27 Pricing Actuary Resume Skills That Stand Out in 2025

As a Pricing Actuary, possessing a diverse set of skills is essential to effectively analyze risk and develop pricing strategies that align with business objectives. This section highlights the top skills that can enhance your resume and demonstrate your expertise in the field. From advanced analytical capabilities to strong communication skills, these attributes will showcase your ability to contribute significantly to your organization’s success in pricing and risk management.

Best Pricing Actuary Technical Skills

In the competitive field of Pricing Actuarial science, possessing strong technical skills is crucial for analyzing risks, developing pricing models, and providing valuable insights. These skills not only enhance your ability to perform complex calculations but also improve your effectiveness in communicating findings to stakeholders. Below are some essential technical skills that can strengthen your resume.

Statistical Analysis

Proficiency in statistical methods is vital for evaluating data patterns and drawing meaningful conclusions that impact pricing strategies.

How to show it: Highlight specific statistical tools you’ve utilized and mention any projects where your analysis led to improved pricing accuracy.

Risk Assessment

The ability to assess and quantify risks helps in formulating pricing models that accurately reflect potential financial outcomes.

How to show it: Include examples where your risk assessments contributed to better pricing decisions or reduced financial exposure.

Predictive Modeling

Creating predictive models allows actuaries to forecast future trends based on historical data, which is essential for setting competitive prices.

How to show it: Detail the types of models you've developed and the results achieved, such as increased profitability or market share.

Data Manipulation

Skill in manipulating large datasets is crucial for cleaning, transforming, and analyzing data effectively to derive insights.

How to show it: Demonstrate your experience with data manipulation tools, citing specific projects where you improved data quality.

Financial Reporting

Expertise in financial reporting ensures that pricing strategies align with overall financial goals and comply with regulatory requirements.

How to show it: List key reports you’ve prepared that influenced pricing strategies or demonstrated compliance with regulations.

Programming Skills

Familiarity with programming languages such as R, Python, or SAS allows actuaries to automate processes and enhance modeling capabilities.

How to show it: Include programming projects that resulted in time savings or improved model accuracy.

Excel Proficiency

Advanced Excel skills are essential for performing complex calculations, creating models, and analyzing data efficiently.

How to show it: Quantify the efficiency gains achieved through your Excel expertise, such as reducing analysis time by a certain percentage.

Database Management

Knowledge of database systems is important for storing, retrieving, and managing actuarial data effectively.

How to show it: Highlight any database projects, focusing on improvements in data retrieval times or accuracy.

Insurance Regulations Knowledge

Understanding industry regulations is crucial for ensuring that pricing models comply with legal standards and ethical considerations.

How to show it: Mention specific regulations you’ve navigated successfully and how your compliance efforts benefited the organization.

Communication Skills

The ability to clearly convey complex actuarial concepts to non-technical stakeholders is essential for collaboration and decision-making.

How to show it: Provide examples of presentations or reports where your communication led to actionable insights for business leaders.

Project Management

Project management skills enable actuaries to oversee projects from inception to completion, ensuring they meet deadlines and goals.

How to show it: Detail projects you've led, focusing on outcomes such as on-time delivery and stakeholder satisfaction.

Best Pricing Actuary Soft Skills

In the role of a Pricing Actuary, technical proficiency is essential, but soft skills play a crucial role in achieving success. These workplace skills enhance collaboration, communication, and problem-solving abilities—key components for making informed pricing decisions and effectively presenting analytical findings. Here are some of the top soft skills that can help you stand out in this competitive field.

Analytical Thinking

Analytical thinking is the ability to assess complex data and extract meaningful insights. For a Pricing Actuary, this skill is vital for interpreting statistical data and making data-driven pricing decisions.

How to show it: Include examples of projects where you analyzed and interpreted data that led to significant pricing improvements or cost savings.

Communication

Effective communication is essential for conveying complex actuarial concepts to non-technical stakeholders. A Pricing Actuary must articulate findings clearly and persuasively.

How to show it: Highlight experiences where you presented data-driven recommendations to management or clients, emphasizing successful outcomes.

Problem-solving

Problem-solving involves identifying issues and developing innovative solutions. Pricing Actuaries encounter various challenges that require creative and practical approaches to resolve.

How to show it: Describe specific instances where your problem-solving skills led to improved pricing strategies or risk assessments.

Attention to Detail

Attention to detail is critical in ensuring accuracy in calculations and analyses. Small errors can lead to significant financial implications, making this skill crucial for Pricing Actuaries.

