Retail Banker Core Responsibilities

A Retail Banker plays a pivotal role in connecting clients with banking services while collaborating across various departments such as sales, compliance, and customer service. Key responsibilities include assessing customer needs, recommending products, and ensuring compliance with regulations. Essential skills include technical proficiency in banking software, operational efficiency, and strong problem-solving abilities. These skills are crucial for achieving the organization's goals and enhancing customer satisfaction. A well-structured resume can effectively showcase these qualifications, highlighting the candidate's capability to drive success.

Common Responsibilities Listed on Retail Banker Resume

- Engage with customers to understand their financial needs and provide tailored solutions.

- Open and manage various types of accounts, including checking and savings.

- Process loan applications and assist clients with mortgage options.

- Conduct transactions accurately, including deposits, withdrawals, and transfers.

- Maintain compliance with banking regulations and internal policies.

- Resolve customer inquiries and issues efficiently and professionally.

- Promote bank products and services to enhance customer engagement.

- Collaborate with team members to improve service delivery and operational efficiency.

- Conduct financial assessments to recommend appropriate banking solutions.

- Monitor account activities to identify and prevent fraudulent transactions.

- Prepare reports on sales performance and customer feedback.

- Participate in training and development programs to enhance banking knowledge.

High-Level Resume Tips for Retail Banker Professionals

In the competitive world of retail banking, a well-crafted resume serves as a crucial tool for professionals aiming to make a strong first impression on potential employers. Your resume is often the first point of contact with hiring managers, and it needs to effectively showcase not only your skills but also your achievements in the field. A compelling resume can set you apart from other candidates, demonstrating your ability to drive results and provide exceptional customer service. This guide will provide practical and actionable resume tips specifically tailored for Retail Banker professionals, equipping you with the insights needed to elevate your application.

Top Resume Tips for Retail Banker Professionals

- Tailor your resume to match the job description, using relevant keywords and phrases that align with the position.

- Highlight your customer service experience, emphasizing your ability to build relationships and resolve customer issues effectively.

- Quantify your achievements by including metrics such as sales targets met, customer satisfaction ratings, and account growth percentages.

- Showcase your knowledge of banking products and services, illustrating your expertise in areas like loans, mortgages, and investment options.

- Include any relevant certifications or licenses, such as those from the Financial Industry Regulatory Authority (FINRA) or the National Association of Federal Credit Unions (NAFCU).

- Demonstrate your proficiency with banking software and technology, as well as any experience with online banking platforms.

- Emphasize your ability to work collaboratively in a team environment, showcasing experiences where teamwork led to successful outcomes.

- Utilize a clean and professional format, ensuring your resume is easy to read and highlights key information effectively.

- Keep your resume concise, ideally one page, focusing on the most relevant and impactful experiences.

By implementing these tips, you can significantly increase your chances of landing a job in the Retail Banker field. A polished resume that aligns with the specific requirements of the role will not only capture the attention of hiring managers but also demonstrate your commitment to excellence and readiness to contribute to their team.

Why Resume Headlines & Titles are Important for Retail Banker

In the competitive landscape of retail banking, a well-crafted resume headline or title serves as a vital first impression for candidates. It is the first element hiring managers see, and it can set the tone for the entire application. A strong headline not only grabs attention immediately but also encapsulates a candidate's key qualifications in a succinct and impactful phrase. By being concise, relevant, and directly aligned with the job description, an effective resume headline can significantly increase the chances of landing an interview, making it an essential component for aspiring retail bankers.

Best Practices for Crafting Resume Headlines for Retail Banker

- Keep it concise: Aim for one to two impactful sentences.

- Be specific: Tailor the headline to reflect the specific retail banking position you are targeting.

- Highlight key qualifications: Incorporate your strongest skills and experiences relevant to the role.

- Use action words: Begin with strong verbs to convey confidence and proactivity.

- Include metrics or achievements: Whenever possible, quantify your success to demonstrate your potential impact.

- Avoid jargon: Use clear and straightforward language to ensure your headline is easily understood.

- Focus on your unique selling point: Identify what sets you apart from other candidates and include it in your headline.

- Revise for relevance: Update your headline for each application to align with the job requirements.

