Wealth Manager Core Responsibilities

A Wealth Manager plays a crucial role in managing clients' financial portfolios by providing tailored investment strategies and financial advice. Key responsibilities include assessing clients' financial goals, developing investment plans, and monitoring market trends. This role requires strong technical, operational, and problem-solving skills to effectively bridge finance, legal, and compliance departments. A well-structured resume that highlights these qualifications can significantly enhance a Wealth Manager's ability to contribute to the organization's overall success.

Common Responsibilities Listed on Wealth Manager Resume

- Develop and implement personalized investment strategies for clients.

- Conduct regular portfolio reviews and market analysis.

- Build and maintain strong client relationships through effective communication.

- Provide financial planning and retirement advice tailored to individual needs.

- Monitor and assess economic trends impacting clients' investments.

- Collaborate with legal and compliance teams to ensure regulatory adherence.

- Educate clients on financial products and market conditions.

- Manage risk assessment to protect clients' assets.

- Prepare detailed financial reports and presentations for clients.

- Continuously seek new clients and business opportunities.

- Stay updated on financial regulations and industry trends.

High-Level Resume Tips for Wealth Manager Professionals

In the competitive world of wealth management, a well-crafted resume serves as a crucial ticket to career advancement. As the first impression a candidate makes on potential employers, the resume must effectively capture both the skills and achievements that set the applicant apart from the competition. For Wealth Manager professionals, it’s essential to showcase not only financial acumen but also a deep understanding of client relationships and market dynamics. This guide will provide practical and actionable resume tips specifically tailored for Wealth Manager professionals, helping you to stand out in a crowded job market.

Top Resume Tips for Wealth Manager Professionals

- Tailor your resume to the specific job description, using keywords and phrases that align with the employer’s requirements.

- Showcase relevant experience in wealth management, including previous positions, internships, and any relevant projects.

- Quantify achievements wherever possible, such as increasing client portfolios by a certain percentage or managing assets of a specific value.

- Highlight industry-specific skills, including investment strategies, portfolio management, financial planning, and regulatory knowledge.

- Include professional certifications and licenses, such as CFP, CFA, or Series 7, to demonstrate your qualifications and commitment to the field.

- Utilize a clean and professional format that enhances readability, making it easy for hiring managers to find key information quickly.

- Incorporate soft skills that are crucial in wealth management, like communication, negotiation, and relationship-building abilities.

- Consider adding a summary statement at the top of your resume that encapsulates your career goals and key strengths in wealth management.

- Keep your resume concise, ideally one page, while ensuring all pertinent information is included without unnecessary fluff.

By implementing these tips, Wealth Manager professionals can significantly enhance their resumes, increasing the likelihood of capturing the attention of hiring managers and landing a job in this dynamic field. A well-structured resume not only showcases your qualifications but also reflects your professionalism and dedication to building a successful career in wealth management.

Why Resume Headlines & Titles are Important for Wealth Manager

In the competitive field of wealth management, a well-crafted resume headline or title is crucial for standing out among a pool of candidates. This brief yet powerful phrase serves as the first impression for hiring managers, encapsulating a candidate's core qualifications and expertise in a succinct manner. A strong headline not only grabs attention but also sets the tone for the rest of the resume, making it easier for potential employers to immediately recognize the candidate's value. It should be concise, relevant, and directly aligned with the specific wealth management position being applied for, effectively summarizing the candidate's skills and experiences at a glance.

Best Practices for Crafting Resume Headlines for Wealth Manager

- Keep it concise: Aim for one impactful phrase that captures your essence.

- Be role-specific: Tailor your headline to the specific wealth manager position you are applying for.

- Highlight key qualifications: Focus on your top skills or achievements that are most relevant to the role.

- Use powerful language: Choose strong action words that convey confidence and expertise.

- Avoid jargon: Ensure your headline is clear and understandable to a broad audience.

- Incorporate metrics where possible: Quantifiable achievements can enhance credibility.

- Stay professional: Use a tone that reflects industry standards and professionalism.

- Update regularly: Refresh your headline to reflect your most recent experiences and skills.

Example Resume Headlines for Wealth Manager

Strong Resume Headlines

"Certified Wealth Manager with 10+ Years of Experience in Investment Strategies and Client Relations"

"Results-Driven Wealth Management Professional Specializing in High-Net-Worth Client Advisory"

"Dynamic Wealth Manager Focused on Tailored Financial Solutions and Sustainable Growth"

Weak Resume Headlines

“Experienced Financial Professional”

“Seeking Wealth Management Position”

The strong headlines are effective because they are specific, showcasing not only the candidate's experience but also their areas of expertise and focus. They immediately convey value and relevance to the hiring manager, making a memorable impression. In contrast, the weak headlines lack specificity and impact; they fail to provide any meaningful insight into the candidate's qualifications or unique selling points, making them less likely to capture the attention of potential employers.

Writing an Exceptional Wealth Manager Resume Summary

A resume summary is a crucial component for Wealth Managers, serving as the first impression a hiring manager receives of a candidate. A well-crafted summary quickly captures attention by succinctly highlighting key skills, relevant experience, and notable accomplishments that align with the demands of the role. Given the competitive nature of the financial services industry, a strong summary not only showcases an applicant's expertise but also demonstrates their value proposition to potential employers. It should be concise, impactful, and tailored specifically to the job being applied for, ensuring that it resonates with the hiring manager's expectations and needs.

