Top 29 Hard and Soft Skills for 2025 Retail Banker Resumes

As a Retail Banker, possessing a diverse set of skills is essential for success in the dynamic banking environment. These skills not only enhance customer service and satisfaction but also drive sales and operational efficiency. In this section, we will explore the top skills that are valuable for Retail Bankers to include on their resumes, showcasing their ability to effectively manage customer relationships, navigate financial products, and contribute to the overall success of the banking institution.

Best Retail Banker Technical Skills

Technical skills are essential for Retail Bankers as they enhance efficiency in operations, improve customer service, and ensure compliance with regulations. A strong set of technical skills not only supports day-to-day tasks but also contributes to career advancement in the banking industry.

Financial Analysis

Understanding financial statements and data analysis is crucial for making informed lending decisions and advising clients.

How to show it: Highlight specific instances where your analysis led to improved client outcomes or bank profitability.

Regulatory Compliance

Knowledge of banking regulations and compliance standards is essential to mitigate risks and ensure the bank operates within legal frameworks.

How to show it: Quantify your experience in maintaining compliance or reducing audit findings in your previous roles.

Risk Management

The ability to identify and assess financial risks helps in safeguarding the bank's assets and ensuring stable operations.

How to show it: Provide examples of how you implemented risk assessment strategies that reduced losses.

Customer Relationship Management (CRM) Software

Proficiency in CRM systems enhances customer service by managing client interactions and data throughout the customer lifecycle.

How to show it: Detail your experience using specific CRM tools and the positive impact on customer retention rates.

Data Entry and Management

Accurate data entry and effective management of customer information are vital for operational efficiency and customer satisfaction.

How to show it: Emphasize your speed and accuracy in data entry and how it contributed to streamlined processes.

Financial Software Proficiency

Familiarity with financial software applications aids in transaction processing, reporting, and financial forecasting.

How to show it: List specific software programs you have used and any efficiencies created through their use.

Loan Processing

Understanding the loan process from application to closing ensures timely approvals and customer satisfaction.

How to show it: Quantify the number of loans processed and highlight any improvements in turnaround time.

Sales Techniques

Effective sales strategies are essential for promoting bank products and services, leading to increased revenue.

How to show it: Provide metrics on sales targets met or exceeded during your tenure.

Technical Support Skills

Providing technical support for banking applications ensures smooth operations and enhances customer service experiences.

How to show it: Discuss instances where your technical support directly improved service levels or systems.

Payment Processing Systems

Knowledge of electronic payment systems is necessary for facilitating transactions and ensuring customer satisfaction.

How to show it: Highlight your experience with different payment systems and any efficiencies you introduced.

Market Research

Conducting market research helps in understanding customer needs and trends, which informs product offerings.

How to show it: Provide examples of how your research influenced product development or marketing strategies.

Best Retail Banker Soft Skills

Soft skills play a pivotal role in the success of a Retail Banker, as they enhance interpersonal interactions and foster a positive customer experience. These skills enable bankers to navigate complex situations, build strong relationships with clients, and effectively collaborate with team members. Highlighting these abilities on your resume can set you apart in a competitive job market.

Communication Skills

Effective communication is essential for Retail Bankers to clearly convey financial products, understand customer needs, and resolve issues.

How to show it: Include examples of how you have communicated complex information to clients, and quantify improvements in customer satisfaction scores.

Active Listening

Active listening ensures that Retail Bankers fully understand customer concerns and needs, leading to better service and solutions.

How to show it: Demonstrate instances where listening led to successful outcomes, such as resolving complaints or creating tailored financial plans.

Problem-Solving Skills

Retail Bankers often face challenges that require quick and effective solutions, making problem-solving a critical skill in their roles.

How to show it: Provide examples of specific problems you solved, detailing the methods used and the positive impacts on clients or the bank.

Time Management

Retail Bankers must juggle multiple tasks efficiently, from managing customer transactions to meeting deadlines for reports.

How to show it: Highlight your ability to prioritize tasks and manage time effectively, citing any improvements in workflow or customer service turnaround.

Teamwork

Collaboration with colleagues is vital for Retail Bankers to ensure seamless service delivery and a positive work environment.

