23 Leveraged Finance Analyst Skills for Your Resume in 2025

As a Leveraged Finance Analyst, your skill set is crucial in navigating the complexities of high-yield debt and leveraged buyouts. Employers seek candidates who possess a robust combination of financial acumen, analytical prowess, and effective communication abilities. In this section, we will explore the top skills that can enhance your resume and set you apart in this competitive field.

Best Leveraged Finance Analyst Technical Skills

Technical skills are crucial for a Leveraged Finance Analyst as they enable professionals to evaluate complex financial data, assess risks, and structure financial deals effectively. Mastering these skills not only enhances analytical capabilities but also increases the potential for making informed decisions that drive successful investment outcomes.

Financial Modeling

Financial modeling is essential for creating representations of a company's financial performance. Analysts use models to project future earnings, assess valuations, and evaluate potential investment opportunities.

How to show it: Include specific examples of financial models you’ve built, such as LBO models, and mention the outcomes achieved through your analyses, like increased ROI or successful deal closures.

Credit Analysis

Credit analysis involves evaluating the creditworthiness of a borrower. This skill helps analysts assess the risk associated with lending and investment decisions.

How to show it: Highlight your experience conducting credit assessments, specifying the criteria used and any improvements in credit ratings or risk mitigation that resulted from your analysis.

Debt Structuring

Debt structuring is the process of designing a capital structure that minimizes costs while maximizing investment returns. It is vital for optimizing financing strategies.

How to show it: Showcase specific transactions where you successfully structured debt, detailing the instruments used and the financial benefits achieved for the client or firm.

Valuation Techniques

Valuation techniques, such as DCF and comparable company analysis, are crucial for determining the fair value of assets and companies in leveraged finance transactions.

How to show it: Quantify your valuation experience by mentioning the number of valuations performed and the accuracy of your projections compared to market outcomes.

Market Research

Market research involves analyzing industry trends, economic indicators, and competitor performance to inform investment strategies. This skill helps analysts stay ahead in a competitive landscape.

How to show it: Detail the market research projects you have completed, including specific insights gained and how they influenced financing decisions or investment strategies.

Risk Assessment

Risk assessment is the identification and evaluation of financial risks associated with leveraged buyouts and other investment strategies. It helps mitigate potential losses.

How to show it: Provide examples of how your risk assessments led to actionable recommendations that reduced risk exposure or improved financial outcomes.

Excel Proficiency

Excel proficiency is fundamental in financial analysis for creating complex spreadsheets, performing calculations, and visualizing data. It is a key tool for analysts.

How to show it: Discuss specific Excel functions or models you have mastered, such as advanced formulas or pivot tables, and how they enhanced your analysis efficiency.

Presentation Skills

Presentation skills are crucial for conveying financial insights and recommendations effectively to stakeholders. Clear communication can influence decision-making processes.

How to show it: Mention any presentations made to senior management or clients, including the impact of your findings on strategic decisions and any positive feedback received.

Understanding of Financial Regulations

Understanding financial regulations is essential for ensuring compliance in leveraged finance transactions. This knowledge helps analysts navigate legal frameworks effectively.

How to show it: List relevant regulations you are familiar with, such as Dodd-Frank or Basel III, and provide examples of how you ensured compliance in past roles.

Negotiation Skills

Negotiation skills are vital for structuring deals and reaching favorable terms with lenders and investors. Effective negotiation can significantly impact financial outcomes.

How to show it: Illustrate your negotiation experiences, including specific deals where your skills helped achieve better terms or conditions, and the resulting financial benefits.

Best Leveraged Finance Analyst Soft Skills

In the fast-paced world of leveraged finance, possessing strong soft skills is essential for analysts to thrive. These workplace skills enhance collaboration, improve problem-solving capabilities, and facilitate effective communication, all of which are vital in navigating complex financial transactions and client relationships.

Communication

Effective communication is crucial for a Leveraged Finance Analyst, as it involves conveying complex financial information clearly to clients and stakeholders.

How to show it: Highlight instances where you successfully presented financial analyses or reports to clients or senior management. Use metrics to demonstrate the impact of your communication, such as improved client satisfaction ratings or successful stakeholder engagements. For more tips on enhancing your communication skills, refer to our resources.

Analytical Thinking

Strong analytical thinking allows analysts to assess financial data critically, identify trends, and make informed recommendations.

How to show it: Provide examples of how your analytical skills led to successful financial strategies or improvements in processes. Quantify outcomes, such as percentage increases in efficiency or revenue growth resulted from your analyses.

