Tax Auditor Core Responsibilities

A Tax Auditor plays a crucial role in ensuring compliance with tax regulations, requiring a blend of technical expertise, operational knowledge, and problem-solving abilities. This professional collaborates across various departments, from finance to legal, to conduct thorough audits and identify discrepancies. Strong analytical skills enable Tax Auditors to interpret complex data, enhancing organizational efficiency and regulatory adherence. A well-structured resume that highlights these qualifications is essential for showcasing one's ability to contribute to the organization’s financial integrity and success.

Common Responsibilities Listed on Tax Auditor Resume

- Conduct thorough audits of financial records and tax returns.

- Analyze financial data for accuracy and compliance with tax laws.

- Identify discrepancies and recommend corrective actions.

- Prepare detailed reports and documentation of audit findings.

- Collaborate with internal departments to resolve tax-related issues.

- Stay updated on changes in tax legislation and regulations.

- Provide guidance on tax planning and risk management.

- Assist in the preparation of tax returns and filings.

- Communicate findings to management and stakeholders effectively.

- Support external audits by providing necessary documentation.

- Maintain confidentiality and security of sensitive financial information.

- Utilize accounting software and tools for data analysis.

High-Level Resume Tips for Tax Auditor Professionals

In the competitive field of tax auditing, a well-crafted resume serves as your personal marketing tool, often being the first impression you make on potential employers. A strong resume must reflect not only your skills and qualifications but also your achievements in previous roles. As a Tax Auditor, your resume should convey your expertise in tax regulations, analytical abilities, and attention to detail. This guide aims to provide practical and actionable resume tips specifically tailored for Tax Auditor professionals, ensuring you effectively showcase your qualifications and stand out in the hiring process.

Top Resume Tips for Tax Auditor Professionals

- Tailor your resume to the job description by incorporating keywords and phrases from the posting.

- Highlight relevant experience, focusing on positions that involved tax preparation, auditing, or compliance.

- Quantify your achievements with specific metrics, such as the percentage of audit errors reduced or tax savings achieved for clients.

- Include industry-specific skills, such as knowledge of tax laws, accounting software, and regulatory compliance.

- Utilize a clear and professional format that enhances readability and draws attention to key information.

- Showcase certifications and professional development, such as CPA or CAA, as these can set you apart from other candidates.

- Incorporate relevant technical skills, including proficiency in tax preparation software and data analysis tools.

- Demonstrate soft skills, like communication and problem-solving abilities, which are essential in dealing with clients and tax authorities.

- Use bullet points for easy navigation and to make your accomplishments stand out more effectively.

- Keep your resume concise, ideally one page, while ensuring all pertinent information is clearly presented.

By implementing these targeted resume tips, you can significantly enhance your chances of landing a job in the Tax Auditor field. A polished and tailored resume not only showcases your qualifications but also reflects your professionalism and commitment to the role, making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Tax Auditor

In the competitive field of tax auditing, a well-crafted resume headline or title is crucial for standing out in a crowded job market. A strong headline can immediately grab the attention of hiring managers, acting as a summary of a candidate's key qualifications in one impactful phrase. It serves not only to highlight the applicant's expertise but also to set the tone for the rest of the resume. A concise and relevant headline that directly relates to the job being applied for can significantly enhance a candidate's chances of making a memorable first impression.

Best Practices for Crafting Resume Headlines for Tax Auditor

- Be concise: Aim for a headline that is brief yet informative, ideally one sentence or phrase.

- Use role-specific language: Incorporate terminology and keywords relevant to tax auditing to demonstrate familiarity with the field.

- Highlight key skills: Focus on your strongest skills or qualifications that directly relate to the tax auditor position.

- Quantify achievements: Whenever possible, include numbers or metrics to showcase your accomplishments.

- Tailor to the job description: Customize your headline based on the specific requirements and preferences mentioned in the job listing.

- Maintain professionalism: Use a formal tone that reflects the seriousness of the tax auditing profession.

- Showcase certifications: If applicable, mention relevant certifications or licenses that enhance your credibility.

- Make it impactful: Use strong action verbs or adjectives that convey confidence and competence.