How to show it: Illustrate your experience working within teams to achieve goals, including any projects that required collective effort and resulted in success.

Adaptability

Retail Bankers must be adaptable to changing regulations, technology, and customer needs, ensuring they remain effective in their roles.

How to show it: Demonstrate your flexibility by providing examples of how you successfully adjusted to changes in the banking environment.

Empathy

Empathy enables Retail Bankers to connect with clients on a personal level, fostering trust and loyalty.

How to show it: Share specific instances where your empathetic approach led to improved client relationships or resolution of sensitive issues.

Attention to Detail

Accuracy is crucial in banking; attention to detail helps prevent errors and ensures compliance with financial regulations.

How to show it: Provide metrics or outcomes that demonstrate your attention to detail, such as error reduction percentages or successful audits.

Sales Skills

Retail Bankers often need to promote financial products; strong sales skills help them to effectively persuade customers.

How to show it: Quantify your sales achievements, such as meeting sales targets or increasing product uptake among clients.

Conflict Resolution

Retail Bankers are frequently faced with customer disputes; strong conflict resolution skills enable them to handle these situations effectively.

How to show it: Share examples where you successfully managed and resolved conflicts, noting any positive feedback from clients.

Customer Service Orientation

A strong customer service orientation ensures that Retail Bankers prioritize client satisfaction and build lasting relationships.

How to show it: Highlight specific achievements in customer service, such as awards received or improvements in customer feedback scores.