Best Practices for Writing a Wealth Manager Resume Summary

- Quantify achievements to provide concrete evidence of success.

- Focus on relevant skills that align with the job description.

- Tailor the summary to the specific job and company for a personalized touch.

- Use action verbs to convey a sense of proactivity and impact.

- Highlight industry knowledge to showcase expertise in wealth management.

- Keep it concise, ideally within 3-5 sentences, to maintain clarity.

- Incorporate keywords from the job listing to pass through applicant tracking systems.

- Showcase soft skills such as relationship building and communication, which are vital in wealth management.

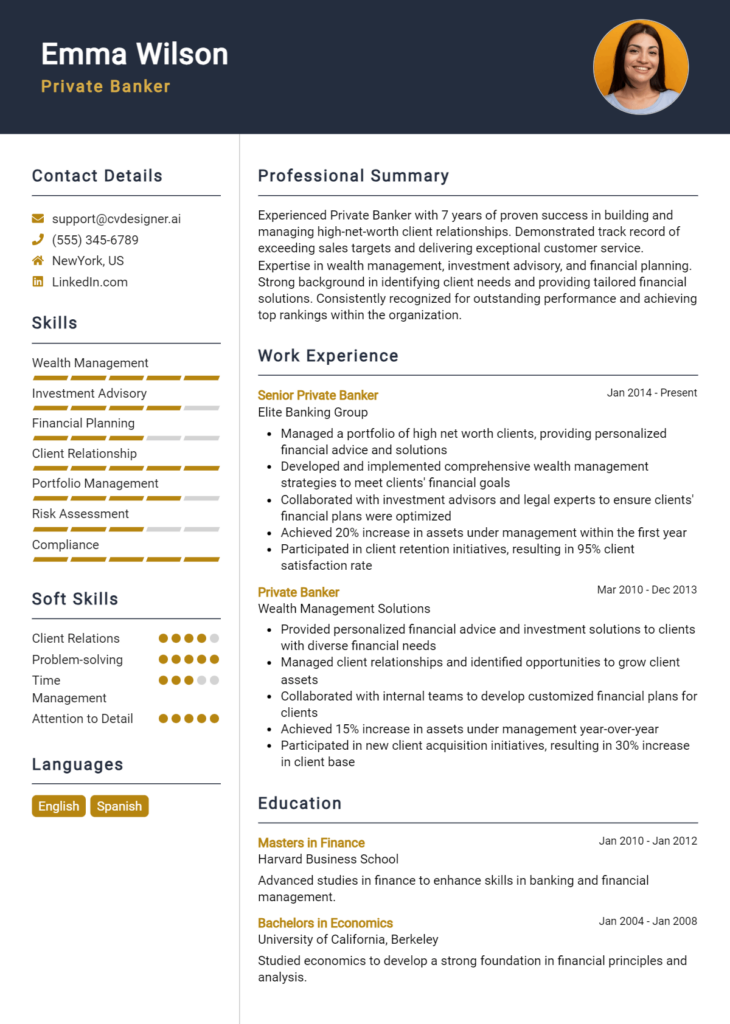

Example Wealth Manager Resume Summaries

Strong Resume Summaries

Results-driven Wealth Manager with over 10 years of experience in managing high-net-worth client portfolios, achieving an average annual return of 12%. Proven expertise in developing tailored investment strategies, leading to a 30% increase in client satisfaction ratings.

Dynamic financial advisor with a track record of growing client assets by $50 million in just three years. Skilled in risk assessment and long-term financial planning, adept at building lasting client relationships through trust and transparency.

Strategic Wealth Manager specializing in estate planning and tax optimization, successfully reducing clients' tax liabilities by an average of 25%. Recognized for exceptional client service and retention, with a 95% client renewal rate.

Weak Resume Summaries

Experienced financial professional looking to leverage skills in wealth management.

Wealth Manager with a diverse background in financial services, seeking new opportunities.

The examples provided illustrate the stark contrast between strong and weak resume summaries. Strong summaries emphasize quantifiable achievements, specific skills, and relevant experience, directly correlating with the requirements of the Wealth Manager role. In contrast, weak summaries lack detail, are overly generic, and fail to convey any measurable accomplishments, leaving hiring managers with little to evaluate. A compelling summary is essential for standing out in a competitive job market.

