Pricing Actuary Core Responsibilities

A Pricing Actuary plays a crucial role in the insurance and finance industries, where they analyze data to develop pricing strategies that align with business objectives. This position requires strong technical skills in statistical analysis and modeling, operational knowledge of market trends, and exceptional problem-solving abilities. By collaborating with underwriting, finance, and risk management teams, a Pricing Actuary ensures that pricing structures are both competitive and profitable. A well-crafted resume that highlights these skills can effectively demonstrate a candidate's ability to contribute to the organization's success.

Common Responsibilities Listed on Pricing Actuary Resume

- Conduct statistical analysis to determine pricing models.

- Collaborate with underwriting teams to assess risk factors.

- Develop and maintain pricing algorithms and tools.

- Analyze market trends to inform pricing strategies.

- Prepare reports and presentations for stakeholders.

- Evaluate the profitability of insurance products.

- Implement regulatory compliance in pricing decisions.

- Monitor and refine pricing based on performance metrics.

- Assist in the development of business forecasts.

- Support cross-departmental initiatives to enhance pricing accuracy.

- Utilize software tools for data analysis and reporting.

High-Level Resume Tips for Pricing Actuary Professionals

In today's competitive job market, a well-crafted resume is essential for Pricing Actuary professionals seeking to make a lasting impression on potential employers. Your resume often serves as the first point of contact, and it's crucial that it effectively showcases not only your technical skills but also your significant achievements in the field. A strong resume can set you apart from other candidates by clearly demonstrating your value to prospective employers. This guide will provide practical and actionable resume tips specifically tailored for Pricing Actuary professionals, ensuring that you present yourself in the best possible light.

Top Resume Tips for Pricing Actuary Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases from the posting.

- Highlight your relevant experience in actuarial pricing, including specific roles and responsibilities that align with the job you are applying for.

- Quantify your achievements with specific metrics, such as cost savings, revenue increases, or improved pricing accuracy.

- Showcase your proficiency with industry-specific software and tools, such as SAS, R, or Excel, to demonstrate your technical capabilities.

- Include relevant certifications and professional memberships, such as those from the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

- Emphasize your analytical skills and problem-solving abilities, as these are crucial in the pricing actuary role.

- Demonstrate your understanding of regulatory requirements and industry trends that impact pricing strategies.

- Include a summary statement at the beginning of your resume that succinctly outlines your experience and career goals.

- Keep your resume concise, ideally one page, while ensuring it highlights your most relevant experiences and accomplishments.

- Proofread your resume thoroughly to avoid any grammatical or typographical errors, as attention to detail is vital in this profession.

By implementing these tips, you can significantly enhance your chances of landing a job in the Pricing Actuary field. A well-optimized resume not only reflects your skills and accomplishments but also communicates your dedication and professionalism, making you a compelling candidate for potential employers.

Why Resume Headlines & Titles are Important for Pricing Actuary

In the competitive field of actuarial science, particularly for Pricing Actuaries, the importance of a well-crafted resume headline cannot be overstated. A strong headline serves as the first impression a hiring manager will have of a candidate, acting as a powerful hook that draws them in. It encapsulates the candidate's key qualifications in a concise and impactful phrase, summarizing their expertise in pricing strategies, risk assessment, and analytical skills. By ensuring the headline is relevant to the job being applied for, candidates can effectively communicate their value proposition right from the start, setting a positive tone for the rest of their resume.

Best Practices for Crafting Resume Headlines for Pricing Actuary

- Keep it concise: Aim for one impactful phrase rather than a long sentence.

- Be specific: Use industry-relevant terminology that directly relates to Pricing Actuary roles.

- Highlight key strengths: Focus on your most notable skills or achievements relevant to pricing and risk analysis.

- Tailor for the job: Customize your headline for each application, reflecting the specific requirements of the role.

- Use active language: Choose powerful action words that convey confidence and expertise.

- Include measurable accomplishments: If possible, reference quantifiable results to enhance credibility.

- Avoid jargon: While industry terms are important, ensure your headline is easily understandable.

- Showcase your unique value: Differentiate yourself from other candidates by emphasizing what sets you apart.

Example Resume Headlines for Pricing Actuary

Strong Resume Headlines

Dynamic Pricing Actuary with 7+ Years of Experience in Risk Assessment and Premium Optimization

Results-Driven Actuary Skilled in Advanced Statistical Modeling and Predictive Analytics

Expert Pricing Actuary Specializing in Data-Driven Strategies and Market Analysis

Certified Actuary with Proven Track Record in Enhancing Profitability through Innovative Pricing Solutions

Weak Resume Headlines

Actuary Looking for a Job

Experienced Professional Seeking Opportunities

The strong headlines are effective because they clearly articulate the candidate's experience and skills relevant to the Pricing Actuary role, using specific language that resonates with hiring managers. They also convey a sense of accomplishment and expertise, making the candidate stand out. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity; they do not provide any insight into the candidate’s qualifications or what makes them a suitable fit for the position, ultimately missing the opportunity to capture the attention of potential employers.