How to show it: Provide examples of how your meticulousness contributed to error-free reports or analyses, reducing risk for the company.

Teamwork

Teamwork is the ability to collaborate effectively with others. Pricing Actuaries often work with cross-functional teams to develop pricing strategies that meet organizational goals.

How to show it: Illustrate your role in a team project that achieved a shared objective, showcasing your collaborative efforts.

Time Management

Time management is the ability to prioritize tasks and meet deadlines. Pricing Actuaries often juggle multiple projects, making this skill essential for maintaining productivity.

How to show it: Detail how you successfully managed competing deadlines while delivering high-quality work, perhaps using metrics to demonstrate efficiency.

Adaptability

Adaptability refers to the capacity to adjust to new conditions. The actuarial landscape can change rapidly, so being flexible is crucial for Pricing Actuaries.

How to show it: Share experiences where you successfully adapted to changes in market conditions or internal processes, illustrating your resilience.

Critical Thinking

Critical thinking involves analyzing facts to form a judgment. For Pricing Actuaries, this is important for evaluating pricing models and their implications.

How to show it: Provide examples of how your critical thinking led to enhanced pricing strategies or improved risk assessments.

Interpersonal Skills

Interpersonal skills are essential for building relationships and networking. Pricing Actuaries interact with various departments and stakeholders, making effective relationship-building crucial.

How to show it: Highlight instances where you successfully collaborated or built rapport with colleagues, resulting in productive partnerships.

Negotiation Skills

Negotiation skills are vital for reaching agreements on pricing strategies. Pricing Actuaries must negotiate terms that are beneficial to both the organization and its clients.

How to show it: Detail experiences where your negotiation led to favorable outcomes, emphasizing your ability to achieve win-win scenarios.

Leadership

Leadership skills are important for guiding teams and influencing decision-making. Even as a Pricing Actuary, demonstrating leadership can drive initiatives and inspire others.

How to show it: Share examples of how you took initiative in projects or led teams to achieve specific pricing objectives.

