26 Liquidity Manager Skills for Your Resume: List Examples

As a Liquidity Manager, possessing a diverse set of skills is crucial for effectively managing an organization's liquidity position and ensuring financial stability. In this section, we will outline the top skills that employers look for in candidates for this role. Highlighting these competencies on your resume can significantly enhance your prospects and demonstrate your capability to navigate the complexities of liquidity management.

Best Liquidity Manager Technical Skills

As a Liquidity Manager, possessing strong technical skills is crucial for effectively managing an organization's cash flow, ensuring sufficient liquidity, and optimizing financial performance. These skills enable professionals to analyze market conditions, forecast cash needs, and implement strategies that align with the company's financial objectives. Below are key technical skills that can enhance your resume and demonstrate your suitability for this role.

Cash Flow Forecasting

This skill involves predicting the future cash inflows and outflows of a business, allowing for proactive financial planning and management.

How to show it: Quantify your forecasting accuracy by providing specific percentages or dollar amounts that reflect your predictions versus actual cash flows.

Risk Management

Understanding and mitigating financial risks associated with liquidity is essential. This includes identifying potential risks and developing strategies to minimize their impact.

How to show it: Highlight specific risk management strategies you've implemented and the resulting decrease in liquidity-related risks, using metrics where possible.

Liquidity Analysis

This skill entails assessing the liquidity position of a company, ensuring it can meet its short-term obligations without compromising financial stability.

How to show it: Detail your experience with liquidity ratios and explain how your analyses led to improved liquidity positions, citing numerical improvements.

Financial Modeling

Creating detailed financial models aids in forecasting liquidity needs and evaluating financial scenarios, which is critical in strategic decision-making.

How to show it: Provide examples of financial models you've built and how they influenced business decisions, including any quantifiable outcomes.

Regulatory Compliance

Knowledge of financial regulations and compliance requirements ensures that liquidity management practices adhere to legal standards, safeguarding the company against fines and penalties.

How to show it: List specific regulations you have worked with and mention how your compliance efforts resulted in successful audits or reduced risks.

Cash Management Systems

Proficiency in cash management systems streamlines the processes of monitoring and controlling cash positions effectively.

How to show it: Describe the systems you are proficient in and how your use of these systems improved cash management efficiency, with metrics to support your claims.

Credit Analysis

Evaluating the creditworthiness of customers and counterparties is vital for managing liquidity and minimizing risk exposure.

How to show it: Share examples of how your credit analyses led to better lending decisions or decreased defaults, providing specific improvements in credit quality.

Financial Reporting

The ability to prepare and present detailed financial reports is crucial for stakeholders to understand liquidity positions and make informed decisions.

How to show it: Highlight the types of reports you’ve created and how your reporting improved stakeholder understanding or decision-making processes.

Investment Strategy

Developing investment strategies that align with liquidity needs can enhance overall financial performance and ensure optimal asset utilization.

How to show it: Provide examples of successful investment strategies you've developed and their impact on the company's liquidity, using specific financial metrics.

Data Analysis

Strong data analysis skills are essential for interpreting financial data and making informed liquidity management decisions based on trends and patterns.

How to show it: Demonstrate your analytical skills by detailing projects where your data insights led to significant operational improvements, with quantifiable results.

Market Analysis

Understanding market trends and economic indicators is key to anticipating liquidity needs and making timely financial decisions.

How to show it: Discuss how your market analyses informed liquidity strategies and resulted in improved financial outcomes, including relevant statistics.

Best Liquidity Manager Soft Skills

As a Liquidity Manager, possessing strong soft skills is just as essential as having technical expertise. These workplace skills foster effective collaboration, enhance problem-solving capabilities, and improve communication with stakeholders. Highlighting these skills on your resume can set you apart from other candidates and demonstrate your ability to manage liquidity effectively.

Communication

Effective communication is vital for a Liquidity Manager. It ensures that complex financial information is conveyed clearly to stakeholders, enabling informed decision-making.

How to show it: Include specific examples of presentations or reports you have delivered, emphasizing feedback received and any resulting actions taken. Quantify the impact of your communication on team performance or project outcomes.

Problem-solving

Strong problem-solving skills allow a Liquidity Manager to quickly identify issues and devise effective solutions to maintain optimal liquidity levels.

How to show it: Demonstrate your problem-solving prowess by sharing instances where you identified potential liquidity risks and implemented successful strategies. Use metrics to showcase the improvements achieved.

