26 Mortgage Closer Skills for Your Resume: List Examples

As a Mortgage Closer, having a well-rounded skill set is crucial to successfully navigate the complexities of real estate transactions. The role requires a unique blend of technical expertise, attention to detail, and strong interpersonal skills to facilitate smooth closings and ensure compliance with all regulations. In this section, we will outline the top skills that should be highlighted on your resume to showcase your qualifications and stand out in the competitive mortgage industry.

Best Mortgage Closer Technical Skills

As a Mortgage Closer, possessing the right technical skills is crucial for ensuring timely and accurate closings. These skills not only enhance your efficiency but also help in maintaining compliance with regulations and improving customer satisfaction. Highlighting these abilities on your resume can significantly increase your appeal to potential employers.

Document Preparation

Expertise in preparing and reviewing closing documents, including the Closing Disclosure and loan agreements, is vital for accuracy and compliance.

How to show it: Detail your experience by mentioning the number of documents processed and any improvements in processing time you achieved.

Regulatory Compliance

Understanding federal and state regulations governing mortgage closings helps mitigate risks and ensures adherence to legal standards.

How to show it: Provide examples of how you maintained compliance and any audits passed without discrepancies.

Title Review

Skilled in reviewing property titles to identify any discrepancies or issues that may affect the closing process.

How to show it: Quantify the number of title reviews conducted and any issues resolved that led to smoother closings.

Communication Skills

Effective communication with borrowers, lenders, and real estate agents is essential for a successful closing process.

How to show it: Highlight instances where your communication skills led to faster resolutions or improved client relationships.

Data Entry and Management

Proficient in entering and managing data in mortgage software systems is crucial for accuracy and efficiency.

How to show it: Indicate the volume of data processed and any software tools you utilized to enhance accuracy and efficiency.

Problem Solving

The ability to quickly identify and resolve issues that arise during the closing process is critical for maintaining momentum.

How to show it: Share specific examples of challenges you faced and how your solutions led to successful outcomes.

Customer Service

Providing exceptional service to clients throughout the closing process helps build trust and satisfaction.

How to show it: Include metrics on client satisfaction scores or testimonials that reflect your commitment to customer service.

Time Management

Efficiently managing multiple tasks and deadlines ensures that closings occur on schedule.

How to show it: Mention how you prioritized tasks and any deadlines you consistently met without compromising quality.

Financial Analysis

Understanding financial documents and assessing borrower qualifications is essential for making informed closing decisions.

How to show it: Discuss any contributions you made to financial analysis that improved loan approval rates or reduced risk.

Technology Proficiency

Familiarity with mortgage processing software and electronic closing technologies is necessary to streamline operations.

How to show it: List specific software platforms you are proficient in and any certifications you hold related to these technologies.

Best Mortgage Closer Soft Skills

In the role of a Mortgage Closer, soft skills are essential for fostering effective communication, building relationships, and navigating complex transactions. These skills not only enhance the work environment but also improve client satisfaction and streamline the closing process. Below are some of the top soft skills that can significantly impact a Mortgage Closer's success.

Communication

Effective communication is crucial for Mortgage Closers as they interact with clients, lenders, and various stakeholders throughout the closing process. Clear communication helps in conveying important information and ensuring all parties are on the same page.

How to show it: Demonstrate your communication skills by providing examples of successful negotiations or customer interactions. Quantify improvements in client satisfaction ratings or mention specific instances where your communication led to successful outcomes.

Attention to Detail

Mortgage Closers must meticulously review documents to ensure accuracy and compliance with regulations. A strong attention to detail prevents costly mistakes and facilitates a smooth closing process.

How to show it: Highlight specific instances where your attention to detail prevented errors or expedited the closing process. Use metrics to show how your diligence improved accuracy rates or reduced closing times.

Problem-solving

The ability to quickly identify and resolve issues is critical for Mortgage Closers, as unexpected challenges can arise at any stage of the closing process. Strong problem-solving skills enable you to find effective solutions that benefit all parties involved.

How to show it: Provide examples of challenges you faced during closings and how you successfully resolved them. Quantify the impact of your solutions on the timeline or satisfaction levels of clients.

Time Management

In a fast-paced environment, effective time management ensures that all tasks are completed on schedule and that deadlines are met. Mortgage Closers must prioritize their workload and manage multiple tasks efficiently.

