Tax Accountant Core Responsibilities

A Tax Accountant plays a crucial role in managing an organization’s financial health by ensuring compliance with tax regulations and optimizing tax liabilities. Key responsibilities include preparing tax returns, conducting audits, and providing strategic tax planning. This role requires strong technical skills in accounting software, operational knowledge of tax laws, and exceptional problem-solving abilities to navigate complex financial scenarios. By bridging finance, legal, and operational departments, Tax Accountants strengthen organizational goals. A well-structured resume can effectively showcase these competencies, ensuring candidates stand out in the competitive job market.

Common Responsibilities Listed on Tax Accountant Resume

- Prepare and file federal and state tax returns accurately and timely.

- Conduct tax research and analysis to ensure compliance with current tax laws.

- Assist in the development and implementation of tax strategies.

- Review financial statements for tax implications and accuracy.

- Identify tax-saving opportunities for the organization.

- Maintain organized records of tax-related documents and correspondence.

- Collaborate with other departments to gather necessary financial information.

- Provide guidance on tax implications of business decisions and transactions.

- Prepare for and assist with tax audits by regulatory agencies.

- Stay updated on changes in tax legislation and industry practices.

- Train and mentor junior staff on tax-related issues and software.

High-Level Resume Tips for Tax Accountant Professionals

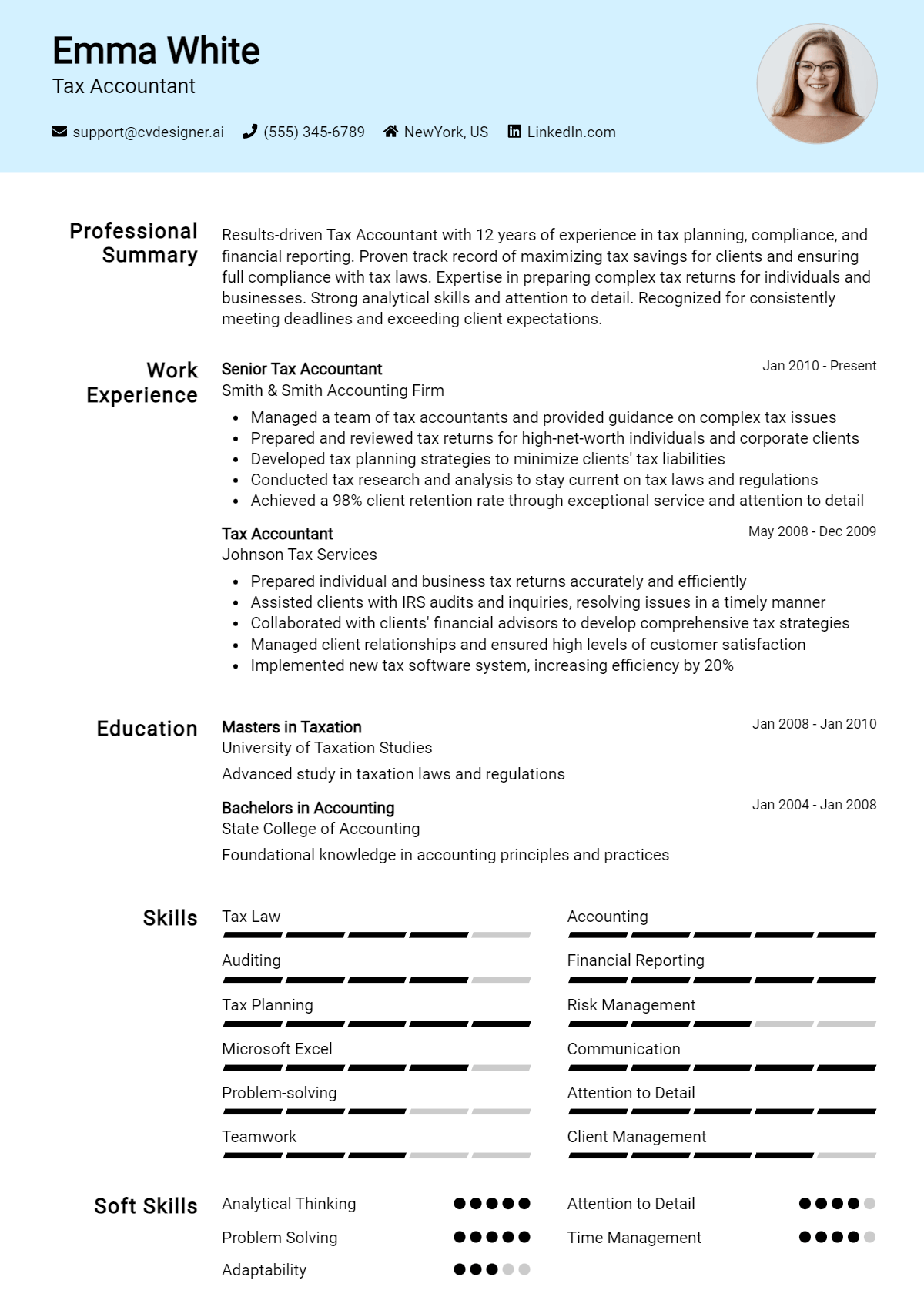

In today's competitive job market, a well-crafted resume is essential for Tax Accountant professionals seeking to make a strong first impression on potential employers. Your resume serves as your personal marketing tool, showcasing your skills, experiences, and achievements in the field of taxation. It must not only reflect your technical expertise but also demonstrate your capability to add value to an organization. A carefully tailored resume can set you apart from other candidates, highlighting your qualifications in a way that resonates with hiring managers. This guide aims to provide practical and actionable resume tips specifically designed for Tax Accountant professionals to help you create a compelling document that opens doors to new opportunities.

Top Resume Tips for Tax Accountant Professionals

- Customize your resume for each job application by incorporating keywords from the job description.