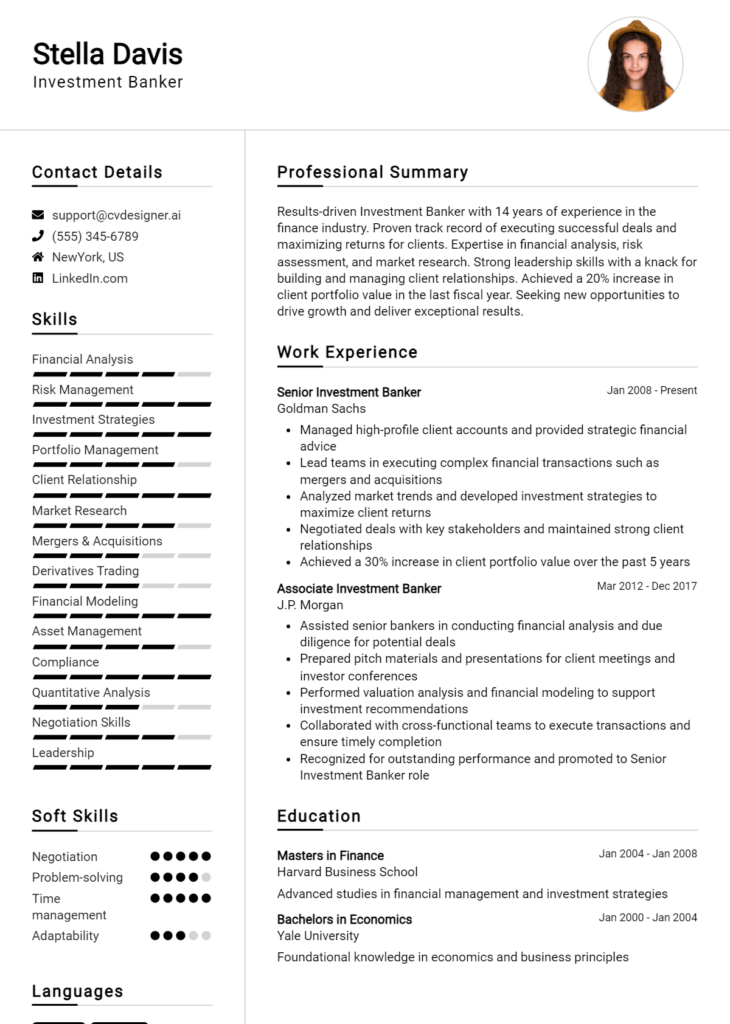

Work Experience Section for Wealth Manager Resume

The work experience section of a Wealth Manager resume is critical as it serves as a testament to the candidate's professional journey and expertise in the financial sector. This section not only highlights the candidate's technical skills, such as investment analysis, financial planning, and portfolio management, but also showcases their ability to lead teams and deliver high-quality financial products to clients. By quantifying achievements and aligning experiences with industry standards, candidates can effectively demonstrate their contribution to previous employers and their readiness to excel in future roles.

Best Practices for Wealth Manager Work Experience

- Emphasize technical expertise relevant to wealth management, such as financial modeling and risk assessment.

- Quantify achievements with specific metrics, like percentage growth in client portfolios or assets under management.

- Highlight leadership roles and team collaboration to showcase your ability to manage projects and drive results.

- Align your experiences with industry standards and best practices to demonstrate your familiarity with current trends.

- Use action verbs to convey your contributions clearly and effectively.

- Focus on client relationships and customer service excellence to underline your commitment to client needs.

- Include relevant certifications and training that enhance your qualifications as a wealth manager.

- Tailor your experiences to the specific job description to make your resume more targeted and impactful.

Example Work Experiences for Wealth Manager

Strong Experiences

- Led a team of financial analysts in developing a comprehensive investment strategy that resulted in a 25% increase in clients' average portfolio returns over two years.

- Managed a portfolio of high-net-worth clients, overseeing assets worth $150 million and achieving a client retention rate of 95% through personalized financial planning.

- Implemented a new financial planning software that streamlined client onboarding processes, reducing time spent by 30% and improving overall client satisfaction scores.

- Conducted in-depth market analysis and presented findings to senior management, leading to strategic investment decisions that increased company revenue by 15% in the last fiscal year.

Weak Experiences

- Worked on various financial projects with no clear outcomes or specific responsibilities.

- Assisted in client meetings without detailing the nature of contributions or results achieved.

- Responsible for managing client accounts but did not specify the size or impact of these accounts.

- Participated in team activities and discussions, but failed to highlight any leadership roles or quantifiable results.

The examples categorized as strong are considered effective because they provide specific details, highlight quantifiable achievements, and demonstrate leadership and collaboration within the wealth management context. In contrast, the weak experiences lack specificity, measurable outcomes, and do not illustrate the candidate's role or impact, making them less compelling to potential employers.

Education and Certifications Section for Wealth Manager Resume

The education and certifications section of a Wealth Manager resume is crucial as it showcases the candidate's academic background and industry-relevant credentials. This section not only highlights formal education but also emphasizes ongoing learning and professional development, which are vital in the constantly changing financial landscape. By including relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility, demonstrating their commitment to excellence and alignment with the demands of the wealth management role.

Best Practices for Wealth Manager Education and Certifications

- Focus on relevant degrees, such as Finance, Economics, or Business Administration.

- Highlight advanced certifications like CFA (Chartered Financial Analyst) or CFP (Certified Financial Planner).

- Include any specialized training or workshops that pertain specifically to wealth management.

- Provide details on relevant coursework that directly relates to investment strategies or financial planning.

- Keep the information concise and avoid overly technical jargon that may confuse the reader.

- Ensure that certifications are current and recognized within the industry, reflecting a dedication to professional growth.

- Consider adding professional development courses or seminars attended recently to showcase continuous learning.

- Organize the section in reverse chronological order, placing the most recent and relevant information at the top.

Example Education and Certifications for Wealth Manager

Strong Examples

- Bachelor of Science in Finance - University of ABC, Graduated May 2020

- Certified Financial Planner (CFP) - Certified in 2022

- Chartered Financial Analyst (CFA) Level I - Passed in June 2023

- Investment Strategies and Portfolio Management - Completed as part of MBA coursework

Weak Examples

- Associate of Arts in General Studies - Completed in 2015

- Certification in Basic Computer Skills - Obtained in 2010

- High School Diploma - Graduated in 2012

- Outdated certification in Real Estate Investment - Obtained in 2017

The examples listed as strong are considered relevant and demonstrate a direct connection to the skills and knowledge required in the wealth management field. They reflect up-to-date education and industry-recognized credentials that enhance the candidate's qualifications. In contrast, the weak examples lack relevance to wealth management, showcasing outdated or unrelated qualifications that do not contribute positively to the candidate's professional profile.