Writing an Exceptional Pricing Actuary Resume Summary

A resume summary is a crucial component for a Pricing Actuary, as it serves as an immediate introduction to the candidate's qualifications and value proposition. Given the competitive nature of the actuarial field, a strong summary captures the attention of hiring managers by succinctly showcasing key skills, relevant experience, and notable accomplishments. This brief yet impactful section should be concise and tailored specifically to the job at hand, ensuring that the candidate stands out from others in the applicant pool.

Best Practices for Writing a Pricing Actuary Resume Summary

- Quantify achievements: Use numbers to highlight your successes, such as percentage increases in profitability or cost reductions.

- Focus on relevant skills: Emphasize technical skills like statistical analysis, risk assessment, and pricing strategy development.

- Tailor for the job description: Customize your summary to align with the specific requirements and responsibilities outlined in the job posting.

- Highlight industry knowledge: Mention familiarity with regulatory requirements, market trends, and actuarial software.

- Be concise: Keep the summary within 2-4 sentences to maintain clarity and impact.

- Use action verbs: Begin statements with strong action verbs that convey initiative and results.

- Showcase soft skills: Include interpersonal skills such as communication, teamwork, and problem-solving that are crucial in an actuarial role.

- Avoid jargon: Use clear language that is easy to understand for hiring managers who may not have a technical background.