Example Resume Headlines for Retail Banker

Strong Resume Headlines

"Results-Driven Retail Banker with 5+ Years of Experience in Client Relationship Building and Financial Solutions"

“Dynamic Retail Banker Specializing in Cross-Selling Financial Products and Exceeding Sales Targets”

“Detail-Oriented Retail Banker with Proven Track Record in Customer Satisfaction and Operational Efficiency”

Weak Resume Headlines

“Retail Banker Looking for a Job”

“Experienced Professional in Finance”

The strong headlines are effective because they provide a clear snapshot of the candidate's qualifications and demonstrate a proactive approach to their career. They incorporate specific skills, experiences, and achievements that resonate with hiring managers. In contrast, the weak headlines fail to impress due to their vagueness and lack of relevance, which do not showcase the candidate's unique strengths or fit for the retail banking role. This makes them less memorable and less likely to capture the interest of prospective employers.

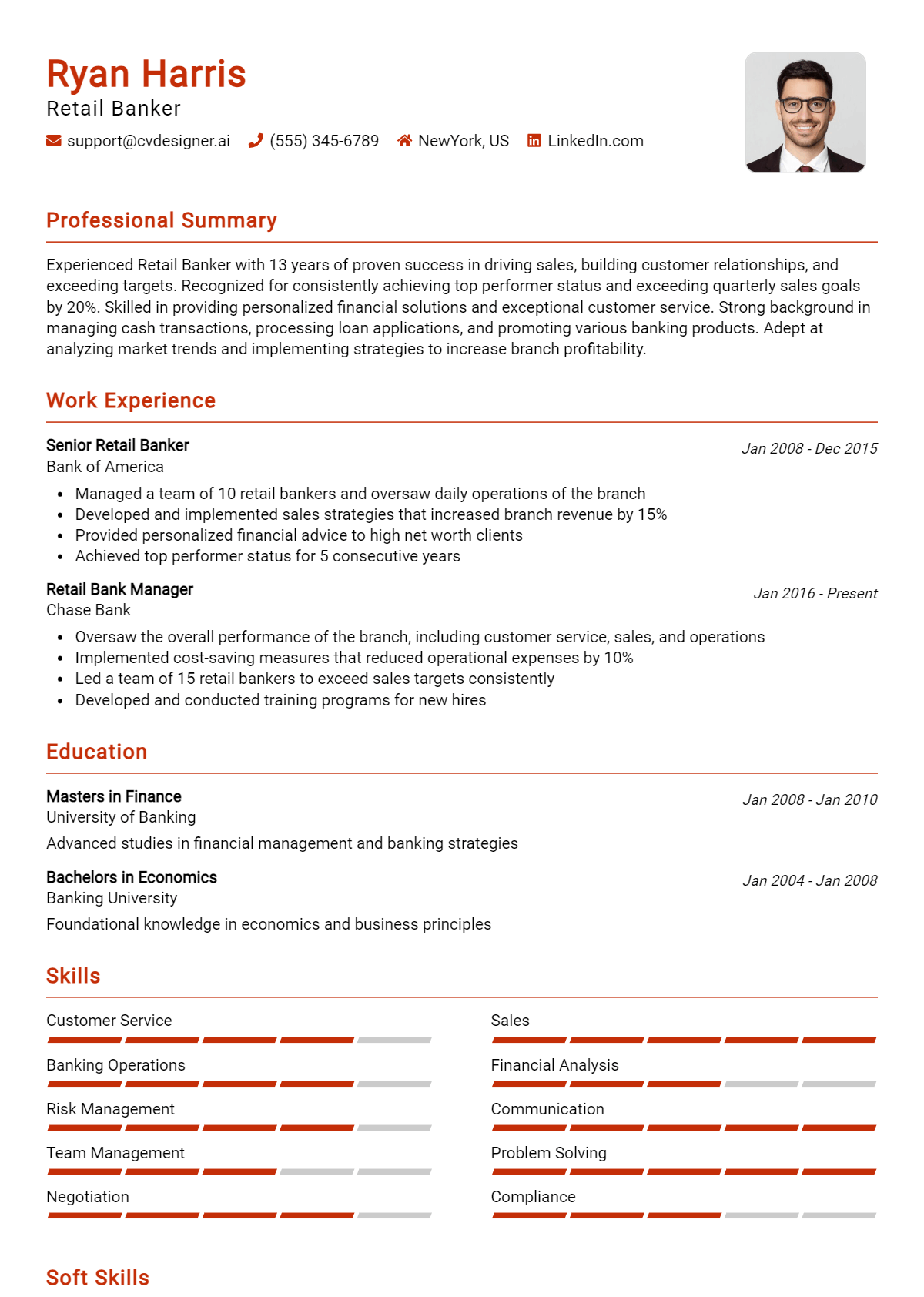

Writing an Exceptional Retail Banker Resume Summary

A well-crafted resume summary is crucial for a Retail Banker because it serves as an engaging introduction that quickly captures the attention of hiring managers. This brief yet impactful section showcases key skills, relevant experience, and notable accomplishments that align with the job role, making it easier for employers to identify a candidate's suitability at a glance. A strong summary should be concise and tailored specifically to the job the candidate is applying for, ensuring that it highlights what makes them a standout in the competitive banking industry.

Best Practices for Writing a Retail Banker Resume Summary

- Quantify achievements with specific numbers to demonstrate impact.

- Focus on relevant skills such as customer service, financial analysis, and sales techniques.

- Tailor the summary to match the job description and company culture.

- Use action verbs to convey a sense of proactivity and results-driven mindset.