Top Skills & Keywords for Wealth Manager Resume

As a Wealth Manager, possessing the right skills is vital to effectively serving clients and managing their financial portfolios. A well-crafted resume that highlights both hard and soft skills can significantly enhance your prospects in this competitive field. The ability to demonstrate financial acumen, strong interpersonal skills, and strategic thinking will not only set you apart from other candidates but also convey your readiness to navigate complex financial landscapes. By showcasing these skills, you can reassure potential employers of your capability to foster client relationships, provide sound financial advice, and achieve their investment goals.

Top Hard & Soft Skills for Wealth Manager

Soft Skills

- Communication

- Relationship Building

- Empathy

- Active Listening

- Negotiation

- Problem-Solving

- Time Management

- Adaptability

- Critical Thinking

- Team Collaboration

Hard Skills

- Financial Analysis

- Investment Strategies

- Portfolio Management

- Tax Planning

- Risk Assessment

- Market Research

- Regulatory Compliance

- Financial Modeling

- Wealth Management Software Proficiency

- Performance Measurement

For a more comprehensive guide on enhancing your resume with the right skills and showcasing your work experience, explore the linked resources.

Stand Out with a Winning Wealth Manager Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Wealth Manager position at [Company Name] as advertised on [Job Portal/Company Website]. With over [X years] of experience in financial advising and portfolio management, I have developed a deep understanding of wealth accumulation strategies and client relationship management. My dedication to providing personalized financial solutions aligns perfectly with your firm's commitment to delivering exceptional client service.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of high-net-worth clients, consistently exceeding their financial objectives through tailored investment strategies and comprehensive financial planning. My ability to analyze market trends and tailor investment strategies has resulted in an average portfolio growth of [X%] over the past [X years]. I pride myself on building lasting relationships grounded in trust and transparency, and I believe that my proactive communication style allows me to effectively address clients' evolving financial needs.

I am particularly impressed by [Company Name]'s innovative approach to wealth management and commitment to ethical investing. I am eager to contribute my expertise in risk assessment and asset allocation to help your clients achieve their financial goals. I am also excited about the opportunity to collaborate with a team of professionals who share my passion for empowering clients through financial literacy and strategic planning.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms can contribute to the continued success of [Company Name]. I am eager to bring my wealth management expertise to your esteemed firm and help clients navigate their financial journeys with confidence.

Sincerely,

[Your Name]

[Your LinkedIn Profile or Contact Information]

Common Mistakes to Avoid in a Wealth Manager Resume

When applying for a Wealth Manager position, crafting a compelling resume is essential to stand out in a competitive field. However, many candidates make common mistakes that can hinder their chances of landing an interview. To help you create an impactful resume, here are some pitfalls to avoid:

Vague Job Descriptions: Failing to provide specific details about previous roles can leave hiring managers unclear about your actual experience and responsibilities. Use quantifiable achievements to highlight your contributions.

Overly Complex Language: Using jargon or complex terminology can alienate the reader. Keep your language clear and concise, ensuring that your accomplishments are easily understood.

Ignoring the Target Audience: Not tailoring your resume to the specific role or firm can result in a lack of relevance. Research the firm’s values and focus areas, and align your experience accordingly.

Neglecting Soft Skills: Wealth management is not solely about numbers; interpersonal skills are crucial. Omitting soft skills like communication and relationship-building can undermine your qualifications.

Inconsistent Formatting: A cluttered or inconsistent resume format can distract from the content. Use a clean, professional layout with uniform fonts and headings to enhance readability.

Lack of Keywords: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Failing to include industry-specific keywords may cause your resume to be overlooked. Analyze job descriptions for relevant terms.

Not Highlighting Professional Development: Wealth management is an evolving field. Ignoring certifications, courses, or professional memberships can make you appear stagnant. Always include relevant education and ongoing training.

Exceeding Length Recommendations: An overly long resume can make it difficult for hiring managers to identify key information. Aim for one page, or two if you have extensive experience, but keep it concise and relevant.

Conclusion

As we’ve explored throughout this article, the role of a Wealth Manager is multifaceted, requiring a blend of financial expertise, strong interpersonal skills, and an understanding of market dynamics. Wealth Managers not only help clients manage their investments but also guide them in making informed decisions to achieve their financial goals. Key skills highlighted include financial analysis, client relationship management, and strategic planning, all of which are essential for success in this competitive field.

In light of this information, it’s crucial to ensure that your resume effectively showcases your qualifications and experiences as a Wealth Manager. A well-crafted resume can make a significant difference in standing out to potential employers.