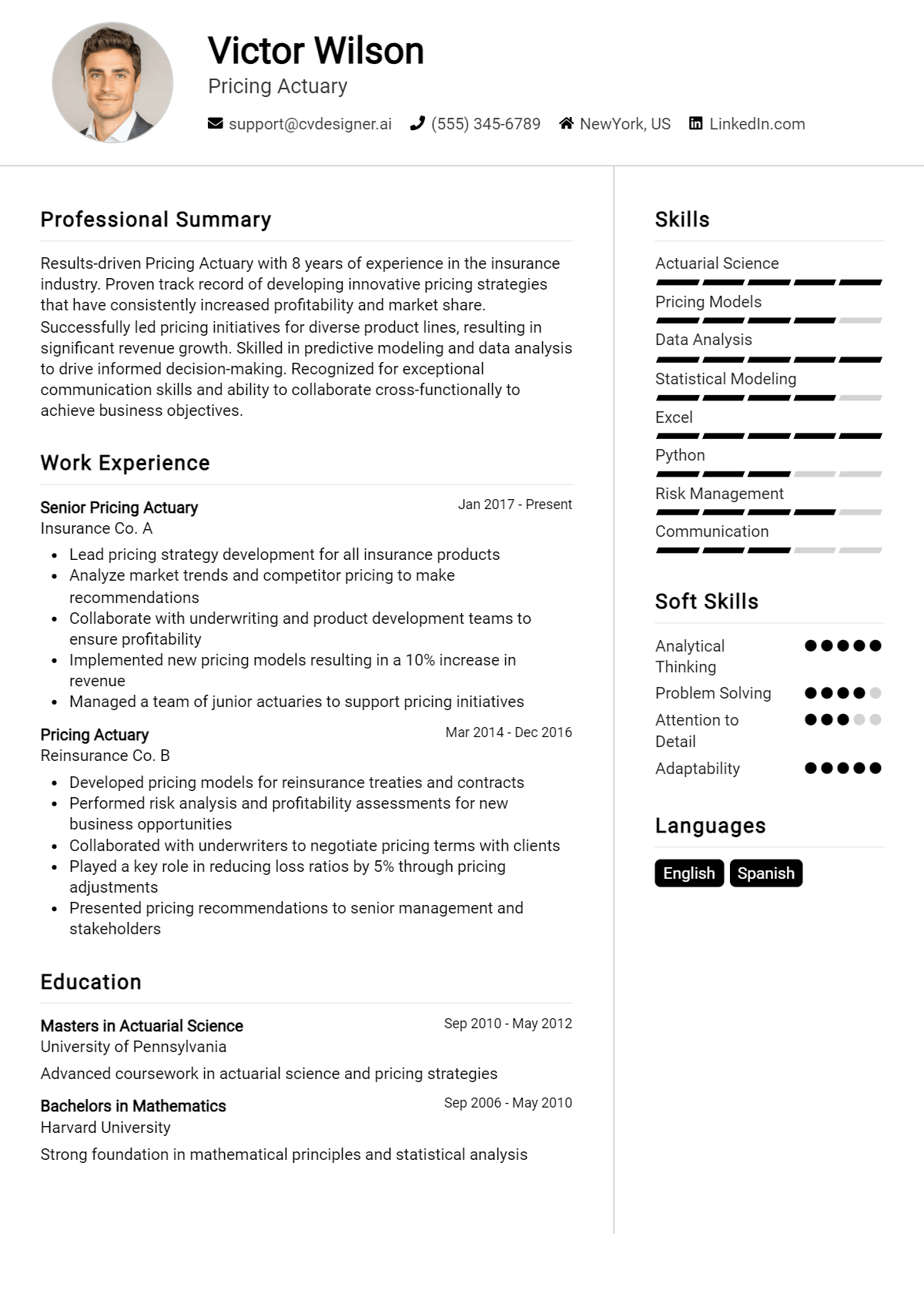

How to List Pricing Actuary Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to potential employers. A well-crafted skills section can help hiring managers quickly identify your qualifications. There are three main sections where you can highlight your skills: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Pricing Actuary skills in the introduction (objective or summary) section offers hiring managers a quick overview of your qualifications. This sets the tone for the rest of your resume.

Example

Detail-oriented Pricing Actuary with expertise in risk assessment and data analysis. Proven ability to develop precise pricing models that enhance profitability. Strong communication and teamwork skills foster collaboration across departments.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how you have applied your Pricing Actuary skills in real-world scenarios. Use this section to match your experience with the specific skills mentioned in job listings.

Example

- Developed pricing models using statistical analysis to improve accuracy by 15%.

- Collaborated with the underwriting team to assess risk factors, enhancing overall portfolio performance.

- Utilized software proficiency in R and Python for data manipulation and reporting.

- Communicated insights to stakeholders, resulting in a 20% reduction in pricing errors.

for Resume Skills

The skills section can showcase either technical or transferable skills. A balanced mix of hard and soft skills should be included to strengthen your overall qualifications as a Pricing Actuary.

Example

- Advanced Statistical Analysis

- Risk Assessment

- Data Modeling

- Programming in R and Python

- Strong Communication Skills

- Team Collaboration

- Problem-Solving Abilities

- Attention to Detail

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can help demonstrate your fit for the role.

Example

As a Pricing Actuary, my strong background in data analysis and risk assessment has enabled me to develop precise pricing strategies that significantly improved company profitability. In my previous role, I successfully reduced pricing errors through effective communication and collaboration, ensuring all departments were aligned with our pricing objectives.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For additional details on how to enhance your resume, explore sections on skills, Technical Skills, and work experience.

The Importance of Pricing Actuary Resume Skills

In the competitive field of actuarial science, particularly for Pricing Actuaries, showcasing relevant skills on your resume is crucial. A well-crafted skills section not only highlights your expertise but also aligns your qualifications with the specific demands of the job. This helps candidates capture the attention of recruiters and present themselves as the ideal fit for the role.

- Demonstrating proficiency in statistical analysis is essential for Pricing Actuaries, as it showcases your ability to interpret complex data sets and make informed pricing decisions based on quantitative evidence.

- Knowledge of actuarial software and programming languages, such as R or Python, is vital. This skill indicates your capability to automate processes and conduct advanced analyses, making you a valuable asset to potential employers.

- Strong communication skills are necessary for translating technical findings into understandable terms for non-technical stakeholders. This not only aids in collaboration but also enhances your ability to influence pricing strategies effectively.

- Understanding of regulatory requirements and compliance issues is critical in the insurance industry. Highlighting this skill shows your awareness of legal frameworks that govern pricing structures and risk assessments.

- Expertise in risk assessment and management is fundamental for a Pricing Actuary. It reflects your ability to evaluate potential risks and their financial implications, which is crucial for setting appropriate pricing models.