Example Resume Headlines for Tax Auditor

Strong Resume Headlines

Detail-Oriented Tax Auditor with Over 5 Years of Experience in Compliance and Reporting

Certified Public Accountant Specializing in Taxation and Financial Analysis

Results-Driven Tax Auditor with a Proven Track Record of Identifying Savings and Mitigating Risks

Weak Resume Headlines

Tax Auditor Looking for a Job

Experienced Professional in Finance

The strong headlines are effective because they clearly articulate the candidate's specific skills, experience, and professional standing, making them immediately relevant to the hiring manager. They avoid ambiguity and convey a clear message about what the candidate brings to the table. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity; they do not capture the candidate's unique qualifications or demonstrate a clear understanding of the role, making it easy for hiring managers to overlook them.

Writing an Exceptional Tax Auditor Resume Summary

A well-crafted resume summary is crucial for a Tax Auditor as it serves as the first impression for hiring managers. This brief paragraph should effectively encapsulate a candidate’s key skills, relevant experience, and notable accomplishments in a way that resonates with the needs of the employer. An impactful summary grabs attention quickly, providing a snapshot of professional qualifications that aligns directly with the job description. It should be concise, engaging, and tailored to highlight what makes the candidate stand out in the competitive field of tax auditing.

Best Practices for Writing a Tax Auditor Resume Summary

- Quantify Achievements: Include specific numbers and results to showcase your impact and effectiveness.

- Focus on Skills: Highlight both technical and soft skills that are pertinent to the tax auditing role.

- Tailor the Summary: Customize your summary for each job application to align with the job description and company values.

- Be Concise: Aim for 3-5 sentences that deliver a powerful message without unnecessary fluff.

- Use Action Words: Start with strong action verbs to convey confidence and proactivity.

- Highlight Relevant Experience: Mention your years of experience, industry knowledge, and specific areas of expertise in tax auditing.

- Showcase Certifications: If applicable, include any relevant certifications or licenses that enhance your credibility.

- Maintain Professional Tone: Keep the language formal yet approachable to reflect professionalism.

