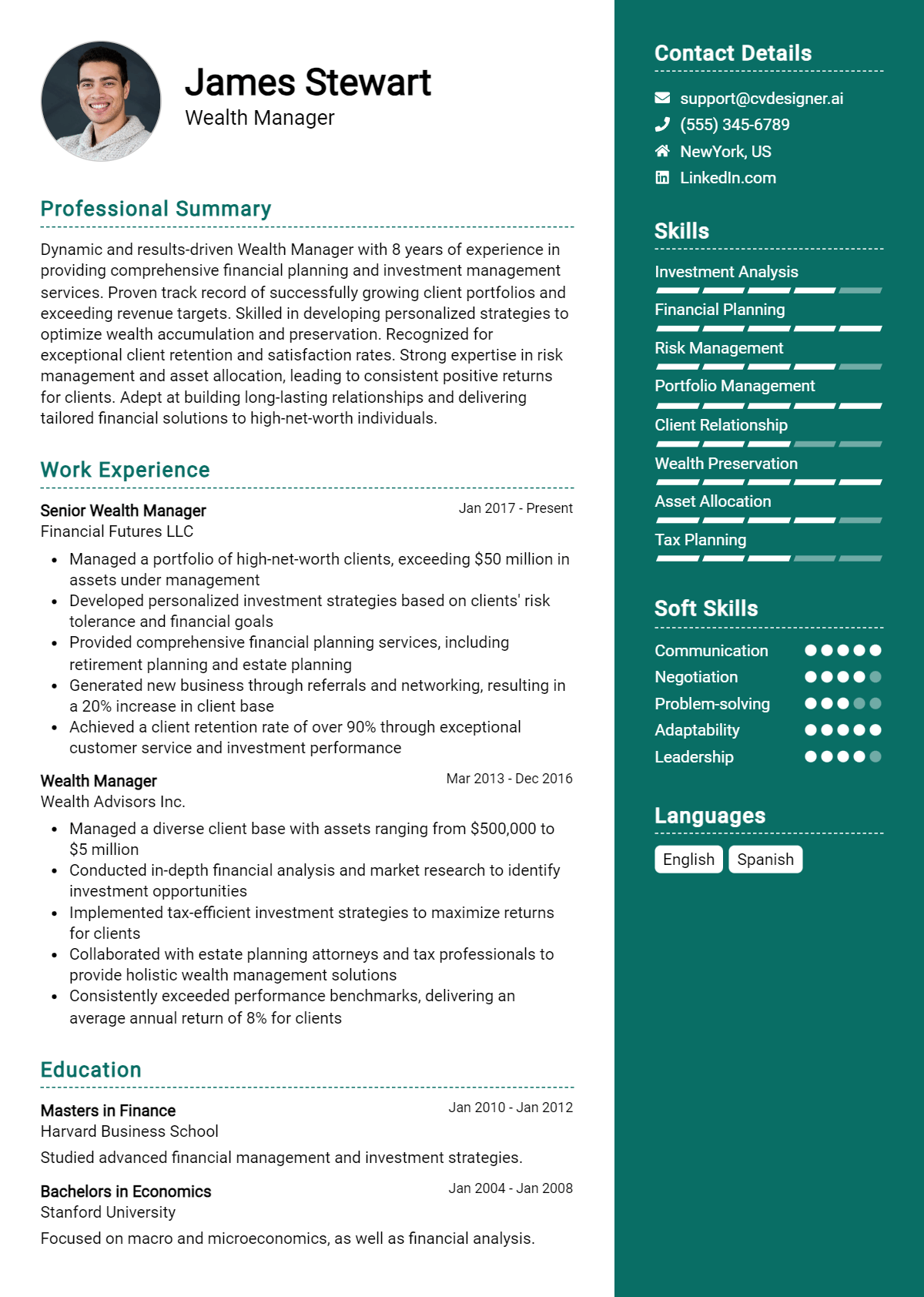

How to List Wealth Manager Skills on Your Resume

Effectively listing skills on your resume is crucial for standing out to employers in the competitive field of wealth management. By clearly showcasing your qualifications, you can capture the attention of hiring managers. There are three main sections where skills can be highlighted: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing Wealth Manager skills in the introduction (objective or summary) section offers hiring managers a quick overview of your qualifications, setting a strong first impression.

Example

A results-driven Wealth Manager with expertise in investment strategies, client relationship management, and financial planning, dedicated to optimizing clients' portfolios and achieving their financial goals.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how Wealth Manager skills have been applied in real-world scenarios, showcasing both hard and soft skills.

Example

- Developed personalized investment strategies for high-net-worth clients, resulting in a 15% increase in portfolio performance.

- Maintained strong client relationships through regular communication and tailored financial advice, leading to a 95% client retention rate.

- Conducted comprehensive financial analyses to identify growth opportunities and minimize risks for clients.

- Collaborated with cross-functional teams to deliver exceptional customer service and support clients’ diverse financial needs.

for Resume Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills should be included to strengthen your overall qualifications.

Example

- Financial Analysis

- Portfolio Management

- Investment Advisory

- Risk Assessment

- Client Relationship Management

- Strategic Planning

- Market Research

- Effective Communication

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how those skills positively impacted your previous roles.