Now is the perfect time to review your Wealth Manager resume. Make sure it highlights your relevant skills and achievements in a way that aligns with industry standards. To assist you in this endeavor, there are several valuable resources available:

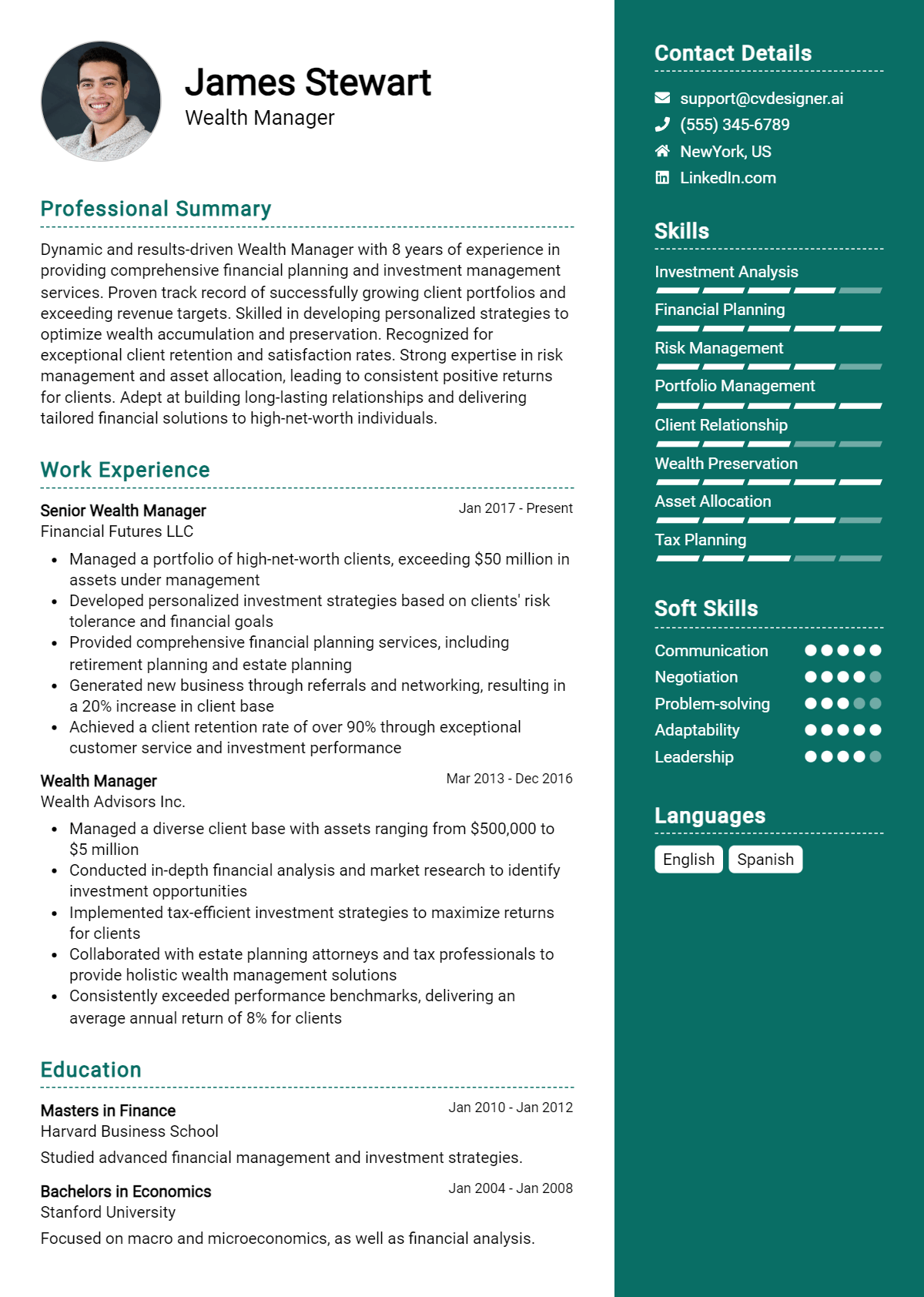