- Keep it concise, ideally within 2-4 sentences, to maintain the reader's attention.

- Highlight unique qualifications or certifications that set you apart from other candidates.

- Incorporate keywords from the job posting to optimize for applicant tracking systems.

- Showcase your commitment to customer satisfaction and relationship building.

Example Retail Banker Resume Summaries

Strong Resume Summaries

Dynamic Retail Banker with over 5 years of experience in enhancing customer satisfaction and driving account growth, achieving a 25% increase in new accounts last year. Proven track record in cross-selling financial products and providing tailored financial solutions, resulting in a 30% boost in overall branch sales.

Results-oriented Retail Banker with a strong background in risk assessment and compliance, adept at identifying client needs and delivering personalized service. Successfully decreased loan processing times by 15%, contributing to improved customer retention ratings and branch performance.

Dedicated Retail Banking professional with expertise in managing client relationships and developing strategic sales initiatives. Recognized for exceeding quarterly sales targets by 40%, while maintaining a customer satisfaction rating of 98% through exceptional service.

Weak Resume Summaries

Retail Banker with experience in the financial industry looking for a new opportunity. I have a good background in customer service and sales.

Enthusiastic banking professional seeking to leverage my skills in a retail environment. I am dedicated to helping customers with their banking needs.

The strong resume summaries are effective because they include quantifiable results, specific skills directly relevant to the Retail Banker role, and demonstrate a clear impact on performance and customer satisfaction. In contrast, the weak summaries lack detail, specificity, and measurable accomplishments, making them less compelling to hiring managers who are looking for candidates who can deliver results in a competitive banking landscape.