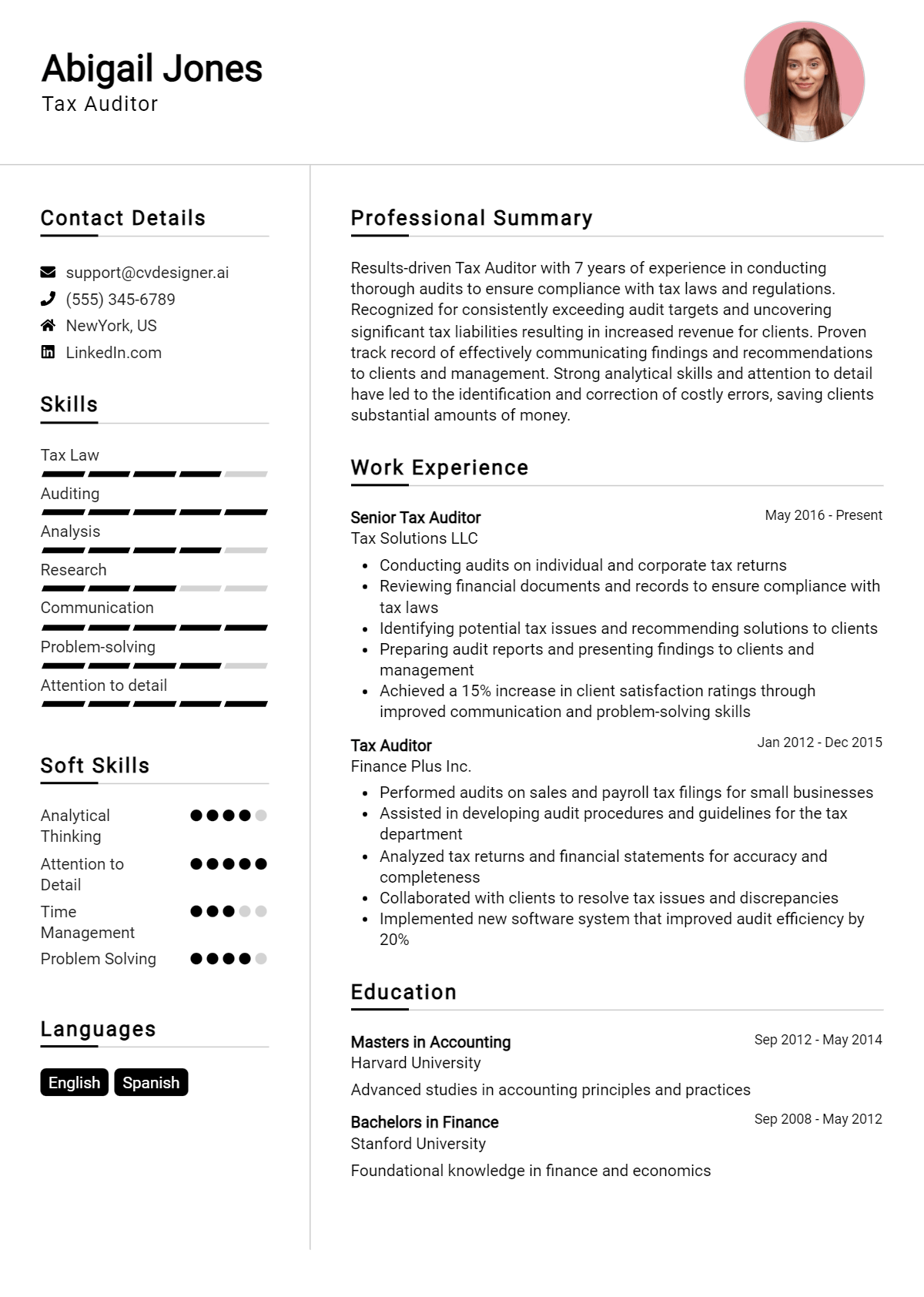

Example Tax Auditor Resume Summaries

Strong Resume Summaries

Detail-oriented Tax Auditor with over 7 years of experience in financial compliance and regulatory auditing, successfully identifying discrepancies that resulted in a 15% reduction in tax liabilities for clients, saving them over $500,000 annually.

Certified Tax Auditor with expertise in forensic accounting and risk assessment, having led audits that uncovered over $1 million in unreported income, enhancing corporate transparency and compliance.

Results-driven Tax Auditor skilled in utilizing advanced auditing software to streamline processes, reducing audit completion time by 30% while ensuring 100% compliance with IRS regulations.

Experienced Tax Auditor with a proven track record of preparing detailed reports and recommendations, contributing to a 20% increase in audit efficiency and a 95% satisfaction rate among clients.

Weak Resume Summaries

I am a Tax Auditor with some experience in the field. I do a variety of tasks related to taxes.

Motivated professional seeking a challenging position in tax auditing. I have good analytical skills.

The strong resume summaries are considered effective because they provide specific details about the candidate's experience, quantifiable achievements, and relevant skills that directly align with the requirements of a Tax Auditor role. They convey a clear narrative of success and expertise. Conversely, the weak summaries lack specificity and measurable outcomes, making them appear generic and unimpactful, which fails to capture the attention of hiring managers.

Work Experience Section for Tax Auditor Resume

The work experience section of a Tax Auditor resume is pivotal in demonstrating a candidate's professional journey, showcasing critical technical skills, leadership abilities, and commitment to delivering high-quality audit outcomes. This section serves as a narrative of the candidate's growth in the field, illustrating their proficiency in tax laws, compliance, and financial analysis. By quantifying achievements, such as improved audit accuracy rates or significant cost savings for clients, candidates can provide tangible evidence of their contributions. Additionally, aligning work experience with industry standards ensures that the candidate meets the expectations of potential employers, reinforcing their qualifications as a skilled tax auditor.

Best Practices for Tax Auditor Work Experience

- Highlight specific technical skills relevant to tax auditing, such as knowledge of tax software and regulatory compliance.

- Quantify achievements, using metrics like percentage improvements in audit efficiency or annual tax savings generated.

- Emphasize collaboration by detailing experiences working with cross-functional teams, such as legal and accounting.

- Use action verbs to convey a proactive approach, such as "led," "developed," or "analyzed."

- Focus on results-driven narratives that illustrate how you contributed to organizational objectives.

- Include relevant certifications and training that enhance your qualifications as a tax auditor.