How to show it: Discuss how you managed competing deadlines or streamlined processes to improve efficiency. Use specific examples and metrics to illustrate your time management successes.

Teamwork

Collaboration with various departments and stakeholders is essential for a successful closing. Teamwork skills enable Mortgage Closers to work harmoniously with colleagues, lenders, and clients to achieve common goals.

How to show it: Highlight instances where your teamwork contributed to successful closings or improved processes. Include metrics to show how collaboration enhanced overall team performance.

Empathy

Understanding clients' needs and concerns is vital in the mortgage industry. Empathy allows Mortgage Closers to build trust and make clients feel valued throughout the closing process.

How to show it: Share examples of how you addressed clients' concerns or went above and beyond to ensure their comfort during the closing. Mention any positive feedback received from clients as a result of your empathetic approach.

Adaptability

The mortgage industry can be unpredictable, and adaptability is key for Mortgage Closers to adjust to changing regulations and client needs. Being flexible helps in navigating challenges effectively.

How to show it: Provide examples of times when you successfully adapted to changes in the process or regulations. Use metrics to demonstrate how your adaptability improved outcomes.

Conflict Resolution

The ability to handle conflicts professionally is essential for fostering positive relationships. Mortgage Closers often mediate disputes and work to find solutions that satisfy all parties involved.

How to show it: Discuss specific conflicts you successfully resolved and the strategies you employed. Quantify the outcomes to emphasize the effectiveness of your conflict resolution skills.

Organizational Skills

Organizational skills are vital for managing documents, timelines, and multiple transactions. A well-organized Mortgage Closer can ensure that everything is in its place, facilitating a smoother closing process.

How to show it: Highlight your organizational methods or tools you utilized to keep track of tasks and documents. Include metrics that demonstrate how your organization improved the closing process.

Negotiation Skills

Negotiation skills are important for Mortgage Closers who must advocate for their clients while also considering lender requirements. Strong negotiators can secure better terms and conditions for clients.

How to show it: Provide examples of negotiations you conducted successfully. Quantify the results, such as improved loan terms or favorable conditions for clients.

Customer Service

Exceptional customer service skills ensure that clients feel supported and informed throughout the closing process. Mortgage Closers who prioritize customer service