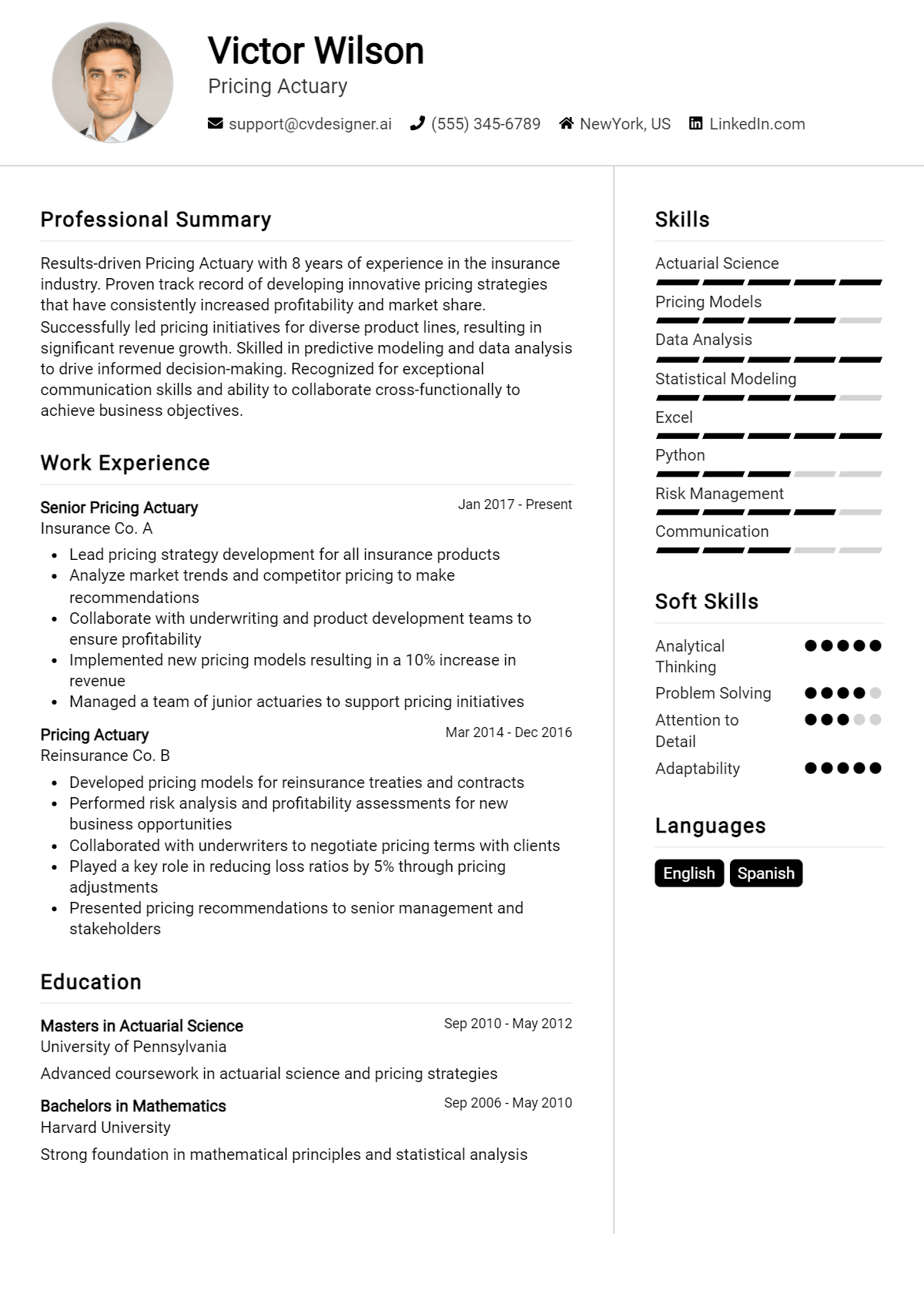

Example Pricing Actuary Resume Summaries

Strong Resume Summaries

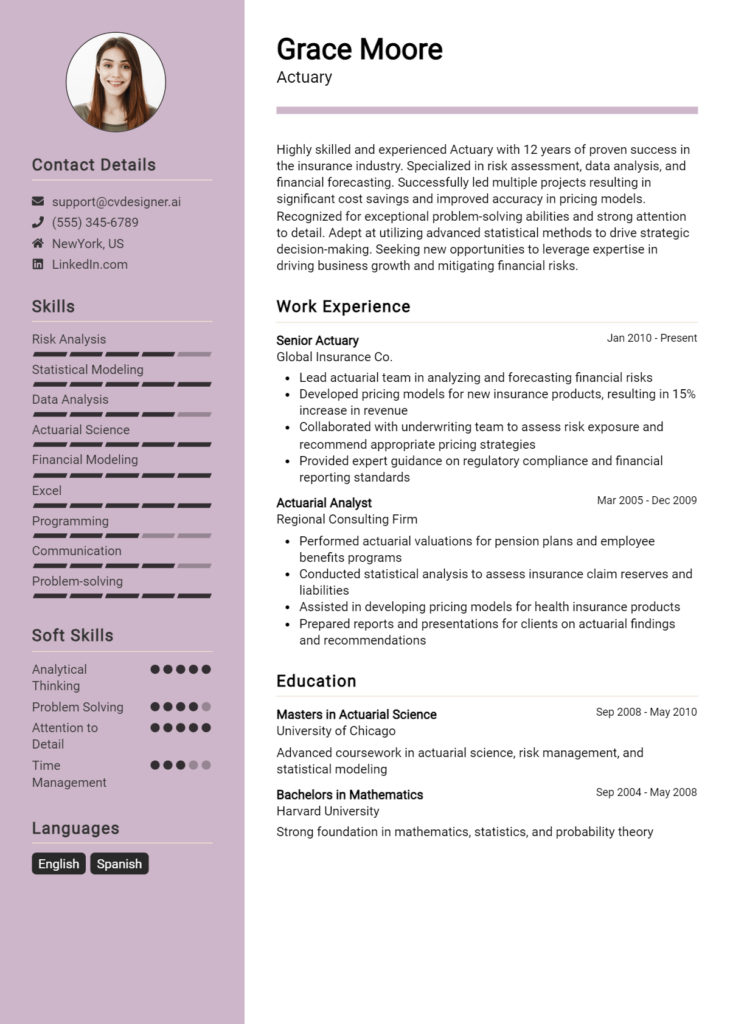

Results-oriented Pricing Actuary with over 5 years of experience in developing pricing models that increased profitability by 15% for a leading insurance firm. Proficient in statistical analysis and risk assessment, with advanced skills in R and Python.

Dynamic actuarial professional specializing in health insurance pricing, successfully implementing a new pricing strategy that reduced claims costs by 20% while improving customer satisfaction ratings by 10%. Excellent communicator with a proven track record of collaborating with cross-functional teams.

Detail-oriented Pricing Actuary with a strong background in predictive modeling and data analytics. Achieved a 30% increase in the accuracy of pricing forecasts and reduced pricing errors by 25% through rigorous data validation and analysis.

Weak Resume Summaries

Actuary with experience in pricing and some knowledge of statistical methods. I am looking for a challenging role in a reputable company.

Professional with actuarial skills who can help with pricing and analysis tasks. I have a strong interest in the insurance industry and am eager to contribute.

The strong resume summaries are effective because they provide quantifiable results, specific skills, and a direct connection to the role of a Pricing Actuary, making them more compelling to hiring managers. In contrast, the weak summaries are vague and lack measurable outcomes, making it difficult for employers to assess the candidate's qualifications or potential contributions to their organization.

Work Experience Section for Pricing Actuary Resume

The work experience section of a Pricing Actuary resume is critical in demonstrating the candidate's technical expertise, leadership abilities, and capacity to deliver high-quality results in a competitive environment. This section serves as a platform to showcase not only the candidate's relevant skills in pricing analysis, risk assessment, and statistical modeling but also their capability to manage teams effectively and produce impactful outcomes. Quantifying achievements with specific metrics and aligning experiences with industry standards are essential to drawing attention to the candidate's contributions and differentiating them from others in the field.

Best Practices for Pricing Actuary Work Experience

- Use clear, concise language to describe roles and responsibilities.