- Tailor experiences to align with the job description, ensuring relevance to potential employers.

- Keep descriptions concise yet informative, ensuring clarity and easy readability.

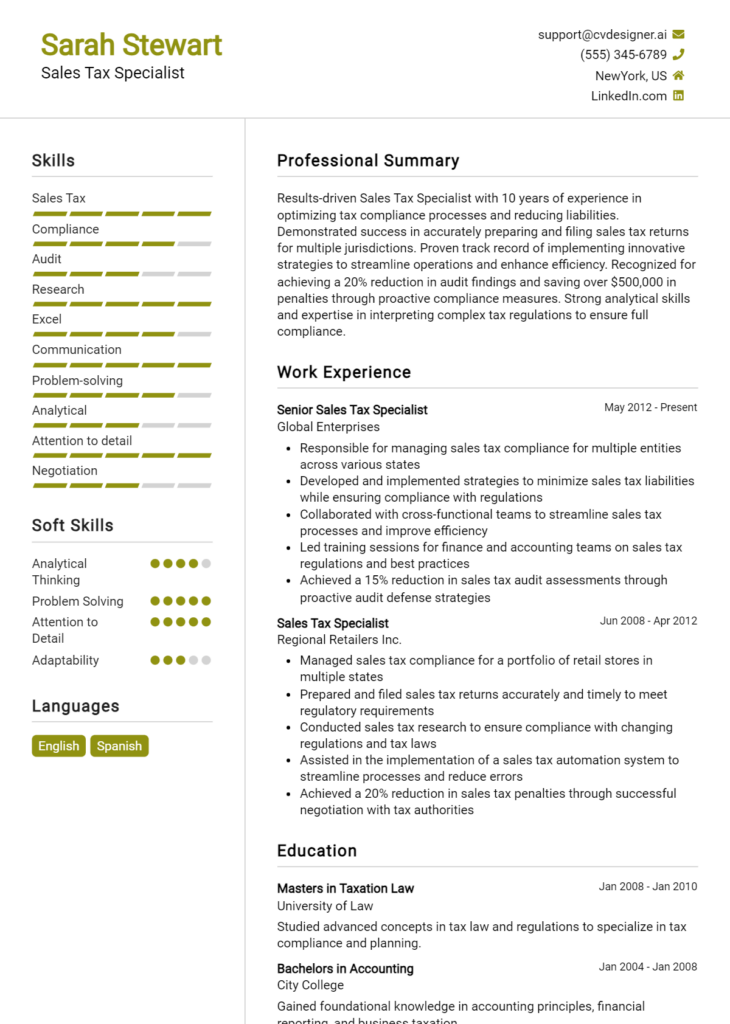

Example Work Experiences for Tax Auditor

Strong Experiences

- Led a team of 5 auditors in a comprehensive tax compliance review, resulting in a 30% reduction in discrepancies and saving the firm $200,000 in potential penalties.

- Implemented a new auditing software that improved audit turnaround time by 25%, enhancing client satisfaction and retention rates.

- Collaborated with legal advisors to successfully navigate complex tax disputes, achieving a favorable outcome in 90% of cases.

- Developed training materials for junior auditors, improving team competency and reducing onboarding time by 40%.

Weak Experiences

- Responsible for reviewing tax documents and ensuring compliance.

- Assisted in audits and contributed to team efforts.

- Participated in meetings to discuss tax-related issues.

- Helped with general tax filing processes.

The examples categorized as strong demonstrate clear, quantifiable outcomes that reflect the candidate's impact in previous roles, showcasing their technical leadership and ability to work collaboratively. In contrast, the weak examples lack specificity and measurable results, making them less compelling. Strong experiences provide potential employers with a clearer picture of the candidate's capabilities, while weak experiences fail to convey any significant contributions or achievements.