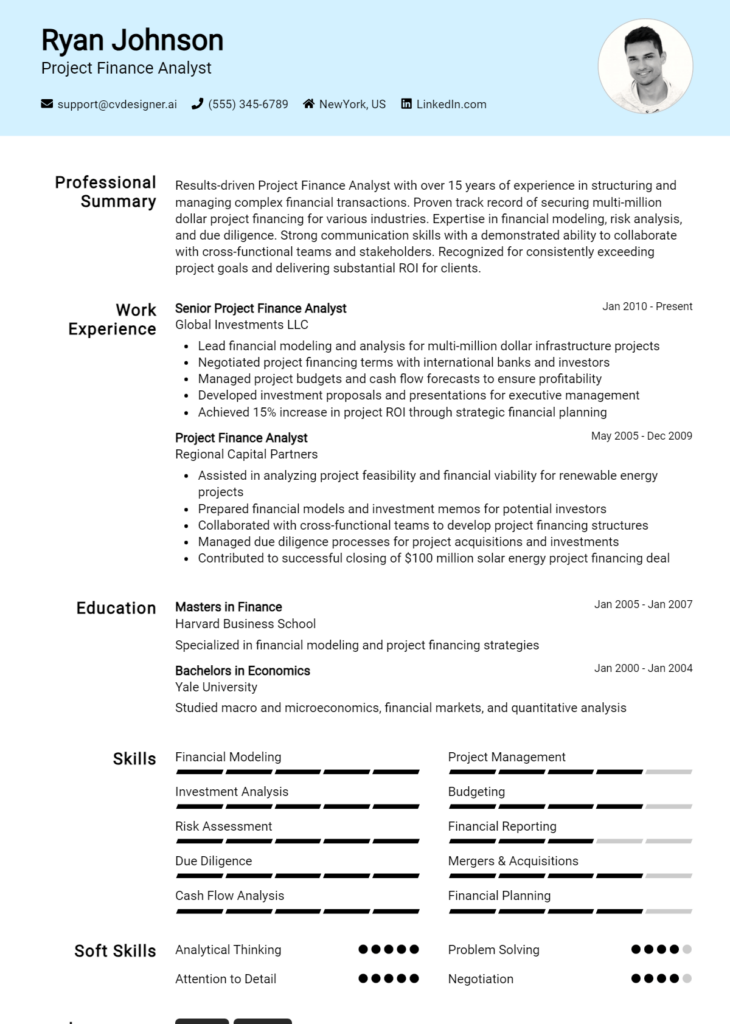

Work Experience Section for Retail Banker Resume

The work experience section of a Retail Banker resume is critical in demonstrating a candidate's proficiency in essential banking operations and their capability to deliver exceptional customer service. This section serves as a platform to showcase not just technical skills, such as knowledge of financial products and regulatory compliance, but also the ability to manage teams effectively and deliver high-quality financial solutions. By quantifying achievements—such as increases in sales, customer satisfaction scores, or compliance rates—and aligning their experiences with industry standards, candidates can significantly enhance their appeal to potential employers.

Best Practices for Retail Banker Work Experience

- Highlight specific technical skills, such as proficiency in banking software and financial analysis tools.

- Quantify achievements with metrics, like percentage increases in sales or customer retention rates.

- Emphasize collaboration within teams and with clients to demonstrate strong interpersonal skills.

- Use action verbs to convey a sense of initiative and leadership in your roles.

- Align your experience with industry standards to showcase relevance and knowledge of best practices.

- Focus on customer-centric achievements to illustrate commitment to service excellence.

- Include any relevant certifications or training that enhances your credibility as a retail banker.

- Tailor your experiences to match the specific job description, using keywords that resonate with potential employers.

Example Work Experiences for Retail Banker

Strong Experiences

- Increased branch sales by 30% over two quarters by implementing targeted marketing strategies and enhancing customer engagement.

- Successfully led a team of 10 in achieving a 95% customer satisfaction score, resulting in recognition as the top branch for service excellence.

- Streamlined compliance processes that reduced audit discrepancies by 40%, ensuring adherence to all regulatory requirements.

- Developed and conducted training sessions for new staff, improving team efficiency by 20% within three months.

Weak Experiences

- Worked at a bank and helped customers with their needs.

- Participated in team meetings and occasionally contributed ideas.

- Handled transactions and managed cash in the branch.

- Supported various banking operations without specific details on contributions.

The examples considered strong effectively highlight quantifiable outcomes, technical leadership, and collaboration, showcasing the candidate's direct impact on the organization. In contrast, the weak experiences lack specificity and measurable results, making it difficult to assess the candidate's contributions or skills. Stronger statements provide a clearer picture of the candidate's capabilities and achievements, while weaker statements leave much to be desired in terms of detail and impact.