Time Management

Time management is crucial for prioritizing tasks and meeting deadlines in a fast-paced financial environment. A Liquidity Manager must handle multiple responsibilities efficiently.

How to show it: Outline how you managed competing priorities and deadlines, including any tools or methodologies used to enhance productivity. Highlight any time-sensitive projects you successfully completed.

Teamwork

Collaboration with different departments is key for a Liquidity Manager. Teamwork fosters a cohesive work environment and ensures that liquidity strategies align with overall business objectives.

How to show it: Provide examples of cross-departmental projects you contributed to, detailing your role and the team's overall success. Mention any initiatives that improved team collaboration or communication.

Adaptability

The financial landscape is constantly evolving, and a Liquidity Manager must be adaptable to changing regulations and market conditions.

How to show it: Share experiences where you successfully adapted to new financial regulations or market trends, illustrating how your flexibility led to better liquidity management.

Analytical Thinking

Analytical thinking helps a Liquidity Manager critically evaluate data and make data-driven decisions that optimize liquidity.

How to show it: Describe instances where your analytical skills led to significant insights or improved liquidity strategies. Include any quantitative results that demonstrate the impact of your analysis.

Attention to Detail

Attention to detail is crucial for ensuring accuracy in financial reporting and compliance with regulations, which are essential for effective liquidity management.

How to show it: Highlight examples of how your attention to detail prevented errors in financial reporting or audits. Share metrics or feedback from supervisors that underscore your meticulous nature.

Negotiation Skills

Negotiation skills are important for a Liquidity Manager to secure favorable terms with banks and financial institutions, impacting liquidity positions positively.

How to show it: Provide concrete examples of negotiations you led, detailing the outcomes and how they improved liquidity or reduced costs for your organization.

Leadership

Leadership skills enable a Liquidity Manager to guide their team effectively and foster a productive work environment, ultimately leading to better liquidity management.

How to show it: Discuss leadership roles you have taken in projects or initiatives, highlighting your contributions and the positive results achieved under your guidance.

Critical Thinking

Critical thinking allows a Liquidity Manager to assess situations thoroughly and make informed decisions that support the organization's financial health.

How to show it: Share examples of critical decisions you made regarding liquidity management, including the thought process behind them and the outcomes achieved.

Interpersonal Skills

Strong interpersonal skills help build relationships with colleagues, stakeholders, and clients, which is essential for effective liquidity management.

How to show it: Describe situations where your interpersonal skills facilitated collaboration or resolved conflicts, leading to improved team dynamics or project success.

How to List Liquidity Manager Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers. By presenting your qualifications clearly, you can grab the attention of hiring managers. There are three main sections where you can highlight your skills: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

