22 Hard and Soft Skills to Put On Tax Auditor Resume for 2025

As a Tax Auditor, possessing a diverse skill set is crucial for effectively evaluating financial records and ensuring compliance with tax regulations. Highlighting the right skills on your resume can significantly enhance your candidacy and showcase your ability to navigate complex tax scenarios. In the following section, we will outline the top skills that every tax auditor should consider including in their resume to stand out in this competitive field.

Best Tax Auditor Technical Skills

Technical skills are crucial for tax auditors as they ensure accuracy and compliance in financial assessments and audits. Proficiency in these areas not only enhances the auditor's effectiveness but also builds trust with clients and regulatory bodies.

Tax Compliance Knowledge

This skill involves understanding tax laws, regulations, and compliance requirements essential for accurate reporting and auditing.

How to show it: Highlight specific tax codes and regulations you have mastered and the outcomes of your compliance assessments.

Financial Reporting

Ability to analyze financial statements and reports, ensuring they comply with GAAP or IFRS standards relevant to tax regulations.

How to show it: Include examples of financial reports you have audited and any discrepancies you identified and corrected.

Data Analysis

Proficiency in analyzing large volumes of financial data to identify trends, anomalies, and potential areas of concern.

How to show it: Quantify your experience with data analysis tools and specify the insights that led to significant financial improvements.

Tax Software Proficiency

Experience with tax preparation and auditing software (such as TurboTax, CCH Axcess, or ProSystem fx) to streamline the audit process.

How to show it: List specific software programs you are adept at and any efficiencies gained through their use.

Attention to Detail

This skill is critical for identifying discrepancies in financial records and ensuring accuracy in tax documents.

How to show it: Provide examples of successful audits where your attention to detail prevented potential financial penalties.

Regulatory Knowledge

Understanding of local, state, and federal tax regulations and how they impact tax auditing and compliance.

How to show it: Demonstrate knowledge of specific regulations and any contributions you made to ensure compliance in past roles.

Risk Assessment

Ability to evaluate financial risks and implement controls to mitigate potential issues during audits.

How to show it: Describe instances where you identified risks and the measures taken to reduce them effectively.

Interpersonal Communication

Strong communication skills to effectively convey audit findings and collaborate with clients and team members.

How to show it: Highlight successful presentations or reports and feedback received from clients or supervisors.

Project Management

Ability to manage multiple audits and deadlines efficiently, ensuring timely completion of tasks.

How to show it: List the number of audits managed simultaneously and any projects completed ahead of schedule.

Knowledge of Accounting Principles

Understanding of fundamental accounting principles, which are essential for accurate tax reporting and auditing.

How to show it: Provide examples of how your accounting knowledge has positively impacted audit outcomes.

Ethics and Integrity

Upholding the highest ethical standards in all audit processes to maintain credibility and trust in the profession.

How to show it: Share instances where your ethical judgment influenced audit decisions or outcomes.

Best Tax Auditor Soft Skills

Soft skills are essential for Tax Auditors as they enhance not only individual performance but also contribute to team dynamics and client relationships. These skills help auditors communicate effectively, solve complex problems, manage time efficiently, and work collaboratively, ensuring compliance and accuracy in financial assessments.

Attention to Detail

Precision is crucial in auditing; small errors can lead to significant financial discrepancies. Tax Auditors must meticulously review financial documents and identify inconsistencies.

How to show it: Include examples of successful audits where your attention to detail prevented errors or identified issues, perhaps citing specific figures.

Communication

Effective communication is vital for Tax Auditors to explain complex tax regulations and findings clearly to clients and stakeholders.

How to show it: Highlight instances where you delivered presentations or wrote reports that clarified tax situations or audit results.

Problem-solving

Tax Auditors often encounter unexpected issues; strong problem-solving skills enable them to navigate challenges and find solutions efficiently.

How to show it: Demonstrate how you identified and resolved discrepancies in financial records, potentially leading to cost savings.