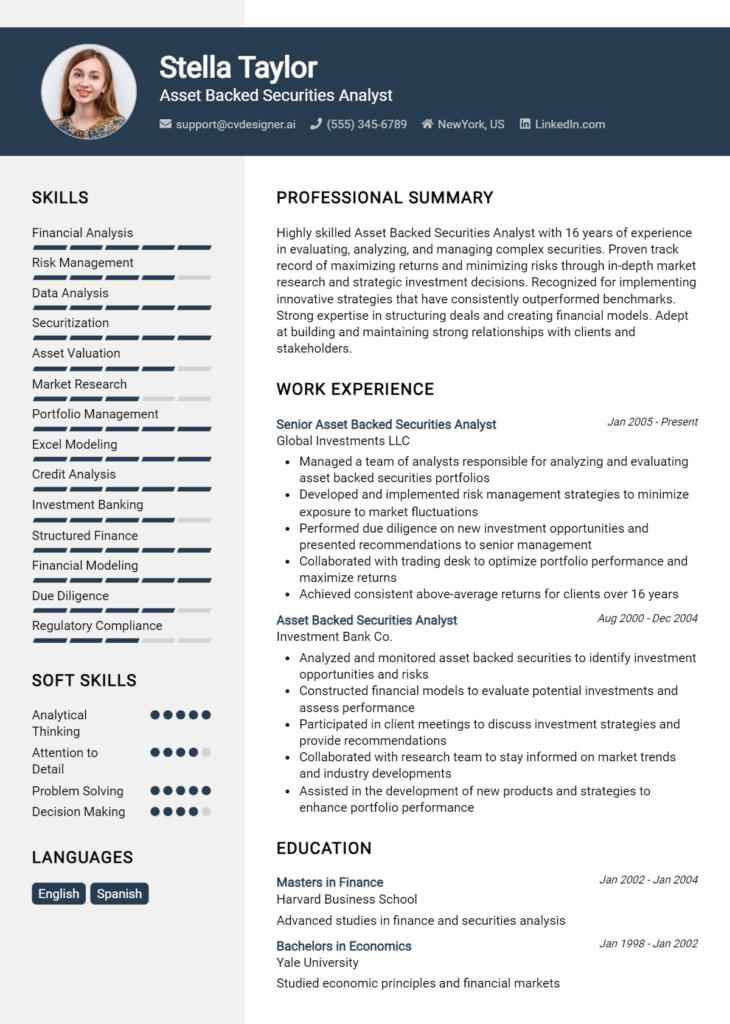

Education and Certifications Section for Retail Banker Resume

The education and certifications section of a Retail Banker resume is crucial in demonstrating a candidate's academic foundation and commitment to the banking industry. This section provides insight into the candidate's qualifications, showcasing relevant degrees, specialized training, and industry-recognized certifications. By including pertinent coursework and certifications, candidates can highlight their continuous learning efforts and align their skills with the specific requirements of the retail banking role. This not only enhances their credibility but also assures employers of their capability to thrive in a dynamic banking environment.

Best Practices for Retail Banker Education and Certifications

- Include relevant degrees such as Finance, Business Administration, or Economics.

- List industry-recognized certifications, such as Certified Financial Planner (CFP) or Certified Bank Teller (CBT).

- Highlight specialized training programs or workshops focused on retail banking or customer service.

- Provide details on relevant coursework that applies to the retail banking sector.

- Ensure the education and certifications are recent and reflect current industry standards.

- Use clear, concise language and avoid jargon that may not be understood by all readers.

- Organize this section in reverse chronological order, starting with the most recent qualifications.

- Tailor the content to match the job description, emphasizing qualifications that align with the specific role.

Example Education and Certifications for Retail Banker

Strong Examples

- Bachelor of Science in Finance, University of XYZ, May 2022

- Certified Financial Planner (CFP), 2023

- Banking Fundamentals Certification, National Banking Association, 2022

- Coursework in Risk Management and Financial Analysis, University of XYZ

Weak Examples

- Associate Degree in Culinary Arts, ABC Community College, 2015

- Certification in Graphic Design, 2019

- High School Diploma, 2010

- Online Course in Social Media Marketing, 2021

The strong examples are considered relevant and impactful because they directly relate to the skills and knowledge necessary for a Retail Banker position. They demonstrate a solid educational background in finance and banking, as well as commitment to professional development through recognized certifications. On the other hand, the weak examples are less effective due to their irrelevance to the retail banking field. They reflect qualifications that do not contribute to the candidate's ability to perform in a banking role, making them less appealing to potential employers.