- Highlight technical skills relevant to pricing actuarial work, such as statistical software, predictive modeling, and data analysis tools.

- Quantify results wherever possible, using metrics like percentage increases in profitability or reductions in loss ratios.

- Emphasize collaboration with cross-functional teams, showcasing effective communication and teamwork.

- Focus on specific projects that demonstrate leadership or innovative approaches to pricing challenges.

- Align experience descriptions with industry standards and terminology to resonate with hiring managers.

- Include keywords commonly found in job descriptions to enhance visibility in applicant tracking systems.

- Tailor the work experience section to reflect the most relevant and recent experiences that align with the target position.

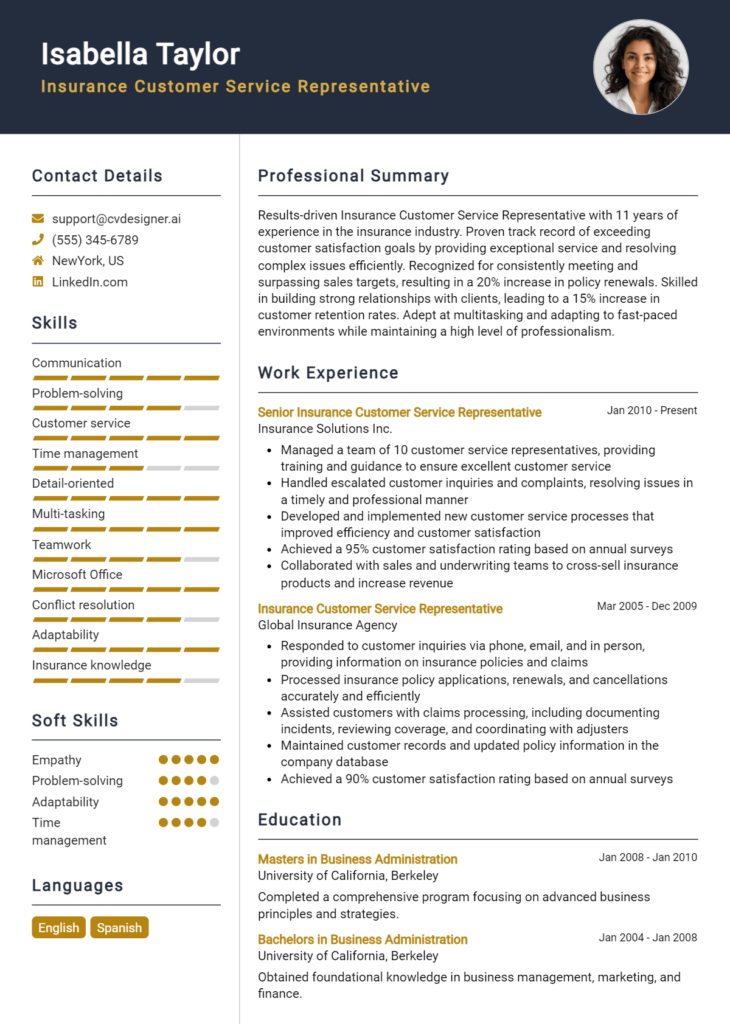

Example Work Experiences for Pricing Actuary

Strong Experiences

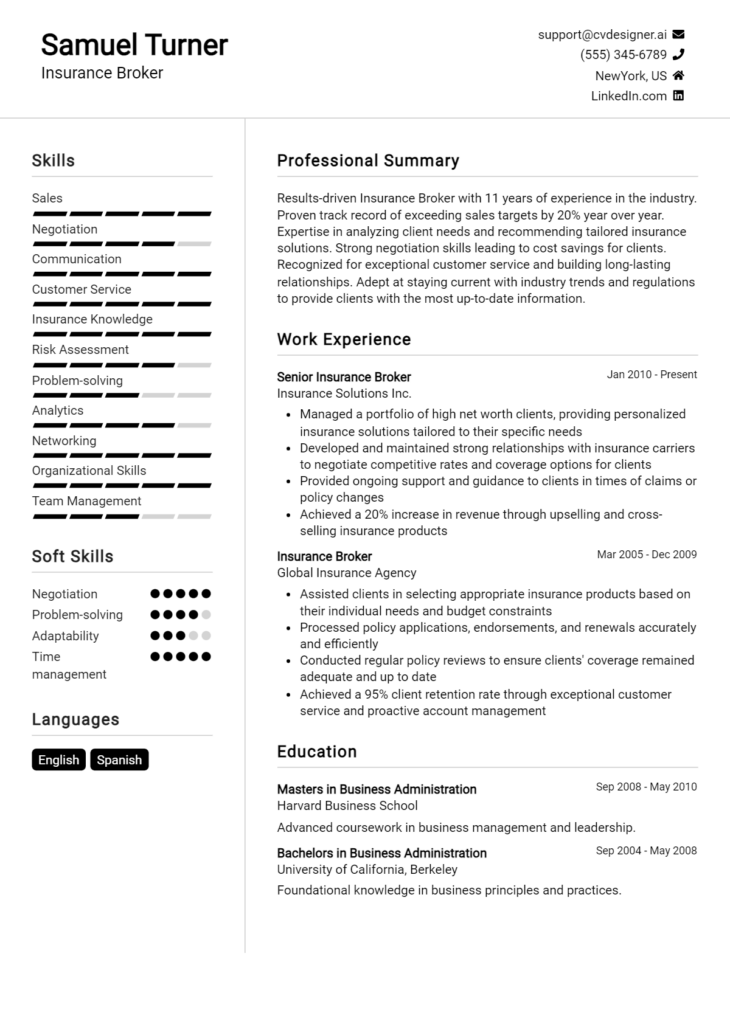

- Led a team of 5 actuaries in the development of a pricing model that improved profitability by 15% year-over-year.

- Implemented a new data analytics process that reduced the time taken for pricing reviews by 30%, enhancing team efficiency.

- Collaborated with underwriting and finance teams to create a comprehensive risk assessment tool, resulting in a 20% decrease in underwriting losses.

- Developed a predictive analytics model that accurately forecasted claim trends, contributing to a 10% reduction in loss ratios across multiple product lines.

Weak Experiences

- Worked on various pricing projects without specific outcomes or metrics to demonstrate impact.

