25 Resume Skills to Use on Your Loan Officer Resume in 2025

As a Loan Officer, possessing the right skills is essential for success in evaluating and approving loan applications, as well as building strong relationships with clients. A well-crafted resume that highlights your key competencies can significantly enhance your chances of landing a job in this competitive field. In the following section, we will outline the top skills that should be showcased on your resume to demonstrate your expertise and suitability for the role of a Loan Officer.

Best Loan Officer Technical Skills

Technical skills are essential for Loan Officers as they navigate the complexities of the mortgage industry. These skills not only enhance efficiency but also ensure compliance with regulations and promote better customer service. Highlighting relevant technical skills on your resume can significantly improve your chances of standing out to potential employers.

Loan Processing Software Proficiency

Understanding and utilizing loan processing software is crucial for managing applications and ensuring timely processing. Familiarity with systems like Encompass or Calyx can streamline workflow and improve accuracy.

How to show it: Include specific software you’ve used and describe how you improved processing times or reduced errors while using these tools.

Financial Analysis

Loan Officers must analyze applicants' financial documents to assess their creditworthiness and ability to repay loans. Strong financial analysis skills enable informed decision-making and risk assessment.

How to show it: Quantify your experience by mentioning how many applications you analyzed and the percentage of loans approved based on your assessments.

Regulatory Compliance Knowledge

Keeping up-to-date with lending regulations ensures that the Loan Officer operates within legal boundaries, preventing costly penalties and fostering trust with clients.

How to show it: Highlight any training or certifications you've completed related to compliance and mention instances where you successfully implemented compliance measures.

Credit Scoring Systems Understanding

A solid grasp of credit scoring systems allows Loan Officers to evaluate applicants effectively and provide tailored advice to improve credit scores.

How to show it: Demonstrate your knowledge by discussing specific credit scoring tools and how your insights helped clients secure loans.

Data Analysis and Reporting

Being able to analyze and report on loan data helps Loan Officers identify trends and make data-driven decisions to optimize loan offerings.

How to show it: Include examples of reports you created and how they influenced your team’s strategies or improved loan performance metrics.

Sales and Negotiation Skills

Strong sales and negotiation skills are vital for Loan Officers to effectively communicate with clients and close deals while ensuring mutual satisfaction.

How to show it: Quantify your sales achievements, such as the number of loans closed or the percentage increase in loan volume due to your negotiation efforts.

Customer Relationship Management (CRM) Software

Proficiency in CRM software helps manage client interactions and maintain strong relationships, leading to increased customer satisfaction and referrals.

How to show it: Mention the CRM tools you’ve used, detailing how they enhanced your client follow-up and retention strategies.

Risk Assessment Skills

Loan Officers must evaluate the risks associated with lending to various applicants, which requires a keen understanding of financial indicators and market conditions.

How to show it: Provide examples of risk assessments you've performed and how your evaluations led to better lending decisions for your organization.

Market Knowledge

Having a deep understanding of the real estate and financial markets allows Loan Officers to provide informed advice and forecasts to clients and stakeholders.

How to show it: Discuss your insights into market trends and how you advised clients based on this knowledge, possibly leading to successful loan placements.

Financial Product Knowledge

Knowledge of various financial products, including different types of loans and mortgage options, enables Loan Officers to tailor solutions to meet client needs.

How to show it: Detail your expertise in specific loan products and how you matched them to customer profiles, resulting in increased client satisfaction.

Attention to Detail

Loan Officers must meticulously review documents and information to avoid errors that could lead to significant financial repercussions for both clients and lenders.

How to show it: Share examples of how your attention to detail prevented errors in loan applications, possibly saving your organization from financial losses.

Best Loan Officer Soft Skills

In the competitive field of loan origination, soft skills play a vital role in ensuring success. Loan Officers must not only understand the technical aspects of lending but also possess strong interpersonal abilities that foster trust and collaboration with clients and colleagues alike. These skills can significantly enhance customer satisfaction and drive business results.

Communication

Effective communication is essential for Loan Officers to clearly convey loan options and terms to clients, as well as to build lasting relationships.

How to show it: Highlight instances where you successfully explained complex information to clients or facilitated discussions that led to loan approvals. Use metrics like customer satisfaction ratings or improved client retention to demonstrate your impact.