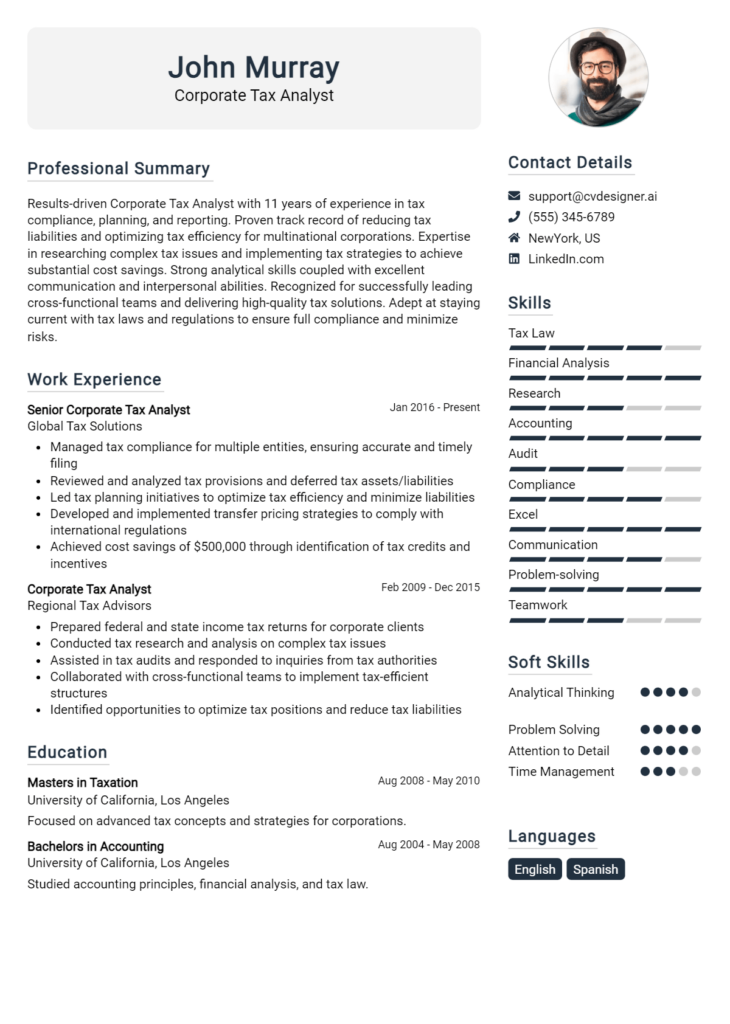

Education and Certifications Section for Tax Auditor Resume

The education and certifications section of a Tax Auditor resume is a critical component that showcases the candidate's academic achievements and professional qualifications. This section not only highlights their foundational knowledge in taxation, accounting, and finance but also demonstrates their commitment to maintaining industry-relevant certifications and engaging in continuous learning. By providing details on relevant coursework, specialized training, and recognized certifications, candidates can significantly enhance their credibility, making them more appealing to potential employers. A well-constructed education and certifications section aligns the candidate's qualifications with the demands of the job role, showcasing their preparedness to excel in tax auditing responsibilities.

Best Practices for Tax Auditor Education and Certifications

- Include only relevant degrees, such as Accounting, Finance, or Taxation.

- Highlight industry-recognized certifications such as CPA (Certified Public Accountant), EA (Enrolled Agent), or CTC (Certified Tax Coach).

- Detail any relevant coursework that directly pertains to tax laws, auditing practices, or financial regulations.

- List any specialized training programs or workshops attended that enhance auditing skills.

- Provide dates of completion for degrees and certifications to demonstrate currency.

- Prioritize certifications that require ongoing education to reflect a commitment to continuous professional development.

- Use a clear format that distinguishes between degrees and certifications for easy reading.

- Avoid listing high school diplomas unless no higher education is completed.

Example Education and Certifications for Tax Auditor

Strong Examples

- Bachelor of Science in Accounting, University of XYZ, Graduated May 2020

- Certified Public Accountant (CPA), Licensed in State ABC, Active since 2021

- Advanced Taxation Course, Online Learning Institute, Completed August 2022

- Enrolled Agent (EA), Authorized to represent taxpayers before the IRS, Obtained January 2023

Weak Examples

- Associate Degree in General Studies, Community College of ABC, Graduated June 2018

- Certificate in Basic Computer Skills, Online Learning Platform, Completed July 2021

- High School Diploma, XYZ High School, Graduated June 2016

- Outdated Certification in Basic Accounting, Expired 2019

The strong examples listed showcase relevant educational qualifications and certifications that directly align with the requirements of a Tax Auditor role, reflecting both educational rigor and professional competency. Conversely, the weak examples illustrate qualifications that lack relevance to the position, either because they are outdated, too basic, or do not pertain to the field of tax auditing. Highlighting strong examples is essential for demonstrating qualifications that meet industry standards and expectations.