Time Management

Tax Auditors must juggle multiple audits and deadlines; effective time management ensures they meet due dates while maintaining quality.

How to show it: Provide examples of how you prioritized tasks or managed time during peak tax seasons to complete audits on schedule.

Teamwork

Collaboration with colleagues and other departments is key in auditing to ensure comprehensive reviews and adherence to regulations.

How to show it: Describe projects where you worked as part of a team, emphasizing your role and the outcome of your collaboration.

Analytical Thinking

Analytical skills are crucial for dissecting financial data and identifying trends or anomalies that could indicate issues.

How to show it: Share instances where your analysis led to significant findings or improved audit processes.

Integrity

Integrity is paramount in auditing, as professionals must uphold ethical standards and maintain confidentiality in financial matters.

How to show it: Highlight your commitment to ethical practices in audits and how it built trust with clients.

Adaptability

The tax landscape is constantly changing; Tax Auditors must adapt to new regulations and technologies to stay effective.

How to show it: Provide examples of how you successfully adapted to changes in tax laws or auditing standards.

Critical Thinking

Critical thinking allows Tax Auditors to evaluate complex situations and make informed decisions based on their findings.

How to show it: Discuss specific cases where your critical thinking skills led to effective audit solutions.

Research Skills

Tax Auditors often need to conduct thorough research to stay updated on tax laws and regulations that affect their audits.

How to show it: Mention instances where your research led to successful audits or compliance with new regulations.

Interpersonal Skills

Building positive relationships with clients and colleagues is vital for a smooth audit process and successful outcomes.

How to show it: Illustrate how your interpersonal skills helped in client interactions or team collaborations.