Problem-solving

Loan Officers often encounter unique challenges that require creative solutions to meet clients' needs and navigate obstacles in the lending process.

How to show it: Provide examples of specific challenges you faced and the innovative solutions you implemented. Quantify outcomes, such as increased loan closure rates or reduced processing times.

Time Management

Managing multiple client applications and deadlines is crucial for Loan Officers, making time management a key skill for maintaining efficiency and productivity.

How to show it: Demonstrate your ability to prioritize tasks by sharing how you managed competing deadlines and met or exceeded loan processing timelines. Include percentages to show improvements in efficiency.

Teamwork

Collaboration with colleagues, underwriters, and other stakeholders is important for Loan Officers to ensure smooth loan processing and customer satisfaction.

How to show it: Share experiences where you worked in a team to achieve a common goal, such as a successful loan campaign. Highlight your role and the positive outcomes of the collaboration.

Empathy

Understanding and relating to clients' financial situations allows Loan Officers to provide tailored solutions and build trust.

How to show it: Include anecdotes where your empathetic approach led to stronger client relationships or successful loan approvals. Use client feedback as evidence of your impact.

Attention to Detail

Loan Officers must carefully review applications and documentation to ensure compliance and accuracy, minimizing the risk of errors.

How to show it: Emphasize your meticulous nature by citing examples of how your attention to detail prevented costly mistakes or expedited the loan approval process.

Negotiation Skills

Loan Officers often negotiate terms and conditions with clients, requiring the ability to reach mutually beneficial agreements.

How to show it: Discuss specific negotiations you've led that resulted in favorable loan terms for clients while still meeting the lender's requirements. Quantify any savings or benefits achieved.

Adaptability

The lending landscape is constantly evolving, and Loan Officers must be adaptable to stay current with regulations and market trends.

How to show it: Illustrate your ability to adapt to changes by sharing how you successfully navigated industry shifts or updated policies. Highlight any training or certifications you've pursued.

Customer Service Orientation

A strong customer service focus helps Loan Officers to meet client needs and resolve issues promptly, fostering loyalty and referrals.

How to show it: Provide metrics such as client retention rates or testimonials that demonstrate your commitment to exceptional service.

Sales Skills

Loan Officers often need to sell loan products effectively, requiring persuasive skills and a strong understanding of customer needs.

How to show it: Share specific sales achievements, such as the number of loans closed or sales targets met. Use percentages to illustrate your success in driving business growth.

Conflict Resolution

Loan Officers may encounter conflicts with clients or within teams, and the ability to resolve these issues amicably is crucial.

How to show it: Highlight instances where you successfully managed conflicts and the outcomes achieved, such as improved relationships or resolution of loan disputes.

For more insights on essential soft skills, explore these links: Soft Skills, Communication, Problem-solving, Time Management, and <a href="https://resumedes

