Top 27 Tax Accountant Resume Skills with Examples for 2025

As a Tax Accountant, possessing a diverse skill set is essential to effectively navigate the complexities of tax regulations and provide valuable services to clients. Highlighting the right skills on your resume can significantly enhance your appeal to potential employers. In the following section, we will explore the top skills that are crucial for success in this role, ensuring you stand out in a competitive job market.

Best Tax Accountant Technical Skills

Having a solid foundation of technical skills is crucial for a Tax Accountant, as these skills not only enhance efficiency but also ensure compliance with the ever-evolving tax regulations. Here are some essential technical skills that can elevate your resume and demonstrate your expertise in the field.

Tax Preparation Software Proficiency

Expertise in tax preparation software such as Intuit ProConnect, Drake Tax, or Thomson Reuters UltraTax is vital for streamlining the tax filing process.

How to show it: Highlight specific software you've used, including any certifications, and mention the number of tax returns processed with those tools.

Tax Compliance Knowledge

Understanding federal, state, and local tax laws is essential for ensuring compliance and advising clients accurately.

How to show it: Detail any courses or training completed on tax laws and showcase any successful audits or compliance checks.

Financial Analysis

The ability to analyze financial data enables Tax Accountants to provide insightful recommendations and identify tax-saving opportunities for clients.

How to show it: Include examples of financial reports you’ve analyzed and the resulting tax strategies implemented.

Attention to Detail

Meticulous attention to detail is critical for accurate tax returns and to avoid costly mistakes that could lead to audits.

How to show it: Share specific instances where your attention to detail prevented errors and mention any recognition received for accuracy.

Data Management Skills

Proficiency in managing and organizing large volumes of financial data is necessary to ensure efficiency in tax preparation and reporting.

How to show it: Discuss your experience with data management systems and quantify the volume of data managed or organized.

Audit Preparation

Experience in preparing for audits is crucial for minimizing risks and ensuring a smooth auditing process.

How to show it: Mention specific audits you’ve prepared for and the outcomes, such as reduced penalties or successful resolutions.

Research Skills

The ability to conduct thorough tax research helps Tax Accountants stay updated on changes in tax legislation and apply them effectively.

How to show it: List relevant research projects or significant findings that impacted your clients’ tax strategies.

Communication Skills

Strong verbal and written communication skills are essential for explaining complex tax concepts clearly to clients.

How to show it: Provide examples of client presentations or reports you’ve created that led to improved understanding or client satisfaction.

Regulatory Reporting

Proficiency in regulatory reporting ensures timely and accurate submission of necessary documentation to tax authorities.

How to show it: Quantify the number of reports filed and highlight any improvements made in reporting timelines.

Client Management

Effective client management skills enhance relationships and ensure client needs are met in a timely manner.

How to show it: Discuss how many clients you managed and any feedback or results from your management efforts.

Tax Planning Strategies

Experience in developing tax planning strategies helps clients minimize their tax liabilities and maximize savings.

How to show it: Describe tax strategies you’ve developed and quantify the savings achieved for clients.

Best Tax Accountant Soft Skills

In the dynamic field of tax accounting, technical expertise is crucial, but soft skills are equally important. These workplace skills enable tax accountants to navigate complex situations, communicate effectively with clients and colleagues, and manage their time efficiently. Highlighting these skills on your resume can set you apart from other candidates and demonstrate your holistic capabilities in the profession.

Communication

Effective communication is essential for tax accountants as they must clearly explain complex tax regulations and financial information to clients and team members.

How to show it: Highlight instances where you've successfully communicated tax strategies or resolved client inquiries.

Problem-solving

Tax accountants often face unique challenges that require innovative solutions, making strong problem-solving skills vital in navigating tax issues.

How to show it: Provide examples of complex tax problems you resolved and the positive outcomes achieved.

Time Management

With deadlines often looming, tax accountants must prioritize tasks effectively to ensure timely completion of tax filings and client deliverables.

How to show it: Quantify your ability to meet deadlines and manage multiple projects simultaneously.