- Assisted in data collection for pricing analysis but did not describe the methods or tools used.

- Participated in team meetings to discuss pricing strategies without detailing contributions or results.

- Involved in actuarial tasks that lacked quantifiable achievements or significant team collaboration.

The examples provided illustrate the difference between strong and weak experiences in a Pricing Actuary resume. Strong experiences are characterized by specific, quantifiable results and a clear demonstration of technical skills and collaboration, making them noteworthy to potential employers. In contrast, weak experiences are vague and lack measurable outcomes, failing to convey the candidate's true capabilities or contributions to the organization.

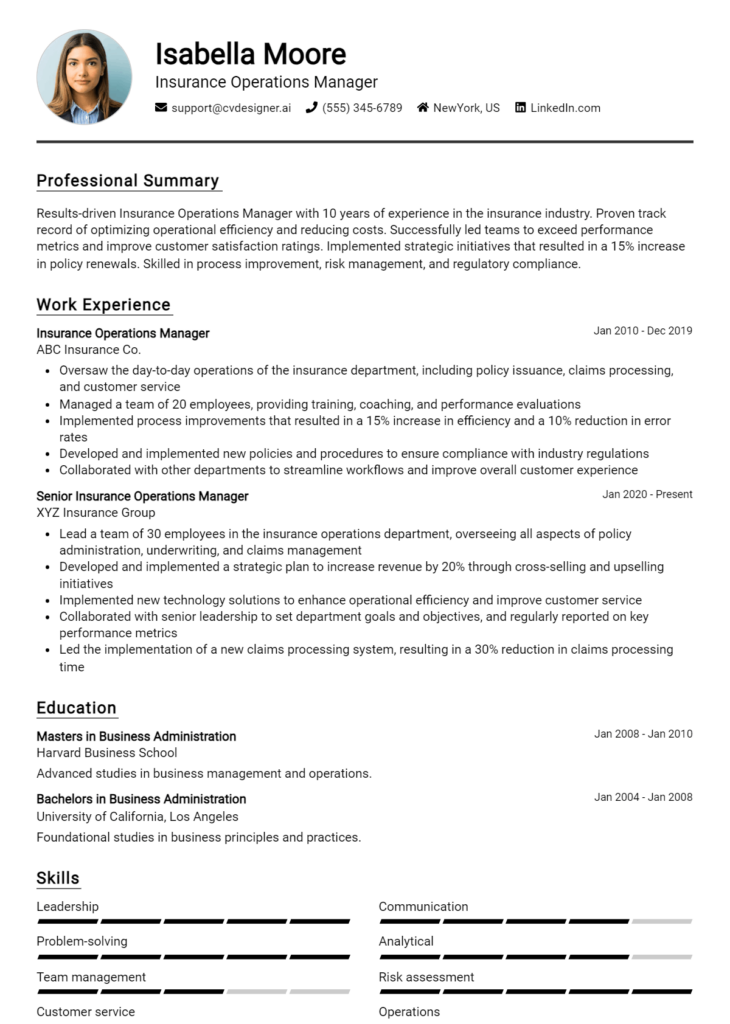

Education and Certifications Section for Pricing Actuary Resume

The education and certifications section of a Pricing Actuary resume is crucial as it highlights the candidate's academic background and industry-relevant credentials, showcasing their expertise and dedication to the field. This section not only reflects the foundational knowledge acquired through formal education but also demonstrates the candidate's commitment to continuous learning through certifications and specialized training. By providing relevant coursework, recognized certifications, and ongoing professional development, candidates can greatly enhance their credibility and alignment with the requirements of the Pricing Actuary role, making them stand out in a competitive job market.