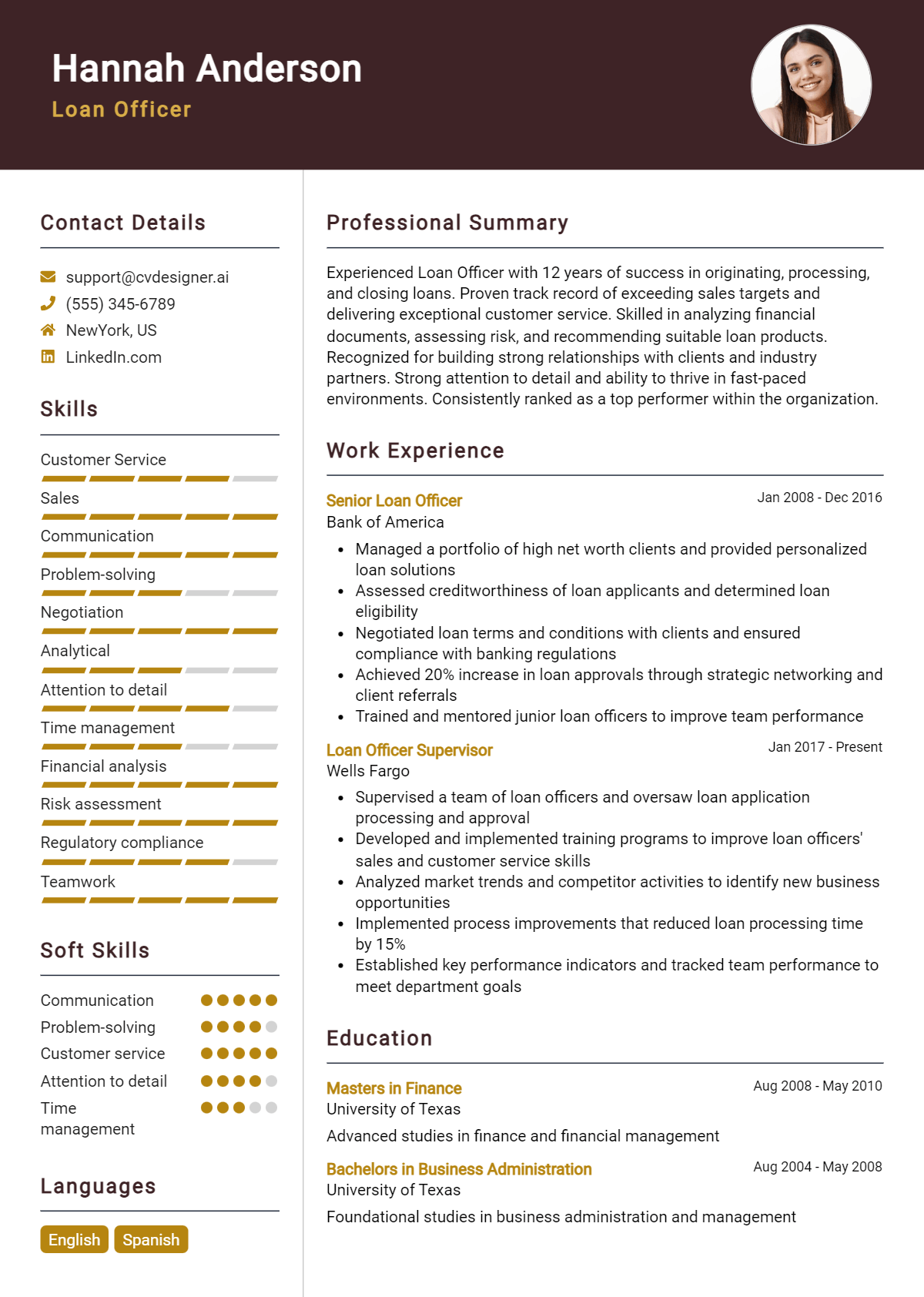

How to List Loan Officer Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to employers in the competitive field of loan officers. A well-crafted skills section can grab the hiring manager's attention and highlight your qualifications. There are three main sections where skills can be showcased: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Loan Officer skills in the introduction section provides hiring managers with a quick overview of your qualifications. This sets the tone for the rest of your resume.

Example

As a dedicated Loan Officer, I excel in client relations, financial analysis, and risk assessment, bringing over five years of experience in guiding clients through the loan process.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Loan Officer skills have been applied in real-world scenarios, showcasing your ability to meet the demands of the role.

Example

- Successfully managed a portfolio of over 100 clients, utilizing customer service and relationship management skills to increase client retention by 30%.

- Conducted thorough financial analyses to assess loan eligibility, leveraging attention to detail to minimize risk for the institution.

- Collaborated with underwriters to streamline the loan approval process, demonstrating strong teamwork and communication skills.

- Implemented innovative marketing strategies that increased loan applications by 25%, showcasing strong problem-solving and sales abilities.

for Resume Skills

The skills section allows you to showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your qualifications and appeal to prospective employers.

Example

- Financial Analysis

- Client Relations

- Risk Assessment

- Attention to Detail

- Sales Skills

- Problem-Solving

- Regulatory Compliance

- Time Management

- Team Collaboration

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can emphasize your fit for the role.

Example

In my previous role, my strong client relations and financial analysis skills helped increase approvals by 20%, ensuring customer satisfaction while also mitigating risks. I am confident that these skills will contribute significantly to your team.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Loan Officer Resume Skills

Highlighting relevant skills on a Loan Officer resume is crucial for candidates seeking to capture the attention of recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific requirements of the job. This alignment increases the chances of making a strong impression and moving forward in the hiring process.

- Demonstrating Technical Proficiency: In today's digital landscape, a Loan Officer must be adept with various financial software and tools. Highlighting technical skills reflects a candidate's ability to efficiently manage loan processing and client data.