- Highlight relevant experience by including specific roles in tax accounting or related fields.

- Quantify your achievements, such as the percentage of tax savings you achieved for clients or the number of audits you successfully managed.

- Showcase industry-specific skills, such as proficiency in tax preparation software and knowledge of current tax laws.

- Include certifications and licenses, such as CPA or EA, to demonstrate your professional qualifications.

- Utilize a clean and professional format that enhances readability and allows key information to stand out.

- Incorporate action verbs to describe your responsibilities and accomplishments effectively.

- Provide a brief summary at the top of your resume that encapsulates your experience and career goals in tax accounting.

- List any continuing education courses or workshops related to tax accounting to showcase your commitment to professional development.

- Proofread your resume thoroughly to eliminate any typos or grammatical errors, as attention to detail is crucial in the accounting field.

By implementing these tips, you can significantly increase your chances of landing a job in the Tax Accountant field. A targeted and polished resume not only highlights your qualifications but also demonstrates your professionalism and attention to detail, qualities that are highly valued by employers in the financial sector. With the right approach, your resume can effectively convey your expertise and make a lasting impression on hiring managers.

Why Resume Headlines & Titles are Important for Tax Accountant

In the competitive field of tax accounting, a well-crafted resume headline or title plays a crucial role in capturing the attention of hiring managers. A strong headline serves as a concise summary of a candidate's key qualifications, providing an impactful first impression. It encapsulates the essence of what makes a candidate suitable for the role, highlighting relevant skills and experiences in just a few words. By ensuring that the headline is directly related to the job being applied for, candidates can significantly improve their chances of standing out in a crowded job market.

Best Practices for Crafting Resume Headlines for Tax Accountant

- Keep it concise: Aim for clarity and brevity, ideally within 5-10 words.

- Be role-specific: Tailor your headline to reflect the specific tax accountant position you are applying for.

- Highlight key strengths: Focus on your most relevant skills or accomplishments that relate to tax accounting.

- Use action-oriented language: Begin with impactful verbs to convey proactivity and results.