- Teamwork and collaboration skills are important, as Pricing Actuaries often work in cross-functional teams. Emphasizing this ability demonstrates your readiness to contribute positively to a collaborative work environment.

- Attention to detail is a key skill that can’t be overlooked. Highlighting this attribute assures employers that you can analyze data meticulously, preventing costly errors in pricing calculations.

- Finally, showcasing your problem-solving skills indicates your ability to tackle complex challenges that arise in pricing strategies, illustrating your proactive approach to overcoming obstacles.

For additional insights and examples, you can explore various Resume Samples.

How To Improve Pricing Actuary Resume Skills

In the rapidly evolving field of actuarial science, staying ahead in pricing strategies and methodologies is crucial for success. Continuous improvement not only enhances your expertise but also makes you a more competitive candidate in the job market. By refining your skills, you can better analyze data, develop more accurate pricing models, and contribute to your organization's profitability. Here are some actionable tips to help you improve your pricing actuary resume skills:

- Engage in ongoing education by pursuing relevant certifications such as the Associate of the Society of Actuaries (ASA) or the Chartered Enterprise Risk Analyst (CERA).

- Gain proficiency in advanced statistical software tools like R, Python, or SAS that are essential for data analysis and modeling.

- Regularly attend industry conferences and workshops to stay updated on the latest trends and best practices in pricing strategies.

- Join professional actuarial organizations to network with peers and access resources that can enhance your knowledge and skills.

- Participate in online courses or webinars focused on specialized topics such as predictive modeling and machine learning in pricing.

- Practice real-world scenarios by working on case studies or simulations that require developing pricing models under various conditions.

- Seek feedback from colleagues and mentors on your work to identify areas for improvement and gain new perspectives.

Frequently Asked Questions

What are the essential skills required for a Pricing Actuary?

A Pricing Actuary should possess strong analytical skills, proficiency in statistical analysis, and a solid understanding of financial mathematics. Additionally, skills in programming languages such as R, SAS, or Python are highly valuable for data manipulation and modeling. Familiarity with actuarial software and tools, as well as effective communication skills, are also crucial for presenting complex data insights to non-technical stakeholders.

How important is experience with statistical modeling for a Pricing Actuary?

Experience with statistical modeling is vital for a Pricing Actuary, as it enables them to accurately assess risks and predict future claims based on historical data. This skill allows actuaries to develop pricing models that reflect the true cost of risk, ensuring competitiveness in the market while maintaining profitability. Proficiency in various modeling techniques enhances an actuary's ability to adapt to different pricing scenarios and regulatory requirements.

What role does communication play in the work of a Pricing Actuary?

Communication is a key skill for a Pricing Actuary as they often need to explain complex actuarial concepts and findings to colleagues, clients, and stakeholders who may not have a technical background. Effective communication helps in facilitating collaboration with underwriting teams and informing business decisions. Strong presentation skills are also crucial for delivering reports and recommendations clearly and persuasively.

What software tools are commonly used by Pricing Actuaries?

Pricing Actuaries commonly use software tools such as Excel for data analysis and modeling, along with specialized actuarial software like Prophet, GGY AXIS, or MoSes for more advanced calculations and simulations. Familiarity with database management systems like SQL and data visualization tools like Tableau or Power BI can also enhance an actuary's ability to analyze and present data effectively.

How can one demonstrate their pricing skills on a resume for a Pricing Actuary position?

To effectively demonstrate pricing skills on a resume, candidates should highlight relevant coursework, certifications, and hands-on experience with pricing models. Including specific projects that showcase analytical techniques used in pricing, alongside quantifiable outcomes, can significantly strengthen a resume. Additionally, mentioning proficiency in programming languages, software tools, and any relevant internships or work experiences in the insurance or finance sectors can further showcase one's qualifications.

Conclusion

Incorporating Pricing Actuary skills in your resume is vital for showcasing your expertise and value to potential employers. By highlighting relevant skills such as statistical analysis, risk assessment, and pricing strategy, candidates can differentiate themselves in a competitive job market. Demonstrating these capabilities not only enhances your application but also signals to employers that you are equipped to contribute positively to their organization.

As you refine your skills, remember that each improvement brings you one step closer to landing your ideal job. Stay committed to enhancing your expertise, and let your resume reflect your dedication and readiness for new challenges. For additional resources, consider exploring our resume templates, resume builder, resume examples, and cover letter templates to further bolster your application efforts.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.