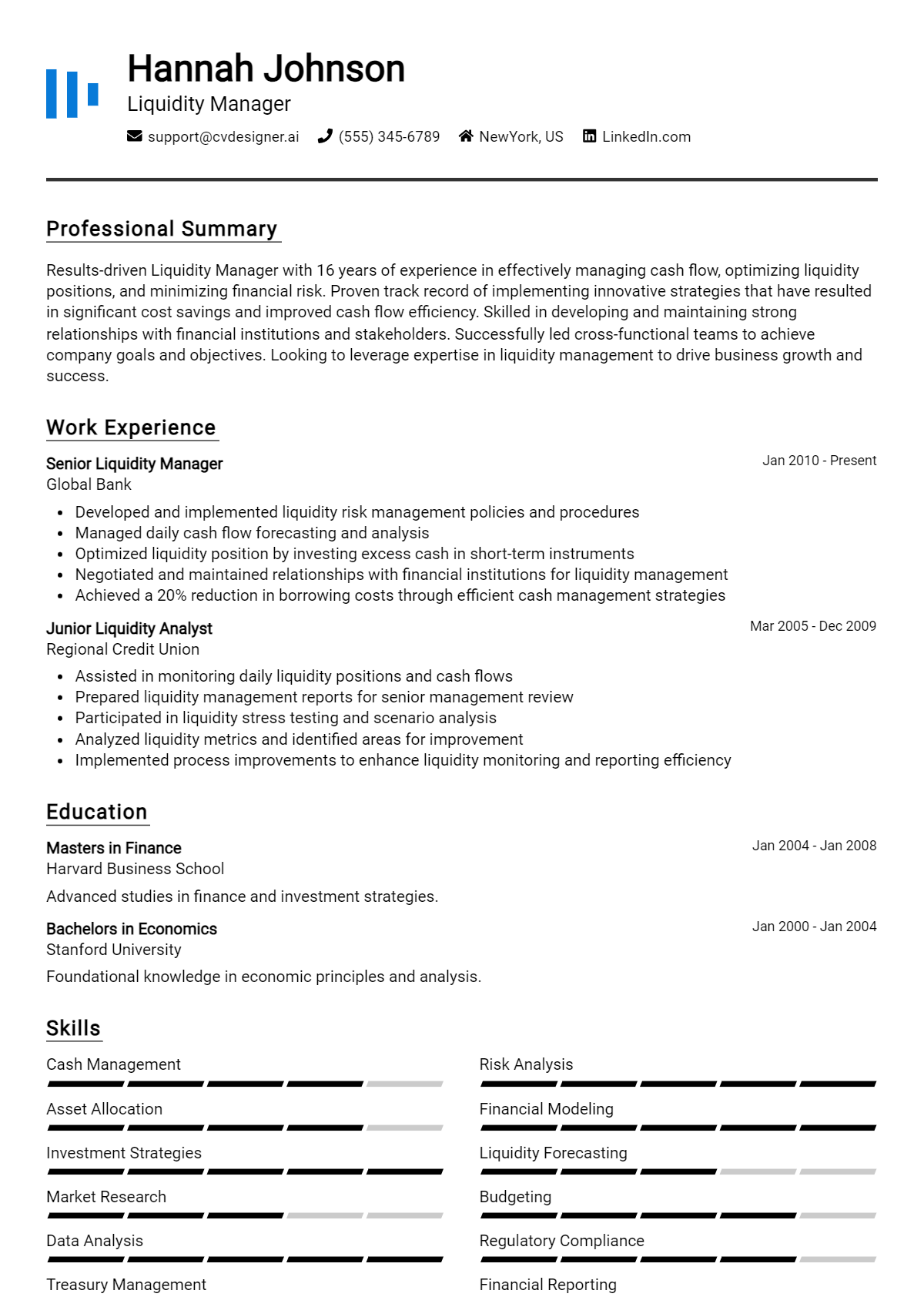

for Resume Summary

Showcasing your Liquidity Manager skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This sets the tone for the rest of your resume.

Example

As a dedicated Liquidity Manager with expertise in cash flow forecasting and risk management, I have successfully streamlined liquidity operations to optimize financial performance and ensure regulatory compliance.

for Resume Work Experience

The work experience section offers the perfect opportunity to demonstrate how your Liquidity Manager skills have been applied in real-world scenarios. Use this section to illustrate how your skills contributed to past roles.

Example

- Managed liquidity risk by implementing cash management strategies that improved cash flow by 20%.

- Developed and monitored liquidity forecasts to ensure adequate funding for operational needs.

- Collaborated with cross-functional teams to enhance the accuracy of liquidity reporting.

- Trained junior staff on regulatory compliance related to liquidity management.

for Resume Skills

The skills section allows you to showcase both technical and transferable skills. Including a balanced mix of hard and soft skills will strengthen your overall qualifications.

Example

- Liquidity Risk Management

- Cash Flow Forecasting

- Financial Analysis

- Regulatory Compliance

- Team Leadership

- Data Analysis

- Communication Skills

- Strategic Planning

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume while providing a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how you can contribute to the company.

Example

In my previous role, my expertise in cash flow forecasting and team leadership directly contributed to a 15% increase in operational efficiency. I have a proven ability to manage liquidity risks effectively, ensuring that our financial strategies align with corporate objectives.

Be sure to link the skills mentioned in your resume to specific achievements in your cover letter, reinforcing your qualifications for the job.

The Importance of Liquidity Manager Resume Skills

In the competitive landscape of finance and banking, a Liquidity Manager plays a crucial role in ensuring the effective management of an organization's cash flow and financial liquidity. Highlighting relevant skills in a resume is essential for candidates applying for this position, as it not only showcases their qualifications but also aligns them with the specific requirements laid out by potential employers. A well-crafted skills section can capture the attention of recruiters and set candidates apart in a crowded job market.

- Demonstrating financial acumen is vital for a Liquidity Manager, as it reflects the candidate's ability to analyze and forecast cash flows effectively, ensuring that the organization can meet its financial obligations.

- Proficiency in risk management is essential, as it allows candidates to identify potential liquidity risks and implement strategies to mitigate these risks, safeguarding the organization's financial health.

- Strong analytical skills are crucial for interpreting complex data related to cash positions and liquidity ratios, enabling effective decision-making that influences the overall financial strategy.