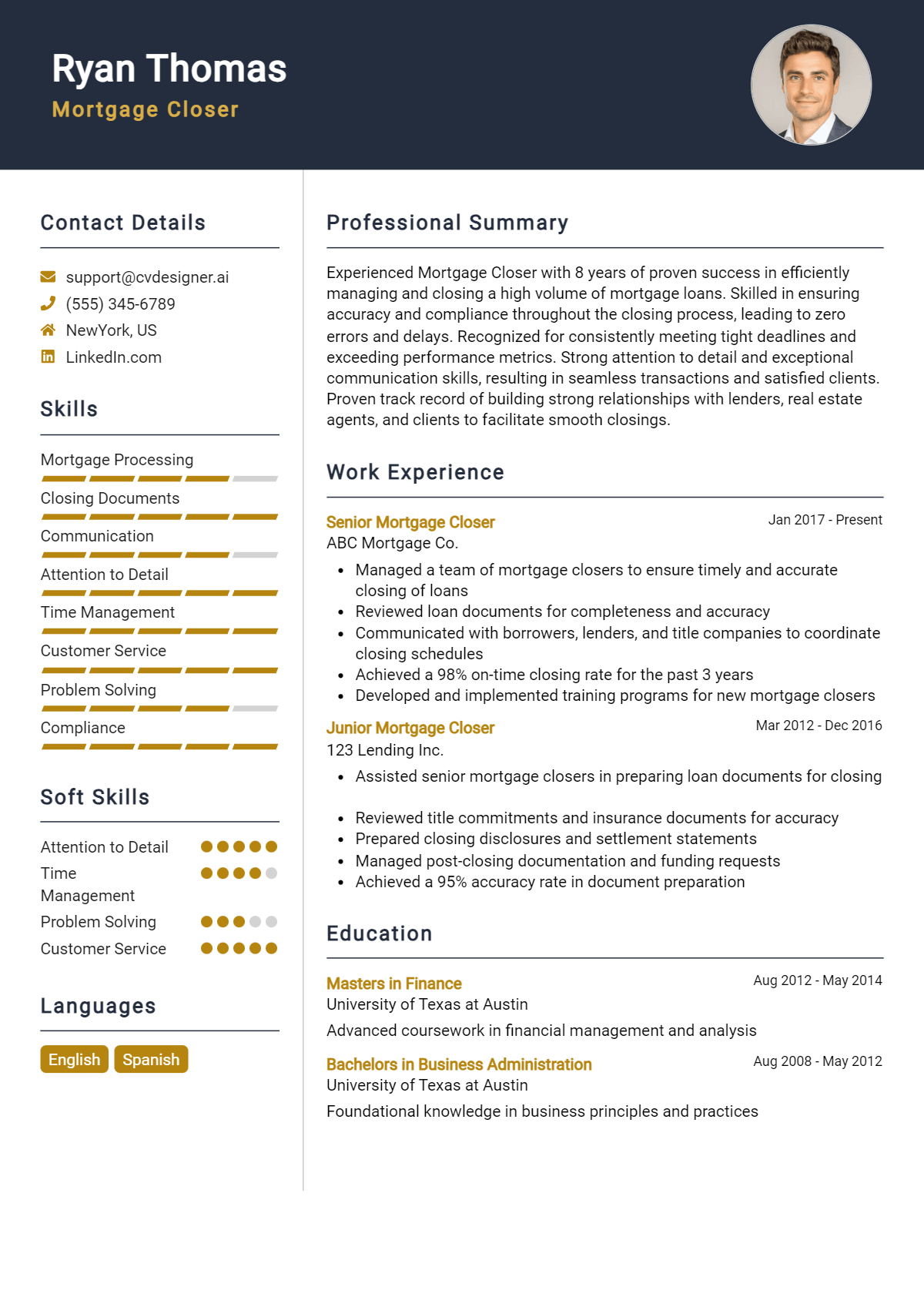

How to List Mortgage Closer Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to potential employers. Highlighting your qualifications in a clear and concise manner can capture the attention of hiring managers. There are three main sections where skills can be showcased: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Mortgage Closer skills in the introduction (objective or summary) section provides hiring managers a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

As a detail-oriented Mortgage Closer with expertise in loan documentation, compliance regulations, and customer service, I have successfully managed closing processes to ensure timely and accurate transactions.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Mortgage Closer skills have been applied in real-world scenarios, allowing you to illustrate your impact in previous roles.

Example

- Coordinated with lenders, real estate agents, and clients to facilitate a seamless closing process.

- Utilized strong attention to detail to review and verify closing documents, ensuring compliance with regulations.

- Implemented effective communication strategies to resolve client inquiries, enhancing customer satisfaction.

- Trained new team members on best practices and company policies, fostering a collaborative work environment.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills should be included to present a well-rounded candidate profile.

Example

- Loan Documentation Expertise

- Attention to Detail

- Regulatory Compliance

- Customer Service Excellence

- Effective Communication

- Time Management

- Problem Solving

- Team Collaboration

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate their relevance and impact in previous roles.

Example

In my previous role, my strong attention to detail and customer service skills were pivotal in reducing closing errors by 20%. I believe these strengths will allow me to excel as a Mortgage Closer at your company.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Mortgage Closer Resume Skills

In the competitive field of mortgage closing, effectively showcasing relevant skills on a resume is crucial for standing out to recruiters. A well-crafted skills section not only highlights a candidate's qualifications but also aligns them with the specific requirements of the job, making it easier for hiring managers to identify the best fit for their team. By emphasizing the right skills, candidates can demonstrate their expertise and increase their chances of securing an interview.

- Demonstrates Technical Proficiency: Highlighting skills related to mortgage software and closing procedures shows potential employers that the candidate is well-versed in the tools and technologies essential for the role.

- Indicates Attention to Detail: Skills that reflect meticulousness, such as document review and compliance knowledge, underscore the importance of accuracy in mortgage closing, which can lead to successful transactions.

- Showcases Communication Abilities: Effective communication skills are vital for liaising with clients, lenders, and other stakeholders. A resume that emphasizes these skills suggests that the candidate can navigate complex conversations smoothly.