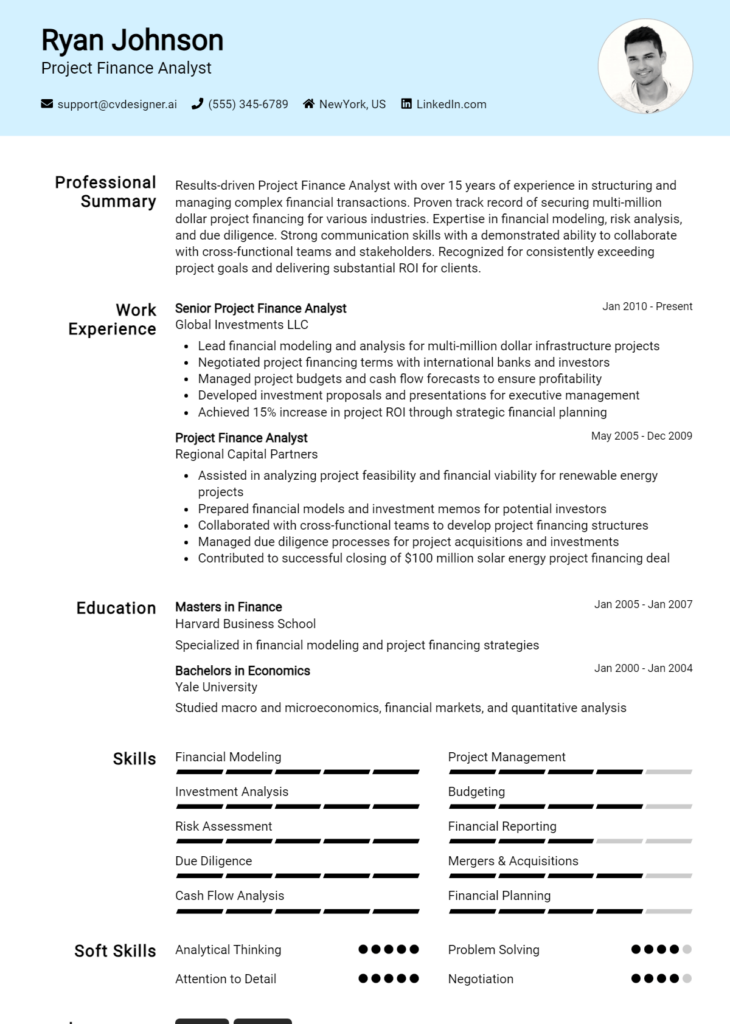

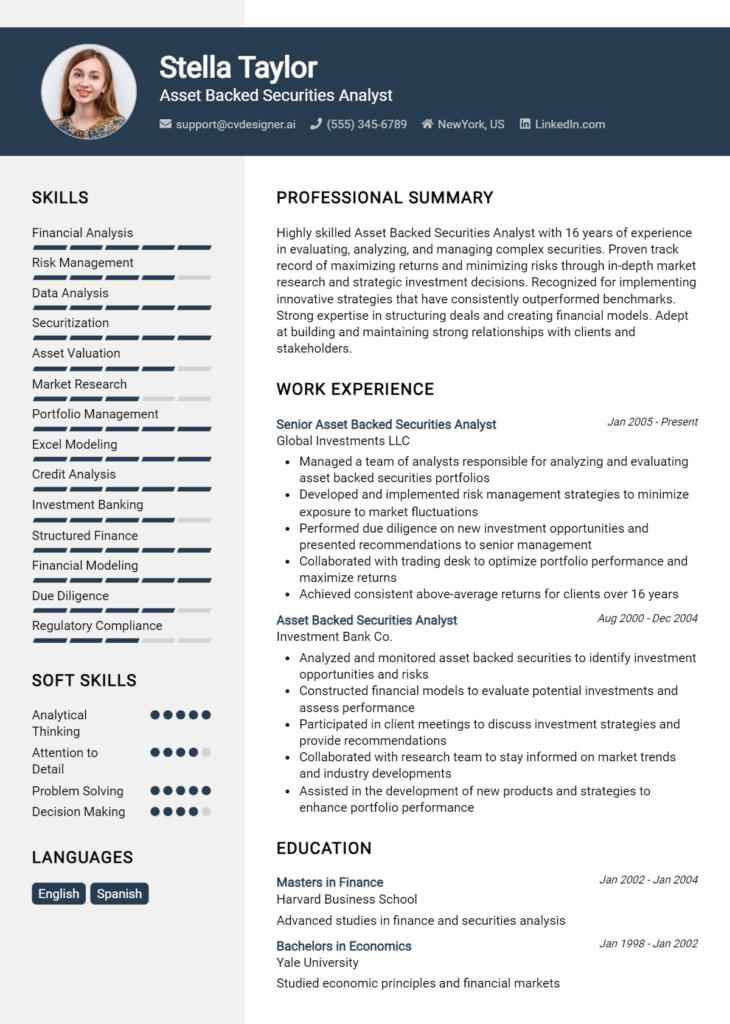

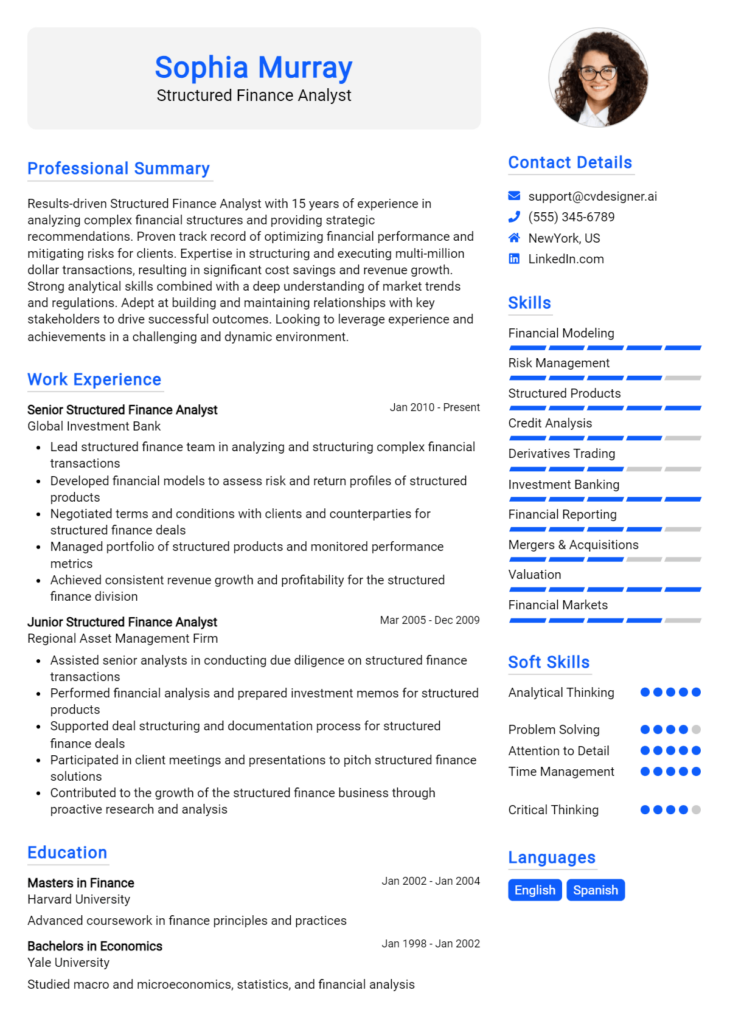

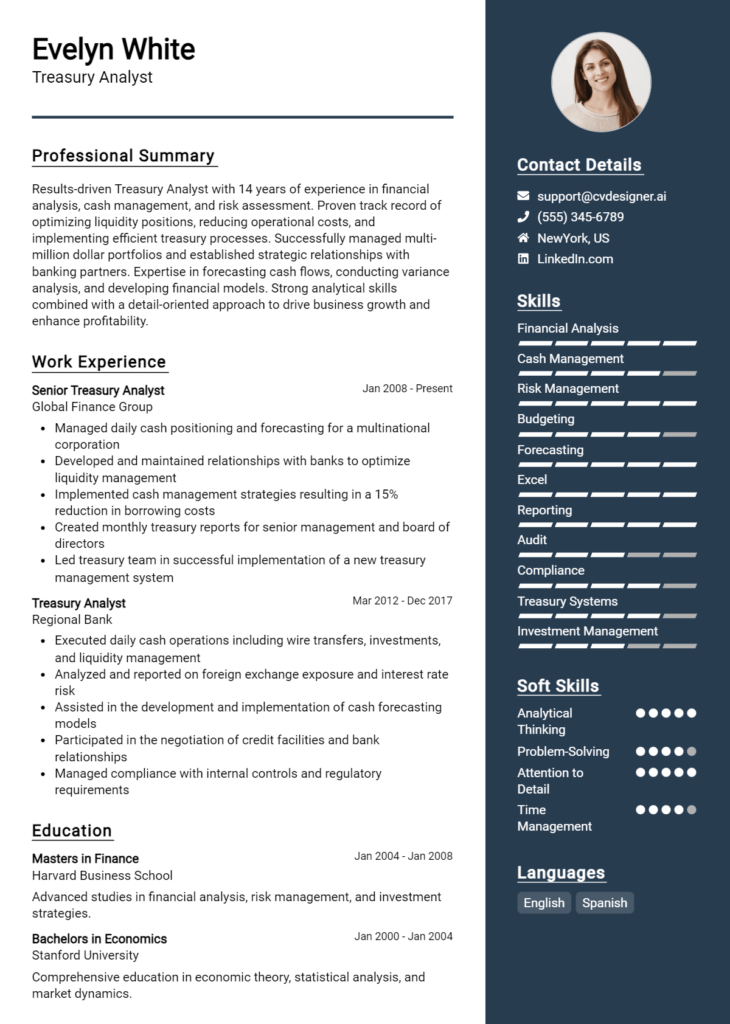

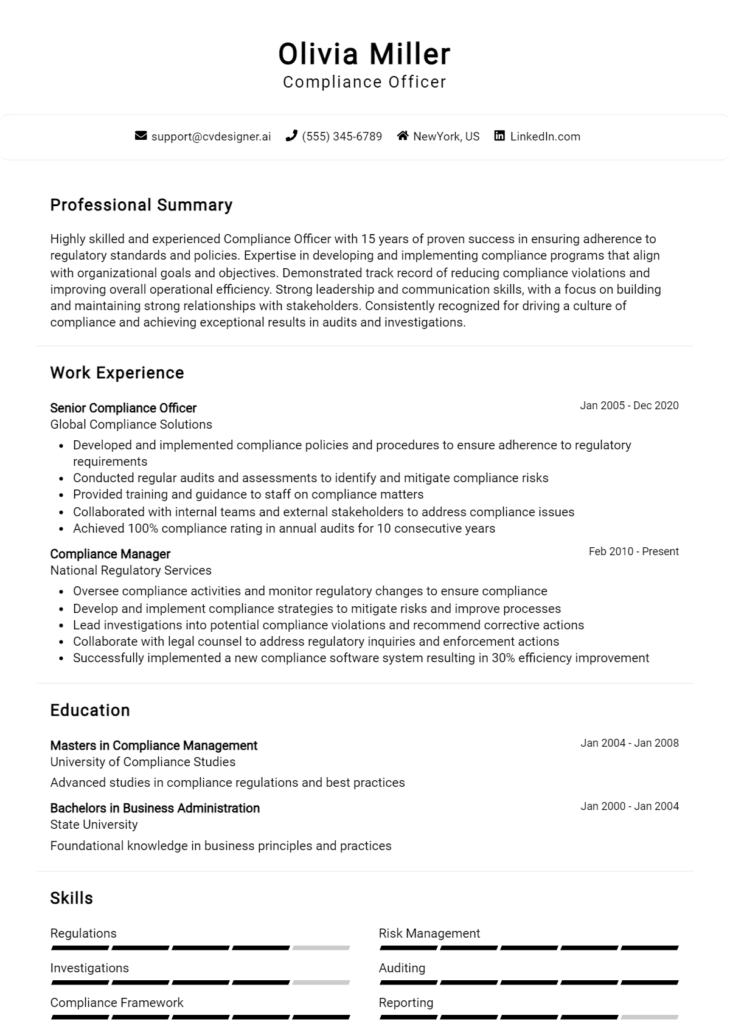

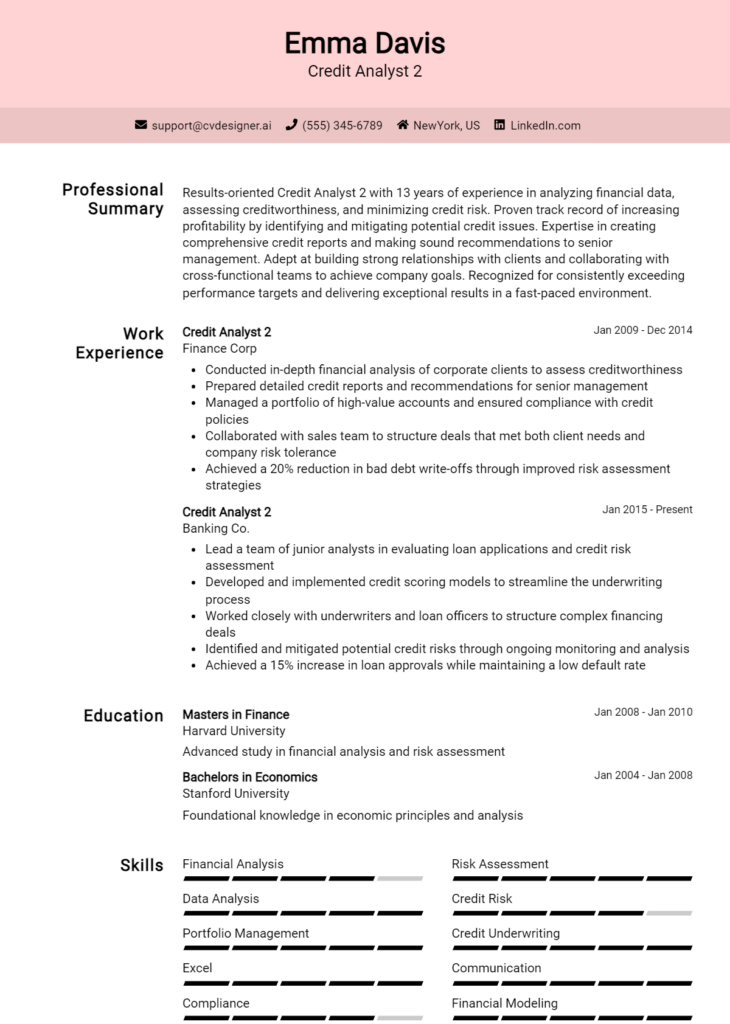