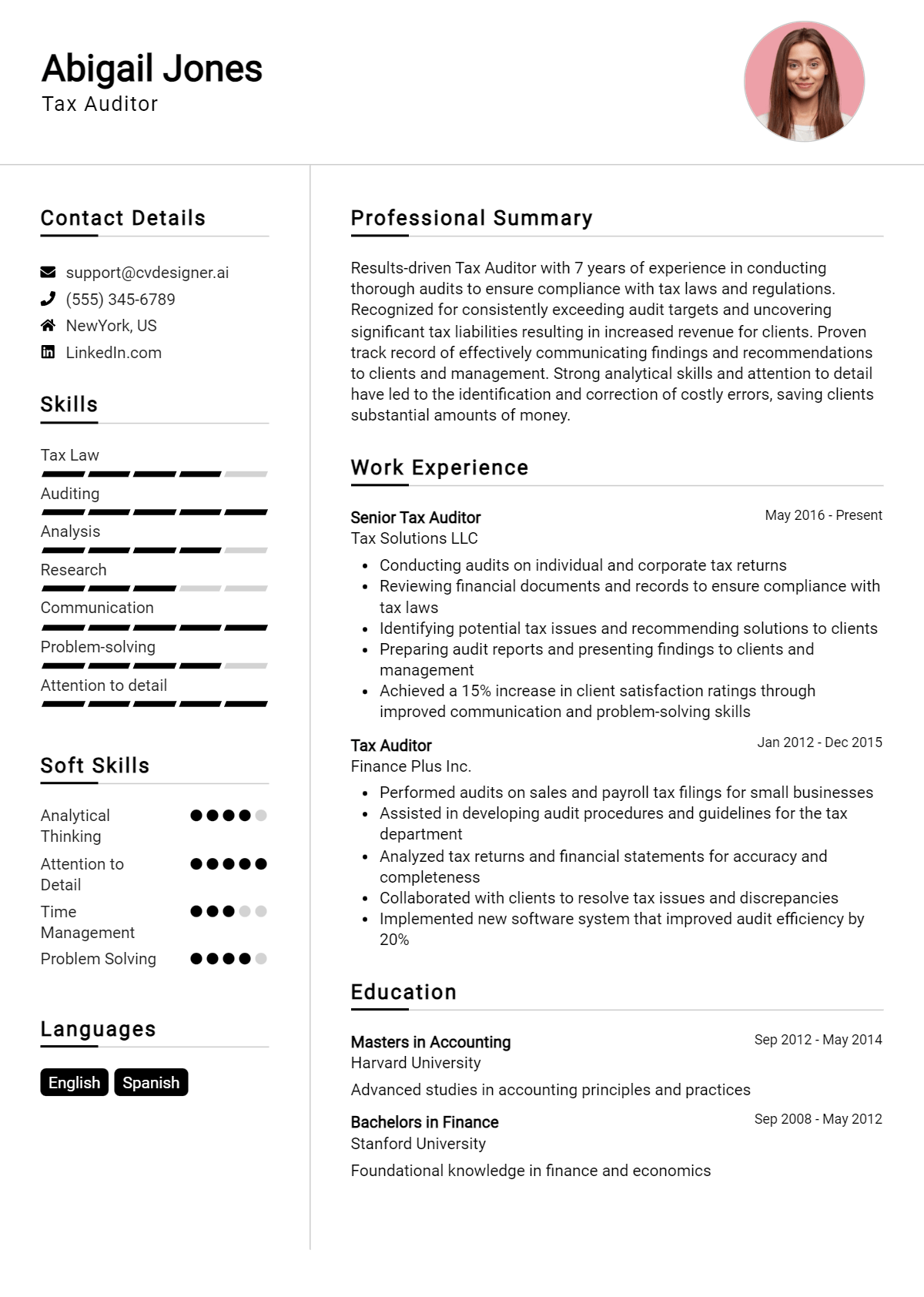

How to List Tax Auditor Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to employers, especially in a specialized field like tax auditing. By highlighting your skills in various sections of your resume—such as the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter—you can give hiring managers a comprehensive overview of your qualifications.

for Resume Summary

Showcasing your Tax Auditor skills in the introduction section provides hiring managers with a quick overview of your qualifications and sets the tone for your resume.

Example

As a highly skilled Tax Auditor with expertise in compliance audits and financial analysis, I have a proven track record of identifying discrepancies and ensuring regulatory adherence, resulting in substantial cost savings for my clients.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Tax Auditor skills have been applied in real-world scenarios.

Example

- Conducted in-depth compliance audits for various clients, leading to a 30% reduction in tax liabilities.

- Utilized analytical skills to identify patterns in financial data that uncovered potential fraudulent activities.

- Worked collaboratively with cross-functional teams to streamline reporting processes, enhancing efficiency by 25%.

- Developed comprehensive training materials on tax regulations, improving team knowledge and compliance rates.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills is essential to demonstrate your overall qualifications.

Example

- Tax Compliance

- Financial Reporting

- Analytical Thinking

- Attention to Detail

- Regulatory Knowledge

- Problem Solving

- Communication Skills

- Time Management

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provides a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how those skills have positively impacted your previous roles.

Example

With my strong background in tax compliance and financial analysis, I have consistently ensured that clients meet regulatory standards while optimizing their tax positions. My ability to communicate complex tax concepts clearly has led to improved client relationships and increased satisfaction.

Remember to link the skills mentioned in your resume to specific achievements in your cover letter, reinforcing your qualifications for the job.

The Importance of Tax Auditor Resume Skills

Highlighting relevant skills in a Tax Auditor resume is crucial for making a strong impression on potential employers. A well-crafted skills section not only helps candidates stand out to recruiters but also aligns their qualifications with the specific job requirements. It showcases the candidate's expertise and demonstrates their ability to effectively analyze financial data, ensure compliance, and provide valuable insights to organizations.

- Demonstrates Compliance Knowledge: A strong skills section reflects the candidate's understanding of tax regulations and compliance requirements, which are essential for a Tax Auditor role.

- Showcases Analytical Abilities: Tax Auditors must possess strong analytical skills to assess financial records accurately. Highlighting these skills can attract employers looking for detail-oriented professionals.

- Indicates Communication Proficiency: Effective communication is key in this role, as Tax Auditors often need to explain complex tax issues clearly to clients or colleagues.