Example

In my previous role, I leveraged my financial planning and investment advisory skills to enhance client satisfaction and drive a 20% growth in assets under management. My passion for client relationship management has allowed me to build strong, lasting connections that contribute to the overall success of the firm.

Linking the skills mentioned in your resume to specific achievements in your cover letter will reinforce your qualifications for the job.

The Importance of Wealth Manager Resume Skills

In the competitive landscape of wealth management, showcasing relevant skills on a resume is crucial for standing out to potential employers. A well-structured skills section not only highlights a candidate's qualifications but also demonstrates their alignment with the specific requirements of the role. By emphasizing the right skills, candidates can effectively communicate their value and increase their chances of making a positive impression on recruiters.

- Wealth Managers must possess strong analytical skills to assess clients' financial situations accurately. This capability allows them to develop tailored investment strategies that align with clients' goals and risk tolerance.

- Effective communication skills are vital for Wealth Managers as they need to explain complex financial concepts clearly to clients. This helps build trust and fosters a strong advisor-client relationship, which is essential for long-term success.

- Proficiency in financial software and technology is increasingly important in the wealth management industry. Knowing how to leverage these tools can enhance the efficiency of managing clients' portfolios and streamline reporting processes.

- Strong interpersonal skills enable Wealth Managers to connect with clients on a personal level, understanding their unique financial aspirations. This emotional intelligence is key to providing personalized service and retaining clients over time.

- Knowledge of regulatory compliance is critical for Wealth Managers. Understanding industry regulations ensures that their investment strategies adhere to legal requirements, thereby protecting both the client and the firm.

- Problem-solving skills are essential for Wealth Managers as they often face complex financial challenges. The ability to think critically and devise effective solutions can significantly impact clients' financial health.

- Networking skills are crucial for Wealth Managers to build relationships within the industry. A robust professional network can lead to referrals and new business opportunities, enhancing their overall success.

- Time management skills allow Wealth Managers to juggle multiple clients and prioritize tasks efficiently. This ensures that all clients receive the attention they deserve, enhancing client satisfaction and loyalty.

For more insights and examples, check out these Resume Samples.

How To Improve Wealth Manager Resume Skills

As a Wealth Manager, it is crucial to continuously enhance your skills to stay competitive in a rapidly evolving financial landscape. Clients expect not only expertise in managing their assets but also a personalized approach that reflects their unique financial goals. By consistently improving your skill set, you can better serve your clients, adapt to market changes, and advance your career in wealth management.

- Stay updated on financial regulations and market trends by subscribing to industry publications and attending relevant seminars.

- Enhance your communication skills through workshops or courses, focusing on both verbal and written communication to effectively convey complex financial concepts.

- Develop strong analytical skills by practicing data analysis and financial modeling, which will help in making informed investment decisions.

- Build expertise in technology by learning about the latest financial software and tools that can streamline investment management processes.

- Network with other professionals in the industry to exchange knowledge and best practices, which can provide new insights and opportunities for collaboration.

- Seek mentorship from experienced wealth managers who can provide guidance, share experiences, and help you refine your strategies.

- Consider obtaining additional certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), to bolster your credentials and demonstrate your commitment to professional growth.

Frequently Asked Questions

What key skills should a wealth manager include in their resume?

A wealth manager's resume should highlight skills such as financial analysis, investment strategy development, portfolio management, and client relationship management. Additionally, proficiency in financial software and tools, as well as strong communication and negotiation abilities, are crucial for effectively managing client assets and building trust.

How important are certifications for a wealth manager's career?

Certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), significantly enhance a wealth manager's credibility and demonstrate expertise in financial planning and investment management. Including these certifications on a resume can set candidates apart in a competitive job market, showcasing their commitment to professional development and industry standards.

What role does client communication play in a wealth manager's job?

Effective client communication is essential for wealth managers, as it helps build strong relationships and trust with clients. Clear communication of complex financial concepts, regular updates on portfolio performance, and understanding client goals are vital skills that should be emphasized on a resume to reflect an ability to foster long-lasting partnerships.

How can a wealth manager demonstrate their analytical skills?

Wealth managers can demonstrate their analytical skills by showcasing their experience in conducting financial assessments, market research, and risk analysis. Including specific examples of how they have used data to inform investment decisions or solve complex financial challenges on their resume can illustrate their analytical capabilities to potential employers.

What experience is relevant for a wealth manager position?

Relevant experience for a wealth manager position includes previous roles in financial services, investment banking, or personal financial advising. Highlighting specific achievements, such as successfully managing client portfolios or increasing client satisfaction ratings, can provide evidence of a candidate’s ability to excel in the wealth management field and should be detailed in their resume.

Conclusion

Including Wealth Manager skills in your resume is crucial for showcasing your expertise and distinguishing yourself from other candidates. By effectively highlighting relevant skills, you demonstrate your value to potential employers and your readiness to contribute to their financial success. Remember, a well-crafted resume not only reflects your qualifications but also your commitment to your career. Take the necessary steps to refine your skills and elevate your job application, paving the way for a successful future in wealth management.

For additional resources to enhance your job application, explore our resume templates, utilize our resume builder, check out resume examples, and create compelling applications with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.