Best Practices for Pricing Actuary Education and Certifications

- Include only relevant degrees and certifications that directly relate to actuarial science and pricing strategies.

- Highlight advanced degrees such as a Master’s in Actuarial Science or Statistics to demonstrate a higher level of expertise.

- List industry-recognized certifications, such as Fellow of the Society of Actuaries (FSA) or Chartered Enterprise Risk Analyst (CERA), to strengthen credibility.

- Detail relevant coursework, projects, or research that showcase specialized knowledge in pricing models and risk assessment.

- Keep the information concise and focused, ensuring it can be easily scanned by hiring managers.

- Include any ongoing education or professional development courses that reflect a commitment to staying current in the field.

- Consider including GPA or honors received if they are impressive and relevant to the position.

- Organize the section in reverse chronological order to emphasize the most recent and relevant qualifications first.

Example Education and Certifications for Pricing Actuary

Strong Examples

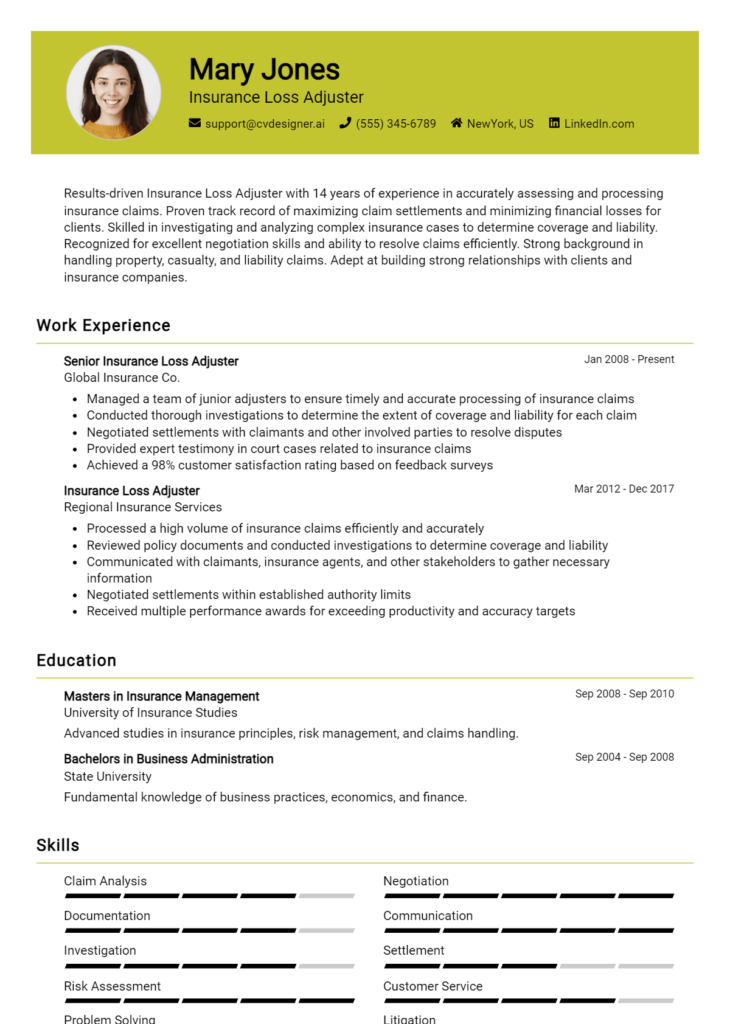

- M.S. in Actuarial Science, University of XYZ, 2021

- Fellow of the Society of Actuaries (FSA), 2023

- Completed coursework in Advanced Pricing Strategies and Risk Management, 2020

- Chartered Property Casualty Underwriter (CPCU), 2022

Weak Examples

- Bachelor's Degree in Philosophy, University of ABC, 2015

- Certification in Basic Computer Skills, 2019

- Completed a course in General Business Practices, 2018

- High School Diploma, 2010

The strong examples are considered effective because they directly relate to the skills and knowledge necessary for a Pricing Actuary, showcasing advanced degrees, relevant certifications, and specialized coursework that highlights the candidate's preparedness for the role. In contrast, the weak examples lack relevance to the actuarial field and do not demonstrate the specialized knowledge or credentials expected in a Pricing Actuary position, which can diminish the candidate's appeal to potential employers.