Problem-solving

The ability to solve complex problems is vital in leveraged finance, where analysts must navigate challenges and find innovative solutions.

How to show it: Detail specific situations where you identified a problem and developed a strategic solution that benefited the project or organization. Use measurable outcomes to illustrate your success. For further insights into problem-solving skills, check our dedicated section.

Time Management

Leveraged Finance Analysts often juggle multiple projects and deadlines. Effective time management ensures all tasks are completed efficiently.

How to show it: Discuss your ability to prioritize tasks and manage tight deadlines. Include examples of how you successfully completed projects ahead of schedule or improved turnaround times. Visit our page on time management skills for more tips.

Teamwork

Collaboration with various stakeholders is essential in leveraged finance. Strong teamwork skills foster a productive working environment.

How to show it: Describe your experience working in teams, emphasizing your role in achieving a common goal. Include metrics that showcase team achievements, such as successful completion of a project or closing a significant deal. For more on teamwork skills, explore our resources.

Attention to Detail

A keen eye for detail is crucial in leveraged finance, where small errors can lead to significant financial repercussions.

How to show it: Provide examples of how your attention to detail prevented costly mistakes or improved the accuracy of financial reports. Quantify your contributions wherever possible to highlight your meticulousness.

Adaptability

The finance industry is constantly evolving, making adaptability a key skill for analysts to stay relevant and effective.

How to show it: Illustrate your ability to adapt to changing circumstances or new technologies. Share specific instances where your adaptability led to successful outcomes or efficiency improvements.

Negotiation Skills

Negotiation skills are essential for Leveraged Finance Analysts when structuring deals and engaging with clients and stakeholders.

How to show it: Highlight successful negotiations you have led, focusing on the outcomes achieved. Include numerical metrics, such as improved terms or reduced costs, to demonstrate your effectiveness.

Networking

Building a strong professional network is vital for Leveraged Finance Analysts to facilitate deal-making and gather market intelligence.

How to show it: Discuss your involvement in industry events, professional groups, or networking activities. Highlight any significant partnerships or connections that resulted from your networking efforts.

Critical Thinking

Critical thinking enables analysts to evaluate financial information objectively and make sound decisions based on data.

How to show it: Provide examples of how your critical thinking skills contributed to strategic decision-making processes. Include metrics or outcomes that showcase the positive impact of your analysis.

Emotional Intelligence

Emotional intelligence helps analysts understand and manage their own emotions and those of others, facilitating better communication and collaboration.

How to show it: Describe situations where your emotional intelligence improved team