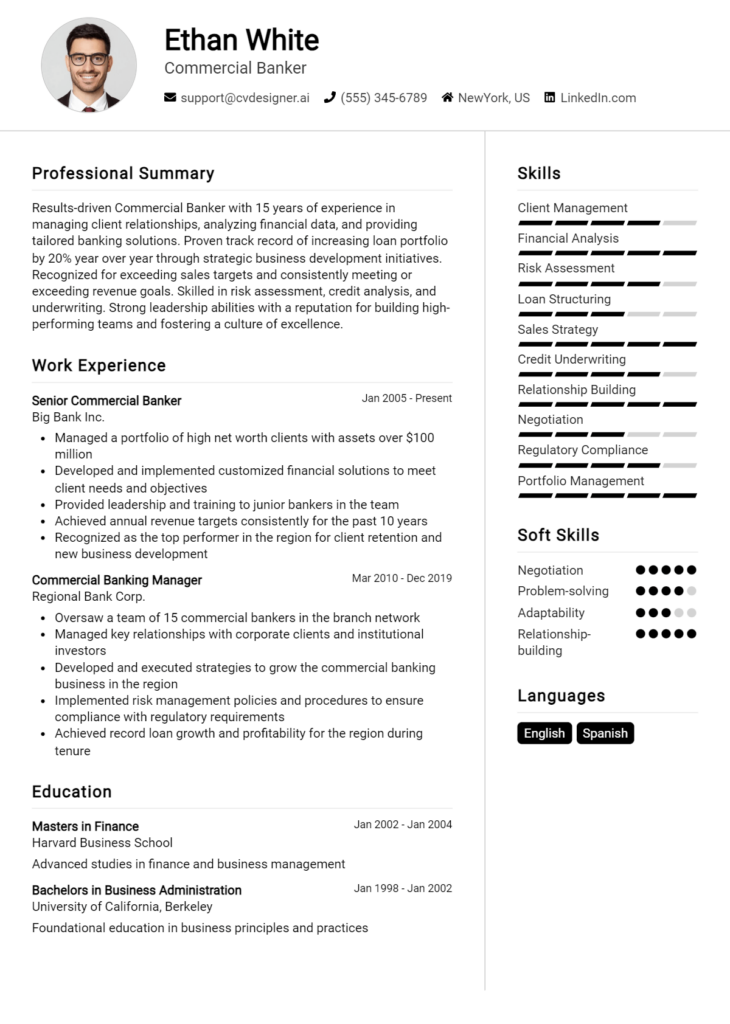

- Explore resume templates to find a design that suits your professional image.

- Utilize the resume builder for a user-friendly way to create a polished document tailored to your strengths.

- Check out resume examples to inspire the content and structure of your resume.

- Don’t forget to draft a compelling introduction with the help of cover letter templates that can enhance your application.

Take action today to refine your resume and position yourself for success in your career as a Wealth Manager!