- Emphasizes Problem-Solving Skills: Employers value candidates who can identify discrepancies and offer solutions. Showcasing problem-solving abilities can set a candidate apart from others.

- Highlights Technical Proficiency: Familiarity with accounting software and tax preparation tools is critical. Listing these technical skills can demonstrate a candidate's readiness for the job.

- Reflects Organizational Skills: Tax Auditors must manage multiple cases simultaneously. Strong organizational skills are vital, and including them in a resume can assure employers of the candidate's capability.

- Illustrates Attention to Detail: Tax Auditors need to scrutinize detailed financial documents. Emphasizing attention to detail can assure recruiters of a candidate's thoroughness in their work.

- Demonstrates Ethical Standards: A solid skills section can reflect a candidate's commitment to ethical practices, which is fundamental in the field of tax auditing.

For additional inspiration, check out various Resume Samples.

How To Improve Tax Auditor Resume Skills

In the ever-evolving landscape of tax regulations and financial practices, it is crucial for tax auditors to continuously enhance their skills. This not only ensures compliance with the latest laws but also improves the quality of audits and boosts career prospects. By staying updated and refining abilities, tax auditors can provide greater value to their clients and employers.

- Attend relevant workshops and seminars to stay updated on tax law changes and best practices.

- Obtain certifications such as CPA or CIA to enhance credibility and knowledge in the field.

- Utilize online courses and webinars focused on auditing techniques and financial analysis.

- Join professional organizations to network with peers and gain insights into industry trends.

- Practice analytical skills by working on real-world case studies or simulations.

- Seek feedback from colleagues to identify areas for improvement in auditing processes.

- Read industry publications and research papers to deepen understanding of complex tax issues.

Frequently Asked Questions

What are the key skills required for a Tax Auditor?

Key skills for a Tax Auditor include strong analytical abilities, attention to detail, and proficiency in tax laws and regulations. Additionally, excellent communication skills are essential for effectively conveying findings and recommendations to clients or management. Familiarity with accounting software and tools, as well as problem-solving skills, are also critical in ensuring accurate audits and compliance.

How important is attention to detail for a Tax Auditor?

Attention to detail is crucial for a Tax Auditor, as even minor errors in financial data can lead to significant discrepancies in tax reporting and compliance. A meticulous approach ensures that all aspects of financial records are thoroughly reviewed, helping to identify potential issues and minimizing the risk of audits or penalties from tax authorities.

What software skills should a Tax Auditor possess?

A Tax Auditor should be proficient in various accounting and tax software, such as QuickBooks, TurboTax, and Excel. Familiarity with spreadsheet functions, data analysis tools, and electronic filing systems is also important for efficiently managing large amounts of financial data and ensuring accurate reporting.

How does communication play a role in a Tax Auditor's responsibilities?

Effective communication is vital for a Tax Auditor, as they must clearly explain complex tax concepts and audit findings to clients, stakeholders, and colleagues. This includes writing detailed reports, conducting presentations, and engaging in discussions to resolve issues. Strong interpersonal skills help build trust and facilitate collaboration with clients during the auditing process.

What problem-solving skills are necessary for a Tax Auditor?

Problem-solving skills are essential for a Tax Auditor to navigate complex financial situations and identify discrepancies in tax filings. Auditors must be able to analyze data, think critically, and develop strategic solutions to address any issues that arise. This ability to troubleshoot effectively ensures compliance and helps clients optimize their tax positions.

Conclusion

Incorporating Tax Auditor skills into your resume is crucial for demonstrating your expertise and commitment to the field. By showcasing relevant skills, you not only stand out among other candidates but also illustrate the value you can bring to potential employers. Highlighting your abilities can make a significant difference in attracting the attention of hiring managers and securing interviews.

As you refine your skills and enhance your resume, remember that each step you take brings you closer to your career goals. Embrace the journey of professional development, and take advantage of available resources such as our resume templates, resume builder, resume examples, and cover letter templates to create a compelling job application. Your future success is just around the corner—keep pushing forward!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.