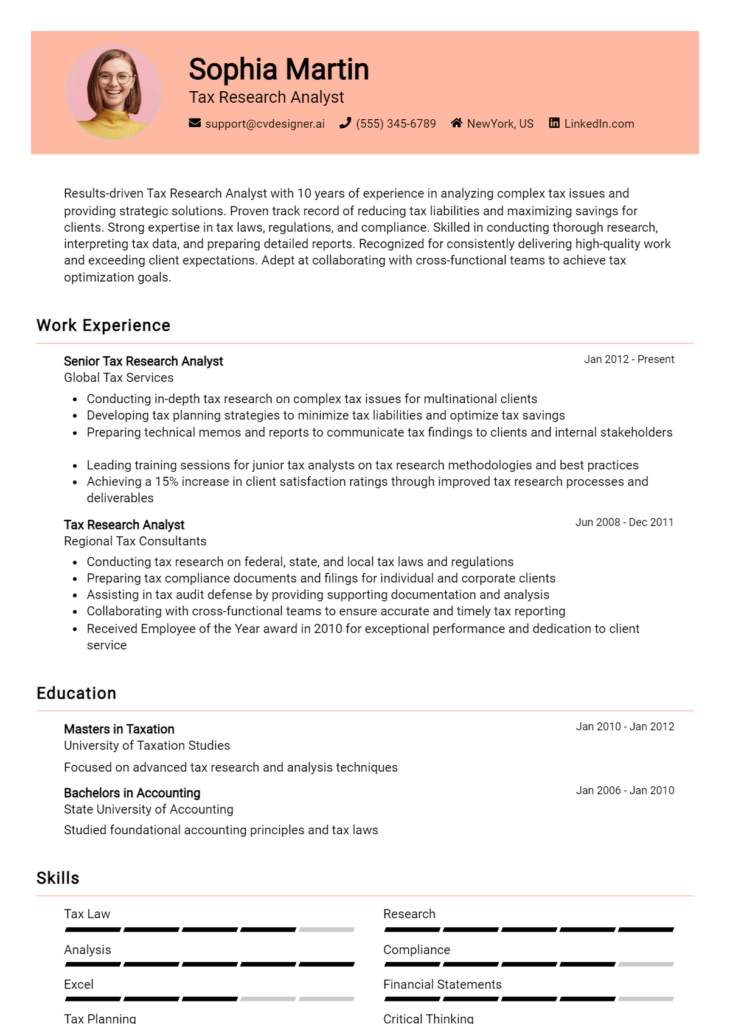

Top Skills & Keywords for Tax Auditor Resume

In the competitive field of tax auditing, having a well-crafted resume that highlights relevant skills is essential for standing out to potential employers. Skills not only demonstrate your qualifications but also reflect your ability to analyze complex financial data, communicate effectively, and adhere to regulatory standards. A strong combination of hard and soft skills can significantly enhance your candidacy, showcasing your expertise in both technical aspects of tax auditing and interpersonal interactions with clients and colleagues. By focusing on these skills, you can create a compelling resume that aligns with the demands of the job and increases your chances of securing an interview.

Top Hard & Soft Skills for Tax Auditor

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Communication Skills

- Time Management

- Team Collaboration

- Adaptability

- Ethical Judgment

- Customer Service Orientation

- Critical Thinking

- Conflict Resolution

- Organization Skills

- Leadership Abilities

- Interpersonal Skills

Hard Skills

- Tax Compliance Knowledge

- Financial Reporting

- Data Analysis

- Knowledge of Accounting Principles

- Proficiency in Tax Software (e.g., QuickBooks, TurboTax)

- Regulatory Knowledge (e.g., IRS regulations)

- Auditing Techniques

- Risk Assessment

- Excel Proficiency

- Financial Statement Analysis

- Budgeting and Forecasting

- Statistical Analysis

- Research Skills

- Documentation and Reporting Skills

For more insights on other relevant skills and how to present your work experience, explore additional resources to enhance your resume.