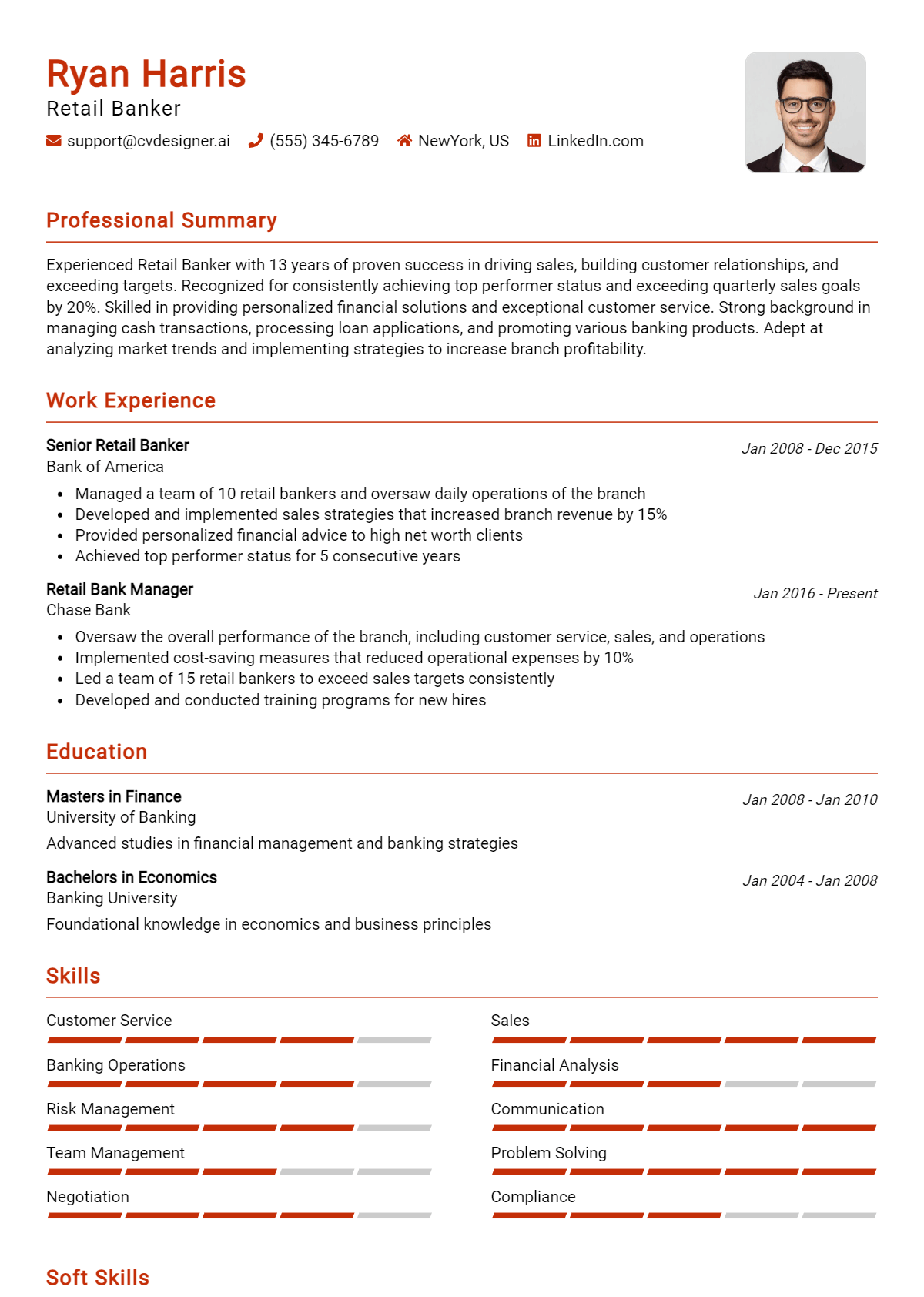

How to List Retail Banker Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to employers in the competitive field of retail banking. Highlighting your abilities can provide a snapshot of your qualifications and expertise. Your skills can be prominently featured in three main sections: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing Retail Banker skills in the introduction (objective or summary) section allows hiring managers to quickly grasp your qualifications. A strong summary can set the tone for your entire resume.

Example

Dedicated Retail Banker with extensive experience in customer service, financial advice, and sales strategies. Proven track record in relationship management and problem-solving to enhance client satisfaction and increase revenue.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how Retail Banker skills have been applied in real-world scenarios. This is where you can show the impact of your skills through specific achievements.

Example

- Utilized financial analysis skills to assess clients' needs, resulting in a 15% increase in loan approvals.

- Provided exceptional customer service, leading to a 20% rise in customer satisfaction scores.

- Collaborated with team members to implement sales strategies that boosted branch revenue by 30%.

- Trained new staff in banking procedures and regulatory compliance, enhancing overall team performance.

for Resume Skills

The skills section can either showcase technical or transferable skills, and it's essential to include a balanced mix of hard and soft skills. This section is crucial for demonstrating your qualifications directly.

Example

- Financial Analysis

- Customer Relationship Management

- Sales Strategies

- Regulatory Compliance

- Problem Solving

- Effective Communication

- Team Collaboration

- Time Management

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provides a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate your fit for the role.

Example

In my previous role, my strong customer service skills directly contributed to a 25% increase in client retention. By leveraging my financial analysis expertise, I was able to tailor solutions that perfectly met client needs, leading to enhanced satisfaction and loyalty.

Encourage the candidate to link the skills mentioned in the resume to specific achievements in their cover letter, reinforcing their qualifications for the job.

The Importance of Retail Banker Resume Skills

In the competitive field of retail banking, a well-crafted resume can be the key differentiator between candidates. Highlighting relevant skills not only showcases a candidate’s qualifications but also aligns them directly with the job requirements laid out by potential employers. A strong skills section helps recruiters quickly identify the competencies that make a candidate suitable for the role, ultimately increasing the chances of securing an interview.

- Effective communication skills are vital for retail bankers, as they interact with customers daily. Highlighting this skill demonstrates the ability to build rapport, understand client needs, and explain complex financial products clearly.

- Attention to detail is crucial in retail banking to ensure accuracy in transactions and compliance with regulations. By emphasizing this skill, candidates show their commitment to maintaining high standards and mitigating risks.

- Customer service skills are essential for successful retail bankers. Candidates should highlight their ability to provide exceptional service, resolve issues, and enhance customer satisfaction, which can lead to increased loyalty and retention.

- Problem-solving skills are important for addressing client inquiries and financial challenges. Showcasing this skill indicates a candidate's capability to think critically and find effective solutions in a fast-paced environment.