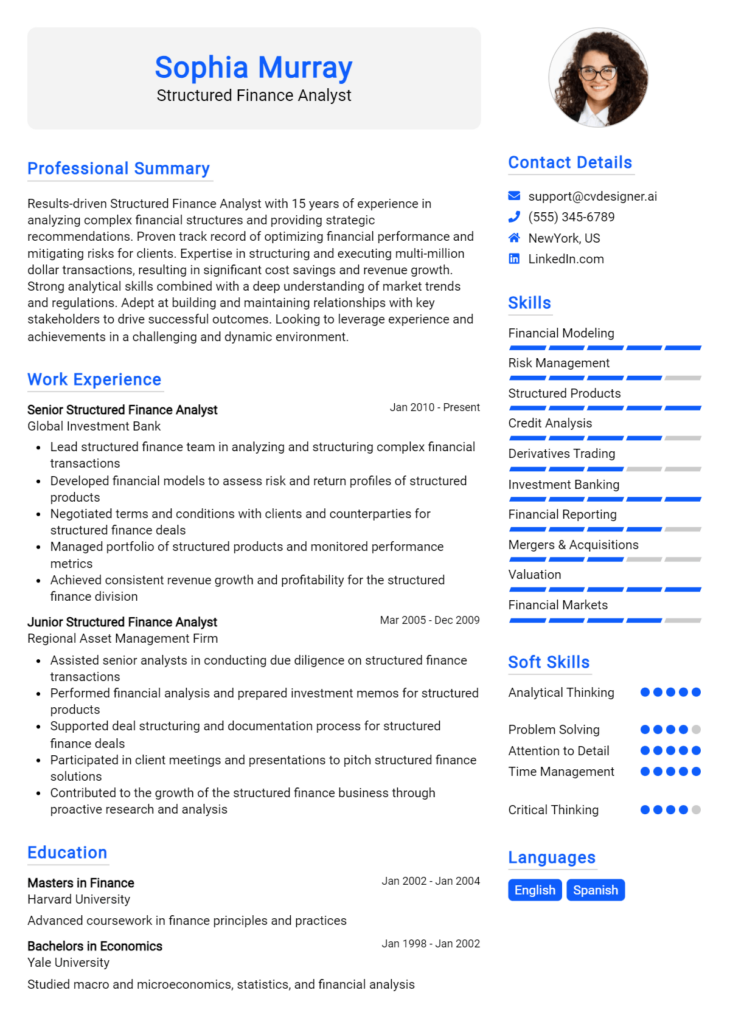

Top Skills & Keywords for Retail Banker Resume

In the competitive field of retail banking, having a well-crafted resume is essential for standing out to potential employers. A Retail Banker’s resume must effectively showcase a blend of both soft and hard skills that are crucial for success in this role. Soft skills, such as communication and customer service, highlight a candidate's ability to engage with clients and build relationships, while hard skills, like financial analysis and proficiency in banking software, demonstrate technical expertise. By emphasizing the right skills, candidates can illustrate their value and readiness to meet the needs of both customers and the institution.

Top Hard & Soft Skills for Retail Banker

Soft Skills

- Excellent communication

- Strong customer service orientation

- Problem-solving abilities

- Attention to detail

- Time management

- Team collaboration

- Adaptability and flexibility

- Empathy and emotional intelligence

- Active listening

- Sales skills

Hard Skills

- Financial analysis

- Proficiency in banking software (e.g., Fiserv, Jack Henry)

- Understanding of banking regulations and compliance

- Cash handling and management

- Risk assessment and management

- Data entry and record-keeping accuracy

- Knowledge of loan products and services

- Investment product knowledge

- Sales forecasting and budgeting

- Basic accounting principles

By incorporating these skills into your resume, you can enhance your candidacy and demonstrate your qualifications as a Retail Banker. Additionally, highlighting relevant work experience that aligns with these skills can further solidify your application.

Stand Out with a Winning Retail Banker Cover Letter

I am writing to express my enthusiasm for the Retail Banker position at [Bank Name] as advertised on [Job Platform/Company Website]. With a solid background in customer service and financial services, coupled with my passion for helping clients achieve their financial goals, I am excited about the opportunity to contribute to your team. My experience in managing customer relationships, along with my strong analytical skills, equips me to effectively meet the diverse needs of your clientele.