Attention to Detail

Tax accounting requires a high level of accuracy, where small errors can lead to significant consequences, making attention to detail crucial.

How to show it: Include metrics that demonstrate your accuracy in tax reporting and compliance.

Teamwork

Collaboration with colleagues and clients is often necessary in tax accounting, making teamwork a vital soft skill for success.

How to show it: Share examples of successful team projects or initiatives you contributed to.

Adaptability

The tax landscape is constantly evolving, and being adaptable allows accountants to stay current with regulations and changes.

How to show it: Demonstrate your ability to learn new tax laws or software quickly and implement them effectively.

Client Management

Building and maintaining strong relationships with clients is essential for tax accountants to ensure repeat business and client satisfaction.

How to show it: Provide examples of successful client engagements and positive feedback received.

Analytical Thinking

Analytical skills help tax accountants evaluate financial data and identify trends that can impact tax strategies.

How to show it: Quantify your contributions to financial analysis that led to improved tax planning.

Negotiation

Negotiation skills are beneficial for tax accountants when dealing with clients, auditors, or tax authorities in settling disputes.

How to show it: Detail successful negotiations that resulted in favorable outcomes for clients.

Critical Thinking

Critical thinking enables tax accountants to evaluate complex information and make informed decisions regarding tax strategies.

How to show it: Illustrate your thought process in making key tax-related decisions.

Emotional Intelligence

Emotional intelligence allows tax accountants to better understand and manage their own emotions and those of their clients, leading to improved interactions.

How to show it: Describe situations where you effectively managed client expectations or emotions in challenging scenarios.