- Sales and persuasion skills can significantly impact a banker’s ability to meet targets and promote products. By including this skill, candidates can demonstrate their proficiency in identifying opportunities and closing deals.

- Technical proficiency with banking software and tools is increasingly important in retail banking. Highlighting this skill assures employers of a candidate's ability to adapt to technology and manage financial transactions efficiently.

- Time management skills are crucial for retail bankers who handle multiple tasks, from customer interactions to administrative duties. By showcasing this ability, candidates demonstrate their efficiency and organizational skills.

- Teamwork and collaboration skills are essential in a retail banking environment. Emphasizing this skill indicates a candidate's ability to work well with colleagues and contribute positively to the workplace culture.

To explore effective examples of retail banker resumes, visit Resume Samples.

How To Improve Retail Banker Resume Skills

In the ever-evolving world of finance, it's crucial for retail bankers to continuously enhance their skills to stay competitive and provide exceptional service to clients. As customer expectations rise and technology advances, improving your skill set not only bolsters your resume but also enhances your ability to meet client needs effectively. Here are some actionable tips to help you improve your retail banking skills:

- Participate in Professional Development Courses: Enroll in courses that focus on customer service, financial products, and regulatory compliance to stay updated with industry standards.

- Enhance Communication Skills: Practice active listening and clear communication, as these skills are vital for understanding client needs and building strong relationships.

- Gain Technical Proficiency: Familiarize yourself with the latest banking software and digital tools to efficiently assist customers and streamline operations.

- Network with Industry Professionals: Attend banking seminars, workshops, and networking events to learn from peers and industry leaders.

- Stay Informed on Market Trends: Regularly read financial news and publications to understand market changes and how they affect your customers.

- Seek Feedback: Regularly ask for feedback from supervisors and clients to identify areas for improvement and adjust your approach accordingly.

- Develop Problem-Solving Skills: Work on case studies and scenarios to strengthen your ability to handle complex customer inquiries and provide effective solutions.

Frequently Asked Questions

What are the essential skills for a retail banker?

Essential skills for a retail banker include strong customer service abilities, effective communication skills, attention to detail, and proficiency in financial products and services. Additionally, a good retail banker should possess analytical skills to assess customer needs and recommend suitable banking solutions, as well as problem-solving skills to address issues that may arise during customer interactions.

How important is customer service in a retail banking role?

Customer service is crucial in a retail banking role as it directly impacts customer satisfaction and loyalty. Retail bankers interact with customers daily, assisting with inquiries, processing transactions, and resolving issues. Excellent customer service skills help build trust and rapport, encouraging customers to choose and remain with the bank for their financial needs.

What role does teamwork play in retail banking?

Teamwork plays a significant role in retail banking as employees often need to collaborate with colleagues from different departments to provide seamless service to customers. Effective communication and cooperation among team members enhance operational efficiency, ensuring that customer requests are handled promptly and accurately, ultimately contributing to a positive banking experience.

How can a retail banker demonstrate financial knowledge?

A retail banker can demonstrate financial knowledge by staying informed about current banking products, interest rates, and market trends. They should also actively participate in training sessions and workshops to enhance their expertise. Additionally, explaining complex financial concepts clearly to customers showcases their knowledge and builds credibility.

What skills can help a retail banker excel in their career?

Skills that can help a retail banker excel include adaptability to changing banking regulations, strong sales skills to promote financial products, and the ability to use banking software efficiently. Developing emotional intelligence to understand customer emotions and needs, as well as continuous learning to keep up with industry advancements, also contribute to career growth in retail banking.

Conclusion

Including Retail Banker skills in your resume is essential for demonstrating your expertise and suitability for the role. By effectively showcasing relevant skills, candidates can differentiate themselves from the competition and highlight their value to potential employers. A well-crafted resume not only reflects your qualifications but also communicates your commitment to the profession.

As you refine your skills and prepare your job application, remember that every improvement you make enhances your chances of success. Embrace the journey of skill development and take the next step towards achieving your career aspirations. For additional resources, explore our resume templates, utilize our resume builder, review our resume examples, and check out our cover letter templates to elevate your application.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.