- Reflects Problem-Solving Capabilities: Highlighting analytical skills and the ability to resolve issues quickly indicates to employers that the candidate can handle unexpected challenges that may arise during the closing process.

- Illustrates Organizational Skills: Strong organizational abilities are crucial for managing multiple files and deadlines in mortgage closing. Candidates who showcase these skills can demonstrate their capacity to handle a busy workload efficiently.

- Conveys Industry Knowledge: Skills that reflect an understanding of real estate laws and regulations signal to recruiters that the candidate is knowledgeable and can operate within legal frameworks effectively.

- Enhances Professional Credibility: A well-defined skills section adds to the candidate's overall professionalism, making them appear more competent and trustworthy in the eyes of potential employers.

- Supports Career Advancement: Highlighting relevant skills not only helps in securing the desired position but also lays the groundwork for future growth within the mortgage industry.

For more insights and examples, check out these Resume Samples.

How To Improve Mortgage Closer Resume Skills

In the competitive field of mortgage closing, continuously improving your skills is essential for standing out in the job market and excelling in your role. As the mortgage industry evolves, staying updated on regulations, technology, and best practices can enhance your efficiency and effectiveness. A well-crafted resume that showcases your skills can open doors to new opportunities and career advancement.

- Stay Updated on Industry Regulations: Regularly review changes in mortgage laws and regulations to ensure compliance and improve your expertise.

- Enhance Technical Skills: Familiarize yourself with mortgage software and tools commonly used in the industry to streamline your workflow.

- Improve Communication Skills: Practice clear and concise communication, both written and verbal, to effectively interact with clients, lenders, and other stakeholders.

- Attend Workshops and Seminars: Participate in industry-related workshops to gain new insights and learn from experienced professionals.

- Network with Industry Professionals: Join professional organizations or attend networking events to connect with others in the field and share knowledge.

- Seek Feedback: Request constructive feedback from colleagues or supervisors to identify areas for improvement and refine your skills.

- Obtain Relevant Certifications: Consider pursuing certifications related to mortgage closing or finance to enhance your qualifications and credibility.

Frequently Asked Questions

What skills should I highlight on my Mortgage Closer resume?

When crafting your Mortgage Closer resume, it is essential to emphasize skills such as attention to detail, strong organizational abilities, and effective communication. Additionally, proficiency in mortgage software, knowledge of loan documentation and compliance regulations, and the ability to work under tight deadlines are critical skills that potential employers look for in candidates.

How important is knowledge of mortgage regulations for a Mortgage Closer?

Knowledge of mortgage regulations is crucial for a Mortgage Closer as it ensures compliance with federal and state laws during the closing process. Understanding these regulations helps to prevent legal issues and ensures that all documentation is accurate and complete, which ultimately safeguards the interests of both the lender and the borrower.

What role does attention to detail play in a Mortgage Closer's job?

Attention to detail is vital for a Mortgage Closer since the role involves reviewing and verifying extensive loan documentation to ensure accuracy. Even minor errors can lead to significant delays or financial repercussions, so being meticulous in checking figures, terms, and compliance details is essential for a successful closing process.

How can strong communication skills benefit a Mortgage Closer?

Strong communication skills are beneficial for a Mortgage Closer as they facilitate clear and effective interaction with various stakeholders, including lenders, borrowers, real estate agents, and title companies. Being able to convey complex information in an understandable manner helps to resolve issues quickly and fosters a positive closing experience for all parties involved.

Is familiarity with mortgage software important for a Mortgage Closer?

Yes, familiarity with mortgage software is important for a Mortgage Closer as it streamlines the closing process and enhances efficiency. Proficiency in using these tools allows a Mortgage Closer to manage documents, track transactions, and generate reports effectively, which ultimately contributes to a smoother and more organized closing experience.

Conclusion

Including Mortgage Closer skills in your resume is essential for showcasing your expertise in this specialized field. By highlighting relevant skills, candidates can differentiate themselves from the competition and demonstrate the value they bring to potential employers. Remember, a well-crafted resume not only reflects your qualifications but also your commitment to excellence in the mortgage industry. Take the time to refine your skills and create a standout application that captures attention!

For additional resources, check out our resume templates, utilize our resume builder, explore resume examples, and consider our cover letter templates to enhance your job application process.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.