- Include certifications or qualifications: Mention relevant qualifications such as CPA if applicable.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

- Make it unique: Differentiate yourself from other candidates by showcasing what sets you apart.

- Align with the job description: Reflect keywords and phrases found in the job listing to enhance relevance.

Example Resume Headlines for Tax Accountant

Strong Resume Headlines

Results-Driven Tax Accountant with 5+ Years of Experience in Corporate Tax Compliance

Detail-Oriented CPA Specializing in Tax Planning and Audit Support

Accomplished Tax Professional with Proven Record in Reducing Client Tax Liabilities

Expert Tax Accountant with Advanced Skills in Tax Software and Financial Analysis

Weak Resume Headlines

Tax Accountant Looking for Job

Experienced Accountant

Seeking Opportunities in Accounting

The strong headlines are effective because they clearly communicate the candidate's specific expertise, experience, and accomplishments in tax accounting, making it easy for hiring managers to see their value quickly. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity; they do not convey any unique skills or qualifications that would compel a hiring manager to consider the candidate further.

Writing an Exceptional Tax Accountant Resume Summary

A resume summary is a critical component for a Tax Accountant, serving as the first impression a hiring manager has of a candidate's qualifications. In a competitive job market, a well-crafted summary quickly captures attention by succinctly showcasing key skills, relevant experience, and notable accomplishments that align with the job role. The summary should be concise yet impactful, tailored to the specific position being applied for, effectively setting the tone for the rest of the resume and encouraging the reader to explore further.

Best Practices for Writing a Tax Accountant Resume Summary

- Quantify Achievements: Use specific numbers to highlight your accomplishments, such as the amount of money saved for clients or the percentage of audits successfully navigated.

- Focus on Skills: Highlight key skills relevant to tax accounting, such as proficiency in tax software, knowledge of tax laws, and analytical abilities.

- Tailor the Summary: Customize your summary for each job application, ensuring it aligns with the job description and requirements.

- Be Concise: Aim for 3-5 sentences that deliver the most pertinent information without unnecessary filler.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence, such as "managed," "developed," or "optimized."

- Highlight Relevant Experience: Briefly mention prior roles or experiences that directly relate to tax accounting.

- Showcase Certifications: If applicable, include relevant certifications or licenses, such as CPA or EA, that enhance your credibility.

- Demonstrate Problem-Solving: Mention any specific challenges you have overcome in your role, showcasing your ability to navigate complex tax issues.

Example Tax Accountant Resume Summaries

Strong Resume Summaries

Dedicated tax accountant with over 7 years of experience in preparing and reviewing complex tax returns for high-net-worth individuals, resulting in an average of 15% reduction in tax liabilities. Proficient in utilizing advanced tax software and staying updated on the latest tax regulations.

Results-driven tax professional with a proven track record of managing audits and compliance for corporate clients, successfully achieving a 98% audit clearance rate. Adept at developing tax strategies that have saved clients over $500,000 annually.

Detail-oriented tax accountant with expertise in international tax compliance and reporting, having successfully navigated the complexities of cross-border transactions for Fortune 500 companies. Certified CPA with a strong analytical background.

Weak Resume Summaries

Experienced accountant looking for a new opportunity in tax. Good at managing finances and helping clients.

Tax accountant with some experience in filing tax returns. Seeking a job where I can improve my skills and contribute to the team.

The strong resume summaries are considered effective because they provide concrete achievements, relevant skills, and specific experiences that clearly relate to the tax accountant role. They use quantifiable results to demonstrate the candidate's impact on previous employers, making them stand out to hiring managers. In contrast, the weak summaries lack specificity and measurable outcomes, making them generic and less impactful, which can fail to capture the attention of potential employers.