In my previous role as a Customer Service Representative at [Previous Bank/Company Name], I consistently exceeded sales targets while providing exceptional service to customers. I developed expertise in financial products such as savings accounts, loans, and investment options, allowing me to recommend the best solutions tailored to each client's unique situation. My ability to build rapport with customers helped foster trust and loyalty, leading to a significant increase in repeat business and referrals. I am confident that my proactive approach and strong communication skills will enable me to thrive in the dynamic environment at [Bank Name].

I am particularly impressed by [Bank Name]'s commitment to community engagement and financial education. I share the same values and believe that empowering customers with knowledge is essential to their financial success. I have successfully organized workshops to educate clients on budgeting, saving, and credit management, which not only enhanced their understanding but also strengthened their relationship with the bank. I am eager to bring this initiative to [Bank Name], helping to cultivate a culture of financial literacy within the community.

Thank you for considering my application. I am excited about the possibility of contributing to [Bank Name] as a Retail Banker and am looking forward to the opportunity to discuss my qualifications further. I am confident that my customer-centric approach and dedication to excellence will make a positive impact on your team and the clients we serve.

Common Mistakes to Avoid in a Retail Banker Resume

When crafting a resume for a Retail Banker position, it's crucial to present yourself in the best light possible. However, many candidates make common mistakes that can detract from their qualifications and experience. Avoiding these pitfalls can significantly increase your chances of landing an interview and ultimately securing the job. Here are some common mistakes to watch out for:

Generic Objective Statement: Using a one-size-fits-all objective that doesn’t speak to the specific role can make your resume blend in with others. Tailor your objective to reflect your interest in the retail banking sector and the specific institution.

Lack of Quantifiable Achievements: Failing to include metrics or specific examples of your accomplishments can make your experience seem less impactful. Use numbers to showcase your success, such as “increased customer satisfaction by 20%” or “managed a portfolio of over $1 million.”

Ignoring Relevant Skills: Not highlighting skills that are crucial for a Retail Banker, such as customer service, sales ability, and financial knowledge, can lead to missed opportunities. Ensure your skills section includes both hard and soft skills relevant to the position.

Too Much Jargon: Overloading your resume with industry-specific terminology can confuse hiring managers who may not have a banking background. Use clear, concise language that is easily understood while still showcasing your expertise.

Inconsistent Formatting: Using different fonts, sizes, or colors throughout your resume can create a chaotic appearance. Maintain a consistent format to enhance readability and professionalism.

Including Irrelevant Experience: Listing every job you’ve had, regardless of relevance to retail banking, can dilute your message. Focus on positions that showcase skills and experience pertinent to the banking industry.

Neglecting to Proofread: Spelling and grammatical errors can undermine your professionalism and attention to detail. Carefully review your resume and consider having a friend or mentor proofread it as well.

Omitting Contact Information: Forgetting to include essential contact information, such as your phone number and email address, can make it difficult for hiring managers to reach you. Ensure this information is clearly displayed at the top of your resume.

Conclusion

As a Retail Banker, your role is crucial in building relationships with clients, understanding their financial needs, and offering tailored banking solutions. You are responsible for processing transactions, promoting bank products, and providing exceptional customer service. Strong communication skills, attention to detail, and a solid understanding of financial products are essential to succeed in this position. Additionally, staying updated on industry trends and regulations can enhance your effectiveness and credibility.

To stand out in this competitive field, it's vital to present a polished and professional resume that highlights your skills and accomplishments. Consider reviewing your Retail Banker resume to ensure it effectively showcases your qualifications and experience.

Take advantage of the resources available to you, such as resume templates, which can help format your information attractively. Utilize the resume builder to create a custom resume that aligns with your unique professional journey. If you're looking for inspiration, browse through resume examples to see how others in your field have positioned themselves. Finally, don’t forget the importance of a compelling introduction with a well-crafted cover letter template that complements your resume.

Now is the time to take action! Review and enhance your Retail Banker resume to ensure you make a lasting impression on potential employers.