- Showcasing Interpersonal Skills: Loan Officers work closely with clients, lenders, and other stakeholders. Emphasizing strong communication and relationship-building skills can set candidates apart, showing their capability to navigate complex interactions.

- Highlighting Analytical Abilities: The role of a Loan Officer requires critical thinking and analytical skills to assess loan applications and financial documents. Candidates should emphasize their ability to analyze data effectively, ensuring informed decision-making.

- Exhibiting Knowledge of Regulations: Understanding lending regulations and compliance is vital for Loan Officers. By showcasing knowledge in this area, candidates demonstrate their commitment to ethical practices and industry standards.

- Proving Sales Skills: Loan Officers often need to promote loan products and services. Candidates should highlight their sales abilities, showing they can effectively meet clients' needs while achieving organizational goals.

- Emphasizing Attention to Detail: The loan process involves numerous documents and details. Candidates should stress their meticulous nature and ability to catch errors, which is essential in preventing costly mistakes.

- Reflecting Problem-Solving Skills: Loan Officers frequently encounter challenges that require quick thinking and innovative solutions. By showcasing problem-solving skills, candidates demonstrate their resourcefulness and adaptability in a dynamic environment.

For more guidance on crafting an effective resume, check out these Resume Samples.

How To Improve Loan Officer Resume Skills

In the competitive field of loan origination, continuously improving your skills is essential for standing out as a top candidate. The financial landscape is constantly evolving, and as a loan officer, staying updated on industry trends, regulations, and customer service techniques can significantly enhance your effectiveness and appeal to potential employers. Here are some actionable tips to help you elevate your resume skills:

- Participate in relevant training programs and workshops to enhance your knowledge of lending products and regulations.

- Obtain certifications such as the Mortgage Loan Originator (MLO) license to demonstrate your commitment to professionalism.

- Develop strong communication skills by engaging in public speaking or customer service training to effectively interact with clients.

- Stay informed about market trends and economic factors that impact lending by subscribing to industry newsletters and attending seminars.

- Network with other professionals in the industry to exchange best practices and identify new opportunities for growth.

- Utilize technology and software tools that streamline the loan application process and improve customer experience.

- Seek feedback from peers and mentors to identify areas for improvement and implement constructive changes in your approach.

Frequently Asked Questions

What key skills should I highlight on my loan officer resume?

When crafting your loan officer resume, it's essential to highlight skills such as strong communication, analytical thinking, and customer service. Proficiency in financial software and an understanding of loan products, regulations, and underwriting processes are also crucial. Additionally, showcasing your ability to build relationships and work collaboratively with clients and colleagues can set you apart from other candidates.

How important is customer service experience for a loan officer?

Customer service experience is vital for a loan officer, as the role requires constant interaction with clients to assess their needs and guide them through the loan process. Exceptional customer service skills can help you manage client expectations, resolve issues efficiently, and foster long-term relationships, which are essential for success in this competitive field.

What role does attention to detail play in a loan officer's job?

Attention to detail is critical for a loan officer, as even minor errors in documentation or calculations can lead to significant issues during the loan approval process. A keen eye for detail ensures that all paperwork is accurate and complete, which helps in minimizing delays and maintaining compliance with regulatory standards.

Are there specific technical skills that are beneficial for loan officers?

Yes, technical skills such as familiarity with mortgage software, customer relationship management (CRM) systems, and data analysis tools are highly beneficial for loan officers. Proficiency in these technologies can streamline the loan process, improve efficiency, and enhance the overall client experience, making you a more competitive candidate in the job market.

How can I demonstrate my sales skills on a loan officer resume?

To effectively demonstrate your sales skills on a loan officer resume, include specific achievements that showcase your ability to close deals and meet sales targets. Quantifying your accomplishments, such as the number of loans processed or your sales growth percentage, can illustrate your effectiveness in driving revenue and highlight your persuasive communication abilities.

Conclusion

Including Loan Officer skills in your resume is crucial for demonstrating your expertise and suitability for the role. By showcasing relevant skills, you not only help yourself stand out among other candidates but also convey the value you can bring to potential employers. Remember, a well-crafted resume can be your ticket to success in the competitive job market.

Take the time to refine your skills and enhance your job application, and you'll be one step closer to achieving your career goals. For additional resources, consider exploring our resume templates, resume builder, resume examples, and cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.