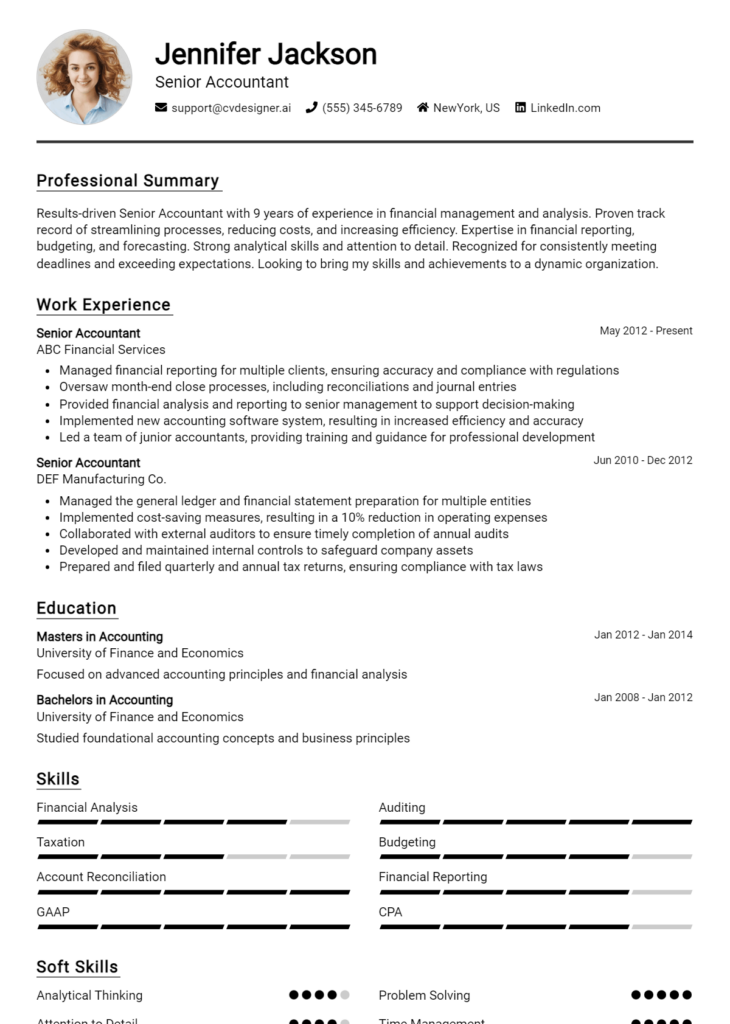

Work Experience Section for Tax Accountant Resume

The work experience section of a Tax Accountant resume is vital as it serves as a testament to the candidate's technical skills and ability to manage teams effectively while delivering high-quality financial products and services. It demonstrates the practical application of tax laws and regulations, showcasing how the candidate has contributed to organizational success through their expertise. By quantifying achievements and aligning their experience with industry standards, candidates can present themselves as valuable assets who have consistently met or exceeded performance expectations in their roles.

Best Practices for Tax Accountant Work Experience

- Highlight relevant technical skills, such as tax preparation, compliance, and software proficiency.

- Quantify achievements with specific metrics, such as percentage of tax savings or number of clients managed.

- Demonstrate leadership abilities by detailing experiences in managing teams or projects.

- Use action verbs to convey a sense of initiative and impact in previous roles.

- Align experiences with industry standards, showcasing knowledge of current tax regulations and practices.

- Emphasize collaborative efforts, such as working with other departments or clients to achieve financial goals.

- Tailor the work experience section to match the job description and requirements of the position applied for.

- Include any relevant certifications or continuing education that enhances your qualifications.

Example Work Experiences for Tax Accountant

Strong Experiences

- Led a team of 5 tax professionals in preparing and filing over 300 individual and corporate tax returns, resulting in a 15% increase in client satisfaction ratings.

- Implemented a new tax software system that improved processing efficiency by 25%, reducing average turnaround time for client filings.

- Collaborated with cross-functional teams to identify tax-saving opportunities, resulting in $500,000 in savings for clients over a fiscal year.

- Successfully managed a portfolio of high-net-worth clients, achieving a 20% year-over-year growth in revenue through targeted tax strategies.

Weak Experiences

- Worked on tax returns for various clients without specifying outcomes or achievements.