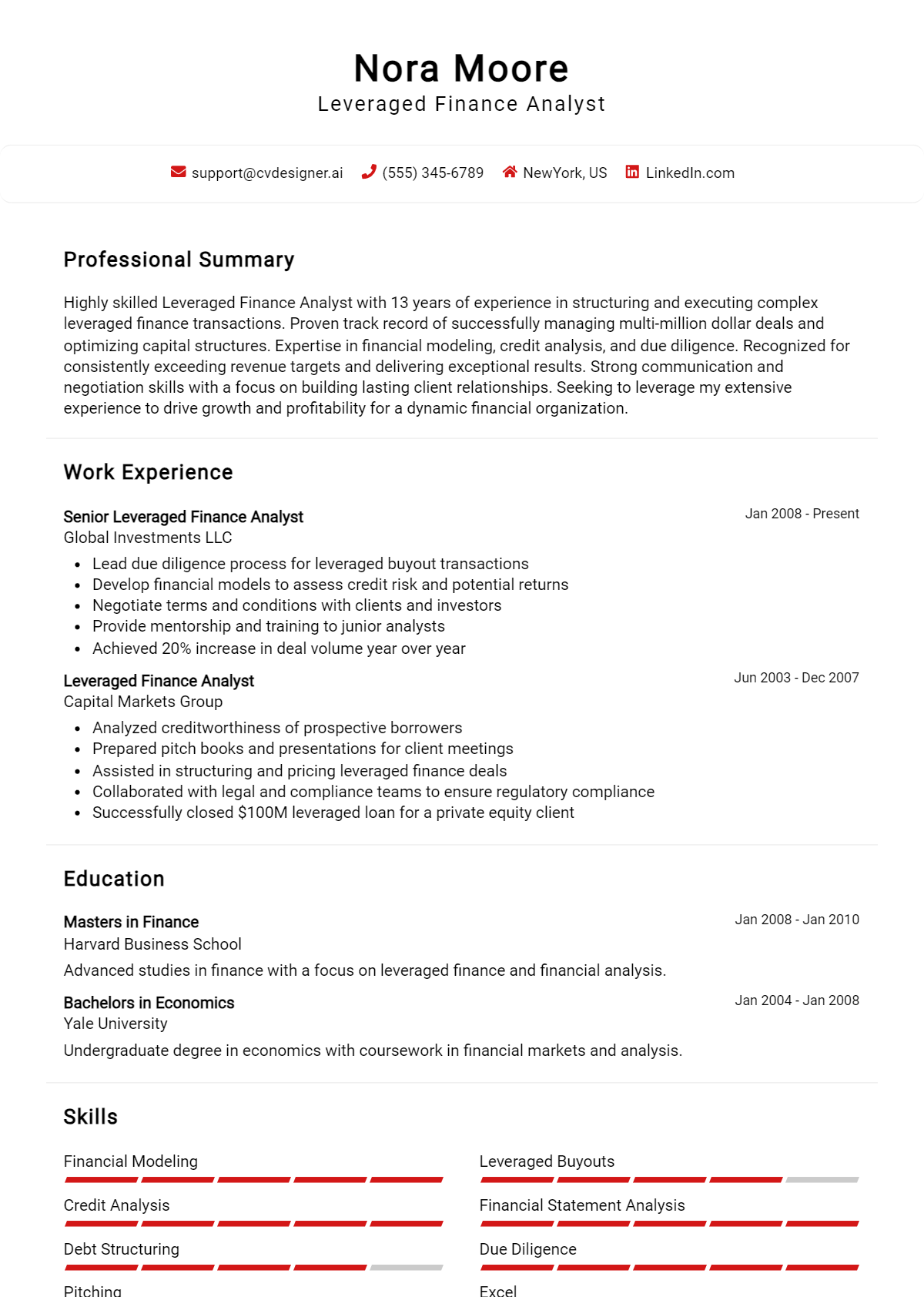

How to List Leveraged Finance Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers, especially in competitive fields like leveraged finance. There are three main sections where you can highlight your skills: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing Leveraged Finance Analyst skills in the introduction (objective or summary) section offers hiring managers a quick overview of your qualifications, making it easier for them to identify your potential fit for the role.

Example

Dynamic Leveraged Finance Analyst with expertise in financial modeling, credit analysis, and market research. Proven track record of enhancing investment strategies while optimizing debt structures to drive profitability.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how Leveraged Finance Analyst skills have been applied in real-world scenarios, showcasing your value to potential employers.

Example

- Conducted in-depth credit risk assessments that led to a 20% reduction in loan defaults.

- Developed comprehensive financial models that supported strategic decision-making for over $500 million in transactions.

- Collaborated with cross-functional teams to enhance portfolio management strategies, resulting in increased returns.

- Presented findings to senior management, effectively communicating complex financial concepts to non-financial stakeholders.

for Resume Skills

The skills section can showcase technical or transferable skills, emphasizing a balanced mix of hard and soft skills that bolster your qualifications.

Example

- Financial Modeling

- Credit Analysis

- Valuation Techniques

- Market Research

- Data Analysis

- Team Collaboration

- Problem Solving

- Communication Skills

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and add a personal touch. Highlighting 2-3 key skills that align with the job description and explaining their positive impact in previous roles can make a significant difference.

Example

In my previous role, my strong financial modeling skills were instrumental in developing strategies that led to a 30% increase in profitability. Additionally, my expertise in credit analysis enabled our team to secure favorable financing terms, ultimately supporting the company’s growth objectives.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Leveraged Finance Analyst Resume Skills

In the competitive field of leveraged finance, showcasing relevant skills on your resume is crucial for standing out to recruiters and potential employers. A well-structured skills section not only highlights your qualifications but also demonstrates your alignment with the specific requirements of the role. By emphasizing your expertise, you can effectively convey your value to hiring managers, making it more likely for your application to catch their attention.

- Demonstrates Technical Proficiency: Highlighting specific skills such as financial modeling and valuation techniques shows that you possess the technical expertise required for the role, giving you an edge over other candidates.

- Aligns with Job Requirements: Tailoring your skills to match the job description helps you align with the expectations of employers, showcasing your attention to detail and understanding of the leveraged finance landscape.

- Showcases Analytical Capabilities: Strong analytical skills are paramount in leveraged finance. By emphasizing these abilities, you convey your competency in evaluating complex financial data and making informed decisions.