Stand Out with a Winning Tax Auditor Cover Letter

I am writing to express my interest in the Tax Auditor position at [Company Name], as advertised on [Where You Found the Job Listing]. With a strong background in accounting and tax regulations, complemented by [X years] of experience in auditing, I believe I am well-equipped to contribute to your team. My meticulous attention to detail and commitment to maintaining compliance with federal and state tax laws have enabled me to identify discrepancies and enhance financial reporting accuracy throughout my career.

In my previous role at [Previous Company Name], I successfully conducted comprehensive audits of individual and corporate tax returns, ensuring adherence to all relevant guidelines. I implemented robust auditing procedures that resulted in a [percentage]% reduction in errors and improved client satisfaction ratings. My analytical skills allow me to dissect complex financial data and present findings in a clear, concise manner, fostering effective communication with clients and stakeholders.

I am particularly drawn to [Company Name] due to its reputation for excellence and integrity in the field of taxation. I am eager to bring my expertise in tax law and auditing to your esteemed organization, where I can help strengthen compliance efforts and support your clients in achieving their financial goals. I am excited about the opportunity to collaborate with your team and contribute to the high standards of auditing that [Company Name] is known for.

Thank you for considering my application. I am looking forward to the possibility of discussing how my skills and experiences align with the needs of your team. Please feel free to contact me at [Your Phone Number] or [Your Email Address] to schedule a conversation.

Common Mistakes to Avoid in a Tax Auditor Resume

When crafting a resume for a Tax Auditor position, it's essential to present your qualifications and experiences in a way that highlights your expertise and attention to detail. However, many candidates inadvertently make mistakes that can detract from their qualifications. Understanding these common pitfalls can help you create a more effective and compelling resume that stands out to hiring managers.

Lack of Specificity: General statements about responsibilities can make your resume bland. Instead, use specific examples and metrics to demonstrate your achievements and impact in previous roles.

Ignoring Keywords: Failing to include relevant keywords from the job description can lead to your resume being overlooked by applicant tracking systems (ATS). Tailor your resume for each position to improve your chances of being noticed.

Overly Complex Language: Using jargon or overly complicated language can make your resume difficult to read. Aim for clarity and conciseness to ensure that hiring managers can quickly understand your qualifications.

Neglecting Soft Skills: While technical skills are vital in auditing, soft skills such as communication, problem-solving, and attention to detail are equally important. Ensure you highlight these skills appropriately.

Inconsistent Formatting: A cluttered or inconsistent format can be distracting. Use a clean, professional layout with consistent fonts, bullet points, and spacing to enhance readability.

Including Irrelevant Information: It's important to stay focused on your qualifications for the Tax Auditor role. Avoid including unrelated work experiences or personal information that doesn't contribute to your candidacy.

Omitting Continuing Education: Tax laws and regulations are constantly changing. Failing to include any continuing education or certifications can make it seem like you're not committed to professional development.

Ignoring Accomplishments: Simply listing job duties misses the opportunity to showcase your achievements. Quantify your successes, such as how much you saved a company through audits or efficiency improvements, to make a stronger impression.

Conclusion

As a Tax Auditor, your role is crucial in ensuring compliance with tax laws and regulations while identifying discrepancies that may affect an organization’s financial integrity. Throughout this article, we explored the essential skills and qualifications needed for a successful career in tax auditing, including attention to detail, analytical skills, and a strong understanding of tax legislation. We also highlighted the importance of effective communication abilities, as presenting findings clearly to clients and stakeholders is a significant part of the job.

To thrive in this field, having a well-crafted resume is essential. It should clearly showcase your relevant experience, skills, and accomplishments that set you apart from other candidates. If you are looking to enhance your resume for a Tax Auditor position, now is the perfect time to do so.

Take advantage of the resources available to you. Utilize resume templates to create a polished and professional layout. If you prefer a more hands-on approach, consider using a resume builder to streamline the process and ensure you include all necessary details. Additionally, review resume examples to gain insights into how others in your field have successfully presented their qualifications. Don't forget about the importance of a compelling cover letter; check out the cover letter templates to help you make a great first impression.

Now is the time to take action! Review your Tax Auditor resume and leverage these tools to enhance your application, ensuring you stand out in this competitive field.