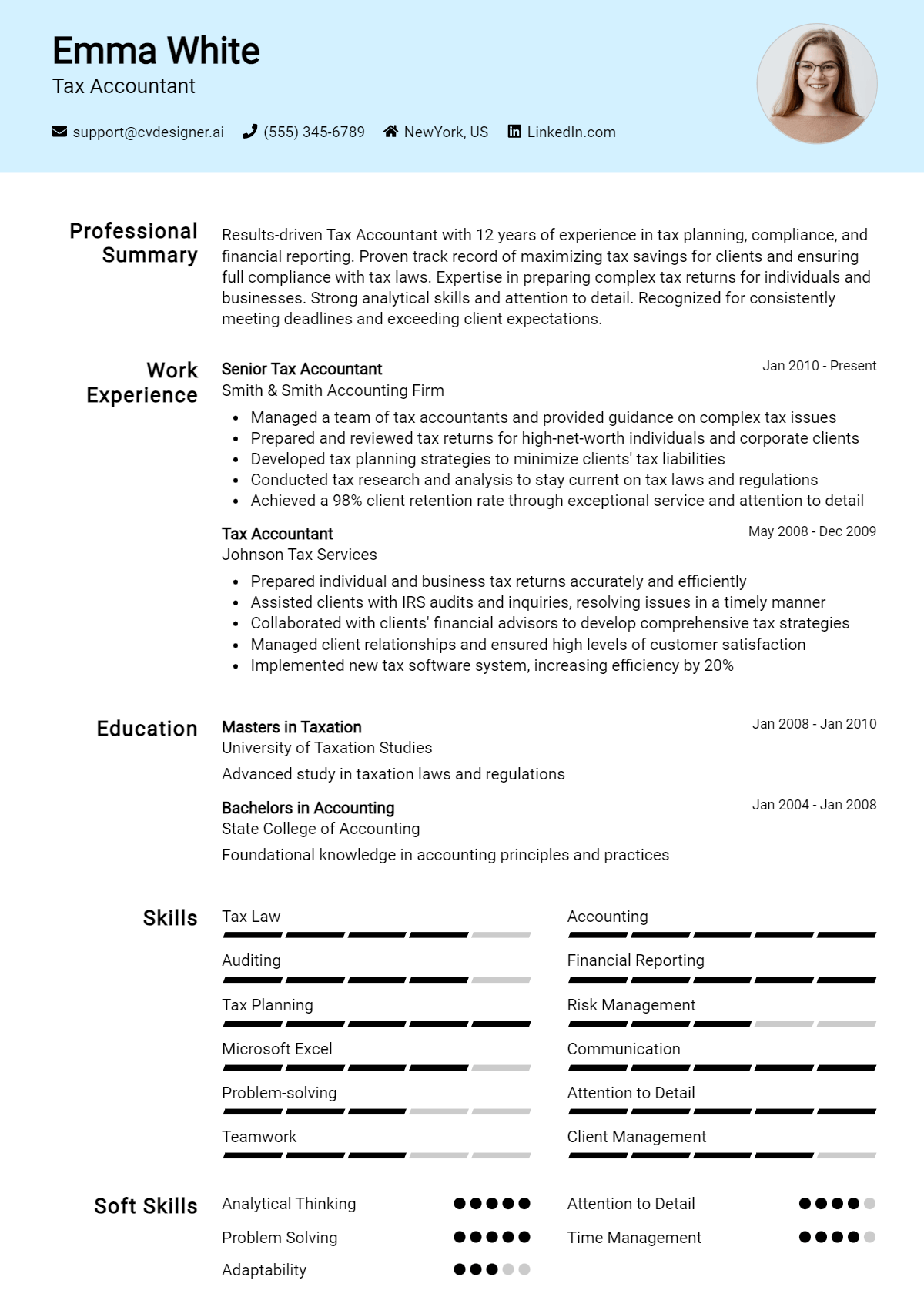

How to List Tax Accountant Skills on Your Resume

Effectively listing skills on your resume is crucial for standing out to employers. It helps to quickly convey your qualifications and expertise. There are three main sections where skills can be highlighted: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing Tax Accountant skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and expertise in the field.

Example

Experienced Tax Accountant with strong analytical skills and attention to detail, specializing in tax compliance and financial reporting to deliver accurate and timely results.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how Tax Accountant skills have been applied in real-world scenarios, showcasing your impact and contributions.

Example

- Prepared and reviewed tax returns, ensuring compliance with regulatory standards and minimizing client liabilities.

- Utilized financial analysis skills to identify tax-saving opportunities for clients, resulting in a 15% reduction in tax liabilities.

- Collaborated with clients to develop tax strategies, enhancing their financial planning and decision-making processes.

- Mentored junior accountants on best practices in tax preparation and client management.

for Resume Skills

The skills section can showcase both technical and transferable skills. It's essential to include a balanced mix of hard and soft skills that strengthen your overall qualifications.

Example

- Tax Compliance

- Financial Reporting

- Analytical Skills

- Attention to Detail

- Client Relationship Management

- Time Management

- Proficient in Tax Software (e.g., TurboTax, H&R Block)

- Effective Communication

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how these skills have positively impacted previous roles.

Example

In my previous position, I leveraged my analytical skills and attention to detail to ensure compliance and accuracy in tax reporting, leading to a 20% increase in client satisfaction. I am eager to bring this expertise to your team and contribute to your success.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For more guidance, explore [skills](https://resumedesign.ai/resume-skills/), [Technical Skills](https://resumedesign.ai/technical-skills/), and [work experience](https://resumedesign.ai/resume-work-experience/).

The Importance of Tax Accountant Resume Skills

In the competitive field of tax accounting, highlighting relevant skills in your resume is crucial for making a strong impression on potential employers. A well-crafted skills section not only showcases your qualifications but also aligns your capabilities with the specific requirements of the job. This is essential in helping candidates stand out to recruiters, as it provides a quick snapshot of their expertise and readiness for the role.

- Demonstrates Expertise: Including specific tax-related skills on your resume highlights your expertise in areas such as tax preparation, compliance, and planning, which are vital for any tax accountant role.

- Aligns with Job Requirements: Tailoring your skills to match the job description ensures that your resume resonates with hiring managers, increasing your chances of being shortlisted for interviews.

- Showcases Adaptability: A diverse range of skills shows your ability to adapt to various tax regulations and technologies, which is increasingly important in the ever-evolving tax landscape.

- Highlights Problem-Solving Abilities: Skills in analytical thinking and problem-solving illustrate your capacity to tackle complex tax issues and provide effective solutions, a key trait for successful tax accountants.