- Assisted in preparing financial documents as part of a team.

- Completed tax-related tasks as assigned, contributing to overall department goals.

- Gained experience in tax accounting while learning different processes.

The examples provided illustrate the distinction between strong and weak experiences. Strong experiences highlight specific, quantifiable outcomes and demonstrate leadership and collaboration, showcasing the candidate's impact on their organization. In contrast, weak experiences lack detail and measurable results, making them less compelling to potential employers. By focusing on concrete achievements and the value brought to previous roles, candidates can create a powerful narrative that enhances their appeal in the job market.

Education and Certifications Section for Tax Accountant Resume

The education and certifications section of a Tax Accountant resume is crucial for showcasing the candidate’s academic background and industry-specific credentials. This section not only highlights relevant degrees but also underscores the importance of continuous learning and professional development through certifications and specialized training. By providing detailed information about relevant coursework and recognized certifications, candidates can significantly enhance their credibility and demonstrate their alignment with the demands of the job role, making them more appealing to potential employers.

Best Practices for Tax Accountant Education and Certifications

- Include only relevant degrees and certifications that pertain to taxation and accounting.

- List your educational qualifications in reverse chronological order, starting with the most recent.

- Highlight advanced certifications such as CPA (Certified Public Accountant) or EA (Enrolled Agent).

- Incorporate relevant coursework that demonstrates specialized knowledge in taxation, auditing, or financial management.

- Only include certifications that are current and recognized in the industry.

- Consider adding any continuing education courses or workshops that enhance your expertise.

- Be specific about the institution and location of your education and certifications.

- Use clear formatting that makes this section easy to read and visually appealing.

Example Education and Certifications for Tax Accountant

Strong Examples

- M.S. in Taxation, University of ABC, Anytown, USA, 2022

- CPA (Certified Public Accountant), State Board of Accountancy, 2021

- B.S. in Accounting, University of XYZ, Anytown, USA, 2020

- Advanced Taxation Certificate, National Tax Association, 2023

Weak Examples

- Diploma in General Studies, Community College, 2015

- Certification in Basic Computer Skills, Online Course, 2019

- B.A. in Business Administration, University of DEF, 2010 (not accounting-focused)

- Certificate of Completion in Tax Preparation (outdated program), 2018

The strong examples are considered effective as they provide relevant and up-to-date qualifications that align directly with the responsibilities of a Tax Accountant. These credentials reflect the candidate's commitment to the field through advanced education and recognized certifications. In contrast, the weak examples lack relevance to the specific requirements of a Tax Accountant role, either by being outdated, too general, or not focused on accounting, which diminishes their impact in a competitive job market.

Top Skills & Keywords for Tax Accountant Resume

As a Tax Accountant, possessing the right skills is essential not only for crafting an effective resume but also for succeeding in the dynamic field of taxation. Tax accountants must demonstrate a blend of analytical abilities, technical knowledge, and interpersonal skills to navigate complex tax regulations and provide valuable insights to clients. Highlighting the right skills on your resume can significantly enhance your chances of standing out to potential employers. It is crucial to showcase both hard and soft skills that reflect your expertise and adaptability in handling various accounting tasks. This balance of competencies indicates your readiness to tackle the demands of the role and contribute positively to an organization.

Top Hard & Soft Skills for Tax Accountant

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Communication Skills

- Time Management

- Ethical Judgment

- Adaptability

- Team Collaboration

- Client Relationship Management

- Organizational Skills

Hard Skills

- Knowledge of Tax Regulations

- Proficiency in Accounting Software (e.g., QuickBooks, TurboTax)

- Financial Reporting

- Data Analysis

- Tax Preparation and Filing

- Budgeting and Forecasting

- Auditing Skills

- Risk Assessment

- Excel Proficiency

- Knowledge of State and Federal Tax Laws

By integrating these skills into your resume, alongside a strong work experience section, you will be well-positioned to showcase your qualifications and attract the attention of hiring managers in the competitive field of tax accounting.