- Indicates Industry Knowledge: Demonstrating familiarity with leveraged buyouts, debt instruments, and market trends signals to recruiters that you are well-versed in the industry, increasing your credibility as a candidate.

- Enhances Communication Skills: The ability to communicate financial insights effectively is vital. Highlighting communication skills on your resume illustrates your capacity to present complex information clearly to stakeholders.

- Reflects Problem-Solving Abilities: Leveraged finance often involves navigating challenges and finding solutions. Showcasing problem-solving skills can set you apart as someone who can handle obstacles effectively.

- Builds Confidence in Your Application: A strong skills section instills confidence in recruiters about your capabilities, making them more likely to consider you for the role and potentially lead to an interview opportunity.

- Facilitates Networking Opportunities: By clearly outlining your skills, you can attract the attention of industry professionals and recruiters who may be seeking candidates with your specific expertise.

For additional guidance on crafting an effective resume, check out these Resume Samples.

How To Improve Leveraged Finance Analyst Resume Skills

In the competitive field of leveraged finance, continuously improving your skills is essential to stay relevant and advance your career. As market dynamics change and new financial instruments emerge, a proactive approach to skill enhancement can set you apart from your peers. Enhancing your expertise not only boosts your resume but also increases your value to potential employers. Here are some actionable tips to help you improve your skills as a Leveraged Finance Analyst:

- Engage in ongoing education by enrolling in finance-related courses, such as advanced financial modeling or corporate finance.

- Stay updated on the latest market trends and economic indicators by regularly reading financial news and analysis from reputable sources.

- Join professional finance organizations or networks to connect with industry professionals and gain insights into best practices.

- Practice your analytical skills by working on real-world case studies or simulations that require in-depth financial analysis.

- Seek feedback from mentors or colleagues on your work, and use their insights to identify areas for improvement.

- Enhance your technical skills by becoming proficient in financial modeling software and tools commonly used in the industry.

- Attend workshops and seminars focused on leveraged finance to learn from experts and expand your knowledge base.

Frequently Asked Questions

What key skills should I highlight on my Leveraged Finance Analyst resume?

When crafting your resume for a Leveraged Finance Analyst position, emphasize analytical skills, financial modeling expertise, and proficiency in valuation techniques. Highlight experience with Excel for data analysis, as well as knowledge of financial statements and credit analysis. Additionally, include soft skills such as communication and teamwork, which are essential for collaborating with other departments and presenting findings to stakeholders.

How important is experience with financial modeling for a Leveraged Finance Analyst?

Experience with financial modeling is crucial for a Leveraged Finance Analyst, as it underpins the ability to assess credit risk and project financial outcomes for leveraged transactions. Demonstrating proficiency in building various financial models, such as discounted cash flow (DCF) and comparable company analyses, will strengthen your resume and showcase your technical capabilities in this competitive field.

What software skills are beneficial for a Leveraged Finance Analyst?

Proficiency in financial software and tools is essential for a Leveraged Finance Analyst. Familiarity with Excel for advanced functions and data manipulation is critical, while experience with financial databases such as Bloomberg or FactSet can be advantageous. Additionally, knowledge of presentation software like PowerPoint is important for effectively communicating analysis and recommendations to clients and team members.

Are certifications relevant for a Leveraged Finance Analyst role?

Certifications can enhance your resume and demonstrate your commitment to the field of finance. Relevant certifications, such as the Chartered Financial Analyst (CFA) designation or Financial Risk Manager (FRM), can provide a competitive edge. While not mandatory, these certifications showcase your expertise in financial analysis, risk management, and investment principles, which are valuable in leveraged finance roles.

How can I demonstrate my analytical skills on my resume?

To effectively demonstrate your analytical skills on your resume, include specific examples of projects where you utilized these skills to make data-driven decisions. Highlight instances where you analyzed financial data, identified trends, or provided actionable insights that led to successful outcomes. Quantifying your achievements, such as improving efficiency or increasing profitability, can further illustrate your analytical capabilities and their impact on past employers.

Conclusion

Including Leveraged Finance Analyst skills in your resume is crucial for standing out in a competitive job market. By effectively showcasing relevant skills, candidates can demonstrate their value to potential employers, highlighting their ability to analyze financial data, assess risk, and contribute to strategic decision-making. Remember, refining your skills not only enhances your resume but also boosts your confidence in your job application process. Take the next step toward your career goals by utilizing resources like our resume templates, resume builder, resume examples, and cover letter templates to create a compelling application that showcases your expertise and ambition.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.