- Enhances Professional Credibility: Displaying relevant certifications and technical skills reinforces your professional credibility and indicates your commitment to maintaining high standards in your work.

- Facilitates Communication: Skills related to communication and interpersonal relations are essential for collaborating with clients and colleagues, making them a vital component of your resume.

- Shows Commitment to Continuous Learning: Highlighting skills in software tools and tax law updates demonstrates your commitment to professional development and staying current in the field.

For more examples on how to structure your resume effectively, check out these Resume Samples.

How To Improve Tax Accountant Resume Skills

As the tax landscape continues to evolve with changing regulations and technological advancements, it is crucial for tax accountants to continuously enhance their skills. Improving your skills not only increases your value in the job market but also ensures you can provide the best possible service to your clients. Here are some actionable tips to help you elevate your tax accounting skills:

- Stay Updated on Tax Laws: Regularly review tax legislation changes and updates to ensure compliance and enhance your advisory capabilities.

- Obtain Relevant Certifications: Pursue additional certifications, such as CPA or enrolled agent status, to demonstrate your expertise and commitment to the profession.

- Enhance Software Proficiency: Get comfortable with popular accounting software like QuickBooks, TurboTax, and tax preparation tools to streamline your workflow.

- Participate in Professional Development: Attend workshops, webinars, and conferences to learn new techniques and network with other professionals in the field.

- Develop Analytical Skills: Practice analyzing financial data to identify trends and anomalies, which can provide valuable insights for tax planning.

- Improve Communication Skills: Work on both verbal and written communication to effectively explain complex tax concepts to clients.

- Join Professional Organizations: Becoming a member of organizations such as the AICPA or your local CPA society can provide access to resources, networking opportunities, and continuous education.

Frequently Asked Questions

What are the essential skills required for a tax accountant?

Essential skills for a tax accountant include strong analytical abilities, attention to detail, and proficiency in tax software. Additionally, excellent communication skills are crucial for explaining complex tax concepts to clients and ensuring compliance with tax regulations. A solid understanding of accounting principles and tax laws is also imperative for effectively preparing and filing tax returns.

How important is proficiency in tax software for a tax accountant?

Proficiency in tax software is vital for tax accountants as it enhances accuracy and efficiency in tax preparation processes. Familiarity with popular tax software such as TurboTax, H&R Block, or specialized accounting software allows tax accountants to automate calculations, manage client information, and streamline the filing process. This skill also helps in staying updated with the latest tax regulations and software updates.

What role does attention to detail play in a tax accountant's job?

Attention to detail is a critical skill for tax accountants, as even minor errors can lead to significant financial repercussions for clients or result in audits by tax authorities. A meticulous approach ensures that all financial data is accurate, complete, and compliant with current tax laws, thereby minimizing risks and maximizing deductions for clients.

How can communication skills benefit a tax accountant?

Communication skills are essential for tax accountants as they often need to explain complex tax laws and regulations to clients who may not have a financial background. Effective communication fosters better relationships with clients, ensuring that they understand their tax obligations and the strategies employed to minimize their tax liability. This also includes presenting findings and recommendations clearly during meetings or in written reports.

Why is knowledge of current tax laws important for a tax accountant?

Knowledge of current tax laws is crucial for tax accountants to provide accurate and compliant advice to their clients. Tax laws frequently change, and being well-versed in these updates allows accountants to identify potential tax savings, advise on compliance issues, and develop strategic tax plans. This expertise positions tax accountants as trusted advisors, essential for both individual and business clients seeking to navigate the complexities of taxation.

Conclusion

Incorporating Tax Accountant skills into your resume is essential for demonstrating your expertise and readiness for the role. By showcasing relevant skills, you not only help yourself stand out in a competitive job market but also convey the value you can bring to potential employers. As you refine your skills and enhance your resume, remember that a well-structured application can open doors to new opportunities. So take the time to polish your qualifications and create a compelling resume that reflects your strengths.

For more resources to aid in your job application journey, explore our resume templates, use our resume builder, check out resume examples, and craft an impressive cover letter with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.