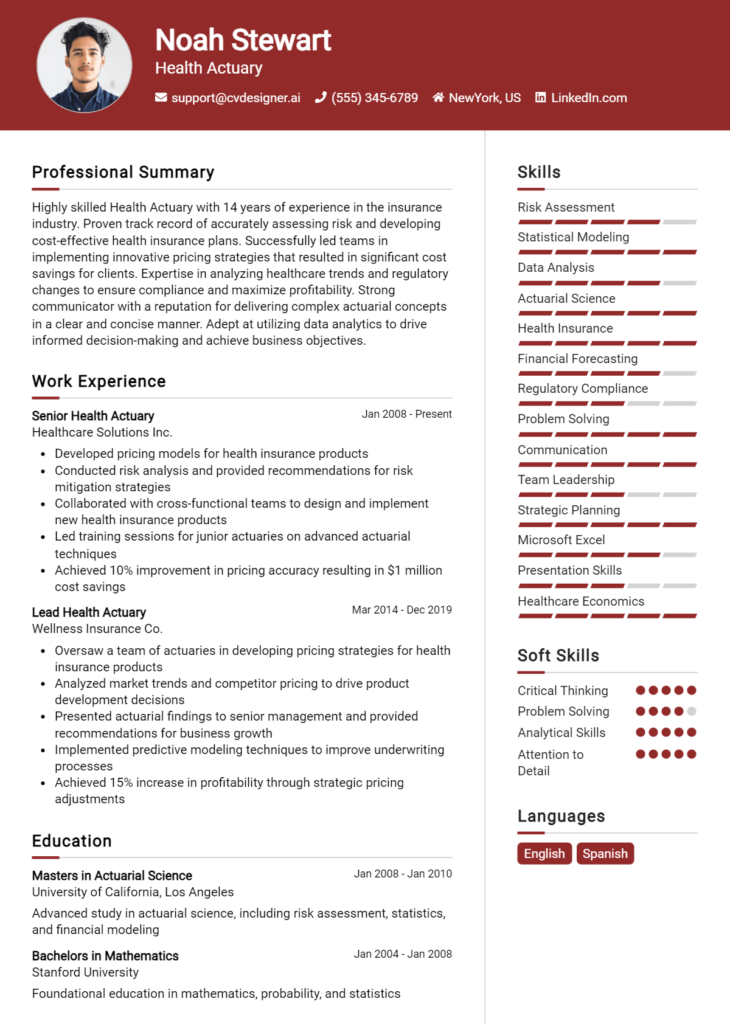

Top Skills & Keywords for Pricing Actuary Resume

As a Pricing Actuary, your resume must effectively showcase your skills to stand out in a competitive job market. Skills not only demonstrate your technical expertise but also highlight your ability to analyze complex data, create pricing models, and communicate findings to stakeholders. Employers are looking for candidates who possess a blend of both hard and soft skills, as these attributes are essential for success in the role. A well-crafted resume that emphasizes these skills can significantly enhance your chances of landing an interview.

Top Hard & Soft Skills for Pricing Actuary

Soft Skills

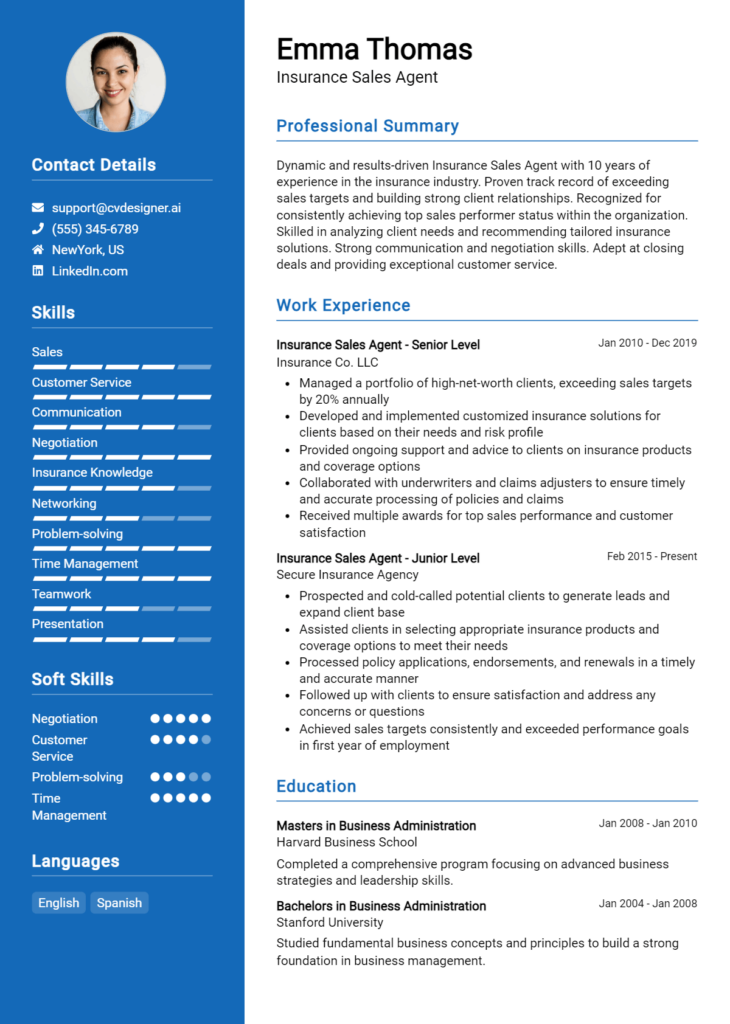

- Analytical Thinking

- Problem Solving

- Communication Skills

- Attention to Detail

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Interpersonal Skills

- Project Management

Hard Skills

- Statistical Analysis

- Risk Assessment

- Pricing Strategy Development

- Actuarial Software Proficiency (e.g., SAS, R, Python)

- Data Visualization

- Financial Modeling

- Knowledge of Insurance Regulations

- Excel Advanced Functions

- Database Management

- Forecasting Techniques

By effectively highlighting both your skills and work experience, you can create a compelling resume that showcases your qualifications and readiness for the role of Pricing Actuary.