Stand Out with a Winning Tax Accountant Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Tax Accountant position at [Company Name]. With a Bachelor’s degree in Accounting and over [X years] of experience in tax preparation and compliance, I am confident in my ability to contribute effectively to your team. My extensive knowledge of current tax laws, combined with my strong analytical skills, has equipped me to deliver exceptional services to clients, ensuring compliance while maximizing their tax efficiency.

In my previous role at [Previous Company Name], I successfully managed tax filings for a diverse portfolio of clients, ranging from small businesses to high-net-worth individuals. I developed tailored tax strategies that resulted in an average savings of [X]% for my clients. My commitment to staying abreast of the latest tax regulations and my proficiency with various accounting software, including [specific software], have allowed me to streamline processes and improve accuracy in reporting. I thrive in collaborative environments and enjoy working closely with clients to understand their unique financial situations and provide personalized solutions.

I am particularly drawn to [Company Name] because of its reputation for innovative tax solutions and commitment to client satisfaction. I believe my proactive approach and dedication to fostering strong client relationships align perfectly with your company’s values. I am eager to bring my expertise in tax law and strategic planning to your esteemed firm and help your clients navigate the complexities of the tax landscape.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the needs of your team. I am excited about the possibility of contributing to [Company Name] and supporting your clients in achieving their financial goals.

Sincerely,

[Your Name]

[Your Contact Information]

Common Mistakes to Avoid in a Tax Accountant Resume

When crafting a resume for a Tax Accountant position, it's crucial to present a polished and professional document that highlights your skills and experiences effectively. However, many candidates make common mistakes that can undermine their chances of securing an interview. By being aware of these pitfalls and avoiding them, you can create a resume that stands out in a competitive job market.

Ignoring Keywords: Failing to incorporate relevant keywords from the job description can result in your resume being overlooked by applicant tracking systems (ATS) that scan for specific terms.

Lack of Specificity: Providing vague descriptions of previous roles and responsibilities can make it difficult for hiring managers to gauge your expertise. Always quantify achievements and specify your contributions.

Overloading with Jargon: While technical terms are important in the accounting field, overusing industry jargon can confuse or alienate readers. Strive for clarity and simplicity without sacrificing professionalism.

Poor Formatting: A cluttered or unorganized layout can distract from your qualifications. Use clear headings, bullet points, and consistent formatting to enhance readability.

Neglecting Soft Skills: Tax accountants require strong interpersonal skills, such as communication and problem-solving. Failing to highlight these soft skills can give an incomplete picture of your capabilities.

Including Irrelevant Information: Listing unrelated work experience or personal details can dilute your resume’s impact. Focus on experiences that directly relate to tax accounting.

Typos and Grammatical Errors: Even minor mistakes can create an impression of carelessness. Thoroughly proofread your resume and consider having a peer review it for errors.

Not Tailoring the Resume: Using a one-size-fits-all approach can diminish your chances. Tailor your resume for each application, emphasizing the most relevant experiences and skills for the specific job.

Conclusion

In conclusion, the role of a Tax Accountant is pivotal in navigating the complexities of tax laws and ensuring compliance for both individuals and businesses. Key responsibilities include preparing tax returns, advising clients on tax strategies, and staying updated on the latest regulations. Tax Accountants must possess strong analytical skills, attention to detail, and a thorough understanding of financial principles.

As you reflect on your career as a Tax Accountant, it's essential to ensure your resume effectively showcases your skills and experiences. A well-crafted resume can make a significant difference in your job search, helping you stand out in a competitive field.

We encourage you to take advantage of resources available to you. Explore our resume templates to find a layout that suits your professional style. Use our resume builder to create a polished resume tailored to the Tax Accountant role. Check out resume examples for inspiration and guidance on how to present your qualifications. Additionally, don't overlook the importance of a strong introduction with our cover letter templates.

Now is the perfect time to review and enhance your Tax Accountant resume to ensure it reflects your best self. Take the next step in your career today!