- Knowledge of regulatory compliance is imperative, as Liquidity Managers must ensure that the organization adheres to financial regulations, thereby avoiding legal pitfalls and potential penalties.

- Effective communication skills are necessary for conveying liquidity strategies and issues to both financial stakeholders and non-financial personnel, fostering collaboration across departments.

- Experience with financial modeling techniques demonstrates a candidate's ability to create predictive models that assess future liquidity needs, providing valuable insights for strategic planning.

- Familiarity with treasury management systems and tools is advantageous, as it equips candidates with the technical skills needed to manage cash flow efficiently and automate processes.

- Leadership capabilities can set a candidate apart, as Liquidity Managers often need to lead teams and collaborate with various departments to ensure cohesive financial operations.

- Adaptability to changing market conditions is vital, as a successful Liquidity Manager must respond to economic fluctuations and adjust strategies accordingly to maintain financial stability.

For more insights and examples, check out these Resume Samples.

How To Improve Liquidity Manager Resume Skills

As a Liquidity Manager, the ability to effectively manage cash flow and ensure the company's financial stability is paramount. The financial landscape is constantly evolving, making it essential for professionals in this role to continuously enhance their skills. By improving your competencies, you not only increase your value to your current employer but also enhance your marketability for future opportunities.

- Stay updated on financial regulations and compliance by attending workshops and seminars.

- Enhance your analytical skills through courses in data analysis and financial modeling.

- Improve your knowledge of cash management systems and software such as SAP, Oracle, or Kyriba.

- Network with other finance professionals to share insights and best practices.

- Consider obtaining certifications such as the Certified Treasury Professional (CTP) or the Chartered Financial Analyst (CFA).

- Develop strong communication and negotiation skills to effectively collaborate with stakeholders.

- Engage in continuous learning through online courses or industry publications to stay abreast of market trends.

Frequently Asked Questions

What are the key skills required for a Liquidity Manager?

A Liquidity Manager should possess strong analytical skills to assess and manage cash flow effectively. Proficiency in financial modeling and forecasting is crucial, along with a solid understanding of financial instruments and markets. Additionally, excellent communication and interpersonal skills are needed to collaborate with various stakeholders and present liquidity strategies clearly. Familiarity with regulatory requirements and risk management practices is also essential for making informed decisions in liquidity management.

How important is experience in financial analysis for a Liquidity Manager?

Experience in financial analysis is extremely important for a Liquidity Manager, as it allows them to interpret complex financial data and identify trends that impact liquidity. This role requires the ability to analyze cash flow statements, balance sheets, and other financial reports to make strategic recommendations. A strong foundation in financial analysis also helps in developing accurate liquidity forecasts and ensuring compliance with financial regulations.

What technical skills should a Liquidity Manager have?

A Liquidity Manager should be proficient in financial software and tools used for cash management and forecasting. Skills in spreadsheet applications, such as Excel, are vital for performing detailed analyses and modeling scenarios. Additionally, familiarity with risk management software and financial databases enhances their ability to monitor liquidity positions and respond to market changes effectively. Understanding of programming languages or data visualization tools can also be beneficial in streamlining reporting processes.

What soft skills are essential for a Liquidity Manager?

Soft skills play a significant role in the effectiveness of a Liquidity Manager. Strong communication skills are essential for articulating liquidity strategies and collaborating with teams across the organization. Problem-solving abilities are crucial for addressing liquidity challenges and making quick decisions under pressure. Furthermore, leadership skills are important for guiding teams and influencing stakeholders to align with liquidity management goals.

How does regulatory knowledge impact a Liquidity Manager's effectiveness?

Regulatory knowledge is critical for a Liquidity Manager, as it ensures compliance with laws and guidelines governing financial operations. Understanding regulations related to liquidity risk management, such as the Basel III framework, helps in crafting strategies that meet regulatory requirements while optimizing liquidity. Staying informed about changes in regulations enables the Liquidity Manager to proactively adjust strategies and mitigate potential risks, thereby enhancing the organization's financial stability.

Conclusion

Including Liquidity Manager skills in your resume is essential for demonstrating your expertise in financial management and your ability to optimize an organization's cash flow. By showcasing relevant skills such as risk assessment, cash forecasting, and strategic planning, candidates can significantly stand out in a competitive job market and provide substantial value to potential employers. Remember, honing your skills not only enhances your resume but also boosts your confidence during the job application process. Take the time to refine your abilities and watch as new opportunities unfold!

For more resources, check out our resume templates, utilize our resume builder, explore resume examples, and don't forget to create an impactful first impression with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.