Stand Out with a Winning Pricing Actuary Cover Letter

I am writing to express my interest in the Pricing Actuary position at [Company Name] as advertised on [where you found the job listing]. With a robust background in actuarial science, extensive experience in pricing strategies, and a deep understanding of risk assessment, I am confident in my ability to contribute effectively to your team and support [Company Name]'s goals in developing competitive pricing models.

In my previous role at [Previous Company Name], I successfully led a project focused on optimizing pricing strategies for our insurance products. By utilizing advanced statistical methods and predictive modeling, I was able to identify key market trends and customer behaviors that drove a 15% increase in profitability over two years. My proficiency in tools such as R and Python, combined with my ability to communicate complex data insights to non-technical stakeholders, has allowed me to collaborate effectively across departments and implement data-driven decisions that enhance our competitive edge.

I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in the industry. I admire your recent initiatives in leveraging technology to improve pricing accuracy and efficiency. I am excited about the opportunity to bring my analytical skills and strategic mindset to your team, helping to refine and advance your pricing methodologies while ensuring that they align with market dynamics and customer needs.

Thank you for considering my application. I look forward to the possibility of discussing how my experience and passion for actuarial science can contribute to the continued success of [Company Name]. I am eager to bring my expertise in pricing strategies to your organization and collaborate with your talented team to achieve outstanding results.

Common Mistakes to Avoid in a Pricing Actuary Resume

When crafting a resume for a Pricing Actuary position, it's crucial to present your skills and experiences in a way that stands out to potential employers. However, there are several common mistakes that candidates often make, which can undermine their chances of landing an interview. Avoiding these pitfalls will help ensure that your resume effectively communicates your qualifications and demonstrates your suitability for the role.

Vague Job Descriptions: Failing to provide specific details about your previous roles can leave employers questioning the depth of your experience. Use quantifiable achievements to illustrate your contributions clearly.

Neglecting Technical Skills: Pricing Actuaries require strong analytical and mathematical skills. Omitting relevant software tools and programming languages (like R, Python, or Excel) can weaken your application.

Using Generic Language: A resume filled with clichés such as "hardworking" or "team player" can come off as unoriginal. Tailor your language to reflect your unique contributions and the specific requirements of the job.

Ignoring Keywords: Job descriptions often contain specific keywords that hiring managers look for. Not incorporating these terms into your resume can result in your application being overlooked, especially in automated applicant tracking systems.

Overloading with Irrelevant Information: Including unrelated work experience or excessive personal details can distract from your qualifications. Focus on experiences that directly relate to pricing, analytics, or actuarial work.

Lack of Clear Formatting: A cluttered or poorly organized resume can make it difficult for hiring managers to quickly assess your qualifications. Use clean formatting, consistent font sizes, and adequate spacing to enhance readability.

Neglecting Professional Development: Not mentioning relevant certifications (such as ACAS or FCAS) or ongoing education can signal a lack of commitment to your professional growth. Highlight any relevant coursework or seminars you’ve attended.

Failing to Tailor Your Resume: Sending out a one-size-fits-all resume can diminish your chances. Customize your resume for each application to address the specific needs and priorities of the prospective employer.

Conclusion

As a Pricing Actuary, your role is crucial in analyzing data to determine the pricing structures of insurance products, thereby impacting the profitability and competitiveness of your organization. Throughout this article, we have explored the essential skills needed for a successful career in this field, including strong analytical capabilities, proficiency in statistical software, and a deep understanding of financial principles. Additionally, we highlighted the importance of communication skills, as actuaries must convey complex information to stakeholders who may not have a technical background.

In conclusion, as you advance your career as a Pricing Actuary, it's imperative to ensure that your resume effectively showcases your skills, experiences, and achievements. Take the time to review and refine your resume to highlight your expertise in data analysis, risk assessment, and pricing strategy.

To assist you in this process, consider utilizing available resources to enhance your job application materials. You can explore various resume templates to find a design that suits your style, use the resume builder for a guided approach to crafting your resume, and draw inspiration from resume examples tailored specifically for actuaries. Additionally, don't forget to create a compelling cover letter using cover letter templates to complement your resume.

Now is the time to take action and elevate your job application to stand out in the competitive field of Pricing Actuarial roles!